M 00-30 .M415 9080 02239 2317

advertisement

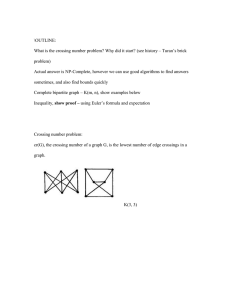

3 9080 02239 2317

HI*

M

.M415

no. 00-30

DEWEY

i3i

15

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

INVESTMENT AND INFORMATION VALUE

FOR A RISK AVERSE FIRM

Susan Athey,

MIT

Working Paper 00-30

November 2000

Room E52-251

50 Memorial Drive

Cambridge, MA 02142

This paper can be downloaded without charge from the

Social Science Research

Network Paper Collection at

http://papers.ssrn.com

ST1TUTE

NOV

8

LIBRARIES

Investment and Information Value for a Risk Averse Firm

Susan Athey,

MIT

November

2000

2,

Abstract

This paper analyzes the problem faced by a risk-averse firm considering

in a risky project.

The

firm receives a signal about the value of the project.

sary and sufficient conditions on the signal distribution such that

nondecreasing in the realization of the signal, and

to their ex ante information value. Finally,

(ii)

identify a class of utility functions for

(i)

different signals

we provide

We

which agents who are

to invest

derive neces-

the agent's investment

is

can be ranked according

conditions under which

compare the incentive to acquire information across agents with

we

how much

it is

possible to

different risk preferences,

less risk averse

and

purchase more

information.

JEL

Classification

Numbers: C44, C60, D81.

Keywords: Portfolio problem, value of information, stochastic orderings, comparative statics

under uncertainty, monotone likelihood ratio order, monotone probability ratio order.

*Some

of the comparative statics results in this paper originally appeared in

an

MIT working

paper entitled "Comparative Statics Under Uncertainty: Single Crossing Properties and LogSupermodularity," which has since been shortened to eliminate these results.

to Christian Gollier, Jonathan Levin, Paul Milgrom,

discussions,

I

am

John Roberts, and Ed Schlee

grateful

for helpful

and the National Science Foundation, graduate fellowship and Grants SBR-9631760

and SES-9983820,

for financial support; I

am

also grateful to the

Cowles Foundation at Yale

University and the Hoover Institution for their hospitality and support. Corresponding address:

MIT

Department of Economics, E52-252C, 50 Memorial Drive, Cambridge,

athey@mit.edu, http://web.mit.edu/athey/www/.

MA 02142.

Email:

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/investmentinformOOathe

Introduction

1

This paper analyzes the problem faced by a risk-averse firm

project with uncertain returns.

project.

The paper

The

who must choose an investment

in a

firm can potentially purchase a signal about the quality of the

consider three comparative statics questions. First, under

what conditions on

the information structure will higher realizations of the signal lead to higher investments on the

we ensure that one

part of the firm? Second, under what conditions can

source) will provide higher ex ante value than another for

all

signal

(i.e.,

one information

such risk averse firms? Third, what

conditions on preferences guarantee that one agent will be willing to pay

more than another

for

better information?

It

turns out that the answers to the three questions are closely related. Consider the

tion. Formally, the firm faces uncertainty

to

G

Q C

signal

is

M..

The agent has a

X, with

given by Fxiwi'l^)-

investment problem

is

The

and observes the realization of a

X

x G

ques-

about the state of the world, W, with typical realization

prior, H(-),

typical realization

first

C

The

K.

posterior F\y\x('\ x )

is

partially informative

on

signal distribution, conditional

computed according

to Bayes' rule.

W

The

=

w,

firm's

given as follows:

max

/

w x {Lo\x),

u(i\{a,uj))dF

\

where uisa

and

(typically concave) utility function,

on the investment, a G A. The marginal returns

state of the world

(cj).

The optimal

statics question concerns necessary

the agent's level of investment

is

policy

and

is

7r

represents a return function which depends

to investment, -^7r(a,u>), are nondecreasing in the

denoted a*{x). In this context, the

sufficient conditions

first

comparative

on the signal distribution such that

nondecreasing in x.

For two extreme cases of assumptions on risk preferences, the answer to this question has been

established in the existing literature. First,

if

condition for investment to be nondecreasing

the agent

risk neutral, the necessary

is

and

that x orders the poterior distribution

is

sufficient

Fw x (-\x)

\

according to First-Order Stochastic Dominance (FOSD).

1

Next suppose that

risk preferences are

unrestricted (not necessarily risk averse). In this case, a necessary and sufficient condition for the

optimal choice of a to be nondecreasing in x

Monotone Likelihood Ratio Order (MLR).

versus low realizations of

W,

2

is

that

x orders the posterior distribution by the

MLR requires

The

/vy|x( w ffl a; )//W'|.x'( w i.l a; )> i s nondecreasing in x.

pointed out the disadvantages of the

MLR order:

it is

very stringent, and

l

See Ormiston and Schlee (1992) or Athey (1999) for alternative proofs.

2

See Ormiston and Schlee (1993) or Athey (forthcoming).

restriction that

7r a

assumption that n

(a,cj) crosses 0, at

is

that the relative likelihood of high

most once, from below,

supermodular (Athey, forthcoming).

More

it is

Many

authors have

equivalent to requiring

generally, this result holds imposing only the

as a function of

a;,

rather than our stronger maintained

that the distribution be ordered by

FOSD

conditional on any two-point set of states. Thus, a small

change in probability mass affecting only two points in the distribution can upset the order.

Now

consider incorporating risk aversion. Several important special cases of this problem have

been considered

au

+

—

(1

For example, the standard portfolio problem has n(a,u>)

in the literature.

where

o)u)q,

u>q is

=

the risk-free rate of return. Eeckhoudt and Gollier (1995) showed in

the portfolio problem that a sufficient, but not necessary, condition on

increase her investment in response to a higher signal

is

F

for a risk-averse agent to

that the posterior distribution,

Fw x (-\x),

\

satisfies

the "Monotone Probability Ratio Order"

low versus high realizations of

this ordering is

FOSD

allow for

Many

more

Fw \x{ u h\ x

W,

restrictive

than

FOSD

some "averaging" over

)

(MPR), which

/ Fwixi^L^)

but

states

than the

fairly special.

=

3

MLR. Both

As expected,

the

MPR and

Sandmo's (1971) model of a firm facing demand

(P(a)+u>)a — c(a), Milgrom (1994) shows that any comparative statics

For example, we might

shocks, for example by allowing

first

main

result

is

a;

to

Sandmo model. This

like to generalize

make

the

demand curve

less elastic.

that the finding from the portfolio problem can be generalized:

MPR order,

nondecreasing whenever the agent

Furthermore, although the

is

risk averse.

condition for comparative statics in the portfolio problem,

allow for

Now consider

of information.

functional form

the model to allow for non-additive

higher signals x increase the distribution in the

when we

x.

and thus lead to more robust orderings.

result that holds in the portfolio problem, also holds in the

Our

nondecreasing in

other economic examples motivate a more general investment return function than that

uncertainty, where Tr(a,uj)

demand

is

,

less restrictive

of the portfolio problem. In a generalized version of

is still

entails that the probability ratio for

if

the optimal investment policy will be

we show

that

MPR is not a necessary

it is

more general (supermodular) investment return functions

a necessary condition

it.

our second question, which concerns the agent's preferences over different sources

For example, an investor might have access to "inside information" about asset

A

returns, or she might purchase investment advice.

firm might engage in market research, or

it

might learn from experience or experimentation. Consumers might have access to different sources

of information about product quality.

Formally, in the ex ante information gathering problem,

the firm chooses between information sources, indexed by a parameter

9 generates a signal

posterior

X

9

and

,

and chooses an

after the agent observes the realization of this signal, she

/

max

/

w x e{u>\x)dFx e{x)

u{ir{a,u;))dF

Gollier (1995)

shows that a necessary condition

is

forms a

—

c(9).

\

6>ee

posterior distribution

Each information source

action. Formally, the agent solves:

max

3

6.

for

comparative statics in the portfolio problem

ordered by "greater central riskiness."

We

will

is

that the

not pursue that order here, because

not apply directly to problems with a structure more general than the portfolio problem.

it

does

we

In this problem,

and

Fwx

states,

<>,

Our approach

(1988)

derive necessary and sufficient conditions

on the

joint distribution of signals

such that higher values of 9 increase the agent's ex ante expected

utility.

Lehmann

to analyzing the agent's information preferences builds directly on

AL

and Athey and Levin (2000) (henceforth AL). Lehmann (1988) and

when

of deriving informativeness orders,

payoff functions are restricted to

lie

in

study the problem

some

U. 4 These

set

authors further restrict attention to "monotone decision problems." These are decision problems

where

(for a

given 9 and U)

all

posteriors in the set

such that, for every decision-maker in the class

Of

signal lead to higher actions.

of the

course,

it is

U

{Fw X 9 ('\ x )i x £

i

%

can be totally ordered

}

under consideration, higher realizations of the

just this comparative statics result that

is

the subject

question addressed in this paper.

first

Lehmann

(1988) studies the particular case where

U

is

the set of

single crossing property; Persico (1996) applies this order to several

all

payoffs that satisfy a

economic problems, including

AL

generalize

to allow for different classes of payoff functions. In particular,

AL derive

portfolio problems, but without fully exploiting the consequences of risk aversion.

Lehmann's (1988) approach

an information ordering

problem when the firm

However,

AL

for

is

supermodular payoff functions, which would apply to the investment

risk neutral.

did not consider the special structure that arises in the case of a risk-averse firm.

This paper provides a

new information

MPR,

is

ranking for the risk-averse firm

is

the risk averse firm, the

Just as the order over posteriors for

order for this case.

weaker than the

MLR and stronger

than FOSD, the information

weaker than Lehmann's order and stronger than AL's information

ranking for supermodular payoff functions.

Our

third question concerns conditions

on agent preferences that imply

ranked according to the information order identified above, one agent

than another

for a

more informative

On

the other hand, an agent

On

the one hand, an agent

who

is

more

may

risk-averse

not find

it

may

choose a policy that

The approach

Lehmann

is

of

(1988) and

necessary and sufficient for

many

authors

(see, for

(1951) informativeness order

is

how

who

is

AL

all

more

signal.

responsive to

on an approach taken

contrasts with the approach taken by Blackwell (1951, 1953). Black-

decision-makers to have a higher ex ante expected value from the decision

example,

LeCam

(1964),

Lehmann

(1988) and

often too strong to be useful in applications.

exploits additional structure that arises in

not comparable using Blackwell's order.

is less

risk

as valuable to purchase better information.

to the comparative statics of information gathering builds

problem. As

AL

be willing to pay more

Our approach

well's order

signals are

pay to avoid the uncertainty that comes with an uninformative

the realizations of signals, and thus

4

if

signal. Notice that there is not a clear intuition for

aversion should affect willingness-to-pay for information.

risk-averse might be willing to

will

that,

economic problems, allowing

AL) have pointed

The approach

for the

of

ranking of

out, Blackwell's

Lehmann

many

(1988)

and

signals that are

by Persico (2000)

for the case of single crossing functions,

and generalized by

AL to

arbitrary sets of

payoff functions U. This paper identifies (rather stringent) sufficient conditions on risk preferences

and

so that one agent will purchase better information than another,

family of utility functions for which agents

who

in particular,

we

identify a

are less risk averse are willing to pay

more

for

information.

The Investment Problem

2

Stochastic Single Crossing and Comparative Statics

2.1

In this section,

we introduce and

the paper. Let

X

and

on Q. Let TZ be the

we

define the set

if

R

be compact subsets of R, and

set of

UR

UR =

For example,

Q

for all

function /

x >

xq.

:

{u

|

u

X

:

X— R

>

we

P,Q

/

Q

—> R, and

V xh >

x that

weak

is

is

have:

are

1

//,

for

set of probability distributions

to R. For a given set

Q,

%l, u(xh, )

single crossing at xq

R (ZlZ,

weak

UR

is

-

u(xl,

€ R}.

•)

the set of supermodular functions

single crossing

if

f(x)

if

<

there exists

for all

x < xo and f{x) >

some x$ such that f(x)

is

single

5

E.V- Then

r{u))dP{oj)

Q

>

P

dominates

implies

Shannon (1995)) shows that

comparative statics

be the

bounded and measurable).

/

in the stochastic single crossing order for R, if

r(u))dQ(uj)

are stochastic single crossing orderings useful?

application of

Lemma

x

the set of nondecreasing functions,

is

crossing at xo- Then,

Why

V

as the set of functions with ^-incremental returns. Formally,

The function

Definition 1 Let

let

bounded, measurable functions mapping

(with incremental returns to

A

characterize several stochastic orders that will be used throughout

The

>

for

all

following

r

6 R.

Lemma

(which follows as an

stochastic single crossing orders can be used to derive

results.

all

order for R, then for

xu >

all

xi, Fw\x('\ x h) dominates Fw\x('\ x l) in the stochastic single crossing

g €

UR

,

there exists a nondecreasing selection a*(x)

from

argmax a f g(a,u))dFw x (u\x).

\

5

Given the assumptions we use

crossing order in terms of

property.

We

in this paper, all of

our results would also hold

Milgrom and Shannon's (1994)

if

we denned the

single crossing property rather

use the weak single crossing property for simplicity.

stochastic single

than the weak single crossing

r

Now

us define several important examples of stochastic single crossing orders, each cor-

let

We

responding to a different set of payoff functions R.

we

subsequently,

will identify the sets

P

Suppose that

First, consider

Second,

p,

with

FOSD.

let \x

Q

and

Q y FO SD P

Formally,

be a measure on

Q

denoted

P-, if

:

r is

-.

q(uio)

q.

and

i-i

single crossing m

•

weak

•

lo

at+ loq

a..e.-/j,.

P{u)q)

Q

>~lr-u>

Fw x {-\x)

x orders

€ Q.

Q are absolutely continuous with respect to

P dominates Q according to single crossing of likelihood

In other words, the likelihood of a state

requiring that

P

for all lo

6

gH

—

—gM

—

and suppose that supp(P)=supp(<2)=fi.

QM < P(u>)

if

such that

£1

p and

^-lr-ujo

(smaller) with q than p. If

which they are stochastic single crossing orders.

for

are probability distributions,

strictly positive densities

ratios at ujq,

R

begin by defining the orders directly;

by

>

lo

P f° r

MLR

(<)loq relative to the likelihood of loq

/^-almost

is

Q

then

all loq,

is

greater

>~lr P- In this languange,

equivalent to requiring that, for

all

xh >

#l>

\

Pw\x{'\ xh) >~lr Pw\x('\ x l)- Equivalently, the density fw\x must be log-supermodular, so that

fw\x{u xH )l fw\x( u} xL )

1S

nondecreasing in

to.

\

\

Third,

we can

similarly define single crossing of probability ratios, replacing the density with

Q ypR-uj P if grj) — puJ) s weak single crossing in lo at loq. If Q )~pr-u P

for all ljo, then Q >~pr P. When Q ypR P, then for every u>q, the likelihood of state loq relative

to the likelihood of all states lo < u>q is higher for Q than P. Requiring that x orders Fw x (-\x) by

the distribution:

i

\

MPR

is

equivalent to requiring that, for

all

xh > x l,

Pw\x('\ x h) >~pr Pw\x('\ x l)- Equivalently,

F\v\x must be log-supermodular.

It

MPR is weaker than MLR (since log-supermodularity is preserved

than FOSD (since the MPR requires that Fw\x{u xH I Pw\x(CJ xL

can be verified directly that

by integration) and stronger

)

\

is

nondecreasing in

to,

and the upper bound of the

2 Suppose that supp(P)=supp(Q)=Cl.

r nondecreasing.

if

and only

Q y PR

The

Q

Q{-

\

>~lr P-

(i)

The

1).

Q yFOSD P

following

if

an d on h

o)

1

too)

if J r

jj,-

1

1

provides

the relationships between them.

W G {wi,^}) >~FOSD P(- W S {^1,^2}) for

for

Q{- W < w

^FOSD P(- W <

(Hi)

lemma

dQ > f rdP for all

almost

all loq

G

all

{^i,^} G

Q

if

and only

Q,

if

p.

idea of this

two-point

6

if

(ii)

is

MLR, MPR, and FOSD, and

alternative characterizations of the

Lemma

ratio

)

\

We say

set,

Lemma

while the

that a function g

can be stated in words:

MPR is

:

CI

equivalent to

— R satisfies single

pair (using the measure induced by

p,

on

CI

2

),

g

MLR is equivalent to FOSD conditional on any

FOSD

conditional on any lower interval of the form

crossing almost everywhere

satisfies single crossing

(a.e.-|i)

on {wi,w«}.

if,

for

almost every

(ui l ,uj

h

)

{ui

:

u <

u>o}.

Parts

(i)

and

As a consequence

the definitions.

Lemma

of this

(ii)

of

(i)

and

are well-known, while part

x orders

(iii),

Fw x {-\x)

follows

(iii)

by the

MPR

if

by checking

and only

if

\

E^fr^^x, W < wo]

is

nondecreasing in x for

MLR order must

Note that because the

uo 6

all

Q and

r nondecreasing.

all

be checked for every pair of

states,

independent of

it is

H and a signal distribution Fx \wi ^ x orders the posteriors

Fw \x{-\x) by MLR, the same conclusion holds H replaced with any other prior distribution.

In contrast, the MPR order might hold for the posteriors generated by a given prior H and a signal

More

the prior.

precisely, given a prior

if

distribution

Fx w

,

while

it

Fx w

7

might

fail for

is

the posteriors generated by another prior

G

and the same

\

signal distribution

.

\

Our next step

is

to define several classes of payoff functions of interest.

which are weak single crossing, while rSC^o)

RND

wo!

the se ^

js

5C

r nondecreasing; _R

f

that, for

The

is

the set of

all r(-)

a \\ r (.) which are weak single crossing at

'

is

the set of

all

(

3( a;

°)

is

the set of

and quasi-concave, where the function changes direction

are in iJ

R sc

sc<3( a'o)

some

for

some

An

ujq-

important subset of

r nondecreasing, g{uj)

following

Lemma

=

l{ aJ < Wo }(w)

•

at ljq, while

n sc Q( u} o)

r(u>).

all r(-)

js

Clearly,

which are single crossing

R SC Q

is

the set of

the set of r which

all

functions g such

RND C RSCQ C Rsc

.

characterizes the stochastic single crossing orders for these payoff func-

tions.

Lemma 3 Suppose that supp(P)=supp(Q)=Q.

ND if and only if Q >~fosd P(i) Q dominates P in the stochastic single crossing order for R

(ii) Suppose that either fl is finite, or else P and Q have continuous, strictly positive densities with

respect to a measure

(a) For loq £ J7, Q dominates P in the stochastic single crossing order for

ftSC{uj

p. (b) Q dominates P in the stochastic single crossing order for

if an(j on iy ^ q y LR _

R sc if and only if Q y LR P.

sc ^ u

(iii) (a) Foruio > inf fi, Q dominates P in the stochastic single crossing order for R

if and

sc

®, if and

only if Q >~pr-cj P- (b) Q dominates P in the stochastic single crossing order for R

only if Q >-p R P.

,

/j,.

)^

UJo

,

°>

The proof

7

follows from

However, under these conditions the

MPR

would hold

for

3

and

4,

and Athey (1999). 8

any prior distribution formed from

H

(using Bayes'

W

< a.

by conditioning on the event

Athey (forthcoming) focuses on problems where

rule)

8

Athey (forthcoming), Theorems

,

(1994) single crossing property, rather than the

weak

R

is

the set of functions that satisfy Milgrom and Shannon's

single crossing property used here (where r

may become

positive

Athey (forthcoming), we may allow for supp(Q) to be greater than supp(P) (in the strong set

sc it can be shown that

order). When we consider the larger set R

Q dominates P in the stochastic single crossing

sc

order for

only if supp(P)=supp(Q)=fi. We maintain the assumption supp(P)=supp(Q)=f2 as a prerequisite

and then return to

0). In

,

R

rather than a conclusion in order to

make

it

easier to state the definitions of the relevant ratio orders.

.

To connect

part

of

(iii)

Lemma 2

the function defined by g(w)

=

and part

l[ UJ<u}0 y(oj)

of Lemma

(iii)

t{uj) is in

observe that

3,

H sc Q(u o) Further,

if r(-) is

Lemma

nondecreasing,

2 implies that

if

Q ^PR P,

Jr(u>)-l {uJ<u o} (u;)dQ(uj)

,

Q(wo)

l {ul<UJo }{u)dP{u>)

J r(to)

>

_

P(wo)

or, rearranging,

l {w<W0} ( W )dQ(w)

fr{ui)

>

|^| y r(«)

•

•

l {w<a o} HdP(u;).

,

This in turn implies

l {ltJ<llJo} (u,)dP(u,)

fr(u>)

In words,

form

Q

P

dominates

l{o,< Wo }(w)

•

=>

is

}(

u; )

r ( w )-

'

The

•

l {w<a o} (u;)dQ( W )

,

nondecreasing, a subset of

the counter-examples required for necessity in part

l{w<w

fr(w)

>

0.

in the stochastic single crossing order for the set of functions of the

where r

r(u>),

>

(iii)

of

Rsc<2.

Lemma

Further,

we can construct

3 using functions of the

form

following characterization lemma, proved in the Appendix, builds on this

logic.

Lemma

single

supp(P)=supp(Q)=Q. For to q > inffi, Q dominates

crossing order for R sc Qv^o) ( & q U ivalently, Q >~pk_ wo P) if and only if

4 Suppose

that

fr(u)dQ(u) >

2.2

^p\

I'r(u)dP-(u>) for all r

G

P

in the stochastic

RSG Q^)

(1)

Comparative Statics in the Investment Problem

Consider the investment problem of a risk-averse firm, as described in the Introduction, where the

firm has access to the signal

X and solves max ae

^i

J u(Tr(a,Lu))dFyy\x(Lo\x)

.

In our analysis,

we

will

refer to the following assumptions.

Al

For each x G X, supp{F-\y^x('\ x ))— ^-

A2

Either

fi is finite,

or else, for each

x G X,

Fw \x('\ x

)

has a strictly positive and continuous

density.

A3

u and

it

are

C2

,

the derivatives are absolutely continuous, and A, Q, and

X

are compact,

convex subsets of K.

A4

For

all 8,

x, the

J u{ix{a,w))dFw \x{u\x)

optimal choice of a

is

is

quasi-concave in a and

interior.

C3

.

Further, assume that for each

A5

7r(a, ui) is

nondecreasing in u, and further, the expected value of the project,

J ir(a, co)dFw x ( w x )

l

\

nondecreasing in

is

a.

Assumptions Al and A2 simplify the analysis by allowing us to work with the

without treating separately the possibility of moving support.

that

Q

if

is

not

finite,

Further,

A2

MLR and MPR

allows us to assume

the posterior distribution has a well-defined, continuous density, and that

The

each x, the likelihood ratio f(u>'\x)/f(u)"\x) exists for almost every (u',io") pair in Q.

for

differentiability

assumptions (A3) simplify the notation and analysis. Assumption

A4

allows us to

ignore the possibility of multiple optima, and to assume that the first-order conditions characterize

the optimal choice of investment (we clearly cannot impose the assumption

neutral, however).

when

the firm

AL

(A3) and (A4) can be relaxed; see Athey (forthcoming) and

Assumption A5 says that higher

states are better,

and that on average, the returns

are non-negative. These assumptions are satisfied in the portfolio problem,

is risk-

for details.

to investment

and they highlight the

elements of the portfolio problem that are critical for comparative statics results. Finally, note that

paper focuses on the case where w

this

is

u

represents

lead to

monotone

supermodular, incorporating the idea that

the marginal returns to the investment.

Now consider the role of risk preferences in deriving orders over posteriors that

decision problems.

The

following Proposition summarizes the comparative statics results for two

extreme cases: firms whose

risk preferences are unrestricted,

Proposition 5 Assume A1-A2, and suppose

«*(•) is nondecreasing for all

i\

supermodular,

if

u nondecreasing

only

if

Fw \x{'\ x

and only

(that

)

*s

all

is,

Fw x (-\x)

\

*s

risk neutral firms.

there is a unique optimal action for each x.

u nondecreasing and

if

and

linear (that

ordered by

FOSD.

(ii)

all

a*(-) is nondecreasing for all

firms with arbitrary risk preferences) and

ordered by

neutral firms), and

all risk

is,

(i)

all

n supermodular,

if

and

MLR.

Proof. Under the assumptions of the proposition, weak single crossing of the incremental returns to

a

is

necessary and sufficient for the comparative statics prediction,

= u o it,

g(u>,a)

Lemma

3.

functions.

Now

(ii)

where u

is

Taking the

Apply

Lemma

nondecreasing and

class of linear,

7ris

supermodular, unless u

However,

nondecreasing and concave, ^g{uj,a)

all

.

Apply

3.

monotonicity restrictions.

not

UR

nondecreasing u returns the class of supermodular payoff

preserved by nondecreasing, concave transformations.

ir is

Taking the class of functions

supermodular, generates the set

consider the problem faced by a risk-averse firm.

supermodular when

(i)

for

is

Thus, g(u>,a)

linear, or else

any g{u,a)

satisfies

Notice that supermodularity

= u

o

7r

u

is

where

= u

o

tt

convex and

7ris

not

not necessarily

tv

satisfies

some

supermodular and u

the single crossing property.

But,

functions with the single crossing property can be generated in this way.

8

is

is

if

u

is

is

concave,

Since the relevant set of payoff functions for risk averse firms

ular payoff functions, but smaller than the set of payoffs

larger than the set of

is

whose marginal returns

supermod-

satisfy the single

crossing property, the comparative statics result for risk averse firms requires an intermediate con-

on the

dition

distribution. It turns out this condition

order for the set

of functions R sc ® defined

given that u' (Ti(a,uj))n a (a,Lj)

is

all ix

MPR,

is

if

and only

nondecreasing in x for

is

x orders

if

MLR and stronger than FOSD.

Eeckhoudt and Gollier (1995), who establish the

is

somewhat

Fw x (-\x)

<

all

The

u concave and nonde-

MPR.

by

for

comparative

find x,

u concave, and

approximate

concave and

7T

it is

strictly larger

is

we construct

in

we can

x, u'(Tr(x,u>))-J^Tr(x,u>),

In other words, the set of functions of the form g

supermodular, contains (and

of

r(w); but, for any such function

supermodular, so that the marginal returns to

this function.

The proof

result for the portfolio problem.

l^ <a y(uj)

3 use payoff functions of the form

statics,

sufficiency part of this result generalizes

necessity builds on our discussion from the last subsection: the counter-examples

Lemma

surprising,

R sc ®.

Appendix. As expected, the condition

result is in the

weaker than

This

in the last subsection.

Then &*()

supermodular,

The proof of this

equivalent to the stochastic single crossing

not necessarily in the set

Proposition 6 Assume A1-A5.

creasing and

is

=

u

o

it,

where u

is

UR

than)

3

The Value

Now

consider the problem of comparing the value of different signals. In particular, suppose the

of Information

{X e }g £ Q, where

indexed by

8.

Formally, the firm has a fixed prior, H(-), about the state of the world. Then, the firm chooses

8,

firm can choose from a family of signals

which determines the

set of possible posteriors

the quality of the signal

{Fw x o (-\x) x €

,

X

e

}

is

as well as the likelihood of

\

each. After observing the realization of the signal

X — x,

e

the firm forms the posterior

FW X

9 ('\

\

and solves max a£ _4 f u(Tr(a,to))dFw

When

x e(u)\x).

evaluating the problem from an ex ante perspective, for each

signal distribution,

noted

\

Fwx e(-,

•).

Fx w

ei

The

,

probability

x),

joint distribution

and

8,

the prior

H

and the

determine a joint distribution over states and signal realizations, de-

marginal distribution of the signal

Pr(W < u\X e <

X)

is

denoted

Fx »{x\W <

mass functions or

Fwx e(-,

•)

is

referred to as the information structure.

Fx e(-).

The notation i<V(u;|X

w) represents Pr(X e

< x\W <

co).

<

The

x) represents

The corresponding

densities are denoted by /.

For a given payoff function

:

AxQ—

>

M.

(such as g

=

u

o

77),

the ex ante value of information

given by

is

V*{9;g)=

max

/

g(a,u)dFwlx e(uj\x) dFxe {x).

/

J x e laeA J n

In the next subsection,

we review and extend the

-2-1

conditions such that -§sV*{9\

uo

90

77)

>

results

AL

from

that give necessary and sufficient

for all payoff functions in a given class.

Monotone Information Orders

3.1

AL

develop a theory which can be used to order information structures for payoff functions of the

form g

AxX—

»

:

UR

functions

As

,

A

higher value of 9 provides a "more informative" signal for a set of payoff

£§V*(9;g)

if

Lehmann

in

R.

(1988),

>

g

for all

UR

<E

.

AL's approach considers only "Monotone Decision Problems." That

is,

the set of admissable information structures must be "i2-ordered," so that the stochastic single

crossing order for R, denoted >-r,

all

xh >

UR

g G

is

is

a complete order on {Fw{-\x)} X £X-

xl, Fw{-\xh) >~r F\v(-\xl).

If

Fwx

13 implies that for

argmax ae ^ f g(a, Lj)dFw X B{u>\x) such

there exists a selection a*(x;9) from

,

Lemma

.R-ordered,

is

e

In other words, for

all

that a*(x;9)

\

nondecreasing in x; thus, throughout we assume that the agent chooses a nondecreasing policy.

For each of the different sets of payoff functions

restrictions implied for

The

restriction to

we have

considered,

Lemma

3 describes the

Fwx e.

monotone decision problems allows us

when the

decision-maker's preferences. In particular,

inherits properties

R

from

g(a,cj).

For example,

if

g

make use

to

decision policy

is

is

of our knowledge of the

nondecreasing, g(a*{x\

supermodular and

Fw x b(-\x)

is

9), to)

ordered by

\

FOSD, then

An

a*(x; 9)

nondecreasing in x and g(a*(x; 9),oj)

realized

X

e

supermodular in

has no intrinsic meaning to a decision-maker:

a transformation

Y = T(X

Why

9

is

9);

;

T X

:

x

so long as the ordering

like,

6 —

>

Y

d

is

Our approach

is

is

that the value attached to a

all

that matters after the signal

preserved. For example,

and

strictly increasing in x,

[0, 1]

we

for

each

9,

It

consider

consider the signal

as

X8

.

plays a central role in our characterization of the

to ranking information structures can be outlined as follows.

XH

and

XL

L To do so,

it is

sufficient to

9^, with corresponding signals

X

"more informative" than

.

.

We

will provide conditions

show that

for

that expected payoffs are higher than

when

under

each g G

there exists a policy (not necessarily optimal) that a decision-maker can use with signal

X

are free to

we can

must give the decision-maker the same payoffs

such a normalization important?

9h >

XH

e

having access to

information orders.

Consider

(x, u>).

the posterior distribution over the state of the world. For this reason,

is

normalize the signal as we

which

is

important thing to note about the setup of the problem

realization of

is

is

XH

,

UR

,

such

the decision-maker uses the optimal policy with signal

L

.

10

Consider how this might be accomplished.

o*(-;8l)

9h)

£*(;

'

'

L —*

A. This yields expected payoffs V*(#l; p).

X

XH —

^4,

>

For example,

function a(x; 9h)

=

L

A=

if

a*(x; 8i)

Instead, our approach

[0, 1],

—x

(3*(-,8 L )

[0,1]

:

A

X =

X

mined.

in the

and X H =

we have not

policy,

then to construct a policy,

is

XL

rather than

[-100, 100],

if

)

yields ex ante

how

a*(x; 8 L )

T X9 x Q —

Y H = T{X H ;8 H

L

and

)

>

:

).

a*(x;8 L ), so that using

to construct

=

x, the the

[0, 1],

and

rescale

Next, we define

L ) with signal

/?*(•;

YL

is

Then, our approach to ranking information structures

.

access to signal

YH

can do better than the agent with

YL

#l)- Since the realizations of both

who has

YH

access to

yet said anything about

how

main

following proposition includes the

results

YH

and

in [0,1],

lie

.

this transformation, T, should

turns out that the answer depends on which class of payoff functions

It

The

tion.

/?*(•;

well-defined for an agent

course,

=

who has

L

access to Y using the same policy,

Of

XH

not immediately obvious

it is

Y L = T(X L ;8 L

by fi*(T(x;8 L );8 L )

reduces to showing that an agent

is

goal

to choose a particular transformation,

is

equivalent to using «*(•; Ql) with signal

this policy

[0, 1]

and take the optimal

,

not well-defined.

is

each signal, defining two new signals

-»

Our

that (when the decision-maker has access to

expected payoffs greater than V*{&L;g). Notice that

this policy.

UR

Consider g G

is

be deter-

under considera-

about information orderings;

proved

it is

Appendix.

Proposition 7 Let

H

be a prior probability distribution over Q, let

eterized signal distribution,

and

let

Fwx

Fx w

be a

e<

smoothly param-

be the corresponding family of information structures.

e

Assume A1-A2.

(i)

Suppose that for each

8,

Fw x b(-\x)

ordered by

is

\

and

all

g supermodular,

Fw

XB

1

by >~lr-uo

i

T(x;u>,8)

For

(Hi)

all u>o

8,

T(x;u,9)

For

is

if,

letting

T{x\ 8)

ordered by

Fw x e{-\x)

is

\

n x for eac h ^o)- Then

™ 8 for all y

> F OSD

ordered by the

-§qV*{8\ g)

>

Then -§gV*(8;g) >

x.

for

MLR

all

in

8 and

x

all

G

is,

R

g G U

all

6

(MIO-spm)

[0, 1].

(that

for

Fw x e(-\x)

\

,

if

is

and only

ordered

if if

we

= Fx w (x\u)),

e\

G

fi

and y G

[0, 1],

Suppose that for each

by ypn-ui

and only

> T~\y; 8))

Suppose that for each

(ii)

let

{-

if

FOSD in

= Fx e(x),

in

x for each

8,

Fw

{-

1

X9

Fw x e(-\x)

loq).

i

is

-1

> T (y;u;o,0))

ordered by the

is

ordered by )^lr-u>

MPR

in

x

(that

is,

in 8.

Fw x e(-\x)

(MIO-sc)

is

ordered

\

Then j^V*(8\g) >

for

all

g G

UR

,

if

and

only, if

we

let

= Fx e(x\W <u),

all loq

>

mtft,

and y G

[0, 1],

Fw{-

\

X9

> T~

l

{y\LOQ,d)) is ordered by

>pr- Uo

in 8.

(MIO-scq)

11

Part

of this proposition

(ii)

originally

is

due to Lehmann (1988);

AL. Part

of single crossing orders over average posteriors by

new

was

first

stated in terms

due to AL, while part

is

(i)

it

(iii)

is

(MIO-sc) has been applied in economics in the area of principal-agent problems (Kim,

here.

and auctions

1995; Jewitt, 1997)

AL

(Persico, 2000).

apply (MIO-spm) to a number of economic

problems, including adverse selection problems and oligopoly games.

To

interpret the three conditions, consider 9 H

Notice that

all

>

6 L and the corresponding signals,

X H and X L

.

three conditions are comparisons across information structures of the average over

"high" posteriors (that

is,

posteriors corresponding to high signal realizations) where posteriors are

,

ordered by the relevant stochastic single crossing order. Each monotone information order requires

XH

that the "high" posteriors for the good signal,

the bad signal,

X

L

when

are "higher" than the "high" posteriors for

,

monotone

correspond to higher investments. For example, consider U R

Recall that

.

the agent uses a

agent whose return to investment changes direction at

chooses a policy where, for some y, she invests

implies that,

cjo),

if

the agent instead observes signal

when

XH

and

,

let

If this

ujq.

X

policy, higher signal realizations

L

A=

{0,1}, and consider an

agent observes signal

> F~\{y\W <

invests exactly

she

,

Then, (MIO-scq)

u>o).

when

XL

XH

> F~},(y\W <

the average over the agent's posteriors conditional on investment are higher (according to

Since the average of the posteriors

is

the prior, the conditions of Proposition 7 likewise require

that the "low" posteriors for the good signal are "lower" than the "low" posteriors for the bad

signal.

Thus, another way to interpret the conditions

is

that they require the posteriors of an agent

given a good signal to be more "spread out" in the appropriate stochastic order.

The

three

they also

monotone information orders

differ in

not only in the relevant order over posteriors;

that different "normalizations," T, of the signals are used.

are tailored to the class of payoff functions,

Observe that in part

u>q

and they are derived

(and similarly, in part

(ii)

(MIO-sc) by requiring that

why, observe that

differ

Fw

{\

X

9

>T

in the proof of the proposition.

we cannot

(iii)),

_1

ordered by the

(y; lj, 9)) is

appears twice in the statement of (MIO-sc):

normalization T, and second,

we check

The normalizations

first,

simplify the statement of

MLR in

we

9 for

condition on

that the posteriors are ordered by >-lr-uj

that the crossing point specified for the stochastic order

is

the

same

-

^

To

see

ujq in

the

all uj.

important

is

as the crossing point used in

the normalization T.

Finally,

jjR

rpj^

"o

^

to

we note

that

we could

also

orcj ers over posteriors

AL establish that (MIO-spm)

Lemma 2 (ii)). To verify that

the definition of (MIO-scq).

It

modify parts

(ii)

and

(iii)

to consider the sets

would simply be checked only

holds for

all priors, if

(MIO-scq)

is

and only

if

UR

"°

for the relevant ojq.

(MIO-sc) holds

stronger than (MIO-spm), simply

analogous

(this is

let ujq

=

supfi in

can further be shown that, given a prior H, (MIO-scq) holds,

12

and

if

and

only

if

(MIO-spm) holds

= H(u\W <

form G(u>)

for all priors of the

Lemma

a) (analogous to

2

(hi)).

Monotone Information Orders

Characterizations of

3.1.1

This section provides two alternative characterizations of (MIO-sc) and (MIO-scq). The charac-

may be

terizations

independently useful, because

it is

stated in terms of signal distributions rather

than posterior distributions.

The

Lemma

For

(c)

characterization

first

8

For

(b)

G

)

x Q, and

[0, 1]

(y,w

all

G

)

9h >

9; (d) for all

(ii)

The following four conditions are

(i)

all (y,u)

all

x Q, and

[0, 1]

Ol, F~]j

>

v

ui

v

all

(Fx l(x\W —

,

<

Fx

cj

loq)

(F~l(y\W

e

Fx

,

For

(y,w

all

For

G

)

all (y,LO

in 6; (d) for

all

Condition

G

)

6H

x Q, and

[0, 1]

>

[0, 1]

6L

is

Lemma is

we seek

MLR) we

signal

when

X

L

,

if

Fx l{X \W =

V-

We

of the world

v

uiq)

say that

is

v

>

XH

Fx w

is

e

<

most

Now

y.

e

,

is,

)

|

W<w

)

is

(ii) is

new

MLR,

size,

to

that

more informative than

thereafter.

r,

is

in

all

x G

XL

.

nonincreasing in

nondecreasing

is

for

u>

Lehmann

all

x G

(1988),

XL

and

.

AL

here. First, consider the interpretation of

W>

loq

against the alternative

with probability no greater than

implement a

is,

XL

test of size y

signal,

we

if

given the size of test y,

is

smaller with

XH

,

With

and consider

Fx h (X h \W =

if

the true state

X H than X L

up when the true

ojq.

reject the null

XH

a test that rejects the null

if,

W=

when

.

state

Part

is

v

(i)(c)

<

ujq.

provides a uniformly more powerful

L

.

consider the interpretation of part

investment,

for

a test of size y. Observe that (given posteriors that

In the terminology of classical statistics, for a fixed size y,

Now

loq

nondecreasing in

requires that the probability of rejecting the null hypothesis goes

X

is

)

likely to reject the null incorrectly

same

nonincreasing in

v)

\

wo, the probability of rejecting the null

hypothesis test than

W=

suppose we gain access to another

test of the

is

|

ordered by (MIO-scq);

to test the null hypothesis that

the posteriors are ordered by

l

implementing a hypothesis

w o) <

are

)

the statement of (MIO-sc) given by

true, that

is

ui

nondecreasing in

is

test that rejects the null hypothesis

y when the null hypothesis

are ordered by the

=

e

,

equivalent to (i)(d); part

and we want a

u>o,

all

e

Fx (F~}(y\W < loq) W < v) is

< w Fx (F~j(y\W < uj \W <v)

u>

F~ H (Fx l(x\W < u

,

part (i)(b). Suppose that

<

x Q, and

>

(a)

l

(i)(d) of this

show that (MIO-sc)

v

all

[F~] (y\W

e

W = wo)

\

Fx w is ordered by (MIO-sc); (b)

= loq) \W = v) is nonincreasing in 9;

equivalent: (a)

The following four conditions are equivalent:

9; (c)

W

given as follows.

is

# sc,(2( w o)_

Suppose that

A=

j

n wor d S) r

{0, 1}.

Then,

(ii)(c).

is

for

Suppose that the agent's marginal return to

nondecreasing on

each

13

9,

u>

<

ujq,

and remains positive

consider the policy where, for

some

y,

the

agent chooses to invest

that

it

the true state of the world

if

Xe

greater than

is

in the set {lo

is

<

u>

:

F~]{y\W <

v}, where v

<

loq,

that the agent chooses to invest. In contrast, by part (h)(b),

less likely

makes

signal

the realization of

if

more

it

Part

(ii)(c)

requires

a "better' signal makes

when

«>woa

"better"

chooses to invest. Given the agent's preferences, these

likely that the agent

changes increase ex ante expected

a>n).

utility.

Notice that, unlike (MIO-sc), (MIO-scq) places requirements on the "average" signal distribu-

That

tions.

W.

is,

in order to

compute

Fx l{-

|

W<

we need

u>q),

prior distribution over

Thus, while (MIO-sc) can be interpreted in terms of "classical" hypothesis testing in

giving conditions for signals to be ranked for

make use

we must be

As AL

more

discuss in

of payoff functions R SC Q

of the additional structure on the set

detail, in order

MPR

order and (MIO-scq) are unchanged for a given signal family

allow for an alternative prior of the form H{lo)

The next lemma

= H(lu\W <

Fx e(-\u;)

of

x that implements

only

if

9

(i)

than

The

y.

is

=

F~],

supermodular in

—

Define x(y;9,uo)

supermodular in

=

w (y

F~]{y

(6,ljq), that

\

o>

W < uq).

9 (

interpret the result of

X

'Lemma

and

W, where

the "cutoff" level

Then

u>o).

Fx w

e

is

ordered by (MIO-sc)

if

and

is,

is

nondecreasing in

loq

for

all x.

(2)

Then

if

Fx w

e

is

ordered by (MIO-scq), x(y;9,u)o)

is

)

,

,

is

nondecreasing in

u>o

for

all x.

(3)

)

Lemma

9

positive

dependence

(ii),

-^j-x{y\ 9,loq)

is

a measure of the positive dependence

defined to increase expected payoffs for the

is

To see this, we

H = ~§gF o\ (x\LJo) > 0. Then,

)

(2)

x W

9 can also be used to establish directly the relationship between MIO-sc and MIO-scq.

can define h{uj ;v) for

is

how

9

is,

fx e{x\W <cj

s

W=

places conditions on

signal,

)

4 FX__x\W <u)—

between

Suppose that

u>o)

—-22

To

\

(6,loq), that

7)qFX 9(x\W =

—

—

—

=

fx e(x\W

(ii)

Lemma

following

changes in 8 and wo-

this policy

Define x(y; 9,ojq)

x(y;8,iVo)

we

than the inverse distributions. The

an investor follows the policy of investing when the realization of the normalized

;9,u)o), is greater

Lemma

if

builds on the characterizations from parts (i)(b) and (ii)(b), stating the condi-

characterizations can be understood in terms of the transformation function, T.

T(X

),

v).

tions directly in terms of (average) signal distributions rather

e

R sc

(rather than

willing to specify a restricted class of prior distributions. Notice, however, that given

a prior H, the

for all 9,

statistics,

possible priors, (MIO-scq) requires a Bayesian

all

perspective, in particular, a pre-specified prior distribution.

to

know the

to

nondecreasing in

ljq

L

i)

e {v ,v"}

as follows:

when

h{uio;if) is

exactly

log-supermodular (Karlin, 1968),

(2)

h(u

;T)

L

)

=

e

f

(x\ujo), h(uj ;r}

log-supermodular. Since integrals of log-supermodular functions are

nondecreasing in

u>o

implies (3)

14

is

nondecreasing

in u>

-

relevant class of decision-makers (in this case, the

MPR)

the positive dependence (in terms of the

Finally, consider briefly

r

nondecreasing

is

if

Condition

.

X

between

9

and W.

(3) requires

that 9 increases

10

an analogous characterization of (MIO-spm). In particular, notice that

and only

The requirement reduces

MPR)

to

if it is

J|

in _R

~Pi(X

e

?M. Now,

5C,<

< F~}{y)

(MIO-spm). Equivalently, -§gFWX 9(v,F~l(y))

\

>

consider

W

<

v)

for all

Lemma 8,

>

part

for all v,y.

(ii)(b),

This

is

when

cjq

= u.

equivalent to

n

v,y.

Information Orders for a Risk- Averse Investor

3.2

For the problem of a risk-averse investor, payoffs satisfy single crossing of incremental returns, and

so

we can apply (MIO-sc). However, (MIO-sc)

must hold conditional on any pair of

is

potentially a very strong condition. Its restrictions

states. In contrast,

(MIO-scq) allows some "averaging" over

states.

Thus, we would

like to relax

(MIO-sc)

.

The next

result establishes that

(MIO-scq)

is

the relevant

information order for risk-averse investors.

Proposition 10 Assume A1-A5. Assume

Then

x.

if

for

result

is

all

Fw x e(-\x)

i

u nondecreasing and concave and

all tt

is

ordered by the

supermodular,

if

MPR

in

and only

(MIO-scq) holds.

The proof of this

it

>

-ggV*(9;u,Tr)

that for each 9,

in the

Appendix.

It builds

uses the characterization of (MIO-scq) derived in

The Information

4

The information

Lemma

= argmax

^"

is

9.

/

/

Jx

Juj

wx e(oj,x) - c{9),

u(-n(a*(x\9,p),Lo);p)dF

p,

which describes the agent's

risk preferences. Consider

the following question about the comparative statics on information gathering:

To

When

of information acquired by the firm increase in p?

begin,

we

present a result that applies to the class of payoffs

UR

10

Persico (2000) provides an analogous interpretation of MIO-sc. See also Jewitt (1997).

11

See

AL

and

stated as follows:

where we have introduced a new parameter,

amount

7,

Acquisition Problem

acquisition problem

9*{p)

on the proofs of Propositions 5 and

for further characterizations of

(MIO-spm)

in

terms of "marginal-preserving spreads."

15

does the

X

Proposition 11 Let

H

be a prior probability distribution

and

eterized signal distribution,

Assume A1-A2. Suppose

that 6

w(x,u)

If for allx H

When

Fw be

orders Fwx

let

let

f2,

FX W

9\

be a

smoothly param-

the corresponding family of information structures.

9

by (MIO-scq). Define

e

=

over

- g(a*{x;9,p L ),uj;p L ).

g(a*(x;8,p H ),w;p H )

> xL w(x H ,co) -w{x L ,u) 6 RSCQ

,

then -§gV(9,u)

,

>

-§gV{0,v).

the relevant functions are differentiable, the requirement of the proposition

is

that

^0^g(a*(x;6,p),uj;p) £ R sc ® In other words, p makes the incremental returns to investment

"more R SC Q." For example, this condition would be satisfied if g(a*(x;9,p),u>;p) = x r(u>), for

.

p

r

G R sc ®. This

result

is

analogous to results established for

R sc

in Persico (2000)

and

R ND

in

AL.

Now

lio

consider applying this to a risk-averse investor.

problem, where ir(a,u)

= aw +

—

(1

a)wo

(this

is

Let us restrict attention to the portfo-

not necessary, but

it

simplifies

an already

complicated analysis). Further, we add the following assumption:

A6

There

exists a c

>

such that for each

Further, the investor

The

satiation condition

is

is

=

a*(x;9,p)

eventually satiated: ui(c

clearly undesirable, but

Consider small changes in

$(x,uj;8,p)

9,

p,

it

Co;

p)

>

=

c for all realizations of the signal.

0.

greatly simplifies the argument.

and define

—[a*(x;0,p)uu(ir(a*(x;9,p),u);p)]

dp

u 112 (iT(a*(x;9,p),Lo);p) a*(x;8,p)

-a*p (x;9,p)

too

uui(^(a*(x;9,p),iv);p)

Uu(Tv(a*(x;9,p),u});p)

+a*(x;9,p)

+

Then, we have the following comparative

Proposition 12 Assume A1-A5,

let

(without loss of generality) that each

for

all 9,

Fw x e{-\x)

\

ing to (MIO-scq).

is

statics result for information acquisition.

A=

X8

ordered in the

u in (iT{a*(x;9,p),Lj);p) Tr(a*(x;9,p),Lo)

is

[0,1],

and suppose

normalized so that

MPR

in x,

Then, whenever ty(x,w;9,p)

nondecreasing.

16

<

= aw + (1 — a)u>o. Assume

-§gFx e(x) = 0. Suppose further that

ir(a,u})

and 9 orders

and a*

is

the signal family

Fwx

e

accord-

supermodular in (x,p), 9*{p)

is

To

make

if

interpret these conditions, observe that

the agent

more

a*

if

is

make the

in (x, p)

sensitive to signal realizations. Typically, this effect

* <

Then, $ <

p reduces risk aversion. The requirement that

to zero, only the

supermodular

term

first

utility function

important.

is

more concave, which

is

Kin <

0.

higher values of p

would be

more complicated.

if

,

If

a*

likely to

is

close

hold

enough

In words, higher values of p

typically corresponds to greater risk aversion. This

captures the idea that for a given decision policy, greater risk aversion makes information more

valuable.

The

If

a*

other terms in capture the effects that arise because p changes the optimal decision policy.

>

(i.e.,

higher values of p

make

the agent invest more), then p can be interpreted most

naturally as a decrease in risk aversion.

second term

is

Under the same

negative.

relative prudence,

—

U

^(^.) W,

is less

is

>

1.

>

and um(w,p)

conditions, the third term

than

a future (multiplicatively separable) risk

in addition, ojq

If,

negative

is

then the

0,

if

the agent's

Since an agent's incentive to save in anticipation of

increasing in relative prudence, this requirement can be

understood as a restriction on the extent to which an agent

is

willing to

pay to avoid exposure to

a multiplicative risk.

What more can we

Consider

first

an agent with

CARA

increase in p (a reduction in risk aversion)

a*

is

and a*

mean x and

assumptions are required to obtain this

\I>

supermodular

in (x,p)?

makes the agent more responsive

<

result.

some 7 >

the

13

an

to signal realizations,

for posterior beliefs, additional

Now, consider our

are that, for

If

variance independent of x,

supermodular in (x,p). For more general functional forms

verified that sufficient conditions for

is

12

preferences, with coefficient of risk aversion —p.

posterior beliefs have a normal distribution with

i.e.,

^ <

say about preferences for which

on ^.

restriction

0, 1

> —p >

7,

It

can be

and wo and

inf

Q

are both greater than 2/7.

Now

consider another specific functional form, a quadratic utility function, where

to provide a definitive prediction. Let ujq

p

>

Co.

Then

define

u

:

Q—

>

M.

=

0,

G

(0, 1) for all x.

is

Note that

Q=

[w,o>]

= pm — —m

The

with

Co

>

>

lo,

and consider

.

not necessarily supermodular. Suppose that

Eiy^lX 6 =

x]/Ew[Vl/2 |^' e

=

x]

first-order conditions for optimality entail that

<**{x,p)

12

[0, 1],

possible

by

u(m)

Notice that u(au)

A=

it is

=

E W [W\X B = x]

P

E W [W 2 \X 9 = x]

this utility function does not satisfy our satiation requirement, so to

apply our proposition directly we

would need to extend the arguments of Proposition 12.

13

Persico (1996) also analyzes this case, using Lehmann's (1988) information order.

17

If

Fw \x

9 ('\

x)

is

ordered by the

that the optimal policy

is

MPR,

the optimal policy

supermodular in

(x, p)

nondecreasing in x. This in turn implies

is

Observe further that

.

E w [W\X e = x]

Ew [W 2 \X 9 = x]'

/

*/

n

^

^

x

a

a

a *,(x;6,p)u

n (7r(a (x;0,p),u>),p) = -p/

Since the optimal policy

0).

non-negative, the expression

is

nonincreasing in p (so that ty(x,Lu;

is

6, p)

<

Notice that

~u

—

—{m;p) —

"

\

(

«'

l

p-m

a

and

d (~ u

—

—— fm;p)^ =

dp\u>

-i

"

(

,y

y

'J

*.

(p-m) 2

So, risk aversion decreases with p. In this case, the result says that as the agent

averse, the policy

To apply

of signals,

The

becomes more

sensitive to information,

{X

less risk

and information becomes more valuable.

these results, suppose that an investor can choose

9

becomes

among

the

members

of a family

8 € 0}, where the posteriors from each signal are totally according to

:

might correspond to

different signals

different opportunities for information gathering,

as annual reports of a firm, a full auditor's report, or being a

manager of the

willingness to pay for signals in this family will be increasing in 6,

if

each

ir^Q-ordered, and 9 orders the family by (MIO-scq). Then, the results in

to provide conditions under

which

MPR.

less risk averse

firm.

member

The

such

investor's

of the family

this section

is

can be used

agents purchase signals that more informative

according to (MIO-scq).

Finally, observe that

(MIO-sc) in place of

Persico (1996) or

5

if

we

are willing to impose the

MPR and

AL

more stringent requirements of

MLR

and

(MIO-scq), the requirements on risk preferences can be relaxed. See

for details.

Conclusions

This paper derives

sufficient conditions for

comparative statics on investment and preference order-

ings over information structures for the problem faced by a risk averse firm,

make an investment

where the firm must

decision on the basis of a noisy signal about the investment returns.

of payoff functions generated

by

class of decision

functions, but smaller than the set of payoffs

problems

is

The

set

larger than the set of supermodular

whose marginal returns are

single crossing. Since the

orders over posteriors and information structures induced by the set of single crossing payoffs are

fairly restrictive,

the weaker orders derived in this paper are potentially more useful in applications.

Using these orderings, we analyze how the value of information changes with

We

show that

information.

for a fixed policy,

making a

However, a decrease in

utility function

risk aversion often

18

risk preferences.

more concave increases the demand

makes an agent more responsive

for

to an

informative signal, and for some utility functions (such as quadratic), this effect dominates. Then,

who

agents

Appendix

6

Proof of

Lemma

necessity,

observe that R sc Q(uo)

P

Q

>-r

of

Rsc Q(

and only

if

UJ o)^

The

4:

fact that (1)

\iQy R P

j

g

is

sufficient follows

& c j ose(j convex cone.

there exists a p

if

>

R = RSCQ{u

for

To prove the

G RSCQ("o)

of RSCQ(wo)_

and only

if

That

t

)/P{u

But, for any closed convex cone R,

l{ UJ<u>0 }(u))

Thus,

).

holds for

if it

by

directly, observe that

£SCQ(u>o)

is,

= Q(u

and

6 R. u In the case

= — l{ ul<UJQ }(u))

t(lj)

holds for

(1)

for all r

r e rSCQ{u>

all

)

and {r

)

for

:

the un j on

ig

o

Q >pr-u

to

>

wo;

f

all

linearity of the integral, (1) holds for all

r

6 E SCQ ^°\ where

E SCQ{-^

is

a set of extreme points

R SC Q("°)

a set of functions such that any r e

is

the following sets: {-1{ W < W0 }( W )}>

K^O —

^-{uokuko}^)}- Then,

can be formed

£,5C(?( o) The se t

r(u) = l{ a <u,<Lj }{u)},

aJ

of

(iii)

Lemma

Consider

6:

and a

a;

<

>

loo

It

u' (TT(a,u}))-i^it(a,cj) is

so that 7r(a,w)

and

u' ra

for u>

Lemma

positive

,

>

13 Consider n H

<

oj

,

straightforward to verify that (1)

first necessity.

The counter-examples

equivalent

is

required for necessity

a

•

we can

also find a

r(u>) for all

is

u, and then given this

7r,

this,

choose u so that v!

choose n

«

when

1

concave.

Before beginning,

sufficiency.

Now,

r(o>).

u concave, a n supermodular, and an

j

This u

u>o.

o»o,

approximately equal to l{ a; < U }(w) •r(w). To see

>

g(u>,T]

r;

L

,

we need

H) >

and suppose that for either

g(u,r) L ) for all

and continuous, and suppose

crossing at

L

a

for

a lemma.

For variants on this

Athey (forthcoming).

Suppose further that

rj

=

remains to establish

result, see

:

3 can be constructed using functions of the form l{ w < Wo }(w)

observe that given r nondecreasing and

a such that

it is

ir

-

P-

Proof of Proposition

in part

implies

and only

if

^

using convex combinations, positive scalar multiples, and limits of functions in

E SCQ{u

For

definitions.

^ desired.

)

more

result

p

if

=

r{u>)

from checking the

Jn rdQ > p JQ rdP

such that

checking the latter inequality for

that the inequality holds only

r

more information.

are less risk averse purchase

ujq.

letl(u>o)

=

,T]

H )/k(uJo,r] L ).

/ g(ut,

f]

satisfies

=

n L or

E Q. Suppose

that k{-\r] H )/k{u)Q\r] H )

Then f g(u,T])k(u},r))du)

k(u

lj

r\

weak

—

77

= H

r}

,

that k(-;rj L )

g(-,n)

and

k{-;rj L ) / k{u)Q\r] L )

single crossing in

r\.

is

e

R sc ^o)

k(-;r}

H

weak

)

are

single

Further, for any n H

>

Then,

H )k{u), H )du) >

rj

l(u

)

/

g(u,

r/

L )A:(w,

L )dw.

T]

'See Jewitt (1986), Gollier and Kimball (1995), and Athey (1999) for alternative proofs.

19

(4)

9(^,1^^, Vh)^ >

/

The

first

R sc (^o)^

in

because

^g

<

1

)

(>) t t°'^| for

$»4 >

is

and

it,

u;

where g(u,T} L )

is

<

The second

positive.

(>)0. If instead,

inequality

it is g(-,r]

H

)

that

sec0 nd inequality hold replacing g(u>,r] L ) with g(u,r) H ); then,

0,

g(u>,T]

nondecreasing in

Fix u and

^g

e q Ua ij^y an( j

H"o,riH )

since g

g{u,fi L )k{uj,T) H )dw

J

inequality follows by our assumptions on g, since k

follows because yufl!

is

13: Suppose that g(-,r)L ) G ft scV°). Then,

Lemma

Proof of

H

H )k{u,ri L )dw >

/ g(uj,r) L )k{u;,r] L )duj

77.

represent the marginal returns to a given x, which are set equal to

let cf){a,x)

zero for an interior optimum:

<p(a,x)=

w x {u\x).

(FOC)

u'(-n(a,u)))-n a {a,u))dF

I

\

Integrating by parts,

=

<f>(a,x)

we have

w x {ui\x)

I ir a {a,uj)dF