Using a Life-Cycle Model to Predict Induced Entry Effects

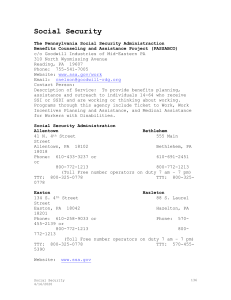

advertisement