BOSTON COLLEGE Department of Economics ECON3381.01

advertisement

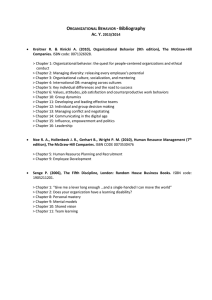

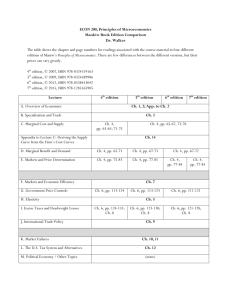

BOSTON COLLEGE Department of Economics ECON3381.01 History of Financial Crises Fall, 2015 T,Th., 12:00 Harold Petersen Maloney Hall, Room 335 petersen@bc.edu, phone 617-552-4550 Office Hrs. M 2-3, W 1-2, Th 2-3 Syllabus Required Texts: Kindleberger, Charles P. and Aliber, Robert Z. Manias, Panics, and Crashes: Financial Crises, 6th ed. 2011. (ISBN 978-0-230-36535-3) A History of Lowenstein, Roger. The End of Wall Street, 2010. (ISBN 978-0-14-311872-5) Blinder, Alan S. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead, 2013. (ISBN 978-0-14-312448-1) Lewis, Michael. Boomerrang: Travels in the New Third World, 2011. Ferguson, Niall. The Ascent of Money, 2008. (ISBN 978-0-143-11617-2) Mackey, Charles. Extraordinarily Popular Delusions & the Madness of Crowds, 1841. (ISBN 978-0-486-43223-6) Chancellor, Edward. Devil Take the Hindmost: A History of Financial Speculation, 1999. (ISBN 978-0-452-28180-6) Nelson, Scott Reynolds. A Nation of Deadbeats: An Uncommon History of America’s Financial Disasters, 2012. (ISBN 978-0-307-47432-2) Shiller, Robert J. Irrational Exuberance, 3rd ed., 2015. Prerequisites: Micro and Macro Theory, Statistics Course Requirements and Grading: Midterm Exam (20%) October 8 Leadership of and Participation in Discussions (40%) Short Papers (20%) Final Paper (20%) Due on Dec. 11 Course Organization and Expectations: This is a small seminar in which students are expected to play a major role in leading discussions. Students will take turns in leading discussions and will be expected to contribute when others are taking the lead. One week after leading a discussion, the student should turn in a written paper on the topic covered. Students are also to select a topic for a final paper. A progress report on this paper will be due by November 12 and the final paper will be due on December 11. (over) Tentative Outline of Topics to be Covered Part I. An Overview of Speculative Bubbles and Financial Crises A. B. C. D. E. Minsky’s Financial Instability Hypothesis. The Corporation and Limited Liability Fractional Reserve Banking The Impact of Leverage on Risk and Return. The Formation of Expectations Part II. The Crisis of 2008 A. Public Policy re. Home Ownership B. Changes in Mortgage Origination C. The Housing Myth D. New Financial Instruments E. The Failure of the Quants F. The Failure of the Ratings Agencies G. The Collapse in 2008 H. Subsequent Action by Government I. The Financial Crisis of 2008 outside the U.S. J. The Continuing Crisis of Government Finance Part III. Early Speculative Booms and Busts A. Banking and Possible Crises in Athens of 400 B.C. B. Early Italian Banking C. The Dutch Tulip Bulb Mania D. John Law and the Mississippi Company E. The South Sea Bubble F. Emerging Markets of the 1820s G. The Railway Mania of 1845 H. The U.S. crisis of 1792 Part IV. More Recent Crises A. B. C. D. E. F. G. H. The Panic of 1837 The Railway Boom and Bust of 1873 The Financial Crisis of 1893 The Panic of 1907 The Roaring Twenties and the Crash of 1929. The Japanese Boom of the 1980s The Asian Crises of 1997 The dot.com Bubble in the U.S. Part V. Pulling it all Together A. Can Bubbles be Detected? B. Too Big to Fail? B. Regulation and Financial Crises C. Another Look at Minsky’s Model