Document 11266122

advertisement

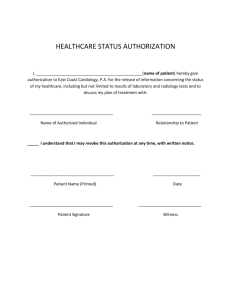

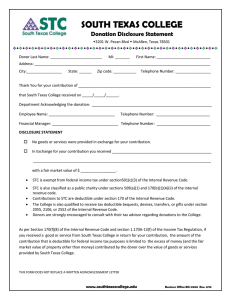

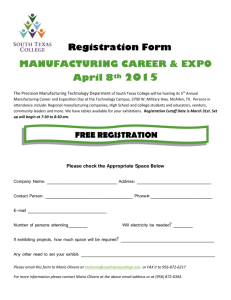

Business Office Organizational Chart FY 2012 – FY 2013 Table of Contents 1 Go Green 2 Fraud & Abuse Awareness and Internal Controls 3 Mary G. Elizondo, Comptroller Mary G. Elizondo, Comptroller Banner Finance Myriam Lopez, Accounting Group Supervisor 4 Budget 5 Payroll, Position Control, & TimeForce 6 Accounts Payable Nicole Perez, Budget Coordinator Payroll Staff Dalinda Gamboa, Accounting Group Supervisor Maricarmen Ramirez, Accountant Table of Contents 10 Accounting Transactions 7 Travel 8 Introduction to True Colors Isidro Ramos and Alisa Fernandez 11 Cashiers 9 Conference & Event Procedures 12 Questions Maricarmen Ramirez, Accountant Nicole Perez, Budget Coordinator General Accounting Staff Cashiers Staff INTRODUCTION Objectives To learn “How To” Prepare and Process Business Office Documentation To “Learn About” Business Office Functions Business Office “Count on Satisfaction” Paperless Initiative 1. Components of Go Green JagMail TouchNet Marketplace - since 2010 Financial Reports to Financial Managers & AA’s - since 2009 Employee paystubs - JagNet since March 2010 Employee Form W-2’s - JagNet since January 2013 ACH payment for vendors and direct deposit for employees (travel) - since 2009 Banner Travel and Expense coming soon! Business Office “Count on Satisfaction” South Texas College Guidelines for Reporting and Investigating Suspected or Known Fraud, Abuse and Other Improprieties S T C G u i d l i n e s http://rav4.southtexascollege.edu/hr/forms/policies/policies_reporting_fraud_procedures.pdf 1. Examples of Acts of Fraud, Abuse and Other Improprieties ACFE – The use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets Encompasses wide variety of conduct, such as pilferage to sophisticated investment swindles Common violations – asset misappropriation, corruption, false statements, false overtime, petty theft and pilferage, use of common property for personal benefits and payroll and sick time abuses 2. Employee Responsibilities Report the act to your immediate supervisor If the supervisor has participated in or condoned the act, report the matter to the next highest level of supervisor or management Director of Human Resources Anonymous Fraud Hotline State Auditor’s Hotline Doing What’s Right THE NETWORK 1-800-482-5158 This toll-free number is staffed by The Network, an independent organization operating 24 hours a day, 7 days a week. You do not have to give your name. An Interview Specialist documents your concern, assigns you a personal reference number, and relays your concerns to the company. Fraud Survey F r a u d s u r v e y http://finance.southtexascollege.edu/businessoffice/survey.html Got Internal Controls? presented by South Texas College Business Office “Count on Satisfaction” The COSO* Definition of Internal Control Definition of I/C: “Internal control is a process - effected by an entity’s board of directors, management, and other personnel - designed to provide reasonable assurance regarding the achievement of objectives in the following categories: a) reliability of financial reporting b) effectiveness and efficiency of operations, c) compliance with applicable laws and regulations. * Committee of Sponsoring Organizations of the Treadway Commission Simple Definition Internal control is what we do to see that the things we want to happen will happen … And the things we don’t want to happen won’t happen. The Integrated Framework of Enterprise Risk Management/Internal Controls 8 Components 4 Entity Objectives 4 Activities Components of I/C: 1) Internal environment 2) Risk assessment 3) Control activities 4) Information and Communication 5) Monitoring Strong Internal Controls Benefits Reducing and preventing errors in a costeffective manner. Ensuring addressed. priority issues are identified and Protecting Providing Having employees & resources. appropriate checks and balances. more efficient audits, resulting in shorter timelines, less testing, and fewer demands on staff. Fraud Triangle When these three sides of the triangle are present, there is a much higher than normal chance of an individual committing a fraud. Financial Manager Handbook http://finance.southtexascollege.edu/businessoffice/forms/FM%20 Handbook.pdf Business Office “Count on Satisfaction” 3. Banner Finance Access to Banner Finance Access to Banner Finance is needed if you: • • Need to review budget status for organizations under your department Need to input online requisitions for your department To request access, complete Banner Finance Access Request Form. • Form is available to download on the Business Office website http://www.southtexascollege.edu/businessoffice/index.html Finance Forms FGIBAVL – Budget Availability Status FGIBDST – Organization Budget Status FGITRND – Detail Transaction Activity FGIOENC – Organization Encumbrance List FGIENCD – Detail Encumbrance Activity Query Data on Banner Allows to separate specific transactions Steps to perform a query 1. Query / Enter or click button 2. Query / Execute or click button 3. To cancel a query – Query / Cancel or click button Wild character “%” can be used in queries Review Budget Status on FGIBAVL FGIBAVL is the form Banner uses to check Non-Sufficient Funds (NSF) The available balance on FGIBAVL is reduced by complete, incomplete, suspended, and unapproved transactions (requisitions, POs, invoices and journal entries) Review Budget Status on FGIBDST Unlike FGIBAVL, only complete and fully approved documents post to FGIBDST FGIBDST also provides a more detailed summary by account code while FGIBAVL shows a summary by account pool. Question Form FGIBDST provides a detailed view by account code while form FGIBAVL provides a summary by account. True or False? Available Balance Calculation on FGIBAVL and FGIBDST Adjusted Budget - Year-to-Date (YTD) Activity - Commitments (Encumbrances) = Available Budget Balance Question Incomplete and unapproved transactions are reflected in the available balance on form FGIBDST. True or False? Transaction Detail - FGITRND The field column can help you determine the type of transaction. • OBD – Budget transaction • RSV – Encumbrance transaction from requisition • ENC – Encumbrance transaction from PO • YTD – Expense transaction from invoice, journal entry or feeds from other system (Student, HR) - “I” documents are Invoices, “J” documents are Journal Entries, and “F” documents are feed transactions FGIOENC FGIOENC provide a list of all open encumbrances (requisitions, purchase orders) for the organization and fund specified. FGIENCD FGIENCD provides detail transactions for an encumbrance (requisition, purchase order). For example, all invoices/change orders done to the encumbrance. Document Inquiry Forms FPIREQN – Requisition Query Form FPIPURR – Purchase Order Query Form FAIINVE – Invoice Query Form FGIDOCR – Document Retrieval Inquiry FOIDOCH - Associated Documents REQ – Requisition PO – Purchase Order INV – Invoice CHK – Check Enter document number Business Office “Count on Satisfaction” 4. Budget Planning, Maintenance and Transfers Budget Planning The Budget Planning Process commences through the Budget Development Application accessible in Jagnet. During the open time period, departments must submit their proposed organization budget requests for upcoming fiscal year(s). Only operating, travel and capital budgets may be updated (+/-). Consider the manual budget transfers processed during the previous year when requesting budget amounts for the upcoming fiscal year(s). Only financial managers and authorized staff may update an organization’s proposed budget. Submit the Banner Budget Development Access Request from to grant additional user access. Organization changes may also be made during this time Create new organizations Inactivate existing organizations Combine organizations that serve the same purpose Budget Planning Continued Proposed budgets are reviewed and may be adjusted by administrators and executives. Proposed budgeted amounts become official after they have been approved by the Board at the Budget Hearing. Copies of the Board approved budget and subsequent amendments are filed with the: Texas Higher Education Coordinating Board, Legislative Budget Board, Legislative Reference Library, and the Governor’s Office of Budget and Planning. Organization budgets may be used during the active fiscal year (September 1 – August 31). Budget Maintenance Department expenses must be properly categorized and charged to the most appropriate organization. The organization charged with the expense should not be determined by funds availability. If the appropriate organization does not have enough funds available for the expense, complete and submit a budget transfer. Do not charge an expense to an another organization due to funds availability. Expenses must be properly categorized in order to adhere to the functional expense classifications from the Integrated Postsecondary Education Data System (IPEDS) Financial Survey. Steps to Prepare a Budget Transfer Determine the amount that needs to be transferred (FGIBAVL) Determine the organization and account with sufficient funds available to cover the negative balance (FGIBAVL) Prepare the Budget Transfer form (BO-3500) http://www.southtexascollege.edu/businessoffice/forms.html Submit form for signature approvals Send approved form to Business Office for processing Check the status of the transfer on FGIBDST Review Organizations for Budget Availability Enter the Required Fields to View Balances • Chart • Fiscal Year • Organization • Account Move to the Next Block Budget Transfer Guidelines Purpose of budget transfer : • • Reallocate budget for future purchases Cover negative balances Budget transfers may be processed between different account codes of the same organization, or between different organizations. Budget transfers may not occur between different fund codes. Only typed budget transfer forms will be processed Transfers may be processed using the expenditure pool accounts only • • • • 710000 Direct Expenditures (Operating) 730000 Travel Expenditures 740000 Capital Expenditures 770000 Construction If the submitted budget transfer form has errors, a new form must be submitted Budget Transfers Approvals Review Budget Transfer Request Form Contact Information Elena Jimenez, Budget Specialist 872-4620 elenae@southtexascollege.edu Nicole Perez, Budget Coordinator 872-4633 mnperez@southtexascollege.edu Budget Website: • • http://www.southtexascollege.edu/businessoffice/forms.html Budget Transfer Tips and Procedures Budget Transfer Form Business Office “Count on Satisfaction” 5. Payroll, TimeForce, & Position Control TimeForce Setup Human Resources - Sets up all new employee finger templates for use of time clocks Payroll Office - Sets up employees in TimeForce based on the “TimeForce Account Request” form submitted by HR Employees - Call Payroll Office for online web access. • Online web access and access to an STC network computer are necessary for reviewing and verifying timecards. Department supervisor/designee - Submit Form BO-7710 to Payroll Office for removal of user when employee terminates employment. Overtime/Straight Time Request & Approval Process All non-exempt employees must have prior written approval when working overtime and/or straight time hours. (Form BO-7721) **Regardless of the number of overtime hours anticipated. TimeForce provides an Overtime Summary Report that shows the historical trend of overtime worked by each employee. Other TimeForce Reports • • • • • Go to “Reports” Tab and under Time Reports Weekly Hours Detail - used to calculate straight time pay hours. Punch Detail Report Exceptions Report - used to verify the completeness of the end of pay period time cards. Under Hours Report - displays all non-exempt salaried employees that did not complete 40 hrs. in a work week. TimeForce Time Card • Adjustments • • Absences • • Must have a completed Form BO-7700 (Time Adjustment Request Form) before entering it in Must have a completed STC Employee Leave Form before entering it in Time card verifications • • • • Done after correcting errors Done after entering absences Must click the “recalculate” button after doing either of these Employee must verify timecard first Business Office Payroll Forms BO-0610 - Working Hours Worksheet – will help determine an employee’s working hours when traveling out of town or attending a conference • BO-7700 - Time Adjustment Request Form – completed by employee for missed punches or corrections • BO-7705 - Mass Entry Adjustments Form - for STC employees that have a flexible work week schedule other than 8 hours per day or for other types of mass punch adjustments (i.e. traveling employees). • BO-7710 - TimeForce Access Authorization Form – to create or delete supervisor/designee, and to add/remove employees • BO-7721 - Overtime Request - to pre-approve overtime hours • BO-7730 - STC Time Card - Use only when TimeForce is not accessible to employees • Other Payroll Tips • • • • Make corrections on time - No corrections will be able to be made in the system after that deadline. Respond to our phone calls or emails in reference to an issue we may have with an employee timecard in a timely manner. Supervisors should give authorization to someone else in their absence to process corrections and verify employee timecards when they are going to be out of the office. W-2s are accessible to all employees on Employee JagNet Position Control Forms NOE Forms 1. Regular NOE 2. Direct Wage NOE 3. NOE for Trainers **Contact Human Resources for copies of the forms Position Control Transfer Form 1. To transfer only salary funds between positions - to clear salary deficits and to replenish pools 2. Use when 1) assignment will be funded differently as stated on the NOE, 2) as requested by Financial Managers 3. Completed by Budget/Position Control Specialist and forwarded for approval signatures NOE Forms Department Title & Home organization code must match , example: Department :Economics Home Org. code :221102 The system will encumber the number of weeks between the start and end date, make sure that the dollar amount calculated under the “Funding Source Information section” is based on the same amount of weeks. Funding Source Information Needed • Position Number & Org Code – to indicate how position will be funded • • Direct Wage Pool or Salary Savings position Positions split funded or funded by grant – use “Split Funded” option • • Provide % Distribution, Fund Code, and Organization Code for each funding source Provide the Pool or Salary Savings position number(s) • State the total amount of funding needed. • Obtain Financial Manager Approval funding the assignment • Incomplete NOEs will be forwarded back to the department • • Missing the above information NOE is missing Department and/or Home Organization Code where employee will be working for (top of NOE) Revisions that make changes to the dollar amount on NOEs already approved are not allowed unless the original NOE is still pending to be processed by HR department. Funding Source Examples NOTE: Some NOEs already have a blank for the organization code 841184 Org.410050 8.50 15 12 1,530.00 Financial Manager 04/20/13 841184; 841423 50% 110000 8.50 Financial Manager 04/20/13 320004 50% 15 12 110000 410013 1,530.00 Financial Manager 2 04/20/13 Effect of Overtime on Balances An organization’s available balance is reduced by the amount of overtime earned by staff. Consider future overtime expenditures when hiring new personnel and transferring funds. HR Module Effects on Finance Module Changes made in the HR Module are reflected in the Finance Module on a monthly basis. • • • Budgeted amounts Payroll feeds Encumbrances NOTE: NOEs in process waiting approvals will not be including until HR department enter them in the system. Calculating the remaining balance of an organization • FMs and their AAs may access Banner FGIBDST form • FGIBDST is updated on the last working day of each month • Example: If FGIBDST is accessed on April 17 the payroll salary information will be as of March 30. Enter own organization code --the fund and program will populate by itself. Account type will be 61 for Salary information only Formula for Organization Net Available Balance If the Organization/Department FGIBDST form is showing the following accounts codes: 610016, 610019, 610020, 610030 and 610045 remove their positive or negative balance from the Net Total Available Balance on the bottom of the right hand side, the difference will be the “Net Total” of the Organization. Remaining Balance Example: -110,417.60+97,418.76+13,680=681.16 See example: Question An organization’s available balance is reduced by the amount of _________________ earned by staff, which must be considered when hiring new personnel and transferring funds. 6. Accounts Payable Accounts Payable Department • The Accounts Payable department is responsible for processing payments for goods and services purchased by the college and payments associated with employee travel. • • Maricarmen Ramirez Yvette Ortiz • • • • • • • • • • • Bertha Arriaga Esmer Palomo Gabriela Gonzalez Efrain Lira Kelly Lara Beatriz Saldana Marcy Gonzalez AP Fax Vanessa Limon Vacant Travel Fax AP Accountant AP Accounting Specialist Accounts Payable Accounting Assistant Accounting Assistant Accounting Assistant Accounting Assistant Accounting Assistant Accounting Assistant Records Technician Travel Accounting Assistant Accounting Assistant 956-872-4609 956-872-4628 956-872-4659 956-872-4611 956-872-4691 956-872-4623 956-872-4642 956-872-4631 956-872-4654 956-872-4648 956-872-4618 956-872-4656 956-872-4630 Accounts Payable Calendar ACCOUNTS PAYABLE CYCLES CALENDAR FISCAL YEAR 2012 - 2013 SEPTEMBER 2012 S M T W TH F OCTOBER 2012 S S 1 NOVEMBER 2012 M T W TH F S 1 2 3 4 5 6 S M T W DECEMBER 2012 TH F S 1 2 3 S M T W TH F S 1 2 3 4 5 6 7 8 7 8 9 10 11 12 13 4 5 6 7 8 9 10 2 3 4 5 6 7 8 9 10 11 12 13 14 15 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 16 17 18 19 20 21 22 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 25 26 27 28 29 28 29 30 31 25 26 27 28 29 30 23 24 25 26 27 28 29 30 31 S M T W TH F S 1 2 3 4 5 6 30 JANUARY 2013 S M FEBRUARY 2013 T W TH F S 1 2 3 4 5 S M T W TH MARCH 2013 F S 1 2 S M T W TH APRIL 2013 F S 1 2 6 7 8 9 10 11 12 3 4 5 6 7 8 9 3 4 5 6 7 8 9 7 8 9 10 11 12 13 13 14 15 16 17 18 19 10 11 12 13 14 15 16 10 11 12 13 14 15 16 14 15 16 17 18 19 20 20 21 22 23 24 25 26 17 18 19 20 21 22 23 17 18 19 20 21 22 23 21 22 23 24 25 26 27 27 28 29 30 31 24 25 26 27 28 24 25 26 27 28 29 30 28 29 30 S M TH F S 1 2 3 31 MAY 2013 S M T JUNE 2013 W TH F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 19 20 21 22 23 24 26 27 28 29 30 31 S M T W TH JULY 2013 F S S 1 AUGUST 2013 M T W TH F S 1 2 3 4 5 6 T W 2 3 4 5 6 7 8 7 8 9 10 11 12 13 4 5 6 7 8 9 10 18 9 10 11 12 13 14 15 14 15 16 17 18 19 20 11 12 13 14 15 16 17 25 16 17 18 19 20 21 22 21 22 23 24 25 26 27 18 19 20 21 22 23 24 23 24 25 26 27 28 29 28 29 30 31 25 26 27 28 29 30 31 30 LEGEND: APPROVED DOCUM ENTATION (INVOICE, COPY OF ON-LINE REQUISITION FOR TRAVEL) DEADLINE - TUESDAYS AT 12:00 P.M . Final FY12 Invoice Che ck cycle date 9/20/12 ACCOUNTS PAYABLE CHECK CYCLE HOLIDAY/COLLEGE CLOSED Accounts Payable Do’s o o o o o o o o o o o o o Do submit prepayment form to AP Do submit all itemized receipts for prepayment purchases Do submit an agenda and sign in sheet for food purchases for staff meetings Do advise vendors that STC is tax exempt Do submit completed Consultant Services Rendered form after services are rendered Do keep track of open PO balances (FGIENCD) Do advise Receiving if items received at Department Do return FM approval invoices immediately Do advise vendor that all checks are mailed Do keep open communication with AP Do provide correct PO number to vendor Do refer to Business Office website for account code listing Do meet all Accounts Payable deadlines, especially end of fiscal year (see attached calendar) Accounts Payable Don’ts • Don’t promise payment date to vendors. The College follows net 30 day payment • Don’t obtain consultant signature on Consultant Services Agreement-Services Rendered form (BO6610) until after services are rendered • Don’t keep invoices/receipts in your office • Don’t alter dollar amounts on invoices • Don’t contact consultant from another country without verifying what paperwork is needed to set them up as vendor Departmental Signature Authority Form Form (BO-1800) must be completed every new fiscal year. Please list all organization name(s) and code(s) that pertain to the financial manager. The financial manager can designate on employee to sign invoices under $1000. This form (BO-1800) must be updated each time a change takes place such as a new organization is added to an existing financial manager or a new financial manager has been assigned to an organizational unit. Financial manager signatures must be their full name and original signature, not initials. Accounts Payable does not accept the following signature types and invoices will be returned: Rubber stamp signatures Signatures on prepared labels Initials Allowable Expenditures Procedures • Located on Business Office Procedures page of Business Office Webpage – http://finance.southtexascollege.edu/businessoffice/forms/Allowable%20Expenditures%20Procedures_New.pdf 1. Promotional Items • Must be intended for official business only • Must be reasonable and relevant to its purpose • Use Acct code 710006 • Inventory may only be maintained by Office of Public Relations and Marketing and Student Outreach 2. Retreats Must be for the purpose of conducting bona fide College business and must therefore be pertinent to the mission of the College • Budget should be available • When possible, retreat should be held on campus, exceptions to be approved by Division VP or President • Try to minimize costs where ever possible • 3. • • • • 4. Food Purchases Meal expenses are processed only through an Auxiliary Account Expenditures of these funds for such purposes must serve a legitimate public purpose or further the educational function of the College Light refreshments may be provided for on-site trainings which last less than 2 hours A meal matrix can be found on the Business Office webpage Gifts The presentation of a non cash gift to a speaker/presenter or organization on behalf of the College is allowed for Business Purposes • Gifts to the speaker/presenter should be justified and approved before they are presented • Gifts to College employees are not allowed. Exceptions must be approved by the College President. • Allowable Expenditures Procedures (Cont) Unallowable Expenses • Food celebrating employees personal events (e.g. birthdays, graduations, weddings, showers, welcome/farewell parties, etc) • Non college-wide meals or refreshments for holiday celebrations • Non college-wide meals or refreshments for annual observances • Meals/refreshments for dept/division parties or entertainment • Meals/refreshments for dept/division employee appreciation events FOIDOCH (Document History) *Enter doc. type and next block. Go to Options for details on highlighted sections. AP Interaction Thank you 7. Travel Travel Forms Travel Guidelines – Business Office Website Travel Authorization Form (BO-0600) Travel Voucher Form (BO-0500) Employee Mileage Reimbursement Authorization (BO-6200) Mileage Log (BO-6200, BO-0400) Standard Mileage Method Form (BO-6800) Direct Deposit Authorization Form (BO-5200) Employee Direct Deposit (Electronic Funds Transfer – EFT) o Part of the Business Office Go green initiative and our commitment to pay vendors/employees promptly o Used for employee travel per diem payments, tuition and mileage reimbursements o EFT payment allows funds to be transferred directly to the employee’s financial institution without the need to cash or deposit a printed check. o No worries about check being lost in mail o Direct Deposit Authorization Form #BO-5200 Travel Authorization Form Do’s Do fill out form completely Do include all backup – Flight itinerary, registration form, conference agenda, lodging confirmation, mileage MapQuest information, and if needed the airfare comparison Do reduce conference agenda meals from Per Diem total Do exclude state taxes from lodging if In-State travel Do obtain all appropriate signatures – In-State (employee, supervisor & FM), Out of State (Division VP and/or President), International Travel (Travel Committee recommendation and President) Do process car rental through purchase requisition Do process memberships through purchase requisition and submit Institutional Membership Form Do submit Travel Authorization form to Business Office within 15 working days prior to travel. Keep in mind the registration due date when submitting travel. Travel Authorization Scenario • • • • • • • • • • • • • John Doe (A00999999) An Accountant in the Business Office at the Pecan Campus He will be leaving to Houston airport at 8am on 6/1/13. He will return McAllen on 6/14/13 at 6:05pm. The trip will be paid out of Business Office Organization code 555555. Attending TACCBO Conference Held 8am 6/2/13-4pm 6/7/13 in Galveston, TX He chose to take vacation starting immediately after the conference and spend the time there with family. He provided a Shands flight quote of $444.80 He submitted an EAN Enterprise car rental requisition # R005555 in the amount of 119.66. The fee to register for the event is $150.00 due by 5/20/13. (it needs to be overnighted to TACCBO, 222 Street Ave, Galveston, TX 72469 Ph# (555) 5555555) Lodging was booked at 119/night with a 9% city tax. Booked for 6/1-6/7-Total $778.26 Lunch will be provided on each day of the conference and the hotel provides breakfast. Mr. Doe’s trip was not itemized in the budget because it was unexpected. TRAVEL VOUCHER Do’s • Do fill out form completely • Do Submit original receipts for authorized expenses: Airfare receipts/boarding receipts, car rental, hotel, taxi, tolls, and regular parking (submit justification if submitting valet parking receipts) • Do obtain all appropriate signatures – In-State (employee, supervisor & FM), Out of State (Division VP and/or President), International Travel (Travel Committee recommendation and President) • Do deposit unused travel funds within 3 working days at cashiers office and attach cashier receipt(s) to the travel voucher • Do submit travel voucher form along with all required receipts to the Business Office within 15 working days after returning from the trip • Do submit justification for early departure and adjust any per diem given in advance. The Financial Manager should determine if the employee should pay for any fees related to early departure such as airfare adjustments, hotel early departure fee, etc. Travel Voucher Scenario • Example • Receipts needed • Submit within 15 days of travel Employee Mileage Reimbursement Authorization Do’s • Do fill out form completely • Do complete and submit form PRIOR to traveling at the beginning of every fiscal year for Staff and within 15 business days of beginning of class for Faculty • Do complete a travel voucher and a mileage log every time the employee requests mileage reimbursement • Do submit odometer vehicle readings when locations are not available in the STC mileage chart. If odometer readings are not provided, please attach a copy of the MapQuest readings. • Do submit a current Texas Driver’s License and proof of vehicle insurance (employee name must be on the insurance card) for travel dates • Do inform employees that check will be mailed or direct deposited to their bank account (Direct Deposit form would need to be on file with AP) STANDARD MILEAGE METHOD FORM • Completed when the employee’s first or last destination point is not their homebase. • Should be attached to the Employee Mileage Reimbursement Authorization Form or to the Travel Voucher. Pecan Campus STANDARD MILEAGE METHOD Example 2 Miles 7 Miles Travel Commute Residence 8 Miles NAH (Home Base) Example: Employee normal commute (residence to home base) is 16 miles round trip and home base is NAH campus. Employee travels from home to the NAH Campus, home base (8 miles), then travels to Pecan Campus (7 miles), then to residence (2 miles) Total Mileage Reimbursement: 1 miles Total daily mileage traveled: 17 miles Normal Commute (round trip) 16 miles Miles reimbursed: 01 miles End of fiscal year travel deadlines All reimbursement requests for travel that occurred before August 31st must be submitted to the Business Office by September 9th. This includes travel voucher reimbursements for mileage, travel, incidentals, registrations, etc. Upcoming Travel and Expense On-Line System • April 2013 and May 2013 – Testing of Travel &Expense System (T&E) by Business Office and Purchasing Department • May 2013 - July 2013 – Business Office will hold travel and expense training sessions • August 2013 – On Line Travel and Expense implementation. Departments that have completed the training will use the T&E system to process all travel transactions • September 2013 – Every department will use the T&E system to process travel transactions. The Business Office will not accept manual travel authorizations and vouchers Student Travel • Student Travel Authorization – There must be budget available in the fund/org submitted on form – Student Travel Authorization form for Student Organizations (BO-5500) must be filled out for all student travel – This includes Travel that is sponsored by outside companies (STC student organization will not pay anything) – If student travel includes lodging, registration or transportation processed with an online requisition, provide the requisition numbers – Must have approval signature of Director of Student Life – Must be submitted to the Business Office with all forms at least 15 business days prior to travel (keeping registration dates in mind) – Must have the name of a responsible STC employee – Employees traveling with Students must also submit an Employee Travel Authorization form Thank you Business Office “Count on Satisfaction” 9. Conference and Event Procedures Procedures for Revenue Generating Conferences and Other Events Purpose To establish guidelines that a College department must follow for a conference or other event that: • Generates revenue, and • Uses an auxiliary organization to record expenses Conference Coordinator The department must identify one employee who will be designated as the department Conference Coordinator. The Coordinator must plan for each component necessary for hosting a conference or event. Items to be Addressed by Conference Coordinator • • • • • • • • • Request and gain approval for conference or event Coordinate related activities and identify the event location Prepare the budget and request creation of a new organization (if needed) Purchase goods and services Execute contracts and service agreements Processing registration Cash handling and deposits Create a website for registration and payment Recordkeeping and reconciliations Request and Gain Approval of the Conference/Event The department conference coordinator should gain approval from appropriate personnel. Each division should develop guidelines for the types of conferences/events beneficial to the College. The purpose of the conference/event should be related to the College’s educational mission. Identify the Conference Location and Develop Guidelines Contact Operations and Maintenance Office to identify and reserve suitable location. Develop conference guidelines regarding such issues as substitute attendees, refunds, cancellations, payment deadlines, etc. Request Creation of New Organization and Prepare Projected Budget If needed, complete the Request to Create a Conference Organization Unit form (BO-2600) Used to create a new auxiliary fund and organization code Request Creation of New Organization and Prepare Projected Budget Continued Projected Conference/Event Budget form (BO-2610) Submit approved and completed form before any expenses are made Project revenue & expenses for the event Identify additional funding sources, if needed Request Creation of New Organization and Prepare Projected Budget Continued Determine a fee amount, per Board of Trustees approved fee schedule, that recovers costs. A processing fee may be charged. Fees should not be set to generate excess revenues to be used for other purposes. The projected budget and the request for an auxiliary organization unit form must be submitted to the Business Office at least 45 days prior to the conference/event. All expenses directly associated with the conference/event must be charged to the conference auxiliary organization. Purchase Goods and Services for the Conference/Event Pre-planning for purchase of goods is key. Please take into consideration prepayments, the amount of time that is needed to prepare requisitions and place orders, and weekly check cycles. The check cycle is available on-line under the Business Office Accounts Payable webpage. Goods and services acquired must comply with College’s policies and procedures. Execute Contracts and Service Agreements All contracts and agreements must be prepared and executed in accordance with College policies and procedures. The Purchasing Office must be consulted from the onset regarding any contracts or agreements. Cash Handling and Deposits The department conference coordinator must read and understand the Business Office cash handling procedures, available on the Business Office procedures webpage. The department conference coordinator and other responsible parties must attend the cash handling training course conducted by the Business Office. Create a Website for Registration and Payment A website may be created to announce the event’s activities, registration, and payment. Site may be configured to capture payments and registration information. Recordkeeping and Reconciliation The department conference coordinator is responsible for: • maintaining a record of all revenues and expenses and for reconciling all activities with the Business Office at the end of the conference/event • submitting the Conference Financial Report form (BO-2620) at the end of the event to their immediate supervisor and to the Business Office Conference/event accounts may be audited in the same manner as all other accounts are audited at the College by internal or external auditors. Recordkeeping and Reconciliation Continued Conference Financial Report – Budget vs. Actual Expenditure Schedule (BO-2620) Submitted no later than 30 days after the end of the conference/event Compares budgeted revenues and expenditures to actual revenues and expenditures Conference/Event Guidelines Auxiliary organizations are selfsustaining. The conference/event should generate sufficient funds to cover all its expenses. All revenues generated are earmarked solely for the conference/event. The revenues may not be used for other departmental expenses or activities. Questions Business Office “Count on Satisfaction” 10. General Accounting Forms A. B. C. D. E. F. Expenditure Transfers Creating New Funds and Organizations Changing Financial Managers Interdepartmental Transfers Donations Fundraising Authorization (A) EXPENDITURE TRANSFERS Purpose To request an expenditure transfer from one organization (Budget Unit) to another organization (Budget Unit). Expenditure transfers are journal entries needed to reclassify expenditures that were recognized and reported correctly per documentation received. Expenditure Transfer form number is BO-8000 http://finance.southtexascollege.edu/businessoffice/forms.html Expenditure transfers Business Office follows accounting guidelines, State Comptrollers guidelines, IRS guidelines, grants and contracts guidelines, internal control and professional ethics. (B) CREATING NEW FUNDS AND ORGANIZATIONS Purpose Fund codes and Organization codes constitute six numerical digits created under the Banner System to identify the types of fund and department/organization for budgeting, recording, posting, approving, and reporting functions and controls. Request to Set Up a Fund Code form is BO-4900 Request to Set Up a New Organization is BO-4910 http://finance.southtexascollege.edu/businessoffice/forms.html Expenditure transfers (B) CREATING NEW FUNDS AND ORGANIZATIONS Process to set up fund and/or organizations. 1. Complete form BO-4900 and/or BO-4910. 2. Submit original forms to Business Office. 3. Once code is created, an e-mailed is sent to the requestor to inform the new fund and/or organization code. Expenditure transfers (C) CHANGING FINANCIAL MANAGERS Purpose To establish responsibility to assist on the control, reconciliation, and accountability of each Fund Code and Organization Code assigned to Financial Managers. Request to Change Financial Manager Form is BO-4800 http://finance.southtexascollege.edu/businessoffice/forms.html Process to change financial managers. 1. Complete form BO-4800 2. Submit completed form to Business Office 3. Once the change of financial manager is recorded, an email is submitted to the new financial manager to inform him of the new fund code and/or organization code he is responsible and accountable for. Expenditure transfers (D) INTERDEPARTMENTAL TRANSFERS - Expenditures & Revenue Purpose To record services or materials provided to other departments. The provider department is responsible for following up on unpaid invoices (IDT). The provider and customer departments are responsible for keeping copies of all billings (invoices) and reconciling them to the departmental monthly transaction reports. Interdepartmental Transfer Form – Expenditures is BO-5300 Interdepartmental Transfer Form – Revenue is BO-5320 http://finance.southtexascollege.edu/businessoffice/forms.html Expenditure transfers What to do when one department provides services or materials to another department? 1. The Provider Department prepares and completes form (BO-5300/BO5320) after good(s) and service(s) are provided. 2. Form is routed to the Customer Department for approvals. 3. Once form is complete and approved, it is submitted to the Business Office within three (3) days that goods/services were provided. (D) INTERDEPARTMENTAL TRANSFERS – Food Service Purpose To record food services provided to in-campus departments and agencies . Interdepartmental Transfer Form – Food Service is BO-5310 Interdepartmental Transfer Form – Student Organization Food Service is BO-5330 http://finance.southtexascollege.edu/businessoffice/forms.html What to do when food services are needed? 1. Department/Entity request a price Food Quote from the Food Service Department. 2. Food Quote form is completed and emailed to the requestor asking them to complete the justification and purpose section of the quote form. 3. Completed Food Quote Form is emailed to the Business Office before the event for approval. Any question will be addressed as needed. 4. An IDT is prepared and approved by the Customer Department. 5. The completed IDT and food service quote is then routed to the Vice President for Financial Services for approval. 6. The Office of VP for Financial Services obtains approval from the Food Service department. 7. The approved IDT and copies of the agenda and/or attendance sheet are submitted to Business Office. Expenditure transfers (E) DONATIONS Purpose “The College may accept gifts and bequests of land, facilities, items of personal property such as books, equipment, training aids, money, stocks, and bonds which may be converted into money, materials, or other items of value which may aid in the accomplishments of the mission of the College. Items received must have a current or foreseeable future use. The operation and maintenance cost for the gifts must be within current budgeted funds.” (See Policy #5910). A letter from the donor specifying the restrictions and use for the donated property must be obtained. Departmental Accounting Report of Donations Form is BO-1500 Donation Disclosure Statement Form is BO-3900 http://finance.southtexascollege.edu/businessoffice/forms.html Expenditure transfers (E) DONATIONS PROCEDURES Procedure If a gift is accepted: 1. The Community member shall offer the donation to the College. 2. The President determines whether to accept the gift/donation with the department’s assistance. 3. The Department accepting the donation must complete and maintain copies of the: 1. Departmental Accounting Report of Donation Form (BO-1500). 2. Donation Disclosure Statement Form (BO-3900). 3. Prepares an Acknowledgment Letter (Thank You Letter). 4. Forms and Acknowledgment Letter must be approved by the President. 5. Disclosure Statement Form and Acknowledgment letter are mailed to the donor. 6. The original Departmental Accounting Report of Donation Form is submitted to the Business Office for posting to general ledger and creation of receipt. 7. Copies are also maintained at the Business Office. Expenditure transfers (F) FUNDRAISING Purpose To support the mission and further the strategic initiatives of the College To prevent multiple solicitation of gifts from the same donor To identify priorities and to ensure proper accounting Fund Raising Authorization Form is BO-4000 Donation for the Fundraising Form is BO-3800 Donation Disclosure Statement Form is BO-3900 Acknowledge Letter http://finance.southtexascollege.edu/businessoffice/forms.html Expenditure transfers Business Office follows accounting guidelines, State Comptrollers guidelines, IRS guidelines, grants and contracts guidelines, internal control and professional ethics. (F) FUNDRAISING Get approval by completing the form BO-4000 Complete Donation Form BO-3800 for any donations received and follow the Donations guidelines Submit approved form to the Business Office Submit Form BO-3900 to Donor and Business Office Keep Copies on file Business Office “Count on Satisfaction” 11. Cashiers’ Department Cashier Office Hours CASHIER WEBSITE A monthly Hours of Operation calendar is available on the website. The calendar provides useful information such as; •Date and time each campus will be open •Contact Phone Number and Address by campus •If you would like to view the monthly cashier schedule, it is under the STC home page. STC home page Cashiers under Quick Links: Contact & Hours PAYMENT DROP BOX: Available at Pecan Campus next to the SPIRIT Office. *Note: Non-CASH Payments ONLY Student Guides Available ONLINE! http://www.southtexascollege.edu Click: Cashiers under Services Menu Under Quick Links click: Student Guide The Business Office distributes the student guide in an effort to explain important student financial concerns. Cashier’s Website Payments & Deadlines Installment Plans & Loans Parking Permits Book Allowances & Refunds STC JagMail JagCard JagNet Login Quick Links: Tuition & Fee Rates Refund Guidelines SPIRIT Office Authorization Forms Student Guide 1098T Contact & Hours http://www.southtexascollege.edu STC home page Click: Cashier’s FACULTY/STAFF PURCHASING A PARKING PERMIT •Mail out – mailed to the address listed on file •Pick-up – •Pecan campus at the Office of Safety & Security (Bldg N159) •Starr campus at the Administration Office (Bldg A109) •Mid-Valley campus at the Administration Office (Bldg G140) Cash Handling Training • Why? Because cash is one of the College most sensitive assets • Who should attend? • Departments receiving cash • Full time, Permanent Employees • When? • Every 2 years • An email will be send with more information Cash Handling and Deposits • The Financial Manager and the Cash Collector must read and understand the Business Office cash handling procedures, available on the Business Office procedures webpage. • The Cash Collector must attend the cash handling training course conducted by the Business Office to be certified. Cashiers DEPARTMENTAL DEPOSIT WORKSHEET 1.- Name of Department/Organization the deposit is made for. 2.- Date when deposit is turned in to cashiers. 3.- Enter the FOAP as provided by the Business Office. Make sure this information is correct. 4.- Deposit description ex: BBQ tickets, tickets sales, fundraiser. 5.- Enter the currency turned in to cashiers, bills on top according to denominations, coins in the bottom according to denominations. Include total Currency at the bottom. 6.- Enter any checks received, include student ID if applicable. If more space is needed than provided you can have a list and just enter see list and enter the total of checks in the space provided in the bottom. 7.- Enter the total of currency plus checks. 8.- Enter credit card payments if applicable 9.- This should be the total of currency plus checks plus credit cards. 10.- Information for the person submitting the deposit. 2 1 3 4 5 6 7 8 9 10 Once the deposit is made the cashier will provide the pink copy for your records. Example of a Departmental Deposit Worksheet Special Cashiering Events Important Information • Notify cashiers department with at least one month in advance – In order to schedule Cashier – Armor Car – Security if necessary • • • • • • • • Provide contact person for the event Provide FOAP for the event Location of the event Time and Date of the event How many cashiers are needed? How long do you need the cashiers? Provide dress code for cashiers Pre Paid Sales? How is the cashier going to identify pre paid sales? Method of reconciliation at the end of the event – Example: Tickets given against cash collected • What types of payments are you accepting? – Cash – Check – Credit Card Analyzing the Information • Market Place Option • Recurring event • Credit Card • Checks • Computer will be needed for the event • Copy machine will be needed if accepting checks Questions THE END CASHIER DEPARTMENT

![Career Center 5 English [005] .indd](http://s3.studylib.net/store/data/008252861_1-a505cad1ddf780a5cb1005da866a969e-300x300.png)