Document 11158603

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium

Member

Libraries

http://www.archive.org/details/dissolvingpartneOOcram

working paper

department

of economics

DISSOLVING A PARTNERSHIP EFFICIENTLY

Peter Cramton, Robert Gibbons,

and Paul Klemperer*

November 1985

406

Number

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

DISSOLVING A PARTNERSHIP EFFICIENTLY

By

Peter Cramton, Robert Gibbons,

and Paul Klemperer*

November 1985

Number ^06

.

*Yale University, Massachusetts Institute of Technology, and St. Catherine's

College, Oxford, respectively. This project was begun at Stanford University

and financially supported by the Sloan Foundation, the National Science

Foundation, and the Center for Economic Policy Research. We are grateful to

David Gold for posing the problem and encouraging its .analysis and to Roger

Guesnerie, Christopher Harris, David Kreps, Robert Wilson, and two referees

for helpful suggestions.

,

DEG3

1988

Dissolving a Partnership Efficiently

By

Peter Cramton, Robert Gibbons, and Paul Klemperer*

November 1985

Abstract

Several partners jointly

a valuation for the

own an

asset that

asset; the valuations arc

a common probability distribution.

We

may

known

be traded

among them. Each partner has

privately and

characterize the set of

drawn independently from

all

incentive-compatible and

interim-individually-rational trading mechanisms, and give a simple necessary and sufficient

condition for such mechanisms to dissolve the partnership ex post efficiently.

is

constructed that achieves such dissolution whenever

it is

A bidding

game

possible. Despite incomplete in-

formation about the valuation of the asset, a partnership can be dissolved ex post

efficiently

provided no single partner owns too large a share; this contrasts with Myerson and Satterthwaite's result that ex post efficiency cannot be achieved

when the

asset

is

owned by a

singlf

party.

"Yale University, Massachusetts Institute of Technology, and St.

Catherine's College,

Oxford, respectively. This project was begun at Stanford University and financially supported

by the Sloan Foundation, the National Science Foundation, and the Center for Economic

Policy Research.

analysis,

We

are grateful to David Gold for posing the problem and encouraging its

and to Roger Guesnerie, Christopher Harris, David Kreps, Robert Wilson, and two

referees for helpful suggestions.

Introduction

1.

When

a partnership

When

municipalities jointly need a hazardous-waste

site

is

to be dissolved,

and how much should

it

or children divide an estate,

who should buy

out his associates and at what price?

dump, which town should provide the

be compensated by the others?

who should keep

When husband and

wife divorce,

how much should

the family house or farm, and

the others be paid?

We

consider partnerships

in

which each player

is

i

endowed with a share

be traded, and specific capital or other transaction costs

on the market and

efficiently

[3]

We

split the proceeds.

make

it inefficient

of

r,-

a good to

to sell the good

look for procedures that allocate the good ex post

while satisfying interim individual rationality. Unlike Myerson and Satterthwaite

—who show that no procedure can

with uncertainty

(r\

=

1

and

r?

=

yield both properties in two-player bargaining

0)

— we show

games

that the distributed ownership found

in

a partnership often makes the two compatible. For the case of n players whose valuations

are independently drawn from an arbitrary distribution,

is

we

derive a simple condition that

necessary and sufficient for efficient, individually-rational dissolution, and

simple bidding game that will accomplish such dissolution whenever

Bayesian Nash equilibrium

The

it

application that inspired our analysis was the Federal

proposed to make the

can be achieved as a

some extensive-form game.

in

Communication Commissions

allocation of licenses for cellular-telephone franchises. After closing the

FCC

we introduce a

final allocation

list

of applicants, the

using a simple lottery. Prior to the lottery each

applicant has an equal chance of winning, and so can be thought of as owning a l/n share in

the license. Our analysis suggests that the applicants would do better to form a cartel (that

would win the lottery with certainty) and then allocate the franchise to one

via our bidding game; this

to

resell.

A

is

more

similar example

is

efficient

than the

lottery, even

if

the winner

airlines shares in the slot equal to their weights in the

two-member

permitted

proposed

lottery,

is

and

to assign the

let

them play

-

game we propose.

As another

is

number

the Federal Aviation Administration's proposal to allocate

landing slots at busy airports by lottery. Again, a more efficient approach

the "bidding

of their

application of the theory, consider the following buy-out provision of

many

partnerships: one side submits a "bu3 -out" offer, and the other side then has

:

1

the choice of either buying or selling at these terms. Since this scheme does not guarantee

ex-post efficiency (the

will

player will not,

first

be inefficiently allocated

valuation),

it

general, submit his valuation, so the object

in

the other's valuation

if

is

between the

first

player's bid and

too can be improved upon by our bidding game.

The bidding game

that achieves

efficient, individually-rational dissolution differs

typical auction in that every player pays or receives a

players' bids. Moreover, the set of bidders

who pay

sum

of

money that

a positive

amount

is

a function of

typically

is

to the winning bidder, but includes the second and other high bidders as well.

—such as

first-

and second-price

rational dissolution. This part of our analysis

He

in

the

Since such

which

in

efficient, individually-

was inspired by Samuelson

a similar problem and solves a two-player example

distribution on [0,1].

— can achieve

all

not limited

bidding arrangements are not frequently observed, we determine the circumstances

more common auctions

from a

[4],

who

describes

which types are drawn from a uniform

finds that split-the-difference bidding (the average of first-

and

second-price) yields an efficient allocation, but he ignores the individual rationality constraint

that players should prefer participation

in

the

game

to retaining their current share.

(He

imposes instead the weaker constraint that players prefer participation to being dispossessed

of their current share.)

We

consider n players and arbitrary distributions and

and other similar auctions ma}' accomplish

only

when

efficient,

partners' shares are very close to equal.

Coase Theorem under incomplete information: instead

sion that efficiency

exactly

this

individually-rational dissolution, but

Samuelson also provides an interesting interpretation

efficiency

show that

may be

when

is

of his

work as an exploration

of the

of the complete-information conclu-

always achieved and that property rights are immaterial, he shows that

lost

and property

efficiency can

rights

may

matter. In these terms, our analysis shows

be achieved and how property rights matter.

»

The

tion

rest of the

game

paper

is

organized as follows. In Sections 2 and 3,

we analyze a

to determine the set of partnerships that can be dissolved efficiently.

introduces a bidding

game that accomplishes

and Section 5 characterizes the

Section 6 shows that

efficient dissolution

set of partnerships for

commonly observed auctions

which

whenever

it

revela-

Section 4

is

possible,

efficient dissolution is possible.

are efficient in

some circumstances.

}

The Revelation Game

2.

n players indexed by

Our model has

good to be traded

Each

are

€

(r,

player's valuation

€

N=

r<

=

and X3"=i

[0, 1]

is

«

known

1)

{ 1,

.

.

n

,

}.

Player

owns a share

i

an(^ ^ias a valuation for the entire

privately, but

drawn independently from a distribution

.

it is

F

common knowledge

with support

r,

of the

good of

t/,-.

that the valuations

and positive continuous

[r, v]

density /.

We

valuations v

t(v)

=

game

consider the direct revelation

=

{i\(v),

to player

t.

.

{v\,.

.

.

tn

,v n

(v) },

=

r

=

where

{n,.

for all v

=

and then receive an allocation s(v)

}

s; is

(Since this allocation

ownership rights,

and ^ii(v)

,

..

which players simultaneously report their

in

..

€

trader-specific,

is

We

,r n }.)

[v,v]

the ownership share and

n

The

.

may depend on

it

money

the net

is

f,

(«),..., s n (t')}

{ «i

outcome functions

transfer

the vector of initial

require that these allocations balance:

pair of

and

{s,t)

is

Cs

i'(

v)

=

1

referred to as a

trading mechanism.

A

in

player with valuation

money and

u,-,

the asset. Also,

share

to be v,r;, while afterwards

player

i

it is

t>_,-..

when he announces

S,(tv)

is

player

+

is

£,'.

Let -i

= K\i

v;r;

+ m,,

which

is

linear

endo%ved with enough money,

is

utility,

mechanism

and

let

only net transfers

(s.t) can be taken

£_,{•} be the expectation

and money transfer

define the expected share

for

by

v,

=

t?;s,-

£-i{si{v)

}

and

=

Ti (17)

£_, { U(v)

,

is

Ui{vi)

(s.t)

has utility

Because of the linear

feasible.

Then we can

so the player's expected payoff

The mechanism

m,-

before participating in the trading

i's utility

operator with respect to

and money

we assume that each

say v, that any required transfer

matter, so player

r,-,

= VjSj[vi) + Ti[vi).

incentive compatible

if all

types of

players

all

want to report

their private information truthfully:

tf.-fc) >"t-vS,(u)

By the

Revelation Principle (Myerson

+ Ti{u)

[2],

Vi

among

attention to incentive-compatible mechanisms.

3

€

TV, tv,

others),

we

«

-

€

[r,

lose

The mechanism

t>].

no generality by restricting

(s,t)

is

interim individually

rational

if all

types of

all

players are better off participating in the

their expected payoff) than holding their initial

>

Ui(vi)

The

following

Vi

r,f,-

£

lemmas develop a necessary and

incentive compatible

and individually

mechanism

(in

terms of

endowments:

A'

and

v,-

E

[r, v].

sufficient condition for

a mechanism to be

rational. Since the proofs are either simple or standard,

they are relegated to the Appendix.

Lemma

i

£ N,

The trading mechanism

1.

Si is increasing

{s,t} is incentive compatible if

and only

if for

every

and

V

T (v;)-T (v )= [

i

i

'udSi(u)

i

(IC)

i

€

for all Vi,v*

Lemma

\v,v).

1 follows

implies that

U,-

from the fact that

convex and increasing

is

in v;,

continuity of V, implies that the net utility

Lemma

at

v-

=

with derivative

—

C/,(t',)

S,-

has a

r,t>,-

Linearity

asset.

almost everywhere. The

minimum

over

v,-

€

\v,v\.

2 identifies this worst-off type, and this allows us to restate individual rationality as

a single condition

Lemma

money and the

utility is linear in

2.

in

Lemma

3.

Given an incentive-compatible mechanism (s.l), traderi's net

i[inf (V.*)

+ sup(V*)] €

=

V*

In the simplest case,

{Vi

£,•

\

is

worst-off type satisfies Si(v*)

r,-;

equal to his initial ownership right

be neither a buyer nor a

<

T{

Vw <

Vi\

S;(w)

continuous and has

=

seller of

minimized

where

[v, v],

Si(ll)

utility: is

that

r,-.

is.

r;

>

Ti

Ww>

Vi}.

range, so the valuation of the

in its

the worst-off type expects to receive a share

Intuitively, the worst-off

type expects on average to

the asset, and therefore he has no incentive to overstate or

understate his valuation. Hence, he does not need to be compensated in order to induce him

to report his valuation truthfully, which

This

is

why he

is

the worst- off type of trader.

an interesting generalization of a similar result

exchange

for bilateral

seller (v) are

longer clear

is

worst

who

is

(r

off;

=

In

{0,1}).

[3]

and who

is

Myerson and Satterthwaite

[3]

the lowest-type buyer (v) and the highest-type

here the worst-off type typically

selling

in

buying.

-1

is

between v and

v, since it is

no

(

Lemma

3.

for all

E

i

An

incentive-compatible mechanism (s,t)

individually rational

is

if

and only

N

r.(O>0,

where

is defined in

v*

i

Lemmas

4.

2.

and individually

rational, stated in

For any share function s such that

transfer function

only

Lemma

(ir)

1-3 lead to a necessary and sufficient condition for a trading mechanism to be

incentive compatible

LEMMA

t

such that (s,t)

is

Lemma

4 below.

S, is increasing for all

E N,

i

there exists a

and individually rational

incentive compatible

if

and

if

n

m

rv

V

[

i>v

Vi

J2 [ \l-F{u))udSi(v)- f

where

v.*

I

is

defined in

The "only

if"

Lemma

>

"if"

part of the

—

lemma

*

is

F(u)udSi(u)

>0,

(/)

2

lemma follows

part of the

balance conditions J2 s ( v )

The

if

anc^ T2

f

«"

v)

directly

=

from the previous lemmas and the budget

which even feasible mechanism must

-

0,

proven by constructing a transfer function

compatible and individually rational provided the inequality

following intuition precise: there exists a transfer rule

t

(7) holds.

t

that

is

satisfy.

incentive

The proof makes the

that entices the worst-off type of each

trader to participate in the mechanism, because (J) guarantees that the expected gains from

trade are sufficient to bribe every trader to

3.

Ex

The

trading mechanism

of the

tell

the truth.

Post Efficiency

(s,

t ) is

mechanism {s(v),f(v)}

is

ex post efficient

if

for each vector of valuations v the

outcome

Pareto-undominated by any alternative allocation (ignoring

incentive constraints). Thus, ex post efficiency requires that the asset go to the trader with

the highest valuation.

post

efficient

partnership (r,F) can be dissolved efficiently

trading mechanism (s,t) that

Such a mechanism

we

A

will

is

For economy of expression,,

mechanisms that are incentive compatible and

individually rational as efficient trading mechanisms.

efficiently will

there exists an ex

incentive compatible and individually rational.

be said to dissolve .the partnership.

will henceforth refer to ex post-efficient

if

A

be referred to as a dissolvable partnership.

5

partnership that can be dissolved

We

now prepared

are

to answer the central question of this paper:

At

can be dissolved efficiently?

partnerships

to

some

and

is

empty; that

first

glance, one might think that the set of dissolvable

This

F

from

A

1.

can be dissolved efficiently

v*

=

-P

an

efficient

partnership with ownership rights

-1 ^,"" 1

Proof: Ex post

and G{v t )

)

if

and only

efficiency requires that the

1

among them.

F{u)udG{u)

Si{vi)

v' satisfies

(D).

I

4..

An

,

J

Efficient

In this section,

(t;*)

n~ 1

=

Bidding

we

trading mechanism.

to dissolve

because

it

(D)

0,

good go to the trader who values

it

the most:

< max r,-

i.',-

=

if Vj

maxT'y.

=

the expected share function S,

Pr{tV > max t;,,-}

r,-,

so v'

=

= F -1 (r " -1

i

Fit;)"-

).

it.

1

=

is

given

G(v,).

game that

serves the

same purpose

Using terminology analogous to that introduced

is

Lemma

4 yields

Game

introduce a bidding

This

in

bj'

Substituting into (J) of

dissolvable partnership, one could use an efficient trading

game

>

Since ties occur with zero probability, they will be ignored

By independence,

Thus,

and valuations independently drawn

two or more traders have the highest valuation, then the shares can be

(In the event that

follows.)

trading mechanism.

= Ffa) n-\

if

what

following theorem gives a necessary

if

!0

split arbitrarily

r

\l- F{u))udG{v)-

/

where

The

not the case.

is

sufficient condition for the existence of

THEOREM

partnerships

the incomplete information about valuations necessarily leads

is,

inefficiency in trade.

What

a useful

mechanism

as an efficient

in Section 3, given

a

or an efficient bidding

complement to the revelation-game analysis

of Section 2,

uses strategy spaces familiar in practice, namely bids rather than valuations. In a

general bidding game, the

n players submit sealed

6

bids, the

good

is

transferred to the highest

bidder, and each bidder

pays a total price Pi{b\

In the efficient bidding

game

that can precede the bidding. Note that in the efficient bidding

game

t

analyzed below, the total price

P,

p, (b 1

and a side-payment

c,

.

,

sum

the

is

. . ,

the winning bidder pays a positive price

bidders.

As

bj

n

p,-,

—

)

'*—*

1

bj

may

as usual, but so

the second and other high

a standard auction, a higher bid buys the player a larger probability of winning.

in

Here, however, making a higher bid

price of losing tickets

THEOREM

of a price

=

6„)

b„).

A

2.

is

bidding

buying more lottery tickets

is like

in that

the purchase

not refunded.

game

with prices

p,(6i,...,fc n )

= 6,-

-— J^6y,

(P)

preceded by side-payments

rv'

c,-(r 1

is

,...,r„)=

an e&cient bidding game:

PROOF:

We solve for a strictly

use the strategy

fc(-),

then

t's

UfaA) =

all

=

J"

b(vj)

but the highest of the

71

|

—

[ti

-

+

b;

and "(ry

u)

1

condition

is

is

is

b(u).)

positive (negative) for

satisfied.

We

|

-b(u)

n

-

u)

=

1

The

6,-

fc,-

(C)

-6(t/)]

-

the

v,-

77

["'

1

others

is

dG(u)

F(vj)/F(u). (Since types are independent,

same expected

i

value, conditional on

therefore solves

than (greater than)

6(u,-),

the second-order

are interested in the symmetric solution, which satisfies

6(v,-)=

—

1

best response for

less

If

with valuation

+

J!

other bids generate the

the value of the highest bid: this

Since dUi/dbi

udG(u),

'

expected utility from bidding

/

dF(vj

rv'

increasing symmetric Bayesian equilibrium.

Jfc-i(6,)

where 5(u)

"

any dissolvable partnership.

dissolves

it

j

'udG[v)--J2

/

vdG{v)

+ b{v).

Since

6'

>

the good.

0, this

equilibrium

The constant

game

the rules of the

6(r)

is

ex post

is

arbitrary,

efficient:

the trader with the highest valuation receives

equals the lowest amount, presumably zero, that

(it

when

allow a player with valuation v to bid), and disappears

p,

and

b

are composed:

Pi [b( Vl ),...,b(v n )]

Some simple

= - f' udG(u)+ -L-J2

(

u )-

algebra verifies that (T) and (C) define the transfer rule used

Lemma

of the proof of

4, so individual rationality

Since the side-payments depend on

F, but not on v

is

udG

I"'

=

r

=

is

guaranteed.

{n,...,r n

}

that follows, since the prices

p,-

who

in

the "If" part

|

(through

t>*

=

{v\,

{vi,...,u„}, they can precede the bidding procedure.

to compensate large shareholders,

P)

.

.

.,

t* })

Their purpose

are effectively dispossessed in the bidding

are independent of

r

and so treat

all

and

game

shareholders alike.

Accordingly, the side-payments are zero for the equal-shares partnership (jf,...,^).

5.

Characterization Results

We now offer four propositions that characterize the set of partnerships which

efficiently.

First,

The proofs

can be dissolved

are not of interest in themselves, and so are given in the Appendix.

we formalize the

idea that

it

is

large shareholders that

make

interim individual ratio-

nality difficult to achieve: for any distribution F, the equal-shares partnership

but the partnership

PROPOSITION

in

The

1.

is

dissolvable

set of partnerships that can be dissolved efficiently is a

nonempty,

which one player owns the entire asset

convex, symmetric subset of the n

shares partnership (£,

PROPOSITION

2.

A

.

.

.

,

is

not.

— 1-dimensional simplex and

is

=

,r„

centered around the equal-

±).

one-owner partnership

{rj

l,r2

=

=

0} cannot be dissolved

i

efficiently.

Proposition 2 generalizes to

seller relationship

rationality.

many .buyers Myerson and

Satterthwaite's

[3]

result that,

a buyer-

cannot simultaneously satisfy ex post efficiency and interim individual

This speaks to the time-honored tradition of solving complex allocation problems

by resorting to

lotteries:

even if the winner

is

8

allowed to resell the object, such a scheme

is

.

inefficient

because the one-owner partnership that results from the lottery cannot be dissolved

efficiently.

These propositions are derived by making the appropriate substitutions

orem

1.

Note that each partner's ownership share

As an example,

if

into (D) of

The-

enters the inequality through v'

r,

the traders' valuations are drawn from a uniform distribution on

[0, 1],

then (D) simplifies to

z_

Thus,

if

for a

(D')

is

uniform distribution,

n

+

1,

(D

1

)

1

the extremities of the simplex cannot be dissolved

from

be dissolved

efficiently

if

i

and only

determines a convex, symmetric subset of the

simplex, shown as the unshaded region in Figure

number

y

1

a partnership r can

By Proposition

satisfied.

-

'

for the case

efficiently.

n

=

3.

Only partnerships

in

For the uniform case, as the

of partners (n) grows, the percentage of partnerships that are dissolvable increases

58%

to

93%

largest possible

to

99%

owner

in

as n increases

from 2 to 4 to

6.

Also, the percentage share of the

a dissolvable partnership increases from

79%

to

82%

increases from 2 to 20 to 200.

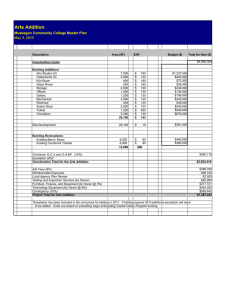

FIGURE

1.

Dissolvable partnerships with

?!

=

3 and F(v)

=

(0.1.0)

(.3.. 7.0)

(.7.

.3.0)

(1,0,0)

.7.0..3)

.3.0. .7)

u.

to

88%

as n

By

amount

contrast with Proposition 2, however, partnerships with an arbitrarily small

may

of distributed ownership

(Note that the proof employs a very special

be dissolvable.

distribution.)

Proposition

some

for

3.

Any

partnership not owned by a single player can be dissolved efficiently

distributions F.

Finally,

if

any partnership

number

replicated a sufficient

is

of times then

can be

it

dis-

solved efficiently. Consider the partnership

R(n

=

777)

|

{r,-

=

l/m,

i

=

1,

.

.,

.

m;

r

-

;

= 0,

j

= m+

1,

.

.

.,nm}.

m times — the

of m goods, so

This partnership results from replicating the n-player, one-owner partnership

m

partners

who own

own

positive shares each

1/771 of

endowment

the total

partnerships continue to be represented by points in a simplex.

any other n-player partnership can be represented

Proposition

4.

such that for

all

Given

m

>

F

in

replication of

a similar way.

and an n-player partnership {n

M the m-fold

The m-fold

,

r„}, there exists a finite

M

replication of the n-player partnership can be dissolved

efficiently.

We

think of this result as complementing the core-convergence theorems for exchange econ-

omies: replicating the economy sufficiently often reduces the effect of the incomplete infor-

mation to

An

zero.

interesting special case

is

R{2

|

For

771).

777

=

1,

Myerson and Satterthwaite

(and our Proposition 2 above) proves that the partnership cannot be dissolved

For larger values of

and Satterthwaite

here each bidder

771,

[l],

R

is

much

like

the double auction studied by Wilson

may demand up

to

m

units of the good.

Satterthwaite show that ex post efficiency

on each side of the market.

is

efficiently.

and Gresik

[5]

When

is

(Think of each

l/m

achieved for the

When

approached

in the limit;

each bidder wants

same example when there

m

more

specifically, for

if

there are

units, on the other hand,

are as few as

each side of the market. (To see this, check that [D') holds for R{2

10

share of

each bidder wants one unit, Gresik and

the uniform case, they find that 99.31 percent of the gains from trade are realized

ex post efficiency

s result

although there each bidder wants only one unit of the good, whereas

the partnership as one unit of the good.)

six traders

:

|

two traders on

2) for this

example.)

.

Simple Trading Rules

6.

The

efficient

Although the

same

bidding

game proposed

efficient

trading mechanism implicit

we

effect,

prefer the bidding

mentioned above,

more important,

shifted from the

of

it

in

Theorem

in

game

for

2 dissolves

in

Lemma

any dissolvable partnership.

4 and

game

mechanism designer

1

achieves the

two (somewhat imprecise) reasons.

And

uses strategy spaces familiar in practice.

the bidding

Theorem

First, as

second, and probably

a great deal of the computational burden has been

to the players: the designer

makes a simple calculation

side-payments and prices, using (C) and (P), while the players do most of the work

their calculation of the optimal bidding strategy b(v,).

In the trading

in

mechanism, on the

other hand, the players simply report their valuations while the designer shoulders

all

of the

computational burden.

In this spirit,

we

find

it

disappointing that the side-payments given by (C) in

depend on the distribution F,

for

it

than do the players. Ideally we would

seems plausible that the designer

like a

of J", so that the designer could always

will

recommend

it

may depend on F and game

We

less well

vithout assessing the distribution of

analyzes the composition of the players' strategies and the designer's

players that

know F

2

bidding game that can be described independently

the partners' private valuations. Unfortunately, the Revelation Principle

no guidance as to how to decompose this

Theorem

map from

is

game

no help here:

rules,

it

but gives

types to outcomes into strategies for the

rules for the designer that are

independent of

F

have not addressed the issue of finding the optimal bidding game or trading mech-

anism that

is

independent of F,

in part

because of the difficulty

(Asking only for independence of F, for instance,

is

in

formalizing this notion.

not enough, because the designer can

ask the players to report F, and then implement the side-payments given by (C)

ports agree, and forbid trade

if

the reports do not agree.) Instead,

approaches to bidding games that are independent of F.

in the

we

offer

if

the

re-

two speculative

hope that these ideas

will

be

expanded upon.

First,

it

may

be possible for the designer to use the players

1

bids to estimate F, and

then to use this estimate to construct side-payments that relax the individual rationality

1

constraints, like those in (C). This process seems both complex and delicate.

11

Second, some bidding games that are independent of

In particular, the

the set of dissolvable partnerships.

equal-shares partnership for any distribution F.

when compared

other virtues

and familiar. Second,

saves the cost of

all

it is

can dissolve a limited subset of

game we

discuss below dissolves the

game

in

Theorem

and the good

is

a

u

k

+

1-price auction" in

For k

k

=

=

1/2

this

it is

the

b t are

is like

first-

all

=

l[kb e

simple

=

+ (l-k)b f

important.

When

it

relies less

),

1 it is like

... ,b„},

and k E

a second-price auction,

the split-the-difference scheme described by Samuelson

is

third,

each of the others

and second-highest bids from {61,62,

a first-price auction, for k

the bidders. This

it is

required to pay.

is

[0,1].

and

for

[4].

Mote that the revenue from bidding (namely, the highest bidder's bid)

among

First,

three

which the players submit sealed bids

who pays

transferred to the highest bidder,

p{b l ,b 2 ,...,b u )

where bj and

And

losing bids by submitting only one nonzero bid.)

we consider

2.

game has

vulnerable to collusion. (In the efficient bidding game, a cartel

heavily on the risk neutrality of the bidders, since only the winner

Specifically,

bidding

In addition, this

to the efficient bidding

less

F

is

divided equally

the original ownership shares are unequal,

the individual rationality constraints could be more easily met by paying losing bidders in

proportion to their shares, but then partners owning different shares would have different

equilibrium bidding strategies so the partner with the highest valuation might not win, violating ex post efficiency. 2

We

begin by calculating an equilibrium bidding strategy for this auction. Calculating the

interim expected utility associated with this equilibrium then determines the set of partnerships that can be dissolved efficiently using the k

is

analogous to that introduced

PROPOSITION

5.

A

k

+

in

Section

1-price auction

-f-

1-price auction.

(Again, the terminology

3.)

has a symmetric equilibrium bidding strategy given

by

b

Proposition

auction

is

6.

The

^=

V

'

\F(r,)

-

•

A-]"

set of partnerships that can be dissolved efficiently using a k

a nonempty, convex, symmetric subset of the simplex and

equal-shares partnership (^

,

i).

12

is

+

1-price

centered around the

Thus, an equal-shares partnership can always be dissolved

auction. Such a simple auction only works, however,

when

equal, since the auction ignores the ownership rights

efficiently

by any k

+

1-price

1

partners' shares are approximately

and this makes large shareholders

r

unwilling to participate. For the uniform case, the A-f 1-price auction dissolves a partnership

<

(maxr,)--'

which for n

=

=

n

and n

if

and only

if

no partner's share exceeds 57.7%, 5.5%, and 0.5%, respectively.

if

the uniform distribution

is

jj^y,

The

2.)

intuition

is

efficient

=

200

satisfied

is

(A special property

of

bidding game, which are given after

that, because the auction treats all players as

share l/n, large shareholders will participate only

the cost of being, in

20,

that these results are independent of k. Contrast these results,

however, with the corresponding results for the

Proposition

2,

effect, dispossessed.

As n

if

if

they owned

the expected gain from trade exceeds

increases, the expected gain

from trade of the

worst-off type decreases: a player with high share and high valuation becomes almost certain

to be just outbid by players with slightly- higher valuations.

if

n<Kp

.

and

PROPOSITION

N

some

there will exist

in a

€

[0, 1]

the limit, only shareholders with p<l/n are willing to participate.

in

7.

As

—

n

oc, the only partnership that can be dissolved efncientiy

That

is.

by a t +

1-

letting p n be the largest

n-player partnership thai any partner can have such that the partnership can be

—

dissolved efncientiy. jj^

7.

given a share p

such that a partner with share p will be willing to participate only

p

price auction is the equal-shares partnership (£,...,£).

share

Thus

1

as n

— oc.

Conclusion

A simple extension

of

Myerson and Satterthwaite

[3]

shows that with incomplete information

no mechanism can guarantee that an object to be traded

who

values

that

if

it

most,

if

the ownership

possible.

Further,

is

it is

initially

among a

possible,

it

owned by

in

is

be allocated to the person

a single party.

In contrast,

we show

partnership, ex-post efficient allocation

is

often

can be achieved by a simple bidding game. In a

of partnerships, our observation that the

be dissolved efncientiy

way

is

distributed

when

more general model

influencing the

the object

will

range of partnerships that can

centered around equal shares suggests that this might be a factor

which partnerships are formed.

13

Footnotes

1.

More

precisely, estimating

an example, suppose that

F

F

seems complex and using the estimate seems

known

is

to be approximately uniform on

delicate.

with v €

[0,T>]

[11,

As

V].

Consider playing the bidding game of Theorem 2 without the side-payments. Then for every

pair of players {i,j}, use the remaining

?i

—

F, as follows.

2 players' bids to estimate

use the symmetric equilibrium bidding strategy identified in the text to

distribution of valuations

F

into a distribution of bids.

distributions described above in order to

And

second, vary

maximize some goodness-of-fit

the two distributions of bids, one observed and the other calculated.

calculate the side-payment cy(ri, ... r„) given in (C) and let

,

this construction, the

i

map

F

an arbitrary

over the set of

imposed on

criterion

Now

First,

use this estimate to

pay j the amount cy/(n—

payments received by any one player depend only on the other

1). In

players'

bids, so the equilibrium strategies are unaffected. Therefore, the size of the subset of the set

of dissolvable partnerships that can be dissolved in this

way depends only on how

elaborately constructed side-payments mimic those defined by (C)

2.

We

could for even- partner j divide j's bid

among the

when F

known.

is

other (n

well these

—

1)

players in

proportion to the other's relative shares, since then incentives for the bidders are unaffected

by their relative shares. This

is

an example of the type of auction discussed

in

the previous

footnote and would typically perform better than the auction considered here, at some cost

in

terms of greater complexity.

14

.

Appendix

This Appendix supplies the proofs of

Lemmas

LEMMA

(s,t) is incentive compatible if

T

i

€A

,

1.

The trading mechanism

S{ is increasing

and Propositions

1-4

1-7.

and only

if for

every

and

Titf) -

r

=

Ti{vi)

u dSi(u)

(IC)

i

for all Vi v*

,

€E

PROOF: Only

T,-(u), or

[v, v]

If (s,t) is

If.

=

incentive compatible, then Ui(v,)

+ T (vi) >

{

r,S,(u)

+

equivalently

>

Ui[vi)

Ui(u)

+

( Vi

-

u)Si{u),

implying that U; has a supporting hyperplane at v with slope

and has derivative ^Ef

=

S,

almost everywhere. Also,

U

i

(We use the

=

(v i )-U,(v:)

S,

£,-(«)

>

0.

Thus,

U,- is

convex

must be increasing, and

1^' S,iv)du.

Stiekjes integral throughout this paper, so that any discontinuities in the ex-

By

pected share function are accounted for in the integral.)

P

=

Si(v) dv

ViSiivi)

-

i.;S,-(t.;j

-

1

which together with the definition

Adding the

integration by parts,

jT' udS,(u).

1

If.

ViSj(v;)

of

17,

yields [IC).

identity

Vi\Si{vi)

-

Si[v*)]

=

dSi{u)

/

vi

to [IC) results in

Vi[Si{vi)

-

5,-(t>?)]

+ r.lv.) -

Ti{vfi

P

=

*

where the inequality follows because the integrand

Si is increasing.

is

(tV

-

«) dS,-(u)

nounegative for

Rearranging the terms on the lefthand side yields

v,s,{vi)

which

is

'»

incentive compatibility.

+ Ti{vj) >

|

15

v,Si{v*)

+ r,(i.;),

>

0,

all 7,7,11

€

[v,w], since

LEMMA

at v*

=

Given an incentive-compatible mechanism (s,t), trader

2.

i[inf(V;*)

+ sup(r')]

V =

*

{v,

|

t

PROOF: The net

by

Lemma

1.

Therefore, trader

S;(u)

>

or v'

=

r,-

and

or S,(u)

decreasing

<

r,

v, respectively.

>

such that 5,(u)

r,-

3.

for all

€

i

An

€

[

t'*

=

r,-

V

r,

v

<

net utility

bound

w,-

V

is E/,-(t',-)

w >

—

v,}.

r U]

,

,

is

convex

But

r,.

-^ =

5,

minimum

then the

in f,

and

left

almost everywhere,

First,

S,-

suppose that

occurs at the boundaries

=

i'*

(1)

suppose

jumps past

r,-,

=

5,-

r,-,

is

continuous and strictly increasing,

which minimizes trader

then the

v,-

at which

S,-

i's

net utility;

jumps minimizes net

over an interval, then each type in the interval

incentive-compatible mechanism {s.t)

is

v

w

three cases deal with the case where there exists u and

r,-:

is

is

equally worse

B

individually rational if and only

if

N

We

Lemma

>

(in)

o.

2.

need only check individual rationality at the valuation

v'

Lemma

2.

or Tjv'-rTj(v')

>

denned

r,-v'

.

in

I

Lemma

4.

For any share function

transfer function

only

which

r,-v,,

Thus, the individual-rationality constraint becomes v' Si(v*)-rT,-(v*) >

r,-v*.

minimized

arbitrarily select any valuation in the interval to be the worst-off type.

v" is defined in

PROOF:

r,

r,

Four cases need to be considered.

r,(v,')

where

is

minimized at the point where the

is

such that S,(v*)

S,-

S,(w) >

v,;

with valuation

u,-.

and S;(w) <

utility; (3) finally, if S,(u)

Lemma

in

The next

not continuous and

o5 and we can

i's

for all u

then there exists a unique

(2) if Si is

i

with respect to

{/,-

T, is

<

Sj(u)

net utility

where

[r.r],

utility to trader

right derivatives of

increasing,

e

i 's

t

such that (s,t)

s

is

such that

S,-

is

increasing for

all

i

€ N,

there exists a

incentive compatible and individually rational

if

and

if

V

y2\[

where

v' is defined in

[l-F{u)}udSi{u)- r* F{v)udS;{u)]>0,

Lemma

2.

16

(I)

PROOF: Only

Lemma

Suppose

if.

(s,i)

incentive compatible and individually rational.

is

Then from

1,

=

Tifa)

Titf)

- J\dSi(u).

t

Integrating over all types in \v,v] yields

V

£i {Ti (v )}

t

=

T,(v:)-

[

=

Ti(v-)-

udSi(u)dF( Vi

f'

—

*

)

1

V

r

I

dF{vi)udSi(u)+

J u=v' J t,=u

=

- J\l -

Tiiv-)

F(v)} v dS,(v)

+

12?=i

t>i v )

=

line follows

v,

F(u)u dSi{u),

J"'

—

I

where the second

fu= v JI"=r dF(vi)udS,(u)

•'

from changing the order of integration. Budget balance requires

we have

for all v, so

£>{r,te)ww {I>(»)}=.o.

1=1

Therefore,

summing

over

all

L r'( r r =

.

From Lemma

if.

is

traders yields

V

S

[ \l-F{u))«dS,iu)- f'

must be nonnegative

3. T,-(v*)

The proof

)

t=i

for all

TV,-

t>( v )

=

=

Lemma

c,-

-

=

c;

-

individual rationality

if

and only

= -X>,(tv)+

" ,=1

which results

in 2V(t£)

=

>'

=

0-

is

Then,

—

0-

J S.

± E"=i

u

dSJ (")i

after changing the order of integration.

incentive compatible.

F(u)]udS,-(tt),

Finally, by

Lemma

so

we can choose

l

udSiiu)-——J2 r[l-F(u)]udSj(u),

r,-(t';)>0.

3,

we have

A little algebra shows the hypothesis of Lemma 4

^"_i T,(r*)>0.

[''

/

+ -i- ?['[!-

if T,-(t:*)>0.

to be equivalent to the condition

c,

c

5_

dS,- («) -r

udSi(v)

f"

guarantees that (s,f)

1

^>'( t; *)

rvj

i

u

/

Q implies J2?=i

Ti{vi)

so

which implies ^"=1

by construction. Let

U (v)

where 32?= i

i,

F(u)udSitv)}.

"

|

17

j*i

J s.

'

PROPOSITION

1.

Tie

be dissolved efficiently

set of partnerships that can

convex, symmetric subset of the n - l-dimensional simplex and

shares partnership (^

Proof: Use (D) to

is

is

a nonempty,

centered around the equal-

£).

,

define

<j>

—

£"

:

>

Z by

V

= 21

^(r)

f

Convexity follows from concavity of

dd

-t.--dF(r-)"-

__

d 2 d>

(£ n_1

drf

—

TT

where the equality

l

dvt

.

—

1

—r <

1

r,

0.

dr,-

>

because at v'(±)

=

we have

f tv/(r,)F(tv) n -

nF"~ —

t?

—

dt,

1

and

0,

n

dr;

d-d>

=

1

-v;

dvj_ _

follows from relabeling the partners. Finally, </>(£,...,£)

)

=

1

72—1

dTidrj

F

[ vJiv^Fivi)"-

which we have because

4>,

dri

Symmetry

-

2

A' r./(v.)F(t:,)"- dr,

(n

+"

2.

n

dv,

dtV

-

A

for all

t;,-

£

B" 1

f

-

dvi

«.-/(«,-)^(tv)

dv,

:

:

/

arises after integrating each

— l)F r'<l

PROPOSITION

F(vi)

/

2

=

{rj

0,

term by parts, and the inequality holds since

\v',v}. so the first

one-owner partnership

>

term dominates the third.

I.t?

=

rn

=

I

0} cannot be dissolved

efficiently.

PROOF: For the n-player partnership

{rj

=

l.r 2

=

r„

=

0}. integrating by parts in

(D) yields

F"~ 1 dv+

which

fails for all finite n.

Proposition

for

some

3.

Any

/

F"dv >

0,

!

partnership not owned by a single player can be dissolved efficiently

distributions F.

PROOF: The proof

where a E

(0. i)

is

by construction, using the distribution F(u)

and u(v)

= 1+

{[T

-

l){v

-

v)/{v

18

-

=

v)} (so u{v)

{1

=

— \u{v)]~°}/{l — T~°}

1

and u{v)

=

T). Take

an arbitrary partnership {r

-2

for .p"

Fn~

and

l

<

r,|

n

u

*w-E=i

nOf"

in

T

=

cf

— T

1

°

1

Using a binomial expansion

.

in

(D) yields

l-2o

i/

-(n-2) 1

2q

1-2q

v 1-cr

a

—

terms

let

l-o

- Q

1

i=i

t,

-(n-1)

- Q

T

in

+•

- 2q

1

show that the above terms

to

and

and performing the integration indicated

(

It suffices

V:}

1

r-

11=1

ignored are of lower order, and so are insignificant, and

all

<

1.

limits are finite because u(v*(r,-)) approaches a finite limit, Vr;

have

r,-

terms

<

in

T

=

since u(v'{\))

1,

T, which does not stay

approach oo, replace

T

by

—

(1

1

a)

-1 /

and

T—

factor of

oo, d

(1

—

—

d).

!

1

- 2a

d(l-a)J

Since q

•

€

(0, i), 2

1

for d

Proposition

4.

such that for

all

£

vt3§--. 1)-

Given

m

—

—

<

^

(It is

crucial that

>

F

1

- 2d

d(l-a)

This yields

collect terms.

(n-l)(l-dy-i

+

rf(l-2a)

'

So 6{r) >

>

it

has an extra

—

1

provided

0,

for sufficiently large T.

and an n-player partnership

M the m-fold

we

To show that the

oo.)

the hrst term goes to oo as d

0. so

the

the terms in the lower

Therefore, the second term above can be ignored, since

1.

1

which holds

T

finite as

1

=r((i-flAs

+oo with 7\ because

the braces tend to

in

i

{rj,. ..,r„

E

tiere exists a finite

},

M

replication of the n-player partnership can be dissolved

efficiently.

PROOF: By the concavity

of

established in Proposition

<j>

holds for the n-player partnership

{n

=

= l/m =

=

j

which

is {r,-

:

and the partnership

1,

,

m;

of interest

tj

is {r,

=

=

l.rj

r„

= m + 1,

71/.V

=

j

. .

.

1

r."

nl

,

=

rj

A (A'-

r'

1

—l

j

=

.

Then

{N/n)

we have

d?/

T

,/ v -

f*'-

show that the

mn = N

=

!

1

to

J

dV

-L,

19

f

(

1)

NFN -

i

result

0}. the 772-fold replication of

mji}. Let

N/n:

1

After integrating by parts in (D) and collecting terms,

**(*)- V(JV-1)

1. it suffices

- {n -

A'(.V-l)

df n

)

du

+

m=

N/n

1,..., TV}.

=

where

t>*

=

v'{n/N)

pair of terms

= ^{(n/N)

(k -

:

Consider two arbitrary values k\ <

N—

J =

oo, v*

Jll

—

F N du. Then /£

tfr K du

(v'

-

(fci

- v)A^ +

.

and

7

A we have

7

let

<

ki

/£ F*"

<

A- 2

r

/ -r

„

>Ai

J

(A-j

(tv-^lAT

+ (* -

r-Sr

- n)At

t>*

=A]

—

e

>

0.

and

let A'i

= 1 — ie,

and

so the last ratio above approaches

fixed

ti,

as required.

Proposition

5.

Let /

.

for

=

t

= Jk F

2

1,2.

As

du and

J[K\. So

f^ du

A*o

1

= 1—

i£.

— ic and

Then

rj

A- 2 )

A'f

k2

(A-l-l)(AV^2)

Fix

v*

(/:,-)

J/K2 <

du <

1

= F

A",

A^A"^', we have

I+J

Ji:

if

n

(li,* ),

J/A'j and

first

:

1

1

(*,

>K

+J> J>

du

du

1

over [r*,U], the

positive for sufficiently large A'

>

F*-

- 1)F A'<1

(A'

J^F K du + J^F K du

_ ^Af- + /;= f»-i du + ;;•

I+J

^

/; f^-i du

Since I

<

1

F*'" du

is

f»

from

A- 2

so for sufficiently large

v,

pair

—

['•

jv

1

1) j;;:

lim

A-oo

A'F^" -

Since

].

The second

strictly positive.

is

—

A

+ K-*2)"

'

(A~i/A* 2 )

—

A

•

made

can therefore be

while v'

to exceed

—

1

A2

—

—

v

— A2

,

(l/n) for

I

AH

l-price auction has a

symmetric equilibrium bidding strategy given

by

v

f

b{Vi)

=

\F(~]

~

V;

\F{vi)

PROOF: Let G(x)

=

F(x) n

~1

b(vj), then r*s expected utility

Uifabi)

= [

+

''

f

If

.

i

—

-

'

f

T

[*6(:r)

7!

—

with valuation

+

(1

-

fc)6,-])

1

r,-

others will use the strategy

is

dG'(x)

-[kbi +(l-k)b(x))dE(y\x)dG(x)

r

-[*%) +

»

"

y=<>- l (b.)

Jx=b-Ub.)

r=t->(i.)-Jv=b(''.)

/

d-

"

Jx=b-l{bi)Jv=v

+

b,

/-i"

A-]"

conjectures that the

from bidding

(v,

-

-

1

20

(1

-*)&(*)]

dfi"(y

|

x)dG{x),

—

where H(y

n

—

1

=

x)

|

[F(y)/F(x)] n

2

(for

other bids given that the largest

^L =

(„ - 6,)p[6- 1 (6

1

do,

The symmetric

is

x.

The

is

the distribution of the second-largest of the

best response for

^lir[6-

)]^

do,

1

(6

1

therefore solves

;

)]- 2 (r[6-

I

(6 1

n

)]

-

k)

= 0.

-

b{vi)

=

n

b{vi)

—f(^r-

differential equation can be solved using the integrating factor \F(vj)

This linear

is

y<x)

equilibrium 6(17) satisfies

vi

solution

.

—

k]

n

\

the

a one-parameter family satisfying

[v,

-

b(v,)} \F{vi)

-

k)"

=

\F(v)

-

k]

n

du.

J"'

We

to

choose c to make the righthand side equal to zero at

±00

F~

as Vi approaches

1

(k)

from above or below. This choice

*(*)-*-

efficient:

It

= F~

u,-

1

[F(vi)

-

(k); otherwise, bids

of c yields the

tend

symmetric

k]n

V >

Finally, since

(k).

1

—

equilibrium

and truth-telling occurs at

= F~

v,-

0, this

equilibrium

is

ex-post

the partner with the highest valuation receives the good with probability one.

That

remains, then, to verify interim individual rationality.

U'[Vj.b(vi))

—

t;v,

>0

for all v;

r

( Vi

€

\v. vj.

—

-

where

[fc&(x)

C7"[f,-, fc(t-*;)]

-

(1

-

is,

we want

u>(r,-, r,)

=

is

k)b{vi)])

dG(x)

n

Jv

l

+ [

f"

-[kb(vi)

-f

I'

±[kb{y)

Partially differentiating with respect to

for fixed 77,

w

is

minimized at

~~w{ri)

=(l

f"(r,-)

+ (1 +

r,

k)b{x)}

dH(y

\

x)

dG(x)

(l-k)b(x)}dH(y\x)dG(x).

and applying the

= G -1 (r,).

Let w(rj)

- k){-±- fb[x)

dG(x)

first-order condition

=

-

w\vj (r,),r,]; then

ri b{v7)}

+

a-{j>*)"- 2 [i - rK)]6(»D - /''

+

-^r f

21

fc

(*) dGr (*)

b(y)dS(y\x)dG(x)}.

shows that,

—

PROPOSITION

auction

is

The

6.

set of partnerships that can be dissolved efficiently using a k

a nonempty, convex, symmetric subset of the simplex and

is

-f-

1-price

centered around the

equal-shares partnership (£,.-.,£)•

PROOF: Convexity follows from the concavity

of u;(r,),

which holds because

tc'(r,-)

= — v*(r,-)

i

and

= — jf-v*(r,) <

u/'(r,)

since

terms involving

—

1

k.

We

n

= G~

l

F(vl)

n-2

—

x

b(x)dG(x)>T

j[

v-

We

[1-F(v*)}b(v:)>

fc(x) in

l

i

b(v:)

the integral and simplifying.

I

11

./

Z

V

P b{x)dG{x)-—

[

-

[

b(y)dH(y\x)dG(x)

x= „- J v =v-

E

7.

As n

—

do, tie only partnership that can be dissolved efficiently

That

price auction is-ihe equal-shares partnership (1,. ..,£).

PROOF:

It suffices

is.

~-

to

—

1

as

j;

— oc.

show that given

6

>

0.

N

there exists

individual rationality fails for a player with share

(1 -f

such that for

,1-

16.

==-)

r, i

|(

— 6^

<

all

+

(d»-*)(v).

Thus,

is

necessarily false for

and valuation

of winning) (value of winning)

<(!)(!)

(1

Let d(8)

n >

= F \v{

T>(

/

(probability of losing) (value of losing)

)

+ (probability

S)/n.

^—

Interim individual rationality for a player with share

iv(

1-

letting p n be the largest

r

r

by a k-~

partnership that any partner can have such that the partnership can be

in a n-player

dissolved efficiently,

which

second,

(l/n), again by substituting b(v') for b{x) and b{y) in the integrals and simpli-

PROPOSITION

share

And

have

Jv

= G~

First, consider the

V

{\/n) by substituting b[v*) for

consider the terms involving k.

fying.

follows from relabeling the

have

-L_

at v'

Symmetry

).

Finally consider the equal-shares partnership in two steps.

partners.

at v'

= F _1 (r^ -1

t'*

+

±6)

all sufficiently

<

I

+ tuT -1

large n.

19

I

,

:

c

)

N

.

i •*-

ripg

interim

s

i

)

<

implies

1.

References

[l]

Gresik,

Thomas

market becomes

A. and

Mark

efficient as the

A. Satterthwaite:

number

"The rate

of traders increases:

at which a simple

an asymptotic result for

optimal trading mechanisms," Research Paper No. 641. Graduate School of Manage-

ment, Northwestern University, 1985.

[2]

Myerson, Roger

B.:

"Incentive compatibility and the bargaining problem,"

Econometrica Vol. 47, (January 1979), 61-73.

[3]

Myerson, Roger B. and Mark A. Satterthwaite:

bilateral trading," Journal of

[4]

Samuelson, William:

Economic Theory

"A comment on

"Efficient

Wilson, ROBERT:

for

Vol. 28, (April 1983), 265-281.

the Coase theorem," in

Models of Bargaining, edited by Alvin Roth, Cambridge University

[5]

mechanisms

Game

Theoretic

Press, 1985.

"Incentive efficiency of double auctions," Econometrica Vol. 53,

(September 1985), 1101-1116.

23

Figure

1.

Dissolvable partnerships with n

=

3

and F(u)

(0.1,0)

(.7, .3,0)

(1,0.0)

7,0,

•3,0,.7)

[Mrl)

24

.3)

-

u.

I

k

J

J

Date Due

91991

JUL 1*199!

Lib-26-67

c^

N