Software Industry in India: Product and Intellectual Property Focus

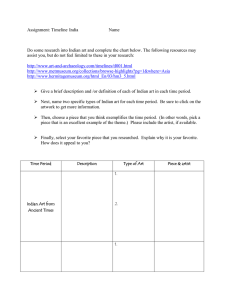

advertisement