ANATOMY OF A COLLAPSE REDUX: ENRON (ENE)

advertisement

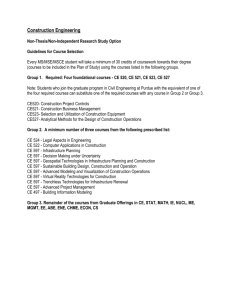

ANATOMY OF A COLLAPSE REDUX: ENRON (ENE) It’s hard to believe it has been roughly two and half years since the collapse of Enron. Some may say it is even harder to believe that it took that long to see Ken Lay indicted. Yes, this past week one of the big news stories was the indictment of the former Chairman of the Board and CEO of Enron. Given all the hoopla surrounding this media event, and the fact that your clients are seeing these news reports, we thought it would be worthwhile to re-run the “Anatomy of a Collapse: Enron (ENE). You will recall we first ran this feature article back on December 3, 2001 in the Daily Equity Report. Since then, it has proven to be a marvelous “prospecting tool” for many of you. So today we wanted to do a redux of sorts on ENE, to once again provide you with this excellent marketing/prospecting story. Below we have printed, in its entirety, the feature article from December 2001. Use this to go out and tell the story of how important technical analysis is, and in particular Point & Figure charting; that it can make a huge difference with respect to your client’s overall investment success. Enron Redux (from December 3, 2001): We hate to rub salt in an open wound but I’ve gotten tons of requests in the last couple of days to do an anatomy of a collapse example using Enron (ENE). For those you new to our service, an “anatomy of a collapse” is where we take a stock that has absolutely collapsed in price and show how if you had been using the technicals instead of just the fundamentals you have taken some type of defensive action instead of watching the stock go down the drain as the fundamental analysts continued to rate the stock a buy. We’re not trying to make fun of the fundamental analyst here. In a New York Times article from December 31st 2000 entitled “How Did So Many Get It Wrong?” Anthony Noto, an internet analyst for Goldman Sachs, says, “`our research is driven by fundamental analysis and is not influenced by anything else.’ He went on to explain that the companies he follows had their stock prices drop last spring not because their operations were failing, but because market psychology had changed. He downgraded the stocks much later because only then had it become clear through his research that the companies’ results were deteriorating. In hindsight, he said, ‘we should have lowered our ratings sooner. We regret that.’” Mr. Noto makes a very important point here and that is as a fundamental analyst, he can’t change his rating until the company’s operations change. In the case of ENE, it might be argued that the fundamental analysts were relying on information that the accounting firms said was correct but in fact really wasn’t correct. The bottom line to you and your customers is that we have to live in the world of reality and that is dealing with the stock price. No matter how fundamentally sound a company might be, it the stock price is falling that’s doing us no good. Sure we can be like Mr. Noto and “regret that” but it doesn’t change the fact that our account lost money and no one’s going to make that up. We’ve used the example many times that to get the best investments, like playing the best music, you have to have both hands on the piano. To sit a musician down at the piano and tell you to play you a song but before he begins you tie one hand behind his back the music that he makes will be marginal at best. If you let him play the piano with both hands, he’ll be able to make very beautiful music. Investing is the same way. To use just the fundamentals is like playing the piano with one hand. You increase your odds of success dramatically if you untie that other hand, the technical side of the equation. From a Barron’s article entitled “Street Fighting: One Manager’s Strategies For Beating the Pros” from June 22nd 1998, Peter Siris, an all-start fundamental analyst, was quoted as saying the following, “well, I used to completely disregard charts because I’m a fundamental investor. But over the years as I look back over the stocks I’ve owned that have done well -- as well as the mistakes I’ve made -- I’ve realized that the charts very often would have shown me great opportunities to buy and sell, if I had looked at them dispassionately. What’s more, when I’ve ignored what the charts had to tell, I’ve usually been wrong. As a fundamental investor, I’ve come to understand that what the charts are saying sometimes is that other people know more than I do about a stock; its movement isn’t just a question of momentum. If you look at charts of stocks like an Oxford Health Plans -- or almost any of the others that have cratered 50% in a day -- in almost all cases, in the three or four weeks before they got killed, you could see them topping out and starting down. The charts, essentially, are the early-warning systems of what the professionals are doing, telling you the direction in which they’re getting ready to make a major move.” So here’s a fundamental analyst saying that the people really in the know about the company will begin to cast their vote before those problems show up on the financial statements. The casting of those votes by the insiders is reflected in the chart. So let’s get to the chart of ENE along with the fundamental comments along the way. Another thing you might want to do is print out the PDF chart as that will really give you a really nice long term view of the price action in the stock and anyone can see the downtrend that this stock has been in since breaking down in the mid 70’s. As you can see, the stock gave you multiple warning signs that something was wrong and some type of defensive action should have be taken. Marrying the fundamentals and the technicals gives you better odds of success. There are thousands of fish in the sea, keep only those with the best of both worlds. Fundamental & Technical Comments on Enron (ENE) (Fundamental Source: Bloomberg ) ~ March 12, 2001: $61.27 Price Target Cut at Prudential Securities Reiterated “Strong Buy” at Lehman March 14, 2001: $62.75 Raised to “Accumulate” at Commerzbank March 21, 2001: $55.89 March 22, 2001: $55.02 Reiterated “Accumulate” at Commerzbank Capital March 26, 2001: $55.02 DWA Comment: “Shares of ENE fell out of bed quickly after violating the trendline at 68. Rallies have been useful for selling into or initiating short positions. See little on the technical side to disrupt that pattern going forward. RS is in a column of O's and main trend is negative. Initial resistance is at 60, then 67. Support 52.” March 29, 2001: $55.31 Reiterated “Recommend List” at Goldman Sachs April 4, 2001: $56.57 DWA Comment: “Remains below the bearish resistance line and well into oversold territory at present price ranges. Still, recent action has formed a consolidation pattern on the trend chart, which can be broken on a move to 54. That move would break a double bottom and complete a bearish triangle pattern. RS is in O's here and we would continue to avoid ENE here. Those looking for a tight trade to the downside may initiate a short position on the breakout at 54, but keep in mind that we are already oversold.” April 16, 2001: $59.44 Reiterated “Recommend List” at Goldman Sachs April 17, 2001: $60.00 Reiterated Near-Term “Buy” at Merrill April 18, 2001: $61.62 Reiterated “Recommend List” at Goldman Sachs Reiterated “Accumulate” at Commerzbank Capital May 2001: $62.41 Bloomberg Markets: “Inside Enron: CEO Jeffry Skilling Reinvents His Company – Again” May 21, 2001: $54.99 Price Target Cut at Prudential June 8, 2001: $51.13 Reiterated “Attractive” at Bear Stearns June 8, 2001: $51.13 DWA Comment: “ENE broke a spread triple bottom at $51 and remains below the bearish resistance line. This stock has underperformed while the utilities sector rallied, and now that the group is beginning to look suspect, this stock is one to fear. Continue to avoid positions in ENE until we can see some clear sign of a bottom near-term. The bottom of the trading band is at 45. Reiterated Near-term “Buy” at Merrill June 15, 2001: $47.26 Reiterated “Buy” at JP Morgan June 20, 2001: $45.80 Reiterated “Recommend List” at Goldman Sachs June 22, 2001: $44.88 Raised to “Accumulate” at A.G. Edwards June 27, 2001: $46.72 Estimate Raised at Goldman Sachs July 10, 2001: $49.22 Reiterated “Buy” at JP Morgan July 13, 2001: $48.78 Estimates Raised at First Albany August 13, 2001: $46.65 DWA Comment: “Stock is making lower tops and lower bottoms. The move to 42 in July took ENE below its March lows though the market remains above those lows. This divergence is typically negative. Also negative is the trend and ENE is under performing the market. Avoid this one.” August 15, 2001: $40.25 Reiterated “Strong Buy” at Banc of America Reiterated “Recommend List” at Goldman Sachs Reiterated “Attractive” at Bear Stearns Cut to Near-Term “Neutral” at Merrill August 16, 2001: $38.93 DWA Comment: “ENE breaks another bottom and all near-term support at $41. The stock now rests at the bottom of the 10-week trading band, but we will continue to avoid.” August 28, 2001: $38.16 Reiterated “Strong Buy” at Banc of America DWA Comment: “Shares of ENE have fallen well below the initial bearish price objective of 44 and are now trading a point shy of the bottom of the 10-week trading band. Still no convincing sign of a bottom here and plays at this point are based on pure speculation of a trading bounce.” Sept 6, 2001: $30.49 Enron Raised to “Buy” at Sanders Morris Harris Sept 26, 2001: $25.15 Upgraded from Accumulate to Buy at AG Edwards; Price Target $45 Oct 3, 2001: $33.49 Reiterated “Recommend List” at Goldman Sachs Oct 4, 2001: $33.10 Downgraded to “Buy” from “Strong Buy” at AG Edwards; Price Target $40 Oct 5, 2001: $31.73 Reiterated “Strong Buy” at First Albany Oct 9, 2001: $33.39 Raised to Long-term “Buy” at Merrill Lynch Oct 16, 2001: $32.84 Raised to Near-term “Accumulate” at Merrill Lynch Oct 17, 2001: $32.20 Reiterated “Strong Buy” at First Albany Oct 19, 2001: $26.05 Cut to “Hold” at AG Edwards Oct 22, 2001: $20.65 “ENE trading below NAV (25-27)” Reiterated “Buy” at CIBC Downgraded from “Buy” to “Hold” at Prudential Oct 23, 2001: $19.79 Cut to “Reduce” at Edward Jones DWA Comment: “ENE falls amid SEC inquiries, the chart breaks yet another bottom at $24 and moves to new chart lows. Best to let this dog sleep outside until some sign of a bottom is shown, continue to avoid.” Oct 24, 2001: $16.41 Cut to “Sell” at Prudential Cut to Long-Term “Buy” at JP Morgan Reiterated “Strong Buy” at Lehman; “the stock is attractively priced) Cut to “Buy” at First Albany Oct 25, 2001: $16.35 Cut to “Market Perform” at Banc of America Reiterated “Buy” at Salomon Smith Barney but Target Cut From 55 to 30 S&P Changes Enron Outlook to Negative Nov 1, 2001: $11.99 Cut to Near-Term “Neutral” at Merrill Reiterated “Buy” at CIBC “but we see no reason to buy the stock” Nov 7, 2001: $ 9.05 Cut to “Sell” at AG Edwards Nov 9, 2001: $ 8.63 Cut to “Hold” at Commerzbank Nov 12, 2001: $ 9.24 Raised to “Hold” at Prudential Nov 13, 2001: $ 9.98 Raised to “Maintain Position” at Edward Jones Nov 21, 2001: $ 5.01 Cut to “Market Perform” at Goldman Sachs Cut to “Hold” at CIBC Cut to “Sell” at Edward Jones Nov 28, 2001: $ .61 Estimates Reduced at Prudential Cut to “Hold” at UBS Warburg Cut to “Sell” at Commerzbank Capital Nov 29, 2001: $ .36 Cut to “Hold” at Credit Suisse First Boston Cut to “Underperform” at RBC Capital Markets Enron (ENE) Point & Figure Chart 85 ---* ----------------------------* 84 * * X X 83 X B * X * * X O X 82 X O X O X O X * X O X 81 X O X O X O X O * X O | 80 X O X O X O X O --* --------X --| 79 X O X O X O O X * X X | 78 O X O X O X O * X O X | 77 O X O O X O X O X | 76 O O O X O X | 75 -------------------O ----X O X --| 74 O X O | 73 O X X | 72 O X O X | 71 O X O X | 70 -------------------O X O --------* 69 O X * | 68 O X * | 67 -------------------O C ----* ----| 66 O X * | 65 -------------------O X * --------| 64 O * | 63 * | 62 | 61 | 60 ---------------------------------| 59 | 58 | 57 | 56 | 55 ---------------------------------| 54 | 53 | 52 | 51 | 50 ---------------------------------| 49 | 48 | 47 | 46 | 45 ---------------------------------| 44 | 43 | 42 | 41 | 40 ---------------------------------| 39 | 38 | 37 | 36 | 35 ---------------------------------| 34 | 33 | 32 | 31 | 30 ---------------------------------| 29 | 28 | 27 | 26 | 25 ---------------------------------| 24 | 23 | 22 | 21 | 20 ---------------------------------| 19.5 | 19.0---------------------------------| 18.5 | 18.0---------------------------------| 17.5 | 17.0---------------------------------| 16.5 | 16.0---------------------------------| 15.5 | 15.0---------------------------------| 14.5 | 14.0---------------------------------| 13.5 | 13.0---------------------------------| 12.5 | 12.0---------------------------------| 11.5 | 11.0---------------------------------| 10.5 | 10.0---------------------------------| 9.5 | 9.0 ---------------------------------| 8.5 | 8.0 ---------------------------------| 7.5 | 7.0 ---------------------------------| 6.5 | 6.0 ---------------------------------| 5.5 | 5.0 ---------------------------------| 4.75 | 4.50---------------------------------| 4.25 | 4.00---------------------------------| 3.75 | 3.50---------------------------------| 3.25 | 3.00---------------------------------| 2.75 | -----------------------------------------------------------------------------------------* O * X * ß ß Relative Strength Chart already in O’s having reversed down in O * X O X * December 2000. Peer RS gave a sell signal in July 2000 1 X O X O * O ----X O X O --* -----------------------------------------------------------------------O X O X O * O X 2 O * ß ß Bearish Resistance Line O X O * ß ß Double bottom at $77 after hitting strong resistance in O X O * the lower $80 area – supply is gaining the upper hand O ----X ----O ------------* - while demand is weakening O X O * O X O * O X O * O X X O X * O X O X ----O X O ------------------* ---ß ß Sector goes to Bear Confirmed status at 70% O X O X * O X O * O O X * 3 O * ----O * --------O X -ß ß Another sell signal after a lower top at 67---------------------* O X O * ----------------O X O ------------------------* -----------------------------------------O X O X * O X O X O * O X O X X O * O X O X O X 5 * ----------------O --O X O --------X O ------------------* -------------------------------O X O X X O X * O X O X O X O X O * O X O X O X X O X O * O X O X 4 X O X O O X * --------------------O X O --O X O X ----O X O --------------------* ---------------------O X O O O X O * O X O X O * O O 6 * O X ß ß Major Bearish Catapult at $51 after --------------------------------------------O 7 O -----trying to build a base in the 54 to O X O 60 area but supply was too strong O X O * O X O X * O X O X O * --------------------------------------------O X O X O -----------------------------------O X O X 8 O O X O O O ß ß Another double bottom at $42 O ß ß Another double bottom at $41 ----------------------------------------------------O -----------------------------------O O O X O X O ----------------------------------------------------O --------X O -----------------------9 X O O X X O O X O X O O X O X O ----------------------------------------------------O --O X --X O -----------------------O X O X O O X O A O O X O X O O O X O ------------------------------------------------------------O --O -----------------------O ß ß No follow thru on a O X breakout below the BRL O X O O X O ----------------------------------------------------------------O --O -------------------O ß ß Double Bottom Sell --------------------------------------------------------------------O -------------------O --------------------------------------------------------------------O -------------------O X --------------------------------------------------------------------O X O ---------------O X O --------------------------------------------------------------------O --O ---------------O ß ß Double Bottom Sell ------------------------------------------------------------------------O ---------------O ------------------------------------------------------------------------O X -------------O X O ------------------------------------------------------------------------O X O -----------O X B ------------------------------------------------------------------------O X O -----------O X O ------------------------------------------------------------------------O --O -----------O ß ß----------------------------------------------------------------------------O X --X -----O X O X O ----------------------------------------------------------------------------O X O X O ---O X O X O ----------------------------------------------------------------------------O X O X O ---O X O O ----------------------------------------------------------------------------O ------O ß ß ---O ------------------------------------------------------------------------------------O ---O ------------------------------------------------------------------------------------O ---O ------------------------------------------------------------------------------------O ---O ------------------------------------------------------------------------------------O ---O ------------------------------------------------------------------------------------O ---O ------------------------------------------------------------------------------------O ----ß ß Continued lower O to $ 0.50 ~ While we make every effort to be free of errors in the data on our site, it is derived from data from other sources. We believe these sources to be reliable but we cannot guarantee their accuracy. Copyright © 1995-2004 Dorsey, Wright & Associates, Inc.