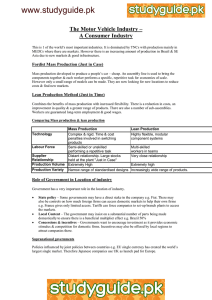

Pollution Prevention Assistance in - the Automotive Supply Chain

advertisement