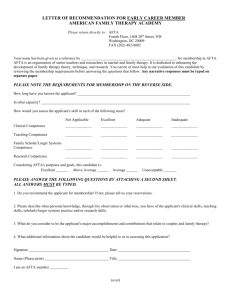

SECRET

advertisement