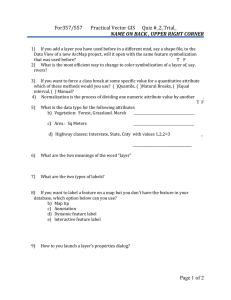

Document 11225555

advertisement