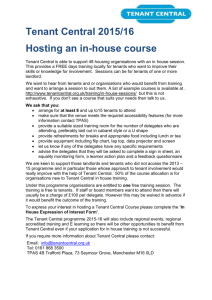

CONSEQUENCES OF QUALITY: Robert W. Easton by

advertisement