Document 11159464

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/memorybasedmodelOOmull

UtWtY

--

i.

1-

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

A MEMORY BASED MODEL OF

BOUNDED RATIONALITY

Sendhil MuUainathan

Working Paper 01 -28

September 2000

Room

E52-251

50 Memorial Drive

Cambridge, MA 02142

This paper can be downloaded without charge from the

Social Science Research Network Paper Collection at

http://papers.ssm.com/paper.tafPabstract id=277357

MASSACHUSEHS

INSTITUTE

OF TECHNOLOGY

AUG 1

5 2001

LIBRARIES

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

A MEMORY BASED MODEL OF

BOUNDED RATIONALITY

Sendhil Mullainathan

Working Paper 01-28

September 2000

Room

E52-251

50 Memorial Drive

Cambridge,

MA 02142

This paper can be downloaded without charge from the

Social Science Research Network Paper Collection at

http://papers.ssrn.com/abstract=277357

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

A MEMORY BASED MODEL OF

BOUNDED RATIONALITY

Sendhil Mullainathan

Working Paper 01 -28

Septennber 2000

Room

E52-251

50 Memorial Drive

Cambridge,

MA 02142

This paper can be downloaded without charge from the

Social Science Research Network Paper Collection at

http://papers.ssm.coin/paper.taf?abstract

id=XXXXX

A Memory

Based Model of Bounded Rationality

Sendhil Mullainathan*

September

20,

2000

Abstract

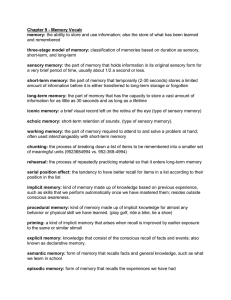

do memory limitations affect economic behavior? I develop a model of memory grounded

in psychology and biology research to investigate this question. Using this model, I study the

case where people apply Bayes rule to the history they recall as if it were the true history. The

resulting beliefs exhibit over-reaction on average. They also exhibit under-reaction with the

model providing enough structure to allow predictions about which effect dominates when. I

then apply this general framework to an otherwise standard model of consumption. It predicts

How

the broad structure of consumption predictability as well as differences in marginal propensity

to consume across different income streams. Most importantly, because it ties the extent of

bias to a measurable aspect of the stochastic process being forecasted, the model

makes

novel,

testable empirical predictions.

"Massachusetts Institute of Technology and National Bureau of Economic Research, e-mail: mullain@mit.edu.

This paper Weis written while I was a graduate student at Harvard University. I am indebted to my thesis committee,

Drew Fudenberg, Lawrence Katz and Andrei Shleifer for their generous advice and encouragement, and to Marianne

Bertrand, Edward Glaeser, David Laibson, and Richard Thaler for many helpful discussions. I have also greatly

benefitted from comments by three anonymous referees, George Baker, John Campbell, Caroline Hoxby, Erzo

and participants at numerous seminars. Financial support from the Chiles Foundation is gratefully

P.P. Luttmer,

acknowledged.

Introduction

1

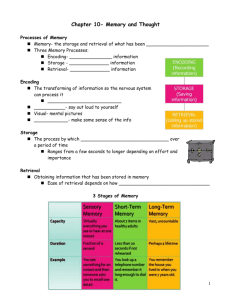

Memory

limitations appear to affect the

information used, such as the prices,

way we form

may come from

forecasts.

Consider purchasing a

outside sources.

But much

car.

Some

come from

will

our recollections, everything from newspaper reports about a recall to recollections of particular

friendly acts by a boss (perhaps suggesting a promotion and, therefore, the ability to

expensive car). Despite

its

obvious importance in

limitations are largely ignored.^

In this paper,

I

many

facets of

economic

life,

buy a more

however,

memory

attempt to develop a tractable model of

human

memory, one that has testable predictions about economic behavior.

To

build this model,

and psychologists. The

easier to

two stylized facts from the broad research on memory by biologists

cull

I

first fact,

remember that event

termed

again.

rehearsal, states that

Most students studying

remembering an event once makes

for

an exam, by reading their lecture

The second

notes and repeatedly attempting to recall the material, take advantage of rehearsal.

fact,

termed associativeness, states that similarity of the memory to current events

Cues

in today's events trigger

how

his Fiat has turned out to

While these

People

may be

cues.

facilitates recall.

Hearing your friend lament about

be a lemon may remind you of other Fiat horror

facts describe the technology of

memory, they don't

tell

us

stories.

how memory

is

used.

naive and treat the histories they recall as true, and apply Bayes' rule to them.

Alternatively, they

and

memories that contain similar

it

may be

sophisticated, by possessing complete knowledge of the recall technology

correct for distortions in recall

when forming

forecasts.

Each of these decision

"partial adjustment" rules

— has

This paper takes the

step and draws out the implications of the naive model.

first

its

rules

appeal and undoubtedly a characterization of both

— as well as

is

necessary.

'See Conlisk (1996) for a general survey of previous work on bounded rationality. Dow (1991) also presents a

limitations, which examines optimal storage of information (in the context of search) given limited

model of memory

capacity.

^I chose to examine the naive rule first since experimental evidence suggests that individuals have neither accurate

models of memory, nor correct for their memory mistakes in laboratory settings, making the naive model a natural

first model to study. Of course, in cases with repetition and room for learning, sophistication may come to have

more descriptive power. This makes it the next natural model to study and work in progress is examining it. This

first pass also abstracts from recall effort. Individuals may work harder to remember certain events in the past over

others. Such effort may take the form of mental exertion or the use of diaries to keep track of important information.

Section 5 discusses these and other extensions to be pursued in future work.

When memory

means

is

used in this way, several interesting features

First, associativeness

result.

that events affect beliefs not just through the information they convey, but also through

the memories they evoke. Receiving a devestating referee report likely evokes

other instances that erode self confidence.

More

many bad memories,

generally, associativeness generates

an over-reaction

(on average) to information as each event draws forth similar, supporting, memories.

cultivates

by a

laid-off

other,

In a related vein, completely

pessimism by selectively evoking negative information.

uninformative signals can influence beliefs

worker on the

if

they affect what

difficulty of finding

a decent job

is

may

Bad news

recalled.

Viewing a

affect beliefs

fictional speech

because

it

may

trigger

more informative memories.

Second, because of rehearsal, the memories evoked by an event linger, causing errors in belief

So the over-reaction caused by associativeness dissipates only slowly. More generally,

to persist.

events will continue to have an effect long after the information they contain has been discredited.

A

smear campaign can have lingering

thoroughly debunked.

on the

target.

The

unflattering

effects

even after

results

little

Most

interestingly, though, the

the extent of such

phenomena

the stochastic process requires

use of

hard to

fully

shadow

to disregard the testimony

comply with such a request.

memory and hence

little

effect of salient information, the hot

model makes a

set of out of

hand or

sample predictions.

to the stochastic process that individuals are forecasting.

little

use of history (such as a

random

walk), there will be

of the biases described. This ability to relate the extent of the

bais to a measurable aspect of the stochastic process being studied

is

proclaimed have been

—and others derived through similar reasoning— match many of the experimentally

belief perseverance.

When

it

it

stay, casting a negative

As another example, consider a judge instructing the jury

found biases in human inference, such as the greater

It relates

the "facts"

memories brought to mind

they just heard. Even a well-intentioned jury would find

These

all

makes the model refutable and

formalized in Section 3.4.

To

assess the effectiveness of the general

model

in

economic contexts,

within a simple Permanent Income Hyopthesis framework.

tions of the standard orthogonality predictions:

Memory

I

apply

it

to

consumption

distortions here generate viola-

consumption changes can be predicted using lagged

information. Intuitively,

when

individuals receive good news about their personal income, such as

a glowing compliment from the boss, they are more

them

remember other good news, causing

likely to

to over-forecast their income.

This generates predictability of future consumption changes.

when

there are multiple income sources, the marginal propensity to

The model

also predicts that

consume permanent income changes

will

be different

for each stream.

Income sources

high marginal propensity to consume when memories play a large role in forecasting

it,

will

show a

such as with

personal labor income rather than with gains in one's 401 (k). Most importantly, as in the general

the model makes a set of out of sample predictions.

Ccise,

It relates

the extent of consumption

predictability to a parameter of the income process that measures the importance of the history.

Moreover, since income streams with a high

the income streams with the largest

MPCs

MPC

connote over-reaction,

it

further predicts that

should also show the greatest negative correlation with

future consumption. Section 4 discusses these predictions.

These results suggest that bounds on human memory can be

match psychological

findings as well as empirical facts in consumption.

sample predictions that can be tested on standard data

modeled. The results

fruitfully

also generates out of

It

Models based on bounded rationality

sets.

often invoke fears oi post hoc rationalization, fears that with a sufficiently flexible set of assumptions

almost any behavior can be "explained". The out of sample predictions are a

such

fears.

As a whole, the

first

step in alleviating

findings suggest that models incorporating realistic limitations on recall

have strong, testable implications about economic behavior.

2

Setup

The

basic

framework examines an individual who forms expectations about a state

variable.

take this variable to be synonymous with permanent income in future discussions, but

many

will

can be

other things: a firm's earning power, macroeconomic conditions, or an employee's abilities

are just a few examples. Forecasts of income clearly influence

or portfolio choice

moves

it

I

for

— and

in Section 4,

I

explicitly study the

many

decisions

— savings, job search,

consumption decision. Labor income

a variety of reasons, such as macroeconomic shocks, technological innovations, or changes

in expectations

about an individual's

combining a diverse

ability.

set of information.

As

Some

these examples indicate, forming forecasts requires

of this information

readily available in records: income in prior months,

"soft" or

loosely speaking, "hard" or

is,

unemployment or GDP. Other information

harder to capture in records: a friend in a similar position being fired or a boss telling

you that you are one of the best employees he has seen. This disjunction between hard and

will

is

be useful

for the

model that

follows.

soft

Knowledge of soft information depends on memory, while

knowledge of hard information typically does not.

The remainder

of this section formalizes the

setup.

Environment

2.1

Let

yt,

income, obey the stochastic process:

t

yt

= Yl^k+et

(1)

k=l

where

et is

a transitory shock distributed N{Q,a^) and

will describe shortly, yt is

I'k

is

a permanent shock, whose structure

observed by the individual and represents the hard information.

that individuals have priors about the value of y which are normally distributed with

variance

Assume

mean

yo

and

CTq.

Each period with probability p an event

income. Each event

no event,

I

I

et

et

occurs, which will provide "soft" information about

has an informative, xt, and non-informative,

will write et

=

(0.0).

= (x(,nt)~7V(0,S);S =

component

=

E[Tit]

=

0.^

When

there

is

The covariance term, a^n

=

*

(Jrnn.

^«

where E[xt]

component.

Conditional on an event occurring, they are distributed:

Crl

et

rit,

/

cov(x,n), measures whether the neutral

typically appears with positive or negative information.

A

concrete example of an

event might be hearing a friend describing his recent unemployment experience.

The

length of his

^In Mullainathan (1998), this assumption is discussed in greater detail. Normality implies that xt and nt axe

symmetrically distributed. Symmetry implies that neither good nor bad events are more memorable (in the sense of

both evocativeness and vividness discussed below.

unemployment

medical

spell

would be informative

[xt),

while the fact that he has a pregnant wife with

up would be uninformative {nt)^ The model includes uninformative, or neutral

bills piling

components, because they

The permanent shock

will affect recall probabilities.

at time

t

will

be defined

iyt=xt

where

zt

~

as:

+ zt

N{0,o'^).^ Thus, while the informative part of the event tells her something about the

shock that period,

informativeness

its

is

incomplete and depends on a^/crf

At the beginning of each period, she observes the event,

with past information to form a forecast,

observed.

2.1.1

The

The game

Perfect

perfect

is

forgetful forecast.

She then combines

At the end of the period the true value of income

is

Forecasts

forecast will serve as a useful base case against

The

this information

then repeated.

Memory

memory

ijt.

C;.

which one can compare the

process in equation (1) generates a signal extraction problem: the individual

must separate out the permanent shocks to

yt

from the transitory ones.

represent a negative shock to permanent income or

both past events and yk help to solve

may

this inference

A 5%

income drop may

only affect current income. Knowledge of

problem. Events e^ are useful because they

allow one to extract a component of the time k innovation (x^) that

is

for sure permanent. Past

income realizations y^ are useful because they allow one tease out the remainder of the permanent

shock

(zfc)

but with

less certainty.

Repeated observations of high income

will suggest a

permanent

rise.^

""Of course, Jis the example also illustrates, every part of an event will have some information content, and the

dichotomy between xt and nt merely simplifies this spectrum.

^A slight awkwardness in this definition should be noted. The variance of zt is higher when there is a shock

than when there is none. In this sense, "signal" may not be a completely accurate word. This assumption does not

drive the results; I use it so that the residual variance of Zt conditional on observing x, is constant, allowing a more

transparent analysis.

^Contrast with the case where yt follows a standard random walk. Then, !/(_i is the only information in the past

needed to forecast yt- For the model formulated in this paper, yt-\ is a sufficient statistic for eJI past information.

This is an artifact, however, of the simplicity of the model. If we complicate it by assuming that different events have

diff'erent levels of mean reversion rather than all being permanent, this will no longer be true. Forecasts must then

rely directly on all past yk and e*.

forecast can

The optimal

posterior at time

t

will

be

easily derived using the

mean

be normally distributed with

beliefs these will equal (see

Lemma

1

Kalman

yt

Filter (see

and variance

Harvey 1993). The

ct^.

In steady state

in the appendix):

t-i

ytiht.et)

=

X,

^

+

+

[a'-^x,

(1

-

A*-^)Ayfc]

(2)

fc=i

aUhuet)

where Ay^

=

-

yt

yk-i and A

=

=

^2 ^^2

al

(3)

-

Understanding the marginal impact of different variables

cast rule.

is

Xk

a direct

+

on Xk

Zk

is

+

x^ influences forecasts one-for-one.

First,

eff"ect

^k

—

will

impact

Its

which contributes X*'^Xk and an indirect

Efc-ii

that contributes (1

unity. Second,

Ay^

—

A*"'^)^;^.

—

A)

<

1

is

the

eff'ect

1

—

because

A*"'^

it

<

1

sum

from

Summing shows

enters forecasts with weight

Third, y^ influences forecasts at A*~'^~^(l

improve intuition about the

as

enters in

of two terms.

(or

There

because Ay^

Ay*;,

=

that the total coefficient

is

clear

from the formula.

Ay^ and

in

Ay^+i. Both

yk and Ay;t have a less than one-for-one impact because both are noisy estimates of

income

fore-

permanent

permanent income changes). That Xk has greater impact reiterates the importance of

events in separating signal from noise.

that for sure

is

no information.

They show the

individual a portion of the income change

permanent. Fourth, n^ has zero impact as expected: neutral components convey

Finally, A

measures the importance of history

receive greater weight. This

is

intuitive.

When

in forecasts.

As A

increases, older yk

A approaches zero, most of the variance comes from

permanent shocks, and hence the process resembles a random walk. In

the least and past values should receive the least weight.

this case, history matters

Memory

2.2

Formal setup

2.2.1

Memory

will

Let history,

be modeled

that transforms true history into perceived history J

be a vector that includes y^ and e^ for k

ht,

ht

Memory maps

map

as a stochastic

ht into

the nature of this

=

t:

(yi,---,yt-i,ei,...,et_i)

a random variable

map and

<

/if.

I

begin by making mathematical assumptions about

then use experimental evidence to characterize the remainder.

As discussed, past values of income are hard information

therefore,

assume that y^

soft information,

will

be recalled perfectly.

Formally, write recalled history as /if

Notice that in the recalled history, y^

transformed into a random variable, ef whose value

(0, 0)

probability that event et

is

is

with probability

recalled at time

t is

is

unaffected, whereas

is

forgotten,

it

is

exactly as

if

1

—

denoted by

ri-t

r^t,

where these probabilities are

no event occurred that period.

Picture history as a series of boxes, one for every time period.

that period's event.

each box and

if

flips

forgotten, the

An empty box

signifies that

a coin with weight

box appears empty

r^t to

A

hnked.*

metaphor may

Each box contains the

When

help.

details of

if

to

the event in that box will be remembered;

to the individual.

Notice some of the implicit assumptions

distorted versions of events:

may be

no event occurred that period. Memory goes

determine

is

r^t

applied independently across events, though algebraically the probabilities

an event

cj

=

governed by:

with probability

Ck

I,

Events, on the other hand, characterize

and are more prone to be forgotten.

(ef,e^, ...,ef_i,yi,...,yt_i).

The

readily available in records.

made

in this specification. Individuals

they either remember them or not.

They

do not remember

also do not ''remember"

'^The recall process readily lends itself to a probabilistic interpretation. Casual conversation consists of phrases

such as "more likely to remember" and experimental work supports this. James(1890) seems to present the first

probabilistic interpretation of memory, though of course he does not use this terminology.

^Formally, conditional on rn and Tjr, Rkt and Rjr are independent.

events that never happened.

feeling of "I think

might

all

matches a non-event, so that there

something happened but I'm not sure what"

be useful tasks

for the future.

evidence for motivation on

scientific

Evidence on

2.2.2

Finally, a forgotten event

how

Weakening of these assumptions

.

To complete the model,

I

need to specify

r^t- I

turn to the

to specify this.

Memory

Research by biologists and psychologists has generated much knowledge about memory.^

on two of these features, which

The

first,

no

is

in

my

I

will focus

opinion are by far the most relevant ones for economists.

memory

rehearsal, states that recalling a

increases future recall probabilities.

Stu-

dents quickly recognize this property: repetition strengthens memories. Experimental evidence on

rehearsal can be found even at the neuronal level. Repeated firings between neurons strengthens

their synaptic connections, or the strenght of the

"memory" stored

experiments with humans shows similar behavior.

of words.

it

One group then

practices recall of this

Two

list

there. ^'^

At a more macro

level,

groups of subjects memorize the same

list

periodically, while the other does not (both see

only once). After the same time has elapsed for both groups, the group that has been periodically

recalling the

list

shows higher

recall of the

list.

That these findings should seem so obvious

is

a

testament to the intuitive appeal of the rehearsal assumption.

The

recall.

second, associativeness, states that events more similar to current events are easier to

For example, hearing a friend talk about his vacation will invoke memories of one's

vacations. Associativeness

The importance

colleagues,

word

is

may

arise

because events serve as cues that help "find"

lost

own

memories.

of associativeness in every day recall has been emphasized by Tulving and his

who study

the role of cues in recall. Subjects learn a

paired with a cue word.

The

subjects are then asked to

either provided with the associated cue or not.

A

broad

set of

list

of words in which each target

remember the

target words,

and are

such experiments finds that recall of

^Schacter (1996) presents an excellent overview of this literature, one that I draw upon.

'°See Kandel, Schwartz and Jessell (1991) for a discussion. A contrasting effect is habituation, wherein synaptic

strength decresises with frequency. This corresponds to the idea that novel stimulus receives notice which lessens as

the novelty wears

off.

I

ignore this property because

it

a property of attention rather than of memory.

the target words

is

subjects

who

is

higher

when

the paired word

learn the sentence (Anderson

The

They are more

likely to

remember

fish

is

et.

present. ^^

al.,

A

related

example of this phenomena

1976)

attacked the

swimmer

this sentence if given the cue "shark"

than

if

given no cue at

all.

Notice, however, that "shark" never appears in the sentence, which illustrates that associativeness

likely

operates also through conceptual similarity.-'^

As these

studies demonstrate, both rehearsal and associativeness have a strong experimental

In fact, the most popular models of

basis.^'^

memory

(and neural function generally), Parallel

Distributed Processing Models, possess both features (Rumelhart and McClelland, 1986). Nevertheless,

I

do not mean to imply that these are the only "important" facts about memory, merely

that these appear to be the most relevant to economists.^''

2.2.3

Formalism

Three parameters appear

rehearsal),

that

and x (which

m+P+X

<

1-

in the formalism:

m

(the baseline recall probability), p (which quantifies

quantifies associativeness).

Let Rkt denote the

random

Assume

that

all

are between zero and one

variable which equals

1 iff

event k

is

and

recalled at

''These paired words sometimes share a natural connection, such as "brain" and 'mind" or "brain" and "drain",

and sometimes are unrelated, such as "brain" and "doughnut". The findings hold in both cases though the the effect

is stronger when the words are connected.

'^Laibson (1997) derives a theory of consumption based on preferences that exhibit a form of conditioning, which

Our papers differ because I focus on expectations rather than

is related to associativeness (MacKintosh, 1983).

preferences. The similarity is interesting, however, and suggests that a memory model, in which individuals must use

past experience to forecast preferences, potential!}' provides one microfoundation to the preferences used by Laibson

(1997).

'^The evolutionary advantage of these two properties are easy to understand. Frequently encountered phenomena

and memories similar to current circumstances are both more relevant. I have not formally pursued such intuitive notion to get at a more evolutionary or optimizing basis of memory. Such a model would require a precise understanding

of the constraints on what memory mechanisms are even biologically feasible.

'"Let me cite the two most interesting omissions. First, researchers now believe that certain memories are episodic

(the time you tasted caviar), while others are semantic (you dislike caviar). This distinction is interesting because

semantic memories may not possess all the episodes that gave rise to them. Second, memory seems to be reconstructive

nature (Neisser 1967). The process of reconstruction uses a priori theories to put together the pieces, so facts that

more likely be forgotten. In a seminal experiment, Bartlett (1932) demonstrated how

in recalling stories, subjects often edit out inconsistent parts. I ignore these for the time being, however, because they

lack the mass of evidence that supports the other two assumptions and because they are analytically more vague.

in

deviate from these theories will

10

time

with R{t-i)t

t,

=

1

and

=

r^t-i)t

Note that E[Rkt]

1-

=

With

^kt-

this notation,

we can

write:

rkt=m + pRk{t-i)+Xakt

The

first

term equals the basehne

recall probability for all

(4)

memories, m. The second term captures

This formalism of rehearsal

rehearsal. Events recalled in the last period get a "boost" of p.

seem awkward. Consider two

constant) both have the

same

The

and

do exhibit exponential decay.

results

=

Alternatively,

(a^fc,7^fc)

occurs not only in expectation but on every

it

and

e^

=

where

akt

measures the similarity of event e^ to

is,

an inverse distance function). Then similarity

o-kt

and with the assumption that

= e"^^

c{x)

att

=

akt

which allows one

=

=

2

if

Ct-

The

two points on a plane. Similarity can then be defined as

(xt,nt) are

a negative function of the distance between the points. Let c

function (that

could build exponential decay

I

would not change.

third term captures associativeness

events ek

(holding the third term

Proposition 6 demonstrates that in expectation,

superficial.

is

Then

yesterday.

Recall appears to display sharp, rather than

dynamics of memorability, so that

directly into the

realization

remembered

is

recall probability.

smooth, decay. This awkwardness

recall probabilities

which occurred two days ago and et-20 which occurred

events: et-2

twenty days ago, and suppose neither

may

-

(c(a;t

either

to write: akt

Cfc

=

Xk)

or

+

c{nt

cj is

-

:

(—00,00) —> (0,1) be a closeness

is

defined as:

Uk))

a non-event.

I

will take the specific function

+6"'"'""'=)^].

5 (e"(^'~^*)^

Thus

<

a^t

<

1

and

1-

Substituting back in to the original equation provides:

rkt

and

/fct

recall that

=

1

-

can write

rkt

I

=

assume that

and similarly

fkt=l +

m + P-Rfc(t-i) + X2

m + p+x

Ffc(

pF^t-i)

=

- X^

1

-

<

1.

It will

i^i^t

-

^k)

+ c{nt -

Uk))

also be useful to define the forgetting probability,

Rkt- Further define the constant /

{c{xt

-

Xk)

(5)

+ c{nt 11

Uk)).

=

1

—

m - p,

so that

we

Finally, note that unlike the other basic

form here

is

arbitrary.

I

assumptions of the model, the choice of functional

could well have included an interaction term between associativeness and

rehearsal or higher order terms.

As another example,

might have allowed

I

for limited capacity so

that only a finite set of memories can be recalled at any time, which would generate crowd out.

The

intuition

behind the results that follow does not rely on the functional form, though some of

these extensions are clearly worth investigating.

Basic Results

3

Dynamics

3.1

of Recall

Before moving to forecasts,

it

be useful to see how

will

recall works.

Simple recursive substitution

yields:

hm

E[fkt\ek]

=

E[fkt\ek\

= =

[l-xE[akt\ek])^-~—

^

t->oo

for all k

<

t.

l

(6)

7

~P

Recall probabilities decay exponentially over time: further back memories have higher

chances of being forgotten. Experimental evidence on recall probabilities indicate that exponential

decay of memories

which

I

fits

will define as

the data rather well.^^ Also,

vividness,

Memories that are very similar

V(efc),

to a

£^[afct|efc]

increases memorability. This term,

measures how strongly associativeness

randomly drawn event

to be triggered through associativeness and, therefore,

will

=

E[xkakt\et]- If today's event

is e(,

likely

more memorable. ^^

to define the average information of these associated events. Define the

£(et)

memory.

be more vivid. The are more

While vividness capture the strength of associations that an event possesses,

is:

affects a

it

will also

be useful

evocativeness of event

then a^t measures the strength of

its

event (memory) e^, while Xk measures the information content of that past event.

et

association with

The expectation

of this product, therefore, measures the average information content of memories brought forth

'^See Crovitz and Schiffman (1974).

A

power function, however, seems to

fit

better.

'^This result, however, has the unfortunate property that outHers, very unusual events, have /oiuer recall probability,

contrary to one's intuition. One resolution to this problem may be found in allowing for the possibility that unusual

events

may

receive greater attention, and that attention

may

12

increase memorability.

by associativeness.

To

illustrate evocativeness, consider the event e*

evocativeness of this event has two parts.

close to

1 will

Second, nj

rif

=

=

=

I

(xt,nt)

(1,1)-

The

imphes positive evocativeness. Other

xt

be evoked, leading to an oversamphng of positive memories and positive evocativeness.

1

can have a positive or negative impact on evocativeness depending on Oxn- Since

depends on Oxn-

When

the effect on evocativeness

is

Oxn

is

knowing that n^ >

zero,

zero. If ffxn

is

positive,

knowing n^

says nothing about Xk, so that

>

tells

us that x^

events are selectively triggered causing a positive effect on evocativeness.

negative, nt

>

Limited

3.2

=

other events with positive n^ are triggered, but the information content of these events

1,

clearly

First, xt

=

We now

tells

us that

Memory

a:^

<

Finally,

>

0:

positive

when o^n

is

generating a negative effect on evocativeness.

Expectations

turn to the forecasts of the forgetful individual.

I

will

make a

crucial

assumption here:

the forgetful individual applies the forecasting rule in equation 2 to the recalled history. In other

words, she takes the the recalled history as the true history. Let y^{hf-,et) denote the

mean and

a1^[hf-,et) denote the variance of a (naive) forgetful Bayesian's posteriors. This assumption can

then be stated formally

I

as:

yf (/if ,et)

=

and d'l^{h^,et)

yt{hf-,et)

=

d^{h^,et).

have referred to this as the naive decision maker, in contrast to the sophisticated decision

maker,

who

completely knows the model of

memory and

corrects his forecast rule accordingly.

Deciding between these two polar models will be an important task, and one that requires a

complete characterization of behavior in both

I

it

cases.

have chosen to investigate the naive case

first

describes behavior at least in the laboratory.

because experimental evidence suggests that

Studies of individual's judgements of their

understanding their memory process

example, Reder 1996).

memories reveal inaccuracy

in

Similarly, experiments have

manipulated the memorability of information and tested whether

(see, for

own

indi-

viduals' decisions correct for this manipulation. Supportive of the naivete assumption, decisions are

insensitive to this manipulation.

Of

course, repetition

'^See, for example, Trope (1978). This also resembles findings by

heuristic, that individuals take

more

easily

remembered events

13

and room

for learning,

Kahneman and Tversky

to also be

more probable.

may

dramatically

(1982) on the availability

alter these findings. Nonetheless, the findings suggest that characterizing the naive decision

would be a useful

first

maker

step.^^

Simple substitution gives the formula

for the forgetful forecast:

t-i

=

yf(/if,e()

+ 5^

X,

[i?fc,A'-^Xfc

+

(1

-

A'-'=)Ayfc]

(8)

k=\

=

a/«(/if,e,)

ai

(9)

In words, forgetful forecasts look just Hke perfect recall forecasts except that forgotten events

{Rkt

=

0) are excluded.

Note that yf

is

a

random

variable.

Taking expectations over

this

random

variable implies that events are weighted by their recall probability.

In order to contrast the perfect recall and forgetful forecasts,

error. First, let errt

=

yt

-

ijt

forgetful forecasts respectively.

and

errl^

Now

=

Vt

- yf

err[^

=

=

yt

+

memory

error of the forgetful individual.

recall

and

- y^

error, that is the difference in forecasts

err^^, so that the

be useful to define a memory

be the forecast errors of the perfect

memory

errt

will

define:

errY"

to be the

it

With

memory

problems. Note that

how memory

distorts the forecast

caused by

error also measures

these definitions in hand,

I

now examine the determinants

of beliefs.

Proposition

The impact of event et on time t beliefs does not depend on its vividness, but does

on its evocativeness. On the other hand, its impact on time t+j beliefs depends

on both vividness and evocativeness.

depend

1

(positively)

Proof:

From Lemma

3

E[y^\e,]

=

xt

+

x£{et)

—1-

\t-i\

''Preliminary results suggest that even more nuanced results may arise in the sophisticated model. For example,

suppose that forecasts are not remembered but that zero-one decisions which condition on forecasts are remembered

with certainty. Then, a herding problem akin to Banerjee (1992) arises. Consider an individual who remembers

is the best choice. For certain histories and

choosing 1 several times but currently faces information that suggests

parameter values, the weight of having chosen 1 in the past ("I must have had some reason to do it") will dominate

and he will choose 1 again. But this implies that the signal that he received this period will be jammed and he will

be stuck in a herding equilibrium.

14

showing the dependence of evocativeness, and the absence of a vividness

intuition here

Evocativeness influences what memories are triggered and,

simple.

is

The

eifect.

Vividness only operates through increased

on behefs.

therefore, has a direct effect

memorability, which of course cannot have an impact on contemporaneous beliefs.

For the impact on future

where we see

as before the

triggered at time

bility

We

beliefs,

appendix shows that:

dependence on evocativeness. This

t

+ j.

Consistent with

also see here that vividness

Thus

increases memorability.

likely to

4 in the

because the memories

is

were rehearsed and, therefore, continue to have higher

t

even at time

Lemma

now

note that as p

plays a role.

As we saw

—)

0,

the

efi'ect

in

forming

beliefs.

One

disappears.

in Proposition 6, vividness

increases the marginal impact of xt by

it

be recalled and used

this,

recall proba-

implication

changes in vividness have no impact: whether or not the event

is

is

making

that

when

recalled,

it

it

xt

more

=

0,

does not

influence beliefs.

This proposition and

sociated a

memory

its

is,

proof makes several points that are worth reiterating. Vividnes, how as-

plays

no

role in

how an

event influences beliefs at the time

only matters as time passes and a chance to forget the event appears.

ity,

vividness influences whether or not an event

information

it

conveys

is

is

By

it

occurs.

It

increasing memorabil-

remembered and thereby whether

or not the

used in the future.

Evocativeness, the average information content of memories associated with an event, does

influence beliefs contemporaneously.

tionately draws forth positive

An

event with positive evocativeness, for example, dispropor-

memories leading

to a

more

positive forecast. Moreover, since these

triggered memories persist (by rehearsal), evocativeness also influences future beliefs, though its

efl'ect

diminishes over time (the p^ exponent).

intuitive notion of "salience" into

bility,

Summarizing, the current model decomposes the

two components: vividness, which captures increased memora-

and evocativeness, which captures the

ability of events to trigger

15

supporting evidence. Both

an event's impact on

affect

beliefs

even completely uninformative signals can affect

Proposition 2 Let et = (0, nj)

This event influences

(nt # 0/

An

but do so in diiferent ways.

be

interesting implication

is

that

beliefs.

an uninformative event but with non-zero neutral component

and only if Oj:n # 0. The sign of this influence equals

beliefs if

sign{oa:nnt).

Proof:

Appealing to

evocativeness

is

non-zero.

E\xkakt\et

The

first

term

is

Lemma

=

The

if

their

evocativeness of an uninformative event equals

(0,nf)]

zero by

uninformative events can influence beliefs only

3,

=

-

i^E[xkc{Q

symmetry of

-

Xk)\et]+ -E[xkc{nk

nt)\et]

and the symmetry of the Xk distribution. To

c(-)

evaluate the second term, apply the law of iterated expectations and condition on

and

nf.

nt)\et\

=

E[E[xk\nunk\c{nk -

5 shows, this

is

non-zero whenever nt

E{xkc{nk

As Lemma

-

hence the event's evocativeness)

The

logic here

is

simple.

in this process is

is

still

and hence the event

beliefs.

is

0,

0)

memories.

- nOk*]

a:,nE{nkc{nk

and the sign of

signal with

shaped by the memories these events

negative information. For example, a^n

>

/

=

this

term (and

sign{crxnnt) which establishes the first part.

Oxm which determines whether

positive neutral cue (n^

nt)\et]

Even though individuals disregard a

uninformative, their beliefs are

These

rik

>

0,

=

trigger.

as completely

The mediator

the neutral cue tends to appear with positive or

a positive neutral cue (nt

If CTi„

a;<

>

0,

>

0) selectively evokes other

these memories will (on average) have Xk

selecitvely evoking positive information

>

memories.

results relate to experimental findings that salient information has a greater effect

Two

experiments highlight the differential

Reyes and Bower (1979) place subjects into the

effect of evocativenss

role of jurors,

prosecution witness testimony about a drunk driving case.

16

who

One

on

and vividness. Thompson,

are asked to read defense and

side's case

was manipulated

to

be

salient while the other's

was manipulated to be

pallid. ^^ After

reading the two sides, subjects rate

When

the guilt of the defendant and are asked to return the next day.

to perform the rating again (they do not read the testimony again).

the salience manipulation has no effect on the

is

comforting since

it

Thompson

lack of an

et.

al.

find that

immediate impact

suggests that the salience manipulation did not also manipulate perceived

informativeness. For example,

we can

rule out the possibility that subjects felt that a witness

testimony contains more details was more

the second days' judgements of guilt:

judgements of

The

days' ratings.

first

they return, they are asked

guilt rose

(fell).

One

The

reliable.

when

whose

salience manipulation did, however, affect

the prosecution's (defense's) case was more salient,

interpretation of these results

is

that the presence of additional

cues (guacamole on white carpet) facilitates recall by marshaling associativeness.^*^ Vividness, as

I

have defined

carpet

it,

increases because these (irrelevant) cues

— are commonly encountered

ones.

The

—

for

example, spilling something on a

increased vividness of one side's case

memories over-represent evidence supporting that

means that

side.

Hamill, Wilson, and Nisbett (1979) present another experiment, one that resembles evocativeness

more than

vividness.

As Nisbett and Ross

One

set of subjects

(1980, p. 57) summarize:

is

presented with a description of a welfare recipient.

"The

central figure

and irresponsible Puerto Rican woman who had been on welfare

was an obese,

for

many

friendly, emotional,

years. Middle-aged

now,

she had lived with a succession of 'husbands,' typically also unemployed, and had borne children

by each of them. Her home was a nightmare of dirty and dilapidated plastic furniture bought on

time at outrageous prices,

filthy

Her children. ..attended school

teens, with the older children

kitchen appliances, and cockroaches walking about in the daylight.

off

and on and had begun

now thoroughly enmeshed

to

run afoul of the law

in a life of heroin,

in their early

numbers-running and

'^The salience manipulation was performed through adding inconsequential details to one side's testimony. For

example, in describing the defendant about to leave a party and drive home, the pallid version states that he bumped

into a table, and knocked a bowl to the floor. The salient version, on the other hand, states that he knocked a bowl

of guacamole dip off a table and onto a white carpet.

""A weakness of the current model of the experiment should be pointed out. The guacamole on white carpet cue

is effective not because it associates with current events but because it associates with past events. In other words,

the model needs to allow not only for current events to form associations that facilitate recall, but also memories

themselves should form associations that further facilitate recall. I expand on this when I discuss future extensions

in Section 5.

17

Another group was given summary

welfare."

median stay (two

(only

10%

years)

on welfare recipients documenting the short

and the small proportion that are on welfare

than four years). These

for longer

statistics

rolls for

statistics contrasted sharply

long periods of time

with the priors of control

subjects.

When

the groups are asked to state their attitudes about welfare recipients, those receiving the

story expressed far

statistics

more unfavorable attitudes than a control group. Those receiving the

showed no

Evocativeness provide one interpretation of these findings.

difference.

story that subjects read

is

recipients in a poor light

such evocative cues.

overflowing with cues

— drug

The

commonly found

pallid

The

in evidence that paints welfare

use by children, immigrant, obese

— whereas

the statistics lack

story thereby triggers evidence from the past that also contain these

cues, evidence that will generally

towards welfare recipients. In

be negative.

It,

this interpretation,

it

therefore,

is

prompts more negative attitudes

not that the single case study

is

taken as

informative. Queried, subjects should state that of course they recognize that one story (especially

a manufactured one) proves nothing, but that

evidence.

Of

course, the pallid statistics

it

reminds them of other previously encountered

do not possess such cues and, therefore, have lower

evocativeness.^^

Together, these experiments illustrate the contrast between vividness and evocativeness.

inessential cues in the testimony (e.g.

guacamole on the carpet)

will

The

not (on average) trigger other

memories that condemn or exonerate the defendant. They do, however, make the testimony more

vivid,

making

it

more

likely to

hand, the welfare mother story

will

be remembered and influence

will selectively trigger

beliefs in the future.

memories.

Its

On

the other

evocativeness means that

it

have greater contemporaneous impact.

^^That they have no effect, however, indicates either that individuals do not put much faith in the statistics(numbers

can be manipulated) or that other factors are at play there. It is also worth noting that an implication of this

interpretation is that the effect of the manipulation (seeing the story) should disappesir over time. If subjects were

brought in at later dates, the difference between treatment and control should diminish and eventuaJly vanish.

18

3.3

Over-reaction and Under-reaction

The previous

propositions illustrate

impact; the memories

how information

similar information. Such

an

effect

The

...

- yf

,

,.

Note that err^

-ii

=

=

errt

+

=

xt)

Cov{errl^, xt)

I

x and

this over-reaction increases with

Cov[err^,xt)

following proposition formalizes this idea.

errors are negatively correlated with the information in the latest event:

Cov{yt

Proof:

how

causes an over-reaction to news: today's events causes similar

evidence to be over-represented in memory.

Proposition 3 Forecast

us about

tell

Associativeness implies that events trigger memories that convey

forecast errors will be biased.

The extent of

But these propositions do not

triggers also matters.

it

content alone does not determine an event's

\

A;

and that

err'^

<

dCovierrP ,xt)

q;^

errt

j dCovierrf' ,xt)

n

U and

q^

<^

independent of

is

xt-

,

<

rv

U.

Therefore,

Cov{errY',Xt). Calculating this:

t-i

E[errrxt]

= J2

^'-'EifktXkXt]

Using the fact that x^ and xt are independent, we can write the

Intuitively, E[xkXtakt]

is

positive because

implies that the overall covariance

is

Ofct

measures

negative.

To

summand as:

similarity.

See

—xE[xkXtakt]-

Lemma

6.

This

get the comparative statics, let's

complete the calculation:

ElerrPxt]

=

-xE[xkXtakt]{X

+

+

A^

•

•

•

+

A*-i)

=

Partial differentiation shows that this decreases with

teresting. It

happens because when A

is

A(l

-xE[xkXtakt]

x and

large, the selective

A.

The

— A*~M

\_^

effect of

A

is

in-

sampling of past memories

becomes more important, since these memories enter with greater weight into the

fore-

cast rule.

Intuitively,

good information may lead to a

rosier

view of the past, which leads to forecasts that

are too large, which leads to a negative forecast error. ^^ Over-reaction increases as

^^

x

rises

because

Evidence on over-reaction can be found in studies of the representativeness heuristic by Kahneman and Tversky

Kahneman (1971) and Grether (1980). These studies find that in forming assessments

(1972,1973), Tversky and

19

X

quantifies the importance of associativeness.

Finally, the effect of

A arises because

the importance of history and thereby the importance of selective recall.

important point, which we

The

will

return to in Section

Cf

=

results in

it

is

an extremely

3.4.

previous proposition paints a picture of individuals over-reacting to information. Rehearsal,

however, generates under- reaction. To see

event

This

meeisures

it

(0,

n^) at time

Prop 2

t.

illustrate

Suppose that

how

this,

consider an individual

this event evokes positive

who

faces

an uninformative

memories so that

beliefs over-react to this non-information: the positive

triggers results in forecasts that are too large.

>

£{et)

0.

The

memories

Since these memories are rehearsed, they will

experience higher recall probabilities in future periods, meaning that forecasts will continue to be

too large. As time goes on, they will decay towards the true value as the effect of the rehearsal on

recall probabilities diminishes.

To an

outsider, the belief changes in later periods will

they were unrfer-reaction. At both times

as the

memories decay

t

+ j and t + j +

The

in each of those periods.

I,

she will see a

Notice that

if

Lemma

observer, therefore, sees a negative change

we

=

(0,n,)]

=

;^-i_^(e,)(Ap)^(Ap

illustrates the negative "drift" in beliefs that follows

-

drift

If we difference

1)

an over-reaction. In other words,

future belief revisions are negatively proportional to the initial evocativeness. Beliefs

appear to

negative

find:

E[Ay^^j_,,\et

which

first

4, that:

p were zero, this term would be zero, emphasizing the role of rehearsal.

this over time,

if

downward adjustment,

followed by another predictable negative change, an apparent under-reaction to the

change. Formally, note from

seem as

towards some equilibrium. The intuition behind this finding

is

all

will, therefore,

that there

is

more

weight on base rate evidence and too much weight on the latest piece of information.

form of perceptions of a "hot hand": individuals seeing a streak expect it to

continue. While this model does not provide compelling evidence of all the actual experimental evidence (in many of

these, the relevant information is directly available and memory plays no role), it generates behavior in real settings

individuals place too

A

similar

little

phenomenon

arises in the

that resembles the findings.

20

information in her forecast errors than the individual realizes:

err^

As with the

in

which their memory

{errt).

both

arises even

more

If

also tells the individual the

it

she

is

positively surprised, the

I

discuss this further in Section 3.4.

intuitively in a slightly modified version of the model.

there

ej,

is

(perhaps a rumor). Abstracting away from

for

rit

now, suppose that x[ equals xt plus noise.

statistic followed

still

depend partly on

x[

by a

revision. In this setup,

even after xt

Because, even though the individual discards the information contained in

it

An

But rehearsal combined with

revealed the individual should pay no attention to x[.

associativeness will imply that beliefs will

Suppose

a period where the individual observes a noisy event

example might be the announcement of a government

is

some

probably has been a positive shock and that she

infer that there

that before observing the true event

once Xt

But,

systematically biased {err^).

is

systematically under-sampling positive memories.

Slow adjustment

ej

+ err'^

permanent component

in the

forgetful individual should

is

errt

perfect recall individual, the forecast error tells the forgetful individual that

change has occurred

way

=

x[,

is

revealed.

Why?

the set of memories

evoked have been rehearsed and they continue to have an impact in later periods. ^^

Finally, the following proposition

Proposition 4 Let

T>

When

t.

shows that forecast errors can be positively auto-correlated.

events are very memorable (f low,

x ond p

large), then

Cow[errf ,er7-,^i] >

Proof:

(Sketch)

details.

The proof

I will

for the finite

(that tend to zero as

follows:

(1)

present a proof for the case where

Use the

t

t

case

exactly the

is

gets large) involved.

fact that

The

f

^^ oo to abstract from

same but with more constants

general strategy of the proof

in all

some terms that

on belief perseverance (e.g. Ross, Lepper and Hubbard,

and Weber, 1990) and on hindsight bias (Fischoff, 1982).

three of these categories emmphasize the inability of subjects to "undo" information. See Mullittle

resembleiiice to the findings

1975), the curse of knowledge (e.g. Camerer, Loewenstein

Experiments

as

err^^ can be written as a function of err™ plus some

terms: (2) Substitute into Elerr'^-^err^] to get a ElerrY^ err^^] plus

^^This result bears a

is

lainathan (1998) for a discussion.

21

resemble

to

J5[xfcerrJ"]; (3) these

generate opposing signs so that the variance term tends

dominate whenever the probabihty of forgetting

For the

first

Lemma

step in the proof, see

is

small.

which shows

7

that:

t-i

err^i

^ XkH -

= pAerr™ +

xak{t+i))

k=l

Substitution into E[err^ierr^] gives (step

pWarierrD +

2):

^ X'+'-'E[x,{1 -

xak(t+i))errr]

k=l

Substitution for the latter gives:

t-i (-1

pXVarierrD +

The

E

XE[{1 - xat(t+i))^terr^]

EE

X^'^'-'^-^ E[xkX,{l

-

xafc(t+i))/j*]

third term can be written as:

X''+''''E[xl{l-xak(t+i))fkt] +

E E >^''^'~'~'p'''E[xkXjil-xam+i)){l-Xajk)]

fc=lj=l

k=l

where since x^ and Xj are independent

E

+

X'^+'-^'^Elxlil

-

xak(t+v)fkt]

-

this

can be written

EE

as:

X''+'--'-^p'-'E[x,x,{l

"

Xakit+i))xajk)]

k=\j=l

fc=l

Putting these terms together gives:

t-\

pXVarierrD

+

E

^'*"^'"''^[^^(/

"

Xafc(.+ i))/a]

k=l

+

-

XE[{l-xatit+i))xterr^]

E E X''+'-''^p'-'E[xkXj(l -

xakit+i))xajk)]

fc=ij=i

Now

the

first

and second terms are

clearly positive,

term are clearly negative. The key insight

memorability gets large

Therefore,

(as

/ -^

when memorability

is

is

where as the third and fourth

that the negative terms tend to zero as

0) since these predicate

on having forgotten xt or x^-

sufficiently high, the overall expression is positive.

22

Positive covariance can be understood as overlapping samples. Forgetting

events from history. Since the samples at times

t

and

T draw from overlapping histories, correlations

The

increasing the autocorrelation in forecast errors.

occurs for the following reason. Suppose that /

is

condition that / must be sufficiently low

very large. Then, the xt from the past will likely

be forgotten and hence xt shows up with large weight

is

analogous to sampling

Moreover, rehearsal implies that memories that were forgotten will be forgotten again,

arise.

Xt

is

in err(^y.

We know

from Proposition 3 that

negatively correlated to err(^. This implies a negative auto-correlation.

The

results so far illustrate

a model such as this

is

that

it

two conflicting

and under-reaction. One advantage of

forces: over-

allows us to trade off such effects and figure out

when we expect

one to arise over the other. The following propositions quantify when belief changes are negatively

(over-reaction)

and when they are positively correlated (under-reaction) to lagged information.

Proposition 5 Suppose

low.

that forgetting probabilities are small, so that f

is

high and p and

x

o,re

Then:

Cm;[Ayi^i,Ayt_i]

When

(10)

>

(11)

these probabilities are large, however:

Cot;[Ay,^i,Ayi_i]

When

<

the covariance is negative, then a

change in A makes

dCov[Ay(l^,Ayt-i

dx

Ayt^i

xjt

more negative:

<

(12)

Now,

Proof:

and

it

is

independent of

all

=

Ayt

7,

we can

err^^^

+ err"^

lagged information. Therefore, the covariance equals:

£[errrAy,_i]

From Lemma

-

write err™

j

- S[err^i Ay,_i]

terms of err'^

in

.

Substituting for this gives:

t

(1

-

\p)E\x,.,err^\

- J^

\'-''^'E[{f_

k=\

23

-

xak(i+i))xkXt-i\

Reapplying

Lemma

7 to

err^

gives:

k=l

fc=l

Note that x^ and Xt^i are independent

(1

-

Define

+

Xp)XpE[xt_,errr.,]

C

to be E[xf_i(l

-

(1

summations

in the

- Ap)A£[xti(/ -

xa{t-i)t)]

for

xa(t-i)t)]

which also equals

-

A;

7^ i

—

1,

A2i;[x2_i(/

E[x^_-^{f^

-

leaving:

-

xait-i)t)]

This

xa(<-i)((+i))]-

gives:

(1

Substituting for the

-

first

+ CA(1 -

\p)XpE[xt-ierrYLi]

A(l

+ p))

part from the proof of Proposition 3 gives:

~^ ^^\~_\

^

E[aktXkXt]

+ CA(1 -

A(l

+

(13)

p))

Suppose events are very memorable, so that the forgetting probability, /

and pare high. Then

or even negative.

is

-

(A(l

The

first

A(l

term

+p))C = {X{1- X{1+ p))E[x'^^_-^{lis

is

low and

xa^t-i)t)]

^iid

p are low. Then, the

small

already negative, so that in this case the correlation

negative. Suppose, on the other hand, that events are easy to forget so that /

and X

is

x

first

term tends to

zero, while the

is

high

second term implying

a positive correlation.

Differentiating with respect to A gives:

1

-

A*-i

-E[aktXkXt]

1which

1

is

the

— A(H-p)

same

as equation (13) except

has been replaced by

second only makes

Consequently

if

it

is

(i) it

has been divided through by A and

1— 2A(l+p). The

more negative since

equation (13)

+ C{l-2X{l+p))

C

is

first

positive

has no result on the sign and the

and

l-A(l+p) >

negative the derivative with respect to A

24

(ii)

is

1

— 2A(l+p).

also negative.

The

behind this proposition

intuition

forgetting

and

On

over- reaction.

is

that there are two effects that govern behef dynamics:

the one hand, yesterday's information

which means that the individual must learn

beliefs

much

to Xt

again. This induces a positive correlation

the other, over-reaction

between

means that the individual responded too

occurred, meaning that beliefs must correct for this. This induces a negative

When

events are on average quite memorable, the over-reaction effect dominates.

events are readily forgotten, the individual must relearn old information.

A

reflects the discussion in Section 3.4.

on A

forgotten,

it

when

correlation.

When

On

and lagged information.

it

may have been

larger

and takes a longer time to undo.^^

3.4

The Role

The dependency

greater emphasis on history implies over-reaction

of History

Recall that A measures the weight put on past values in the forecast. In this section

how A mediates

is

and slow

over-reaction

learning.

I

will

I

will

examine

argue that A can be measured easily and

therefore the empirical tests involving A can actually be implemented.

Let's begin

by considering the impact of forgetting an event. The memory error equals:

(-1

err^

=

y,

_ yf =

^

i-l

A*"'^!!

- R^tjxk =

Y,

If Fj^t

=

1,

so that event e^

is

forgotten, the

memory

error

would go up by

that the impact of forgetting an event declines as time passes

rate of decline depends on A.

distant past.

Xk

is

does this happen?

them means that

learns about the

learning

is

slow.

yt-

is

distant the

an event

in the

due to forgetting

this

absence of this signal, the individual

time through

yt.

Since

yt is noisy,

memory, the more time there has been

This establishes who there

biases,

it is

will

however, this

to learn about the

be slow learning. This

natural to ask whether an individual might not be simply

memory

completely. Mullainathan (1998) shows that ignoring

bias but almost surely raises variance (since information is lost).

better off by simply ignoring their

Moreover, the

k gets large).

lost

This shows

Events provide perfect signals of the permanent shocks, so

yt instead.

Given both these over amd under-reaction

—

As time proceeds, the information

permanent shock but

The more

{t

\^~'^Xk.

A, the larger is the effect of forgetting

this perfect signal is lost. In the

event thorough observations of

^''

larger

slowly re- learned through the

forgetting

still

Why

The

>^'~HFkt)xk

k=l

k=l

25

memory may reduce

learning occurs at rate A because A measures the noise-signal ratio in

When

yt-

it is

large, y is

a very noisy signal of permanent income and forgotten events are learned about very slowly.

summarize, A captures who quickly a forgotten event can relearned through the

quickly errors in

Let's

now

memory

y,

To

and hence how

are corrected.

return to rederiving

how

beliefs

respond to an event

e^:

t-i

E[y('\et]

=

xt-J2^*~''^i^kfkt\et]

t-l

k=l

xt

To

we

get the second equation,

+ X^{et)

exploit the fact that

third equation comes from the definition of

A;,

+

(a

<f(e4).

A2

[x^

To

+

is

A^

+

.

.

.

+

A*-i)

independent of Xj as

is

fkU-i^Xk-

The

interpret this equation, notice that at time

associativeness results in a selective sampling that has effect equal to the evocativeness, £{et).

But

as we've seen the impact of recall mistakes

on

beliefs

depends on

A.

In the formula,

that selectively recalling the events at time k has impact X^~^£{et). Taking

the impact of selective recall

i

—

)•

we

see

co for simplicity,

is:

^£[e^)(\

+

\^

+

+ ..)=x£{et)j

\^

A

Therefore, as A increases, the importance of selective recall increases. Intuitively,

when A

is

large,

the triggering of certain types of memories over others has bigger impacts because the past matters

more.

We,

therefore, see

two basic properties of

slowly individuals adjust their

since A can be

^'Cajroll

measured

in

memory

A.

It

both measures extent of over-reaction and how

mistakes. These two observations are especially interesting

standard data

sets."^^

and Sajnwick (1995) present a technique that allows us to estimate A. Notice that Var{i\'^yt) = dal + ia"^.

/^dVt in the data for many different d and regressing them on d, one can back out the variances.

By computing

26

Application to Consumption

4

Having developed the general

individuals.^^ Let

i

results,

the model to the consumption decision of

now apply

I

index individuals, and yu represent and income, c^ denote consumption and

u{c) be the instantaneous utility function taken to be the

individual maximizes discounted (subjective) expected

same

utility,

across individuals.

where the discount rate

Suppose the

is S.

Assume

that she faces no borrowing or savings constraints and can borrow or save risklessly at a rate

that 5

= Y^.

Under these

t,

Further, impose a no-Ponzi

game condition

so that there

is

conditions, marginal utility of consumption will be equated:

no

infinite

u'{ct)

=

r,

and

borrowing.

u'{ct) for

all

T. Taking a quadratic or log-utility function implies that consumption will be equalized across

time. In the current model, this allows us to write consumption as:

Cit

where ^o

=

and

Aj(f+i)

^cu =

=

+ r){Ait + yu -

(1

i^^vu

t

—

1

This

forecast error.

determine consumption

in this

is

is

= Yqr^^y^^ + ^^^-d

proportional to the change in income expectations plus

permanent income considerations completely

model.

individual and an aggregate component.

we write

influences the individual.

the assets. Differencing across time gives:

yf(i-i)

intuitive since

Now, suppose that the income process

individual specific one,

Cit) is

+ yr{t-i) -

In other words, the change in consumption

the time

= r"— ^zt + yu

1 + r

yit

=

y^t

is

the

Letting

+ '^iVt-

sum

yt

of two components:

be the aggregate component, and y° be the

where a, measures how much the aggregate shock

Both the aggregate and individual income components follow processes

described so far and the individual income components are

for

both processes. Let

q

one specific to the

iid

across people. ^^ Events are observed

be aggregate consumption.

^^Mullainathan (1998) presents an application to asset pricing as well.

^^There is a slight oddness in the results here. Income is normally distributed meaning that it might well be

negative. Using a log-normal distribution would generate all the results here but with added technical complications.