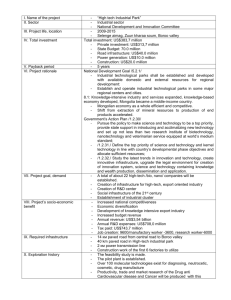

HIGH-TECH CAPITAL FORMATION AND

advertisement