Document 11163319

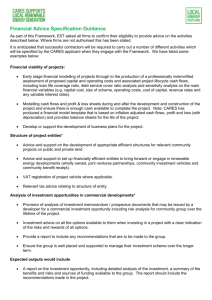

advertisement