MA Remarks Economics Technology

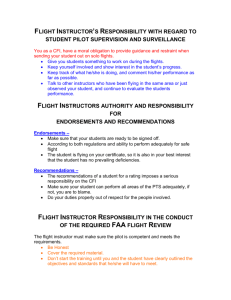

advertisement

Massachusetts Institute of Technology Department of Economics Working Paper Series and Bailouts: Policy Remarks and a Literature Review Flight to Quality Ricardo J. Caballero Pablo Kurlat Working Paper 08-21 October 9, 2008 RoomE52-251 50 Memorial Drive 02142 Cambridge, MA paper can be downloaded without charge from the Social Science Research Network Paper Collection at This httsp ://ssm.com/abstract= 1 29745 6 . Flight to Quality Policy and Bailouts: Remarks and a Literature Review Ricardo J. Caballero and Pablo Kurlat^ October 9, 2008 Abstract Flight to quality weal<nesses in episodes involve a combination of extreme may in US or uncertainty- aversion, the balance sheets of key financial intermediaries, and strategic or speculative behavior, that increases credit spreads on entire risk- financial system is all but the safest and most liquid assets. Unlike previous episodes, the currently at the center of the trouble, with no safe haven pockets, w/hich lead to greater real effects. The US government's credit is still impeccable, w/hich facilitates policies support of the financial system. Policy must take into account incentives for behavior during the crisis, discouraging excessive prudence, w/hich sometimes implies relegating post-crisis moral hazard concerns to a secondary role. JEL Codes: E44,G14,G21 Keywords: subprime ^ MIT and NBER, and MIT; crisis, liquidity, bailout, intermediation, credit spreads respectively. Prepared for the Meeting on Financial Stability the Financial and Real Sectors, Federal Reserve Board of Governors, Washington D.C., and the Linkages between October 3, 2008 Digitized by the Internet Archive in 2011 with funding from MIT Libraries http://www.archive.org/details/flighttoqualityb0821caba Introduction The term "flight to quality" is used to describe an environment where investors seek to sell assets perceived as risky and purchase safe assets instead, leading to widening risk premia and severe disruptions credit in and other extremely severe episode of Financial 2007 that has Markets all accounts, the U.S. the U.S. are struggling with a chronic perceived as "unsafe;" the ensuing to zero and triggered record setting spikes gold and in September flight to quality Relative to the rest of the world, the U.S. episodes for at least three reasons: risk, First, is significantly the U.S. as a whole in 15'^ of this year, even brought treasury rates more in world history. resilient to flight to quality perceived as a "safe haven," and hence and banks in particular, are net recipients search of "quality." This good correlation between leverage and the direction of funds key ingredient for financial where the banking sector stability, is was the U.S. typically sees sustained and stabilizing net capital inflows toward safest assets. Second, the highly leveraged financial sector, of funds is problem since mid Policymakers, realizing that time oil. running out, reacted by announcing the largest financial "bailout" package its currently experiencing an flight to quality oscillated in intensity but with ever increasing peaks. By while investors run from is this kind. in money market funds were down By financial markets. the first which is absent in many is a other financial systems around the world and partly due to the victim of financial panics. Third, first reason, the US has a flexible economic policy framework. However, one of the main reasons the current episode has become so severe stabilizing mechanism has vanished. While deposits have followed the standard forms of funding are leaving the financial system financial over in is that this second pattern, almost herds. This process has dried up liquidity markets and has strained banks' balance sheets from plummeting asset values and hard The system was simply not ready liabilities. triggering all manner for such a dramatic rise in Knightian uncertainty. The first purpose of this article is in key to-roll- correlations, in endogenous tightening of amplification mechanisms, ranging from requirements to a sudden turnaround other all in margin to survey the empirical and theoretical literature describing these mechanisms. The second purpose of mechanisms. In rather obvious: to discuss the policy implications of flight to quality is brief terms, the general policy When last resort facilities sound and the this article flight to quality is is particularly the case mechanism mentioned above -the when government instruments rise in foreign capital treasuries remains active, as the cost of capital to finance the intervention to quality itself (i.e., these times is there to transfer is sharp some existing literature is severe, predictable and reliable systemic bailouts and lender of are highly desirable. This first stabilizing message that emerges from the rise in demand for Treasury Bills is brought are inflows toward down by the flight and Bonds). The goal of policy of the government's liquidity, collateral and trust, to at the distressed domestic financial sector. Tiie last section of the paper summarizes some of these policy implications and adds a few conjectures. There however, is, way a less "linear" to present the policy results from the existing theories, and from what these miss. This of the common article is some by providing a critical some description of features of current bailout proposals. Given the nature of the meeting for which this being prepared, we do this introduction, while others of is and conjectures that flow this directly here. may wish Most readers may wish to continue and to read only up to the end of paper a brief description find in the rest of the much of common a of the articles that provide the backbone (but not the entire skeleton) for what is said here. Most proposals, one including the principles: First, they recognize the need to just approved by Congress, have recapitalize the financial of several key asset and insurance markets. Second, there is most see moral hazard at this time is likely first two "principles" but are less the standard moral hazard view real life, unlike in many when and if costly. Speculators to stabilize it. to let and is its make all crisis in disregard for the incentive problems types of of strategic decisions within a go of their assets, knowing that strategic players have to decide the to punish in particular, first likely as it would place. generates within it crisis. a miscalculation when crises. In Distressed agents have to on the to reinforce a right timing downward tempo may can be very spiral, to wait before intervening, fully and when aware that blown crisis of predicting what require that a full in the game the likelihood of a bailout and the form it is expected to take change for bickering to be put aside. Each of these agents likely to do. In particular, the incentives for both distressed firms and speculators within the both to the resolution of the current A standard of us think that almost more future crises caused the delaying can be counterproductive, but that the political others are many persuaded by the third one. The main problem of Governments have to decide how long becomes observable liquidity of our models, crises are not an instant but a time period. This time dimension creates ample opportunity for decide In fact, as a reason to limit the extent of the intervention and, financial sector to repeat the excesses that We share the system and to improve the to yield a large excess return to the government. Third, shareholders. Not doing so, the argument goes, would encourage the few general an agreement on the need to protect taxpayers by giving the government a share of the upside as well. any reasonable intervention in crisis is crisis. These incentives are central, as well as for the severity of the next crises. advice stemming from the moral hazard camp is to subject shareholders to exemplary punishnrient (the words used by Treasury Secretary Paulson during the Bear Stearns intervention). This dimension, all is sound advice in the absence of a time dimension within crises. With no time shareholders were part of the takes place the crisis is boom over; the next concern is that preceded the crisis and as soon as the bailout not to repeat the excesses that led to the crisis. means punishing those Punishing shareholders learn the lesson sooner rather than However, this advice less crisis, and it is better that they later. can backfire when we add back that shareholders will be exemplarily punished needed that led to the current if the crisis the time dimension. Now, the expectation worsens delays in the decision to inject As a concrete example, sovereign wealth funds are capital by stabilizing investors. much now much eager to inject equity into the U.S. financial system than they once were. Conversely, destabilizing speculators and shortsellers see the value of their strategy reinforced by the policy of exemplary punishment. For both reasons, crises become more acute, as the equity market becomes extremely onesided when uncertainty and turns into a during bouts of panic and confusion. The anti-moral hazard strategy enzyme. crisis This risk rise theme also highlights an aspect that being minimized is component. One of the puzzling behaviors during the current remained on the side, despite obvious fire sales. crisis is in current proposals: the strategic why so much informed capital has For relatively small investors, or those constrained by regulation on the size of their position, the fear of exemplary punishment should another bout of panic take place most likely may be the answer. However, for large investors,, answer is In this role, which is Of course, there may crisis. In is crisis such as a thing as too reaction complicates the crisis resolution as its markets become is illiquid to wait or pull out such a context, a potential bailout plays yet and hence to reduce the predator's much it If of a good thing, as the anticipation of a bailout the anticipation turns out to be incorrect, this delays external capital injections until refusal to accept an offer by J.C. Flowers the example often used to support rises, to unfold. increase the incentive to wait by the seller. The case of AIG and uncertainty to increase the perception of competition incentive to wait for the full-blown the potential to gain control, the context, the optimal strategy of the predators resources from the target, waiting for a deeper another When predatory and strategic behavior. and market power develops. who have it may be too weekend before However, one should note that its demise late. is an problem caused by this is a the unpredictability of policy, not by the predictable component of this policy. If the government has ample access to liquidity, this position. and balance sheets are being destroyed by the reinforcing feedback of acute mispricing and predatory actions, "good moral hazard," as it it is important that the private sector can count on this would ultimately be too liquidity. That's costly for the private sector to hoard liquidity for such episodes. Along the same vein, when Knightian uncertainty too much private risk taking. Within the crisis, is prevalent, the main problem markets are on the other side of risk is too little taking relative to the conventional moral hazard concern, and hence inducing a more aggressive use of private liquidity positive rather than a negative development. That is, while it is not is a true that excessive risk taking prior to the crisis can be a source of trouble, once a crisis is reached, the greater concern is insufficient risk taking and explicit public support can encourage rather than prevent desirable private sector behavior. These concerns lead to several observations regarding how the many details of the bailout, of which are yet to be determined, should be arranged. One objective must be to signal to signal the strategic investors waiting in the sidelines that prices will stop falling and thus discourage speculative waiting. Speculators will not expect that prices of securities will be lower than those established at the Treasury's auction (if indeed an auction is used), at least in the period that immediately follows the auction. Thus the date of the auction provides a clear deadline to any speculative waiting. timetable for purchasing a given list of securities may Announcing a therefore have a salutary effect on prices even before the actual purchases take place. To the extent of mispricing possible, the first securities to be purchased should be those greatest. is For instance, certain AAA-rated tranches of subprime mortgage backed securities have been trading at prices that are hard to market. these securities were If first on the Treasury's the possible gains from speculative waiting One risk is that lead to fire-sale prices if some when amount distress will have on auction in shareholders. this would send the Treasury purchases the securities. To this purchase. would harm other security-holders, sufficiently large equity stake list, except by the extreme illiquidity of the a signal to speculators that of the holders of a particular security are especially distressed, this market their remaining holdings. One way to Finally, justify soon disappear. will by the profits the taxpayers would make on excessively low prices where the evidence Still, if some there is a extent, this risk is may mitigated concern that purchases at nothing else, from having to mark-to- partially avoid this situation is to commit to purchasing a of each security to minimize the impact that any particular security-holder's prices. the Treasury's plan contains as-yet-unclear provisions for giving the government an the companies One way it assists. Presumably this will involve diluting the holdings of current to take into account the within-crisis incentives this policy generates would be to give special consideration (for instance, lower dilution) to firms that raised fresh capital since the start of the crisis, and to those that experienced the most extreme predatory attacks which cannot be justified on the grounds of fundamentals. To be Instead, our clear, our position argument is that it is not that the standard moral hazard concerns should be disregarded. is important that mindful of the perverse incentives that they approach is one example of a may when designing policies to address trigger within crises. misguided policy along these been another one, but there are many hazard without backfiring during the crisis. lines, letting post-crisis regulatory it, we are more The "exemplary punishment" Lehman Brothers fail may have responses that could deal with moral Evidence A defining feature of a flight to quality Depending on the elasticity of supply, this may is decrease a materialize as a the relative dennand for risky assets. in supplied, or in both.^ For already-issued securities, which at least flight to quality may respond show/s up as a change in relative prices. their relative price, in the quantity fall in in the short run are in fixed supply, a For newly issued securities or loans, quantities as well. Accordingly, different studies have focused on either quantities or prices when exploring evidence on flights to quality. Obviously there are more than two possible levels of riskiness ("risky" and "safe") and a quality may may involve shifts in relative behavior toward any group or subgroup of assets. For instance, involve a preference for bonds over stocks, for corporate bonds, or many AAA bonds it over junk bonds, for treasuries over of these at once. Different studies have looked at the evidence on the basis of one or several of these pairings of Finding 1: The flight to assets. amount and composition of banl< loans reveal that flight to quality is countercyclical. This pattern exacerbates the business cycle by depriving lower quality borrowers from financial resources during contractions. A series of early studies focused financing varied with on quantities, examining how the composition of macroeconomic conditions. Kashyap, tightening of monetary policy there Stein, were systematic increases paper compared to bank lending. The underlying view is & in firms' external Wilcox (1993) found that following the relative quantity of commercial that large firms have access to a commercial paper market whereas small firms are more dependent on bank lending, perhaps because bank monitoring essential to is overcome informational asymmetries. Thus, a relative reduction in bank lending can be interpreted as a flight to quality. Similarly, Gertler and Gilchrist (1993) and Oliner and Rudebusch (1993) found that the relative proportion of loans to large corporations increases in these episodes, and Lang and Nakamura (1995) found that the prime+1% (which they interpret as relatively safe) monetary policy. fluctuations as much is at rates below countercyclical and rises after tightenings of Commerce's Quarterly Financial Report of manufacturing firms, Furthermore, they compare the a greater proportion of small (manufacturing) firms. the growth rates of sales, inventories, and debt in small and large firms and conclude that The broad conclusion of these studies is that financial The terms supply and demand are subject to some ambiguity. A decrease claims made as one third of aggregate fluctuations could be explained by the differences large firms. ^ in loans Bernanke, Gertler, and Gilchrist (1996) offer evidence consistent with these findings using data from the Department of which includes is new fraction of customarily described as a decrease in demand in in between small and constraints for lower-quality investors' desires to acquire risky the context of securities, and a decrease the context of bank loans. This essay follows this customary use unless there is risk of confusion. in supply in y, ' 1, borrowers tighten real in periods of recession or tight money and that they have quantitatively important consequences. Finding 2: During nnild flight to quality episodes, funds flow toward banks. However, banks' safe haven status weakens for severe flights to quality, where only the safest assets experience Gatev and Strahan (2006) study the other side of banks' balance sheets. they find that when the spread between Treasury bills Inflows. In data for 1988-2002, and high grade commercial paper Increases, banks (but not other financial intermediaries) tend to experience inflows of deposits and a decreased cost of funding. This suggests that banks tend to be seen as safe havens in periods of turmoil. Gatev and Strahan attribute this advantage to implicit government backing and suggest that this why banks reasons U.S. for 1998, banks grew 2.5% in the flights shift their toward banks. Nontransactional deposits the second half of the year, whereas they had grown 5.2% CD in toward banks rather than from banks. however, show a very small Furthermore, although LIBOR and widened one of the are better placed than other institutions to offer liquidity insurance. At least sample, flights to quality seem to have been The data is in the in first half. rates decreased, their spreads with respect to Treasury rates substantially, as did other indicators of risk such as the VIX. Overall, the evidence suggests that flight to quality also involved a worsening in the relative position of banks compared to the very safest assets. As the figures show, however, the episode both spreads and the VIX were within a normal range. was very short lived. By the end of the year 6.5 LIBOR 3 month CD 3 month CP rate ^^^ 3 month Treasury V. 5.5 4.5 3.5 Jan98 Jan98 Mar 98 Apr 98 May 98 Jun 98 Figure 1. After the Russian default ttiere Jul98 was a decrease Aug98Sep98 Oct98 Nov 98 Dec 98 in interest rates, Jan 99 including interest rates paid by banks on CDs and LIBOR Figure term 2. AAA The "TED spread" increased, as did bonds. There was tiie some degree of flight spread on high grade commercial paper and on long to guality even within the safest assets. This lasted a very short time. 50 •VIX 45 40 35 30 0) 25 20 Russian default 15 10 5 Jan98 Jan98 Mar98 Apr98 May98 Jun98 Figure 3. Aug 98 Sep98 Oct98 Nov98 Dec98 Jan99 Jul98 Other indicators of risl(, such as the VIX, increased sharply but briefly. Both stock market crashes and large reallocation of funds towards bonds are Finding 3: increases the likelihood of the other. The US bond market also serves as a safe but each rare, haven for international equity market crashes. Both Bemanke et. al. times and use the expression in and Gatev and Strahan study long data "flight to quality" in studies of systematic, the availability of financing for different kinds of firms. they describe constitutes a flight to quality in environment use. Other studies, looking that explicitly refers to crashes in stock more extreme the bond and bond markets between but not necessarily large, shifts not clear, however, that the in than quantities, have focused on a definition G5 countries (between 1987 and 1999) tend flight once every 30 different markets at these phenomenon that observers of the current financial to quality a crash as pattern, years). an episode where there They whether to occur with stock market crashes is stock prices (estimated to occur once every 39 years) or a drop of prices (estimated to occur "normal" events. Hartmann, Straetmans, and de Vries (2004) study accompanied by bond market booms. They define in It is same sense at prices rather simultaneously or instead tend to follow a more than 20% series that include mostly find evidence of a weekly drop of more than 8% in strengthened linkages extreme values, but these are approximately just as likely to go in either direction, especially likely i.e. co-crashes are approximately as frequent as flights to quality. Flight to quality toward the US bond market: it is estimated that 4.6% of US, 7.9% of German, 7.7% of French, 8.3% of UK, and 3.0% of Japanese stock market crashes boom coincide with a will lower, reflecting the greater perceived safety and liquidity of for short identifiable events) the correlation and this this as was especially the case evidence of a in much US bonds. Gonzalo and Olmo (2005) find a It is the Asian find evidence that during crises periods (defined by crisis of 1997 and the Russian flight to quality effect. Overall, this literature news there is of 1998. They interpret crisis tends to confirm the view that often a flight from risky assets like in stocks to less bonds. worth emphasizing that, unlike to quality have not generally been the typical emerging markets experience, accompanied by generalized in flights accompanied the stock market crash of 1987, net foreign inflows increased from 0.16% to 0.22% of US GDP; increased from 0.31% to 0.38%, and Finding 4: Flight to quality is in in the brief in capital flights, indeed, case that non-residents are net purchasers of government bonds quality that of distress, but only between stock and bond markets becomes stronger and negative, periods of uncertainty or distress or bad risky assets like US bond is between stock returns and bond returns during periods term bonds. Baur and Lucey (2008) in booms markets. The likelihood of stock market crashes coinciding with non-US bond market similar negative association is it to quality. into the U.S. flights the In flight to US government bonds before the Gulf war flight to quality usually the is 1990, they in 1998 from 0.06% to 0.15%^ perceptible even across nearly equivalent assets. Stocks and bonds are coarse categories of assets and there is what can be learned by a limit to studying asset prices at that level of aggregation. Several studies have studied the behavior of narrowly defined assets order to determine exactly what happens during in more flights to quality. Longstaff (2004) studied the spreads between bonds issued by Refcorp and comparable US Treasury bonds. Refcorp is a US government agency whose risk in its liabilities is liabilities are guaranteed by the Treasury, so legally the credit identical to that in Treasury bonds. Nevertheless, the yield on average between 1991 and 2001, between 10 and 16 on Refcorp bonds was, on Treasury bonds basis points higher than (depending on maturity). This difference accounted for as much as 10% to 15% of the value of Treasuries. Longstaff labels this spread a flight-to-liquidity premium. a series of time-varying associated with (a) ^ measures of investor sentiment. He finds that increases drops market mutual funds He then regresses in consumer confidence, (since these are The comparisons are are the against the third quarter and last one the amount the premium are of funds held of the safer asset classes, an inflow of funds 3 quarters of 1987 2"" half of (b) increases in in premium on this in money- presumably against the previous 3 quarters; the last quarter of 1990 1998 against the l" half respectively, in all cases seasonally adjusted. and indicates a flight to quality") their premium tends (c) Treasury buy-backs (since these make Treasury bonds more scarce, when comparing to increase). Krishnamurthy (2002) finds similar results the yields on on-the-run and off-the-run Treasury bonds. He finds that higher spreads on off-the-run bonds are associated with higher spreads between commercial paper and Treasuries. Finding 5: The relative importance of liquidity over credit quality rises during flight to quality episodes. In both of these studies the authors identify premia that increase be associated with credit quality but rather with and hence closely related it and Kavajecz (2008) address direct measures of the it is liquidity are that investors seek. Beber, Brandt, question by taking advantage of the fact that the credit quality and this bonds from different Euro-area countries have liquidity of times of distress but do not seem to Of course, credit quality and liquidity. hard to determine exactly what is in credit quality of different countries a slight negative correlation.^ They have from spreads on credit default swaps and construct measures of liquidity on the basis of data on bid-ask spreads and the depth of limit order books. They find that both credit quality and liquidity are significant determinants of bond yields. normal times, credit quality plays a greater VSTOXX options index), or when order flows), the importance of Overall, the evidence premium on role; however, at times of uncertainty measured by the there are flights into or out of the bond market (as measured by net liquidity for explaining the cross-sectional variation of yields increases. from these studies suggests that at times of uncertainty, investors place a assets that are not just safe but have very low transaction costs. Finding 6: The macroeconomic cost of recent flight to quality episodes although (as In this may well be the result of aggressive in the U.S. has been limited, and successful policy responses. Asset pricing evidence indicates that from investors' point of view the possibility of flights to quality is a real concern. From a policy point of episodes lead to consequences part due to the may be in what constitutes associated with either a drop in the evidence is to what extent these tentative at best, toward firms with more solid in a flight to quality. Conceivably, a flight to quality less balance sheets. Bernanke, Gertler, and Gilchrist (1996) in this direction, but the magnitude of the efficiency due to misallocated investment cannot be ascertained. In the turmoil that followed the Russian default and the collapse of 1998, the U.S. This statement ^' this point is aggregate investment or a redirection of investment toward and related studies contain suggestive evidence losses On the real economy. difficulty in defining risky projects or view the more important concern economy did not credit qualities. to suffer greatly. Real may have become outdated For instance, Italian bonds are I seem among GDP grew since Longstaff' s paper the most liquid in was at LTCM in the summer an annualized rate of 3.6% of in written. Europe despite the fact that Italy has one of the lowest '.'<: ' the first half of resilience, 1998 and 5.4% in the second half, investment at 7.2% and 9.8% respectively. This however, may be due to the relative brevity of the scare. As shown back within a normal range by the end of the year after a sharp spike increased their volume of loans by 5.0% half), in haven status of the What do in U.S. as a these findings tell in 2, spreads were September. Furthermore, banks issues of corporate debt economy. The Fed's aggressive easing by 75 basis points to 4.75% Figure the second half of the year (compared to 3.9% which partly compensated the decrease credit to the real in in of the second half of 1998) monetary may whole further lowered the cost of in the first and preserved the flow of policy (the target rate was lowered also have played a role. Finally, the safe capital. and nature of the current crisis ? us about the severity The current episode has many of the features of previous flights to quality. Firstly, there have been sharp and opposite movements of bond and stock markets. The S&P 500 index was 27% lower than in June 2007, while the Lehman Brothers Aggregate bond index was more than 10% higher. This the kind of co-movement studied by Hartmann with the pattern of previous episodes monetary policy) has led to sharp (in drops 1 et. al. (2004), albeit at a lower frequency. In is keeping particular 1998), investors' flight to safe assets (plus the Fed's in yields. LIBOR 3 month CD rate ----3 month CP 3 month Treasury Mar 07 Dec 06 Figure 4. Jun07 Safe interest rates have gone down also noted flight in to quality is JunOS Sep 08 since the beginning of the current turmoil in the 2007, as they did The Mar 08 Dec 07 Sep 07 in summer of 1998. evident even within traditionally very safe asset classes. This feature previous episodes but its magnitude and persistence is far greater this time. was LIBOR spreads over Treasuries have been between 100 and 200 basis points for most of the past year, reaching peal<s of 280 basis points that only lasted a flight in September. In 1998 the peak spread was approximately 160 basis points and even few days. The force of the flight from banks towards banks. This may yet translate into the especially if real the credit channels identified by Bernanke is proving stronger than the force of the economy et. al. in a way that (1996) react strongly. was not seen in 1998, "•i:i| '>.> 400 LIBOR spread 350 3 (b.p.) month CP spread (b.p.) - -— - AAA 30-year spread 300 (b.p) 250 o °- 200 150 100 50 Dec 06 Figure 5. Mar 07 Jun07 Sep 07 Dec 07 Mar 08 JunOS Sep 08 Spreads between Treasuries yields and other safe assets have remained persistently high for over a year. i The VIX index, which was more than much more threefold since then. It at comparatively low levels at the beginning of 2007, has increased has not reached the peak levels of 1998 but the increase has been persistent, evidence of a lasting pullout from volatility. 70 •VIX 60 50 40 X u •a c 30 20 10 Mar07 Dec 06 Figure Jun07 6. Dec 07 Sep 07 MarOS JunOS Sep 08 The VIX index has also remained high for over a year. Theory A number of authors have attributed the existence of flights to quality to various institutional features of financial markets, which lead to feedback effects between asset prices and investors' preference for liquidity. Proposition 1: When asset price volatility rises, illiquidity risk rises and this feeds back into an increase in effective risk aversion. Vayanos (2004) presents times of market a increase in there one safe asset and many is stochastic process. The volatility, risky assets. The volatility of premia illiquidity flight to quality. In the risky assets is itself may the model, an exogenous each carries a different (exogenous and constant) assumed to be fund managers whose incentives are governed by the fee they are paid. This is proportional to assets under management liquidated, to the liquidation value of the fund (the fund will be liquidated fixed threshold, as clients and risk which are precisely the features of a risky assets are illiquid in that transaction cost. Investors are management model that may explain why both withdraw their money). When market volatility is if or, if performance low, the fund falls is below a managers are not very concerned with withdrawals and therefore do not care about each asset's transaction when the volatility of the market is high, the probability that the fund's threshold increases. This brings two effects. value of each asset, so illiquidity First, cost. However, falls below the performance managers place greater weight on the premia increase. Secondly, each liquidation risky asset's contribution to and likelihood of the fund's liquidation increases, so effective risk aversion increases risk the premia increase. Proposition 2: Agency problems specialists' capital is Building on pro-cyclical amount of limit the and hence Holmstrom and uninformed investors can bear, which means risk triggers flight to quality during severe contractions. Tirole's (1997) analysis of the role of intermediary capital in connecting uninformed investors to projects. He and Krishnamurthy (2008) study a model related to that of Vayanos. While the latter takes the fact that that poorly performing fund managers will face withdrawals as a given feature of the environment, they instead model the relationship between investment managers and investors skills explicitly. In their model, investment in a risky provided by a specialist. Both specialists and uninformed investors contribute capital to an how much each intermediary institution (such as a bank) and write contracts that govern as a function of the return on the investment portfolio, which two asset requires specific limits to what the is managed by the investors can get the specialist to do on their behalf. First, to exert effort, which lowers expected returns. To motivate effort, investors must specialists a function of realized returns. chosen by the specialist (i.e. what fraction a portfolio balance that optimizes his party receives There are specialist. the specialist may fail make the payment to Second, investors cannot monitor the portfolio composition is own invested in the risky asset). Hence the specialist desired exposure to market upper bound on the proportion of aggregate risk risk. will choose These two forces place an that non-specialist investors can bear: If they wish to increase their exposure to risk they must persuade the specialist to increase the riskiness of the portfolio by reducing sensitivity of from shirking places his a limit payments to on how much they can do such that specialists are willing to bear wealth there will this where intermediary theory focuses on how why this. minimum be a negative relation between the model offers a rationale as to periods realized returns; however, the need to prevent the Therefore the equilibrium price of proportion; since specialists' capital risk aversion and the price of is specialist risk will decreasing risky assets. in Thus effective risk aversion (and therefore risk premia) increases in institutions have suffered delegation of investment losses. In common management may with Vayanos (2004), this create flight to quality patterns asset prices at times of distress. By modeling the structure of the agency relationship explicitly. Krishnamurthy highlight the role of be in He and specialists' capital. Proposition 3: The tightening of margin requirements during periods of high price volatility reinforces flight to quality, as funds are reallocated from more to less volatile assets. Krishnamurthy (2008) explores a play a role in flights to quality. In his model there are two (perhaps a bank) issues a claim at an (limited) liquid funds. pays a fair price; if If channel by which intermediaries' capital slightly different Initial layers of intermediation. date and commits to repurchase few investors request repurchasing, the bank's instead funds of the bank. Investors many ask for repurchasing, the price The feedback mechanism works as follows: Since in try to resell the asset to the bank. Since funds are sufficient and governed by the amount of meet margin some will that the inefficient equilibrium here is work through market model by Brunnermeier and Pedersen in supply and decrease in the Thus they will like failure. Diamond and The difference know the fundamental (2008). In demand and prices. it, Margin requirements play speculators buy and their own value of the assets and therefore overall riskiness value at may risk. Crucially, financiers fundamentals. Furthermore, this implies that liquidity flights to quality will Proposition 4: When risk) as an liquidity spirals as and prices deviate more from occur since the assets that are least be subject to lower margin requirements, and therefore their prices fundamentals at times of do not misinterpret price deviations from and thus increase margin requirements. This may lead to margins means that speculators cannot provide as much volatile will sell risky thus providing liquidity to asset fundamentals (which would lead to arbitrage opportunities for speculators and thus reduce rising is keeping prices close to fundamental values). Speculators have limited capital and borrow from financiers who set margin constraints to control in liquid not triggered by fear of what others are doing but by institutional smoothing temporary imbalances increase it lower the equilibrium price of the features of models of bank runs features, in particular margin requirements that (i.e. a constraints. Dybvig (1983), such as the possibility of multiple equilibria due to coordination markets its the asset to a fixed multiple of their the bank has limited funds, this of the asset even further. The model has assets, intermediary from investors using hedge funds are leveraged, price of the asset will necessitate a decrease in their holdings to a similar role in the first the bank are the second intermediaries (perhaps hedge funds) and they in are subject to margin constraints that limit their investment equity. is liquid it The may will be closer to illiquidity. marl<ets are relatively new, they are subject to Knightian uncertainty. This uncertainty has the potential to explain the extreme withdrawal fron) risk-sharing during severe flight to quality episodes. A second class of "Knightian" uncertainty. In models of resort to decision make rules when based on a distinction between argument goes, market participants that seek to optimize worst-case-scenario outcomes, with flights to quality. cash and have to decide is and Krishnamurthy (2008) model how They study an economy where to risk and lack the precise probabilistic judgments about future events. Instead, they destabilizing aggregate consequences. Caballero behavior affects quality certain circumstances, the information or experience to may flights to consume it. identical agents The economy may be hit have an this possibly form of endowment of by liquidity shocks, whereby some agents have a sudden need for cash. Conditional on a first (aggregate) liquidity shock, there is a probability that a second shock, affecting the agents spared by the first shock, also takes place. Agents write insurance contracts that dictate transfers of cash to by either a first shock or a second shock. The efficient allocation against being hit by the event. likely market If one another first shock than against being hit agents knew the probabilities of being is the event of one of thenn by the second, simply because hit be either shock, this shocks but have Knightian uncertainty about whether they be will in is first by the hit in a more probabilities of in outcome, which the second wave, and are not willing to commit enough of their capital to insuring those wave. There first is or second wave. Thus free insurance market they seek to insure themselves against the worst possible being this the allocation a free know aggregate the thus an inefficient is flight to quality: hit is more insured such that agents are insurance would produce. By assumption, however, agents in in a is hit Out of fear of being part of a second wave of shocks, agents prefer to hoard the safest asset (cash) instead of offering insurance contracts against first wave shock, which as a result, they are underinsured against. Put differently, private liquidity freezes too soon. Brock and Manski (2008) also study the role of Knightian uncertainty in a model of a market for Lenders must decide what fraction of their assets to allocate to loans and what fraction to a risky loans. safe asset. At some point there is an unexpected shock that lenders do not know rules following the possible decision how to interpret. Three shock are considered: a standard one where lenders place subjective probabilities on the possibility of repayment; one where they seek to maximize their payoffs under the worst possible repayment scenario (maxmin), and one where they minimize the maximum possible regret from their decision (minmax-regret). show the to quality effect (increases flight amount equilibrium A question is what in In contractual interest rates on loans and decreases of loans) can be greater under the left calibrated numerical examples, they maxmin liquidity shocks. Caballero the in or minmax-regret criteria. open by theories that appeal to Knightian uncertainty to explain max-min decision making by investors exactly triggers robust or that in flights to quality response to aggregate and Krishnamurthy (2008) argue that unfamiliar contexts, often related to recent financial innovation, are prone to this kind of behavior. As an example, they contrast the market's reaction to the demise of same in 1998 to its reaction to the losses suffered by Central's default is in 1970 to their reaction to Mercury Finance's default Evidence on the overall relevance of Knightian uncertainty Wang in 2006. In the in 1997. In each case the that market participants' increased familiarity, with the operations of hedge funds and with commercial paper respectively, accounts for the calm with which the and Amaranth Krischnamurthy (2008) contrasts the reaction of commercial paper investors to Penn line, argument LTCM (2005). They prices far better than find that a model allowing one with pure of-the-money put options. in financial markets for uncertainty aversion risk aversion. In particular, it latter fits is event was received. provided by Liu, Pan, the evidence on option accounts for the premium on far-out- When markets Proposition 5: turn illiquid develops and this leads to strategic One important is and important players become power constrained, pricing exacerbation. illiquidity feature of the Knightian uncertainty nnodel of Caballero and Krishnamurty (2008) that market participants to pool their liquid assets efficiently, hoarding fail them in fear of worst-case scenarios instead of insuring each other against intermediately-bad shocks. Acharya, Gromb, and Yorulmazer (2008) provide an alternative explanation for the specific context of the interbank loan market, stemming from failure of private liquid coinsurance banks exercising monopoly power may over banks that have liquidity needs. They model a bank (bank A) which needs cash and either of two ways. One enough stake must retain a large of assets. Alternatively, its raise more cash specificity by borrowing from a liquid bank (bank is since in its A does B); there sell some of its obtain a limit to this is asset portfolio to have incentives to engage bank A may simply it in because A costly monitoring in assets to bank B; by assumption, this can not need to retain a stake; however, the assets have varying degrees of and B cannot obtain as much value from them as A would. Under perfect competition, interbank borrowing would always be the preferred option and asset sales would only be used maximum cash that can be raised by borrowing were insufficient to meet A's cash needs, some degree sales. the in of monopoly power, the only way The mechanism in to transfer value from the paper resembles a flight to quality A to B is if the if instead B has through inefficient asset that banks hoard liquidity rather than in lend to each other. However, they do so for opportunistic and strategic rather than precautionary One reasons. of the reasons for the current high rates observed in the interbank loan market may be that they are not being set competitively as liquid banks speculate with the possibility of purchasing assets at distress prices. Brunnermeier and Pedersen (2005) also explore strategic considerations and show how they may lead to "predatory trading" during a flight to quality. They model a situation known (to a limited The market number for this asset impact on the price. is of speculators) that a trader needs to liquidate his position not perfectly meaning that the distressed liquid, The optimal reaction by the informed speculators is order to profit from buying in exacerbate the problem. if his wealth falls price, forcing risk speculators back at a lower price know a given threshold, the prices of some they may try to risky illiquid assets flights to quality episodes. While the specifics are different, in that a given trader may asset. to trade in the down same direction the price of the Furthermore, margin constraints will become provoke fall some this may distressed and need to sell down the by selling to drive later. This may explain why in a more sharply than one would expect considerations alone. The various theories of element later. the trader into distress and profiting from buying back flight to quality, based on below If it in becomes it trader's sales will have an as the distressed trader as fast as possible (attempting to "front run"), driving asset where all the theories is suggest several mechanisms that can be at play some common themes emerge. an actual or feared weakness in In particular, a the balance sheet of in these common some market participants, who by eitiier tlieir specialized sl<ill or information play a key role the determination of in many asset prices, risk premia, or the allocation of funds. This observation informs recommendations that the theories have of the policy inspired. Policy Walter Bagehot famously argued be ready not only to keep others. security it in 1873 that in a panic "the holders of the cash reserve must advance for their ow/n liabilities, but to They must lend to merchants, to minor bankers, to is good." A Principle 1: l<ey What do modern is to "issue a guarantee" be acted upon aggressively, even private sector about asset values if the government has way that it prices. A a lender or a (at least certain kinds of) when in clear agreem.ent with similar effect can be achieved by public purchases of illiquid assets. would prevent bank is information than the less Bagehot's a fair price, eliminating the equilibrium with mis-coordination market maker of last resort runs. Similarly, Brock, could allay the fears that lead investors to act government extreme flight Krishnamurthy's (2008) model, a loan to intermediaries would enable them to In bank acting as either that man,' w/henever the . honor their promise to purchase assets at and depressed man and to tlie private sector tliat The implications of the models discussed above are recommendations. freely for the liabilities of theories have to add to or subtract from this recommendation? aspect of intervention to quality events will 'this most it investment. A in would prevent the with this last approach is is a that not subject to the kind of uncertainty faced by the private sector. private investors are being excessively prudent central the same and Manski (2008) argue that the government max-min fashion by guaranteeing difficulty fire sales in A minimum it return on assumes that the In practice, determining not to ascertain.. Caballero and Krishnamurthy (2008) consider a form of intervention that can be useful even the government is not better informed than the private sector. because agents, fearful of being other against a first hit is model, the inefficiency arises by a second liquidity shock, are excessively unwilling to insure each shock and prefer to hoard form of intervention In their If liquidity rather to provide insurance against a second agents to insure each other against a first than pool wave it. They show that the optimal of shocks, which persuades private shock. By acting as a lender of truly last resort, the central bank may help overcome private banks' reluctance to act as each other's lenders of "intermediate resort." crisis A practical difficulty with implementing this policy is how that the private sector should be encouraged to deal with on warrant intervention. to distinguish intermediately severe its own with true catastrophes that moral hazard concerns are important for regulatory purposes but Principle 2: Conventional so for less interventions during crises. A major concern, known moral hazard. If financial firms expect to receive an incentive to take on excessive of excess investment illiquid the days of Bagehot and studied extensively since, in risk. assets. in illiquid This risk Due to emergency financing should they require may take the form of excessive leverage or, the issue of it, they have more subtly, arbitrageurs' limited resources, each firm that has to assets depresses prices for everyone else, but does not take this effect into account decision making. This concern institutions. The current one of the is rationales for the may be a case for subjecting are imposed on banks, such as limits on leverage and (2008) argues and may in this direction, in its has highlighted that these externalities can be created by institutions crisis asset markets, there sell prudential regulation of financial other than commercial banks, such as hedge funds. Given their prominent role many is them in supplying liquidity to to the kinds of prudential regulations that minimum requirements. Krishnamurthy liquidity cautioning however that these regulations necessarily be a blunt tool will distort decisions in the (usual) non-crisis states of the world. when Referring back back to Caballero and Krishnamurthy (2008), prevalent, the main problem is too aggressive use of private liquidity little is a once a crisis is private risk taking, positive rather than a negative highlights an important policy concern. While a source of trouble, much not too it is true that excessive reached, the greater concern is risk Knightian uncertainty and hence inducing a is more development. Their model taking prior to the crisis insufficient risk taking can be and public support can encourage rather than prevent desirable private sector behavior. Principle 3: In the presence of speculative and predatory behavior, there intervention tools, including equity support and shortselling If the worry order. Acharya, is is space for a wide range of constraints. about opportunistic or speculative behavior, several possible Gromb, and Yorulmazer (2008) point out that if policies may be monopolistic behavior by liquid banks in is make what prevents the smooth functioning of interbank markets, a central loans to troubled banks could improve their outside option bargaining, leading to less inefficient asset sales without the need to ever disburse emergency by predatory traders, as in in the list may prove useful. on shortselling give some support to financial institutions was If instead the concern is willing to about front running Brunnermeier and Pedersen's (2005) model, unorthodox measures trading halts or limits on shortselling restrictions loans. in bank that stood The share price responses to recently this idea. Interestingly, when like announced shortselling of several restricted last July, the share prices of other financial institutions not included reacted similarly to those that were included. This is probably partly due to the fact that the were aimed shortselling constraints at stabilizing the core of the financial system, which maximizes positive feedbacl<s/ •Restricted July 15 Not restricted July 15 S&P500 80 3 60 I 40 20 ni l-Jun-08 l-Aug-08 l-Jul-08 l-Sep-08 were announced on July 15 and announcement was met by a sharp increase in share prices, but for the companies included in the restricted list and for other financial companies (the graph shows the averages of the companies incuded in the ban and that of the five largest financial companies not included in the ban). The reintroduction of a wider ban on September 19 was also accompanied by a Figure were in Restrictions 7. on short-selling place until August 12. The sliares in certain financial firms initial sharp We close with a brief discussion of important implementation issues which are not well covered by existing theories but rather by only occasional Conjecture without ^ rise. 1: The "political politicians. This hints. tempo" of intervention is significantly slower than that implied by the models negotiated delay exacerbates uncertainty and flight to quality. See also Caballero (1999) for a discussion of the value of equity market interventions Kong's stock market intervention to fight a speculative attack during the Asian crisis in the in the context of Hong late 1990s. The models assume that the conditions under which the government would intervene can be precisely formulated ex-ante taken by a political and are well understood by market participants. In practice, decisions are how the costs and benefits of intervention process that among are to be allocated subject to disputes about is distressed firms, other market participants, and taxpayers. The process therefore subject to both delays and uncertainty about outcomes. This flight to quality since measures that could be might not calm investors' fears An important if sufficient if is it harder to defuse a they were promptly and credibly announced they do not know when, whether, or quality of any intervention policy may make is how they will be implemented. the promptness and predictability of political its implementation process. Conjecture 2: Agents learn within a crisis, which raises the intervention threshold as time goes by. Unfamiliar conditions, financial instruments, or events are particularly susceptible to flights to quality. However, what unfamiliar at the beginning of a is may crisis rapidly become familiar. Many market participants were caught unaware by the collapse of Bear Sterns, whereas the collapse of Lehman Brothers was more widely anticipated. progressively better, their assessment of risks should on worst-case scenarios diminished. If this is so, market participants understand the situation If become more firmly grounded and their reliance then private co-insurance should gradually take precedence over public insurance, and the threshold for intervention should become increasingly demanding. Conjecture 3: Conventional lender of last resort interventions are insufficient once capital constraints become binding. A lender of last resort is useful when financial institutions from either meeting firm facing a If institutions run. instead the from taking on risk, main usefulness of lending of availability of cash form of intervention is the binding constraint that prevents their obligations or extending credit, as binding constraint is then traditional lending of last resort in this context of a traditional bank run. To the extent that this this is is is may be that insufficient capital last resort will to reduce not the main one risk the case with a prevents financial not be able to relax particular source of this. risk, the The risk that investors are worried about, of limited usefulness. Conjecture 4: Whether intervention should be done through asset buybacl<s or direct equity injections depends on which market is experiencing the largest distortions. Intervention should be designed to achieve the greatest possible impact per dollar. If there is confidence that certain assets held by financial institutions are significantly undervalued, then limited asset buybacks can (i) sustain asset prices, allowing financial institutions to escape the rigors of mark-to- ri',' 1,; market accounting at fire-sale prices; (ii) deliver a profit to (or an indirect way of recapitalizing them; and possible in (iii) ensure a linnit the losses of) financial institutions, profit for taxpayers. This, is only the cases of securities that are significantly undervalued, which creates a sufficiently large wedge between current valuations and fair prices to allow for profits for both the seller and the taxpayer. The behavior of liquidity premia during flights to quality suggests that this the most however, illiquid securities, including Assessing identify obviously fair values of new and may be the case for untried ones. illiquid securities is a considerable practical challenge. If it is hard to undervalued assets, direct equity injections are a more straightforward approach. This policy simultaneously capitalizes financial institutions (see, e.g., Caballero 1999). and most likely yields a high return to taxpayers References Acharya, Denis Gromb, and Tanju Yorulnnazer. Imperfect Competition o Viral V. Market for Liquidity. o Dirk Baur o IMS, April An Empirical Analysis of Stock- 2006. from the Euro-area bond market. Review of Financial Studies 2008 Ben Bernanke, Mark Quality. Thie o Flight-to-quality or contagion? Alessandro Beber, Michael W. Brandt, and Kenneth A. Kavajecz. Flight-to-quality or Flight-to- Liquidity? Evidence o the Inter-Bank Working Paper, London Business School, 2008. and Brian M. Lucey. Bond Correlations. in Gertler, and Simon Gilchrist. The and the Financial Accelerator Flight to Review of Economics and Statistics, 78(1):1-15, February 1996. and Charles Willian A. Brock F. Manski. Competitive Lending w/ith Partial Knowledge of Loan Repayment. Working paper. University of Wisconsin, 2008. o Markus K. Brunnermeier and Lasse H. Pedersen. Predatory Trading. Tlie Journal of Finance, 60(4):1825-1863, 2005. o Markus Brunnermeier and Lasse K. H. Pedersen. Market Liquidity and Funding Liquidity. Review of Financial Studies, forthcoming, 2008. An Update. Mimeo, MIT, o Ricardo J. Caballero. Stock Market Interventions: o Ricardo J. Caballero and Arvind Krishnamurthy. Collective Risk July 1999. Management in a Flight to Quality Episode. Journal of Finance, Forthcoming, 2008. o Douglas, W. Diamond, and Philip H. Dybvig. Bank Runs, Deposit Insurance, and Liquidity. Journal of Political Economy, 91(3): 401-419, June 1983. o Evan Gatev and Philip E. Strahan. Banks' Advantage in Hedging Liquidity Risk: Theory and Evidence from the Commercial Paper Market. The Journal of Finance, 61(2):867-892, 2006. o Jesus Gonzalo Universidad Carlos o P. III, Hartmann, and Jose Olmo. Contagion versus Departamento de Economia, S. Flight to Quality in Financial Markets. April 2005. Straetmans, and C.G. Vries. Asset Market Linkages in Crisis Periods. Review of Economics and Statistics, 86(l):313-326, 2004. o Zhiguo He and Arvind Krishnamurthy. A Model of Capital and Crises. Working paper. Northwestern University, 2008. o Bengt Holmstrbm and Jean Tirole. Financial Intermediation, Loanable Funds, and the Real Sector. The Quarterly Journal of Economics, 112(3): 663-691, August 1997. o Anil K. Kashyap, Jeremy C. Stein, and David W. Wilcox. Monetary Policy and Credit Conditions: Evidence from the Composition of External Finance. American Economic Review, 83(1):78- 98, March 1993. o Arvind Krishnamurthy. Amplification Mechanisms in Liquidity Crises. Working paper. Northwestern University, 2008. o William W. Lang and Leonard I. Nakamura. Flight to Quality in Banking and Economic Activity. Journal of Monetary Economics, 36(1):145-164, 1995. o Jun Liu, Jun Pan, and Tan Wang. An Equilibrium Model of Rare-Event Premia and for Option Smirks. o its Implication Review of Financial Studies, 18(1):131-164, 2005. Francis A. Longstaff. The Flight-to-Liquldlty Premium in US Treasury Bond Prices. and the Pricing of Risk. The Journal of Business, 77(3):511-526, 2004. o DImltri Vayanos. Flight to Quality, Flight to Liquidity, Paper, 2004. NBER Working