ENERGY FACTS Energy Supply and Infrastructure Constraints: Access Issues

advertisement

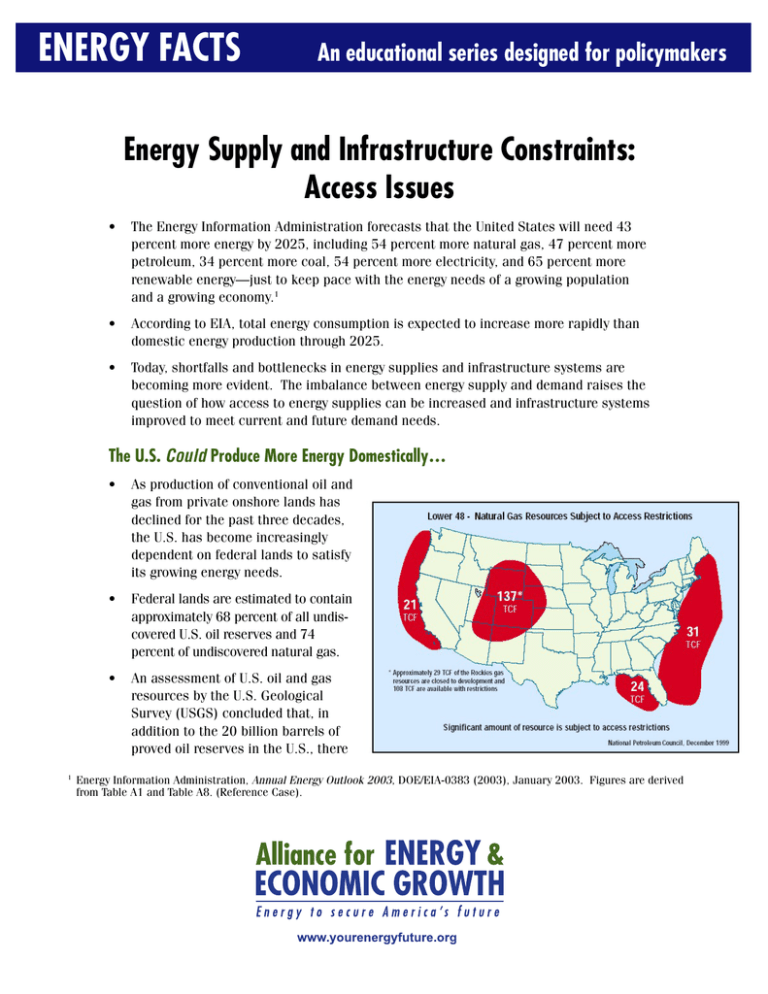

ENERGY FACTS An educational series designed for policymakers Energy Supply and Infrastructure Constraints: Access Issues • The Energy Information Administration forecasts that the United States will need 43 percent more energy by 2025, including 54 percent more natural gas, 47 percent more petroleum, 34 percent more coal, 54 percent more electricity, and 65 percent more renewable energy—just to keep pace with the energy needs of a growing population and a growing economy.1 • According to EIA, total energy consumption is expected to increase more rapidly than domestic energy production through 2025. • Today, shortfalls and bottlenecks in energy supplies and infrastructure systems are becoming more evident. The imbalance between energy supply and demand raises the question of how access to energy supplies can be increased and infrastructure systems improved to meet current and future demand needs. The U.S. Could Produce More Energy Domestically… 1 • As production of conventional oil and gas from private onshore lands has declined for the past three decades, the U.S. has become increasingly dependent on federal lands to satisfy its growing energy needs. • Federal lands are estimated to contain approximately 68 percent of all undiscovered U.S. oil reserves and 74 percent of undiscovered natural gas. • An assessment of U.S. oil and gas resources by the U.S. Geological Survey (USGS) concluded that, in addition to the 20 billion barrels of proved oil reserves in the U.S., there Energy Information Administration, Annual Energy Outlook 2003, DOE/EIA-0383 (2003), January 2003. Figures are derived from Table A1 and Table A8. (Reference Case). are another 30 billion barrels of undiscovered oil that could be recovered using conventional exploration technology and at least 60 billion barrels of unproved reserves that can be recovered with new technology. • Over one-third of the nation’s coal reserve is found on lands owned or controlled by the federal government. More than 70 percent of coal mining in western states comes from mines located on federal lands. …But, Restrictions Limit Access to U.S. Energy Resources. • The Department of Interior has noted that there are nearly 1,000 different stipulations that can impede resource development on federal lands. About 30 to 40 percent of potential domestic natural gas resources is either off limits or under serious restrictions. • In the Mountain West, where some of our nation’s largest energy resources exist, over 60 percent of federal land is off limits to energy production or available with extra lease restrictions. About 600 million acres of the Outer Continental Shelf (OCS) are off limits to oil and gas leasing until 2012. (About 52 trillion cubic feet of natural gas are contained in the OCS and are off limits.) • In 2001, the Department of Interior drastically reduced the acreage available for oil and natural gas leasing in the Gulf of Mexico. The 75-percent reduction in the lands scheduled for lease by the Department of Interior in Lease Sale 181 left accessible only 44 percent of the natural gas and oil resources in the original lease area, limiting the ability of energy companies to deliver American energy to American consumers. Current Energy Infrastructure Systems Are Not Adequate. • Investment in energy infrastructure systems—electricity transmission lines and natural gas transmission and distribution pipelines—seriously lags demand. New systems must be built and existing systems expanded in order to deliver energy supplies when and where they are needed. • According to the North American Electric Reliability Council, “in some areas of North America, electric transmission systems are reaching their limits…resulting from increased electricity transfers and customer demand increases.”2 • Transmission investment in the year 2000 was more than $2.5 billion less (in $2001) than the level of investment in 1975. Over this same period, electricity sales nearly doubled.3 • A significant obstacle contributing to the decline in transmission investment has been the siting of new transmission lines on both private and public lands. Unlike the strong federal authority that rests with FERC to site natural gas pipelines, the states currently site electric transmission lines. 2 North American Electric Reliability Council, Reliability Assessment 2002-2011, October 2002. 3 Energy Information Administration Annual Energy Review; Table 8.5 Electricity End Use (1949-2001). • Obtaining regulatory approvals for new transmission projects from federal, state, and local agencies is complex and often leads to costly delays. Multiple federal agencies are involved in right-of-way authorization and related environmental permitting. The challenge of locating across federal lands and public opposition make the process even more daunting. • Like the electric transmission grid, the current network of natural gas transmission and distribution pipelines is not adequate to meet the growing demand for natural gas. According to the National Petroleum Council, natural gas distribution utilities must construct at least 255,000 miles of new pipeline in order to bring natural gas to consumers, expanding the current distribution system by about 25 percent.4 • Another study estimates that the interstate pipeline industry will have to spend $47.7 billion (in constant 2001 dollars) on new infrastructure and $2.8 billion on additional storage facilities by 2015. An average of $3.2 billion of new interstate pipeline construction will have to be invested annually to keep pace with demand growth.5 • Obtaining regulatory approvals for natural gas transmission and distribution pipelines is complex and often leads to costly delays. o FERC must approve all new interstate pipelines and any expansions to existing interstate systems. On average, it takes 2.5 years or more from the time the company begins the process to build a new pipeline until FERC grants a final certificate. o The permitting process for siting new distribution pipelines on federal lands is often burdened with unnecessary duplication of paperwork and processing, which leads to costly delays for new service. Supply and Infrastructure Constraints Have Economic Consequences. • Natural gas demand has been and is projected to continue growing faster than available supplies. High natural gas prices severely affect consumers in the form of higher heating bills for the majority of homes that use natural gas heating and higher electricity bills, given that 66 percent more natural gas is now being used to generate electricity than in 1990. • High natural gas prices also affect the cost of fertilizer, metals, and plastics. The combined higher costs of natural gas and oil are particularly hard on farmers, who depend on affordable diesel, propane, and fertilizer. Due to the current price instabilities in oil and natural gas markets caused by an over-reliance on foreign energy sources, American production agriculture is expecting to pay $1 billion to $2 billion more this spring than last year just to get a crop in the ground. • Increased congestion on electricity transmission lines is increasing costs to consumers. A recent report by the Federal Energy Regulatory Commission (FERC) concluded that transmission bottlenecks cost consumers more than $1 billion in the summers of 2000 and 2001 alone.6 4 National Petroleum Council, Meeting the Challenge of the Nation’s Growing Natural Gas Demand, December 1999. 5 Pipeline and Storage Infrastructure for a 30 Tcf Market (An Updated Assessment), by Energy and Environmental Analysis, Inc. for the INGAA Foundation. 6 Federal Energy Regulatory Commission, Electric Transmission Constraint Study, December 19, 2001. March 2003