The Economic Impacts of the Regional and Mid-Atlantic States

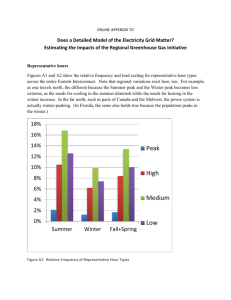

advertisement