LABORATORY TRANSPORTATION FLIGHT 88-2

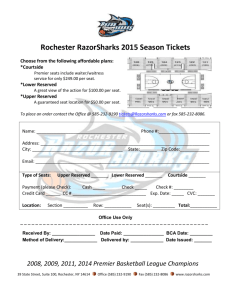

advertisement