U.S. Crude Oil and Natural Gas Proved Reserves, 2013 December 2014

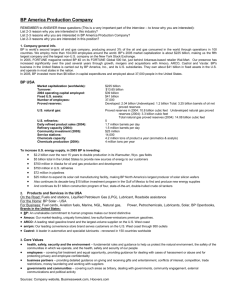

advertisement