CONSEQUENCES OF QUALITY: Robert W. Easton by

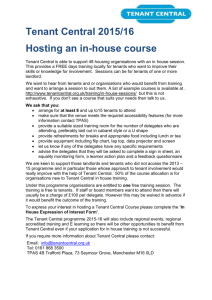

advertisement