INTERNAL CONTROLS OVER FINANCIAL REPORTING

advertisement

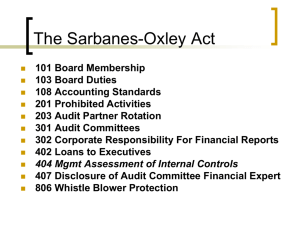

INTERNAL CONTROLS OVER FINANCIAL REPORTING Many stakeholders acknowledge that it’s not just the accuracy of the numbers that is important; now, organizations also must prove their internal controls in the financial reporting process are effective. Evaluating ICOFR begins with a clear definition of internal controls, and the COSO definition (Committee of Sponsoring Organizations) is the most widely-used definition in the world. COSO has been written into the ICOFR regulations in many countries as the model, or framework, of internal controls you must use. To comply with ICOFR regulations, an organization must understand the financial reporting process, the COSO internal control framework, how to identify the most important financial reporting risks, and how to test both the manual and automated financial reporting controls to be sure they work on a continuing basis. Understand and apply a structured and systematic approach to ICOFR Identify the roles and responsibilities of the participants in the ICOFR process Implement an ICOFR program Prepare a documented and supported Statement of Assurance on ICOFR Coordinate ICOFR requirements with performance and accountability reporting and other related requirements Management, Finance & Accounting Staff and potential ICOFR project team leaders from the organizations that are required to report on ICOFR Module 1: Introduction To ICOFR Module 2: The COSO Framework Module 3: Other Frameworks & Guidelines Module 4: Plan & Scope The Evaluation Module 5: Document Controls Module 6: Evaluate Design and Operating Effectiveness Module 7: Identify and correct deficiencies Module 8: Report On Internal Control If you have any enquiries, please contact +60 (3) 56213630 or email: info@comfori.com