THE UNIFORMITY OF TAXATION PENALTIES IN AUSTRALIA

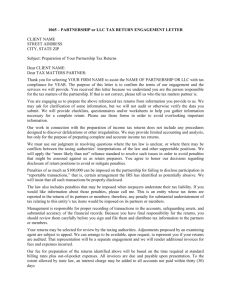

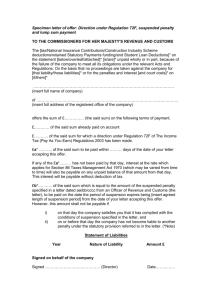

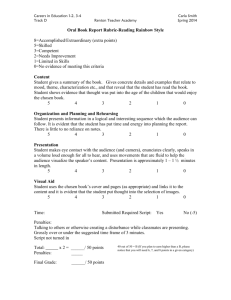

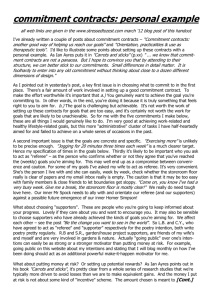

advertisement