(c) crown copyright Catalogue Reference:CAB/24/232 Image Reference:0002

(c) crown copyright

Catalogue Reference:CAB/24/232 Image Reference:0002

ITHIS

D O C U M E N T I S T H E E R O P E R T Y O F H I S B R I T A N N I C M A J E S T Y ' S G O V E R N M E N T ^

U U

TO BE K E P T U N D E R LOCK A N D KEY.

It is requested that special care may be taken to ensure the secrecy of this document.

SECRET.

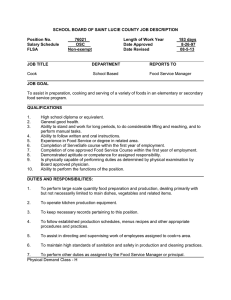

297.A. (32). COPY MO. /

A

C A B I N E T .

OTTAWA AGREEMENTS BILL.

At the request of the Chancellor of the

Exchequer, the accompanying draft copy of the

Ottawa Agreements Bill is circulated to those

Ministers who are directly concerned with the

Ottawa Conference.

(Signed) M.P.A, HANKEY.

Secretary to the Cabinet.

2, Whitehall Gardens, S.W.I.

28th September

9

1932.

MOST SECRET.

To be kept under lock and key.

Ottawa Agreements Bill.

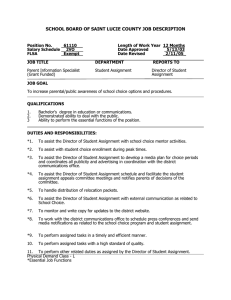

ARRANGEMENT OF CLAUSES.

Clause.

1. Imposition of new duties.

2. Exemptions from new duties and from duties under 22 Geo. 5. c. 8.

3. Amendment as to duty on wine.

4. Preferential rates of duty on tobacco [and coffee] being Empire products.

5. Security of preferences granted pursuant to agree ment with the Dominion of Canada against action by foreign Governments.

6. Amendment as to powers of Treasury under 22 & 23

Geo. 5. c. 8 and 22 & 23 Geo. 5. c. 25.

7. Regulation of importation of certain frozen and chilled meat from foreign countries.

8. Amendment of law as to importation of Canadian cattle.

9. Provisions as to powers of Treasury and Board of

Trade.

10. Provisions as to orders.

11. Special provisions in relation to Irish Eree State

(Special Duties) Act, 1932.

12. Duration of agreements.

13. Interpretation.

14. Short title and duration.

SCHEDTJLES :

Eirst Schedule.—Agreements made at the

Imperial Economic Conference, Ottawa, 1932.

Second Schedule.—Customs duties to be imposed in pursuance of agreements.

Third Schedule.—Enactments applied for the purposes of section one.

Fourth Schedule.—Amendments of 13 Geo. 5. c. 5.

1 8 9 - 6 A

D R A F T

O F A

B I L L

T O

Enable effect to be given to the Agreements, A.D. 1932. made at Ottawa on the twentieth day of August, nineteen hundred and thirty-two, between His

Majesty's Government in the United Kingdom and His Majesty's Governments in Canada, the

Commonwealth of Australia, New Zealand, the

Union of South Africa, and Newfoundland, respectively, the Government of India, and the

Government of Southern Rhodesia, and for that purpose to impose certain duties of customs; to facilitate the fulfilment of the said agree ments by increasing certain duties of customs on wines [and coffee]; and for purposes con nected with the matters aforesaid.

Most Gracious Sovereign,

W

E, Your Majesty's most dutiful and loyal subjects, the Commons in Parliament assembled, with a view to the giving of effect to the agreements made at

Ottawa on the twentieth day of August, nineteen hundred

5 and thirty-two between your Majesty's Government in the United Kingdom and your Majesty's Governments in Canada, the Commonwealth of Australia, New Zealand, the Union of South Africa and Newfoundland, respectively, the Government of India, and the Government of

10 Southern Rhodesia, (being the agreements set out in the

First Schedule to this Act), and to the making of an addition to the public revenue, have freely and voluntarily

1 8 9 - 6 A 2

A.D. 1932.

resolved to give and grant unto Your Majesty the duties for which provision is hereinafter contained; and do therefore most humbly beseech Your Majesty that it may be enacted, and be it enacted by the King's most

5 Excellent Majesty, by.and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows :—

Imposition of new duties.

1.

—(1) In fulfilment of the agreements set out in

10 referred to as " t h e scheduled agreements ") there shall, on and after such date as the Treasury may, after con sultation with the appropriate department, by order direct, be charged on the importation into the United

15 Kingdom of the goods specified in the first column of the Second Schedule to this Act, the duties of customs respectively specified in the second column of that

Schedule, so, however, that in the case of those duties in respect of which periods are specified in the third column of that Schedule, the said duties shall, in every year, be charged only on goods so imported as aforesaid during those periods respectively.

20

(2) The power of the Treasury to make orders determining the date on and after which the duties

25 power to determine different dates as respects different duties, but the date so determined as respects any duty shall be the earliest date on which the Treasury is satisfied that it is necessaryto impose the duty for the fulfilment of

30 any of the scheduled agreements, and that the law of the country on behalf of the Government of which that agreement was made provides for the fulfilment of the agreement.

(3) If, after consultation with the appropriate

35 any duty imposed by this section that the duty can be removed, or that the rate thereof can be reduced, without contravening any of the scheduled agreements for the time being in force, the Treasury may by order direct that, as

40 from such date as may be specified in the order, that duty shall not be charged or, as the case may be, shall be charged at such reduced rate specified in the order as appears to the Treasury to be the lowest rate at which

the duty can be charged without contravening any of the A D said agreements.

(4) Where an order has been made under the last foregoing subsection and the Treasury, after consultation

5 with the appropriate Department, are satisfied that the reimposition, or the increase, of the duty specified in the order is necessary for the fulfilment of any of the scheduled agreements for the time being in force, the Treasury shall by order direct that, as from such date as may be specified

1 0 in the order, the duty shall again be charged or, as the case may be, shall be charged at such increased rate specified in the order as appears to the Treasury to be the lowest rate at which the duty can be charged without contravening any of the said agreements :

1 5 Provided that nothing in this subsection shall authorise any such duty to be charged at a rate higher than the rate specified in the Second Schedule to this Act.

(5) Subject to the provisions of this Act, the duties of customs chargeable on any goods under this section

2 0 shall be charged in addition to any other duties of customs for the time being chargeable thereon:

Provided that—

25

(a) nothing in this subsection shall affect the pro visions of paragraph (a) of subsection ( 2 ) of section one of the Imports Duties Act, 1 9 3 2

(which exempts from the general ad valorem duty goods for the time being chargeable with a duty of customs by or under any enactment other than that Act) ;

4

and

3 0

3 5

(b) as from the date on which a duty of customs becomes chargeable under this section on any goods, any additional duty chargeable on those goods immediately before that date under section three of the Imports Duties Act, 1932, shall cease to be charged.

(6) Notwithstanding anything in the last foregoing subsection, at any time after a duty of customs becomes chargeable under this section on any goods, the Import

Duties Advisory Committee may treat the said duty for

4 0 the purpose of the said section three of the Import Duties

Act, 1932, as if it was the general ad valorem duty, and recommend, subject to and in accordance with the said section three, that an additional duty ought, to be

A.D. 1932.

charged on those goods, and the Treasury may make an

— order under that section accordingly:

Provided that this subsection shall not apply to goods which, immediately before they became chargeable as aforesaid, were exempt from the general ad valorem 5 duty by virtue of the provisions of paragraph (a) of subsection (2) of section one of the said Act.

(7) The provisions of the enactments set out in the

Third Schedule to this Act shall apply for the purpose of this section as they apply for the purposes of the 10

Import Duties Act, 1932, as if references to any duty chargeable under that Act or any provision thereof included a reference to any duty chargeable under this section.

Exemptions from new duties and from duties under

22 Geo. 5. c. 8.

L.—(1) Neither the duties chargeable under the 15 foregoing provisions of this Act nor the general ad valorem duty nor, subject as hereinafter provided, any additional duty shall be charged in the case of goods which are shown to the satisfaction of the Commissioners to have been consigned from any part of the British 20

Empire and grown, produced or manufactured in any country the Government of which is a party to one of the scheduled agreements, being an agreement for the time being in force :

Provided that this subsection shall be without £5 prejudice to the power of the Treasury under section three of the Import Duties Act, 1932, to direct that additional duty shall be charged on any goods [alternative eggs, poultry, butter, cheese or other milk products] so consigned, produced or manufactured, if and when that 30 power can be exercised without contravention of any such agreement.

(2) The duties chargeable under the foregoing pro visions of this Act shall not be charged in the case of goods which, by virtue of section five of the Import 35

Duties Act, 1932 (Avhich provides for colonial exemption) are not for the time being chargeable with the general ad valorem duty or any additional duty.

(3) During the period of two years from the coni mencement of this Act, copper produced in Northern or 40

Southern Rhodesia and refined outside the British Empire shall, if consigned from the country in which it was

refined, be treated for the purposes of this section as if A.D. 1932. it had been consigned from a part of the British —

Empire.

(4) The provisions of section six ofj and the Third

5 Schedule to, the Imports Duties Act, 1932, shall apply for the purposes of this section as they apply for the purposes of sections four and five of that Act, as if refer ences to any duty chargeable under that Act or any pro vision thereof included a reference to any duty chargeable

1 0 under the foregoing provisions of this Act.

3 . ( 1 ) With a view to the giving of effect to the Amendment agreements set out in Parts I and IV of the First

Schedule to this Act,— o n

(a) the duty of customs chargeable under section

1 5 five of the Finance Act, 1 9 2 7 , on wine, not being an Empire product and not exceeding twenty-five degrees of proof spirit, shall, as from the date on which this increase comes into force, be increased from three shillings per

2 0 gallon to four shillings per gallon; and

(b) the customs duty chargeable under the said section on wine not exceeding twenty-seven degrees of proof spirit, being an Empire pro duct, shall be charged at a preferential rate

2 5 representing the full rate of duty for the time being chargeable on wine not exceeding twenty five degrees of proof spirit and not being an

Empire product, reduced by two shillings per gallon:

3 0 Provided that—

(i) if the Treasury are satisfied that the provisions of paragraph (b) of this subsection are no longer necessary for the fulfilment of any scheduled agreement for the time being in

3 5 force, the Treasury may by order direct that that paragraph shall have effect as if the words "one shilling per gallon" were therein substituted for " two shillings per gallon," so however that any such order shall be revoked

4 0 as soon as the Treasury are satisfied t h a t the provisions of the said paragraph are again necessary as asoresaid; and

A.D. 1932. (ii) in relation to wine produced or manufactured in a country the Government of which is a party to one of the scheduled agreements, the said paragraph shall have effect as aforesaid during any period during which that agree ment is not in force.

5

(2) This section shall come into force on such date as the Treasury may by order direct, being the earliest date on which the Treasury is satisfied either that the law of

1 0 the Commonwealth of Australia provides for the fulfilment of the agreement set out in Part I I of the First Schedule to this Act, or that the law of the Union of South Africa provides for the fulfilment of the agreement set out in

Part IV of that Schedule.

Preferential rates of duty on tobacco

[and coffee] being

Empire products.

4.

—(1) Subsection (1) of section seven of the Finance 1 5

Act, 1926, (which provides for the stabilisation of rates of imperial preference) shall, hi relation to the customs duties chargeable on tobacco, have effect as if the period of ten years mentioned in that subsection were extended to the nineteenth day of August, nineteen hundred and forty-two.

2 0

[(2) Coffee, being an Empire product, shall be charged with customs duties at preferential rates representing the full rate of duty for the time being chargeable on coffee, not being an Empire product, reduced by nine shillings and fourpence per hundred weight.]

2 5

Security of preferences granted pursuant to agreement with the

Dominion of Canada against action by foreign

Govern ments.

5.—(1) If at any time the Board of Trade are satisfied that the making of an order under this section is necessary for the purpose of securing that the benefits of any exemp 3 0 tion from customs duty or of any preferential rate of customs duty granted in respect of goods of any class or description by, or in accordance with, the provisions of this Act, in pursuance of the agreement set out in Part I

3 5 of the First Schedule to this Act, shall not be lost or diminished [alternative frustrated in -whole or in part] by reason of any action taken by the Government of any foreign country affecting the price of goods of that class or description, the Board of Trade may by order prohibit the importation into the United Kingdom of goods of that class or description grown, produced or manufactured in that foreign country.

4 0

(2) Any order made under this section shall be A.D. 1932. revoked by a subsequent order made in like manner as — soon as the Board of Trade are satisfied that the further operation of the order is no longer necessary for the

5 purpose for which it was made.

(3) No order shall be made under this section except with the concurrence of the Treasury, given after consul tation with any other Government Department w r appears to the Treasury to be interested. hich

10 (4) The Board of Trade may make regulations pre scribing, either generally or in relation to goods of any particular class or description, the conditions which must be fulfilled in order to estabbsh that goods have not been grown, produced or manufactured in a foreign

15 country with respect to which an order is in force under this section, and while any such order is in force, it shall be lawful for the Commissioners, on the importation of any goods which, if produced or manufactured in that foreign country, would be prohibited by the order to

20 be imported, and which are consigned either from that country or from such other countries as the Board of Trade may direct, to require the importer to furnish to the Commissioners, in such form as they may prescribe, proof t h a t conditions so prescribed by the

25 Board have been fulfilled, and if such proof is not furnished to the Commissioners' satisfaction, the goods shall be deemed to be goods grown, produced or manu factured in the first-mentioned country.

30

(5) Goods prohibited to be imported by virtue of an

order made under this section shall be deemed to be included among the goods enumerated and described in the table of prohibitions and restrictions inwards con tained in section forty-two of the Customs Consolidation

Act, 1876, and the provisions of that Act and of any Act

35 amending or extending that Act shall apply accordingly.

6.

—(1) The following powers of the Treasury, namely—

40

(a) the power under subsection (3) of section one of Amendment the Import Duties Act, 1932, to direct that f

goods shall be added to the First Schedule to

un

J^ asury that Act j * ^2 $5 23

(6) the power under section seven of the Finance o' e0m

5. . g

Act, 1932, to direct that goods shall cease to be and 22 &

c

23 included in the said Schedule; Geo.

5. c. 25.

189 B

A.D. 1932. (c) the power under subsection (5) of section nineteen of the Import Duties Act, 1932, to revoke any order in force on the twentieth day of August, nineteen hundred and thirty-two, being an order directing that an additional duty shall be charged;

5

(d) the power under subsection (5) of the said section nineteen to vary such an order as aforesaid by reducing the rate of any additional d u t y ; shall not be exercised in such manner as to contravene any of the scheduled agreements.

(2) The power of the Treasury under subsection (3) of section one of the Import Duties Act, 1932, to direct that goods shall be added to the First Schedule of that

15 Act shall, to such extent as appears to the Treasury to be necessary for the purpose of fulfilling the agreement set out in Part VI of the First Schedule to this Act, be exercised, notwithstanding anything in section one of that Act, without any recommendation from the Import

Duties Advisory Committee.

Regulation of importation of certain frozen and chilled meat from foreign countries.

7.—(1) The Board of Trade, after consultation with the Ministry of Agriculture and Fisheries, may by order regulate the importation mto the United Kingdom of frozen mutton, frozen lamb, frozen beef, and chilled beef, in accordance with the agreement set , out in

Part I I of the First Schedule to this Act.

(2) Any order made under this section may contain such provisions as appear to the Board of Trade to be necessary for securing the due operation of the scheme of regulation contained in the order. 30

(3) Any order made under this section may be varied by any subsequent order made in like manner.

Amendment 8.—(1) The provisions of section one of the Im of law as to portation of Animals Act, 1922 (Session 2) (which oTc^nadian P r o v ^ e s ^ * n e landing of Canadian store cattle in cattle Great Britain without being required to be slaughtered) shall apply to all Canadian cattle as they apply to

Canadian store cattle, so, however, that the Minister may require any such cattle to be slaughtered within the landing place if, in his opinion, they could be used 4 0 for breeding and are not suitable for that purpose; and accordingly the provisions of the said Act set out in the

3 5

first column of Part I of the Fourth Schedule to this Act A.D. 1932. shall have effect subject to the amendments set out in the second column of that Part of that Schedule.

—

(2) The provisions of subsection (2) of section one of the said Act, which are set out in the first column of

Part I I of the said Schedule, shall have effect, subject to the amendments, being amendments of minor detail, which are set out in the second column of that Part of t h a t Schedule.

10 9.—(1) The Treasury may refer any question connected with the discharge of their functions under

Provisions

as to powers this Act for the advice of the Import Duties Advisory of Treasury

Committee and the Committee shall make a report to ^ f ^ r a d e ^ the Treasury on any question so referred to them.

15

(2) Any order or regulations authorised under this

Act to be made by the Board of Trade may be made by the President of the Board or in his absence by a Secretary of State, and any other thing required or authorised under this Act to be done by, to, or before the Board of Trade

20 may be done by, to, or before the President of the Board or any person authorised by him in that behalf.

(3) Any expenses incurred by the Board of Trade for the purposes of this Act shall be defrayed out of moneys provided by Parliament.

25 10.

—(1) Any order made by the Treasury under Provisions this Act with respect to any duty of customs shall be as to orders. laid before the Commons House of Parliament as soon as may be after it is made, and any other order made under this Act, whether by the Treasury or by the Board

30 of Trade, shall be laid before both Houses of Parliament as soon as may be after it is made.

(2) Any order made by the Treasury under this Act increasing or re-imposing any duty of customs shall cease to have effect on the expiration of a period of

35 twenty-eight days from the date on which it is made, unless at some time before the expiration of that period it has been approved by resolution passed by the

Commons House of Parliament but without prejudice to anything previously done thereunder or to the making

40 of a new order.

189 B 2

314

A.D. 1932. ( 3 ) Any order made under this Act—

(a) with respect to the prohibition of the importa tion into the United Kingdom of goods of any class or description produced or manufactured in a foreign country; or 5

(6) with respect to the regulation of the importa tion into the United Kingdom of frozen and chilled meat; or

(c) declaring that an agreement shall not be deemed to be in force or revoking such a lo declaration, shall cease to have effect on the expiration of a period of twenty-eight days from the date on which it. is made, unless at some time before the expiration of that period, it has been approved by resolution passed by each 15

House of Parliament but without prejudice to anything previously done thereunder or to the making of a new order.

(4) I n reckoning any such period of twenty-eight days as aforesaid, no account shall be taken of any time 2 0 during which Parliament is dissolved or prorogued, or during which either House, or, in a case where the approval of the Commons House alone is required, t h a t

House, is adjourned for more than four days.

Special provisions in relation to Irish

Free State

(Special

Duties) Act,

1932.

11.

If and so long as any duty of customs is charged 2 5 under the Irish Free State (Special Duties) Act, 1 9 3 2 , on goods of any class or description specified in the

Second Schedule to this Act, the duties imposed by this

Act shall not be charged on the importation into the

United Kingdom of goods of that class or description 3 0 imported from the Irish Free State or exported from the

Irish Free State to any other country and thence brought into the United Kingdom, but duties of customs shall be chargeable thereon as if this Act had not been

Duration of agreements.

12.

—(1) For the purposes of this Act, each of the scheduled agreements shall be deemed to be in force unless and until the Treasury by order declare t h a t the agreement has ceased, or is for the purpose of this Act to be deemed to have ceased, to be in force. 4 0

(2) An order may be made under this section declaring A.D. 1932. that an agreement has ceased to be in force if the Treasury " are satisfied that it has been determined in accordance with the terms thereof, or by mutual agreement.

5 ( 3 ) An order may be made under this section de claring that an agreement is to be deemed for the purposes of this Act to have ceased to be in force if the Treasury, after consultation with any Government Department which appears to them to be interested, are satisfied that

1 0 the agreement is not being fulfilled on the part of the country between the Government of which and His

Majesty's Government in the United Mingdom the agree ment w r as made, but if, after the like consultation, the

Treasury are satisfied that the said agreement is, after

1 5 the making of the order, being fulfilled on the part of the said country, they shall thereupon revoke the order, and as from the date of the revocation the agreement shall again be deemed to be in force.

1 3 . — ( 1 ) In this Act, unless the context otherwise Interprets

2 0 requires, the following expressions have the meanings tion. hereby respectively assigned to them, that is to say :—

" E m p i r e product" has the same meaning as in subsection ( 1 ) of section one of the Finance Act,

1 9 1 9 :

2 5 " General ad valorem duty " and " additional duty " mean the duties by those names respectively imposed by or under the Import Duties Act,

1 9 3 2 :

" The Commissioners " means the Commissioners of

3 0 Customs and Excise :

" Appropriate department " and " British Empire " nave respectively the same meanings as in the

Import Duties Act, 1 9 3 2 .

(2) References in this Act to any scheduled agree

3 5 ment shall be construed as references to that agreement as for the time being modified in accordance with the provisions thereof.

(3) If any question arises as to who was, or is, the appropriate department in relation to any provision of

4 0 this Act, the question shall be referred to the Treasury, whose decision shall for all purposes be final.

A.D. 1932.

14.(1) This Act may be cited as the Ottawa

Shortlitle and duration.

r e e m e r r t s

Act, 1932.

(2) The provisions of this Act shall, unless Parliament

. otherwise determines, cease to have effect on the twentieth day of August, nineteen hundred and thirty-seven: 5

Provided that—

(a) this subsection shall not apply to the pro visions of this Act which amend section seven of the Finance Act, 1926, in relation to the customs duty chargeable on tobacco, or 10 amend the Importation of Animals Act, 1922

(Session 2); and

(6) the expiry of the said provisions shall not affect the previous operation thereof or of any order made thereunder or any obligation or 15 liability previously incurred under the said provisions, or any such order in respect of any duty of customs, penalty, forfeiture or punish ment, or the taking of any steps or the institution or carrying on of any proceedings 20 to determine the amount of any such duty or enforce any such obligation or hability.

S C H E D U L E S .

F I R S T S C H E D U L E .

A G R E E M E N T S M A D E A T T H E I M P E R I A L E C O N O M I C

C O N F E R E N C E , O T T A W A , 1 9 3 2 .

P A B T I .

U N I T E D K I N G D O M — C A N A D I A N A G R E E M E N T .

P A R T I I .

U N I T E D K I N G D O M — A U S T R A L I A N A G R E E M E N T .

A.D.

1032.

1 S T

S e n .

—cont.

U N I T E D K I N G D O M — N E W Z E A L A N D A G R E E M E N T .

P A R T I V .

U N I T E D K I N G D O M — S O U T H A F R I C A N A G R E E M E N T .

P A R T V .

U N I T E D K I N G D O M — N E W F O U N D L A N D A G R E E M E N T .

P A R T V I . A .D.

1 9 3 2 .

U N I T E D K I N G D O M — I N D I A N A G R E E M E N T . 1ST SOH.

—cont.

P A R T V I I . ,

U N I T E D K I N G D O M — S O U T H E R N R H O D E S I A N A G R E E M E N T .

1 8 9 C

A.D. 1932. S E C O N D S C H E D U L E .

CUSTOMS D U T I E S TO B E IMPOSED IN PURSUANCE

OF AGREEMENTS.

Goods on the Importation of which

Customs Duties are chargeable under this Act.

Rates of Duty.

Period of year during which duty charged.

Wheat in grain -

Maize, flat, white -

Rice, husked, including cargo rice and cleaned rice whole, but not including broken rice -

Butter -

Cheese -

-

-

Id.

per lb.

15*. per cwt.

15 per cent, ad valorem.

Eggs in shell:—

(a) not exceeding 14 lbs. in weight per great hundred

(6) over 14 lbs. but not exceeding

17 lbs. in weight per great hundred

(c) over 17 lbs. in weight per great hundred

Condensed Milk, whole—'

Not sweetened -

Sweetened, or slightly sweetened

[Milk Powder and other preserved milk excluding condensed milk—

Not sweetened -

Sweetened -

-

-

-

-

-

-

Fresh or raw fruit:—

Apples -

Pears -

Oranges -

-

2s. per qtr. of

480 lbs.

10 per cent, ad valorem.

Is.

Is. per great

Is.

4s.

hundred.

6d.

hundred.

9d.

per great

per great hundred.

6s. per cwt.

5s. per cwt.

6s. per cwt.

5s. per cwt.]

6d.

per cwt.

4s.

Qd.

per cwt.

3s.

6d.

per cwt.

Grapefruit

Grapes other than hothouse

5s. per cwt.

\.\ per lb.

April 1 to

Nov. 30

(inclusive).

April 1 to

Nov. 30

(inclusive).

Feb. 1 to

June 30

(inclusive).

r

. &.T

V. -V V t ;

[ 2 2 & 2 3 GEO. 5.] Ottawa Agreements.

Goods,on the Importation of which

Customs Duties are chargeable under this Act.

Poriod of year

Rates of Duty. during which duty charged. .

A.D. 1932.

2 N D S C H .

—cont.

Peaches and Nectarines

Plums -

14s.

per cwt. Dec. 1 to

Mar. 31

(inclusive).

9s.

4d.

per cwt. Dec. 1 to

Mar. 31

(inclusive).

1 0 Preserved or dried fruits :—

Apples preserved in syrup -

Figs and fig cake, plums (com monly called french plums and

3s. 6d.

per cwt. prunelloes), plums not otherwise

1 5 described, prunes and raisins 3s.

6d.

per cwt.

Other fruits (except stoned cherries) preserved in syrup

Honey -

2 0 Linseed

15 per cent, ad valorem.

7s. per cwt.

. . . . . 10 per cent,

Cod liver oil

Castor oil ad valorem.

Is.

4d.

per gallon.

15 per cent, ad valorem.

2 5 Linseed oil -

Coconut oil

Ground-nut oil

Rape oil -

-

-

-

-

Sesamum oil

3 0 Chilled or frozen salmon

Copper, unwrought, whether refined or not, in ingots, bars, blocks, slabs, cakes, or rods -

Magnesium chloride

lid.

per lb.

2d.,,

Is.

per cwt.

3 5 T H I R D S C H E D U L E .

E N A C T M E N T S A P P L I E D E O R T H E P U R P O S E S

OE S E C T I O N O N E .

Section nine of the Import Duties Act, 1932 (which empowers the Board of Trade to require information).

40 Section ten of the said Act (which prohibits the disclosure of information).

1 8 9 D

A,D. 1932. Section eleven of the said Act (which contains provisions as

- to shipbuilding yards).

^-cfnt' Section thirteen of the said Act (which provides for the importation free of duty of goods imported with a view to re exportation).

5

Section fourteen of the said Act (which makes provision as to the re-importation of goods liable to duty under the said Act).

Section fifteen of the said Act (which makes provision as to the valuation of goods for the purposes of the said Act).

Section sixteen of the said Act (which provides for the 10 determination of disputes as to the valuation of goods).

The Second Schedule of the said Act (which makes provision as to drawbacks of duties chargeable under the said Act).

Section nine of the Finance Act, 1932 (which makes further provision for the drawback of duties under Part I of the Import 15

Duties Act, 1932).

F O U R T H SCHEDULE.

A M E N D M E N T S OE 13 G E O . 5. c. 5.

PART I .

AMENDMENTS CONSEQUENTIAL ON EXTENSION OF SECTION ONE 20

TO ALL CANADIAN CATTLE.

Provision amende d. Amendment.

Subsection (1) The word " store " shall be repealed, and the of section one following proviso shall be inserted at the end of the subsection, viz.:— 25

" Provided that the Minister may require any such cattle to he slaughtered as aforesaid if, in his opinion, they could be used for breeding, and are not suit able for that purpose." 30

Subsection (8) The following words shall be substituted for the of section one. words from " store cattle " to the end of the subsection, viz. :—

" ' Cattle ' has the meaning assigned to it by subsection (1) of section fifty-nine 35 of the principal Act as originally enacted."

Section two - The following words shall he repealed, viz., the word " store," the words from "in the case of" to "therefrom, and if," and the words 40

" other than tuberculosis."

PART I I .

MINOR AMENDMENTS OP SUBSECTION (2) OE SECTION 1.

Provision amended. Amendment.

Paragraph (a) -

Paragraph (c) -

- The word " indelibly " shall be repealed.

- In sub-paragraph (i) the words " one clear day " shall be substituted for " three clear days," and sub-paragraph (iv) shall be repealed.

A.D. 1932.

4 T H S

—cont.

MOST SECRET.

To be kept under lock and key.

Ottawa Agreements.

D R A F T

O F A

B I L L

To enable effect to be given to the Agreements made at Ottawa on the twentieth day of

August, nineteen hundred and thirty-two, between His Majesty's Government in the

United Kingdom and His Majesty's Govern ments in Canada, the Commonwealth of

Australia, New Zealand, the Union of South

Africa, and Newfoundland, respectively, the

Government of India, and the Govern ment of Southern Rhodesia, and for that pur pose to impose certain duties of customs; to facilitate the fulfilment of the said agreements by increasing certain duties of customs on wines

[and coffee]; and for purposes connected with the matters aforesaid.

XXXII.—A. (6.)

21th September 1932.

1 8 9 - 6