y B a

advertisement

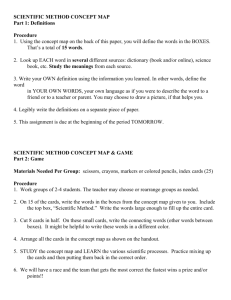

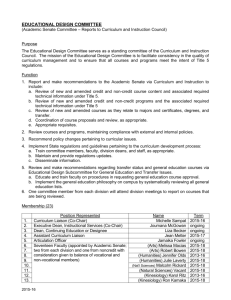

How to Best Redevelop Vacant Big Box Retail Property in Texas By Alfonso Barrera-Villarreal B.B.A. Real Estate – Finance, 2004 Southern Methodist University Submitted to the Program in Real Estate Development in Conjunction with the Center for Real Estate in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development At the Massachusetts Institute of Technology September 2011 2011 Alfonso Barrera-Villarreal All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of Author________________________________________________________ Center for Real Estate July 29, 2011 Certified by______________________________________________________________ William C. Wheaton Professor of Economics Thesis Supervisor Accepted by_____________________________________________________________ David M. Geltner Chairman, Interdepartmental Degree Program in Real Estate Development 1 How to Best Redevelop Vacant Big Box Retail Property in Texas By Alfonso Barrera-Villarreal Submitted to the Program in Real Estate Development in Conjunction with the Center for Real Estate on July 29, 2011 in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development ABSTRACT The purpose of this thesis is to analyze how a developer can best redevelop a vacant big box retail property. To accomplish this, statistical, geographical and demographical analysis was done on previously repositioned vacant big boxes. To make this project manageable, the timeline for this study was limited to properties redeveloped within the last ten years and the geographic scope was narrowed to the state of Texas. Sales data on vacant big boxes sold in Texas within the last ten years was collected from Real Capital Analytics. Research was conducted via Internet, telephone and site visits in order to determine the current use of each property and was later categorized by current use. Each property’s tax appraised value at the time of sale and today was collected from each properties county appraisal district and compared in order to measure changes in value from the re-positioning. Three previous and relevant studies have been conducted prior to this thesis, two by Colliers International and one by Texas A&M University. All three are discussed in detail and incorporated into this thesis. Results show that big boxes in high population density locations found new tenants much faster than those in less dense locations. Rental rates on average fell further for freestanding repositioned big boxes when compared to big boxes that were a part of a multi-tenant property. The properties where the old structure was demolished and a new structure was built had the largest increase in both total tax-assessed value and taxassessed land value. Properties that still had the same existing structure and remained vacant lost the most tax-appraised value. Thesis Supervisor: William C. Wheaton Title: Professor of Economics 2 Acknowledgements I would like to express sincere gratitude to those who have guided me throughout the compilation of this thesis beginning with my thesis advisor and economics professor, William C. Wheaton for his patience and continued guidance. Michael Sweezey of Real Capital Analytics for providing me with the sales transaction data needed to complete this research project. Torto Wheaton Research (CBRE TWR) for their generosity in providing historical market data. I want to express my profound gratitude to my parents, Dr. Alfonso and Laura Barrera for their unconditional love and support. Thank you to my uncle Paul Covey for mentoring me and providing me with his always insightful advice and finally Sarah Jawda for her patience in editing this thesis. 3 Table of Contents Chapter 1: Introduction………………….………………………………………....5 Chapter 2: The Big Box Retail Concept………….………………………………11 A Brief History……………...……………………………………………...11 Definition of a Big Box……...……………………………………………..13 The Outlook for Big Box Retail……….…………………………………..15 Chapter 3: Colliers International and Texas A&M Vacant Big Box Studies.....17 Part I: Colliers International: The Big Box Dilemma……………...……17 Part II: Colliers International: Re-Tenanting Bankrupted Big Boxes….29 Part III: Texas A&M: Lights Out: When Wal-Marts Go Dark……..….37 Critique…………………………………………………………..…………42 Chapter 4: New Research on Repositioned Big Boxes…………………………..43 Spotlight on Demolished/Built New Structure Category……….……….50 Spotlight on Demolished/Raw Land Category……………...…………...53 Chapter 5: Conclusion……………………………………………..……………...55 Appendix…………………………………………………………………….……..58 Dallas-Fort Worth Demographic Maps………………….………………59 Houston Demographic Maps……………………………………………...62 San Antonio Demographic Maps…………………………………………65 4 Chapter 1: Introduction According to CoStar Group, at the end of the first quarter of 2010 the US had just over 11.6 billion square feet of retail space, 870.7 million square feet of which was vacant. Colliers International estimates that approximately 300 million square feet of that 11.6 billion figure was vacant big box space. Therefore, vacant big boxes today account for approximately 34% of all retail vacancy in the US. Shockingly, 120 million square feet of vacant big box space came to market in the US between January 2008 and 2010 alone, which is roughly the equivalent of the total retail inventories of Baltimore, Cincinnati, and Kansas City combined.1 The alarming aforementioned quantity of vacant big box space is of concern to the communities they inhabit and to their neighboring businesses for a number of reasons. First are the visual impacts; an abandoned building attracts vandals and is a visible sign of economic decline and growing disinvestment in the area. As noted by Beaumont and Tucker, writing for the National Trust for Historic Preservation “[that] terms like ‘retail graveyards’ and ‘greyfields’ have emerged to describe the growing problem of vacant superstores. Local officials are concerned that these outlets breed crime and vandalism, depress nearby property values and saddle municipalities with financial and legal liabilities.”2 Additionally, the removal of a large tenant often affects the neighboring businesses that many times rely on the increased traffic to the center because of the anchor big box tenant. The landlords of these centers also suffer because any remaining 1 Brown, H. S. Garrick. The Big Box Dilemma, Part 1: Second Generation Big Box Retail, Colliers International | White Paper, Summer 2010. 2 Beaumont, Constance and Tucker, Leslie, “Big-Box Sprawl (And How to Control It)”, Municipal Lawyer, March/April 2002 Vol. 43, No. 2 5 co-tenants may have co-tenancy clauses in their leases calling for reduced or eliminated rents or even kick-out clauses in the event that the anchor does vacate therefore putting the entire center in jeopardy because landlords usually rely on this rental income to cover any debt service payments. Some retailers negotiate leases that allow them to vacate the space and open a new location as long as they keep paying the rent, but this is just as detrimental to the community as if they were not paying any rent. The cities in which these vacancies are located suffer from losses in sales tax, which many times account for approximately 40% of a city’s tax revenue.3 4 Cities, communities and developers around the country are now asking themselves – How do we best re-position vacant big boxes? This thesis strives to answer this tough question by first analyzing previously redeveloped big boxes and second, studying which redevelopment solutions have proven most successful. In order to make the scope of this project more manageable, the geographic area was narrowed to the state of Texas and the timeline was limited to that of the last ten years (2001-2011). According to CoStar, Texas’ major cities: Austin, Dallas-Fort Worth, Houston, San Antonio and El Paso, all have a total of approximately 927 million square feet of existing retail space as of the end of the first quarter of 2011. Of those 927 million square feet, roughly 70 million square feet is vacant. The Colliers report which states that 34% of all 3 Farr, Jessica LeVeen, http://www.frbatlanta.org/pubs/partners/partners-vol_15_no_2the_ghostbox_dilemma_communities_cope_with_vacant_retail_property.cfm?redirected =true 4 Perry, L. Theodis Jr., “Big-Box” Retail Development, Managing Maryland’s Growth: Models and Guidelines, Maryland Department of Planning, October, 2001 6 retail vacancy in the US comes from vacant big boxes, suggests that Texas has approximately 24 million square feet of vacant big box space. The chart below illustrates an approximate breakdown of each Texas city’s retail real estate market as of the end of the first quarter of 2011: TX1Q2011 City Existing Inventory Vacancy YT D Ne t YT D Under Quoted (SF in millions) (SF in millions) Absorption Deliveries Const SF Rates # Bldgs Total Total GL A SF Va c % Austin 5 ,6 4 1 77 5 6 .0 % 155,054 94,137 143,857 $18.20 DFW 21,870 362 32 8 .9 % 148,493 214,789 1,352,305 $13.62 El Paso 4 ,8 5 4 45 2 5 .5 % 56,318 71,306 612,951 $12.12 Houston 16,160 321 23 7 .2 % 551,148 88,688 519,124 $14.47 San 11,369 121 8 6 .5 % 126,479 130,435 976,295 $14.39 59,894 927 70 7 .5 9 % 1,037,492 599,355 3,604,532 $14.56 Antonio Total 5 This thesis both embodies and analyzes in depth three different previously conducted studies on vacant big boxes. Colliers International on a national level compiled two of the three studies spotlighted in this thesis. This first Colliers study addresses which big box tenants are vacating spaces and which are absorbing them, while the second study evaluates the factors that statistically seem to affect the probability of a vacant big box being re-tenanted and the time in which it takes to find a new tenant. Texas A&M University conducted the third and final study on a regional level. It focuses on Wal- 5 Austin, Dallas-Fort Worth, El Paso, Houston, & San Antonio Retail Market, The CoStar Retail Report, CoStar Group, First Quarter 2011 7 Marts that have “gone dark” in Texas and tracks which tenants are absorbing these newly “dark” spaces. All three studies were informative and influential in the organization of this thesis. This study on vacant big boxes aims to expand on the three aforementioned and current bodies of knowledge by going a step further in statistically analyzing the changes in value over time for the properties being tracked in our sample. This study commenced by collecting sales data on vacant big box property from Real Capital Analytics (RCA) that specifically met both the geographic and timeline requirements of this study. The primary data provided by RCA on each sale included the address, size of the building/property and buyer/seller’s names. In many cases, the name of the retailer that vacated the space and the sales price were also provided. Each property’s tax-assessed value was collected from the individual county’s public tax records. Data collected included both the total tax-assessed value and the land taxassessed value at the time of sale in addition to today’s tax assessed value for each. Total tax-assessed value includes the land value. The land value was collected separately in order to control for capital expenditure differences across properties. Then the percentage change in the tax-assessed values from the time of sale to today’s tax-assessed values was recorded to determine the success of the investor’s strategy. The sample size of the study included 87 different properties. I categorized them by their current uses into seven different categories including: 1. Same Structure/Similar Tenant 8 2. Same Structure/Different Category Retail Tenant 3. Same Structure/Split into Multi-tenant 4. Same Structure/Different Commercial Use 5. Same Structure/Vacant 6. Demolished/Built New Structure 7. Demolished/Raw Land The category with the largest average increase in land value is the demolished/built new structure category with an average increase of about 129% from the time the property was purchased vacant to today. The category with the next highest average increase in land value is the same structure/different category tenant category, with an average increase in land value of about 27%. A summary of the changes in total property tax value and land value are illustrated below: Total Change in Value Change in Land only Same Structure/Vacant -6.81% 0 .8 8 % Demolished/Raw Land 1 9 .6 5 % 1 5 .5 7 % Same Structure/Diff Com'l Use 2 8 .5 8 % 1 1 .0 6 % Same Structure/Similar Tenant 4 2 .8 6 % 1 2 .2 1 % Same Structure/Diff Category Tenant 5 5 .6 5 % 2 6 .6 5 % Same Structure/Split into Multi-Tenant 4 9 .6 6 % 2 .2 9 % 2123.75% 128.82% Demolished/Built New Structure Concealed in these statistics are properties in each category that had much more extreme gains or losses in value than the chart above suggests. The percentage changes in values 9 reported above are only the average of each category. This fact reinforces the concept that real estate is a peculiar asset class in that each property is unique, irreplaceable, and its behavior is determined on a case-by-case basis. This study does not provide a formula for successful repositioning of big box retail property, but it does, however evoke a better understanding of how and where to most successfully reposition big box retail property. 10 Chapter 2: The Big Box Retail Concept A Brief History Several factors contributed to the creation of the big box retail concept. One factor is the mass production of an affordable automobile, the model T-Ford, which began production in 1908, was the first mass-produced affordable car. Then in 1956 U.S. president Dwight D. Eisenhower signed into effect the Interstate Highway act of 1956. This was to create an interstate highway system that connected the entire country, and enabled mass crosscountry automobile travel. Up until the mid 1950’s cities had experienced growth only through accretion in a predictable pattern. The wide use of the automobile and easy access to highways allowed for development to occur further and further away from the center of cities. This was enhanced by the convergence of cheap land, cheap gas, and soldiers returning from World War II looking for a place to raise a family. Developers were going out further from the city center and building the tract housing we’re familiar with today. The only thing that seemed to limit this growth pattern, later referred to as sprawl, was the ability to reach the property by car. The lax zoning and regional planners at the time did not foresee it be beneficial to preemptively create any additional arterial roads to travel between these new developments and the city center. Regional planners decided to improve the existing roads and expand them to have additional lanes in order to meet the increased demand, on an as-needed basis. The result is that now we have an unprecedented number of people routinely traveling ever-longer distances, on a daily basis and over a proportionally decreasing number of ever-larger roadways. 11 The retail trade is as old as civilization itself. Traditionally, retailers positioned themselves where the highest concentration of their customer base was located -- in urban areas and city centers. This way they were assured a steady flow of customers and customers in turn had convenient access to the goods and services they needed. When their customers started moving away from city centers in the late 1950’s due to sprawl, retailers had to rethink their location strategy. The solution was to locate themselves on the roadways where the maximum number of customers where driving by every day on a routine basis –today’s highways and major roads. This way, they just had to sit and wait for their customer to drive by. Retailers found that they could reach an even larger customer base by strategically positioning themselves on high traffic roads/intersections between where people lived and worked, than they had ever been able to reach at one location. As more and more people moved out to the suburbs and more of retailer’s customers drove on these roads, these retailers’ fortunes and sizes grew in direct response and proportion. As Seth Harry states in his paper, A Short History of Suburban Retail “Suburbia and the automobile created, in effect, a nation of free ranging consumers the likes of which the world had never seen before” In the late 1930’s, William J. Reilly of the University of Texas crafted Reilly’s Law of Retail Gravitation. Detailed in the Urban Land Institutes Shopping Center Development Handbook, it states as follows: When two cities compete for retail trade area from the immediate rural (suburban) areas, the breaking point for the attraction of such trade will be more or less in direct 12 proportion to the population of the two cities and in inverse proportion to the square of the distance from the immediate area of each city. Though written to describe city’s trade areas, this is relevant today when describing a particular retailers’ trade area. Basically, it states that customers will always decide to go to the larger store with more merchandise that is easiest to get to. In retailers’ never ending war for customers’ dollars this helps explain why we see larger and larger big boxes with larger and larger variety of goods. This highlights the main reason big box retail exists today. Largely due to the effect of this law, it has become common business practice for successful big box retailers to vacate older, smaller spaces in favor of opening newer, larger boxes on larger sites nearby in hopes of dominating the trade area for the goods it sells.6 Definition of a Big Box At this point it is important to define big box retail property. A big box retail property (a big box) is generally defined as a store that is several times the size of a traditional store of its category. For example the big box version of the local hardware store is a Home Depot or Lowes. What qualifies as a big box in different communities will vary, but there are some relatively common standards which include but are not limited to the following: big boxes generally occupy substantially more than 50,000 square feet with typical sizes ranging between 90,000 and 200,000 square feet, while others can be as small as 10,000 square feet such as pharmacies, for example. Their profits derive from high sales volume 6 Harry, Seth, A Short History of Suburban Retail, Seth Harry and Associates, Inc., Architects and Retail Planning Consultants, February 2004. 13 rather than price mark-up and the structures are large, windowless, rectangular, singlestory buildings with standard facades, acres of parking and a high reliance on auto-borne shoppers. These traits combined, equal the essence of the big box business strategy which is essentially to sell high volume of goods at a low margin, offering customers a wide variety of goods at the lowest prices possible with the high volume of sales producing a sufficient profit for the retailer. From the large general merchandise discount stores also emerged “category killers,” such as Toys “R” Us. “Category killers” specialize in the selling of large volumes of a specific category of good at a discount from a big box. These “category killers” often put smaller local competitors out of business. In the 1990’s, big box retailers started opening “superstores” also referred to as “supercenters” which offered groceries and various other supplies, blurring the line between discount stores and supermarkets. 7 Today there are several categories of big boxes, the main four include that of Discount Department Stores (Wal-mart, Target): They range in size from approximately 80,000 square feet to 150,000 square feet and offer a wide variety of merchandise including home furnishings, apparel and cosmetics. The second main category is that of Superstores (Wal-mart Superstore, Super Target). These are Discount Department stores that also sell groceries in about 30% of their store area. These can be as large as 200,000 square feet or larger. Third, we find Warehouse Clubs (Costco, Sam’s Club): These offer a large variety of general merchandise and groceries in bulk at wholesale prices. There 7 Texas Perspectives, Inc. & Gateway Planning Group, Big Box Retail and Austin: prepared for the City of Austin, June 1, 2004. 14 are a more limited number of product items than offered at general discount stores or supermarkets and require annual membership dues while the store’s size ranges from 100,000 to 170,000 square feet. The last of the four main big box categories is called the Category Killers (Toys “R” Us, Circuit City). These category killers offer a large selection of merchandise specialized in a particular product category. Store sizes range from 10,000 to 80,000 square feet. 8Samples of big boxes tracked in this study include big boxes in each of these categories. Typical Category Size Ranges (in 000) 250 200 150 100 As Small As As Large As 50 Discount Store Super Store Warehouse Store Category Killer 0 The Outlook for Big Box Retail The “big box” as we know it today, was first used by retailers such as Woolworth and Sears Roebuck & Co in the first half of the twentieth century. Wal-mart, K-mart and 8 Texas Perspectives, Inc. & Gateway Planning Group, Big Box Retail and Austin: prepared for the City of Austin, June 1, 2004. 15 Target, the three largest discount retailers in America today were all in business by 1962. A 1963 report by the American Society of Planning Officials states “the discount store has [become] a formidable force on the retail scene.” The exploding popularity of discount retailing is evidenced by the sales figures. In 1962, discount retail sales accounted for $4.25 billion in the U.S. By 2003 the sales figure for discount retailers grew to over $346 billion. By contrast, all other conventional retailers’ sales were only $214 billion in that same year. 1 These tremendous sales figures prove that big box retail is a huge part of the American and global economy. Some sources say that retail sales account for 2/3 of GDP, and if big boxes are responsible for the majority of that number, it does not seem to be a concept that will disappear in the near future.9 Although new construction of big boxes has slowed slightly during this recession, it has not halted their growth. Wal-mart for example, states on their website, it plans to add another 37 million square feet of Wal-mart stores globally in 2011 to the approximately 38 million square feet they added globally in 2010. Wal-mart continues it’s aggressive expansion plans, all while it has 144 vacant Wal-mart buildings listed for sale on it’s Wal-Mart Realty website. It’s likely that there is a new and larger Super Wal-mart in close proximity to these aforementioned vacant and smaller former Wal-mart stores. Each vacant big box provides developers and their communities with both the challenges and opportunities to re-develop these abandoned structures. 9 Texas Perspectives, Inc. & Gateway Planning Group, Big Box Retail and Austin: prepared for the City of Austin, June 1, 2004. 16 Chapter 3: Colliers International and Texas A&M Vacant Big Box Studies In the summer of 2010 and again in the spring of 2011, Colliers International (Colliers) both conducted and published two national studies regarding vacant big boxes. In 2005, Texas A&M University also conducted and published a report on vacant big boxes in Texas. The first Colliers report is focused on which retailers are vacating big box space, which retailers are absorbing these vacancies and details on recent sales of big box property. The second Colliers study focuses on the properties left behind by big box retailers and discusses factors that seem to have affected the likelihood of finding a new tenant; also the length of time it takes in which to find a new tenant. The Texas A&M study is focused more specifically on what has happened to vacant Wal-Mart spaces in Texas, which retailers are absorbing them and how long it is taking to lease them. This chapter will go into detail discussing the findings of these three studies, beginning with the two Colliers reports which are on a national level and closing with the Texas A&M report to transition into the Texas sample of properties tracked in this thesis discussed in the following chapter. Part I Colliers International: The Big-Box Dilemma According to CoStar Group, at the end of the first quarter of 2010, the US had just over 11.6 billion square feet of retail space, of which 870.7 million square feet was vacant. Colliers International estimates that approximately 300 million square feet of that total vacancy figure is from vacant big box space. Therefore, vacant big boxes account for 17 more than 34% of all retail vacancy in the US. The recent economic crisis has provided retailers the toughest business environment they have encountered in decades. While all shopping center types have lost tenants, big box occupancy has been particularly hard hit. Shockingly, 120 million square feet of big box vacant space has come to market between January 2008 and 2010 alone, which is roughly the equivalent of the total retail inventories of Baltimore, Cincinnati and Kansas City combined. For purposes of this study, Colliers defines a “big box” as a single story, freestanding building of at least 20,000 square feet. These smaller 20,000 square foot big boxes are often referred to as junior boxes or junior anchors. These junior boxes have been a large part of the big box vacancy trend. Beginning in 2008, the bankruptcies of a number of large retail companies such as Linens‘n Things, Circuit City, Steve & Barry’s, Mervyn’s, Goody’s, Gottschalks and Sportsman’s Warehouse resulted in approximately 85 million square feet of vacant space in a period of just over one year. The collapse of Linens’n Things and Circuit City which are both considered junior boxes, have led to over 1,150 junior box vacancies across the country. Bankruptcies, however, were not the only culprit for these vacant big boxes. Many retailers that were experiencing declining sales have been closing stores, keeping their best, more profitable locations. For example, Sears and Home Depot have each closed or slated for closure roughly 50 locations. 18 Major Big Box Closings, 2006 – June 2010 Retailer Units Closed Approx. Square Feet Vacated (millions) Linens ‘n Things 589 18.2 Circuit City 567 17.1 Steve & Barry’s 276 15.1 Mervyn’s 149 11.1 Goody’s 282 6.3 Gottschalks 61 4.8 Home Depot Expo Design 34 3.7 Sportsman’s Warehouse 38 2.4 Boscov’s 10 2.0 Joe’s Sports & Outdoor 36 1.9 Wickes Furniture 43 1.8 Large, finer department stores such as Dillard’s, Macy’s and Saks Fifth Avenue have all closed underperforming stores while recent projections point to more closures in the near future. Grocery stores have not been immune to this trend either; numerous chains have cancelled leases and closed stores nationwide. Even Wal-Mart’s Sam’s Club has had to close 10 locations, accounting for approximately 1.2 million square feet of currently vacant and available big box space. 19 The number of vacant big boxes in major cities is astounding. More than 50 big box stores closed in Las Vegas alone since 2007. Charlotte has had 25 individual big boxes become vacant since 2008. At the time this report was published, Chicago had approximately 175 vacant big boxes on the market, accounting for roughly 9.5 million square feet of inventory. While Minneapolis reported nearly 80 vacant big boxes and Sacramento showed 65. The study also looks into what has been happening to the vacant big boxes across the country. Part of the Colliers study looks into Circuit City spaces in particular. The retailers interested in leasing many of the former Circuit City spaces are primarily discounters, off-price apparel retailers and grocery concept stores. Electronic store HHGregg has opened more than 30 locations in the 18 months before this report. Most of these new stores are located in former Circuit City spaces. HHGregg will single-handedly absorb approximately 2.5 million square feet of vacant big box space across the country through the end of 2010. HHGregg isn’t alone, Best Buy had leased or was in negotiation to lease 25 former Circuit City’s at the time this report was being published. Furthermore, two organic grocery concepts, Henry’s Farmers Markets and Sprouts have also taken former Circuit City space. Therefore, of the roughly 17 million square feet of retail space vacated by Circuit City, Colliers International reports that 4 million square feet would be backfilled by the end of 2010. The 149 former Mervyn’s locations are also attracting some retailers’ attention. Colliers expected that by the end of 2010, roughly half of the vacant Mervyn’s spaces would be 20 occupied. Kohl’s aggressively went after vacant Mervyn’s spaces on the West Coast, taking 32 former Mervyn’s locations comprising of approximately 2.4 million square feet. Forever 21 took 15 former Mervyn’s locations comprising of approximately 1.1 million square feet. Burlington Coat Factory, Osh Sporting Goods, Hobby Lobby, TJ Maxx, JoAnn’s Fabrics and Crafts, and a number of grocers have all either taken former Mervyn’s locations or were in negotiations to lease former Mervyn’s locations at the time the Colliers report was published. Former Linens ‘n Things spaces have also proven attractive to HHGregg and TJX Company’s TJ Maxx and Marshall’s brands. Former Linens ‘n Things with typical footprints of 30,000 to 40,000 square feet fit their site preferences perfectly. There is reason to believe that deal activity on these vacant big boxes will continue in the foreseeable future. Of the more than 500 retailers that Colliers tracks, between January and May of 2010, nearly one third of them increased their growth plans for 2011. For example, Ross Dress for Less is aggressive with its expansions plans of adding as many as 550 new stores in the next several years, many of which will likely be second generations big box locations. Strong store sales likely played a major part in these retailers’ decisions. However, it isn’t out of the question for these retailers to scale back their expansion plans should store sales start to plummet or if the recession suffers another dip, as some speculate could happen. 21 RETAILERS ACTIVELY LEASING SECOND GENERATION BIG BOX SPACE The following is a list of retailers that have either signed deals for vacated big box space or would consider these types of properties according to Colliers. 99 Cents Only Fresh & Easy Rooms To Go A.C. Moore Golfsmith Ross Dress for Less A.J. Wright Goodwill Roundy’s Academy Sports Goody’s (Stage Stores is Saks Off Fifth Aldi reviving the concept) Salvation Army Ashley Furniture Grocery Outlet Save Mart Bass Pro Shops H-E-B Savers Bed, Bath & Beyond H&M Schnuck’s Best Buy Henry’s Farmers Markets Seafood City Big 5 Sporting Goods HHGregg Shoe Show Big Lots! Hobby Lobby ShopRite Supermarkets BJ’s Wholesale Club Home Goods SmartCo Foods Bloom JCPenney Smart & Final Extra Bloomingdale’s Outlet Jewel-Osco Sports Authority Bottom Dollar Food Jo-Ann Stores Sprouts Burlington Coat Factory Kohl’s Staples buybuyBaby Lord & Taylor Outlet Store Stater Brothers Cabela’s Marshall’s Sunflower Farmers Market 22 Christmas Tree Meijer Target Shops by BB&B Michael’s TJ Maxx Costco Newflower Farmer’s Top’s Friendly Markets Market Dave & Buster’s Nieman Marcus Last Call Toys R Us Dick’s Sporting Goods Nordstrom Rack Tractor Supply Dollar Tree Ocean State Job Lots Trader Joe’s DSW Ollie’s Bargain Outlets Vons Family Farm & Home OSH Wal-Mart Famous Labels Petco Winco Foods Food Lion PetSmart Wonder! Stores Food Maxx Price Chopper Forever 21 PriceRite Fred Meyer Publix/Publix Sabor The large quantity of retail space on the market has put the negotiating power in the hands of the retailers. Landlords have to lease space at 30% to 40% below what they used to achieve for the same property while still having to provide the finish out. In cases where the tenant is doing their own finish out, leases are being closed for as much as 50% below what rental rates once were, though this is largely in weaker suburban and rural markets. In addition, retailers are opting to sign on for only 10-year lease terms with early termination options as opposed to 20-year terms, which used to be the norm before 2008. 23 Big Boxes are also selling for steep discounts compared with the prices from the prerecession market. For example, a Kmart in the Greater Los Angeles suburb of Highland, California, sold for approximately $64 per square foot in 2005. When that particular Kmart went dark and the rental payments halted, the landlord defaulted on their loan and the property became bank-owned. The bank sold the vacant property in December 2009, bringing in $17.26 per square foot – almost 75% less than what it sold for at its peak value. Another property in Memphis that was developed as a build-to-suit for Sportsman’s Warehouse with an annual rent of $11 per square foot sold in 2007 for $7.8 million. In March of 2009 Sportsman’s Warehouse declared bankruptcy and rental payments ceased indefinitely. In early 2010, the space was re-lease to Ashley Furniture at $6 per square foot on a 10-year lease term. It was for sale at the time this Colliers report was published, but was expected to achieve a sales price of only $3.2 million, or roughly 41% less than its 2007 value. Purchase prices today are 40% or more below their 2006 and 2007 peaks. We do not see prices returning to those peak levels. Moreover, Colliers observes those peak prices as unrealistic and unsustainable. This 40% adjustment represents what Colliers believes may be the new “normal,” to which buyers and sellers may need to adjust. The critical factor in creating value is occupancy. Colliers has seen vacant big boxes sell for half as much as their occupied counterparts. They expect this large divide to persist between stabilized assets and distressed/vacant assets for years to come. The average price of big box space sold nationwide in 2010 was $97 per square foot, with an average cap rate of 7.8%, 24 according to Real Capital Analytics. However, Colliers has seen big boxes in urban areas leased to national credit tenants sell for twice the national average and at cap rates as low as 6.5%. Colliers has also seen vacant big boxes in rural locations sell for less than $20 per square foot. The table below lists data on a number of recent big box sale transactions from around the country. SELECT 2010 BIG BOX RETAIL SALES TRANSACTIONS SALE Property Name City, State Price DATE 05/10 Square Price PSF Feet BJ Wholesale Club Falls Church, $25,000,00 (occupied – ground VA 0 87,708 $285 lease sale) 05/10 Petsmart (occupied) Milford, OH $5,178,388 24,442 $189 05/10 Lowe’s (occupied – Geneva, NY $5,000,000 139,410 $36 Victorville, $4,040,000 125,000 $32 108,510 $126 ground lease sale) 04/10 Former Wal-Mart CA 04/10 04/10 BJs Wholesale Club Franklin, $13,667,00 (occupied) MA 0 Former Circuit City Independenc $1,400,000 32.770 $43 $7,700,000 108.532 $71 e, MO 04/10 BJs Wholesale Club Canton, OH 25 (occupied) 04/10 Dick’s Sporting Goods Eugene, OR (occupied) 03/10 Borders Books & Music $11,625,00 60,122 $193 $9,800,000 38,015 $258 $750,000 58,443 $13 $854,000 36,336 $24 0 Santa Barbara, CA 03/10 Former Furniture Clinton Express Township, MI 03/10 Former Best Buy Westland, MI 03/10 Kohl’s McAllen, TX $7,300,000 88,248 $83 03/10 Garden Ridge Round Rock, $8,500,000 152,496 $56 (occupied) TX LA Fitness (occupied) Highland, $9,215,000 45,000 $205 02/10 CA 02/10 Home Depot Passaic, NJ $7,700,000 117,827 $65 02/10 Barnes & Noble Cary, NC $5,350,000 40,000 $134 02/10 Former Dillard’s Akron, OH $80,500 125,821 $1 Former Carpet & Tile Youngstown, $780,000 26,550 $29 Liquidators OH Former PathMark Philadelphia, $6,200,000 57,288 $108 (redevelopment play) 02/10 02/10 PA 26 01/10 Target Riverside, $8,000,000 191,484 $42 CA 01/10 Former Kmart Colton, CA $2,900,000 108,000 $27 01/10 Former Circuit City Cincinnati, $2,150,000 33,401 $64 $825,000 177,775 $5 $7,700,000 78,000 $99 OH 01/10 Former Kmart Defiance, OH 01/10 Academy Sports (sale- San Marcos, leaseback) TX While consolidation in the grocery industry is intensifying and fueling even more vacant big boxes, there are numerous discount and specialty grocers that are actively absorbing some of these vacancies left behind. Wal-Mart alone is expected to add as many as 300 new stores in 2011, some of which are expected to be around 20,000 square feet, perfect to backfill many of the spaces vacated by junior boxes. Other grocery chains on the move include: Aldi, Trader Joe’s, Grocery Outlet, Henry’s Farmer’s Markets and Sprouts. Even with the large number of retailers backfilling the vacant big boxes, it will not be enough to absorb the numbers in which vacant big boxes are coming into the market. Although the worst is probably over, Colliers predicts that there will continue to be more vacant big boxes coming to market during the next few years. 27 Traditional grocers will not only face competition from discount and specialty grocers, but also from other retail sectors. Target added more than 300 grocery components to its existing stores in 2010. Walgreens, CVS, 7-11, and even some dollar stores are beefing up their fresh food operations. Smaller regional grocery operations – most of which are unionized – will struggle to compete in this environment. Colliers expects that many of these smaller grocery chains will go under, forcing some of the larger chains to close down under-performing locations. Most of these additional vacancies will most likely occur in the suburbs where the markets are already over-saturated. Conclusion Vacant big boxes in top-tier locations – those situated within busy shopping centers or on prime intersections are already leasing and quickly. Colliers expects most of these prime locations to lease within 12 – 24 months of coming to market. Those vacant big boxes situated in weaker locations will have much longer lease up times. It could be three or four years before some of these locations get leased. Owners of vacant big boxes larger than 50,000 square feet may find that they will have to divide the space to accommodate multiple smaller tenants. Unfortunately this can be a large expense of approximately $4 to $6 per square foot when you consider splitting the plumbing, heating, air conditioning and ventilation systems for each space. For the weakest locations there may not be any quick or easy solution. Owners of these locations may have to consider non-retail uses or even demolition as last resort options.10 10 Brown, H. S. Garrick. The Big Box Dilemma, Part 1: Second Generation Big Box Retail, Colliers International | White Paper, Summer 2010. 28 Part II Colliers International: Re-Tenanting Bankrupted Big Boxes According to Colliers International, the overall U.S. retail vacancy rate rose from 6.8% in 2008 to 11.0% in 2010, bringing to market approximately 400 million square feet of space. While some of that space came from small footprint stores such as the approximately 700 vacant Blockbuster Video locations, a significant share of the vacancy has come from vacated big box retailers. As the retail real estate market is recovering, there are signs of more pain to come, such as the current closings of 226 Borders locations and possibly 20 more to come. Electronics retailer Best Buy, recently had a 16% drop in quarterly earnings and will likely close some of its under-performing stores as well. The questions are now: How will these closures affect the property owners? What factors will impact the owner’s ability to re-lease these spaces? What factors affect the speed of lease-up of these spaces? To investigate these questions and hopefully help predict the behavior of future big box vacancies, Colliers International studied the behavior of big box space vacated by four recently bankrupted retail chains: Circuit City, Linens ‘n Things, Mervyns and Gottschalks. Together these retailers closed over 1200 locations equating to an estimated 56 million square feet of vacant space. Below is a chart outlining the number of stores analyzed for each of the aforementioned retailers, compared to their total number of stores nation-wide. 29 Retailer Geographic Former Locations Sampled Locations Footprint Circuit City National 567 97 Linens ‘n Things National 453 77 Mervyns Regional 176 49 Gottschalks Regional 63 10 1,259 223 Total Colliers International’s evaluated the sample of 223 suburban store trade areas discussed above to evaluate population densities in trade areas where spaces have been re-leased and where they remain vacant. The results confirmed Colliers’ hypothesis: higher average population density was positively correlated with the space being re-leased. The average population density was even more important than the growth rate of the trade area where the vacant big box was located. Findings are displayed below: Population Growth Avg. Population Avg. Population % Difference Category (2000 – Density of Re- Density of Still- 2010) Tenanted Locations Vacant Locations Slowest growing 2,718.3 2,248.0 20.9% 2,994.9 2,494.5 20.1% trade areas 2nd Slowest growing trade areas 30 2nd Fastest growing 2,885.7 2,190.1 31.8% 2,151.5 1,771.7 21.4% 2,675.9 2,148.8 24.5% trade areas Fastest growing trade areas Average There also appears to be a correlation between the average population density and the average time it takes to lease the vacant big box. The higher the population density, the faster the space seems to be re-tenanted. For example, in the top 25% of the most densely populated trade areas, vacant big boxes were re-leased in only 2.4 quarters on average. Compared to the vacant big boxes in less dense trade areas that took on average 3.4 quarters to find a tenant. That equates to a difference of approximately 100 days. See chart below: Population Density Category Average Quarters to Re-Tenant the Space Least Densely Populated Trade Areas 3.4 2nd Least Densely Populated Trade Areas 3.4 2nd Most Densely Populated Trade Areas 3.4 Most Densely Populated Trade Areas 2.4 Average 3.1 31 The Sun-belt states, which occupy the southern tier of the U.S. include: Alabama, Arizona, California, Florida, Georgia, Louisiana, Mississippi, Nevada, New Mexico, South Carolina, Tennessee, Texas, and North Carolina, with their attractive climate have seen recent population growth from people migrating from northern states, as well as Mexico. This may be part of the reason the vacant big boxes in these states seem to lease up so much faster. On average, it took over 144 fewer days to re-lease space in the Sunbelt states as opposed to non-sun belt states. In the most densely populated trade areas in these Sun Belt states, the average time to lease up a vacant big box was 1.7 quarters compared to 4.4 quarters in non-Sun Belt locations. This equates to a difference of about 243 days. See chart below: Population Density Avg. Quarters to Lease in Avg. Quarters to Lease in Category Sun Belt Non-Sun Belt Least Densely Populated 2.9 3.8 2nd Least Densely Populated 2.8 4.1 Trade Areas Trade Areas 2nd Most Densely Populated 3.0 3.9 1.7 4.4 2.4 4.0 Trade Areas Most Densely Populated Trade Areas Average 32 Overall, landlords of freestanding big boxes were more successful in re-leasing their vacancies compared to their multi-tenant property counterparts, but not by much. 53% of freestanding locations were re-tenanted compared to 46% of locations in multi-tenant properties. However when isolating this comparison to the Sun Belt states, freestanding locations had found tenants 60% of the time, compared to only 45% in multi-tenant properties. Colliers believes that this may be explained partly because of the high concentration of vacant Mervyns locations in the southwest. Many former Mervyns locations have been leased up aggressively by Forever 21 and Kohl’s. Colliers estimates that these two chains have absorbed approximately 3.6 million square feet of former Mervyns space. Also noted was that freestanding vacant big boxes leased up faster on average when compared to their multi-tenant property counterparts. Freestanding big boxes averaged 2.9 quarters to find a new tenant versus, 3.6 quarters for multi-tenant properties. These differences were more pronounced in the Sun Belt states. See chart below: Average Quarters to Re-Tenant the Space Location Type Sun Belt Non-Sun Belt Big Box Average Freestanding 2.1 3.9 2.9 Centers 3.1 4.2 3.6 33 When comparing freestanding big boxes and big boxes in multi-tenant properties between the first quarter of 2009 and January 2011, the biggest difference was in the asking rental rates. Asking rates in freestanding big boxes fell 36.9% versus just 12.8% in multi-tenant properties. While landlords of freestanding big boxes were able to re-tenant their properties more quickly, it seems to have been at the expense of major rental rate decreases. See chart below: Category Avg. Asking Rent at Avg. Asking Rent Change in Rent 2009 Q1 End of Jan 2011 Big Box Sample* $19.46 $15.97 -17.9% Freestanding $21.93 $13.84 -36.9% $19.36 $16.88 -12.8% Total Retail** $17.35 $15.56 -10.3% Shopping Center** $16.76 $15.27 -8.9% Power Center** $20.10 $17.79 -11.5% Malls** $23.56 $19.37 -17.8% General Retail** $17.25 $15.57 -9.7% Sample* Multi-Tenant Sample* *Source: CoStar Database, end of January 2011. **Source: CoStar Q4 2010 National Retail report. 34 Regardless of whether the property was in a Sun Belt state or not, there seemed to be very little additional vacancy in the centers where these bankrupt big boxes vacated. Centers that lost one or more of the tenants tracked in this study had an average vacancy rate of 26.2% after the big box left. Since these centers’ average vacancy rate before the big box left was 5.2%, this means that on average, only 1% of additional vacancy resulted from the big box leaving. This lack of additional vacancy however, doesn’t mean that landlords escaped any additional rent loss. Numerous national co-tenants had negotiated co-tenancy clauses into their leases that reduced or eliminated their rent while the big box remained vacant. By January 2011, the average vacancy in these centers decreased to 17.4%, an improvement, but still more than triple the average vacancy before these big boxes vacated. The important fact to note here is that the centers that were able to re-tenant those vacated spaces had an average vacancy rate of only 5.4%, while the properties with the big box still vacant averaged 28.5%. Interestingly, centers where the big box occupied 41-50% of the total space by far had the fastest lease-up time, at slightly less than just one quarter. In centers where the big box occupied 60 – 90% of the total space, it took an average of seven quarters to re-lease those spaces; nearly double the average of 3.7 quarters. 35 Conclusion The continuing low levels of new retail space coming to market should amplify the competition for higher-grade locations. Disparities in population density point to the fact that suburban retail can expect an uneven recovery that will be decided on a location-bylocation basis. The wide divergence in asking rents in freestanding versus multi-tenant properties suggests that the safety of having multiple tenants saved these landlords from losing so much ground on their rental rates, even though it took them longer to re-tenant these spaces. However, damage to the landlord may be hidden in the co-tenancy clauses of the remaining tenants and the rent losses the landlords may have endured to keep them there. Centers where the big box made up less than 40% of the total space tended to be less volatile in terms of average time to re-tenant the space. As the percentage of the total space in the center that the big box represented grew, so did the volatility in the likelihood of re-tenanting the space and the time required.11 11 Simonson, Jeff. “Re-Tenanting Bankrupted Big Boxes: Paving the way for Retail’s rebound”. Colliers International White Paper, April 2011. 36 Part III Texas A&M University Real Estate Center: Lights Out: When Wal-Marts Go Dark The Texas A&M University Real Estate Center completed a survey in 2004-2005 to find out what had happened specifically to spaces vacated by Wal-Mart in Texas. During the last four months of 2004, the center phoned local economic departments, chambers of commerce and other city officials in more than 500 Texas cities. The survey revealed that at least 107 Wal-Mart’s closed in 103 different Texas cities between 1987 and 2004. The findings showed that by far, the most common deciding factor to close a Wal-Mart in Texas was to open a newer, larger supercenter store. Of the 107 Texas closures, 92 of them were to build a supercenter in the same city. Wal-Mart supercenters range in size from 98,000 to over 200,000 square feet and require a land area of approximately 20 acres, a size requirement that many of their older smaller sites did not meet. Of the remaining 15 closures, 12 were to open a super center in a different town/city and the three remaining closures were to relocate in the same city due to highway changes that had negatively affected their current locations. 37 3% Reasons For Walmarts Closings Build Supercenter in the same city (92) 11% Build Supercenter in Different City (12) 86% Relocate because of Unfavorable Highway Changes (3) As for the locations they left behind, 30 of the 107 closures remained vacant in 2004. Five of these 30 vacant properties had been vacant for more than five years, while 13 of the 30 had been vacant six months or less. The average vacancy period was just under three years for the 30 properties. Why did the vacated Wal-Mart spaces take so long to lease? Well, some of the vacated Wal-Mart spaces were hampered by the fact that Wal-Mart had restrictions to block competing retailers from occupying those spaces. Wal-Mart executives have to make these decisions from a headquarters normally in a distant city regarding a competitor taking their old space and unfortunately, their goal of keeping competitors out and maximizing stock value can be in conflict with the goals of landlords and elected officials living in communities where these vacant Wal-Mart stores are located. 38 What kind of tenants eventually leased these vacant Wal-Mart spaces? 65 of the 107closed Wal-Mart’s were fully occupied by 2004. Of these 65, about half (33 stores) were occupied by a single tenant. Ten of these 65 were non-retail tenants, primarily call centers, schools or local government offices. A call center pays property taxes, but unfortunately for the city, school or government office uses do not pay property taxes. None of these uses bring in sales tax revenue for the city. 44 of the 107 closed Wal-Mart stores were retrofitted to accommodate multiple tenants. 32 of them were fully occupied at the end of 2004. Only six of these retrofitted sites contained non-retail tenants and of these retrofitted sites, two tenant conversions were the most popular with 19 properties followed by three tenant properties with 13 sites. What Happend to the Vacant Walmarts Fully Leased Partially Leased 28% Vacant 61% 11% 39 Breakdown of Fully Leased Tenants By Type 6 of which are Non-Retail Uses 49% 10 of which are non-retail uses 51% Single Tenant Building Multi-Tenant Building The retail tenants most commonly occupying 100% of a former Wal-Mart space were Hobby Lobby (six stores) followed by Tractor Supply (three stores). Four of the vacant Wal-Mart sites were purchased by retailers for the land and converted into a car dealership, two home improvement stores and one grocery store. These were in excellent locations where alternative sites of this size were not abundant in the area. The most common tenant in these multi-tenant retrofitted buildings was Tractor Supply with 16 different locations, followed by Bealls with 11 locations and various dollar store brands had locations in ten of the properties. Non-retail tenants were usually medical offices, government offices or call centers. Most Common Tenants in these Repositioned Wal-Mart Spaces: 40 Single Tenant Building Multi-Tenant Building Hobby Lobby (6 properties) Tractor Supply (16 properties) Tractor Supply (3 properties) Bealls (11 properties) Dollar Stores (10 properties) At the end of 2004, about 100 of the smaller, older Wal-Mart discount stores existed in the state of Texas. They will likely become ripe to close in favor of opening a super WalMart at some point and could eventually go dark as well - leaving each community to deal with the vacant big box, causing additional conflict between Wal-Mart and each community they inhabit. Hopefully, a compromise can be found that will benefit both Wal-Mart and the surrounding community. A potential measure to mitigate the risk of vacant big boxes noted by this report details that some U.S cities have began requiring big boxes to take out a “demolition bond” or set up some other mechanism to clear the site if they vacate a building and it remains vacant for a specified period of time. None of the Texas cities surveyed had implemented any such policy. Conclusion In summary, of the 107 Wal-Mart’s that closed, only about 61% of them were fully occupied at the time of this study. Of the properties that were fully occupied, a single tenant who took the entire space occupies about half while the remaining space becomes 41 divided by multiple tenants, usually two or sometimes three who occupy the other half. The average time to lease these properties was just under three years, with some properties leasing in under six months while others took longer than five years. 12 Critique Each of these previously conducted studies by Colliers and Texas A&M University have contributed greatly to the current body of knowledge on vacant big boxes in the U.S. All three however, lack an analysis on what has occurred to the values of each vacant big box property. This thesis aims to unveil just that. In the next chapter, a thorough investigation of which factors contribute to a vacant big box property’s increase or decrease in value over time will be analyzed and discussed in detail. Also, none of the previous publications mapped the properties they studied, in order to search for any geographic patters. This study will create maps using the latest GIS technology, categorizing each property by its current use and also demonstrating it’s change in value. The second Colliers study looked into population density and population growth being factors affecting the outcome of these vacant big boxes, but the Texas A&M study did not. None of them compared the outcomes to median household income. In the course of this thesis, maps were created to compare the current uses and changes in value to their geographic locations as well as population growth and density, as well as median household income, all with the use of GIS mapping technology. This thesis aims to add to the current body of knowledge with these research techniques. 12 Hunt, D. Harold & Ginder, John, “Lights Out: When Wal-Mart’s Go Dark”, Tierra Grande, Publication 1720, April 2005. 42 Chapter 4: New Research on Repositioned Big Boxes This chapter discusses in detail the findings that resulted from the in depth analysis performed in attempt to answer the question posed by this thesis: How to best re-position vacant big box property? The analysis tracked 87 big box properties that sold while vacant during the last ten years (2001 – 2011). In order to better manage the data in this study, the geographic scope was limited to the state of Texas. All of the sales figures were collected from Real Capital Analytics. These properties were spread across the following six major cities (metro areas) in Texas: Austin, Dallas-Fort Worth, Houston, San Antonio, Corpus Christie and El Paso. The tax-appraised values for each individual property was collected from their appropriate local county appraisal district and values were tracked from the time of sale to 2011. The percentage change in both total taxappraised value and land value was recorded for each property and placed into categories by their current use. The current use categories utilized are as follows: 1. Same Structure/Similar Tenant 2. Same Structure/Different Category of Retail Tenant 3. Same Structure/Split into Multi-Tenant Retail 4. Same Structure/Different Commercial Use 5. Same Structure/Vacant 6. Demolished/Built New Structure 7. Demolished/Raw Land 43 Of the 87 properties tracked, 23 or about 30%, remain vacant at the time of this study. This includes properties in both the Same Structure/Vacant and Demolished/Raw Land categories. The category with the greatest average increase in value from the time of purchase was the Demolished/Built New Structure category, with an average increase of 2,123.75%. One could rightfully argue that the majority of the increase in tax-appraised value was derived from the newly constructed building. In order to control for this, the tax-appraised land value was isolated and measured from the time of sale to today. This was done for each category and the category with the highest increase in land value over this period was also the Demolished/Built New Structure category, with an average increase in land value of 128.82%. The category that decreased most in value since the time of sale was the Same Structure/Vacant category, with an average decrease in value of -6.81%. This category also had the poorest performance in land value over the study period with an average change in land value of 0.88%. The annualized change in value for each property was also measured. This was calculated by taking the total change in value over the time period and dividing it by the number of years since it’s sale. The average annual change for each category was also recorded. Below is a chart of each category’s percentage change in value from the time of sale to 2011: Same Structure/Vacant Demolished/Vacant land Same Structure/Diff. Com'l Use Same Structure/Similar Tenant Total Change in Value Annual Change in Value Total Change in Land Value Annual Change in Land Value -6.81% -2.69% 0 .8 8 % 0 .1 6 % 1 9 .6 5 % 2 .4 3 % 1 5 .5 7 % 1 .8 5 % 2 8 .5 8 % 5 .1 6 % 1 1 .0 6 % 2 .8 5 % 4 2 .8 6 % 1 4 .3 1 % 1 2 .2 1 % 2 .5 4 % 44 Same Structure/Diff. Category Tenant Same Structure/Split into Multi Tenant Demolished/Built Ne w 5 5 .6 5 % 2 2 .6 3 % 2 6 .6 5 % 4 .9 3 % 4 9 .6 6 % 2 4 .6 6 % 2 .2 9 % -1.35% 2,123.75% 344.90% 128.82% 1 7 .4 6 % Once the properties’ percentage change in tax-appraised values was calculated and the properties were categorized by current use, they were mapped to search for any apparent patterns. Factors for which the maps were searched include: 1. Geographic patterns of current uses 2. Geographic patterns of changes in value 3. Correlations of current use or change in value with median household income 4. Correlations of current use or change in value with population growth 5. Correlations of current use or change in value with population density There were a total of 12 different maps created in this study. Four different maps for each of the three major cities tracked: Dallas-Fort Worth, Houston, and San Antonio. The four maps of each city consisted of: 1. A master map, mapping the properties with category and value change data 2. The master map with house hold per capita income data 3. The master map with population growth data 4. The master map with population density data 45 No obvious patterns were noted in analyzing the aforementioned maps. Below are the master maps for each of the three cites. The other three demographic maps for each city are included in the appendix. See maps below: 46 47 48 49 The big box retailers vacating the properties discussed in this sample included numerous of the same as those mentioned in the previous studies conducted by both Colliers and Texas A&M University. The retailer that vacated the most spaces in the sample analyzed in this study was Target with eight locations, followed by Albertson’s with six. In addition, the retailers absorbing the vacancies in this sample also include many of the names discussed in the aforementioned studies. The retailers that absorbed most of the vacancies in this sample include Marshall’s and Academy Sports & Outdoors, each with three locations, followed by 24-Hr Fitness, Ashley’s Furniture, Office Depot, Bed Bath & Beyond and Food Town each with two locations within this sample study. Spotlight on Demolished/Built New Structure Category: There were only three properties in the sample that fell into the Demolished/Built New category. As a result of this category being rare and the one with the highest increase in value, it merits closer examination. Of this type, there was one property in three of the six cities (metro areas) discussed in this study: Dallas-Fort Worth, Houston and El Paso. The highlighted Fort Worth property is located at 1500 North Main Street, Fort Worth, TX 76106 and was purchased vacant by The Legaspi Company (Legaspi) from the Fort Worth Local Development Corporation in January of 2006. The purchase price was rumored to be approximately $3 million. Legaspi is best known in Fort Worth for redeveloping Fort Worth Town Center into La Gran Plaza, a thriving Hispanic retail and cultural center (www.lagranplazamall.com). The subject property is located in a primarily Hispanic demographic area and the land is approximately 1.2399 acres in size, 54,014 SF 50 per the Tarrant county tax appraisal district. Legaspi was quick to demolish the once existing 59,000 square foot vacant structure that was on the property at the time of sale and added a new 56,622 multi-story square foot structure in it’s place resembling an antique Mexican hacienda that includes multiple smaller retail and office spaces. Critical to Legaspi’s success was that they were able to quickly lease up and stabilize the property. Current tenants include H&R Block and United Way. The Tarrant county tax appraisal district valued the property at $200,000 in 2006, well below the alleged purchase price of $3 million, signaling that this property was not a distress sale. The taxappraised value on the same property today, in 2011 is $5,514,766. That is an increase in tax-appraised value of approximately 2,608.88%. The capital invested in the construction of the new building was not discovered in this analysis but the land value increased from $175,546 in 2006 to $216,056 in 2011, which is an increase of about 23%. The second property that fell into the Demolished/Built New category is the 371,921 square feet of land (8.54 acres) located at 800 W Sam Houston Pkwy N, Houston, TX 77024, at the southeast quadrant of I-10 and the Sam Houston Tollway (Beltway 8) in Houston. This was the former location of the regional Town & Country Mall. This property had slowly decayed, losing business to both Memorial City Mall and the Galleria - both more popular nearby malls. In December of 2003, Bob Yazdani purchased the vacant property for approximately $12.6 million from MetroNational. The previous structure on the property consisted of about 400,000 square feet and was built in 1983. Yazdani sold the property to Midway Companies in May of 2004. Midway 51 developed it into City Centre - the current use on the site (www.citycentrehouston.com). City Centre is a high-end, open-air and mixed-use development, including retail, office, hotel and residential uses. It has been able to attract quality restaurant tenants such as: Eddie V’s, RA Sushi, the Tasting Room, and Ruggles Green. It also has a large athletic club, Lifetime Fitness, and a high-end movie theater, Studio Movie Grill. This redevelopment has been very successful at bringing new life to the property. The Harris county tax appraisal district appraised the property at approximately $2,465,650 in 2003, equating to just the value of the land. In 2011, it is appraised at over $70 million. That was an impressive increase in appraised value of approximately 2,739%. As was previously noted, the appraisal district valued the land at $2,465,650 in 2003. Just eight years later in 2011, the land is appraised at $10,045,850. This is approximately a 307% increase in the tax-appraised value for the land. The third property in this category is located in El Paso, TX. It is in the neighborhood of 517,014 square feet of land (11.87 acres) located at 4011 Alabama Street, El Paso, TX 79930. The property was an 80,000 square foot freestanding big box built in 1978. In February of 2007, Independence Place Fort Bliss LP purchased the property from B&L Partners at an undisclosed sales price. The existing structure was quickly demolished and 12 multi-family buildings totaling an area of approximately 289,000 square feet were built in its place. Today the establishment is known as an Oakwood apartment complex. Oakwood provides corporate, fully furnished, temporary apartments as well as unfurnished traditional apartments. In 2007 the tax appraisal district valued the property at $1,393,903. In 2011, it is appraised at $15,657,729. That’s approximately a 1,023.3% 52 increase. The land was appraised at $580,206 in 2007; in 2011 it’s appraised at $904,744, a 55.94% increase. Spotlight on the Demolished/Raw Land category The properties in the Demolished/Raw Land category could possibly be poised to see a similar huge increase in tax-appraised value as that of the Demolished/Built New Structure category once they’re re-developed. Of the three properties that fall into this category, two are located in Fort Worth and one in Houston. The two in Fort Worth actually sit alongside one another at 7550 and 7600 Grapevine Hwy, North Richland Hills, TX 76180 and total approximately 21 acres of land. They were both formerly department stores Mervyn’s and Macy’s respectively, at North Hills Mall which has since been torn down. Goldrich&Kest Industries purchased both of properties in 2005, one in January and the other in March. The purchase price on 7550 Grapevine Hwy is unknown. 7600 Grapevine Hwy, the former Macy’s store was purchased for $7.4 million. In 2006, the 7550 property was appraised at $1,129,615 and the 7600 Grapevine Hwy property was appraised at $1,822,201. The sale of 7600 Grapevine Hwy was obviously not a distress sale, but more likely an investment in the land for future development. In 2011, 7550 Grapevine Hwy was appraised at $686,410 and 7600 Grapevine Hwy at $1,148,134, displaying a decrease in appraised value of 39.24% and 36.99% respectively. They are both currently appraised at land value only. The land value has decreased for both properties by 33.33% since 2006. 53 One particular property in Houston falling into this category is 3.3 acres located at 7925 Katy Freeway, Houston, TX 77024. This is a former Recreational Equipment Inc. (REI) location. The 43,036 square foot building had been built in 1965. Beeson properties purchased this property in August of 2005 from REI at an undisclosed purchase price. The property was tax-appraised at $1,024,145 in 2005, which was the value of the land alone. In 2011, the property had a tax-appraised value of $2,408,501. That is a 135.17% increase. The majority of this increase in value is due to the land. It is located on the freeway in front of one of the most affluent residential areas in Houston, the Memorial villages. The Harris County tax appraisal district valued the land at $1,024,145 in 2005 and in 2011 the land is appraised at $2,185,276. This is a 113.39% increase in land value alone. Conclusion The majority of the properties tracked have been successfully re-tenanted. Only about 30% of the properties were vacant at the time of this study. It was discovered that the Demolished/Built New Structure category had the highest increase in value, in both total tax-assessed value as well as land value. The properties that fell into the Same Structure/Vacant category had the poorest performance also in both total tax-assessed value and land value. Target was the retailer that vacated the most spaces in the sample, at 8 locations. Marshall’s and Academy Sports & Outdoors were the retailers that absorbed the largest number of vacated spaces in the sample studied, at three locations each. There were no patterns or correlations found by mapping the properties, providing evidence that the appropriate re-development strategy should be considered on a case-bycase basis. 54 Chapter 5: Conclusion Of the roughly 300 million square feet of vacant big box retail space in the United States, Texas accounts for approximately 24 million or 8% - hence raising the ultimate question: What is the best re-development strategy for vacant big box space in Texas today? The vast majority of these astonishing vacant big box figures hail from retailers either going bankrupt or choosing to relocate in order to develop a larger store nearby. The recession is still a major factor as uncertainty of the future directly affects consumer spending. The recession, along with other market trends will likely cause even more retailers to go bankrupt; while those who survive such as Wal-Mart are moving forward aggressively in opening ever-larger stores around the globe. Therefore, vacant big box redevelopment will be an on-going affair in the foreseeable future, with no end in sight. Vacant big boxes in top-tier locations are leasing and quickly each within approximately 12 to 24 months of coming to market. Regardless of their location, Big boxes over 50,000 square feet may have to be split in order to accommodate multiple smaller tenants in order to get leased. Vacant big boxes in weaker locations will take much longer to lease, possibly four plus years. For those in the weakest of locations, owners should consider non-retail uses or possibly even demolishing the big box on the site in order to accommodate for future, more profitable uses. The Colliers report, Re-Tenanting Bankrupted Big Boxes, suggests that properties located in the Sun Belt states find tenants in less time than properties in non-Sun Belt states, a 55 clear advantage for all states within the category including Texas. High population density is positively correlated with the likelihood of the vacant big box being re-leased. Population density is a bigger factor than even that of area growth. High-density locations in Sun Belt states such as Texas, find new tenants the fastest with an average lease-up time of approximately 1.7 quarters or about 153 days compared to the highest density locations in non-Sun Belt states where the average time of lease-up is approximately 4.4 quarters or 396 days. This is a difference of about 243 days, more than eight months on average. Also in the Sun Belt states, freestanding vacant big boxes on average found a new tenant in about 2.1 quarters as opposed to big boxes that were a part of shopping centers that in comparison took about 3.1 quarters. Rental rates for freestanding properties however, fell 36.9% from their pre-vacant state, versus those located in multi tenant properties whose rent fell only 12.8%. The stability associated with having multiple tenants in the property seems to have helped landlords keep rents more stable, although other tenants in the center may have had cotenancy clauses affecting the landlord’s rental revenues while the space was vacant. Despite the fact that freestanding big boxes are leased up the fastest, they seem to have taken the biggest hit on rental rate. Additional vacancy in centers with a vacant big box does not seem to have been significant, only an additional 1% of vacancy was reported on average, due to the vacant big box. There is no magic formula for success in re-positioning vacant big box property but from the data gathered in this thesis, it seems that the best candidate vacant big box properties 56 to re-position in Texas are those in the highest density areas. Careful attention must be paid to the future rental rate assumptions as we’ve seen large differences in rental rate drops between different types of buildings. Expect freestanding locations to lose much more ground on their rental rates than big boxes in multi-tenant properties. Opportunities in which the finances allow to demolish and build a new structure seem to experience the greatest increases in tax-appraised value but careful analysis should be made while considering all costs and benefits regarding all possible re-development scenarios. 57 Appendix: 58 59 60 61 62 63 64 65 66 67