outh E X C h A N G E

advertisement

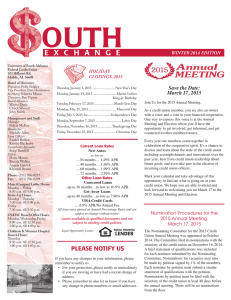

outh E X C H A N G E University of South Alabama Federal Credit Union 103 Hillcrest Rd. Mobile, AL 36608 Board of Directors: President, Polly Stokley Vice President, Pam Henderson Secretary, Scherita Mixon Treasurer, Ben Tipton Board Members Wayne Davis Chuck Warnol John Smith Management and Staff: Manager Felicia McKee Assistant Manager Jessica Dickson Bookkeeper Michele Allen Loan Officers Sandra Bolden Kristin Blackerby Compliance Specialist Stacy Barnhill Tellers Brenda Walker Angela Garrick Khyrstal Brown Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday – Friday 8:00 a.m. till 5:00 p.m. Drive-Up Hours: Monday - Thursday 7:30 a.m. till 5:00 p.m. Friday 7:30 a.m. till 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. Children’s & Women’s Hospital Branch Hours: Thursday 8:30 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. Pack up your supply list and head to your CU for a low-rate BACK TO SCHOOL LOAN Short On School Funds? Here’s Help Does it seem as though that school supply list is growing longer? That’s because it is. As schools cut their budgets, parents are picking up the cost for more items, for example, tissues and hand sanitizer. According to the website teacherlists. com, the average number of items on supply lists rose to 18 in 2014, a 29 percent increase from the previous year. It’s likely that trend will continue in 2015. Add the expenses for electronics, shoes, clothing, plus fees for sports and extracurricular activities, and it’s easy to understand how backto-school spending now ranks second only to holiday shopping. If that’s putting a strain on your cash flow, the credit union can help. A 12 month loan from the credit union may save you money because instead of using a high-interest-rate charge card you can pay cash for your purchases. Paying cash can help you stick to your budget, too. So before it’s time to head back-to-school, head to the credit union. Call, click or stop by. 7 Safety Tips for Mobile Branch Users Mobile Our mobile app means your credit Banking union account is just a few taps Safety away. Just don’t sacrifice safety for Tips the convenience. Here are seven tips to stay safe: 1. Password protect your phone or tablet to restrict access. 2. Keep track of your device and avoid leaving it unattended; enable the time-out or auto-lock feature. 3. Don’t stay logged into your account. 4. Avoid doing business from an unsecured WiFi network, such as those in coffee shops or hotel lobbies. You are vulnerable to scammers who may be able to access your personal information. 5. Don’t send account numbers or other sensitive information through regular e-mails or text messages. 6. Carefully and frequently monitor your accounts to detect any unauthorized activity. 7. If your mobile device is lost or stolen, contact the credit union immediately. Equal Opportunity Lender. Equal Housing LENDER SUMMER 2015 EDITION Don’t Dump your CREDIT or you could get a 1099C Be Creditwise What Can Happen When You Leave Debt Behind? If you’re thinking your debt is so large you can’t possibly pay it back, take note. Even if you are able to negotiate a debt cancellation with the credit union or other lender, you may not be out of the woods. You may be facing a huge tax bill. Certain exceptions apply, but if you receive a Form 1099-C, “Cancellation of Debt,” you must report the amount on that form to the Internal Revenue Service as taxable income. According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. Why? The IRS classifies any debt cancellation as income because you received a payment you didn’t return. When you first got a loan, you didn’t pay any tax on the money you received because you signed a contract to pay it back. But once the contract is gone, the money is yours to do with as you please. Basically, you received income for free. And, as everyone knows, there is no free lunch. So Uncle Sam wants his share. Common examples of when you would receive Form 1099-C include credit card default, repossession, foreclosure, return of property to a lender, abandonment of property, or the modification of a loan on your principal residence. Certain exceptions and exclusions apply; see your tax advisor for details. But first, if you are in over your head, contact the credit union to explore all of your options. Doris Martin has retired after 20 years of dedicated service at the credit union. We wish her all the best in her retirement. We will miss you, Doris! STATEMENT OF FINANCIAL CONDITION As of April 30, 2015 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS Liabilities & Equity: Liabilities (Payables) Member Deposits: Certificates of Deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 10,635,743.79 26,681,723.30 46,899.12 666,036.64 96,939.22 $38,127,342.07 82,087.78 2,813,867.81 4,584,440.99 1,357,012.59 387,314.01 24,997,226.64 336,491.99 3,568,900.26 $38,127,342.07 The credit union wishes everyone a safe 4th of July. Protect yourself against ID THEFT during your summer travels Protect Yourself Against ID Theft During Summer Travel Summer, it’s a time to take that long deserved vacation after months of cold and snowy weather. It’s also a time for identity thieves to take advantage of vacationers. Stop Those Calls The National Do Not Call Registry, ran by the federal government, allows you to restrict telemarketing calls permanently by registering your phone number(s). You can register at https://www.donotcall. gov or by calling 1-888-382-1222. Most telemarketers should not call your number once it has been on the registry for 31 days. Both your home and mobile phone numbers can be registered for free. If you still receive calls, you can file a complaint at https://www.donotcall.gov. 8.9% Annual Percentage Rate No Annual Fees Pick up a USAFCU VISA credit card application at your nearest branch and start enjoying your lower rate today! Credit cards available to qualified borrowers; all loans subject to existing credit policies. Credit card rate quoted as annual percentage rate. Holiday Closings, 2015 Friday, July 3, 2015.................................Independence Day Monday, September 7, 2015............................... Labor Day Thursday, November 26, 2015..................Thanksgiving Day Thursday, December 24, 2015.......................Close at 1 p.m. Friday, December 25, 2015.......................... Christmas Day Thursday, December 31, 2015.......................Close at 1 p.m. Friday, January 1, 2016................................ New Year’s Day Your credit union wants you to enjoy your travels and keep your identity protected by sharing some tips: * Keep your travel plans and photos off social media until you return home. Also, turn off all location tracking to your smart phones and social media accounts. When you share information about leaving for a trip away from home, you’re giving ID thieves an open invitation. * Place a hold on your mail or have a neighbor pick up your mail and packages. * Be careful using wireless Internet connections when it comes to financial or credit card information. Most public Wi-Fi networks are not secure and if your information is unencrypted during transmission, it can be intercepted. Use your cell phone’s carrier service instead. * Limit the amount of credit cards you bring on your trip and instead of using debit, use credit when making a purchase. This detours prying eyes from getting your PIN number. * If you need cash from an ATM machine, go to one inside since you’re in an unfamiliar place and not aware of your surroundings. If at all possible, use cash or get travelers checks from your credit union. * Keep all your receipts and travel information until you get home, then shred what is not needed. * When you return home, monitor your financial statements for a while to make sure no fraudulent activity has occurred. Bon voyage and enjoy your summer travels! The Last Word For every up there is a down, for every frown there is a smile, for every night there is a day and for every problem, there is a way.