Master of Science in Architectural Studies 1985

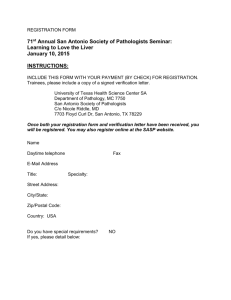

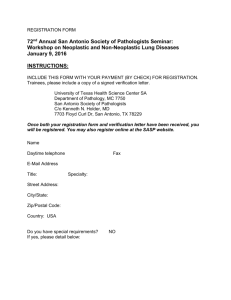

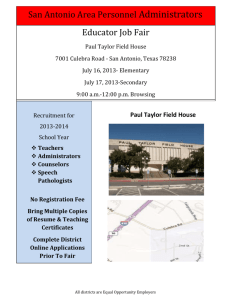

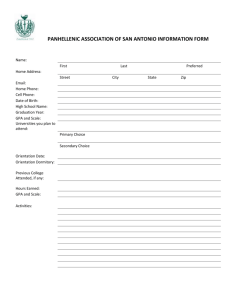

advertisement