Document 11222705

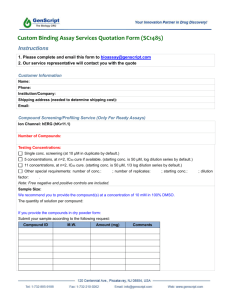

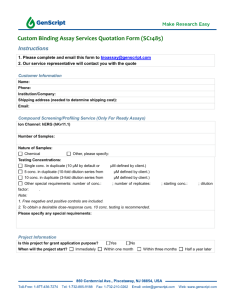

advertisement