(c) crown copyright Catalogue Reference:CAB/129/122 Image Reference:0012

advertisement

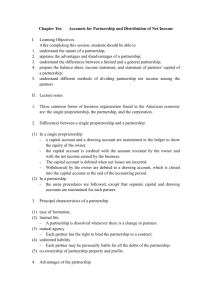

(c) crown copyright Catalogue Reference:CAB/129/122 Image Reference:0012 HIS D O C U M E N T I S T H E P R O P E R T Y O F H E R B R I T A N N I C M A J E S T Y ' S C.(65) 112 23rd July, GOVERNMENT) COPY NO. 59 1965 CABINET EARNINGS-RELATED SHORT-TERM 3ENEFITS M e m o r a n d u m b y t h e M i n i s t e r of P e n s i o n s a n d National Insurance PART I - INTRODUCTORY In F e b r u a r y I w a s i n v i t e d t o s u b m i t t o the S o c i a l S e r v i c e s C o m m i t t e e p r o p o s a l s f o r a n i n t e r m s c h e m e of e a r n i n g s - r e l a t e d s h o r t ­ t e r m b e n e f i t s w h i c h c o u l d b e b r o u g h t i n t o o p e r a t i o n b y t h e A u t u m n of 1 9 6 6 i n a d v a n c e of t h e g e n e r a l r e v i e w of t h e n a t i o n a l i n s u r a n c e scheme. T h e s e p r o p o s a l s have been under consideration by the Social S e r v i c e s S u b - C o m m i t t e e on Social S e c u r i t y C a s h Benefits and a l t h o u g h d i s c u s s i o n s a r e c o n t i n u i n g o n m a t t e r s of d e t a i l t h e s t a g e h a s n o w b e e n r e a c h e d w h e r e i t i s b o t h p o s s i b l e a n d , i n v i e w of t h e t i m e f a c t o r , e s s e n t i a l f o r m e t o s e e k t h e a u t h o r i t y of t h e C a b i n e t t o p r o c e e d w i t h t h e t y p e of s c h e m e w h i c h , i n t h e l i g h t of t h e S u b - C o m m i t t e e ' s discussion, I now propose. 2. T h e m a i n f e a t u r e s of t h e p r o p o s e d s c h e m e , w h i c h w o u l d sickness as well as unemployment, a r e : ­ ( i ) ( i i ) cover e a r n i n g s - r e l a t e d s u p p l e m e n t s w o u l d b e a t t h e r a t e of o n e t h i r d of a v e r a g e w e e k l y e a r n i n g s b e t w e e n £ 9 a n d £ 3 0 ( p a r a g r a p h 10) j the s u p p l e m e n t s would be paid in addition to t h e p e r s o n a l benefit and dependency allowances payable u n d e r the flat­ r a t e s c h e m e u p t o a l i m i t of 85 p e r c e n t of g r o s s e a r n i n g s ( p a r a g r a p h 10); ( i i i ) a v e r a g e weekly e a r n i n g s would be the g r o s s e a r n i n g s a s s e s s a b l e t o P . A. Y. E . t a x in t h e t a x y e a r p r e c e d i n g t h e c l a i m t o b e n e f i t d i v i d e d by 50 ( p a r a g r a p h 13); ( i v ) n o a l l o w a n c e s w o u l d b e m a d e f o r i n t e r r u p t i o n s of e a r n i n g s in the r e l e v a n t t a x y e a r ( p a r a g r a p h 14); ( v ) t h e m a x i m u m d u r a t i o n of e a r n i n g s - r e l a t e d s u p p l e m e n t s w o u l d b e s i x m o n t h s ; f o r t h i s p u r p o s e s p e l l s of s i c k n e s s and u n e m p l o y m e n t s e p a r a t e d by l e s s t h a n t h i r t e e n w e e k s would be a g g r e g a t e d ( p a r a g r a p h 15); ( v i ) t h e r e would be twelve " a b s o l u t e " waiting days for e a r n i n g s - r e l a t e d s u p p l e m e n t s ( p a r a g r a p h 16); -1­ ( v i i ) contracted-out e m p l o y e e s , and their e m p l o y e r s , would be liable for graduated contributions for pensions and s h o r t ­ t e r m benefits at the s a m e r a t e s as everyone else and their c o n t r a c t e d - o u t s t a t u s would in f u t u r e be r e c o g n i s e d by an a b a t e m e n t of t h e i r f l a t - r a t e c o n t r i b u t i o n s a n d r e t i r e m e n t p e n s i o n ( p a r a g r a p h 23) j ( v i i i ) t h e m i n i m u m c o s t of t h e s c h e m e i n c l u d i n g a d m i n i s t r a t i o n c o s t s w o u l d b e of t h e o r d e r of £ 5 0 m i l l i o n ( p a r a g r a p h 2 4 ) ; ( i x ) (x) the s c h e m e would be financed by additional graduated c o n t r i b u t i o n s b u t t h e p r o c e e d s of t h e f l a t - r a t e a b a t e m e n t plan for the c o n t r a c t e d - o u t would be applied to r e d u c e flat-rate contributions ( p a r a g r a p h 26); a b o u t 2 , 0 0 0 e x t r a s t a f f m a y b e n e e d e d i n t h e M i n i s t r y of P e n s i o n s and N a t i o n a l I n s u r a n c e and about 800 in t h e M i n i s t r y of L a b o u r ( p a r a g r a p h 2 7 ) . P A R T II - A I M S A N D A S S U M P T I O N S General 3. T h e s e p r o p o s a l s m u s t b e j u d g e d by r e f e r e n c e to c e r t a i n f u n d a m e n t a l c o n s i d e r a t i o n s of p o l i c y . We m a d e it c l e a r in o u r E l e c t i o n M a n i f e s t o t h a t the r a t e a t w h i c h w e could c a r r y out i m p r o v e ­ m e n t s i n s o c i a l s e c u r i t y w o u l d h a v e t o d e p e n d o n t h e p r o g r e s s of t h e economy. The need to keep additional expenditure to the m i n i m u m c o n s i s t e n t w i t h t h e p r o v i s i o n of a n a c c e p t a b l e a n d w o r t h w h i l e s c h e m e i s b o r n e o u t i n t h e p r e s e n t p r o p o s a l s w h i c h f a l l s h o r t of t h o s e I s h o u l d have b e e n m a k i n g had the financial situation p e r m i t t e d m o r e r a d i c a l changes. T h e s c a l e of b e n e f i t i s n o b e t t e r t h a n t h a t u n d e r d i s c u s s i o n l a s t y e a r b y t h e p r e v i o u s G o v e r n m e n t w i t h b o t h s i d e s of i n d u s t r y a n d the p r o p o s a l s a s they now stand r e p r e s e n t in m y view the b a r e m i n i m u m for a worthwhile scheme. Timetable 4. If i t i s d e c i d e d t o g o a h e a d w i t h a n i n t e r i m s c h e m e f o r o p e r a t i o n f r o m t h e A u t u m n of 1 9 6 6 t h e r e i s o n l y j u s t e n o u g h t i m e available for the w o r k to b e done. The Bill would have to be p a s s e d b y t h e e n d of M a r c h 1 9 6 6 , n o t o n l y t o a l l o w t i m e f o r t h e s u b s e q u e n t s t a g e s ( r e g u l a t i o n - m a k i n g , p r e p a r a t i o n of w o r k i n g p r o c e d u r e s , p r i n t i n g , r e c r u i t m e n t a n d t r a i n i n g of s t a f f , e t c . ) b u t a l s o t o e n s u r e that e m p l o y e r s and e m p l o y e e s retain the tax documents relating to the i n c o m e tax y e a r 1965/66 which will be needed to support c l a i m s u n d e r t h e n e w s c h e m e w h e n it s t a r t s . T h e l e g i s l a t i o n w i l l b e complicated and P a r l i a m e n t a r y Counsel should be instructed as soon s s p o s s i b l e a f t e r t h e m a i n o u t l i n e of t h e s c h e m e h a s b e e n a p p r o v e d a n d c o n c u r r e n t l y w i t h t h e d i s c u s s i o n s a b o u t t h e b r o a d d e t a i l s of i t which I shall need to hold with the T r a d e s Union C o n g r e s s , T h e C o n f e d e r a t i o n of B r i t i s h I n d u s t r i e s a n d o t h e r i n t e r e s t e d b o d i e s . D e l a y i n a n y of t h e s e s t a g e s w o u l d p r e j u d i c e t h e c h a n c e of s t a r t i n g the s c h e m e in the following Autumn. -2­ The need for simplificatiqr^ 5. I a m c o n c e r n e d a b o u t t h e c o m p l e x i t y of t h e e x i s t i n g n a t i o n a l i n s u r a n c e s c h e m e , a n d t h e b u r d e n i t i m p o s e s o n t h e l o c a l o f f i c e r s of b o t h m y D e p a r t m e n t a n d t h e M i n i s t r y of L a b o u r , o n e m p l o y e r s a n d o n the general public. T h e i n t r o d u c t i o n of e a r n i n g s - r e l a t e d s h o r t - t e r m b e n e f i t s w i l l a d d t o t h e e x i s t i n g b u r d e n t h e t a s k of w o r k i n g o u t a p e r s o n a l benefit r a t e for e a c h c l a i m a n t b a s e d on hie individual earnings. Although the proposed s c h e m e m u s t inevitably cause e m p l o y e r s c o n s i d e r a b l e a d d i t i o n a l w o r k , it m a k e s t h e m i n i m u m p o s s i b l e d i s t u r b a n c e to t h e i r existing pay and r e c o r d a r r a n g e m e n t s . I feel this i s i m p o r t a n t , not only to avoid saddling e m p l o y e r s with a g o o d d e a l of a d d i t i o n a l c o s t f o r w o r k n o t d i r e c t l y r e l a t e d t o t h e i r b u s i n e s s , b u t a l s o b e c a u s e w e s h a l l n e e d t h e r e a d y c o - o p e r a t i o n of e m p l o y e r s to m a k e the s c h e m e w o r k at all. We c a n o n l y e x p e c t t h i s c o - o p e r a t i o n if w e c a n d e m o n s t r a t e t h a t w e h a v e d o n e o u r b e s t t o m i n i m i s e the a d d i t i o n a l b u r d e n s on t h e m . I m p l i c a t i o n s of e a r n i n g s - r e l a t e d benefits 6. M u c h of t h e c r i t i c i s m of f l a t - r a t e b e n e f i t s r e l a t e s t o t h e l e v e l of t h e p e r s o n a l r a t e of b e n e f i t ( a t p r e s e n t £ 4 ) i n r e l a t i o n t o t h e n e e d s of t h e h i g h e r - p a i d w o r k e r f a c e d w i t h a s u d d e n a.nd s u b s t a n t i a l d r o p i n income during unemployment or sickness. C r i t i c s of t h e p r e s e n t s c h e m e do not a l w a y s a p p r e c i a t e t h a t , for the l o w e r - p a i d w o r k e r w i t h a f a m i l y , f l a t - r a t e b e n e f i t a l r e a d y p r o v i d e s a h i g h p r o p o r t i o n of n o r m a l e a r n i n g s - at l e a s t a s high a s m o s t e a r n i n g s - r e l a t e d s c h e m e s in other c o u n t r i e s . F o r e x a m p l e , a m a r r i e d m a n with four c h i l d r e n who i s e a r n i n g £ 1 2 a week can get a national i n s u r a n c e weekly b e n e f i t ( e x c l u d i n g f a m i l y a l l o w a n c e s ) of £ 9 . , 1 6 s . - n e a r l y 9 0 p e r c e n t of h i s t a k e - h o m e p a y . C l e a r l y , the scope for giving additional help t o s u c h w o r k e r s i s l i m i t e d a n d t h e l a r g e r b e n e f i t s of t h e n e w s c h e m e m u s t inevitably go to t h o s e with r e l a t i v e l y high e a r n i n g s and relatively few family r e s p o n s i b i l i t i e s . T h i s s h i f t of e m p h a s i s i s i n s e p a r a b l e from e a r n i n g s - r e l a t i o n and the a i m m u s t be to strike a reasonable balance between the earnings-related element and the f a m i l y - r e l a t e d e l e m e n t in the t o t a l benefit. 7. Li t h e l o n g r u n , t h e a n s w e r m a y l i e i n r a d i c a l c h a n g e s i n t h e p r o v i s i o n v/e m a k e f o r c h i l d r e n t h r o u g h f a m i l y a l l o w a n c e s a n d i n c o m e tax so that m o r e help is given to the low w a g e - e a r n e r with a l a r g e family whether he is at w o r k or not. Such changes could not, h o w e v e r , be c o n t e m p l a t e d a s p a r t of a n i n t e r i m s c h e m e of e a r n i n g s ­ r e l a t e d s h o r t - t e r m benefits for o p e r a t i o n next y e a r , and the n e w s c h e m e h a s h a d t o be m a d e t o fit the e x i s t i n g s t r u c t u r e . T h e p r o b l e m of over-compensation 8. T o c r e a t e a s i t u a t i o n w h e r e l a r g e n u m b e r s of s i c k a n d u n e m p l o y e d p e o p l e c o u l d g e t a s m u c h , o r e v e n m o r e , b y w a y of n a t i o n a l i n s u r a n c e benefits a s they could get by w o r k i n g would b e highly undesirable. It w o u l d i n v i t e a b u s e a n d e x p o s e t h e s c h e m e t o ridicule. I n e x t r e m e c a s e s of l o w e a r n e r s w i t h v e r y l a r g e f a m i l i e s t h e f l a t - r a t e s c h e m e h a s a l r e a d y r e a c h e d t h e p o i n t of o v e r - c o m p e n s a ­ tion and m y c o l l e a g u e s and I v/ere all a.greed that the new s c h e m e , p a r t i c u l a r l y as it will be r e l a t e d to e a r n i n g s , m u s t not m a k e such a situation widespread. 9. I t w a s c l e a r f r o m t h e s t a r t t h a t i n t h e a b s e n c e of r a d i c a l c h a n g e s i n f a m i l y a l l o w a n c e s a s c h e m e s u c h a s p r o p o s e d i n "IMew F r o n t i e r s " , u n d e r which an e a r n i n g s - r e l a t e d stipplernent equal to o n e - q u a r t e r of a n i n d i v i d u a l s t o t a l e a r n i n g s w o u l d b e a d d e d t o h i s f l a t - r a t e b e n e f i t , would offend a g a i n s t t h i s p r i n c i p l e . We c o n s i d e r e d t h e p o s s i b i l i t y of e l i m i n a t i n g o r r e d u c i n g t h e w e e k l y a l l o w a n c e f o r a d e p e n d e n t w i f e of £ 2 . 1 0 s . a t p r e s e n t p a y a b l e u n d e r t h e f l a t - r a t e s c h e m e b u t c o n c l u d e d t h a t s u c h a r a d i c a l s h i f t of e m p h a s i s f r o m family r e s p o n s i b i l i t y to e a r n i n g s - r e l a t i o n would be politically unacceptable. I t h e r e f o r e find it n e c e s s a r y to p r o p o s e a s o m e w h a t l e s s g e n e r o u s s c a l e of e a r n i n g s - r e l a t e d b e n e f i t . Although this does not c r e a t e such a s e r i o u s o v e r - c o m p e n s a t i o n problem., s o m e financial incentive to get a job is obviously r e q u i r e d and it will still be n e c e s s a r y to i n c o r p o r a t e in the s c h e m e an o v e r - r i d i n g benefit m a x i m u m in o r d e r to e n s u r e that the e a r n i n g s - r e l a t e d supplement d o e s n o t b r i n g t o t a l b e n e f i t a b o v e s o m e t h i n g l i k e 9 0 p e r c e n t of t a k e ­ h o m e pay (that i s , g r o s s e a r n i n g s l e s s i n c o m e t a x and national insurance contributions). T h i s will not, h o w e v e r , affect the e x i s t i n g r i g h t s of t h o s e w h o c a n a l r e a d y g e t f l a t - r a t e b e n e f i t i n e x c e s s of 9 0 p e r c e n t of t a k e - h o m e p a y . PART H I - DETAILS OF THE P R O P O S E D The benefit SCHEME formula 10. Within the l i m i t s i m p o s e d by the c o n s i d e r a t i o n s r e f e r r e d to in t h e f i r s t p a r t of t h i s m e m o r a n d u m m y a i m h a s b e e n t o d e v i s e a benefit f o r m u l a which would give s o m e t h i n g like h a l f - p a y to t h e single m a n on a v e r a g e e a r n i n g s without p r o d u c i n g a n a c u t e o v e r ­ c o m p e n s a t i o n p r o b l e m for the l o w e r - p a i d and without giving the higher-paid a proportionately better benefit than the lower-paid. The f o r m u l a p r o p o s e d to m e e t this situation would give an e a r n i n g s ­ r e l a t e d s u p p l e m e n t of o n e - t h i r d of t h e a m o u n t of g r o s s e a r n i n g s between £ 9 and £30 subject to a ceiling where the total benefit (flat-rate p e r s o n a l benefit plus dependency allowances plus supplement) w o u l d o t h e r w i s e e x c e e d a b o u t 9 0 p e r c e n t of t a k e - h o m e p a y . (For p r a c t i c a l p u r p o s e s 9 0 p e r c e n t of t a k e - h o m e p a y c a n b e e x p r e s s e d a s 85 p e r c e n t of t h e g r o s s e a r n i n g s of t h o s e a f f e c t e d w h o p a y l i t t l e o r n o income tax. ) 11. F o r the single m a n on a v e r a g e e a r n i n g s t h i s f o r m u l a would p r o d u c e a t o t a l b e n e f i t of 5 1 p e r c e n t of t a k e - h o m e p a y . F o r the single m a n on h i g h e r or l o w e r e a r n i n g s the p r o p o r t i o n would not be significantly different. The m a r r i e d m a n with t h r e e c h i l d r e n would g e t a p r o p o r t i o n of t a k e - h o m e p a y r a n g i n g f r o m 9 0 p e r c e n t f o r t h e w o r k e r o n £ 1 2 a w e e k o r l e s s t o 65 p e r c e n t a t t h e e a r n i n g s m a x i m u m of £ 3 0 a w e e k . T h e e f f e c t of t h e b e n e f i t c e i l i n g w o u l d b e that the £ 1 2 a week w o r k e r with m o r e than t h r e e children would be limited to the r a t e a p p r o p r i a t e to the t h r e e - c h i l d family. A fuller r a n g e of e x a m p l e s i s g i v e n i n A p p e n d i x A . -4­ 12. T h e m i n i m u m of t h e r e c k o n a b l e e a r n i n g s r a n g e of £ 9 i s t h a t u s e d for contributions and benefits in the existing graduated pension scheme. T h e £ 1 3 m a x i m u m of t h e e a r n i n g s r a n g e u n d e r t h a t s c h e m e w o u l d n o t , h o w e v e r , p r o v i d e a n a c c e p t a b l e l e v e l of b e n e f i t for the higher-paid worker. Although it will p r o b a b l y be d e s i r a b l e eventually to have the s a m e m a x i m u m for both s h o r t - t e r m benefit and g r a d u a t e d p e n s i o n p u r p o s e s , I see no s e r i o u s difficulty in having a different m a x i m u m for the two s c h e m e s for the t i m e being. A £30 m a x i m u m w o u l d c o v e r i n f u l l t h e e a r n i n g s of w e l l o v e r 9 0 p e r c e n t of e m p l o y e d m e n a n d i s l i k e l y t o f i t i n w i t h l o n g - t e r m d e v e l o p m e n t s for pension. Reckonable Earnings 13. The e a r n i n g s which would count for benefit (and contributions) w o u l d b e t h e g r o s s e a r n i n g s a s s e s s a b l e t o P . A. Y. E . t a x , a s a l r e a d y d e f i n e d f o r t h e p u r p o s e of t h e g r a d u a t e d p e n s i o n s c h e m e . Benefit would be b a s e d on e a r n i n g s in t h e t a x y e a r p r e c e d i n g the c l a i m t o benefit. The benefit ceiling, w h e r e this applied, would a l s o be related to the s a m e earnings figure. I n r e c o g n i t i o n of t h e f a c t t h a t t h e c u r r e n t l e v e l of e a r n i n g s m a y b e s o m e w h a t h i g h e r , I p r o p o s e t h a t t h e a m o u n t of a v e r a g e w e e k l y e a r n i n g s s h o u l d b e a r r i v e d a t b y d i v i d i n g t h i s a n n u a l f i g u r e b y 5 0 r a t h e r t h a n 5 2 . 18 - e q u i v a l e n t t o about a 4 p e r cent r i s e in earnings. I should have liked to have been able to b a s e the benefit on e a r n i n g s in the t w e l v e m o n t h s p r e c e d i n g e a c h claim, for benefit but after studying t h e p o s s i b i l i t i e s in d e t a i l I a m convinced that the p r e v i o u s t a x y e a r is t h e only p r a c t i c a b l e reference period. My colleagues in the S u b - C o m m i t t e e support this view. A n y o t h e r b a s i s w o u l d c r e a t e a n e n o r m o u s a m o u n t of additional work for e m p l o y e r s without n e c e s s a r i l y producing better results. / 14. Only a c t u a l e a r n i n g s in the p r e v i o u s tax y e a r vould count for benefit. W h e r e e a r n i n g s a r e r e d u c e d by s i c k n e s s or u n e m p l o y m e n t ( o r a n y o t h e r i n t e r r u p t i o n of e a r n i n g s s u c h a s a b s e n c e a b r o a d o r i m p r i s o n m e n t ) t h i s w o u l d b e r e f l e c t e d i n a l o w e r r a t e of e a r n i n g s ­ related benefit. T h i s p r o p o s a l m a y d i s a p p o i n t s o m e of o u r supporters particularly as "New F r o n t i e r s " indicated that the scheme w o u l d m a k e a l l o w a n c e f o r w e e k s of s i c k n e s s a n d u n e m p l o y m e n t . T h e T . U. C . w i l l c e r t a i n l y p r e s s f o r t h i s . There are three powerful c o u n t e r - a r g u m e n t s : t h e f i r s t i s t h a t t h e p r i n c i p l e of d e e m i n g e a r n i n g s i s q u e s t i o n a b l e if i t m e a n s t h a t l o w w a g e - e a r n e r s i n r e g u l a r e m p l o y ­ m e n t h a v e to s u b s i d i s e t h o s e with h i g h e r i n c o m e s but a g r e a t e r r i s k of u n e m p l o y m e n t . Secondly, the flat-rate system under which c o n t r i b u t i o n s a r e c r e d i t e d f o r w e e k s of s i c k n e s s a n d u n e m p l o y m e n t w i l l c o n t i n u e t o p r o v i d e t h e b a s i c p r o t e c t i o n d u r i n g p e r i o d s of s i c k ­ n e s s and u n e m p l o y m e n t . T h i r d l y - a n d i n t h e c o n t e x t of a n i n t e r i m s c h e m e t h i s m u s t , I t h i n k , b e c o n c l u s i v e - a s y s t e m of a l l o w a n c e s f o r e a r n i n g s l o s t a s a r e s u l t of s i c k n e s s o r u n e m p l o y m e n t i n t h e relevant tax y e a r would be a complication involving considerable extra work. We shall have a c u t e difficulties in s o m e a r e a s in r e c r u i t i n g s u f f i c i e n t staff t o o p e r a t e e v e n t h e m o s t s t r a i g h t - f o r w a r d s c h e m e of e a r n i n g s - r e l a t e d b e n e f i t s b y t h e A u t u m n of 1 9 6 6 . I should be m o s t r e l u c t a n t to put the whole s c h e m e in j e o p a r d y for the s a k e of w h a t i s n o m o r e t h a n a r e f i n e m e n t of t h e b e n e f i t f o r m u l a h o w e v e r d e s i r a b l e i t m i g h t b e if t i m e a n d r e s o u r c e s w e r e n o t a t a premium. E v e n t u a l l y , w i t h t h e i n c r e a s i n g u s e of c o m p u t e r s i n m y D e p a r t m e n t , it m a y b e p o s s i b l e to c o p e with t h e a d d i t i o n a l v/ork involved should this be thought d e s i r a b l e . D u r a t i o n of e a r n i n g s - r e l a t e d benefit 15. E a r n i n g s - r e l a t e d benefit would be paid for up to six m o n t h s i n a " p e r i o d of i n t e r r u p t i o n of e m p l o y m e n t " (a p e r i o d w h i c h c o v e r s a n y s p e l l s of s i c k n e s s o r u n e m p l o y m e n t s e p a r a t e d b y l e s s t h a n 13 v/eeks). S i c k n e s s and u n e m p l o y m e n t would b e a g g r e g a t e d for this p u r p o s e s o t h a t t h e r e v/ould b e n o a d v a n t a g e t o b e g a i n e d f r o m d r a w i n g one benefit r a t h e r than the o t h e r . It w a s s u g g e s t e d i n " N e w F r o n t i e r s " t h a t w a g e - r e l a t e d b e n e f i t s s h o u l d c o v e r t h e f i r s t y e a r of absence from work. However,ray colleagues and I thought that a s i x ­ m o n t h period would be adequate, particularly in an i n t e r i m s c h e m e , and that to pay e a r n i n g s - r e l a t e d u n e m p l o y m e n t benefit for longer t h a n s i x m o n t h s m i g h t h a v e a n a d v e r s e effect on t h e e c o n o m y in discouraging unemployed people from seeking or accepting new jobs promptly. This m a y also provide the opportunity for s o m e rational ­ i s a t i o n of t h e d u r a t i o n of f l a t - r a t e u n e m p l o y m e n t b e n e f i t s o t h a t i n s t e a d of t h e p r e s e n t v a r i a b l e p e r i o d of s e v e n t o n i n e t e e n m o n t h s b a s e d on the c l a i m a n f s i n s u r a n c e r e c o r d t h e s e would b e six m o n t h s of e a r n i n g s - r e l a t e d b e n e f i t f o l l o w e d b y s i x m o n t h s of f l a t - r a t e benefit. Twelve m o n t h s would thus b e c o m e the s t a n d a r d m a x i m u m d i r a t i o n of u n e m p l o y m e n t b e n e f i t f o r e v e r y b o d y . Waiting days 16. F o r f l a t - r a t e b e n e f i t s , t h e r e v/ould, a s n o w , b e t h r e e " w a i t i n g d a y s " a t t h e s t a r t of a n y p e r i o d of i n t e r r u p t i o n of e m p l o y m e n t . B e n e f i t i s p a i d f o r t h e s e d a y s if t h e p e r i o d of i n t e r r u p t i o n of e m p l o y m e n t l a s t s f o r 12 d a y s o r m o r e . For earnings-related b e n e f i t , i t w o u l d b e n e c e s s a r y t o s e r v e 12 w a i t i n g d a y s a t t h e s t a r t of a p e r i o d of i n t e r r u p t i o n of e m p l o y m e n t . These waiting days would be " a b s o l u t e " , that i s , benefit would not be paid r e t r o s p e c t i v e l y for them. T h u s e a r n i n g s - r e l a t e d benefit would not n o r m a l l y be p a y a b l e f o r s p e l l s of s i c k n e s s o r u n e m p l o y m e n t l a s t i n g l e s s t h a n a fortnight. 17. M y o r i g i n a l hope w a s to be able to t r e a t the f l a t - r a t e and e a r n i n g s - r e l a t e d e l e m e n t s as a single benefit with a s t a n d a r d waiting p e r i o d but t h e only p r a c t i c a b l e way to do this would h a v e b e e n by i m p o s i n g s i x a b s o l u t e w a i t i n g d a y s f o r b o t h p a r t s of b o t h b e n e f i t s . T h i s would h a v e m e a n t a substantial r e d u c t i o n in existing r i g h t s to flat-rate benefits. M o s t people would h a v e m a d e u p on t h e e a r n i n g s ­ r e l a t e d s w i n g s what they l o s t on the f l a t - r a t e r o u n d a b o u t s b u t t h e r e would have b e e n s o m e c l a i m a n t s , e s p e c i a l l y t h o s e with low e a r n i n g s and l a r g e f a m i l i e s who would lose m o r e than they gained. Although t h e p r o p o r t i o n of c a s e s w o u l d b e r e l a t i v e l y s m a l l t h e y v/ould b e t h e c l a i m a n t s in g r e a t e s t n e e d , and m y c o l l e a g u e s and I concluded that this approach was politically unacceptable. Without the substantial s a v i n g of b o t h c o s t a n d a d m i n i s t r a t i v e r e s o u r c e s w h i c h w o u l d h a v e a c c r u e d f r o m not paying f l a t - r a t e benefit for the f i r s t six d a y s it would not h a v e b e e n f e a s i b l e to pay e a r n i n g s - r e l a t e d benefits without a longer waiting period than six days. It i s h i g h l y d e s i r a b l e , i n o r d e r t o a v o i d s . n o r n a I i e s a.nd c o n f u s i o n t o c l a i m a n t s , that the s u p p l e m e n t s to both benefits should b e g o v e r n e d by the s a m e c o n d i t i o n s , a n d we c o n c l u d e d t h a t t h e r e s h o u l d b e a 1 2 - d a y w a i t i n g p e r i o d £ o r t h e e a r n i n g s - r e l a t e d e l e m e n t of b o t h b e n e f i t s . On t h i s a p p r o a c h , t h e n e w s c h e m e c a n b e p r e s e n t e d a s a p p r o p r i a t e t o t h e m o r e s e r i o u s i n t e r r u p t i o n s of e a r n i n g s w h e r e s i c k n e s s o r u n e m p l o y m e n t l a s t s for m o r e than a fortnight. -6­ Consequential Matters 18. T h e r e a r e m a n y d e t a i l e d a s p e c t s of t h e s c h e m e w h i c h a r e still under discussion and I should not wish to trouble the Cabinet w i t h t h e s e m a t t e r s u n l e s s s e r i o u s d i f f e r e n c e s of o p i n i o n w e r e t o e m e r g e in the Sub-Committee. T h e r e a r e , however, two other s h o r t - t e r m b e n e f i t s w h i c h m a y b e a f f e c t e d b y t h e i n t r o d u c t i o n of a s c h e m e of e a r n i n g s - r e l a t e d s i c k n e s s a n d u n e m p l o y m e n t b e n e f i t a n d these a r e , I think, sufficiently i m p o r t a n t politically to m e r i t consideration at this stage. Injury Benefit 19. Injury benefit under the Industrial Injuries s c h e m e is payable a s a n a l t e r n a t i v e t o s i c k n e s s b e n e f i t f o r t h e f i r s t s i x m o n t h s of incapacity resulting f r o m an accident at work or an industrial disease. T h e r a t e h a s b e e n m a i n t a i n e d a t a b o u t 70 p e r c e n t a b o v e s t a n d a r d s i c k n e s s b e n e f i t s i n c e t h e s t a r t of t h e s c h e m e s , a n d i s n o w £ 6 . 15 s. a w e e k . I n j u r y benefit i s followed by a d i s a b l e m e n t b e n e f i t i n t h o s e c a s e s ( a b o u t 15 p e r c e n t ) w h e r e s o m e m e a s u r a b l e disability r e m a i n s when injury benefit c e a s e s . S u p p l e m e n t a t i o n of s i c k n e s s benefit as p r o p o s e d would m e a n that s i c k n e s s benefit would b e h i g h e r t h a n i n j u r y b e n e f i t f o r e v e r y o n e w i t h e a r n i n g s of £ 1 7 . 5 s . o r m o r e - that i s , on t h e e s t i m a t e d f i g u r e s for A p r i l , 1965, s o m e 5 6 p e r c e n t of m e n a n d 1 p e r c e n t of w o m e n . 20. In m y v i e w it w o u l d n o t b e s u f f i c i e n t m e r e l y t o a l l o w i n j u r e d people to d r a w the supplemented s i c k n e s s benefit or injury benefit, whichever was the better. This would effectively abolish for a l a r g e p a r t of t h e e m p l o y e d p o p u l a t i o n a p r e f e r e n c e w h i c h h a s e x i s t e d for v e r y m a n y y e a r s (and which i s p a r a l l e l e d in n e a r l y e v e r y o t h e r i n d u s t r i a l i s e d c o u n t r y ) , w h i c h wo^^ld b e w r o n g , a n d w o u l d i n a n y c a s e s t a n d n o c h a n c e of a c c e p t a n c e b y t h e T . U. C . To m y mind the right c o u r s e , and a d m i n i s t r a t i v e l y the s i m p l e s t o n e , would be to allow the sickness benefit supplement, where payable, to be added to flat-rate injury benefit. T h e e x i s t i n g £ 2 . 15 s . d i f f e r e n t i a l would t h u s b e p r e s e r v e d , a n d t h i s c a n b e j u s t i f i e d on t h e v i e w t h a t it r e p r e s e n t s t h e e l e m e n t of c o m p e n s a t i o n f o r t h e i n j u r y . It f o l l o w s that the benefit ceiling for the industrial injury case should be £ 2 . 15s. above that p r o p o s e d for s i c k n e s s benefit. T h e l e v e l s of benefit p r o d u c e d by t h i s p r o p o s a l a r e shown in Appendix B. It will be noticed that in the r a n g e w h e r e the benefit ceiling o p e r a t e s m a n y b e n e f i c i a r i e s a r e a l r e a d y r e c e i v i n g m o r e b y w a y of f l a t - r a t e i n j u r y b e n e f i t tha.n t h e a m o u n t a l l o w e d b y t h e p r o p o s e d b e n e f i t ceiling and this entitlement would be p r e s e r v e d . Widow^s Allowance 21. Widow's allowance is at p r e s e n t a f l a t - r a t e r e s e t t l e m e n t a l l o w a n c e p a i d f o r t h e f i r s t 1 3 w e e k s of w i d o w h o o d a t a h i g h e r r a t e than the standard widow's benefit. As "New F r o n t i e r s " recognised, t h e r e is a c a s e for graduating this allowance by r e f e r e n c e to the h u s b a n d ' s e a r n i n g s and for extending its duration to six m o n t h s . This would do something positive for widows. F u r t h e r m o r e , the O p p o s i t i o n ^ 1964 E l e c t i o n M a n i f e s t o c o m m i t t e d t h e m to extending -7­ e a r n i n g s - r e l a t e d b e n e f i t t o t h e e a r l y m o n t h s of w i d o w h o o d a n d if o u r s c h e m e does not provide for this we can certainly expect an a m e n d m e n t on C o m m i t t e e which would b e difficult t o r e s i s t . F o r all these r e a s o n s I should like to include widow's allowance in the s c h e m e from the outset but against this m u s t be reckoned the additional cost - see p a r a g r a p h 24 b e l o w . The S u b - C o m m i t t e e considered that the i n c l u s i o n of w i d o w ' s a l l o w a n c e w a s a d e s i r a b l e , b u t n o t e s s e n t i a l , f e a t u r e of t h e s c h e m e a n d t h a t t h e q u e s t i o n of i t s i n c l u s i o n s h o u l d b e r e f e r r e d to the Cabinet for decision. C ontr actin g -Out 22. A t p r e s e n t e m p l o y e e s w h o a r e n o t c o n t r a c t e d - o u t of t h e national insurance graduated pension s c h e m e , and their e m p l o y e r s , pay both a flat-rate contribution and a graduated contribution (4-J; p e r c e n t a s i d e ) c n e a r n i n g s b e t w e e n £ 9 a n d £ 1 8 a w e e k . Additional graduated contributions will be needed to pay for the new e a r n i n g s - r e l a t e d b e n e f i t s b u t e m p l o y e e s w h o a r e c o n t r a c t e d - o u t of t h e g r a d u a t e d p e n s i o n s c h e m e b y v i r t u e of t h e i r r i g h t s t o a n o c c u p a t i o n a l pension, and their e m p l o y e r s do not at p r e s e n t pay graduated contributions. They a r e , h o w e v e r , r e q u i r e d to pay a substantially higher flat-ra.te contribution than that paid by t h o s e who a r e not c ont r a ct ed - out. 2 3 . T h e r e i s n o q u e s t i o n of e x c l u d i n g e m p l o y e e s c o n t r a c t e d - o u t of the graduated pension scheme from the new earnings-related short­ t e r m benefits but t h e r e a r e compelling r e a s o n s against s u p e r - I m p o s i n g on t h e i r f l a t - r a t e c o n t r i b u t i o n a v e r y s m a l l g r a d u a t e d contribution. Not only would the a m o u n t a p p e a r d e r i s o r y and be costly to a d m i n i s t e r in relation to its yield but once people in c o n t r a c t e d - o u t e m p l o y m e n t a r e r e q u i r e d t o p a y g r a d u a t e d c o n t r i b u t i o n s it w o u l d be i n d e f e n s i b l e t o m a k e t h e m g o o n p a y i n g t h e i r h i g h e r r a t e of f l a t - r a t e c o n t r i b u t i o n w h i c h b e a r s h e a v i l y and u n f a i r l y on t h e l o w e r - p a i d c o n t r a c t e d - o u t worker. A c c o r d i n g l y m y coU.ea.gues on t h e S u b - C o m m i t t e e a g r e e d with m e that the opportunity should be taken for r e s h a p i n g the c o n t r a c t i n g - o u t a r r a n g e m e n t s so a s to m a k e the c o n t r a c t e d - o u t liable to pay graduated contributions for pensions as well as s h o r t - t e r m benefits. T h i s would h a v e the following a d v a n t a g e s : ­ (a) It would r e m o v e p r e s e n t i n e q u i t i e s w h e r e b y t h e h i g h e r f l a t e - r a t e c o n t r i b u t i o n p a y a b l e b y t h e c o n t r a c t e d - o u t i m p o s e s a n ^^nfair b u r d e n on t h e l o w e r - p a i d w o r k e r a n d h i s e m p l o y e r w h e r e a s the higher-paid worker is charged too litte. (b) It w o u l d e n s u r e t h a t t h e c o n t r a c t e d - o u t e m p l o y e e e n j o y e d the p r o t e c t i o n which the State s c h e m e p r o v i d e s so far a s graduated r e t i r e m e n t pension for widows is concerned (a p o i n t w e m a d e i n o u r E l e c t i o n M a n i f e s t o ) . ( c ) I t w o u l d p a v e t h e w a y f o r t h e l a t e r i n t r o d u c t i o n of o u r o w n e a r n i n g s - r e l a t e d pension s c h e m e or for the next general uprating which is a l m o s t bound to r e q u i r e an i n c r e a s e in t h e s p a n , if n o t t h e r a t e , of g r a d u a t e d p e n s i o n c o n t r i b u t i o n s . Under this plan the c o n t r a c t e d - o u t would pay the s a m e graduated contributions as everyone e l s e and would e a r n graduated additions to pension accordingly. They would, however, pay a lower flate-rate contribution than those not c o n t r a c t e d - o u t and t h e i r total State pension -8­ ( f l a t - r a t e p l u s g r a d u a t e d ) w o u l d b e a b a t e d t o t a k e a c c o u n t of t h i s . B o t h t h e s e d e d u c t i o n s w o u l d b e r e l a t e d t o t h e v a l u e of t h e o c c u p a t i o n a l pension which the employer is r e q u i r e d to provide as a condition for c o n t r a c t i n g - o u t of t h e S t a t e s c h e m e . T h e change would involve no a l t e r a t i o n s in t h e conditions which a t p r e s e n t h a v e to be s a t i s f i e d by an occupational pension s c h e m e to qualify for c o n t r a c t i n g - o u t and no f u r t h e r c h a n g e v/ould b e r e q u i r e d i n t h e s e c o n d i t i o n s t o m a t c h f u t u r e c h a n g e s in the State p r o v i s i o n s . Finance 24. T h e b a s i c c o s t of a s c h e m e of e a r n i n g s - r e l a t e d s i c k n e s s a n d u n e m p l o y m e n t benefit on the lines p r o p o s e d above is e s t i m a t e d at £ 4 4 m i l l i o n a y e a r of w h i c h s o m e £ 3 0 m i l l i o n i s a t t r i b u t a b l e t o s i c k n e s s b e n e f i t a n d £ 1 4 m i l l i o n t o u n e m p l o y m e n t b e n e f i t ( a s s u m i n g 1. 5 p e r c e n t unemployment). T o t h i s m u s t b e a d d e d t h e c o s t of a d m i n i s t r a t i o n w h i c h m i g h t b e of t h e o r d e r of £ 3 m i l l i o n a.nd a m i n i m u m of £ l\ m i l l i o n t o enable the industrially injured to d r a w e a r n i n g s - r e l a t e d sickness b e n e f i t i n s t e a d of i n j u r y b e n e f i t w h e r e t h i s w a s t o t h e c l a i m a n t s advantage. A further £34 million would be needed to pay e a r n i n g s ­ r e l a t e d s u p p l e m e n t s o n t o p of i n j u r y b e n e f i t . T h e m i n i m u m c o s t of Earnings­ t h e s c h e m e v / o u l d t h e r e f o r e b e of t h e o r d e r of £ 5 0 m i l l i o n . r e l a t e d w i d o w ' s a l l o w a n c e p a y a b l e f o r 6 m o n t h s i n s t e a d of t h e p r e s e n t f l a t - r a t e a l l o w a n c e p a y a b l e f o r 3 m o n t h s w o u l d c o o t a b o u t a. f u r t h e r £7 million. 25. T h e change in the a r r a n g e m e n t s for c o n t r a c t i n g - o u t ( p a r a g r a p h s 2 2 - 2 3 a b o v e ) v/ould p r o d u c e a d d i t i o n a l c o n t r i b u t i o n i n c o m e of a b o u t £ 4 3 m i l l i o n a y e a r m o s t of w h i c h w o u l d c o m e f r o m h i g h e r - p a i d w o r k e r s a n d t h e i r e m p l o y e r s , r a a n y of t h e m i n t h e p u b l i c sector. T h i s a m o u n t i s s u b s t a n t i a l l y a m e a s u r e of t h e e x t e n t t o which the higher-paid contracted-out at p r e s e n t e s c a p e their fair s h a r e of t h e t o t a l c o s t of n a t i o n a l i n s u r a n c e . Ultimately this change­ o v e r w i l l l e a d t o s o m e i n c r e a s e d e x p e n d i t u r e i n t h e f o r m of e x t r a g r a d u a t e d r e t i r e m e n t a n d w i d o w s p e n s i o n s t o w h i c h c o n t r a c t e d - o u t e m p l o y e e s will b e c o m e entitled; but in the next few y e a r s t h e r e will be no significant expenditure involved. 1 26. E a r n i n g s - r e l a t e d s h o r t - t e r m b e n e f i t s , on the s c a l e p r o p o s e d , w o u l d r e q u i r e a g r a d u a t e d c o n t r i b u t i o n of a b o u t 0. 4 p e r c e n t a s i d e of e a r n i n g s b e t w e e n £ 9 a n d £ 3 0 . The principle that t h e r e should be additional graduated contributions to support the new scheme is c e r t a i n l y one t h a t we s h o u l d w i s h to m a i n t a i n a n d it i s p r o p o s e d t h a t w e s h o u l d u s e t h e p r o c e e d s of t h e c h a n g e i n t h e c o n t r a c t i n g - o u t a r r a n g e m e n t s to r e d u c e the f l a t - r a t e contribution payable by e v e r y o n e . A r e d u c t i o n cf a b o u t 4 d . a s i d e s h o u l d b e p o s s i b l e . These arrange­ r n e n t s a r e still t o b e w o r k e d out in d e t a i l . Administration 27. It i s p r o v i s i o n a l l y e s t i m a t e d t h a t a s c h e m e on t h e s e l i n e s would r e q u i r e about 2, 000 a d d i t i o n a l staff i n m y D e p a r t m e n t , m a i n l y to handle sickness benefit claims. T h e n u m b e r of a d d i t i o n a l s t a f f n e e d e d b y t h e M i n i s t r y of L a b o u r m i g h t b e a b o u t 8 0 0 . The extension of g r a d u a t e d c o n t r i b u t i o n s t o t h e c o n t r a c t e d - o u t a n d t h e w i d e r s p a n of e a r n i n g s a t t r a c t i n g c o n t r i b u t i o n s w i l l m e a n m o r e w o r k f o r t h e Inland Revenue. S o m e e x t r a staff w i l l b e n e e d e d but it i s n o t expected that the n u m b e r will be l a r g e . -9­ P A R T IV - Q U E S T I O N S F O R D E C I S I O N 28. I n o w i n v i t e t h e d e c i s i o n of t h e C a b i n e t w h e t h e r I a m t o p r o c e e w i t h t h e p r e p a r a t i o n of a s c h e m e of e a r n i n g s - r e l a t e d s h o r t - t e r m b e n e f i t s on t h e l i n e s I h a v e d e s c r i b e d i n t h i s m e m o r a n d u m , i n c l u d i n g c o n s u l t a t i o n s with t h e T. U. C. , t h e C. B . L a n d o t h e r i n t e r e s t e d bodiei I should a l s o w e l c o m e d e c i s i o n s on t h e following q u e s t i o n s on which the Social S e r v i c e s S u b - C o m m i t t e e on Social Security C a s h Benefits was not able to r e a c h final c o n c l u s i o n s : ­ (i) ( i i ) Should e a r n i n g s - r e l a t e d widow's allowance be included in the s c h e m e ? ( p a r a g r a p h 21). Should e a r n i n g s - r e l a t e d s u p p l e m e n t s be paid on t o p of i n j u r y b e n e f i t ? ( p a r a g r a p h s 19 a n d 2 0 ) . M. H. M i n i s t r y of P e n s i o n s a n d N a t i o n a l I n s u r a n c e , W. C . 2. , 23rd July, 1965 -10- CONFIDENTIXL vVS^KLY BKraFIT (rLAT-RATK FLU.S EAKI-XTTOS-KJ3LATED SUT PLK: EAJgllirGS-RKLATED SUPrLETEire r Gross earnings of £12 a week (1) Total benefit plus family allowances £ Single nan (2) as ,. of take-home pay* plus f ariily allowances (1) s. do r Gross earnings of £18 a week (2) (1) £ 5 * d. l') AS A FROPORTIOII OF TAK.K-?;0?vE F,Of ^ 1/3RD OF GTIOSS RAT".inCS B S T j ^ T £% AT TP, £?Q — ' " — — Gross earnings of £ 1 5 a week Total benefit plus family allowances r (1) (1) as , of take-home pay" plus family allowances Total benefit plus family allowances £ s. 0 0 0 51 6 0 0 51 7 9 (2) (l) as , of take-home pay- plus family allowances r Gross earning s of £30 week Gross earninga of £ 2 5 a week (1) Total benefit plus family allowances £ s. d. (l) as of take-home pay* plus family allowances (1) Total benefit plus family allowances £ (2) (l) as of take-home pay* plus family allowances s. d. 0 51 9 6 8 51 11 0 0 50 10 0 65 11 16 8 61 13 10 0 59 berried nan 7 10 0 71 8 10 0 67 Married man 4- 1 child 8 12 6 78 9 12 6 72 10 12 6 69 12 19 2 64. 24 12 6 62 Harried man * 2 childi-en 9 15 0 84 10 15 0 75 11 15 0 70 14 1 8 65 15 15 0 63 Married man + 3 children 10 19 6 91 11 IS 6 80 12 19 6 74 15 6 2 67 16 19 r O 65 Married man + 4 children 12 4 (/ 97* 13 4 0 86 14 4 0 78 16 10 8 69 18 4 0 66 Married man + 5 children 13 8 & 103^ 14 8 6 91 15 8 6 82 17 15 2 71 19 8 r O 67 Married man * 6 children 14 13 o/ 108^ 15 13 o/ 95^ 16 13 0 86 18 19 a o 73 20 13 0 69 -Gross pay less income tax mid graduated and flat-rate contributions. /In these cases the amount of earnings-related supplement would be reduced or extinguished by the operation cf a benefit ceiling of 85.. of gross earnings, i.e., about 9Q of take-home pay. coio?ide;;tial V/KEKI.T INJTJE3T l^JS;:^ j p i S W E F T T ' R A T E P L U S A S A P R O P O K T I O K Off T A K E HOME j^^J^L^UgP^gMiSEl PAX E/..MING-S BELATED SUPPLEMENT e fol' OF £ROSS BETWEEN £ 9 and £30 Gross w e e k l y e a r n i n g s £12 of: B e n e f i t c e l l i n g 8j?j2 g r o s s e a r n i n g + £2 15s. £12 (1) Benefit f o r Present flat rate plus family allowances total benefit plus family allowances £ Se d. £ s. a. S i n g l e man 6 15 ­ 9 ­ ­ 7 ^ H a r r i e f i man 15 5 10 5 M a r r i e d can * 1 child 10 n Marriednan * 2 ohildi^ai 11 10 M a r r i e d man 4- 3 c h i l d r e n 12 14 -a. £15 (2) O) (1) a s Jg o f t o t a l benefit take-home plus pay' ' p l u s family family allowances allowances : e s. £18 ios. - a . (2) (1) as g (1) of take-home pay* p l u s family allowances ' ­ £ s. 1s. (1) aa% a. 15 12 5 - 71.0 92.6 13 7 6 13 10 94.2 113.7 14 14 6 118.9 15 19 17 3 ­ 7 6 102.8 12 7 ­ 12 10 ­ 108.0 6 13 14 6 - total benefit plus family allowances Z s. -s. (1) ( 1 ) as % o f take-home pay* plus family allowances s. a. 15 ** 3a. - a . (1) a s f o f take-home pay ' p l u s family allowances 0 5 63.0 83.5 12. 1 8 14 11 8 65.5 75.2 16 IT 86.2 15 14 2 77.5 17 7 6 73.4 14 10 07.2 16 16 8 77.5 18 10 - 73.8 98.6 15 14 6 89.4 18 1 2 78.7 I9 14 6 75.0 - 103.3 16 19 - 92.7 19 5 8 79.7 a, - 75.5 6 107.8 13 3 o 96.7 20 2 81.2 22 6 76.4. - 77.7 6 - 13 19 ­ 14 19 M a r r i e d man 4- 5 c h i l d r e n 15 3 6 16 3 M a r r i e d man 4- 6 o h i l d r e n 16 8 ­ 21 14 8 100.6 112.0 18 8 128.2 19 8 J* 17 8 * Gross pay less income tax and graduated flat-rate contributions x Benefit would be reduced to ceiling (at hear of column) plus family allowances £ Benefit would be reduced to flat rate plus family allowances, as shown in first column. 123.7 total benefit plus family allowances £ a. M a r r i e d man -s- 4 o h i l d r e n -* £26 -a. (2) 0 ) of take-home pay^ p l u s family allowances 9 8 15 11 5 £24 -d. (2) total benefit plus family allowances £30 £25 74.0 83,6 78.7 97.2 7 6 a. £18 £15 19s. KfJNINGS - CONFIDENTIAL 10 19 23 o 1 71.4