MODELING AIRLINE GROUP PASSENGER DEMAND FOR ARCHIVES

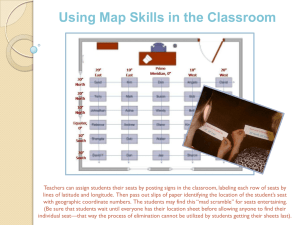

advertisement