Document 11243433

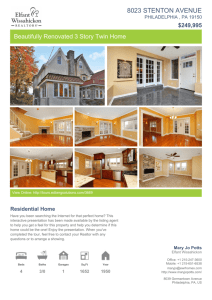

advertisement