Estimation of moment-based models with latent variables work in progress

advertisement

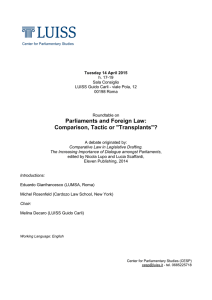

Estimation of moment-based models with latent variables work in progress Ra¤aella Giacomini and Giuseppe Ragusa UCL/Cemmap and UCI/Luiss UPenn, 5/4/2010 Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 1 / 35 Dynamic latent variables in macroeconomic models E.g., time-varying parameters, structural shocks, stochastic volatility etc. Typical parametric setting: X T = (X1 , ..., XT ) = (Y T , Z T ), Y T observable, Z T latent Joint density p (X , θ 0 ) = p (Y T jZ T , θ 0 )p (Z T , θ 0 ) =) estimation of θ 0 based on integrated likelihood b θ = arg max θ Z p (Y T jZ T , θ )p (Z T , θ )dZ T Integrated likelihood computed by state-space methods Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 2 / 35 Existing state-space methods State equation ! p (Z T , θ ) known in closed form Observation equation ! p (Y T jZ T , θ ) "…ltering" density known in closed form (e.g. Kalman …lter) or easy to simulate Integral can be computed by MCMC methods Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 3 / 35 State-space methods for limited information models? We consider the following scenario: p (Z T , θ ) known ! state equation same as before p (Y T jZ T , θ ) unknown. Only information about θ is in the form of (non-linear) moment conditions Et 1 [g (Yt , Zt , θ )] = 0 ! substitute observation equation with moment conditions Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 4 / 35 Applications. GMM with time-varying parameters Example #1. Time-varying "structural" parameters: E [g (Yt , βt )] = 0 βt = Φβt 1 + εt , εt iidN (0, Σ) E [ ] de…ned with respect to joint distribution of Yt and βt Want to estimate θ = (Φ, Σ) and sequence of "smoothed" βt Application: Cogley and Sbordone’s (2005) analysis of stability of structural parameters in a Calvo model of in‡ation Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 5 / 35 Applications. "Robust" stochastic volatility estimation Example #2. Yt = σt εt log σ2t = α + β log σ2t 1 + vt , vt iidN (0, 1) Existing estimation methods require distributional assumption on εt (typically N (0, 1)) Problem: does not capture "fat tails" of …nancial data =) include jumps or use fat-tailed distribution for εt (not as straightforward as in GARCH case) Our method is robust to misspeci…cation in distribution of εt Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 6 / 35 Applications. Nonlinear DSGE models Example #3. Prototypical DSGE model. Optimality conditions: Et 1 [m(Yt , St , Zt , β)] = 0 St = f (St Zt = ΦZt 1 , Yt , Zt , β ) 1 + εt , εt iidN (0, Σ) Want to estimate θ = ( β, Φ, Σ) Yt = observable variables St = endogenous latent variables Zt = exogenous latent variables m ( ) and f ( ) known Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 7 / 35 An and Schorfheide (2007) DSGE model In AS model, the endogenous latent variable equation has a simple form: St = f (Yt , Zt , β) (1) Can substitute St and rewrite the equilibrium conditions as Et Zt = ΦZt 1 [g (Yt , Zt , β)] = 0 1 + εt , εt iid N (0, Σ) Warning: not all DSGEs …t this framework Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 8 / 35 Existing approaches to estimation of DSGE models 1 2 Theory does not provide likelihood ! must use approximation methods Linearize around steady state (Smets and Wouters, 2003; Woodford, 2003) Solve the model to …nd policy functions Yt = h(St , Zt ) Construct likelihood by Kalman …lter 3 Nonlinear approximations (Fernandez-Villaverde and Rubio-Ramirez, 2005) Solve the model (numerically or analytically in the case of second order approximations around steady state) to …nd policy functions Construct likelihood by nonlinear state-space methods (e.g., particle …lter) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 9 / 35 Drawbacks of existing likelihood-based approaches 1 2 Linearization = possible loss of information (Fernandez-Villaverde and Rubio-Ramirez, 2005) Must impose structure to solve the model 1 2 3 Add "shocks"/measurement error to avoid stochastic singularity Restrict parameters to rule out indeterminacy (multiple rational expectations solutions) Nonlinear state-space methods computationally intensive (must solve the model for each parameter draw) =) so far mostly applied to simple models Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 10 / 35 Relationship with simulation-based method of moments GMM, SMM, EMM, Indirect inference (eg, Ruge-Murcia, 2010) Di¤erence: requires knowledge of p (Y T jZ T ) or focuses on moments of the type EY [g (Y , β)] = 0, (2) where g (Y , β) can be computed by simulation In our case, the model gives EY,Z [m (Y , Z , β)] = 0 =) can be written as (2) only if p (Z jY ) known Unlike these methods, we directly obtain estimates of the smoothed latent variables Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 11 / 35 The idea Propose methods for estimating non-linear moment-based models that "exploit" the information contained in the moment conditions Methods are: 1 2 Computationally convenient Classical or Bayesian Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 12 / 35 Key elements of methodology Recall problem we want to solve (e.g., classical framework) max θ Z p (Y T jZ T , θ ) p (Z T , θ )dZ T " unknown " known Two steps: 1 2 3 Approximate the unknown likelihood p (Y T jZ T , θ ) Integrate out the latent variables using classical or Bayesian methods For DSGEs: from an exact likelihood of the approximate model.... to an approximate likelihood of the exact model Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 13 / 35 Approximate likelihoods We consider two di¤erent approximation strategies Both use projection theory (for no latent variables, Kim (2002), Chernozhukov and Hong (2003), Ragusa (2009)): out of all probability measures satisfying the moment conditions, choose the one that minimizes the Kullback-Leibler information distance Method 1 does not require solving the model (but not applicable to models with dynamic latent endogenous variables) Method 2 applicable to all models but requires solution of (approximate) model Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 14 / 35 Approximate likelihoods - Method 1 Find density that satis…es moment conditions and minimizes distance from the true density: gives approximate likelihood exp e p (Y T jZ T , θ ) ∝ 1 0 g Y T , Z T , θ VT 1 Y T , Z T , θ gT Y T , Z T , θ 2 T gT Z T , θ VT Y T , Z T , θ 1 = p T T ∑ g (Yt , Zt , θ ) wt 1 t =1 = Var (gT Y T , Z T , θ ), wt Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables 1 instruments UPenn, 5/4/2010 15 / 35 Approximate likelihoods - Method 1 exp e p (Y T jZ T , θ ) ∝ 1 0 g Y T , Z T , θ VT 1 Y T , Z T , θ gT Y T , Z T , θ 2 T e p (Y T jZ T , θ ) is a simple transformation of the GMM objective function. Intuition: When (Z T , θ ) is consistent with the model gT Y T , Z T , θ 0 T T =) pe(Y jZ , θ ) close to max value of 1. When (Z T , θ ) is inconsistent with the moment conditions =) large values of gT0 Y T , Z T , θ VT 1 Y T , Z T , θ gT Y T , Z T , θ =) p e(Y T jZ T , θ ) 0. Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 16 / 35 Approximate likelihoods - Method 2 t t 1) Write p (Y T jZ T ) = ΠT t =1 p (Yt jZ , Y Choose approximate density b p (Yt jZ t , Y t 1 , θ ) (does not need to satisfy moment condition but easy to calculate) For DSGEs, e.g., linearize model around steady state and apply Kalman …lter =) b p (Yt jZ t , Y t 1 , θ ) are the …ltered densities Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 17 / 35 Approximate likelihoods - Method 2 "Tilt" b p (Yt jZ t , Y t 1 , θ ) towards moment condition Et 1 [g (Yt , Zt , θ )] = 0 , new density e p ( ) satis…es moment condition and minimizes Kullback Leibler distance from b p( ) : Solve problem: min h 2H Z Z s.t. log Z Z h(Yt jZ t , Y t 1 ) b p (Yt jZ t , Y t 1 , θ ) b p Yt jZ t , Y t g (Yt , Zt , θ )h(Yt jZ t , Y t Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables 1 1 , θ dYt dF Z t , )dYt dF (Zt ) = 0 UPenn, 5/4/2010 18 / 35 Approximate likelihoods - Method 2 Under regularity conditions the solution is where e p (Yt jZ t , Y t 1 , θ ) = exp fη t + λt g (Yt , Zt , θ )g b p (Yt jZ t , Y t (η t , λt ) = arg min η,λ Z 1 , θ) exp fη + λg (Yt , Zt , θ )g b p (Yt jZ t , Y t 1 , θ )dY λt = "weights for each moment condition"; η t = integration constant (η t , λt ) are functions of Z t , Y t 1 , θ Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 19 / 35 Approximate likelihoods - Method 2 e p (Yt jZ t , Y t 1 , θ) = exp fη t + λt g (Yt , Zt , θ )g b p (Yt jZ t , Y t 1 ,θ In practice, approximate integral and compute (η t , λt ) by simulating N times from b p (Yt jZ t , Y t 1 , θ ) =) (η t , λt ) = arg min η,λ 1 N N ∑ exp i =1 n (i ) η + λg Yt , Zt , θ o Well-behaved objective function =) for DSGEs, small additional computational cost relative to Kalman …lter (cf. particle …lter?) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 20 / 35 The two methods in a simple case No latent variables, Y T = (Y1 , ..., YT ) mean µ0 , variance σ20 Moment condition identifying parameters are g1 (Yt , µ, σ2 ) = Yt g2 (Yt , µ, σ2 ) = Yt2 µ σ2 Method 1: b2 b, σ µ = arg max exp θ =(µ,σ2 ) 1 0 g Y T , θ VT 1 Y T , θ gT Y T , θ 2 T =) our estimator is same as GMM (Chernozhukov and Hong (2003)) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 21 / 35 The two methods in a simple case 2 Method 2: Start from n pdf of N (µ, σo) : 1 µ)2 and "tilt it" towards b p (Yt ) = p 1 exp 2σ (Yt 2πσ moment conditions 1 e p (Yt ) = exp η + λ1 (Yt µ) + λ2 Yt2 σ2 p e 2πσ µ0 µ λ1 = ; σ0 σ 1 1 λ2 = 2σ 2σ0 1 2 (Y t No tilting if µ = µ0 , σ2 = σ20 In this case e p (Yt ) N (µ0 , σ20 ) =) our estimator is the same as (Q)MLE Normality here is a special result - e p ( ) no longer normal if e.g., g ( ) non-linear Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 22 / 35 Step 2. Integrate out latent variables Classical estimation approach: solve b θ = max θ Z e p (Y T jZ T , θ )p (Z T , θ )dZ T using Jacquier, Johannes and Polson (2007) to compute integral here works well in our limited experience Bayesian estimation approach: assume prior for θ (and Z0 ), π (θ ) and calculate the approximate posterior e p (θ, Z T jY T ) ∝ e p (Y T jZ T , θ )p (Z T j θ ) π ( θ ) Integration of latent variables step is the same as previous literature Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 23 / 35 Econometric properties For method 2 (tilted density), can show that MLE based on approximate integrated likelihood e p (Y T , θ ) is consistent for θ = arg min θ Z log e p (Y T , θ ) p (Y T ) p (Y T )dY T θ = parameter that sets the approximate density that is consistent with the moment conditions as close as possible to true density In particular if moment condition uniquely identi…es parameter θ 0 , by construction θ = θ 0 Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 24 / 35 Econometric properties Back to simple example: Yt iid (µ0 , σ20 ), g (Yt , θ ) = (Yt µ, Yt2 σ2 ), initial density b p N (µ, σ2 ) If tilt towards both moments, approximate density e p N (µ0 , σ20 ) =) our estimator (=QMLE) consistent for true parameters What if tilt towards only one moment condition? E.g., only use g2 (Yt , θ ) = Yt2 σ2 =) p e N ( σ σ0 , σ20 ) Variance estimated consistently; mean not estimated consistently Suggests that not using moments can cause distortions =) need to understand tradeo¤s between too many/too few moments Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables µ UPenn, 5/4/2010 25 / 35 Econometric properties Hypothesis testing, model selection relatively straightforward for method 2 E.g., could test whether λ (or individual components) = 0 , understand importance of non-linearities in DSGE models Open issue: identi…cation (here assumed but challenging because of presence of latent variables + nonlinearity of moment conditions) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 26 / 35 Method 1 in a simple example Data-generating process Yt = .9Zt + vt iid N (0, 1) Zt = .9Zt 1 + εt iid N (0, 1) Moment condition E [Zt (Yt βZt )] = 0 Zt = ρZt 1 + εt g (Yt , Zt , β) = Zt (Yt βZt ) Priors: β U (0, 2), ρ U (0, 1), Z0 iid N (0, 1) N (0, 1 1 ), ρ2 T = 100 Use Jacquier et al. (2007) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 27 / 35 1.5 1.0 0.5 0.0 Density 2.0 2.5 3.0 Distribution of β −3 −2 −1 0 c(−2, −2) 1 2 3 6 4 2 0 Density 8 10 Distribution of ρ −1.0 −0.5 0.0 ρ 0.5 1.0 −6 Smoothed Probabilities ● ●● ● ● ● ● ● ● ●● −4 ●● ● ●●● ● ●● ● ● ●●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● x −2 ● ● ● ●● ●● ● ●● ● ● ●●●● ●● ● ●● ●●● ● ●● ● ● ● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ●● ● ● ● ●●● ● ●●● ● 0 ● ●● ● ● ● ● ● ● ● ● ● 2 ● ● ● ● ● ●● ●● ● ● ● ● ● ●● ●● ● ● ● ● ● ●● ●● ● ● ●● ● ● ● ● ● ●● ●● ● ● ● ● ●● ●● ●● ● ● ● ● ●● ● ● ● ●● Smoothed p(z|x) Actual z ● ● ● ● ● ● ● 4 ● 0 20 40 60 Time 80 100 Simulation: AS New Keynesian model 1 = βEt e 1 ν τĉt (e νφπ 2 1) = (e π̂t τ ĉt +1 +τ ĉt +R̂t ẑt +1 π̂ t +1 1) 1 1 π̂t 1 e + 2ν 2ν βE (e π̂t +1 e ĉt ŷt = e ĝt (3) φπ 2 π̂t (e 2 1) e (4) τ ĉt +1 +τ ĉt +ŷt +1 yˆt +π̂ t +1 1) 2 R̂t = ρr R̂t 1 + (1 ρr )ψ1 π̂ t + (1 ẑt = ρz ẑt 1 + σz εz,t ĝt = ρg ĝt 1 + σg εg ,t ρr )ψ2 (ŷt (5) ĝt ) + σR εR ,t(6) ε’s independent N (0, 1) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 28 / 35 AS New Keynesian model Observable variables: Yt = (Xt , π t , Rt )0 (output, in‡ation and interest rate), where Xt = γ(Q ) + 100(ŷt ŷt 1 + ẑt ) π t = π (A) + 400π̂ t Rt = π (A) + r (A) + 4γ(Q ) + 400R̂t . ŷt , R̂t , π̂ t = deviation from steady state Endogenous latent variable: St = b ct = deviation from steady state of consumption Exogenous latent variables: Zt = (b zt , gbt )0 = technology and government spending Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 29 / 35 AS model in compact form (4) implies expression for St as a function of Yt and Zt =) substitute into moment conditions Write policy rule as moment conditions Choose instruments to transform Et [ ] into E [ ] Write model as E [g (Yt +1 , Yt , Zt +1 , Zt , θ )] = 0 Zt = ρz 0 0 ρg Zt 1 + εt , εt iidN 0 0 , σ2z 0 0 σ2g g ( ) is 11 1, θ = (τ, ν, φ, 1/g, ψ1 , ψ2 , ρR , σR , π (A) , γ(Q ) , r (A) , ρz , ρg , σz , σg ) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 30 / 35 AS model posterior Approximate posterior e p (θ, Z T jY T ) ∝ exp 1 0 gT Y T , Z T , θ VT 1 Y T , Z T , θ gT Y 2 T ∏ p(zt jzt t =1 T 1, θ) ∏ p(gt jgt t =1 1 , γ )p (z0 , g0 j γ ) z0 and g0 drawn from their stationary distributions Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 31 / 35 Simulation exercise Same DGP as AS: Generate a time series (T = 80) from a second order approximation to the model Parameters and priors as in AS Compare posteriors for θ obtained by our method to those in AS (both linear and nonlinear solution methods) Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 32 / 35 AS estimation results Draws from priors and posteriors for parameters π (A ) , γ (Q ) , r (A ) , ρ z , ρ g , σ z , σ g Red lines = true parameter values Estimation time: 100,000 MCMC draws 6 days Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 33 / 35 72 Figure 17: Posterior Draws: Linear versus Quadratic Approximation II Linear/Kalman Posterior 1 0.8 0.8 0.8 0.6 γ(Q) 1 0.6 0.6 0.4 0.4 0.4 0.2 0.2 0.2 0 2 4 0 6 2 4 0 6 6 6 6 5 5 5 π(A) 7 (A) 7 4 4 3 3 2 2 2 1 1 2 0 1 r(A) 1 2 1.4 1.2 1.2 1.2 0.8 0.8 0.6 0.6 0.6 0.4 0.4 0.4 1.5 0.2 0.5 1 ρg 0.2 0.5 6 6 5 4 4 4 σz 5 3 3 2 2 1 1 1 0.005 σg Notes: See Figure 16. 0.01 0 0 0.005 σg 0.01 x 10 3 2 0 1.5 −3 x 10 5 0 1 ρg −3 x 10 σz σz 1.5 ρg −3 6 2 1 ρz ρz 1 z 1 1 1 r(A) 1.4 0.2 0.5 0 r(A) 1.4 0.8 6 4 3 1 4 π(A) 7 0 2 π(A) π π(A) π(A) ρ Quadratic/Particle Posterior 1 γ(Q) γ (Q) Prior 0 0 0.005 σg 0.01 72 Figure 17: Posterior Draws: Linear versus Quadratic Approximation II Linear/Kalman Posterior 1 0.8 0.8 0.8 0.6 γ(Q) 1 0.6 0.6 0.4 0.4 0.4 0.2 0.2 0.2 0 2 4 0 6 2 4 0 6 6 6 6 5 5 5 π(A) 7 (A) 7 4 4 3 3 2 2 2 1 1 2 0 1 r(A) 1 2 1.4 1.2 1.2 1.2 0.8 0.8 0.6 0.6 0.6 0.4 0.4 0.4 1.5 0.2 0.5 1 ρg 0.2 0.5 6 6 5 4 4 4 σz 5 3 3 2 2 1 1 1 0.005 σg Notes: See Figure 16. 0.01 0 0 0.005 σg 0.01 x 10 3 2 0 1.5 −3 x 10 5 0 1 ρg −3 x 10 σz σz 1.5 ρg −3 6 2 1 ρz ρz 1 z 1 1 1 r(A) 1.4 0.2 0.5 0 r(A) 1.4 0.8 6 4 3 1 4 π(A) 7 0 2 π(A) π π(A) π(A) ρ Quadratic/Particle Posterior 1 γ(Q) γ (Q) Prior 0 0 0.005 σg 0.01 Our estimation results Draws from priors and posteriors for parameters π (A ) , γ (Q ) , r (A ) , ρ z , ρ g , σ z , σ g Red lines = true parameter values Estimation time: 2 million MCMC draws 4-5 hours Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 34 / 35 1.0 ● ● ● ● 0.8 ● ● ● ● ● ● ● ● ●● ●● ●● ● ●● ● ●● ● ● ● ●●● ● ● ● ● ● ● ● ● ●● ● 2 ● 3 ● ●● ● ● ● ● 4 ( ) 5 π ●A ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 6 ● ● ● ● ● ● ● 0.4 1 ● ● 0.2 0.0 ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ●● ● ● ●● ● ● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ● ●● ● ●●● ● ● ● ● ● ● ● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ● ● ● ● ●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ●● ● ● ● ●● ● ●● ● ● ● ● ● ●● ● ● ● ● ● ●● ●● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ●● ●● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ● ●● ● ● ● ●● ● ● ● ● ● ●● ● ● ● ● ●● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● 0.6 ●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● 0.4 ● ● ● ● ● ●● ● ● 0.2 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● 0.0 0.6 ● ●● ● ● ● ● ● ●● ● γ(Q) ● ●● ●●● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ●● ●● ● ●● ●● ● ● ● ● ● ● ●● ●● ● ● ● ● ● ●● ●● ● ● ● ● ●● ● ● ● ● ● ● ● ●● ●● ● ●● ●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● ● ●●● ● ● ● ●● ● ● ● ● ● ● ● ● ●● ●● ● ● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●●●● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ●●● ●● ● ●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●●● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ●● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●● ●● ● ● ●● ● ●● ● ● ● ● ● γ(Q) ● ● ● ● ● 0.8 ● ● ● 7 1 2 3 ● 4 (A) 5 6 7 π ● ● ● ● ● ● ● ● 7 7 ● ● ●● ● ● 2 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ● 1 1.0 ● 6 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 1.2 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 1 ● ● ● ● ● 3 3 ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ●●● ● ●●●●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ●● ●● ● ● ●● ●● ● ● ●●● ●● ●● ●● ●● ● ● ● ● ● ● ● ● ●● ● ●● ●● ● ●● ● ● ●●● ● ● ●● ●● ●●●●●● ●●● ● ●● ● ● ● ● ●●● ● ● ●● ● ●● ● ● ●● ● ● ● ● ●● ● ● ● ● ● ● ●● ● ●● ● ●●● ●● ● ● ● ●● ● ●● ●● ● ● ● ● ● ● ● ● ●●●●●● ●● ● ● ●● ● ●● ● ● ● ● ● ●● ● ●● ● ●● ●● ●● ●● ● ● ● ● ● ● ● ●● ●● ● ● ● ● ● ●● ● ● ● ●● ● ● ●● ● ● ●● ● ● ●● ●● ●●● ● ●●● ●●●● ●●● ● ●● ● ●● ● ●● ● ● ● ●● ●● ●● ● ● ●● ● ● ● ● ●● ● ●● ● ●●● ● ●● ● ● ● ● ● ● ●●● ● ● ●● ●● ● ● ● ● ●●● ● ● ● ●● ● ● ● ● ●●● ● ● ● ●● ● ● ● ●● ●● ●● ●● ● ●● ● ●●● ●● ● ●●● ● ●● ● ●● ● ● ● ●● ● ●● ●●● ● ● ● ●● ● ●● ● ● ● ●● ● ● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● ● ●● ● ●● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 4 ● ● ● ● ● 4 ● ● ● ● ● ● ● ● ● π(A) ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●● ● ● π(A) 5 ● ● ● ● ● ● ● ● ● ● ● ● 5 ● ● ● ● ● ● ● ● ● ● 6 ● ● ● ● 2 ● ● ● ● ● Posteriors 1.0 Priors ● 1.4 r(A) 1.6 ● 1.8 2.0 1.0 1.2 1.4 r(A) 1.6 1.8 2.0 Priors Posteriors 1.4 ● ● ● ● ● ●● ● ● ● ●● ●● ● ●●● ● ●● ● ● ● ● ● ● ● ●● ●●●● ●●● ● ● ● ● ●● ● ●● ●● ● ●●● ● ●● ●●● ● ● ● ●● ● ●● ● ●● ● ● ● ● ●● ● ●● ● ● ● ● ● ● ●●● ●●●● ●● ●● ●● ● ● ● ● ●●● ● ● ●●● ●● ● ● ●● ●● ●●● ● ● ● ● ● ●●●● ● ● ● ● ● ●●● ● ● ● ●●● ●● ● ● ●● ● ●●● ● ●●● ● ●●● ● ● ● ● ●● ●● ●● ● ● ● ●● ● ● ● ●● ●●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●●● ●● ● ● ●●●●● ● ● ● ● ●●● ● ●● ●●● ● ●● ●● ● ● ● ● ●●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● ●● ● ● ●● ● ●● ●●● ● ●● ●● ● ●● ● ● ●● ●● ●● ● ●● ● ●●● ● ● ● ● ● ●●● ● ● ●● ● ● ● ● ●● ● ● ● ●● ●● ●● ● ● ● ● ● ●● ●● ●● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●●● ●● ● ● ● ●●● ● ● ●● ●●●● ● ●●●● ● ● ● ● ● ● ● ● ● ● ● ● ●●●●● ● ● ● ● ● ●● ● ● ● ● ●● ●● ● ● ● ● ● ● ●● ●● ● ● ● ●● ● ● ●● ● ●●● ●● ● ● ● ● ● ● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 0.6 0.8 ●● ● ● ● ● ● ● ● 1.2 ρg ● ● ● ● 1.0 ● rho_z ● ●● ● ●● ●● ● ● ●●●●●● ●● ● ●● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ●● ● ● ● ● ● ●● ● ●● ● ●● ● ● ● ● ● ● ● ●● ● ●● ●● ● ● ● ●● ● ●●●● ● ●●● ● ● ●● ● ● ●●● ● ●●● ● ●● ●● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ●●●● ● ●● ●● ●●● ● ●●● ●●●●● ●● ● ●● ●● ●● ● ●● ● ● ● ● ● ●● ●● ● ● ● ● ●●● ●●● ● ● ● ● ● ● ● ● ●● ●●● ● ● ●● ●●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●●● ●●● ●●● ●● ● ● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ●● ●● ● ●●● ● ●● ●● ●● ● ●● ● ●● ● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ●● ● ● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ●● ●● ● ●● ● ● ● 0.6 0.6 ● ● 0.4 ρz 0.8 ● ● 0.2 ● ● ●● ● 0.4 1.0 1.0 ● ● 0.2 1.2 1.2 ● 0.8 1.4 ● ● 1.4 0.6 0.8 1.0 1.2 1.4 rho_g ● ● ● ● ● ● ● 0.006 ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● ● ● ● ● ● ● ●●●● ● ● ● ●● ● ● ● ● ●●● ● ● ● ● ● ● ● ●● ● ●● ●●● ●●● ●● ● ● ● ● ● ● ● ● ● ● ● ●●● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ● ●● ●● ● ● ●● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●● ●●● ● ● ● ● ●● ●● ●● ● ● ● ● ● ● ● ●● ●● ● ● ●● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ●● ● ● ● ●●● ●● ● ● ● ● ● ● ●●● ● ● ● ● ● ●● ●● ● ● ●● ●●● ● ● ● ●● ● ● ● ●● ● ● ● ●● ● ● ●● ● ● ● ●● ●●●● ● ● ● ● ● ●● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ● ●● ● ●● ● ●●●● ●●● ● ● ● ●● ●● ● ●● ● ● ● ●●● ● ● ● ●● ●● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ●● ● ● ●● ● ● ● ●● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●●● ●●● ● ● ● ●●● ● ●●● ●● ● ●● ●●● ● ● ●●● ●● ● ● ● ● ●● ● ● ● ●● ● ● ●● ● ●● ● ● ● ● ● ● ● ● ● ● ●● ● ●● ● ● ● ● ●● ●● ● ● ● ●● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ●● ● ●● ● ● ●● ● ●● ● ●● ● ● ● ●●● ● ● ●●● ● ● ● ● ● ●● ●● ● ● ● ● ● ● ●● ●● ● ● ● ● ●● ● ● ● ● ● ● ●● ● ● ● ● ● ● ●● ● ● ● ● ●●● ● ●● ● ●● ● ● ● ●● ● ●● ●● ● ●● ● ● ●● ● ● ● ● ● ●● ●●●● ● ●● ●●● ● ● ● ●● ●● ● ●● ●● ● ● ●● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ●● ● ● ● ●●● ● ● ●● ● ● ● ●●● ● ● ● ● ● ● ● ● ● ● ●● ● 0.003 ● sigma_z ● 0.005 ● ● ● ● 0.004 ● ● ● ● ● ● ● ●● ● ● 0.002 0.004 ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● 0.000 ● ● ● ● ● 0.000 σz 0.003 ● ● ● ● ● ● 0.002 ●● ●● ● ● 0.001 0.006 0.005 ● ● ● ● ● ● ● ● ● ● ● 0.001 ● ● ●● ● ● 0.000 0.002 0.004 0.006 σz 0.008 0.010 0.000 0.002 0.004 0.006 sigma_g 0.008 0.010 Conclusion Two new methods for estimating structural parameters in moment-based models that depend on dynamic latent variables Projection-based approximate likelihoods that satisfy the moment conditions Marries the computational convenience of MCMC in high-dimensional problems with the ability of GMM to handle nonlinear moment conditions Directly delivers "smoothed" latent variables Potential for estimating realistic models and understanding importance of non-linearities Giacomini and Ragusa (UCL/Cemmap and UCI/Luiss) Moments and latent variables UPenn, 5/4/2010 35 / 35