Document 11158582

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/dynamiceffectsofOOblan

working paper

department

of economics

THE DYNAMIC EFFECTS OF

AGGREGATE DEMAND AND SUPPLY DISTURBANCE

Olivier Jean Blanchard

Danny Quah

No.

497

May 1988

The Dynamic

Effects of Aggregate

Demand and Supply

Disturbances.

by

Olivier Jean Blanchard

and Danny Quah

*

February 1988.

*

Both authors are with the Economics Department, MIT, and the NBER. We thank Stanley Fischer,

Rotemberg, and Mark Watson for helpful discussions, and the NSF for financial assistance. We are

grateful for the comments of participants at an NBER Economic Fluctuations meeting, and for the

Julio

also

hospitality of the

MIT

Statistics Center.

The Dynamic

Effects of Aggregate

Demand and Supply

Disturbances.

by

and Danny Quah

EkonomicB Department, MIT.

February 1988.

Olivier Jean Blanchard

Abstract

We decompose

the behavior of

GNP

and unemployment

dynamic

into the

effects of

shocks: shocks that have a permanent effect on output and shocks that do not.

£rst as supply shocks, the second as

We £nd

ment; the

dynamic

that

effect

demand

peaks

after a

and a plateau

Thb

is

bump shaped

effect

on both output and unemploy-

year and vanishes after two to three years.

on unemployment of demand disturbances

effect

interpret the

shocks.

disturbances have a

effect of supply disturbances

ment.

demand

We

two types of

is

a mirror

Up

to a scaJe factor, the

image of that on output. The

on output increases steadily over time, to reach a peak after two years

after five years.

"Favorabie" supply disturbances

may

initially increase

followed by a decline in unemployment, with a slow return over time to

unemployits

original

value.

While

this

dynamic characterization

contributions of

series of

of the

demand and supply

is

fairly sharp, the

data are not as specific as to the relative

disturbances to output fluctuations.

Wis find that the time

demand-determined output Buctuations has peaks and troughs which coincide with most

NBER

troughs and peaks. But variance decompositions of output at various horizons giving

the respective contributions of supply and

demand disturbances

instance, at a forecast horizon of four quarters,

contribution of

demand

we End

that,

are not precisely estimated.

For

under alternative assumptions, the

disturbances ranges from 30 to 80 per cent.

Introduction.

GNP

In response to an innovation in

This fact

horizons.

is

of 1%, one should revise one's forecast

by more Ihan 1% over long

documented by Campbell and Mankiw {1987a), building on

earlier

work by Nelson

and Plosser (1982).

What

in the

does this statistical fact

economy,

its

implications would be clear;

disturbances are, and

But

as

if,

is likely,

mean for macroeconomics?

why

GNP

is

their

dynamic

affected by

effects

all

If

there were only one

we would need

of disturbance

do would be to find what those

have the shape characterized by Campbell and Mankiw.

more than one main type

of disturbance, say

and by aggregate supply disturbances, the interpretation becomes more

moving average representation

of output

the two disturbances.

knowing only the aggregate

Clearly,

to

main type

difficult. In

by aggregate demand

that case, the univariate

a combination of the dynamic response of output to each of

is

Campbell and Mankiw show that

effect

does not allow us to recover those two

GNP

is

equally

consistent with, for example, either white noise productivity growth and small, short-lived, effects of

demand

responses.

GNP,

disturbances on

effects of

We

demand

or instead, with serially correlated productivity growth and larger, serially correlated,

disturbances.

are interested in investigating the

on output

behavior

that this

as well as of disturbances that

in

is

the

their estimated univariate representation for

permanent component are

dynamic

effects of disturbances that

have permanent impact. Studies that impose

necessEirily incapable of addressing this issue

the interesting characterization to obtain).

serial correlation

the components are orthogonal at

permcinent component

is

we

feel

strongly

Allowing the permanent component to have rich

all

decomposed

into

permanent and transitory components where

leads and lags, and such that the variance of the

first

difference of the

either impose additional a priori restrictions on the response of output to each of

the disturbances, or use information from time series other than

first

(and

random walk

arbitrarily close to zero.

To proceed, one must

The

strict

however destroys identification to a profound extent: Quah (1988) shows how any general

difference stationary process can always be

tation.

have only transitory impact

approach has been followed

in

GNP, and

estimate a multivariate represen-

Clark (1987a), and Watson (1986)

adopts the second approach and considers the joint behavior of

GNP

among

others. This paper

and unemployment. This approach has

3

ako been taken

mainly in

its

in

Clark (1987b), Campbell and Mankiw (1987b), and Evans (1986); our approach differs

choice of identifying restrictions. Not surprisingly,

we

find

our restrictions more appealing than

theirs.

Our approach

is

assume that neither has a long run

run

We

conceptually straightforward.

effect

eissume that there are two kinds of disturbances.

We

on unemployment.

assume however that the

on output while the second does not. These assumptions are

effect

first

We

has a long

sufficient to just identify the

two

types of disturbances, their time series and their dynamic effects on output and unemployment.

WhUe

the disturbances are defined by the identification restrictions,

we

believe that they can be given

a simple economic interpretation.

We

think of the disturbances that have a long run effect on output as

being mostly productivity shocks.

We

think of the disturbances that have no such long run effect as being

mostly non-productivity-induced demand disturbances.

as well as

We

find this interpretation useful

supported by the results of the paper. For short, (and we hope, not too misleadingly)

these types of disturbances as aggregate supply and aggregate

Under these

identification restrictions

terization of fluctuations:

ment; the

effect

and reasonable,

effect

demand

and

demand disturbances

disturbances have a

hump shaped

effect

peaks after a year and vanishes after two to three years.

respectively.

is

a mirror

on both output and unemploy-

Up

to a scale factor, the

image of that on output. The

in

may

initially increase

unemployment, with a slow return over time to

While

this

contributions of

dynamic characterization

demand and supply

is

its

unemployment. This

the

we

all

NBER

supply

Eifter five

followed by a decline

original value.

fairly sharp,

the data are not as specific as to the relative

disturbances to output fluctuations.

the time series of demand-determined output fluctuations, that

putting

is

dynamic

effect of

disturbances on output increases steadily over time, to reach a peak after two years and a plateau

years. "Favorable" supply disturbances

refer to

economic interpretation, we obtain the following charac-

this

on unemployment of demand disturbances

we

is

On

the one hand,

we

find that

the time series of output constructed by

supply disturbance realizations equal to zero, has peaks and troughs which coincide with most of

troughs and peaks. But, when

we turn

to variance decompositions of output at various horizons,

find that the respective contributions of supply

and demand disturbances are not precisely estimated. For

instance, at a forecast horizon of four quarters,

we

find that,

under alternative cissumptions, the contribution

4

of

demand

disturbances ranges from 30 to 80%.

The paper has

pretation of the disturbances.

of

demand and supply

contributions of

1.

1

discusses identification. Section 2 discusses our economic inter-

Section 4 characterizes the

Section 3 discusses estimation.

disturbances on output and unemployment.

demand and supply

disturbances to fluctuations

in

dynamic

effects

Section 5 characterizes the relative

output and unemployment.

Identification.

We

assume that there

but

may

two types of disturbances

are

long run effect on either

all

Section

five sections.

have a long run

affecting

unemployment and output. The

unemployment or output. The second has no long run

effect

on output.

We

at length in the

next section, we refer to the

first as

As indicated

no

on unemployment,

assume further that these disturbances are uncorrelated

leads and lags. These restrictions in effect define the two disturbances.

and discussed

effect

first heis

at

in the introduction,

demand disturbances and

to the second

as supply disturbances.

We now

and

U

how

discuss

these restrictions identifj- the two disturbances and their

denote the logarithm of

our assumptions imply that the

GNP

first

and the

level of

difference of

dynamic

unemployment, respectively. As

Y AY,

,

and the

level of

will

effects.

Let

Y

be clear below,

unemployment, U, have a

jointly

stationary bivziriate autoregressive representation:

D{L)Xt

where

with

X

denotes the

2x1

vector

=

where D(0)

vt,

\AY

U]'

uncorrelated, with v

=

[vy

vu]

(1) is

circle.

The white

=n

(l)

in lag operators

D{L)

is

noise bivariate vector sequence

of order n,

t;

is

serially

•

Under our assumption that there

equation

I and E{vtvl)

The matrix polynomial

.

determinantal roots outside the unit

all

=

the reduced form of a

are two types of disturbances in the

model which describes the dynamic

economy, demand and supply,

effects of those disturbances

on

output and unemployment. The vector v comprises reduced form disturbances, which are linear combinations

of these

By

model.

demand and supply

disturbances.

specifying the reduced form as above,

We

we have already imposed

a

number

of restrictions on the

have required that neither of the two reduced form disturbances has a long run

effect

on

5

unemplojTnent; this implies

effect

in

turn that neither of the two types of underlying disturbances has a long run

on unemployment. By contrast, since

in equation (1),

it is

the

first

The only

restriction that

disturbances have no long run effect on output. This

demand and supply

The

it is

is

sides of equation (1)

where

is

Ct

by D[L)~^

the vector of

uncorrelated,

=

C{L)vt,

= D{L)-\

where C(L)

e,t

=

We now

Multiplying both

=

so that C{0)

I.

(2)

demand and supply disturbance

A{L)ct

=

demand

loss of generality take the covziriance

e.t]

[cdt

the supply disturbance. Given the assumption that

,

with

e^t

being the demand

demand and supply disturbances

matrix of

e

to be the identity matrix.

disturbances have no long run effect on output implies that aii(l)

show that our model

demand

=

are

The

in equation

disturbances in the output growth equation

just identified

is

from the estimated reduced form. Combining equations

(3) gives:

Xt

Thus, our model

first

Cf

to zero.

We now

and

(3)

disturbances,

In words, the coefficients on current and lagged

must sum

this

demand

gives:

demand and supply

we can without

condition that

The

that

is:

disturbance and

(2)

is

to have

the key assumption that will allow us to identify the

to obtain the moving average representation of the reduced form.

Xt

(3).

is

we have not yet imposed

the other hand, the moving average representation corresponding to our

model

output which appears

disturbances, and to recover interpretable dynamics from the reduced form.

Xt

On

level of

used.

step

first

and not the

we have allowed both reduced form disturbances, and thus both demand and supply,

a long run effect on the level of output.

show how

difference

is

= A[L)et =

just identified

condition states that

if

C{L)vt,

and only

if

where C(0)

=

/,

and E[vtv't)

there exists a unique matrix

=

CI.

S such

that Set

=

^t

and

SS'

=

5

a square root of the covariance matrix of the reduced form disturbances:

is

n, and A{L)

= C[L)S

and aii(l)

=

0.

imposes three restrictions on the four elements of S. The second imposes a linear restriction on the

first

6

column

of S. This

the fourth restriction needed for identification. That restriction

is

<:ii(l)sii

There always

exists a

Identification

is

S

ci2{l)s2i

that satisGes these

=

given explicitly by:

0.

restrictions.''^

thus achieved by using a long run restriction. This raises a knotty technical issue.

is

well-known that,

unique matrix

+

is

in the

It

absence of precise prior knowledge of lag lengths, inference and restrictions on

asymptotic behavior of the kind we are interested

in here

is

delicate.^

More

precisely,

viewed

in

terms of

Fourier transforms, the restriction immediately above operates on a zero measure interval of the range of

frequencies, and so

to

is

especially suspect.

some 5-neighborhood

It is

of frequency zero,

easy however to generalize this restriction to one that applies

and then to perform estimation

in

the frequency domain.

By

imposing that the restriction holds over a frequency band, we would be using an overidentifying rather than

just identifying restriction.

limit of the results

In

its

Under appropriate

regularity conditions,

from frequency domain estimation,

summary, our procedure

is

as follows.

moving average representation, equation

moving average representation

of the

We

(2).

first

We

we can show that our

results are the

as S tends to zero.

estimate the reduced form, equation

then construct the matrix S, and use

demand and supply disturbance model, equation

it

(l),

and derive

to recover the

(3).

^

The proof is as follows. First obtain the Choleski factorization of Cl. Then any matrix .S is an orthonormal transformation of the Choleski matrix. The restriction on the first column imposed by aii(l) =

determines the orthonormal transformation uniquely, up to column sign chcinges. This is the method we

actually use to construct S.

See for instance Sims (1972). We are extrapolating here from Sims's results which assume strictly

We conjecture that similar problems arise in the VAR case. If anything, one would

expect the difficulties to be compounded. Cochrane (1988) has also recognized this.

exogenous regressors.

2.

Interpretation.

Interpreting residuals in small dimensional systems as "structural" disturbances

interpretation of disturbances as supply and

demand

disturbajices

is

always perilous, and our

is

no exception.

We

discuss various issues

in turn.

Granting our assumption that the economy

is

affected

by two main types of disturbances, productivity

and non-productivity-induced demand shocks, one may reasonably argue that even demand disturbances

have long run

effects

on output: changes

affect the saving rate

in the subjective

and the long run capital stock and output. The presence

learning by doing, also raises the possibility that

all

effects

sample.

effects in the

We

may

that of supply shocks, a proposition

we

demand shocks may

consider reasonable, our decomposition

arbitrarily small relative to that of supply, the correct identifying

is

shown

and

of

Even

if

in the technical appendix. This proposition

well have such long run

demand shocks

effects of

are small

compared

to

"nearly correct" in the

is

following sense: in a sequence of economies where the size of the long run effect of

use. This

effects.

well

be sufficiently long lasting to be indistinguishable

believe that

on output. To the extent however that the long run

may

of increiising returns,

demand shocks may have some long run

they do not, their effects through capital accumulation

from truly permanent

discount rate, or changes in fiscal policy

demand shocks becomes

scheme approaches that which we actually

is

the ajialogue in our context to the "near

identification" proposition in traditional approaches to identification.

Granting our assumption that the economy

permanent

effects

is

affected

on output, the other only with transitory

following Prescott (1987), one might instead view the

disturbances,

will

some with permanent and some with

by two main types of disturbances, one with

effects, alternative

economy

as being affected

transitory effects on output.

then identify those two disturbances. While this

is

interpretations are possible:

Our

by two types

of supply

identifying assumptions

not our prefered interpretation,

we

shall briefly discuss

our results under that alternative interpretation below.

This raises a

final set of issues constituting

low dimensional dynamic system.

having different dynamic

effects

problems inherent

Suppose that, there are

in fact

in

estimation and interpretation of any

many

on output and unemployment. Clearly,

some with permanent and some with

sources of shocks, each of

if

there are

transitory effects on output, as well as

many supply

many demand

them

shocks,

shocks,

some

8

with permanent and some with transitory

effects

in aggregate fluctuations, our decomposition

is

likely to

which aU or most supply shocks have permanent

a transitory effect on output.

the

dynamic

demand

effects of

We

in general.

One might hope

show

on output, and

effects

if

they

be meaningless.

on output, and

all

all

play an equally import2int role

A more

or

interesting case

is

able to distinguish correctly

disturbances from those of supply disturbances. This

From

conditions for this separation to occur.

that in

most demand shocks have only

that, in this case, our procedure

is

unfortunately not true

where we establish necessary and

this explicitly in the technical appendix,

is

we

the reasoning in the technical appendix,

sufficient

also see that

there are important sets of circumstances under which our procedure does correctly identify the different

effects of

demand and

must bear a

stable

supply.

dynamic

Roughly speaking, the

Thus

function confronting the different

demand and supply

components

relation to each other, across the individual

individual supply disturbances.

of

different

if

there

demand

is

output and unemployment

demand disturbances and

only one supply disturbance, and there

is

interpretation of shocks

is

we

find to

subject to various caveats.

be not at

We

across the

a stable production

disturbances, our procedure correctly isolates the

disturbances. This particular set of conditions

To summarize, our

in

believe

dynamic

all

it

effects

unreasonable.

nevertheless to

be reasonable, and to be supported by the results presented below.

We now

briefly discuss the relation of

our paper to others on the same topic.

approach relates to the business-cycle-versus-trend distinction

We

first

examine how our

:

Following estimation, we can construct two output series, a series reflecting only the effects of supply

disturbances, obtained by setting

only the effects of

first series,

is

the supply

stationary.

A

demand

By

is

component

demand

disturbances to zero, and a series reflecting

of output, will be non-stationary while the second, the

By

construction, the

demand component,

construction also, the two series are uncorrelated.

in describing

output movements

is

the "business cycle versus trend" distinction.

no standard definition of these components, the trend

that would realize, were

all

actual output around

trend.

A

realizations of the

disturbances, obtained by setting supply realizations to zero.

standard distinction

While there

all

its

precise definition

is

usually taken to be that part of output

prices perfectly flexible; business cycles are then taken to be the dyncimics of

would obviously be tricky but

is

not needed for our argument.

In

models with

9

It is

tempting to associate the

first series

we

construct with the "trend"

component

second series with the "business cycle" component. In our view, that association

are in fact imperfectly flexible, deviations from trend will arise not only

also

from supply disturbances: business

another way, supply disturbances

separately business cycles and trend

is

unwarranted.

and the

If

prices

from demand disturbances, but

cycles will occur due to both supply

will affect

is

of output

and demand disturbances. Put

both the business cycle and the trend component. Identifying

likely to

be

difficult, as

the two will be correlated through their joint

dependence on current and past supply disturbances.

With

this discussion in

mind, we now review the approaches to identification used by others.

Campbell and Mankiw (1987b) assume the existence

of

two types of disturbances, "trend" and "cycle"

disturbances, which are assumed to be uncorrelated. Their identifying restriction

bances do not

affect

unemployment. The discussion above suggests that

between cycle and trend components

is

unattractive;

if

their

this

is

then that trend distur-

assumption of zero correlation

two disturbances are instead reinterpreted

as

supply and demand disturbances respectively, the identifying restriction that supply disturbances do not

affect

unemployment

is

equally unattractive.

Clark (1987b) also assumes the existence of "trend" and "cycle" disturbances, and also assumes that

"trend" disturbances do not affect unemployment but allows for contemporaneous correlation between trend

and cycle disturbances. While

the

dynamic

this

is

effects of disturbances

The paper

closest to ours

is

an improvement over Campbell and Mankiw,

on output and unemployment

nor

demand

on the

of a

as supply

reduced form identical to equation

are difficult to interpret.

(1)

and demand disturbances respectively. By

above, he also assumes that neither supply

disturbances have a long run effect on unemployment, but that both

level of output.

may have

a long run effect

However, instead of using the long run restriction that we use here, he assumes that

supply disturbances have no contemporaneous

way

ways that

severely constrains

that of Evans (1986). Evans assumes two disturbances, "unemployment"

and "output" disturbances, which can be reinterpreted

assuming the existence

in

it still

of achieving identification;

it

effect

on output.

We

find this restriction less appealing as a

should be clear however that our paper builds on Evans' work.

imperfect information, this would be the path of output, absent imperfect information. In models with

nominal rigidities, this would be the path of output, absent nominal rigidities. In models that assume

market clearing and perfect information, such as Prescott (1987), the distinction between business cycles

and trend is not a useful one.

10

Estimation.

S.

One

problem needs to be confronted before estimation.

final

assumes that both the

around given

level of

possibility

is

in

the US. This raises a

that, in fact,

hysteresiB studied by

We

A

second possibility

bances.

The

first,

if

Summers and coauthor

do not consider

is

it

number

unemployment

disturbances, or by both. This might occur

approach.

difference of the logarithm of

first

The unemployment data suggest however

levels.

over the post war period

One

unemployment and the

The representation we use

for

a small secular increase in

This would require an altogether different modeling

(1986).*

that there are, in addition to

which might include changes

demand

in productivity,

in the

disturbances, two types of supply distur-

has long run effects on output but not on

composition of the labor force, changes in

is

substantially

more

is

what we do below, by

using the residuals to estimate equation

unemployment

of

(1).

first

regressing

of results, those obtained

removing

this

this is the case,

is

than what we want to do.

one strategy

A

short cut,

to allow for a deterministic time trend

unemployment on a

The estimated time trend

3.6% over the post war period. As we

If

from demand and two from supply, and

difficult

equilibrium unemployment drifts slowly through time,

unemployment. This

unemployment

further here.

characterize their dynamic effects. This

in

are stationary

example the economy were characterized by the type of

to postulate the existence of those three disturbances, one

if

(l)

permanently affected by either supply or demand

is

search technology and so on, does have long run effects on unemployment.

acceptable

GNP

equation

of issues.

unemployment. The second, which might include changes

would be

in

and

implies an increase in equilibrium

find this estimate to

be high,

estimated trend from unemployment (which

removed" case below), those obtained removing a trend with slope equal

linear time trend

we

we

report three sets

shall call the "trend

to half of the estimated value ("half

trend removed"), and those obtained not removing any trend ("no trend removed").

We estimate

1950-2 to 1987-2.

twelve lags with

the

*

first five

We

equation

We

little

(l)

using quarterly data for real

GNP

and the aggregate unemployment rate from

present the results of estimation allowing for eight lags.

difference Ln the results.

years, as the

We

also

(We performed estimation with

experimented with estimating the system omitting

Korean War era seems anomalous. Again, the empirical

results

remain practically

understand their argument as applying more to Europe than to the post war US.

11

unchajiged.)

to

Evans

The system

is

the

same

as that estimated

We

for a description of the characteristics of the estimated autoregressive system..

interpreting the dynamic effects of supply cind

4.

by Evans, with a longer sample; we refer the reader

Dynamic

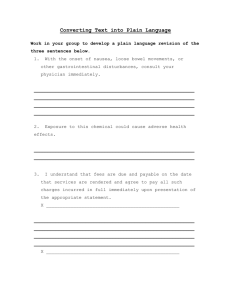

The dynamic

effects of

effects of

demand

demand and supply

disturbances.

disturbances.

demand and supply disturbances

and

are reported in Figures 1

correspond to the case where half of the estimated unemployment trend

The corresponding

before estimation of the joint process.^

directly turn to

is

These

2.

figures

removed from unemployment

figures for the other

two cases are

for the

most

part simil2ir, and are given in the Appendix. Differences between the three sets of results will be pointed out

in the text.

The upper part

of Figure

on output and unemployment.

unemployment on the

now with one standard

The

Y

scale for the logarithm of

unemployment

other;

we

is

is

given on the

of the

the scale for

left,

gives point estimates of the

dynamic

effects

dynamic responses, but

hump shaped

effect

on output and unemployment.

depending on the treatment of the unemployment trend. The

fully

The

size of the effect

removed. The responses

effects are consistent

on output and unemployment,

in

in

on output

is

Their

effects of

largest in the case

effects

peak

demand then

when

the trend

output and unemployment are mirror images of each

with a traditioneJ view of the dynamic effects of aggregate

which movements

in

aggregate

demand

build

up

until the

demand

adjustment of

and wages leads the economy back to equilibrium.

Supply disturbances have an

effect

on the

level of

output which cumulates steadily over time.

We have chosen to present the figures for this case in the text not because we

because the results are -not surprisingly- in between those of the two other cases.

in

demand disturbance

return to this aspect of the results below after discussing the effects of supply disturbances.

These dynamic

prices

1

output

effects of a

deviation bands around those estimates.®

decline to vanish after 8 to 14 quarters.

in

dynamic

and U. Figure 2 again provides point estimates

disturbances have a

after 2 to 4 quarters,

gives point estimates of the

right. Similarly, the lower part of Figure

of a supply disturbance on

Demand

1

like it

The

best but simply

More precisely, these figures give the square root of mean squared deviations from the point estimate

1000 bootstrap replications. Thus, the bands need not be and indeed are not symmetric. In every case,

entire pseudo-histories are created by drawing with replacement from the empirical distribution of the VAR

mnovations. These calculations were performed using a combination of RATS and S on a Sun workstation

running UNIX BSD 4.2.

responses

to

demand

CD

d

CNJ

d

C\J

d

--0.5

to

10

30

20

responses

to

40

supply

m

d

LO

d

LO

10

20

30

40

output response to

demand

output response to supply

o

CM

^

CM

q

LO

CO

o

?\

>

'

CD

d

^

o

/•

•

\'^

V,

'

1-

\

^

/•

v.\

;.

'•.....

/•

q

-

•

'l

^-

/• /

_

•

^

C\J

d

-

,'

w \\

>

IT)

/

/•

C\J

1

/

^

\

1

/

d

•

\

d

/

1

10

1

1

1

20

unempi response

1

30

to

1

1

q

o

40

1

,

1

10

1

1

.

20

demand unempi response

o

d

J

30

1

u

40

to supply

CM

d

o

d

CM

d

CM

d

d

CD

d

d

10

20

30

40

10

20

30

40

12

peak response

is

about two to three times the

initial effect aind tiikes

decreases to stabilize eventually at two thirds of

its

quite different: a positive supply disturbance (that

may

on output)

a few quarters,

initially increase

The response

of

Nominal

real.

rigidities

to maintain constant

new higher

Figure

as

can explain

demand does

employment;

unemployment

is,

why

to

its

Eire

in

original steady state value.

by about

reversed after

The dynamic

effects of

response to a positive supply shock, say an increase in

wage

real

rigidities

can explain

which persists

why

increases in productivity can lead to

until real

wages have caught up with the

1

also sheds interesting light

on the relation between changes in unemployment and output known

yields a coefficient of -2.4, the absolute value of

is

a

mongrel

which

coefficient, as the joint

is

output on annual changes

in

known

as

suggests that there

indeed a tight relation between output and unemployment.

implied coefficient

is

is

roughly equal to

2,

its initial

rise or fall; in

coefficient.

disturbances

exactly what

In the short run, output increases,

unemployment and output deviations

are of opposite

of the coefficient

than Okun's

is

close to 4, higher in absolute value

is

higher for supply disturbances than for

demand

expect. Supply disturbances are likely to affect the relation between output

and employment, and to increase output with

we return

of the

unemployment

of the implied coefficient

we

The absolute value

1

the long run, output remains higher whereas by assumption

That the absolute value

is

Under

lower than Okun's coefficient. In the case of supply disturbances,

value. In the intervening period,

and the absolute value

coefficient.

economy. In the case of demand disturbances. Figure

no such close relation between output and unemployment.

unemployment may

Okun's

in

behavior of output and unemployment

of disturbance affecting the

Finally,

effect

suggestive of the presence of rigidities, both nominal

depends on the type

sign,

run

is

not initially increase enough to match the increase in output needed

after a few quarters,

our interpretation, this coefficient

returns to

unemployment

level of productivity.

unemployment

is

effect

five years.

Okun's Law. In our sample, a regression of annual percentage changes

there

in

The

a supply disturbance that has a positive long

are largely over

unemployment and output

productivity, aggregate

a decrease Ln

unemployment

peak value. The dynamic response

slightly. If this increase occurs, the effect is

and unemployment slowly returns

a supply disturbance on

and

unemployment

place after eight quarters.

little

or

no change

in

employment.

to the issue of alternative interpretations of the data.

Suppose

for

example that the

13

two disturbances we have

effects,

isolated were in fact both supply disturbances, the first having only

the second having permanent effects, and that

all

the behavior of output and

unemployment

in

What

markets cleared under perfect information.

interpretation could be given to the djTiamic responses given in Figure 1?

bances should lead to strong intertemporal substitution

temporary

effects

Temporary productivity

distur-

on labor supply, and this clearly could explain

the upper part of Figure

1.

As permanent disturbances

to

productivity cumulate over time, this could explain the dynamic effects of the disturbances on output in the

lower part of Figure

1.

The

anticipation of higher productivity later

would induce workers,

in reaction to

a positive innovation in productivity, to intertemporally substitute away from current work toward work in

the future; this would explain the initial increase and the subsequent decline in

absence of more information, the dynamic

interpretations.

effects

presented in Figure

1

unemployment. Thus,

in

the

are clearly susceptible to alternative

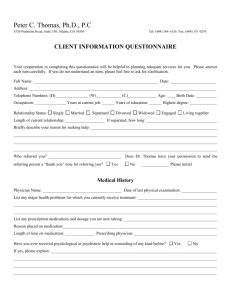

Output fluctuations absent

Demand

CO

C\J

CO

o

CO

CO

r-*

CO

->;};

o

1950

1960

1980

1970

Output fluctuations due

to

1990

Demand,

CD

O

CM

O

o

CD

O

1950

1960

1970

1980

1990

Unemployment

1950

1960

Unemployment

fluctuations

absent Demand.

1980

1970

fluctuations

due

to

1990

Demand,

CO

OJ

o

C\J

CO

1950

1960

1970

1980

1990

14

Relative contributions of

5.

Having shown the dynamic

demand and supply

effects of

disturbances.

each type of disturbance, the next step

contribution to fluctuations in output and unemployment.

and

entails a

comparison of the

We

historical time series of the

do

this in

is

to assess their relative

two ways. The

demand component

of

first is

informal,

output to the

NBER

chronology of business cycles. The second examines variance decompositions of output and unemployment

in

demand and supply

a.

Demand

disturbances at various horizons,

distwrbcinceB and

NBER

buBiness cycles.

estimation of the joint process for output and unemployment, and our identifying restrictions, we

PYom

can compute the demand components of output and unemployment. These are the time paths of output and

unemployment that would have obtained

innovations to zero,

From

we can generate

demand component

and supply components

The time

series

4 (unemployment).

historical

are

of

absence of supply disturbances. Similarly, by setting

the time series of supply

in the level of

unemployment

output

The upper panel

as vertical lines

is

output and unemployment.

long run effect on output, the resulting

stationary.

corresponding to the "half-trend removed" case

By

the

same token, both the demand

is

presented in Figures 3 (output) and

presents the historical supply component, the lower panel presents the

above the horizontal

All three assumptions about the trend in

component

is

in

demand

are stationary.

demand component. Superimposed on

drawn

components

demand disturbances have no

the identifying restriction that

series of the

in the

quite large, approaching

5%

these time series are the

axis,

NBER

peaks and troughs. Peaks

troughs as vertical lines below the axis.

unemployment

yield qualitatively similar results.

The demand

on each side of the origin. (The demand component

is

larger on

average in the "trend removed" case.)

The peaks and troughs

The two

in

of the

demand component

in

output match closely the

recessions of 1974-1975 and 1979-1980 deserve special mention.

NBER

peaks and troughs.

Our decomposition

about equal proportions to adverse supply and demand disturbances. This

estimated values of the supply and demand innovations over these periods:

is

best

attributes

them

shown by giving the

15

The

73-3

73-4

74-1

74-2

74-3

74-4

75-1

Cd

-0.1

0.2

-0.8

0.9

-1.4

-1.2

-3.0

e.

-1.6

-0.1

-1.0

-1.1

-1.4

0.4

1.2

79-1

79-2

79-3

79-4

80-1

80-2

Cd

-0.7

1.1

0.3

-0.4

-0.4

-3.1

e.

-0.6

-2.0

0.5

-0.9

0.9

-0.9

recession of 1974-75

of negative

demand

is

therefore explained

by an

initial string of

Similarly, the 1979-80 recession

disturbances.

negative supply disturbances, and then

is

first

dominated by a large negative

supply disturbance, and then a large negative demand disturbance. Without appearing to interpret every

single residual,

It

may

we

find these estimated sequences of

also simply be that the supply disturbances of these

supply disturbances, such as changes

short-run contractionary

they

as

may look more

demand

like

effect,

in

output and increases

demand disturbances under our

quite plausible.

two periods were different from typical

which dominate the sample.

in productivity,

with both declines

in

They had a stronger

unemployment. As a

identification restrictions,

and are therefore

result,

classified

disturbances.^

Notice that the supply component

deterministic trend.

to the supply component).

demand component

in

output, presented in the upper panel in Figure

Unemployment

GNP. This

of

demand components

is

oil

unemployment

in

unemployment

fluctuations due to

(the time trend

demand correspond

not a

demand

The model

disturbances.

is

added back

closely to those in the

consistent with our earlier finding on the mirror image

responses of unemployment and output growth to

fluctuation in

3, is clearly

exhibits slower growth in the late 1950's, as well as in the 1970's.

It

Figure 4 gives the supply and

time of the

demand and supply disturbances

moving average

attributes substantial

to supply disturbances, again with increases in the late 1950's

and around the

disturbances of the 1970'e.^

This suggests extending the analysis to incorporate information from another variable. That variable

would be chosen so that it itself is likely to react differently to supply and demand disturbances. Obvious

candidates would be the price level or the relative price of raw materials. In Blanchard and Watson (1986),

evidence from four time series is used to decompose fluctuations into supply and demand disturbances. There

the recession of 1975

demand and supply disturbances,

we reestimated the model, leaving

attributed in roughly equal proportions to adverse

is

demand disturbances.

The estimated dynamic

that of 1980 mostly to

In view of those results,

out 1973-1 to 1976-4.

effects of

both demeind and supply disturbances were nearly

identical to those described above.

By construction, the supply component of unemployment is close to actual unemployment for the first

few observations in the sample. Thus, the large decrease from 1950 to 1952 in the supply component simply

reflects the actual

movement

from 1955-2 through the end

in

of

unemployment

our sample.

We

in this period.

found

little

In light of this,

change

we re-estimated the model

in the empirical results.

16

b.

Variance decompositions.

While the above empirical evidence

computing variance decompositions

Tables

1

through

unemployment

the

is

for

suggestive, a

more formal

output and unemployment at various horizons.

3 give those variance decompositions,

under the three alternative assumptions about

trend. These tables have the following interpretation. Define the k quarter-ahead forecast

error in output as the difference betvifeen the actual value of output and

This forecast error

of k quarters earlier.

the last k quarters.

The number

for

one hundred minus that number.

in

output

at horizon

k,k

=

1,

.

.

,

.

forecast from equation (1) as

in

40 gives the percentage of variance of

The contribution

of supply,

similar interpretation holds for the

not reported,

numbers

parentheses are standard deviations. ° The results are given for

unemployment

Our

A

its

due to both unanticipated demand and supply disturbances

is

the /c-quarter ahead forecast error due to demand.

numbers

assessment can be given by

statistical

all

for

given by

is

unemployment. The

three assumptions about the

trend, as there are important differences across these alternative hypotheses.

identifying restrictions impose only one restriction on the variance decompositions,

namely that

the contribution of supply disturbcinces to the variance of output tends to unity as the horizon increases.

All other aspects are unconstrained.

Two main

First, the

conclusions emerge from these tables.

data do not give a precise answer as to the relative contribution of demand and supply distur-

bances to movements in output at short and medium term horizons. The results vary with the treatment of

the

unemployment

30%

trend: the relative contribution of

(no trend removed) to

reason for this

may

82%

demand

disturbances, four quarters ahead, ranges from

(trend removed); eight quarters ahead,

be seen by comparing Figure

1

in the

demand disturbances

are smaller,

still

ranges from

13%

to

50%. The

with the corresponding Figures in the Appendix, derived

under alternative assumptions about the unemployment trend.

effects of

it

and the

effects of

While they are qualitatively

similar, the

supply disturbances are stronger and quicker,

"no trend removed" case.

Even

for a given

assumption about trend, the standard deviation bands are

the "half trend removed" case, the one standard deviation

band on the

large.

For example, in

relative contribution of

Again, these standard errors are asymmetric, and obtained as described above.

demand

Table

1.

Variance decomposition of output and unemployment

(no unemployment trend removed)

Percentage of variance due to demand:

Output

Horizon

Unemployment

(Quarters)

35.8

100.0

(22.3, 37.6)

(22.3, 0.0)

40.5

96.0

(24.8, 35.3)

(25.4, 2.8)

1

2

35.5

89.0

(22.1, 37.3)

(24.8, 7.8)

3

30.1

80.5

(19.0, 38.4)

(22.4, 13.8)

4

8

(

(

4.0, 31.7)

(

1.5, 14.6)

12

2.

(12.8, 36.7)

37.5

8.4

40

Table

50.1

13.0

6.9, 36.7)

(

6.6, 47.3)

(

3.7, 54.1)

29.5

2.9

Variance decomposition of output and unemployment

(Half trend removed)

Proportion of variance due to demand:

Output

Horizon

nemployment

(Quarters)

57.6

95.5

(21.4, 24.1)

(24.8, 3.2)

1

2

62.1

98.7

(22.3, 21.6)

(27.2, 0.9)

56.7

97.6

(21.2, 23.4)

(26.0, 1.4)

3

4

50.3

93.8

(20.0, 24.4)

(23.4, 3.7)

8

23.9

68.1

(10.4, 25.3)

(13.5, 20.8)

12

54.0

15.4

6.3, 20.2)

(

40

(

9.3, 31.9)

(

7.8, 36.3)

48.6

6.4

(

3.1, 6.8)

Table

3.

Variance decomposition of output and unemployment

(trend removed)

Proportion of variance due to demand:

Horizon

Output

Unemployment

(Quarters)

1

2

3

4

8

12

40

86.4

73.2

(22.8, 8.3)

(20.0, 15.2)

89.8

83.7

(23.5, 6.3)

(27.2, 8.7)

86.5

89.9

(24.2, 7.9)

(30.3, 5.5)

81.8

93.2

(25.7, 9.2)

(30.7, 3.4)

49.5

86.6

(19.6, 14.6)

(23.8, 6.6)

34.0

77.2

(14.7, 12.2)

(19.1, 11.4)

15.9

73.5

[17.6, 13.2)

17

30%

disturbances four quarters ahead ranges from

to

49%.

At longer horizons, the contribution

to

75%. Eight quarters ahead,

demand disturbances

of

it still

14%

ranges from

goes to zero by construction;

it

is

typically small after four years.

The second main conclusion

is

that the contribution of

medium term

substantial and more precisely estimated, at short and

disturbances contribute between

80% and 90%

of the variance of

contribution, eight quarters ahead, varies between

"half trend

removed" case ranges from 60%

ahead. There

is

to

demand disturbances

98%

50%

to

to

unemployment

more

is

demand

horizons. In all three cases,

unemployment four quarters ahead;

87%. The one standard deviation band

four quarters ahead, and from

considerable uncertainty as to the relative contribution of

55%

to

89%

their

in

the

eight quarters

demand and supply

disturbances

at long horizons.

6.

Conclusion.

We

have assumed the existence of two types of disturbances generating unemployment and output dynamics,

the

first

type having permanent effects on output, the second having only transitory

effects.

We have

argued

that these two types of disturbances could usefully be interpreted as productivity and non-productivity

induced demand shocks respectively,

we have concluded

which disappears

demand disturbances have

that

after

or, for short, as

supply and demand shocks. Under that interpretation,

a

hump shaped

make

on output and unemployment

approximately two to three years, and that supply disturbances have an

output which cumulates over time to reach a plateau after

disturbances

effect

five years.

We

effect

on

have also concluded that demand

a substantial contribution to output fluctuations at short and

medium term

horizons;

however, the data do not allow us to quantify this contribution with great precision.

Our

identifying restrictions allow us to ask interesting questions of the

that have permanent effects.

component

to be a pure

While we

two

These questions cannot be addressed by studies that

and

specific extensions.

effects of disturbances

restrict the

permanent

random walk.

find this simple exercise to have

especially to validate

dynamic

refine

The

been worthwhile, we also believe that further work

our identification of shocks as supply and demand shocks.

first is to

We

is

have

needed,

in

mind

examine the co-movements of what we have labeled the demand and

18

supply components of

GNP

with a larger set of macroeconomic vaxiables.

confirm our interpretation of shocks.

We

find in particular the supply

positively correlated with real wages at high to

medium

demand component.^" The second

to enlarge the

extension

is

Preliminary results appear to

component

of

GNP

to be strongly

frequencies, while no such correlation emerges for the

system to one

in four Vciriables,

unemployment,

output, prices and wages. This would re-examine the empirical questions in Blanchard (1986), by using the

long run identification restriction developed in this paper.

This extension appears important; one would

expect that wage and price data will help identify more explicitly supply and

the

The methodology and results

sum of correlations from lags

will

be described

-5 to

in

+5 between

innovations in real wages obtained from univariate

demand

disturbances.

a future paper. The statement in the text refers to

the supply innovation derived in this paper and the

ARIMA

estimation.

19

Technical Appendix

This technical appendix discusses further and establishes the claims

made

in the section

on interpreta-

tion.

First,

asserted in the text that our identification scheme

we

approximately correct even when both

is

disturbances have permanent effects on the level of output, provided that the long-run effect of

output

is

The

small.

first

We now

prove

demand on

this.

element of the model, output growth, has the moving average representation

in

demand and

supply disturbances:

AV; = aii(L)edt

where aii(l)

is

+

ai2(i)e,<

Y

the cumulative effect on the level of output

of the disturbance ej.

representation C{L), together with the innovation covariance matrix

fl, is

The moving average

related to our desired interpretable

representation through some identifying matrix S, such that:

SS'

The model

is

identified

=

demand disturbance be

6 instead,

in the

is

where

implied identifying matrix from that which

thus seen to be a finite-dimensional problem, any matrix

that

In the paper,

implies a different identifying matrix S(S). Let |S'((5)-.S(0)|

measures the deviation

is

C{L)S.

we

selected the unique

0.

Let the long-run effect of the

S, this

=

and A{L)

n,

by choosing a unique identifying matrix S.

matrix S such that aii(l)

For each

=

norm

>

6

=

without

we

maxy,*:

loss of generality.

(5'y*:((5)

use. Since the

will induce the

-

5'yfc(0))

;

this

approximation

same topology, which

is all

needed to study the continuity properties of our identification scheme. All of the empirical results

vary continuously

in

S

relative to this topology. Thus,

|5'(<f)

In words,

if

an economy has long-run

-

effects in

5(0)1

correct point estimates.

—

demand

scheme which incorrectly assumes the long-run

it is

sufRcient to

as

,5

—

show that

0.

that are small but different from zero, our identifying

effects to

be zero nevertheless recovers approximately the

20

We

prove this as follows.

orthogonal matrix

V [6)

Since both 5(0) and S(6) are matrix square roots of

the long-run effect of

demand

is

the

A{1;6)

But

recall that the

and

of supply on the level of output,

for

there exists an

such that:

S(6)=S(0)V(S),

Then

Cl,

elements of the

first

(1, 1)

=

of

=

C{l)S(0)V(6).

C(l)5(0) are respectively, the long-run

when the long-run

any V{S), the new implied long-run

effect of

I.

element in the matrix;

C(l)S{6)

row

V[S)V(Sy =

y/here

demand

effect of

is

demand

identifying assumption that the long-run effect of

demand

is

demand

effects of

Thus

restricted to be zero.

simply the long-run effect of supply (under our

is

zero) multiplied

by the (2,2) element of the

orthogonal matrix V[6). As 6 tends to eero, the (2,2) element of V{6) tends continuously to zero as well.

V [S)

But, up to a column sign change, the unique

This establishes that S[6)

S -* 0.

—

5(0), element by element. Hence,

»

we have shown that

is

the identity matrix.

\S[S)

—

5(0)

—

as

»

|

Q.E.D.

Next, we turn to the effects of multiple

vector of

demand disturbances

fdt,

and a

\Ut

where

with (2,2) element equal to zero

B-jk are

dimension

column vectors

as /,,

and Bii{z]

=

J

p,

demand and supply

-

x

1

disturbances: Suppose that there

vector of supply disturbances

V^2:(L)'

—

z)Pii{z), for

z.

pd

"x

1

so that:

B22(Lyj {f,tj

of analytic functions; Bji has the

(1

f,t,

is

some vector

same dimension

as /j, Bj2 has the

of analytic functions fin.

same

Each disturbance

has a different distributed lag effect on output and unemployment.

Since our

VAR

immediate that we

To

results.

method

allows identification of only as

will not be able to recover the individual

clarify the issues involved,

Suppose that there

Suppose further that the

is

first

we provide an

explicit

many

components

of /

=

it

is

(/^ /^)'.

example where our procedure produces misleading

only one supply disturbance and two

demand disturbance

disturbances as observed variables,

demand

affects only output,

disturbances: fdt

whOe

the second

=

{fdi,t, id2,t]'-

demand disturbance

21

affects only

assume that the true model

An

unrestricted

calculations in

calculations

The supply disturbance

unemployment.

VAR

representation corresponding to this data generating process

be found

Formally,

is:

Rozanov (1965) Theorem

may

both output and unemployment.

affects

in

Essay IV

in

10.1 (pp.

Quah

1

-(^

44-48).

(1986).)

is

found by applying the

(A slightly more readable discussion of those

The implied moving average representation

is:

1

^-'-'-

^'V")"'

straightforward to verify that the matrix covariogram implied by this moving average matches that of

It is

the true underlying model. Further, the unique zero of the determinant

the unit circle.

Therefore this moving average representation

is,

is 2,

and consequently

lies

outside

obtained from the vector

as asserted,

autoregressive representation of the true model.

However,

this

moving average does not

satisfy our identifying

has only transitory effects on the level of output.

This moving average representation

disturbances [fdi, jd2>

/.)•

is

We

assumption that the "demand" disturbance

therefore apply our identifying transformation to obtain:

what we would recover

if

in fact

Notice that while the supply disturbance

the data

/,

affects

is

generated by the three

both output growth and

unemployment equally and only contemporaneously, we would

identify e, to have a larger effect on output

than on unemployment, together with a distributed lag

on output. Further a positive demand

effect

turbance, restricted to have only a transitory effect on output,

is

seen to have a contemporaneous negative

impact on unemployment. In the true model however, no demand disturbances

ment

affect

output and unemploy-

together, either contemporzmeously or at any lag. In conclusion, a researcher following our bivariate

procedure

is likely

to be seriously misled

we

disturbances. Having seen this,

and

dis-

explicitly

We

when

in fact the true

underlying model

is

driven by more than two

ask under what circumstances will this mismatch in the

number

modeled disturbances be benign?

state the necesseiry

and

sufficient conditions for this as a

Theorem which

is

proved below.

of actual

22

Theorem:

(i.)

(ii.)

(iii.)

(v.)

(vi.)

fvii.j

=

X,

ft

=

X

Let

5(L)/t

(fat

I

with /d pd X

.

if

A;

(x.)

and

0,

/. p.

X

otherwise

1

;

;

pii, B21, B12, B22 are column vectors ofanaJytic functions;

55*

ranJc

is fuii

A[z)

—

011(2)

Ct

=

—

(1

=

=

\z\

1,

wiiere

exists a bivariate

^^,

{

on

^^1

I

I,

\

], **'j"ti

\

°ni

^12)

^121) '^22

z)qii(2), with Qii analytic on

=

EtfCt-k

I

if

k

=

Q,

Pn

and B21 Pd x

1,

-^12 aiid

^22

P«

X

1

,'

denotes complex conjugation followed by transposition.

*

moving average representation

022(2)/

y 021(2]

(ix.)

=

1,

= [\-z)p,,[z);

B,,{z)

Then there

(viii.)

;

f',t)'

=

Eftft-k

be a bivariate stochastic sequence generated by

and

\z\

<

X, Xt

for

=

scalar functions, det

yl

A[L)et, such that:

^

for all

\z\

<

1;

and

1;

otherwise.

is

\e.t J

In the bivariate representation, e^

if

and only

if

(i.)

-

(vii.)

and unemployment. There

f,,

and

t, is

orthogonal to

B21

=

li.

622

=

I2

•

and

Jags

B12.

axe pj

demand and

p,

supply disturbances;

tlie

(v.)

disturbances have only transitory effects on the ievei of output.

VAR

fd, at aJi ieads

/i5ii,

describe the true data generating process for

condition that allows the existence of a

by our

orthogonal to

there exists a pair of scalar functions 71, 72 such that:

Conditions

demand

is

procedure

is

described by

VAR mean

(viii.)

-

square approximation.

(x.):

the

observed data

in

output growth

expresses the requirement that

Condition

(vii.)

is

a regularity

The moving average recovered

Theorem guarantees that

there always exists such

a representation.

The second part

of the

Theorem

establishes necessary

and

sufficient conditions

such that the bivariate identification procedure does not inappropriately confuse

turbances. In words, correct identification

is

possible

if

and only

if

on the underlying model

demand and supply

dis-

the individual distributed lag responses

23

in

output growth and unemployment axe

mean

across the different supply disturbances. This does not

and unemployment across demand disturbances must be

up

sets of circumstances

there

in general

a bivariate procedure

dynamic responses

that the

demand component

components

in

in the level of

in

interpretations below.

output growth

identical or proportional, simply that they differ

disturbances. Suppose further that each of the

output has the same distributed lag relation with the corresponding

Then our procedure

is

consistent with our 'production function'-based

correctly distinguishes the

dynamic

(i.)

-

(vs.),

the matrix epectriLl density of

of whose elements are analytic, with det

moving average

in

Roianov

C^

for

\z\

X

is

(1965), there exists a 2

<

1,

and Sx

C

=

CC

M whose second column

length

1,

as a vector.

is

A =

Then

the transpose of the Brst

CM

(1

- zHaiip +

-

z)aiia*i

tiat on

be orthogonal to

\z\

=

1:

(a.)

\a,,\^=P[AP[S;

(b.)

\a,2?

= B[,{B[^y;

/,,

and

e, to

on

=

\z\

from

(ix.)).

row of C evaluated

+

A

This represents

1.

VAR mean

its

Form

at z

has been constructed so that on

lai^r

=

|1

- ^r^li

aisa'j

=

(l

-

=

5^1 (S2i)*

ksiP +

to

matrix function C, each

2

=

the

1,

first

2x2

|a22|2

(^li)'

z)^[^ (B^ J*

be orthogonal to f^ at

+

all

+

B[, {B[,)'

+ B[^ (S^J*

5^2 (522)*

leads

and

\z\

square

(demand)

orthog-onaJ

normalized to have

provides the moving average representation satisfying

For the second part of the Theorem, notice that

|1

x

5(z)5(z)*|, .j.

need not satisfy the condition that the

disturbance have only transitory impact on the level of output (condition

matrix

=

given by Sx{i^)

unit variance orthogonal white noise, obtainable

in

approximation. However such a moving average

e<f

demand and supply

effects of

output and unemployment.

reasoning analogous to that in pp. 44-48

as a

misleading, there are important and reasonable

is

demand

unemployment. This cissumption

Proof of Theorem: By

For

in

under which our technique provides the "correct" answers. For instance, suppose that

only one supply disturbance but multiple

is

demand components

X

disturbances, and

to a scalar lag distribution.

Thus even though

By

demand

sufficiently similcir across the different

=

(viii.)

-

(x.).

1:

;

;

.

lags, it is

necessary and sufficient

24

(c.)

aiiaji

=

fi'ii

(d.)

012022

=

-012 (-^22)

(f.)

\a22?

=

[B2S

;

>

B!,^(B'^^y.

Consider relations

(a.),

(c),

and

Denoting complex conjugation of

(e.).

B

by B, the triangle inequality

implies that:

y=i

j=i

where the inequality

is

B21

strict unless

is

a

complex scalar multiple of

Pn

for each z on

=

\z\

Next, by

1.

the Cauchy-Schwasz inequality,

again y/ith strict inequality except

when B21

is

a

complex scalar multiple of Pn,

for each z on

\z\

=

1.

Therefore:

|aiia2il^

where the inequality

is

strict

A

if

and only

similar argument applied to

there exists

Q.E.D.

some complex

lo^iil^

except when B21

strict inequality is a contradiction as

simultaneously satisSed

^

if

(b.),

an

a

^22^,

on

and

\z\

=

1,

complex scalar multiple of fin on

and 022 axe just scaiar

there exists

(d.),

is

•

/"unctions.

Thus

some complex scalar function

(f.)

|r|

(a.), (c),

')i{z)

=

and

scalar function ')2(^] such that B22

=

72

Bi2-

if

tiie

(e.)

can be

=

7i -^ii-

such that B21

shows that they can hold simultaneously

But

1.

and only

if

This establishes the Theorem.

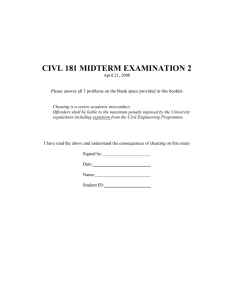

responses

to

demand

CD

O

d

CM

o

10

20

responses

40

30

to

supply

LO

LO

d

LO

d

LO

10

20

/]o

40

30

UA^twployrv^jii^

tre^nd

^^^lov^J,

responses

demand

to

Ln

*

o

o

o

0.1

0.0

-0.1

•

un

o

_

-0.2

-0.3

/•

\

/

\

-0.4

/

\

S

f

-0.5

-0.6

LO

10

20

responses

30

to

40

supply

in

LO

CJ

o

o

LO

O

LO

10

20

30

^n empf oy^vvOvt

40

^'^^-^

^rvtove^^

25

References

Blanchard, Olivier, "Wages, Prices, and Output:

An

Empirical Investigation,"

mimeo MIT,

1986.

Blanchard, Olivier and Mark Watson, "Are business cycles all alike?" in "The American business cycle;

NBER and University of Chicago Press, 1986, 123-156.

continuity and change", R. Gordon ed,

Cochrane, John, "How big

Economy

is

the

random walk component

in

GNP

?",

forthcoming Journai of Political

1988.

Campbell, J.Y. and N.G. Mankiw, 'Are Output Fluctuations Transitory?"

nomics, November 1987, 857-880.

Quarteriy JournaJ of Eco-

Campbell, John and N. Gregory Mankiw, "Permanent and transitory components

AER Papers and Proceedings, May 1987, 111-117 (b).

in

macroeconomic

fluctuations",

Clark, P.K.

November

"The Cyclical Component

,

in

US Economic

Activity,"

Quarter/y Journai of Economics,

1987, 797-814 (a).

Clark, Peter, "Trend reversion in real output and unemployment" forthcoming Journai of Econometrics,

,

1987

(b).

Evans, George, "Output and unemployment

in

the United States", mimeo, Stanford, 1986.

Nelson, Charles and Charles Plosser, "Trends £ind random walks

of Monetary Economics, September 1982, 10, 139-162.

in

macroeconomic time