-

advertisement

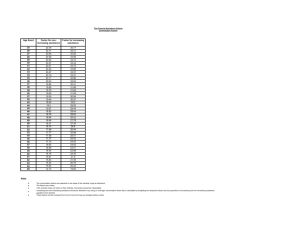

UnIsex Rating in Insurance An Honors Thes 1s (I D 499) by Anju Gupta Thesis Director Ball State University Muncie, Indiana April, 1989 May, 1989 .-. .Introduct1on When the Equal Rights Amendment missed ratification by three states in 1982 CGest, 1985:40), the fight for equal rights for men and women did not end. Various feminists groups, including the National organization of Women (NOW), continue to lobby for equal rights for women in many different areas. Recently, the fight for equal rights has reached the insurance industry. In order to calculate premiums on insurance policies, companies use sex-distinct tables. NOW and other feminist groups argue that the use of these tables discriminates against women. To insure the equal treatment of men and women, NOW maintains that these sex-distinct tables should be abolished and a unisex table should be used. The insurance industry, however, argues gender is a primary risk factor in setting rates (Dennon, 1988: 1), and if important risk factors are eliminated, overpricing and underpricing wi 11 occur (Carroll, 1988:56). In the course of this paper, I will attempt to present both supporting and opposing views of this argument as fairly as possible. However, the main point of this paper is to present an actuarial view of the argument. I will outline a brief history of the unisex debate, and then I will present both views of the issue. Then, I will try to explain the actuarial viewpoint of the issue of using gender as a basis of ratemaking for insurance products. What Does Unisex Rating Mean? - When actuaries design tables for pricing insurance products, they use actual data from past experience. They group lives according to the risks each life represents. The risks which they use for classification have been found to allocate cost fairly according to the degree of risk which the insurer bears. These risks include such characteristics as the age of the insured, the gender of the insured, whether the insured smokes or not, and many others. The use of unisex tables would eliminate gender as a risk classification. Rather than establish separate male and female tables, actuaries would design a table based on a group blended by gender. One method of blending would involve adding the percentage of male business 2 - times male lives to the percentage of female business times female lives. For example, 1f approximately seventy percent of an insurance company's business came from males and the other thirty percent from females, the blended group at age x would consist of seventy percent of the male I ives at age x plus thirty percent of the female lives at age x. Once this blended group has been established, the actuaries would calculate, using the same methods as they would with sex-distinct rates, the mortality tables. From these mortality tables, the net single premiums, annuity values, and premiums would be calculated. Using sex-distinct tables produces different premium rates for males and females. However, premiums for females are not higher on all insurance products. While men pay higher premiums for equal life insurance coverage than do women, annuities used in pension programs charge women more than men. Unisex legislation would mandate the use of unisex mortality tables in the annuity and premium calculations. However, the issue is not about the use of unisex tables; the issue Is about the validity of gender as a risk classification. History Over the past years, there has been a great deal of legislation which addresses the issue of equality among men and women. Some of this legislation has been directed at the insurance industry. The Supreme Court made two landmark decisions, City of Los Angeles Water and Power vs. t1anlJartand Arizona Governing Committee vs. Norris, which addressed the issue of sex-distinction in pensions. On the state level, there have been several states which enacted legislation requiring the use of unisex tables for either auto insurance or all 1ines of insurance. Title VII of the the Civil Rights Act of 1964 was used to cHe in allegations of discrimination in both the t1anlJartand Norris cases. Each of the titles in the Civil Rights Act of 1964 prohibits discrimination in particular areas, and Title VII prohibits discrimination in the area of employment (Cary and Peratis, 1978:53). Congress expressly declared that no employer "shall discriminate against any individual on the basis of 'race, color, religion, sex, or national origin'" (Cary and Peratis, 1978:30). In 1978, the case of the City of Los Angeles Water and Power vs t1anlJartcame before the Supreme Court. In this case, the employees of the Los Angeles Department of Water and Power sued the Department for requiring female employees to make larger monthly contributions to a - - . 3 pension plan than their male counterparts in order to receive the same monthly benef1t (Cary and Peratls, 1978:71-72). The use of gender-based tables in computing benefit amounts for a mandatory defined benefit plan was found to be in violation of the Civi I Rights Act of 1964 (Kurlowickz and Damiani, 1987:30). In 1983, the case of Arizona Governing Committee vs. Norris was brought before the Supreme Court. In this case, Nathalie NorriS, an employee of the State of Arizona, sued her employer for violating the Civil Rights Act of 1964 by administering a pension plan which computed benefits using a sex-distinct table. The Supreme Court ruled in favor of Norris, requiring plan sponsors to only use unisex tables when computing benefits. Prior to the Supreme Court decision, a female employee would receive a lower monthly pension benefit than her male counterpart (Gibson et aI, 1983: 1). Since a large majority of insurance regulation is conducted on the state level, many of the significant cases in which unisex legislation has passed occur in the states. However, in 1983, Republican Senator Bob Packwood of Oregon introduced a bill at the federal level, that was eventually defeated, which would have prohibited the use of gender-based tables in alllines of insurance (Dennon, 1988: n Several states have enacted legislation which requires the use of unisex tables, and still others are considering it. There are several states which require the use of unisex tables in setting rates on automobile insurance. As early as 1974, the use of unisex tables for auto insurance became effective in the state of Hawaii. In 1975, North Carolina followed with legislation requiring unisex auto insurance. Unisex auto insurance is required in the state of Michigan, effective since 1981. A regulation requiring the use of unisex auto rates was scheduled to take effect in September, 1986 in Pennsylvania; however, the state legislature passed a bi 11 null ifying the regulation before it could take effect (Dennon, 1988:2). In 1983, Montana became the first state to enact legislation requiring the use of un1sex tables for all lines of insurance. This law went into effect in October, 1985 (Youngman, 1987: 1). The state legislature voted to repeal the law in 1987; however, Governor Ted Schwinden vetoed the repeal on the basis of constitutional guarantee against discrimination (Dennon, 1988:2). The State of Massachusetts recently became the second state to require the use of unisex tables for alllines of insurance. The state is the first to move to unisex rating as a result of a regulation, rather than legislat10n (McGhee, 1988:6). The regulation was promulgated on September 18, 1987 and became effective September 1, 1988 (Benjamin, 1988:4). 4 There are other states which are currently investigating the idea of unisex rating. During the 1988 Iowa state legislative session, a study committee on the elimination of discriminatory insurance practices was establishelj, In Minnesota, a special eleven-member task force has been established by Minnesota Insurance Commissioner Michael Hatch to stUdy the issue (,Jones, 1988: n William E. Kingsley, an American Council of Life Insurance (AClI) executive Vice-president, remarked that the AClI expects a big push for unisex rating in the insurance industry. Since the defeat of the federal b111 for un1sex rat1ng, there has been 1ncreased Interest In unIsex rating bi lls among state legislators (Arndt, 1987:3). Support for Untsex Rating Support for unisex rating comes from several different directions. The most prominent area of support is feminist organizations, such as the National Organization of Women (NOW) as well as others. The American Civil Liberties Union (ACLU) also actively supports unisex legislation. Although most insurance companies have opposed unisex rating, some have supported it. Most notably, John Hancock Financial Services has both supported unisex rating and worked to help enact unisex legislation (Hathaway, 1988:54). Proponents of unisex rating have used many arguments to support their cause; however, the most common argument used is that the use of sex-distinct tables in insurance is unfairly discriminatory. Although gender has been found to be a good predictor of risk, some feel it should not be used to set rate differentials because, as gender is a characteristic that cannot be changed, the individual should not be punished for it (Dennon, 1988:25). While insurers continue to support the use of gender as a reliable and significant cost factor, proponents maintain that gender-based Insurance is offensive to basic civil rights principles (Zimmerman, 1986:24). Gender has been found to be a socially unacceptable method of grouping people for business purposes (Bennett, 1986: 106). According to the Senate Commerce Committee in 1982, ..... treating men and women equally in insurance is not so much a matter of statistics as of 'simple justice'" (Dennon, 1988:25). Marcia Youngman, the Non-Gender Insurance Project Director for the Women's Lobbyist Fund of Montana, is a strong supporter of unisex rating. In her testimony to the Massachusetts Division of Insurance, Ms. Youngman stated that her group supported the unisex legislation for economic reasons as well as for civil rights reasons (Youngman, 1987: 1). Ms. youngman discussed the effects of unisex legislation in Montana, including higher 5 - - rates due to factors unrelated to the law such as 111egal pollt1cal ratemaklng and poor rate adjustment processes (Youngman, 1987: 1-4). The Women's Lobbyist Fund of Montana conducted a rate study to discover the impacts of the unisex law on various types of insurance. The results of this study showed that while some rates went up and some went down, ..... the rate picture is generally much fairer than before, ..... (Youngman, 1987:5). Ms. Youngman also stated in her testimony that the industry uses gender-related statistics inconsistently, in ways that have not treated women faIrly. She feels actuarIal data Is used In several areas In a way which minimizes benefits to women. Ms. Youngman summarized her feelings by stating, "It is in the best interest of companies as well as consumers to rate people according to performance and lifestyle factors that allow companies to reward people for safe and healthy behaviors and thus attract low-risk customers, rather than according to the uncontrollable factor of gender" (Youngman, 1987:7). The ACLU supports unisex rating on the basis of the fundamental polICy that ..... certaln protected characteristlcs--race, color, religion, sex, marital status and national origin--should not be taken into account In setting insurance rates ..... (ElliS, 1988:2). In her statement on the behalf of the ACLU before the Iowa Study Committee on the Elimination of Discriminatory Insurance Practices, Deborah A Ellis stated that insurance is one of the few areas in this country in which intentional sex discrimination is permitted and defended (ElliS, 1988:4). She also made the point that insurance companies do not use either race or religion as a baSis of rIsk class1flcation; therefore, the same policy should apply to gender (ElliS, 1988:6). Ms. Ell is attacked the industry'S claIm that sex distInctions are based on actuarial SCience, saying that the only "science" involved was the taking of a group average (ElliS, 1988: 11). As Ms. Ellis stated, "The fact of the matter is that all actuarial groupings are inevitably entirely arbitrary, or based upon social value jUdgments, or, in the worst case, are merely reflections of social stereotypes and prejudice" (ElliS, 1988: 12). In actuarial tables, women as a group live longer than men; however, Indlvldual women do not always llve as long as actuarial tables predict (Erickson, 1988: 1). Proponents of unisex rating use this argument frequently to support their views. As Jenny A Erickson, Assistant Legislative Counsel at John Hancock Financial Services, stated to the Iowa Study Committee on the Elimination of Discriminatory Insurance Practices, divergent perspectives on the same important essence of insurance loss prediction make debate difficult (Erickson, 1988: 1) However, as Ms. Erickson stated, "The issue is no longer an actuarial one, it's a social one" (Erickson, 1988:2). In a poll conducted among their clients, John Hancock Financial Services found that gender-based rates were offensive to customers, who viewed the issue as one of fairness and unfairness. The 6 - company supports un1sex rat1ng as a gOOd soc1al poliCY whose time has come (Hathaway, t 988:54-55). Opposition to Unisex Rating Whlle there Is strong support for unisex rating, there is also a great deal of opposition directed towards the issue. The majority of this opposition comes from the insurance industry sector. The American Council of Life Insurance (ACLI), various companies, and specific actuaries have come out in strong opposition of unisex legislation. The main argument used by the opponents is that, under a system using unisex rates, one sex subsidizes the other on almost all lines of business. Other arguments used include the fact that experience has shown that males have higher mortality rates than females and the fact that gender-based rates are actuarlally sound. Insurance companies use gender as a primary risk for setting rates in several I ines of insurance. The industry defends this practice, saying gender allocates cost fairly according to the degree of risk which the insurer bears (Dennon, 1988: 1). Whi Ie a growing number of insurance customers feel this system is unfair, Wi 11 iam E. Kingsley of the ACLI suggest that there is a basic lack of understanding of risk-based rating (Arndt, 1987:3). Barbara Lautzenhe1ser, a pract1clng actuary for over twenty-seven years, argues that gender is valid as a risk classification, and, if it is eliminated, a subsidy would occur as insureds with different expected losses were placed in the same class (Lautzenheiser, 1988: 1). William F. Carroll, president of the Life Insurance Association of Massachusetts, says that gender is a significant risk factor in mortal ity rates, and that if it is ignored, overpricing and underpricing wi 11 result (Carroll, 1988:56). As Joseph 5. Diamond indicated in an editorial in the NatIonal UnderwrIter, "'equal treatment' doesn't necessarily mean the same treatment; ... it really means fair and equitable treatment for all" (Diamond, 1988: 18), Fairness in insurance means pricing each person according to the risk he or she represents (Carroll, t 988:56). In a study done in connection with her doctoral thesis, Deborah Lee Wingard studied both the biological and behavioral factors which affect the sex differential in mortality rates. While most studies explore the behavioral factors which account for mortality differences between the two sexes, they do note that the male death rate is higher even 1n prenatal 11fe, when behavioral factors could have little effect (Wingard, 1980: 1). Ms. Wingard discovered in her study that women have lower death rates than 7 -- men in almost every country, at almost every age, and for most causes of death, indicating better overall fitness among women (Wingard, 1980: 11 ). As Ms. Lautzenheiser indicated in her testimony before the Iowa Study Committee on the Elimination of Discriminatory Insurance Practices, the risk classification plans and variables used to distinguish among different classes are based on actual data collected by the insurer (Lautzenheiser, 1988: 1). Actuaries have carefully analyzed this data and constructed tables reflecting the differences. While some object to this practice because it treats women as a class rather than individuals, the industry defends the practice because there are I imitations within actuarial science; the future cannot be predicted on each individual basis. Proponents of unisex rating frequently accuse the industry of loading female policies with higher expense costs than male policies. Ms. Lautzenheiser says that mortality costs, which are lower for women, are the only differences in costs between the two sexes (Lautzenheiser, 1988:5). Competition within the industry automatically demands that prices fairly reflect costs (Lautzenheiser, 1988: 1). If women's rates are higher than men's rates, even under a unisex system, it is not due to a conspiracy by the insurance industry, but rather due to actuarially sound rates (Lautzenheiser, 1988: 13). Actuarial Section Given a group of lives starting at age x and the survivor experience in the following years, actuaries can design mortality tables. Using these tables, the actuaries can then calculate net single premiums, annUity values, an(j premium values. These calculations are made using the same formulas, regardless of what data was used to construct the mortal ity tables. Construction of Mortality Tables: When designing mortality tables, the actuary starts with the raw data on a group of lives starting at age O. (This can be done starting at any age x.) - Let 10 = the number of 1ives in the original group, Let Ix = the number of lives in the group at age x. 8 The original group, previous year. 10, will reduce at each age by the number of deaths in the Let dx = the number of deaths in the year x = Ix - lx+l. To make the terminology less cumbersome, let (x) = a person aged x. The probab il i ty that a person aged x will surv i ve to age x+ 1 equals the number of lives at age x+ 1 divided by the number of lives at age x. Let nPx = the probability that (x) survives n years = the number of liyes at age x+n the number of I ives at age X . Px = the number of lives at age x+ 1 the number of I ives at age x =..1:tl Ix . Following the basic laws of probability, the probability of a person aged x dying before age x+ 1 equals one minus the probability of a person aged x surviving to age x+ 1. Let Qx = the probabi I ity that (x) dies before age x+ 1 = 1 - Px = 1 --k1. Ix . .- From this formula the probability of dying within one year is calculated for each age x, from zero to ninety-nine, or the last year of survivorship. These probabilities then constitute the mortality table. To illustrate the calculations performed when designing a mortality table, the data on the blended group of lives will be used. However, the same formulas and steps were used to calculate the mortal1ty tables for the male and female groups of lives. The data used in these calculations is from 9 the actual experience of the Principal Mutual Life Insurance Company, located in Des Moines, Iowa. Given data on males and females for age zero through age ninety-nine, a blended group is established, assuming that eighty percent of the total business was male and twenty percent of the total business was female. The original number of 1ives, starting at age zero, is 10 = 501883 . To construct the mortality table, the probabllity of dying within one year is calculated for each age x. For example, for a person aged forty-four, P44 =~ = 144 q44 =1- 461435 466085 P44 =1- = 0.99582 0.99852 = 0.00418. In the mortality tables, the probabilities of dying within one year, or the qx's, are multiplied by one thousand, which produces 1000qx's. In calculations involving Qx, the factor of one thousand is removed by division; therefore, this factor does not affect the calculations, but it does make reading the table easier. Net Single Premiums; Once the mortality table has been established, the net single premiums can be calculated. Let bt = the benefit payment for a 1ife insurance. The benefit function, bt, is usually defined as the face value on the insurance polley and, therefore, is a constant value. However, it can also be a function with a value that changes over time. Let vt = the discount function for time of policy issue. bt x v t = the present value of the benefit payment at the time of policy issue. - The discount function is used to discount the future benefit payment back to the time of policy Issue. 10 ,- The net single premium represents the expected present value of the benefit payment at the time the policy is issued. For a whole life insurance polley for a person aged x, the net single premium equals the present value of the benefit payment times the mortality function at age x, summed over the span of 1ife. Let Ax = the net single premium for who le 1ife insurance for a person aged x 00 Ax = 2: bk+IVk.+l k PxQx+k . k.=o Summing over such a long period of time can become difficult. Therefore, actuaries have developed commutation functions. These functions can be used to calculate net single premiums in terms of stored intermediate values. The commutation functions are defined in Actuarial Mathematics as follows: 00 Mx = 2: Cx+k (Bowers et aI, 1986: 112). 1<.-0 Using these definitions of commutation functions, the net single premium for a whole life insurance policy can be calculated. FreQuently, net single premiums are calculated so that the benefit is payable at the moment of death. In order to calculate these types of net single premiums, continuous values are integrated over the span of life rather than whole values being summed. That is, Ax = the net single premium for whole life insurance, benefit payable at the moment of death - 11 -. OD Ax = fobtvttPxl.1x+tdt , where I.1x is the force of mortality, while Ax is the net single premium for whole life insurance, benefit payable at the end of the year in which the death occurs. However, the net single premium with the benefit payable at the moment of death can be obtained using the net single premium with the benefit payable at the end of the year in which the death occurs. In order to make this calculation, several measurements of the interest rate will be used. Let i = the interest rate used to discount the benefit back to the time of policy issue. Let vt .a uniform Ax + i )-t . 8 = In(l + D. Let Assuming = (1 = distribution of deaths, it has been shown that _i Ax ~ (Bowers et aI, 1986: 104). Using commutation functions, Ax = bt x _i 'E> Mx 0;. To illustrate the necessary steps in the calculation of the whole life net single premium, the blended mortality table is used, although the same formulas are used to calculate the whole life net single premiums for males and females. Let the face value on a whole life insurance policy for a person aged forty-four be one. The assumed interest rate in the calculations will be seven percent. The net single premium for the whole life policy with benefits payable at the moment of death is OC> AM = JovttP44Jl44+tdt. Using commutation functions, - 12 -A44 = = 0.07 X In( 1.07) 3972.30 23745.37 0.17308 . The whole life net single premium for a male aged forty-four is A44 = 0.18086, and the whole life net single premium for a female aged forty-four is ~ = 0.14190. The significant differences between these three values will be discussed in the section on premiums. Term insurance can also be used to illustrate premium differences for males and females. To calculate the net single premium for a term policy, benefit payable at the moment of death, the actuary follows the same basic steps as for a whole life policy. Once again there is a benefit function, bt, and a discount function, vt. However, rather than integrating from zero to infinity, trle integration is from zero to n-1, with n being the duration of the term policy. To calculate the net single premium for a n-year term policy, benefit payable at the moment of death for a person aged X, let Ax: ri1 = the net Single premium for n-year term insurance for a person aged x 0-1 = 2: bk+1Vk+1kPxqx+k. k=O Commutation funct ions can be used to calculate this. The net single premium for a n-year term policy, benefit payable at the end of the year in which the death occurs is, in terms of commutation functions, Ax: ri\ = bt (M x - Mx+o) Ox The net single premium for a n-year term policy with benefit payable at the - 13 moment of death is n A~c 1i\ = JblvttPx Ux+t dt . o Under the uniform distribution of deaths, A~: nt = _i Ax: iil b = bt x _i (M x - Mx+n ) ~ Ox Using the mortality rates from the blended table, the net single premium for a ten-year term policy for a person aged thirty-five, with a benefit of one payable at the moment of death is 10 A35: -. 10\ = fo vttP35U35+tdt. Using commutation functions, A35:1O\ = _i (M35 - M45) ~ D35 = 0.07 x (4770.96 - 3879.45) In( 1.07) 44796.45 = 0.02059. The net single premium on a ten-year term policy is calculated for males and females using the same formulas. These calculations produce -, A3s:i01 = 0.02146 for a·male aged thirty-five and, for a female aged thirty-five, A3s:1Ol = 0.01708. - The differences between these three values will be investigated in the premium calculations. 14 - Anou1tles: Annuity values can also be calculated using the newly-constructed mortality table. Let vt = the discount function for the time of po I icy issue. This discount function is the same as that used for calculating net single premiums. There are two types of annuIties: an annUity-Immediate, wh1ch pays at the end of the year, and an annuity-due, which pays at the beginning of the year. Let ax = the actuarial present value of a whole life annuity-due of one for a person aged x co ,- Commutation functions can be used to calculate this actuarial present value. A new commutation function, Nx, is introduced. co Let Nx = 2: Ou . u=x Us1ng th1s deflnit10n for the commutation function, it can be shown that ax = Nx Ox (Bowers et aI, 1986:140). Given a person aged forty-four, the actuarial present value of a whole life annuity-due of one can be calculated. To illustrate the necessary steps, the blended mortality table will be used. co a44 = 2: vkkP44. k=O Using commutation functions, - 15 'a44 = 302245.45 23745.37 = 12.73. The actuarial present value of the same annulty for a male aged forty-four is For a female aged forty-four, the actuarial present value of a whole life annuity-due is a44 = 13.19. The effect of these differences in values can be seen in the premium calculations. Therefore, they will be investigated further in the section regarding premiums. The actuarial present value of a n-year temporary life annuity-due can be calculated as well. The discount function remains the same as with a whole life annuity-due. Let aX:!i\ = the actuarial present value of a n-year temporary life annuity-due of one for a person aged x n-l = 2: VkkPx . k=O This actuarial present value can be calculated using commutation functions. ax: iii = Nx - Nx+n Dx To calculate the actuarial present value for a ten-year temporary annuity-due of one for a person aged thirty-five, using the blended mortality table, 9 a35:1O) - = 2: k=O Vk.k.P35. 16 - using commutation functions, a35: 101 = N35 - N45 D35 = 611818.28 - 278500.08 I 44796.45 7.44. = The same formulas are used to calculate the actuarial present values of a temporary annuity-due for a male and for a female. For a male aged thirtyfive, the actuarial present value of a ten-year temporary annuity-due is a35: 101 = 7.44. The actuarial present value for a similar annuity-due for a female aged thirty-five is a35:161 = 7.45. The significance of these values and theIr effect on the premiums will be investigated later. Calculations can also be made for annuities payable on monthly, quarterly, or semi-annual basis. These are referred to as annuities which are payable on a nthly basis. The actuarial present value of an annuity of this type can be calculated using the actuarial present value of an annuitydue. Several measurements of interest rate will be used. I = Interest rate. Let d = i 1+i . Let i(m) = m[(1+i)1/m - Let d(m) 1]. = m[ 1 - (1 +i)-l/m] As shown in Actuarial MathematiCS, ~(m) = - id i(m)d(m) . 17 - f3(m) = i - i(m) i(m)d(m) (Bowers et aI, 1986: 137-138). Using these definitions, let ax(m) =O\(m)ax - J3(m) . Commutatlon functlons can tnen be used to calculate tnls value. To illustrate the calculation of the actuarial present value of an annuity-due of one with rr.thly payments, the blended mortality table will be used. For a person aged fifty-five, the actuarial present value of a whole life annuity-due with monthly payments is 'ass(12) =0<.( 12)ass - J3( 12). Using an interest rate of seven percent, i = 0.07 d = 0.07 = 0.06542056 1.07 i(12) = 12[( 1.07)1/12 - 1] = 0.06784974 d(12) = 12[ 1 - (1.07)-1/12] = 0.06746827 0\( 12) = B( 12) = (0.07)( 0.06542056) = 1.00037888 (0.06784974)( 0.06746827) 0.07 - 0.06784974 (0.06784974)( 0.06746827) = 0.46972346 Therefore, a55(12) ,- = 1.00037888a55 - 0.46972346. 18 - Using commutation functIons, a55(12) = 1.00037888Ns5 - 0.46972346 D55 = 1.00037888 116006.44 - 0.46972346 10513.42 = 10.57. The same formulas can be used to calculate the actuarial present value of a whole life annuity-due with monthly payments for a male aged fifty-five. The result is a55(12) = 10.37. The actuarial present value of a similar annuity-due for a female aged fifty-five is ass(12) = 11.34. These vall.;,es have an impact on pension benefits and wi 11 be discussed further in that sect ion. Net Annua'l Premiums: After the net single premiums and actuarial present values of annuities have been calculated, the net annual premiums can be calculated. Let P(Ax ) = the net annual payment, semi-continuous premium for a whole I ife insurance for a person aged x. Assuming the equivalence principle, PCAx ) = Ax ax . -. When premiums are calculated using separate male and female tables, a significant difference can be seen between the two values. For example, the net annual premium on a sixty thousand dollar whole life policy for a female aged forty-four is 19 - PCA44) = $60,000 A44 a44 = $60,000 (0.1419) ( 13.19) = $654.54. However, the net annual premium on a sixty thousand dollar whole life policy for a male aged forty-four is P(A44) = $60,000 A44 a44 = $60 000 (0.18086) 1 ( 12.61) = $860.32. The difference between the two values is significant. The actual dollar difference of over two hundred dollars indicates that this policy is over thirty percent more expensive for men than for women. This difference is not affected at all by any factors other than actual life experience. Using a blended table to calculate the net annual premium on a sixty thousand dollar whole life policy for a person aged forty-four produces P(A44 ) = $60,000 A44 ;344 _ i = $60,000 (0.17308) ( 12.73) = $815.85 . If this blended table were used, the premium for females would increase by almost twenty-five percent while the premium for males would decrease by approximately five percent. Those opposed to unisex insurance use these figures to support their argument that, under gender-neutral rule, the female risks would be subsidizing the male risks by paying higher rates. The difference between the life experience of males and females is not a small, insignificant 20 -- percentage; by blend1ng these two groups, the female group Is beIng penalized unfairly while the male group is being given an advantage. Term insurance is another insurance product in which male and female premiums are significantly different. To calculate the net annual premium for term insurance, let peAk: nj) = the net annual payment, semi-continuous premium for a n-year term life insurance for a person aged x. Assuming the equivalence principle, P(A~:"ij) = AX: 1i1 ax: Ii] . There are significant differences in the premiums for males and females for term 1nsurance as well as for whole 11fe Insurance. For example, the net annual premium on a twenty thousand dollar ten-year term policy for a female aged thirty-five is P(A35:m) = $20,000 A35:1o\ a35:iOl = $20,000 (0.01708) (7.45) = $45.84. The net annual premium on a twenty thousand dollar ten-year term policy for a male aged thirty-five is P(A35:~) = $20,000 A35:101 a35:1Ol = $20,000 (0.02146) (7.44) =$57.71. The male and female premiums once again show a remarkable difference. The premIum for a male 1s almost twenty-s1x percent hIgher than that for a female. H)is difference is affected by nothIng other than actual life experience. 21 -" using the blended table which would be mandated under unisex legislation, the net annual premium for a twenty thousand dollar ten-year term policy for a person aged thirty-five is P(A~5:loP = $20,000 A~5:tQ. a35:Tq = $20,000 (0.02059) (7.44) = $55.34. As in the case of whole life insurance, use of a blended table would overchargE- females and undercharge males. The net annual premium for this policy for females would increase by over twenty percent and the premium for males would decrease by approximately four percent when an unisex table is used. Although the differences between the male, female and blended premiums for term insurance are not as large as for whole life, the differences are sti 11 there. These values continue to support the arguments of those opposing unisex insurance. - Pension Benefits: Unisex legislation is already in effect in the area of pensions. In the case of C1ty of Los Angeles Water and Power vs t1annart, the Supreme Court outlawed the practice of requiring men and women to contribute different amounts to a pension plan in order to obtain the same coverage. Then, in the case of Arizona Governing Committee vs NorriS-in 1983, the Supreme Court mandated the use of unisex tables in the calculation of pension benefits. Before investigating the effects of using unisex tables for pension plans, the pension benefit must be calculated. As most pensions pay benefits on a monthly benefit, let ax (12) = the actuarial present value of the whole life annuity-due used to calculate monthly pension benefits for a person aged x. Let B = the total value of the pension upon retirement. Let 8)/12) = the monthly pension benefit for a person aged x. 22 The monthly penslon beneflt 1s slmply the total value of the penslon dlvlded by the whole life annuity-due payable monthly, for an entire year. The monthly benefit on a forty thousand dollar pension for a male aged fifty-five is B55(12) = $40,000 12a55(12) . = $40,000 12( 10.37) = $321.34. The monthly benefit on a forty thousand dollar pension for a female aged fifty-five is B55(12) = $40,000 12aS5(12) = $40,000 12( 11.34) = $294.06 . There is a significant difference between the male and female benefits. In the case of the pension, the female benefit is over nine percent smaller than the male benefit. Using the blended table, B55(12) = $40,000 12a55(12) = $40,000 12( 10.57) = $315.40. While using a unisex table improves the benefit to females by seven percent, it decreases the benefit to males by almost two percent. 23 As In the case of life Insurance, the use of the unisex table is penalizing one group unfairly and giving the other group an advantage. However, in the case of the pension benefit, the male group is being penalized and the female group is being given an advantage. Opinion .- The actuarial calculations in this paper strongly support the arguments of those who oppose unisex rating. In life insurance, premiums for males Ijecrease using a unisex table while premiums for females increase using the unisex table. In the case of penSions, the benefits for females increase using unisex annuities and the benefits for males decrease using unisex annuities. This situation indicates that one gender subsidizes the other under unisex ratng. Although females receive higher pension benefits when unisex rates are used, it could be considered unfair that males receive lower pension benefits. In the case of life insurance, many females may be upset to find that their premiums will rise drastically under unisex rating whi Ie premiums for males drop. Frequently, proponents of unisex rating use the argument that gender is a characteristic which cannot be changed; therefore, a person should not be penalized for his or her gender. However, if unisex rating were to become mandated, this situation of penalizing an individual on the basis of gender would not only sti 11 exist, but it would become magnified. Under the current system using gender-based tables, the risk borne by each person due to his or her gender is fairly allocated. If unisex rating became the law, each person would be bearing his or her own risk as well as subsidizing the risk of an equally situated person of the opposite sex. The system of unisex rating will not provide equality for all. Instead, it w111 discriminate unfairly against large segments ofpeople in almost all lines of insurance. No unfair discrimination against women is taking place in the insurance industry. However, unisex rating would mandate unfair discrimination against both sexes. By saying unisex rating is right, proponents are saying it is fair to overcharge half of the insureds and undercharge the other half. As the fight for unisex rating continues, the question arises about what the consumers know. However, there seems to be very little action on the part of unisex proponents to educate the consumers about the issue. They wi 11 be the ones directly affected by unisex rating, and they should be the ones to decide. 24 - The fight for unisex rating may continue forever. Although they do not want unisex rating to go into effect, many companies view it as inevitable. If the mandating of unisex tables is inevitable, then the legislation should be federal rather than from the state. I f unisex rating represents equality for the citizens of one state, it should represent equality for the citizens of the entire country. Actuarially, unisex rating is not logical. It defers the risk one individual represents to another individual. Different groups will be overcharged whl1e others are undercharged. However, 1f unisex rat1ng represents equality, then this situation will exist. Whether supporting or opposing the unisex rating in insurance, it is obvious that in this case equal ity does have a price. 2S - ~ - 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Male yX ---------- Male Ix ------- ------- 1.00000000 0.93457944 0.87343873 0.81629788 0.76289618 0.71298618 0.66634222 0.62274974 0.58200910 0.54393374 0.50834929 0.47509280 0.44401196 0.41496445 0.38781724 0.36244602 0.33873460 0.31657439 0.29586392 0.27650833 0.25841900 0.24151309 0.22571317 0.21094688 0.19714662 0.18424918 0.17219549 0.16093037 0.15040221 0.14056282 0.13136712 0.12277301 0.11474113 0.10723470 0.10021934 0.09366294 0.08753546 0.08180884 0.07645686 0.07145501 0.06678038 0.06241157 0.05832857 0.05451268 0.05094643 0.04761349 0.04449859 0.04158747 0.03886679 0.03632410 371097 370121 369740 369374 369016 368673 368349 368043 367756 367480 367208 366933 366636 366299 365907 365453 364934 364354 363727 363065 362382 361693 361006 360327 359664 359017 358389 357773 357161 356554 355941 355318 354678 354015 353325 352601 351836 351020 350146 349208 348195 347098 345911 344628 343239 341739 340123 338382 336511 334502 2.63 1.03 0.99 0.97 0.93 0.88 0.83 0.78 0.75 0.74 0.75 0.81 0.92 1.07 1.24 1.42 1.59 1.72 1.82 1.88 1.90 1.90 1.88 1.84 1.80 1.75 1.72 1.71 1.70 1.72 1.75 1.80 1.87 1.95 2.05 2.17 2.32 2.49 2.68 2.90 3.15 3.42 3.71 4.03 4.37 4.73 5.12 5.53 5.97 6.46 1000qx 26 -, 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 -" 0.03394776 0.03172688 0.02965129 0.02771148 0.02589858 0.02420428 0.02262083 0.02114096 0.01975791 0.01846533 0.01725732 0.01612834 0.01507321 0.01408711 0.01316553 0.01260423 0.01149928 0.01074699 0.01004392 0.00938684 0.00877275 0.00819883 0.00766246 0.00716117 0.00669269 0.00625485 0.00584565 0.00546323 0.00510582 0.00477179 0.00445962 0.00416787 0.00389520 0.00364038 0.00340222 0.00317965 0.00297163 0.00277723 0.00259554 0.00242574 0.00226704 0.00211873 0.00198012 0.00185058 0.00172952 0.00161637 0.00151063 0.00141180 0.00131944 0.00123312 332341 330015 327497 324769 321804 318583 315091 311319 307259 302902 298231 293221 287837 282046 275816 269122 261958 254327 246242 237710 228722 219260 209299 198817 187814 176339 164480 152358 140113 127878 115760 103844 92204 80917 70087 59846 50332 41664 33926 27157 21354 16476 12454 9198 6603 4556 2953 1710 785 200 7.00 7.63 8.33 9.13 10.01 10.96 11.97 13.04 14.18 15.42 16.80 18.36 20.12 22.09 24.27 26.62 29.13 31.79 34.65 37.81 41.37 45.43 50.08 55.34 61.10 67.25 73.70 80.37 87.32 94.76 102.94 112.09 122.41 133.84 146.12 158.97 172.22 185.72 199.52 213.68 228.43 244.11 261.44 282.13 310.01 351.84 420.93 540.94 745.22 1000.00 27 Af1J 0 1 - 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Male Dx --------- 371097.00 345907.48 322945.24 301519.21 281520.54 262858.75 245446.49 229198.68 214037.34 199884.77 186669.93 174327.23 162790.77 152001.06 141905.04 132456.99 123615.77 115345.15 107613.69 100390.50 93646.40 87353.59 81483.81 76009.86 70906.54 66148.59 61712.97 57576.54 53717.80 50118.23 46758.94 43623.46 40696.15 37962.69 35410.00 33025.65 30798.13 28716.54 26771.06 24952.66 23252.59 21662.93 20176.49 18786.60 17486.80 16271.39 15134.99 14072.45 13079.10 12150.48 Male ex Male Mx Male Nx ------- -------- 912.15 332.78 298.77 273.12 244.55 215.89 190.56 167.04 150.13 138.27 130.65 131.87 139.84 152.02 164.55 175.80 183.61 185.51 183.05 176.50 166.40 155.06 143.23 130.71 119.21 108.14 99.13 92.05 85.32 80.53 76.49 73.43 71.10 69.15 67.81 66.96 66.76 66.82 67.02 67.65 68.47 69.24 69.94 70.76 71.42 71.91 72.40 72.72 72.98 73.36 ---------- 9754.98 8842.83 8510.05 8211.28 7938.17 7693.61 7477.72 7287.15 7120.12 6969.99 6831. 72 6701.07 6569.20 6429.36 6277.33 6112.78 5936.98 5753.37 5567.86 5384.81 5208.31 5041.91 4886.84 4743.61 4612.90 4493.69 4385.55 4286.42 4194.37 4109.05 4028.52 3952.04 3878.60 3807.51 3738.35 3670.54 3603.58 3536.82 3470.00 3402.97 3335.33 3266.86 3197.62 3127.68 3056.92 2985.50 2913.59 2841.19 2768.47 2695.49 5523370.93 5152273.93 4806366.45 4483421.22 4181902.01 3900381.47 3637522.71 3392076.22 3162877.54 2948840.20 2748955.43 2562285.50 2387958.27 2225167.51 2073166.44 1931261.40 1798804.42 1675188.64 1559843.50 1452229.80 1351839.31 1258192.91 1170839.32 1089355.51 1013345.65 942439.11 876290.52 814577.55 757001.01 703283.21 653164.97 606406.03 562782.57 522086.42 484123.73 448713.73 415688.08 384889.96 356173.42 329402.35 304449.69 281197.10 259534.17 239357.67 220571.08 203084.27 186812.89 171677.89 157605.44 144526.34 28 - 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 . 95 96 97 98 99 - 11282.23 10470.35 9710.71 8999.83 8334.27 7711.07 7127.62 6581.58 6070.79 5593.19 5146.67 4729.17 4338.63 3973.21 3631.26 3311.34 3012.33 2733.25 2473.23 2231.35 2006.52 1797.68 1603.74 1423.76 1256.98 1102.97 961.49 832.37 715.39 610.21 516.25 432.81 359.15 294.57 238.45 190.29 149.57 115.71 88.06 65.88 48.41 34.91 24.66 17.02 11.42 7.36 4.46 2.41 1.04 0.25 73.80 74.66 75.60 76.79 77.96 78.99 79.74 80.22 80.45 80.61 80.80 81.15 81.58 82.02 82.36 82.38 82.01 81.21 80.09 78.85 77.58 76.33 75.06 73.64 71.77 69.32 66.23 62.52 58.38 54.04 49.66 45.34 41.09 36.85 32.56 28.27 24.07 20.08 16.42 13.16 10.34 7.96 6.03 4.49 3.31 2.42 1. 75 1.22 0.72 0.23 2622.13 2548.33 2473.67 2398.07 2321.28 2243.32 2164.33 2084.59 2004.37 1923.92 1843.31 1762.50 1681.35 1599.77 1517.75 1435.39 1353.01 1271.00 1189.79 1109.70 1030.85 953.27 876.95 801.89 728.25 656.47 587.15 520.92 458.40 400.02 345.98 296.31 250.97 209.88 173.04 140.48 112.20 88.13 68.05 51.63 38.47 28.14 20.17 14.15 9.66 6.35 3.93 2.17 0.95 0.23 132375.86 121093.63 110623.28 100912.57 91912.74 83578.47 75867.40 68739.78 62158.20 56087.41 50494.22 45347.55 40618.38 36279.76 32306.54 28675.28 25363.94 22351.61 19618.36 17145.13 14913.78 12907.26 11109.59 9505.84 8082.08 6825.10 5722.13 4760.63 3928.27 3212.88 2602.67 2086.42 1653.62 1294.46 999.89 761.44 571.15 421.58 305.87 217.82 151.94 103.53 68.62 43.96 26.94 15.52 8.16 3.70 1.28 0.25 29 ,- Male Aq3 ° 1 - -. 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 1000Ax Male ax ------- ------- 27.20 26.45 27.26 28.18 29.17 30.28 31.52 32.89 34.42 36.08 37.86 39.77 41.75 43.76 45.77 47.75 49.69 51.61 53.53 55.49 57.54 59.72 62.05 64.57 67.31 70.28 73.52 77.02 80.78 84.82 89.14 93.73 98.60 103.77 109.23 114.99 121.06 127.43 134.10 141.10 148.40 156.02 163.97 172.25 180.86 189.83 199.17 208.88 219.00 229.52 14.88 14.89 14.88 14.87 14.85 14.84 14.82 14.80 14.78 14.75 14.73 14.70 14.67 14.64 14.61 14.58 14.55 14.52 14.49 14.47 14.44 14.40 14.37 14.33 14.29 14.25 14.20 14.15 14.09 14.03 13.97 13.90 13.83 13.75 13.67 13.59 13.50 13.40 13.30 13.20 13.09 12.98 12.86 12.74 12.61 12.48 12.34 12.20 12.05 11.89 Male $60,000P(Ax ) ----------109.63 106.54 109.91 113.69 117.83 122.45 127.61 133.36 139.74 146.73 154.27 162.35 170.77 179.36 187.96 196.48 204.88 213.20 221.58 230.18 239.17 248.76 259.09 270.31 282.58 295.99 310.67 326.65 343.95 362.69 382.87 404.56 427.82 452.71 479.35 507.79 538.14 570.43 604.77 641.29 680.06 721.18 764.82 811.15 860.32 912.57 968.16 1027.33 1090.42 1157.76 30 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 - 240.46 251.81 263.55 275.68 288.16 300.99 314.16 327.69 341.59 355.88 370.55 385.59 400.94 416.57 432.43 448.48 464.70 481.10 497.71 514.53 531.53 548.63 565.74 582.71 599.41 615.78 631.80 647.49 662.94 678.23 693.37 708.32 722.97 737.17 750.79 763.77 776.14 788.00 799.49 810.81 822.17 833.86 846.26 859.79 874.93 891.95 910.83 930.97 950.80 966.92 11.73 11.57 11.39 11.21 11.03 10.84 10.64 10.44 10.24 10.03 9.81 9.59 9.36 9.13 8.90 8.66 8.42 8.18 7.93 7.68 7.43 7.18 6.93 6.68 6.43 6.19 5.95 5.72 5.49 5.27 5.04 4.82 4.60 4.39 4.19 4.00 3.82 3.64 3.47 3.31 3.14 2.97 2.78 2.58 2.36 2.11 1.83 1.53 1.24 1.00 1229.62 1306.35 1388.10 1475.17 1567.76 1666.19 1770.90 1882.51 2001.73 2129.35 2266.12 2412.69 2569.58 2737.28 2916.32 3107.33 3311.38 3529.89 3764.73 4017.83 4290.76 4584.69 4900.07 5236.58 5593.46 5970.80 6369.66 6792.58 7243.88 7728.81 8251.92 8816.06 9421.46 10065.05 10742.70 11452.19 12194.90 12976.72 13809.69 14712.95 15717.10 16869.42 18246.52 19973.58 22251.80 25390.83 29885.23 36480.19 46076.93 58015.25 31 -" Male ~ 1000Ax:~ -------- 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 8.15 6.41 6.22 6.11 6.10 6.22 6.49 6.92 7.50 8.20 9.00 9.85 10.69 11.47 12.14 12.65 12.98 13.16 13.20 13.15 13.03 12.91 12.80 12.74 12.76 12.87 13.11 13.47 13.95 14.58 15.34 16.25 17.31 18.53 19.91 21.46 23.18 25.06 27.11 29.33 31.73 34.32 37.12 40.18 43.52 47.19 51.22 55.63 60.44 65.70 Male ax: 10) 7.48 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.48 7.48 7.48 7.47 7.47 7.47 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.46 7.45 7.45 7.45 7.44 7.44 7.43 7.42 7.42 7.41 7.40 7.39 7.38 7.37 7.36 7.34 7.33 7.31 7.30 7.28 Male $20 ,000P(Ak TOJ) -------------21.80 17.11 16.61 16.33 16.30 16.61 17.34 18.49 20.04 21.92 24.04 26.33 28.60 30.71 32.50 33.88 34.80 35.27 35.40 35.25 34.94 34.60 34.31 34.15 34.19 34.50 35.13 36.10 37.39 39.08 41.13 43.60 46.47 49.75 53.50 57.71 62.38 67.51 73.10 79.18 85.76 92.86 100.60 109.05 118.31 128.51 139.74 152.09 165.65 180.53 32 -- -, ,- 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 71.42 77.65 84.42 91.77 99.75 108.40 117.77 127.89 138.82 150.61 163.32 177.04 191.82 207.77 224.94 243.37 263.04 283.92 305.95 329.06 353.14 378.10 403.83 430.19 456.99 484.01 511.06 537.95 564.54 590.70 616.27 641.07 664.87 687.49 708.88 729.25 748.97 768.58 788.31 807.19 822.17 833.86 846.26 859.79 874.93 891.95 910.83 930.97 950.80 966.92 7.26 7.23 7.21 7.18 7.15 7.12 7.09 7.05 7.01 6.96 6.91 6.86 6.80 6.74 6.67 6.60 6.52 6.44 6.34 6.24 6.14 6.02 5.90 5.77 5.63 5.50 5.36 5.21 5.06 4.91 4.75 4.58 4.41 4.25 4.08 3.92 3.76 3.61 3.01 3.30 3.14 2.97 2.78 2.58 2.36 2.11 1.83 1.53 1.24 1.00 196.81 214.67 234.19 255.58 278.94 304.94 332.41 362.91 396.23 432.64 472.49 516.17 564.06 616.64 674.38 737.63 806.81 882.30 964.55 1054.02 1151.11 1256.27 1369.80 1491.80 1622.16 1760.83 1907.91 2063.91 2229.82 2406.96 2596.36 2798.52 3013.12 3238.90 3474.67 3720.72 3979.53 4256.27 4557.95 4887.96 5239.03 5623.14 6082.17 6657.86 7417.27 8463.61 9961.74 12160.06 15358.98 19338.42 - 33 Af¥J 0 1 - -. 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 ax(Male12) Male Monthly Benefit on $40,000 Pension ------ --------------------------- 14.42 14.43 14.42 14.41 14.39 14.37 14.36 14.34 14.31 14.29 14.26 14.23 14.20 14.17 14.15 14.12 14.09 14.06 14.03 14.00 13.97 13.94 13.90 13.87 13.83 13.78 13.74 13.68 13.63 13.57 13.50 13.44 13.36 13.29 13.21 13.12 13.03 12.94 12.84 12.74 12.63 12.52 12.40 12.28 12.15 12.02 11.88 231.16 230.99 231.18 231.40 231.63 231.90 232.19 232.52 232.89 233.29 233.72 234.18 234.66 235.16 235.65 236.14 236.62 237.10 237.58 238.07 238.58 239.13 239.73 240.37 241.07 241.84 242.69 243.60 244.60 245.67 246.83 248.08 249.42 250.85 252.38 254.02 255.77 251.63 259.61 261.72 263.96 266.33 268.85 271.53 274.38 277.41 280.63 11.73 284.06 11.59 11.43 287.73 291.64 34 - 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 .- 11.27 11. 10 10.93 10.75 10.56 10.37 10.18 9.98 9.77 9.56 9.35 9.12 8.90 8.66 8.43 8.19 7.95 7.71 7.47 7.22 6.97 6.71 6.46 6.21 5.96 5.72 5.48 5.25 5.02 4.80 4.57 4.35 4.14 3.93 3.73 3.53 3.35 3.18 3.01 2.84 2.67 2.50 2.31 2.11 1.89 1.64 1.36 1.06 0.77 0.53 295.83 300.30 305.07 310.16 315.57 321.34 327.49 334.05 341.07 348.61 356.70 365.38 374.71 ·384.70 395.39 406.84 419.10 432.28 446.50 461.88 478.53 496.55 515.98 536.82 559.05 582.70 607.85 634.70 663.56 694.81 728.80 765.80 805.89 848.96 894.82 943.41 994.91 1049.83 1109.18 1174.52 1248.40 1334.81 1440.46 1576.76 1763.36 2034.02 2451.64 3138.60 4335.45 6281.54 3S AtfJ .- 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 yx Female ---------- Female Ix -------- 1.00000000 0.93457944 0.87343873 0.81629788 0.76289618 0.71298618 0.66634222 0.62274974 0.58200910 0.54393374 0.50834929 0.47509280 0.44401196 0.41496445 0.38781724 0.36244602 0.33873460 0.31657439 0.29586392 0.27650833 0.25841900 0.24151309 0.22571317 0.21094688 0.19714662 0.18424918 0.17219549 0.16093037 0.15040221 0.14056282 0.13136712 0.12277301 0.11474113 0.10723470 0.10021934 0.09366294 0.08753546 0.08180884 0.07645686 0.07145501 0.06678038 0.06241157 0.05832857 0.05451268 0.05094643 0.04761349 0.04449859 0.04158747 0.03886679 0.03632410 130109 129864 129755 129651 129550 129450 129353 129259 129167 129077 128988 128900 128810 128716 128617 128512 128400 128282 128159 128031 127899 127763 127625 127485 127342 127196 127047 126895 126738 126576 126409 126236 126057 125872 125678 125476 125263 125035 124790 124524 124235 123921 123580 123212 122818 122396 121946 121468 120959 120417 1000Qx ------1.88 0.84 0.80 0.78 0.77 0.75 0.73 0.71 0.70 0.69 0.68 0.70 0.73 0.77 0.82 0.87 0.92 0.96 1.00 1.03 1.06 1.08 1.10 1.12 1.15 1.17 1.20 1.24 1.28 1.32 1.37 1.42 1.47 1.54 1.61 1.70 1.82 1.96 2.13 2.32 2.53 2.75 2.98 3.20 3.44 3.68 3.92 4.19 4.48 4.79 36 - - 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 0.03394776 0.03172688 0.02965129 0.02771148 0.02589858 0.02420428 0.02262083 0.02114096 0.01975791 0.01846533 0.01725732 0.01612834 0.01507321 0.01408711 0.01316553 0.01260423 0.01149928 0.01074699 0.01004392 0.00938684 0.00877275 0.00819883 0.00766246 0.00716117 0.00669269 0.00625485 0.00584565 0.00546323 0.00510582 0.00477179 0.00445962 0.00416787 0.00389520 0.00364038 0.00340222 0.00317965 0.00297163 0.00277723 0.00259554 0.00242574 0.00226704 0.00211873 0.00198012 0.00185058 0.00172952 0.00161637 0.00151063 0.00141180 0.00131944 0.00123312 119840 119225 118569 117867 117115 116313 115460 114559 113614 112626 111590 110496 109331 108075 106710 105225 103616 101885 100038 98078 95996 93773 91379 88777 85937 82839 79479 75867 72022 67966 63713 59274 54661 49892 45008 40074 35173 30396 25831 21559 17645 14136 11059 8419 6201 4370 2880 1688 781 200 5.13 5.50 5.92 6.38 6.85 7.33 7.80 8.25 8.70 9.20 9.80 10.54 11.46 12.63 13.92 15.29 16.71 18.13 19.59 21.23 23.16 25.53 28.47 31.99 36.05 40.56 45.45 50.68 56.32 62.58 69.67 77.83 87.25 97.89 109.62 122.30 135.81 150.18 165.38 181.55 198.87 217.67 238.72 263.45 295.27 340.96 413.89 537.32 743.92 1000.00 37 ACIJ 0 1 - 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 " Female Female Female Female Dx --------- ex ------- Mx -------- Nx ---------- 130109.00 121368.22 113333.04 105883.84 98833.07 92296.06 86193.37 80496.01 75176.37 70209.34 65570.96 61239.46 57193.18 53412.56 49879.89 46578.66 43493.52 40610.80 37917.62 35401.64 33051.53 30856.44 28806.64 26892.56 25105.04 23435.76 21876.92 20421.26 19061.68 17791.88 16605.99 15498.37 14463.92 13497.85 12595.37 11752.45 10964.95 10228.97 9541.05 8897.86 8296.46 7734.10 7208.24 6716.62 6257.14 5827.70 5426.42 5051.55 4701.29 4374.04 228.97 95.20 84.89 77.05 71.30 64.64 58.54 53.54 48.95 45.24 41.81 39.96 39.01 38.39 38.06 37.94 37.36 36.39 35.39 34.11 32.85 31.15 29.53 28.19 26.90 25.66 24.46 23.61 22.77 21.94 21.24 20.54 19.84 19.44 18.92 18.65 18.65 18.73 19.01 19.30 19.60 19.89 20.06 20.07 20.09 20.02 19.88 19.78 19.69 19.59 2605.91 2376.99 2281.78 2196.89 2119.84 2048.54 1983.90 1925.36 1871.82 1822.86 1777.62 1735.81 1695.85 1656.85 1618.45 1580.40 1542.46 1505.10 1468.71 1433.32 1399.21 1366.36 1335.21 1305.68 1277.49 1250.59 1224.93 1200.47 1176.85 1154.08 1132.15 1110.91 1090.37 1070.53 1051.09 1032.17 1013.52 994.87 976.14 957.13 937.83 918.23 898.34 878.28 858.21 838.12 818.09 798.21 778.43 758.74 1948975.05 1818866.04 1697497.81 1584164.77 1478330.93 1379497.86 1287201.80 1201008.43 1120512.42 1045336.05 975126.72 909555.76 848316.30 791123.12 737710.55 687830.66 641252.00 597758.48 557147.68 519230.06 483828.42 450776.89 419920.45 391113.81 364221.25 339116.20 315680.44 293808.52 273382.26 254320.59 236528.71 219922.72 204424.35 189960.43 176462.58 163867.21 152114.76 141149.81 130920.84 121379.79 112481.93 104185.46 96451.36 89243.12 82526.50 76269.36 70441.66 65015.23 59963.69 55262.40 38 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 .95 96 97 98 99 - 4068.30 3782.64 3515.72 3266.27 3033.11 2815.27 2611.80 2421.89 2244.77 2079.68 1925.74 1782.12 1647.97 1522.46 1404.89 1294.71 1191.51 1094.96 1004.77 920.64 842.15 768.83 700.19 635.75 575.15 518.15 464.61 414.48 367.73 324.32 284.14 247.05 212.92 181.63 153.13 127.42 104.52 84.42 67.05 52.30 40.00 29.95 21.90 15.58 10.72 7.06 4.35 2.38 1.03 0.25 19.51 19.45 19.45 19.48 19.41 19.30 19.05 18.67 18.24 17.88 17.64 17.56 17.69 17.97 18.27 18.50 18.60 18.55 18.40 18.26 18.23 18.34 18.63 19.01 19.38 19.64 19.73 19.63 19.35 18.97 18.50 17.97 17.36 16.62 15.69 14.56 13.27 11.85 10.36 8.87 7.43 6.09 4.89 3.84 2.96 2.25 1.68 1.20 0.72 0.23 739.15 719.64 700.19 680.74 661.26 641.85 622.55 603.51 584.84 566.59 548.71 531.07 516.51 495.81 477.84 459.57 441.07 422.47 403.92 385.52 367.25 349.03 330.68 312.05 293.04 273.66 254.02 234.29 214.66 195.30 176.34 157.84 139.87 122.51 105.89 90.20 75.64 62.37 50.52 40.16 31.29 23.85 17.76 12.87 9.04 6.08 3.83 2.14 0.95 0.23 50888.36 46820.06 43037.42 39521.70 36255.43 33222.32 30407.05 27795.25 25373.36 23129.58 21048.91 19123.16 17341.05 15693.08 14171.61 12765.72 11471.01 10279.50 9184.54 8179.77 7259.12 6416.98 5648.15 4947.96 4312.21 3737.06 3218.92 2754.31 2339.83 1972.10 1647.78 1363.65 1116.60 903.68 722.06 568.93 441.51 336.99 252.57 185.53 133.23 93.23 63.28 41.38 25.80 15.07 8.01 3.66 1.28 0.25 39 - Aq3 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Female Female Female 1000Ax ax ------- ------- $60,000P(Ax ) 20.72 20.26 20.83 21.48 22.19 22.96 23.81 24.75 25.76 26.86 28.05 29.33 30.68 32.09 33.57 35.10 36.69 38.34 40.07 41.89 43.80 45.81 47.95 50.23 52.65 55.21 57.93 60.82 63.88 67.11 70.54 74.16 77.99 82.06 86.34 90.86 95.63 100.63 105.85 111.29 116.95 122.83 128.94 135.29 141.90 148.79 155.98 163.48 171.31 179.47 14.98 14.99 14.98 14.97 14.96 14.95 14.93 14.92 14.91 14.89 14.87 14.85 14.83 14.81 14.79 14.77 14.74 14.72 14.69 14.67 14.64 14.61 14.58 14.54 14.51 14.47 14.43 14.39 14.34 14.29 14.24 14.19 14.13 14.07 14.01 13.94 13.87 13.80 13.72 13.64 13.56 13.47 13.38 13.29 13.19 13.09 12.98 12.87 12.75 12.63 ----------83.00 81.12 83.44 86.09 89.01 92.18 95.68 99.52 103.70 108.25 113.16 118.47 124.10 130.01 136.19 142.63 149.32 156.30 163.64 171.36 179.52 188.16 197.38 207.23 217.73 228.92 240.87 253.64 267.23 281.70 297.13 313.57 331. 11 349.83 369.75 391.01 413.61 437.53 462.84 489.50 517.57 547.11 578.18 610.92 645.54 682.15 720.94 762.13 805.86 852.30 40 - 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 187.97 196.83 206.05 215.63 255.56 235.88 246.61 257.81 269.55 281.87 294.80 308.31 322.38 336.94 351.90 367.24 382.99 399.18 415.91 433.24 451.18 469.68 488.62 507.82 527.14 546.44 565.67 584.83 603.94 623.03 642.08 661.00 679.65 697.84 715.45 732.40 748.70 764.41 779.63 794.49 809.18 823.92 839.02 854.84 871.79 890.16 909.98 930.65 950.72 966.92 12.51 12.38 12.24 12.10 11.95 11.80 11.64 11.48 11.30 11.12 10.93 10.73 10.52 10.31 10.09 9.86 9.63 9.39 9.14 8.88 8.62 8.35 8.07 7.78 7.50 7.21 6.93 6.65 6.36 6.08 5.80 5.52 5.24 4.98 4.72 4.46 4.22 3.99 3.77 3.55 3.33 3.11 2.89 2.66 2.41 2.13 1.84 1.54 1.24 1.00 901.66 954.14 1009.94 1069.23 1132.21 1199.30 1270.95 1347.84 1430.81 1520.71 1618.24 1723.92 1838.22 1961.27 2093.26 2234.78 2386.89 2551.21 2729.98 2925.70 3140.56 3376.40 3634.39 3914.92 4218.48 4545.84 4989.80 5280.40 5694.93 6147.62 6643.08 7185.05 7775.79 8415.27 9103.49 9841.92 10634.64 11489.24 12417.15 13437.12 14577.23 15881.61 17421.48 19311.87 21744.17 25026.62 29561.98 36355.91 46027.59 58015.25 - 41 Ar¥J 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Female Female 1OOoAx: --------6.59 5.47 5.35 5.28 5.25 5.25 5.30 5.40 5.55 5.74 5.97 6.24 6.52 6.80 7.07 7.33 7.55 7.76 7.96 8.16 8.36 8.57 8.79 9.05 9.33 9.64 10.00 10.42 10.89 11.45 12.11 12.86 13.74 14.74 15.84 17.08 18.44 19.89 21.44 23.07 24.78 26.57 28.44 30.43 32.56 34.84 37.28 39.88 42.60 45.45 aX:1q f6l Female $20,000P(Ai fOP ------ -------------- 7.48 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.48 7.48 7.48 7.48 7.48 7.48 7.48 7.48 7.48 7.48 7.48 7.47 7.47 7.47 7.47 7.46 7.46 7.46 7.45 7.45 7.44 7.44 7.43 7.42 7.42 7.41 7.40 7.39 7.39 7.38 7.37 7.36 7.35 17.60 14.59 14.28 14.09 14.01 14.01 14.14 14.42 14.81 15.32 15.94 16.66 17.42 18.17 18.89 19.57 20.18 20.74 21.28 21.81 22.35 22.90 23.51 24.19 24.95 25.79 26.74 27.87 29.15 30.66 32.41 34.45 36.80 39.50 42.49 45.84 49.51 53.45 57.65 62.09 66.74 71.63 76.76 82.21 88.07 94.34 101.06 108.25 115.81 123.73 -- 42 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 -, 48.43 51.58 54.94 58.58 62.56 66.99 71.89 77.34 83.38 90.08 97.49 105.68 114.78 124.88 136.09 148.56 162.42 177.80 194.88 213.76 234.55 257.28 281.95 308.46 336.66 366.33 397.24 429.14 461.79 494.92 528.16 561.11 593.35 624.51 654.39 683.05 710.82 738.14 765.01 789.93 809.18 823.92 839.02 854.84 871.79 890.16 909.98 930.65 950.72 966.92 7.33 7.32 7.31 7.30 7.28 7.27 7.25 7.23 7.21 7.19 7.16 7.13 7.10 7.06 7.02 6.97 6.93 6.87 6.81 6.74 6.66 6.57 6.47 6.36 6.24 6.11 5.98 5.83 5.68 5.51 5.33 5.14 4.95 4.75 4.55 4.35 4.15 3.95 3.75 3.54 3.33 3.11 2.89 2.66 2.41 2.13 1.84 1.54 1.24 1.00 132.06 140.88 150.33 160.58 171.85 184.38 198.32 213.87 231.25 250.64 272.29 296.46 323.53 353.88 387.89 426.07 469.02 517.43 572.04 634.04 704.01 782.88 871.31 969.78 1078.67 1198.26 1329.00 1471.62 1627.17 1796.88 1981.71 2182.29 2398.78 2630.78 2878.37 3142.88 3427.74 3738.73 4082.11 4459.26 4859.08 5293.87 5807.16 6437.29 7248.06 8342.21 9883.99 12118.64 15342.53 19338.42 43 - Female ArjJ 0 1 - - 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Female 'aX< 12) Month ly Benefit on $40,000 Pension ------ --------------------------- 14.52 14.52 14.51 14.50 14.49 14.48 14.47 14.46 14.44 14.42 14.41 14.39 14.37 14.35 14.33 14.30 14.28 14.26 14.23 14.20 14.17 14.14 14.11 14.08 14.04 14.01 13.97 13.92 13.88 13.83 13.78 13.73 13.67 13.61 13.55 13.48 13.41 13.33 13.26 13.18 13.09 13.01 12.92 12.82 12.72 12.62 12.52 12.41 12.29 12.17 229.64 229.53 229.66 229.82 229.98 230.16 230.36 230.58 230.82 231.08 231.37 231.67 231.99 232.33 232.68 233.05 233.44 233.84 234.26 234.70 235.17 235.66 236.19 236.75 237.35 238.00 238.68 239.41 240.19 241.02 241.91 242.85 243.86 244.94 246.08 247.30 248.60 249.98 251.43 252.97 254.58 256.29 258.08 259.97 261.96 264.08 266.32 268.70 271.23 273.91 -- .- 44 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 12.04 11.91 11.78 11.63 11.49 11.34 11.18 11.01 10.84 10.66 10.46 10.26 10.06 9.84 9.62 9.39 9.16 8.92 8.67 8.42 8.15 7.88 7.60 7.32 7.03 6.75 6.46 6.18 5.90 5.61 5.33 5.05 4.78 4.51 4.25 4.00 3.76 3.52 3.30 3.08 2.86 2.64 2.42 2.19 1.94 1.67 1.37 1.07 0.77 0.53 276.77 279.82 283.05 286.50 290.16 294.06 298.24 302.72 307.56 312.82 318.53 324.73 331.45 338.69 346.47 354.84 363.85 373.61 384.26 395.95 408.83 423.02 438.60 455.61 474.11 494.16 515.90 539.55 565.40 593.83 625.19 659.78 697.85 739.48 784.78 833.97 887.47 945.96 1010.44 1082. 53 1164.64 1260.62 1376.85 1524.03 1721.09 2001.77 2429.03 3124.74 4328.58 6281.54 - .- - 4S Blended ~ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 yX Blended Ix 1000Qx ---------- -------- ------- 1.00000000 0.93457944 0.87343873 0.81629788 0.76289618 0.71298618 0.66634222 0.62274974 0.58200910 0.54393374 0.50834929 0.47509280 0.44401196 0.41496445 0.38781724 0.36244602 0.33873460 0.31657439 0.29586392 0.27650833 0.25841900 0.24151309 0.22571317 0.21094688 0.19714662 0.18424918 0.17219549 0.16093037 0.15040221 0.14056282 0.13136712 0.12277301 0.11474113 0.10723470 0.10021934 0.09366294 0.08753546 0.08180884 0.07645686 0.07145501 0.06678038 0.06241157 0.05832857 0.05451268 0.05094643 0.04761349 0.04449859 0.04158747 0.03886679 0.03632410 501883 500637 500140 499663 499198 498749 498323 497920 497538 497170 496807 496442 496050 495613 495112 494539 493891 493171 492397 491580 490738 489886 489035 488191 487362 486548 485753 484968 484184 483402 482610 481801 480971 480109 479212 478273 477280 476220 475085 473864 472545 471115 469566 467893 466085 464135 462038 459784 457365 454771 2.48 0.99 0.95 0.93 0.90 0.85 0.81 0.77 0.74 0.73 0.73 0.79 0.88 1.01 1.16 1.31 1.46 1.57 1.66 1.71 1.74 1.74 1.73 1.70 1.67 1.63 1.62 1.62 1.62 1.64 1.68 1.72 1.79 1.87 1:96 2.08 2.22 2.38 2.57 2.78 3.03 3.29 3.56 3.86 4.18 4.52 4.88 5.26 5.67 6.13 -, .- - 46 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 0.03394776 0.03172668 0.02965129 0.02771148 0.02569858 0.02420428 0.02262083 0.02114096 0.01975791 0.01846533 0.01725732 0.01612834 0.01507321 0.01408711 0.01316553 0.01260423 0.01149928 0.01074699 0.01004392 0.00938684 0.00877275 0.00819883 0.00766246 0.00716117 0.00669269 0.00625485 0.00584565 0.00546323 0.00510582 0.00477179 0.00445962 0.00416787 0.00389520 0.00364038 0.00340222 0.00317965 0.00297163 0.00277723 0.00259554 0.00242574 0.00226704 0.00211873 0.00198012 0.00185058 0.00172952 0.00161637 0.00151063 0.00141180 0.00131944 0.00123312 451965 448992 445759 442262 438470 434362 429921 425139 420012 414528 406667 402394 395660 388416 380611 372212 363208 353604 343418 332662 321317 309350 296712 283350 269241 254423 238990 223080 206859 190489 174097 157783 141638 125757 110286 95417 81363 68322 56452 45858 36584 28623 21919 16379 11877 8264 5393 3138 1445 369 6.62 7.20 7.65 8.57 9.37 10.22 11.12 12.06 13.06 14.14 15.35 16.73 18.31 20.09 22.07 24.19 26.44 28.81 31.32 34.10 37.24 40.85 45.03 49.79 55.04 60.66 66.57 72.71 79.14 86.05 93.71 102.32 112.12 123.02 134.82 147.29 160.28 173.74 187.66 202.23 217.61 234.22 252.75 274.86 304.20 347.41 416.13 539.52 744.64 1000.00 -- 47 Aq3 Blended Blended Blended Dx ex ------1164.49 434.10 389.37 354.75 320.13 283.86 250.97 222.33 200.17 184.53 173.41 174.05 181.34 194.30 207.68 219.50 227.93 229.00 225.91 217.59 205.77 192.08 178.04 163.43 149.98 136.90 126.33 117.92 109.92 104.04 99.32 95.24 92.44 89.90 87.95 86.92 86.72 86.78 87.25 88.08 89.25 90.35 91.20 92.11 92.85 93.31 93.74 94.02 94.22 94.58 Mx --------0 1 - 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 501883.00 467885.05 436841.65 407873.85 380835.76 355601.14 332053.66 310079.55 289571.65 270427.54 252551.49 235856.02 220252.13 205661.77 192012.97 179243.69 167297.97 156125.31 145682.50 135925.97 126816.02 118313.88 110381.64 102982.37 96081.77 89464.07 83644.48 78046.08 72822.34 67948.35 63399.08 59152.16 55187.15 51484.34 48026.31 44796.45 41778.92 38959.00 36323.51 33859.96 31556.74 29403.03 27389.11 25506.10 23745.37 22099.09 20560.04 19121.25 17776.31 16519.15 Blended Nx -------- ---------- 12575.61 11411.12 10977.02 10587.65 10232.90 9912.77 9628.91 9377.94 9155.61 8955.45 8770.92 8597.51 8423.45 8242.12 8047.82 7840.14 7620.64 7392.70 7163.70 6937.80 6720.21 6514.44 6322.36 6144.32 5980.88 5830.91 5694.01 5567.68 5449.76 5339.84 5235.80 5136.48 5041.24 4948.81 4858.91 4770.96 4684.04 4597.32 4510.54 4423.29 4335.21 4245.96 4155.61 4064.11 3972.30 3879.45 3786.14 3692.40 3598.38 3504.16 7479412.99 6977529.99 6509644.94 6072803.30 5664929.45 5284093.69 4928492.54 4596438.89 4286359.34 3396787.69 3726360.15 3473808.66 3237952.65 3017700.51 2812038.74 2620025.77 2440782.08 2273484.11 2117358.80 1971676.29 1835750.33 1708934.30 1590620.42 1480238.79 1377256.42 1281174.64 1191528.58 1107884.10 1029838.02 957015.68 889067.33 825668.24 766516.09 711328.93 659844.59 611818.28 567021.82 525242.90 486283.89 449960.39 416100.43 384543.70 355140.67 327751.55 302245.45 278500.08 256401.00 235840.96 216719.71 198943.40 ,- .- - 48 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 15343.88 14245.11 13217.33 12255.74 11355.75 10513.42 9725.17 8987.85 8298.56 7654.40 7052.50 6489.95 5963,87 5471.66 5010.94 4579.78 4176.63 3800.18 3449.26 3122.64 2818.83 2536.31 2273.54 2029.12 1801.95 1591.38 1397.05 1218.74 1056.18 908.97 776.41 657.62 551.71 457.80 375.22 303.39 241. 78 189.75 146.52 111.24 82.94 60.64 43.40 30.31 20.54 13.36 8.15 4.43 1.91 0.46 94.96 95.86 96.91 98.21 99.43 100.46 101.10 101.30 101.26 101.15 101.17 101.50 102.05 102.76 103.34 103.54 103.21 102.31 100.96 99.53 98.12 96.84 95.69 94.43 92.68 90.22 86.92 82.82 78.11 73.10 67.99 62.89 57.81 52.64 47.28 41.76 36.22 30.81 25.70 21.02 16.87 13.27 10.25 7.79 5.84 4.34 3.18 2.23 1.33 0.43 3409.58 3314.62 3218.76 3121.85 3023.65 2924.21 282376 3722.66 2621.36 2520,10 2418.95 2317.78 2216.28 2114.23 2011.47 1908.13 1804.59 1701.37 1599.07 1498.10 1398.58 1300.46 1203.62 1107.93 1013.51 920,82 830.61 743.69 660.87 582.75 509.65 441.65 378.77 320.95 268.32 221.04 179.28 143.06 112.25 86.55 65.53 48.66 35.38 25.13 17.35 11.51 7.17 3.99 1.75 0.43 182424.25 167080.37 152835.26 139617.93 127362.19 116006.44 105493.02 95767.85 86780.01 78481.45 70827.05 63774.55 57284.61 51320.74 45849.08 40838.14 36258.36 32081.73 28281.55 24832.28 21709.64 18890.81 16354.50 14080.96 12051.84 10249,89 8658.52 7261.46 6042.73 4986.54 4077.57 3301.16 2643.54 2091.84 1634.03 1258.81 955.42 713.64 523.90 377.37 266.13 183.20 122.55 79.15 48.84 28.30 14.94 6.79 2.36 0.46 - 49 At}3 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Blended BlenOOd 1000Ax ax ------- ------- 25.92 25.23 26.00 26.86 27.80 28.84 30.00 31.29 32.71 34.26 35.93 37.71 39.57 41.46 43.36 45.25 47.13 48.99 50.88 52.81 54.88 56.97 59.26 61.73 64.40 67.29 70.43 73.81 77.43 81.31 85.44 89.84 94.51 99.45 104.67 110.19 115.19 122.09 128.47 135.16 142.13 149.40 156.98 164.86 173.08 181.62 190.52 199.79 209.43 219.47 14.90 14.91 14.90 14.42 14.87 14.86 14.84 14.82 14.80 14.78 14.75 14.73 14.70 14.67 14.65 14.62 14.59 14.56 14.53 14.51 14.48 14.44 14.41 14.37 14.33 14.29 14.25 14.20 14.14 14.08 14.02 13.96 13.89 13.82 13.74 13.66 13.57 13.48 13.39 13.29 13.19 13.08 12.97 12.85 12.73 12.60 12.47 12.33 12.19 12.04 Blended $60 ,000P(Ax ) ----------104.37 101.52 104.68 108.23 112.13 116.45 121.28 126.65 132.59 139.09 146.11 153.64 161.49 169.55 177.66 185.76 193.82 201.85 210.02 218.43 227.25 236.63 246.74 257.67 269.57 282.52 296.65 311.96 328.50 346.37 365.57 386.18 408.27 431.87 457.11 484.07 512.80 543.34 575.79 610.24 646.75 685.42 726.37 769.80 815.85 864.71 916.65 971.89 1030.71 1093.40 so .-. 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 - 229.90 240.74 251.95 263.54 275.48 287.77 300.40 313.41 326.81 340.63 354.86 369.49 384.48 399.77 415.31 431.06 447.02 463.20 479.64 496.36 513.32 530.48 547.72 564.91 581.92 598.66 615.12 631.33 647.36 663.29 679.14 694.84 710.29 725.34 739.85 753.77 767.14 780.04 792.60 804.99 817.42 830.14 843.49 857.86 873.68 891.23 910.49 930.84 950.77 966.92 11.89 11.73 11.56 11.39 11.22 11.03 10.85 10.66 10.46 10.25 10.04 9.83 9.61 9.38 9.15 8.92 8.68 8.44 8.20 7.95 7.70 7.45 7.19 6.94 6.69 6.44 6.20 5.96 5.72 5.49 5.25 5.02 4.79 4.57 4.35 4.15 3.95 3.76 3.58 3.39 3.21 3.02 2.82 2.61 2.38 2.12 1.83 1.53 1.24 1.00 1160.23 1231.50 1307.35 1388.02 1473.72 1564.78 1661.61 1764.82 1875.14 1993.32 2120.09 2256.06 2401.66 2557.32 2723.39 2900.46 3089.56 3292.06 3509.86 3744.99 3999.07 4273.39 4568.56 4884.36 5220.35 5576.77 5954.95 6357.58 6789.01 7254.54 7758.83 8305.05 8894.29 9524.48 10193.31 10900.21 11648.08 12444.02 . 13300.46 14237.40 15284.37 16488.51 17923.74 19711.67 22048.60 25242.94 29792.32 36430.51 46054.75 58015.25 51 .- Blenood AgJ 1OOOA x:fOJ BlendOO ax: fOl ------ Blended nw 7.84 6.22 6.05 5.95 5.94 6.03 6.26 6.62 7.12 7.72 8.40 9.14 9.87 10.55 11.14 11.60 11.91 12.09 12.17 12.16 12.11 12.05 12.01 12.01 12.08 12.23 12.49 12.86 13.34 13.96 14.70 15.58 16.60 17.77 19.10 20.59 22.24 24.03 25.98 28.08 30.35 32.77 35.39 38.23 41.33 44.72 46 7.48 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.49 7.48 7.48 7.48 7.47 7.47 7.47 7.47 7.47 7.46 7.47 7.47 7.47 7.47 7.47 7.47 7.47 7.47 7.46 7.46 7.46 7.46 7.45 7.45 7.45 7.44 7.43 7.43 7.42 7.41 7.40 7.40 7.39 7.38 7.36 7.35 48.43 $20,OOOP(A*: -------------20.98 16.62 16.15 15.89 15.85 16.10 16.70 17.68 19.00 20.62 22.44 24.42 26.39 28.23 29.81 31.05 31.91 32.40 32.61 32.59 32.45 32.28 32.17 32.17 32.36 32.77 33.46 34.46 35.75 37.40 39.40 41.77 44.55 47.71 51.30 55.34 59.81 64.70 70.02 75.77 81.96 88.62 95.62 103.67 112.24 121.64 7.34 47 48 49 131.96 52.47 56.86 61.63 7.33 7.31 7.29 143.25 155.59 169.04 -------- 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 S2 - - 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 66.80 72.40 78.47 7.27 7.25 7.23 85.06 7.20 92.22 99.99 7.18 7.15 7.12 108.42 117.56 127.45 138.14 149.69 162.18 175.67 190.27 206.05 223.04 241.27 260.73 281.41 303.28 326.27 350.32 375.36 401.27 427.86 454.95 482.35 509.88 537.41 564.78 591.82 618.28 643.93 668.54 692.02 714.53 736.46 758.31 780.23 801.04 817.42 830.14 843.49 857.86 873.68 891.23 910.49 930.84 950.77 966.92 7.09 7.05 7.01 6.96 6.92 6.86 6.81 6.74 6.68 6.61 6.53 6.45 6.36 6.26 6.15 6.03 5.91 5.78 5.65 5.51 5.37 5.23 5.07 4.91 4.74 4.57 183.68 199.67 217.09 236.13 256.94 279.71 304.60 331.82 361.61 394.18 429.86 469.00 511.94 559.14 611.00 667.88 730.21 798.40 872.95 954.39 1043.20 1139.89 1244.84 1358.26 1480.11 1610.48 1749.61 1898.08 2056.96 2227.61 2411.12 2608.08 2818.45 4.40 3041.29 4.22 4.06 3.89 3.73 3.56 3.39 3.21 3.02 2.82 2.61 2.38 2.12 1.83 1.53 1.24 3276.02 3523.47 3786.63 1.00 4071.18 4384.05 4728.18 5094.79 5496.17 5974.58 6570.56 7349.53 8414.31 9930.77 12143.50 15351.58 19338.42 S3 Af1j 0 1 -. - 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Blended ax( 12) Blended Monthly Benefit on $40,000 Pension ------ --------------------------- 14.44 14.45 14.44 14.42 14.41 14.40 14.38 14.36 14.34 14.32 14.29 14.26 14.24 14.21 14.18 14.15 14.13 14.10 14.07 14.04 14.01 13.98 13.95 13.91 13.87 13.83 13.78 13.73 13.68 13.62 13.56 13.49 13.42 13.35 13.27 13.19 13.11 13.02 12.92 12.82 12.72 12.61 12.50 12.39 12.26 12.14 12.01 11.87 11.73 11.58 230.86 230.70 230.88 231.08 231.31 231.55 231.83 232.14 232.48 232.85 233.25 233.68 234.13 234.59 235.06 235.52 235.99 236.44 236.91 237.40 237.90 238.44 239.02 239.65 240.33 241.07 241.88 242.76 243.71 244.74 245.84 247.02 248.29 249.65 251.10 252.66 254.31 256.07 257.94 259.93 262.03 264.26 266.63 269.14 271.80 274.63 277.64 280.85 284.26 287.90 - 54 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 11.42 11.26 11.10 10.93 10.75 10.57 10.38 10.19 9.99 9.79 9.58 9.36 9.14 8.91 8.68 8.45 8.21 7.98 7.73 7.49 7.23 6.98 6.73 6.49 6.22 5.97 5.73 5.49 5.25 5.02 4.78 4.55 4.32 4.10 3.89 3.68 3.48 3.29 3.11 2.92 2.74 2.55 2.35 2.14 1.91 1.65 1.36 1.06 0.77 0.53 291.79 295.94 300.36 305.06 310.07 315.40 321.07 327.13 333.62 340.58 348.06 356.10 364.73 373.98 383.87 394.44 405.77 417.94 431.07 445.30 460.73 477.47 495.56 515.01 535.82 558.01 581. 70 607.08 634.47 664.24 696.75 732.27 770.95 812.75 857.60 905.56 956.93 1012.33 1072.80 1139,.99 1216.40 1306.05 1415.46 1555.81 1746.39 2020.89 2442.62 3133.05 4332.36 6281.54 -. B1bl10graphy Arndt, ShE'ri!. "ACLI Predicts Big Push for Unisex Rating." National Underwriter - Life & Health/Financial Services Edition, NO.8 Feb. 23, 1987, pp. 3-50. Benjamin, Deborah. "Affidavit Presented in Superior Court of the Commonwealth of Massachusetts in Civil Action No. 88-0221, the American Council of Life Insurance, et al. vs Roger Singer, Commissioner of Insurance." May 26, 1988. Bennett, Andrea. "Setting the Unisex Pace." Best's Review -Life/Health Insurance Edition, 86 Jan. 1986, pp. 22-108. Bowers, Newton L. Jr., et al. Actuarial Mathematics. Itasca: The Society of Actuaries, 1986. Carroll, William F. "Let Consumers Choose." Best's Review - Life/Health Insurance Edition, 89 June 1988, p. 56. Cary, Eve and Kathleen Wi llert Peratis. Woman and the Law. Skokie: National Textbook Company, 1978. Dennon, A. R "The Facts About Unisex Insurance." Consumer Research Magazine, 71 Feb. 1988, pp.25-27. Diamond, .Joseph F. "Editorial Comment: Why Not Unisex Rating?" National Underwriter - Life & Health/Financial Services Edition, No. 22 Ma~' 30, 1988, p. 18. Ellis, Deborah A. "Statement on Behalf of the American Civil Liberties Union Before the Elimination of Discrimination Insurance Practices Study Committee." Nov. 17, 1988. Erickson, Jenny A. "Remarks Before the Iowa Study Committee on the Elimination of Discriminatory Insurance Practices." Nov.17, 1988. Gest, Ted. "Can Feminists Bounce Back from Reverses?" U.S. News & World ~m:t 99 Nov. 11, 1985, p. 40. S6 Gibson, Dunn & Crutcher, Offices of. "Labor Law Perspective: Unisex Actuarial Tables Mandatedfor Benefit Plans." Washington D.C., July . 1983. Hathaway, Raeburn B. Jr. "Good Social Policy." Best's Review - Life/Health Insurance Edition, 89 June 1988, pp. 54-55. Jones, David C. "Minnesota Panel Exploring Unisex." National Underwriter L.J.Le.& Healtb/FlOanClal SerVIces Edltlon, NO. 32 Aug, 5, 1955, pp. 1-6. Kurlowickz, Ted and Martha Conrad Damiani. "Unisex Rates: Time for Action." Best's Review - Life/Health Insurance Edition, 87 Jan, 1987, pp.28-118, Lautzenheiser, Barbara J, "Testimony on Gender Based Rating Before the Iowa Study Committee." Dec. 16, 1988. McGhee, Neil. "Unisex Rule on Track in Mass." National Underwrjter - Life & ~th/Financial Services Edition, No, 25 June 20, 1988, p. 3. Principal Mutual Life Insurance Company. "Tables of Actual Life Experience." Wingard, Deborah Lee. "The Sex Differential in Mortality Rates: Demographic and Behavioral Factors." Dissertation, Univ. Of Callfornla,Berkeley, 1980. Youngman, Marcia. "Testimony to the Massachusetts Division of Insurance," July 20, 1987. Zimmerman, Edward J. "Where the Action Is." Best's Review - Life/Health Insurance Edit ion, 86 Jan, 1986, pp. 24-106,