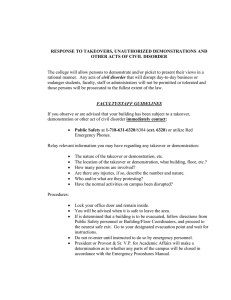

EVOLUTION OF AUSTRALIAN TAKEOVER LEGISLATION

advertisement