paper department economics technology

advertisement

Mil;

3

^OfiO

LIBRARIES

0074^35

vorking paper

department

of economics

Breach of Trust in Takeovers

and the Optimal Corporate Charter

Monlka Schnitzer

No.

92-10

Feb. 1992

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

Breach of Trust in Takeovers

and the Optimal Corporate Charter

Honlka Schnltzer

No.

92-10

Feb. 1992

Breach of Trust

in

Takeovers

and the Optimal Corporate Charter

Monika Schnitzer*

First draft:

May

1991

This version: February 1992

University of Bonn, visiting scholar at the Massachusetts Institute of Technology.

This paper is based on Chapter 4 of my dissertation which was written within the European Doctoral Program in Quantitative Economics at Bonn University. I am grateful to

participants of the Tilburg Conference on Information Economics and seminars at Boston

University, MIT, University of Pennsylvania, University of Princeton, University of California at San Diego and University of California at Berkeley. I want to thank in particular

David Canning, Oliver Hart, Bengt Holmstrom, Georg Noldeke, Klaus Schmidt and Urs

Schweizer for many helpful comments and discussions. The usual disclaimer applies.

*

Abstract: This paper analyzes

how takeovers and takeover defenses

target companies, using an incomplete contracts framework.

We

affect the value of

consider a raider

who

intends to improve the efficiency of production and to appropriate the rents enjoyed by

stakeholders of the company. Anticipating this rent shifting the stakeholders invest too

little in

focus

cies.

relationship specific assets which

is

We

may

the ex post value increase.

Our main

on how the corporate charter should be designed to mitigate these

inefficien-

offset

show that shareholders can use poison

pills

and golden parachutes to solve the

underinvestment problem without forgoing profitable takeovers.

JEL

Classification Nos.: 026, 611, 511.

Keywords: Takeovers, Incomplete Contracts, Poison

Address of the author:

Monika Schnitzer

Department

of

Economics, E52-371

Massachusetts Institute of Technology

Cambridge,

USA

MA

02139

Pills.

1

The takeover wave

Introduction

of the eighties has roused a very controversial debate on their pros

cons. Proponents of a liberal takeover policy argue that takeovers are important to

and

company more efficiently and

reorganize a

But a number

to discipline or even replace sluggish managers. 1

of critics have challenged this view. Their

main objection

is

that takeovers

are often used to appropriate rents enjoyed by stakeholders, like workers, managers or

suppliers of the firm.

2

This "breach of trust", so the argument, has negative implications

not only for the stakeholders, but also for the owners of the company. However,

unclear

why

The

rents.

make huge

exactly shareholders should be negatively affected

remains

stakeholders lose their

empirical evidence suggests that shareholders of target companies typically

when

gains

there have been

poison

if

it

many

their

company

is

taken over.

What

is

puzzling, though,

is

that

incidences where shareholders approved of takeover defenses like

thus apparently forgoing potential gains from takeovers.

pills,

Despite the attention the recent takeover activity has received the theoretical foundations for evaluating takeovers and takeover defenses are

of this paper

is

to develop a formal

made precise, and

We

framework

in

still

rather thin.

The purpose

which the arguments given above can be

to explore whether they can account for the puzzling empirical evidence.

argue that the stakeholders' rents

may have

a positive impact on their incentive to

undertake relationship specific investments, and we investigate the role of poison

pills in

protecting these rents and thus promoting investment incentives.

Poison

pills

would not be necessary

if

the shareholders could give the stakehold-

optimal investment incentives by writing complete contingent contracts. However,

ers

complete contracts are not

feasible, this

may be

impossible.

It is

well

known

if

that in a

world of incomplete contracts the choice of the governance structure (Williamson, 1985)

has an important impact on economic behavior and efficiency.

erature on governance structures has been very

much

The

influenced by

recent theoretical

lit-

Grossman and Hart's

(1986) seminal article on the optimal allocation of ownership rights in a vertical relationship.

x

Their major innovation was to define "ownership" of an asset as the "residual right

This view

reflects the

theory of the market for corporate control. In a seminal article

pointed out that the separation of ownership and control in modern companies gives

Manne

problems which can be overcome by the threat of takeovers as a form of external competition

2

See

e.g. Shleifer

and Summers (1988).

(1965)

rise to incentive

for control.

to control" this asset in

all

contingencies which have not been dealt with in an explicit

contract before. Almost

all

of the subsequent literature followed

However, a governance structure

focusing on the allocation of asset ownership.

more complex than

Grossman and Hart

just the institution of ownership.

We

in

may be

argue that also the corporate

charter should be seen as part of the governance structure of a company. In the corporate

charter the shareholders determine to what extent they delegate their residual rights of

control, e.g. the right to use poison pills as takeover defenses.

To

simplify the analysis

We

agers.

we

man-

use a standard principal agent framework to model explicitly the rent the

manager derives from

his

employment and how

We

lationship specific investments.

this rent,

focus on only one group of stakeholders, the top

show

this rent affects his incentive to

that

first

if

make

re-

takeovers lead to an expropriation of

then the anticipation of a takeover causes underinvestment in relationship spe-

cific assets.

Since takeovers

may

face a tradeoff between ex ante

increase the efficiency of production ex post, shareholders

and ex post

efficiency distortions.

This result highlights

that takeovers cannot be evaluated only on the basis of the value increase induced by

the actual takeover, because this value increase does not reflect what the potential value

might have been

Then we

vestment

if

the threat of a takeover had not induced the manager to underinvest.

investigate

effect.

We

how

to design the corporate charter to

demonstrate that poison

pills

overcome the underin-

together with golden parachutes can

prevent rent shifting without preventing ex post profitable takeovers. Suppose the manager

is

given the right to fight takeovers with poison

takeover to succeed, they have to

make

pills.

If

the shareholders want the

sure that the manager does not object to

they have to compensate him for the rents he

is

it, i.e.

going to lose with a golden parachute.

Since his rents are protected, the possibility of a takeover does not affect the investment

incentives.

We

show that from the point

of view of social welfare

it

is

always desirable to

design the corporate charter such that rent shifting and underinvestment are avoided.

However, from the shareholders' perspective

this

may be

different.

If

the shareholders

participate in the profits generated by rent shifting in form of a higher takeover price,

and

if

this

outweighs the losses due to underinvestment, then the shareholders

may

opt

not to protect the manager's rents. In fact, their incentive to participate in rent shifting

may be

so large that they

may

encourage even ex post

inefficient takeovers. In this case

rent shifting gives rise to both ex ante and ex post inefficiencies.

of the theoretical literature has focused on takeovers as an instrument to

Most

discipline

managers

in their production decision in order to

company (Grossman and Hart

enhance the value of the

In these models

1980, Scharfstein 1988).

it

is

not in

the interest of the shareholders to allow takeover defenses (unless they serve to increase

This view

the takeover price).

is

questioned by Laffont and Tirole's (1988) study of a

dynamic regulation problem which they apply

to a takeover context.

They

the incumbent's (manager's) incentives to invest in future cost saving

(shareholders) might switch to a second source (raider) later on.

regulator might prefer to

commit

to a switching rule

and Tirole

spirit of

in that

we

and

turns out that the

Thus takeover defenses may

Our approach

differs

from the one of Laffont

interprete takeover defenses as residual rights of control in the

the incomplete contracts approach rather than as an instrument with which to

manipulate the takeover probability.

poison

the regulator

which favors the incumbent (takeover

defenses) in order to improve his investment incentives.

actually enhance the value of the company.

It

if

investigate

pills,

If

the corporate charter allows the manager to use

then this right protects the manager's interests but, in contrast to Laffont

Tirole's model, poison pills are never used in equilibrium.

The

rest of this

paper

and discuss the assumption

is

organized as follows: In Section 2

of incomplete contracts. In Section 3

we introduce the model

we study how

anticipated

takeovers affect the manager's investment incentives. In Section 4 a model of the tender

procedure

is

In Section 5

introduced which endogenizes the takeover price and takeover probability.

we

discuss the optimal choice of the corporate charter from the point of view

of the shareholders

and of

social welfare. Section 6 concludes.

2

2.1

We

a

start with

The Model

The General Framework

an overview of the general framework and

little bit later.

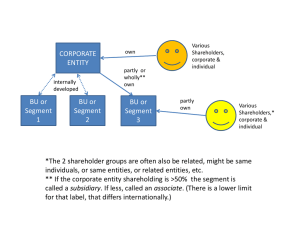

Consider a company that

is

fill

owned by a

in the details of the

large

number

model

of shareholders

status

quo

subgame

no takeover

manager

possible

hired

•

takeover

corporate

manager

charter

invests

attempt

takeover

takeover

subgame

set

production phase

up phase

FIGURE

who need

in

1:

The time

life

Shareholders and manager are engaged

a manager to carry out production.

a dynamic principal-agent relationship.

the

structure of the model.

of the

company, a

set

We

distinguish two phases of activities within

up phase and a production phase. In the

set

up phase,

the manager decides on the level of relationship specific investments that reduce the

expected costs of production later on. For example he spends some

effort to set

firm, to design the product or to organize production. This investment

is

up the

assumed

to

be

observable, but not verifiable at the end of the set up phase.

In the production phase the

he invested in the

set

manager has

up phase the

less effort

to spend effort

on production. The more

he has to spend now for any given

of production. Before he chooses an effort level the

manager

level

receives private information

about the state of the world which determines the productivity of his ex ante investment.

The manager can

gives

him a

exploit his informational advantage to get an information rent

better incentive to invest in the

Between the two phases,

i.e.

first

after the

which

place.

manager's investment costs are sunk but

before the production phase starts, a raider can launch a hostile takeover attempt.

If

the

takeover succeeds the raider can expropriate the manager's quasi-rent but he

increase the efficiency of production.

that the raider

fires

The

simplest

The corporate

when the company

model both

is

charter

is

they

set up, before

e.g.

our model

The

is

illustrated in Figure

contracts approach initiated by

i.e.

pills

or by facili-

usually written by a few founding shareholders

shares to a large

sell

number

of other sharehold-

The time

5.

structure of

1.

central contractual assumption of our

Assumption

assume

3

by introducing poison

This corporate charter will be specified in detail in Section

ers.

effects is to

also

influence the takeover price and the takeover probability

through the design of the corporate charter,

4

to

the manager and becomes owner-manager himself.

The shareholders can

tating dilution.

way

may

model follows

Grossman and Hart

closely the incomplete

(1986).

1 In the set up phase, no contingent contracts can be written,

no contracts that condition on anything that happens in the production

phase.

How

can this assumption be justified? Clearly, the contract cannot condition on the state

of the world or the manager's effort level in the production phase, because these are private

information of the manager. Nor can the manager's investment level be contracted upon.

Although the investment

in a contract in such a

is

way

observable

that

it

courts. For the other variables the

it is

not verifiable,

i.e. it is

impossible to specify

can be verified unambiguously to an outsider

argument

is

slightly

more

subtle.

like

it

the

We explicitly assume

that contingent contracts on, say, the production level are feasible at the beginning of the

production phase, but that the same contracts could not be written in the set up phase.

The

idea

is

that in the set up phase the production technology and the type of product

to be produced in the future

may depend on

the world (not modelled explicitly) which

3

An

the realization of a rather complex state of

may be

very costly

alternative scenario would be that the raider keeps the

if

manager but

not impossible to specify

offers

a more

efficient contract

because he can observe the realization of the state of the world.

4

Poison

pills

may

are introduced with the intention to

make a company

"indigestable" for a raider.

A

example oblige the raider to make huge payments to the shareholders or the creditors

of the company in case of a hostile takeover, such that the takeover becomes too costly. Dilution is

poison

pill

for

explained in detail in Section

4.

in a contract.

This will be

design of the product are clear,

Let us

now

simpler once the production technology and the final

much

i.e.

In the set

some more

describe the model in

2.2

up phase the manager

stage the shareholders can offer

any contract that gives him

5

beginning of the production phase.

in the

The

Set

detail.

Up Phase

hired from a competitive market for managers. At this

is

him only a

fixed

wage contract. The manager

at least his outside option utility

his relationship specific investment

The manager then makes

of (non-monetary) disutility,

the investment level

(i.e.

i

will accept

which we normalize to

i

which

is

measured

zero.

in units

causes the manager a disutility

0-

At the end

Section 4

we

of the set

hostile takeover occurs with probability q.

up phase a

In

specify a tender procedure which determines endogenously takeover price

and takeover probability.

2.3

Status

Quo Subgame

The Production Phase

(S)

If

no takeover occurs, production

in

terms of "producing" a

profit y,

is

carried out by the manager.

costs except for the manager's wage.

e

which

is

The

the realization of a

shareholders. For simplicity

and a good state

02,

his effort decision

we assume

some

(non-monetary)

in units of

of as the

Grossman and Hart

but which

drawn by nature with probability

demand

contractible in the production phase

of "q" in

production

effort

disutility

(1986). For a

is

is

is

observed

not observable by the

that there are only two states of the world, a bad

situation, a

Note that the assumption that the production

may be

to spend

variable 6, called the state of the world, which

by the manager before he takes

5

measured

all

productivity of his effort depends on his ex ante investment and on

random

They may be thought

is

think of production

the total profit of the firm net of

is

To produce y the manager has

not observable. This effort

to the manager.

state 6\

y

i.e.

We

level

(1

— /i) and

/j,

respectively.

parameter of the firm's cost function

cannot be contracted upon

exactly the

more formal

same

as the

in the set up phase but

assumptions on the contractibility

justification see their footnote 14.

no

takeover

manager

manager

payoffs

observes 9

chooses e

realized

shareholders

offer

and reports 9

FIGURE

2:

The time

structure of the status quo subgame.

or any other industry specific parameter.

is

shown

The time

structure of the status quo

subgame

in Figure 2.

At the beginning

of the status

quo subgame, but before the manager learns about

the state of the world, the shareholders offer the manager a contract as a take-it-or-leaveit offer.

Using the revelation principle, we model

this contract as

a direct mechanism.

This means that the contract specifies a wage and a production level conditional on the

manager's report,

level y{9) are

about the state of the world. The wage w(9) and the production

6,

chosen such that the manager

world truthfully.

If

is

always induced to announce the state of the

the manager rejects this contract no production takes place and he

gets his outside option utility. If he accepts he observes the realisation of 6

9.

Then he chooses some unobservable

effort e

and receives w(9)

if

and announces

he produces y(9).

Takeover Subgame (T)

Let us

now turn

to the situation where a raider has taken over the company. In this case

we assume that the

raider fires the

manager and becomes owner-manager

himself,

i.e.

he observes 9 and carries out production himself. To save notation, we assume that the

raider has the

same function

structure of the takeover

All players are

of disutility of effort as the

subgame

is

assumed to be

given in Figure

risk neutral

In principle, the shareholders could overcome

incumbent manager. The time

3.

and to maximize their expected

all

utilities.

problems that arise from asymmetric

information by making the manager residual claimant and extracting his expected profit

as a

lump sum payment ex

manager

is

ante.

We exclude this possibility

with the assumption that the

wealth constrained, so that he cannot pay a lump

sum

transfer in advance.

m

takeover

raider

raider

observes

fires

raider

payoffs

chooses e

realized

manager

FIGURE

The time

3:

Furthermore, we assume that he

is

structure of the takeover subgame.

subject to only limited

the manager chooses, in any state of the world, not to

liability.

fulfill

6

This implies that

if

the contract he has signed

he can be punished only to a limited extend. For expositional convenience, we focus on

the special case of zero liability which means that he cannot be punished at

to leave the firm

manager

and

is

and take

receives a

wage

all

but

is

Thus,

if

he does not

of zero. His utility function

is

assumed to be additively separable

his outside option.

fulfill

his contract, the

given by

U = w—e—

The value

of the firm in the production phase

is

i

(1)

.

given by

V = y-w.

we make the

Finally

Assumption

>

0,

i

>

0,

(2)

following technological assumptions.

2 Let e(y,i.8) be the minimal effort necessary to produce the

profit y given the

y

6

investment level

€ {#i,#2},

i

and

Then for

the state of the world 6.

e(t/,z,0) is twice continuously differentiate

all

and

(2.0) e(y,i,0 1 )>e{y,i,6 2 ).

(2.1) e(y,i,0)

is strictly

e(y,0,6i)

<

oo

if

y

increasing and convex in y, with e(0,i,6)

<

oo.

There

may

be a discontinuity at y

fixed costs. Furthermore, there exists a y

(2.2) e y (y,t,0i)

5

free

>

See Sappington (1983).

e y (y,i,0 2 )

and

e

w (y,t',0i) >

>

such that y

e yy (y,i,0 2 ).

>

=

=

and

due to

e(y,i,0i).

(2.3) e(y,i,6) is decreasing in

(2.4) ei(y,i,Oi)

>

ei(y,i,6 2 ).

(2.5) e yi (y,i,6)

=

Q.

Assumptions

and

(2.0)

(2.1)

i.

guarantee that there

is

an interior solution for the

best production level in both states of the world. According to the

first

part of (2.2) not

only total costs but also marginal costs are higher in the bad state of the world.

"single crossing property"

The second

is

first

This

a standard assumption in the mechanism design literature.

part of (2.2) ensures that the second order conditions are satisfied. (2.3) and

the cost reducing effect of the investment

(2.4) say that

higher in the good state of

is

the world than in the bad state of the world. (2.5) together with (2.3) implies that the

investment reduces only fixed production costs but not marginal production costs. This

assumption ensures (together with assumption

(2.1)

and

(2.2)) that the

manager's rent

is

monotonically increasing in his investment. Without assumption (2.5) we would have to

make assumptions on

third derivatives of the cost function, which do not have an intuitive

interpretation in our set-up, in order to get unambiguous results.

3

In this section

Rent Shifting and Efficiency

we analyze the

subgame and the impact

status quo and the takeover

of

the takeover probability on the manager's investment incentives. As a point of reference

let

us determine the

B

FB

(yf ,y 2

)

first

best levels of production for a given investment

= axgrnax{W =

(l-fi)-(y 1 -e(y 1 ,i,e 1 ))

i.

+ (i{y 2 -e(y2 ,i,d2 ))}

(3)

yi.src

Given Assumption

following

first

2.1,

y[

B

B and

y£ are

and uniquely defined by the

order conditions:

ey

3.1

The

strictly positive

B

(yf

^0

Production

shareholders' problem

is

3)

=

1,

i€

in the Status

to design a contract that

subject to the constraint that

it

is

{1,2}

Quo Subgame

maximizes the value of the company

optimal for the manager to accept and

9

(4)

.

fulfill

the

contract.

7

They know

that at this stage the manager's investment costs are sunk and thus

not relevant for his decision to accept the contract. Since they observe the investment

they can take

its

impact on the manager's

account.

effort cost into

To determine the optimal contract we do not have

to investigate the class of

feasible contracts but can refer to the revelation principle (Myerson, 1979)

attention to the class of

"direct

all

a contract {w(0),y(0)} saying that

incentive compatible, that

manager

well

announce the state of the world

to

known

that the optimal direct

truthfully.

mechanism

may

is

By

direct

it

mechanism has to be

must be optimal

for the

the revelation principle

it is

truthfully implements the best possible

outcome the shareholders can attain from any other

it

A

given the scheme {w(0),y(0)}

is

restrict

the manager announces the state of the world to

he has to produce y{0) and gets the payment w(0).

be

and

all

mechanisms". In our context a direct mechanism

if

i,

contract, no matter

how

sophisticated

be.

Let

j/j

=

y(0j)

=

and Wj

w(0j) with j G {1,2}.

The maximization problem

of the

shareholders can then be stated as the following program:

V=

max

,V2

2/1

M

(1

-

fi)[yi

- wi] + fi[y 2 - w 2

]

(5)

,

!«"2

subject to

IC1:

u>i

IC2:

w2 -

-e(yi,i,0i)

e(y 2 ,i,0 2 )

>

u> 2

-e(y 2 ,i,0i)

>

u>i

-

e(yi,i,62 )

IR1:

wi-e(yi,t,0i)

>

,

IR2:

w 2 -e(y 2 ,i,0 2

>

.

The

first

truthfully.

necessary to

make

Since

,

two conditions (incentive compatibility constraints) guarantee that the manager

announces

7

)

,

all

The second two

sure the

manager

shareholders have the

think of this contract offer as being

conditions (individual rationality constraints) are

will accept

and

fulfill

the contract. 8

common objective to maximize the value

made by one representative shareholder.

8

of their

company we can

The assumption of limited liability implies that a contract that does not satisfy both conditions

cannot be enforced, even if it is accepted. If only one of the two conditions holds the manager might

accept with the intention to fulfill the contract only in that state of the world for which the condition is

10

Proposition

1

An

imization problem

77ie

interior solution (yf ,yf ,wf ,u;f ) of the shareholders

uniquely defined by the following four equations

is

wf

=

e(yf,i,^),

w%

=

e{yli,6 2 )

e„(yf,i,0i)

=

l-A*[l-e,(yf,i,«a)],

(8)

e y {yl,i,e 2 )

=

1

(9)

(6)

+

e(yS,i,0 1 )-e(yS,i,9 2

)

(7)

,

.

corresponding expected equilibrium profit of the firm,

Vs =

is

max-

increasing in

i,

-

(1

p)[yf

-

tof]

+

p[yf

-

(10)

«,f],

since

lf <0

"af

-

<0

1

-

= °-

1=

°-

<»)

Proof: See appendix.

In the following

we

focus on the case where this interior solution

is

indeed optimal. 9

Note that the optimal mechanism has the following properties.

•

The manager

is

fully

compensated

an information rent [e(yf

necessary to induce

i,

•

since [e,(yf ,i,#i)

The optimal

world (y 2

=

him

—

,

i,

to

#i)

for his

— e(t/f

,

i,

announce 9 2

ei(yf,i,6 2 )]

>

production costs. Additionally he receives

6 2 )] in the

good state of the world which

truthfully.

This information increases with

by Assumption

2.4.

incentive scheme induces efficient production in the good state of the

y2

B and

)

inefficiently

low production in the bad state

course, the shareholders could implement the

Of

is

may

first

(j/f

< yf B ). Of

best production level in the

be optimal. However,

bad

in this case the shareholders could have

no production and no payment in that state of the world, so

that the contract would be "fulfilled" by the manager and would yield the same payoff for shareholders.

9

If a corner solution yields a higher payoff to the shareholders than the interior solution then the

shareholders will offer no production and no wage if the bad state is announced and j/f and w^ =

e (j/| *i ^2 )

tne g°°d state. In this case the manager does not get an information rent in the good state.

However, in a more general model, in which 6 is drawn from a larger set {<?i,02,

,6n) the expected

information rent of the manager is always positive as long as there is more than one state of the world

with a positive level of production. See Sappington (1983).

satisfied.

course, such a contract

offered another contract, in which there

>

is

m

•

11

•

state as well.

rent in the

But then they would have

to

pay the manager a higher information

good state to prevent him from announcing the bad

state.

The optimal

contract trades off the efficiency loss in the bad state and the information rent

necessary to induce truthtelling in the good state.

The

•

shareholders are aware that the manager's investment reduces his effort costs

and opportunistically exploit the

fact that investment costs are sunk.

higher the investment the lower the wages they

offer.

Thus, the

However, they cannot

fully

appropriate the returns on the investment because the productivity of the investment

depends on the state of the world which they cannot observe. So the returns on the

investment are shared by shareholders and manager.

Production

3.2

Let us

now turn

to the case in

in the

Takeover Subgame

which a takeover occured

after the set

up phase. What

can the raider do better than the shareholders? To keep the model as simple as possible

we have assumed

that the raider

out production himself. 10

An

more

generally, he

is

the manager and, after having observed

alternative specification would be to

keeps the manager, but that he

(or,

fires

is

8, carries

assume that the raider

able to observe 6 after he has bought the

company

better informed about the relevant state of the world than

shareholders are). In both cases the manager loses his information rent after the takeover

(at least partially).

Both

specifications induce the following value increases: In the

implements the

profits.

In the

efficient

production level y^ B yielding an efficiency gain which increases

good state he can

manager would otherwise

subgame

bad state the raider

raise profits

by appropriating the information rent the

Thus the expected value

enjoy.

of the firm in the takeover

is

V T = V s + E + R,

(12)

where

E=

(1

-

B

^){[yf

- e(y™

•",*)]

-

[yf

-

e(yf,i,*i)]}

10

The investment stays in the company when the manager leaves.

investment in the firm's organization rather than in human capital.

12

It

(13)

should be thought of as an

denotes the expected efficiency gain from choosing the first-best production level in state

#i

and

R=

ti [e(yf,i,0 1

)-e(yf,i,02 )]

(14)

denotes the expected information rent the manager would have enjoyed in state 6 2

that

1

>

^j?

and

due to Assumption

=

eyi

by Assumption

now

problem

it

is

Note further that

^=

since

£=

Note

by Proposition

2.5.

The Underinvestment

3.3

Consider

2.4.

.

Effect

The

the manager's investment decision in the set up phase.

shareholders'

that they cannot directly compensate the manager for his investment because

is

In addition, any indirect compensation contract which conditions

not verifiable.

on future realization of the company's

profits

is

ruled out by the incomplete contracts

assumption. Therefore the manager's incentive to undertake relationship specific invest-

ments comes only from

his

expected information rent. Let i SB

=

axgma,x{R(i)

— i)

denote

the second best investment level given the incomplete contract setting.

Note that i SB

is

W(i)

By Assumptions

for all

that

i

>

2.5

too low. Given yf

and

2.3

—

i

-(l-

±[(R(i)-i)]

=

/

SB

Suppose

>

the

i

R(i FB )

1

))

first

+

best investment level

FB <

On

(yf,i,e 1 )-ne (yli,e 2 )-l

.

.

Since

i

FB G

i

ipates

what

+

i

is

argmax

happen

in the

must be the case

it

-

[R(i)

i],

so

we have

these two inequalities yields

)

R(i

strictly increasing in

takeovers affect the manager's investment?

will

(16)

argmax W(i),

SB €

)

R(i)

>

l

the other hand

)

How do

(15)

z[e J ( J,f,i^ 1 )-e,(yf,z-^ 2 )]-l

SB

i

fi)e t

- i FB Combining

—

FB maximizes

fi(yl-e(yli,e 2 ))-i.

SB W(i FB - R(i FB + i FB > W(i

However, by (16) W(i)

i

we have

=

W(i FB ) > W(i SB ).

R(i SB )

j/f ,

= (l-n)(yf-e(yf,i,e

^[W{i)\

0.

,

production phase.

13

If

i,

SB

)

+

SB

i

a contradiction.

The manager

there

(17)

.

is

rationally antic-

no takeover, he keeps

his

.

job and receives an information rent in the good state of the world whereas in case of

a takeover he gets only his outside option

function of his investment

is

Therefore his expected utility as a

utility.

given by

U = (l-q)R(i)-i

Suppose that the takeover probability

is

q

(18)

.

exogenously given. Proposition 2 summarizes

the impact of a potential takeover on the manager's investment decision.

Proposition 2 An optimal investment

for

all q

€

Furthermore

[0, 1].

Proof: Note that R(i)

because by Assumption

2.1

and that

i

e(yf,i,#i)

is

€ argmax,- U(i,q') and

By

the definitions of

%'

(1

Vs

any given yf R(i)

.

is

bounded above

e(j/f,i,#2)

>

>

Vi

0.

Take any

€

q',q"

[0,1],

q'

<

q"

Let

.

G argmax, U(i,q").

i"

and

for

is

prove the second part of the proposition

using a simple revealed preference argument.

i'

and so

bounded above and

We

maximum.

Therefore (18) must have a

which maximizes (18) exists

i"(q) is decreasing in q

continuous in

is

level i*(q)

i"

we know

that

- q')R(i') -

i'

>

(1

-

q')R(i")

-

i"

(19)

-

i"

>

(1

-

q")R(i')

-

i'

(20)

[(1

-

q')

-

-

and

(1

-

q")R(i")

Thus

[(1

Since

V

q'

(i),

<

-

q" and R(i)

which

is

q')

is

-

(1

-

q")]R(i')

>

strictly increasing in

strictly increasing in

i

i

(1

q")]R(i")

by Assumption

by Proposition

1, is

2.4

it

(21)

.

follows that

i'

>

i".

therefore decreasing in q as

Q.E.D.

well.

Proposition 2 shows that anticipated takeovers

lationship specific assets as

compared

may

cause underinvestment in

to the second best characterized

re-

above and thus

aggravate the efficiency distortion of the manager's investment decision. This underinvest-

ment has a negative impact on the company's

we have shown

potential value

that a raider can increase the value of the

14

Vs

.

In the previous section

company ex

post, for a given

level of investment,

through rent shifting and enhancing the efficiency of production. But

Proposition 2 makes clear that the costs and benefits of takeovers cannot be judged only

on the basis of

ex ante.

If

this

ex post value increase since

the underinvestment effect

is

it

does not reflect the reduction in value

strong enough

it

may

offset

the shareholders'

potential gains from selling their company.

The Tender Procedure

4

we model the

In this section

raider's tender offer

and the shareholder's strategies with

respect to this offer explicitly in order to determine takeover price and takeover probability

endogenously.

We

whom

is

assume that the target company

holds one single share.

tendered. This

The

means that the

raider

is

common

small shareholders each of

makes a conditional

offer

ir

each share that

for

raider buys the tendered shares only

at least the majority of all shares to gain control of the

offers are

N

owned by

if

he can acquire

company. Such conditional tender

practice on the market for corporate control.

For his takeover attempt, the raider has to incur transaction costs

is

a random variable, with support

distribution function F(t) which

is

[0,i],

and

assumed

is

t.

Ex ante

t

distributed according to the cumulative

to have a continuous

and

strictly positive

density f(t).

Given the tender

We

to tender.

offer

ir,

each shareholder has to decide individually whether or not

assume that the number

of shareholders

is

so large that each individual

11

shareholder neglects the influence of his tender decision on the takeover success.

What

are the payoffs of this tender

and suppose the takeover succeeds.

his payoff is the

because

of the

if

expected value of

If

his

game? Consider

for his

own

an individual shareholder

he tendered his share, he gets

minority share. This value

a raider succeeds in acquiring the majority of

company

first

all

may

7r.

If

differ

he did not,

from

shares he might dilute the value

benefit but at the expense of minority shareholders.

n This

V T /N

12

The

assumption is made in most tender models, starting with Grossman and Hart (1980).

For instance he can pay himself a wage that exceeds the market wage or he can sell assets of the

company under value to another company he owns.

12

15

extent to which he can do this

Let d denote the

is

V

Jd

,

maximum

because the raider

is

determined by corporate law and the corporate charter.

possible level of dilution.

always dilute as

will

Then the value

much

decision, since the tender offer

The

raider's payoff

is

Suppose the takeover

as possible.

does not succeed. In this case the shareholder's payoff

is

of a minority share

^-, irrespective of his tender

conditional.

depends on the number of tendered shares.

tendered, the takeover succeeds and his payoff

n

If

> —

shares are

is

n^—jr--^j+d-t.

If

n <

y

shares are tendered, the takeover attempt

(22)

fails

and the

raider's payoff

is

-t.

Note that an

offer

problem which was

first

7r

<

v

d

^

is

due

to the free rider

analyzed by Grossman and Hart (1980). Since each individual

own tender

does not consider his

has no chance to succeed. This

decision to be decisive,

it is

a weakly dominant strategy

to hold out.

To exclude

body weakly

so called "no trade"-equilibria in

prefers to tender,

we

which the takeover

restrict attention to equilibria in

fails

although every-

undominated

strate-

gies.

Proposition 3

If

d

>

t,

then there

outcome of the tender game

in

is

a unique

subgame perfect equilibrium

which the raider offers

takeover succeeds. Equilibrium payoffs are d

—

t

7r*

~

=

for the raider and n*

and

=

the

~d

for each shareholder.

Proof: See Appendix.

The aggregate

make a

is

q

=

payoff for

all

shareholders

is

II

=

Nir*.

If

d

<

t,

the raider cannot

profitable tender offer. Hence, the ex ante probability of a takeover in equilibrium

prob(d

-t>

Note that

after a takeover.

0)

this

=

F(d).

ex ante probability does not depend on the value of the company

This implies that the manager does not influence the likelihood of a

16

takeover with his investment decision. So Proposition

investment decision assuming an exogenously given

dogenously. However, this

dilution d as

ally

a.

lump sum

assume that d

is

is

2,

q,

which characterized the optimal

holds also

q

if

due to our particular specification of the

transfer

from the company to the

We

raider.

is

determined en-

maximum

level of

could more gener-

an increasing function of the potential ex post value of the company.

In this case the manager's investment would increase the possible level of dilution

thus the likelihood of a takeover.

This would give an additional disincentive to invest

and thus reinforce our underinvestment

we

tractable

Now we

However, to keep the model

result of Section 3.

will stick to the simpler specification

5

and

where d

is

sum

a lump

dilution.

The Optimal Corporate Charter

We

can turn to the optimal choice of the corporate charter.

consider two in-

struments with which the shareholders can influence the takeover probability and the

manager's investment incentives.

(1)

The shareholders choose

the parameter

d, i.e.

the

maximum

level of dilution.

By

choosing d the shareholders can determine the takeover probability and affect the

takeover price. 13

(2)

They decide whether

or not the

manager

is

allowed to use takeover defenses.

We

distinguish two cases

(i)

the manager

is

(ii)

the manager

is

not allowed to use any poison

free to use poison pills

for the raider to acquire the

How

is

will the shareholders use these

pills at all (referred

and thus can make

company

(referred to as p

instruments?

The

first

=

0),

virtually impossible

it

=

to as p

1).

step to answer this question

to determine the optimal level of dilution for a given p.

13

Our tender model

of Section 4 with free riding and dilution introduces in a natural

variable d that can be influenced by the shareholders in their corporate charter.

would be Holmstrom and Nalebuff's (1991) tender model where the

specifying in the corporate charter the necessary control majority.

17

A

way the

policy

possible alternative

raider's profits can

be influenced by

Suppose the manager

not allowed to use poison

is

value of the firm as a function of d

V e (d\p=0)

Recall that

E

pills (p

=

Then

0).

the expected

is

=

(l-q)V S (i) +

=

(l-q)V S (i) + q(V T (i)-d)

=

V s (i) +

[E

+

qIT(i)

R(i)

-

(23)

F(d)

d]

.

independent of the manager's investment. Let

is

= argmaxF e (<f|p =

d

(24)

0)

d

The

choice of do

is

driven by three effects:

• a direct effect

on the takeover price 77

• a direct effect

on the raider's

•

an indirect

effect

profit,

increasing functions of

d — t, and thus on the takeover probability F(d);

V s (i)

is

a decreasing function of the

and the takeover price II (i)

= V T (i) — d

are

i.

Suppose next the manager

Certainly not.

holders can "bribe"

d;

on the manager's investment which

takeover probability. Recall that

any takeover?

= VT —

him not

is

allowed to use poison

pills (p

Once the manager has made

to use his poison

pills.

The

=

his

idea

is

1).

Does

this prevent

investment the shareto offer

him a golden

parachute which compensates him for the expected information rent he forgoes in case

of a takeover.

selling the

14

company which

"bribe" the manager.

but poison

pills

G reduces the shareholders' expected profit from

s

II — V — G = E — d. But as long as E > d it pays to

This golden parachute

is

now

As a consequence takeover attempts occur with

positive probability,

are never used in equilibrium.

In contrast to the situation where p

on the manager's investment. The reason

golden parachute

G

=

is

takeovers do not have a negative impact

that the shareholders have to specify this

only after the manager's investment has

become observable. Thus

they can use this observation to evaluate the expected information rent R(i) given the

14

The

implicit assumption here

is

that the shareholders have

all

the bargaining power. This corresponds

to our previous assumption that shareholders as the principal have

a contract offer to the manager. See footnote

7.

18

all

the bargaining power

when making

actual investment

rent. Since the

i,

and choose the golden parachute G(i) to match exactly the forgone

manager

receives R(i) anyway, either as an information rent or as a golden

parachute, he will choose the second best investment level

the firm as a function of d

V

e

is

(d\p=l)

now

i

SB

15

.

The expected

value of

given by

=

(l-q)V S (i SB +

=

V s (i SB + [E-d\-

)

q [Il(i

)

SB

F(d)

)-G(i SB )}

(25)

.

Let

dx

=

a,rg

max V e (d\p =

1)

(26)

In contrast to the situation above the choice of d\ affects only

•

the takeover price as a function of d and

• the raider's profit

but

it

and thus the takeover probability F(d),

does not affect the investment level i SB

.

Proposition 4 summarizes the discussion of poison

Proposition 4 There

pills.

are two candidates for a corporate charter which

max-

imizes shareholders profits:

'

-

A

corporate charter which allows the

tect his

manager

poison

pills to

pro-

information rent induces second best investments.

Given

this

to use

corporate charter there will be a takeover attempt

E>

d.

if

and only

15

G=

R(i)

manager

leads

In this case the shareholders offer a golden parachute

which the manager accepts and he does not use poison

-

ift<d and

pills.

A

corporate charter which gives no control rights to the

to

underinvestment as compared

to the

second

best.

Under

this corporate

Obviously, a golden parachute fixed before the investment has been taken would not do the job,

it cannot condition on the actual investment and thus would not have any effect on the manager's

investment incentives. Note that our combination of poison pills and golden parachutes has an interesting

since

parallel in the renegotiation literature. It

is

well

known

that renegotiation of ex post inefficient incentive

schemes has a negative impact on ex ante efficiency. However, Hermalin and Katz (1991) have shown

that this need not be the case if new information becomes available to the contracting parties after the

contract has been written.

19

charter a takeover occurs

and only

if

<

if t

d.

In case of a takeover

shareholders capture the manager's information rent in form of a higher

takeover price.

Which

two alternatives the shareholders

of these

importance of the underinvestment

effect

will

choose depends on the relative

and the gain from rent

shifting,

on the

i.e.

parameters of the model.

In the remainder of this section

maximizing corporate charter which

Proposition 5 Suppose d can

we

is

be

contrast these two alternatives with the welfare

characterized in Proposition

16

chosen continuously. Then the welfare max-

imizing corporate charter allows the manager to use poison

pills,

p

i

SB

< i FB and

=

1.

Thus

first

i

=

SB

i

.

order condition for the optimal level

dw

e

and since f(dw)

>

E. Since

W

e

is

+ I E_

Jo

{

[E-d w ]f(d w

dw =

is

)

FOC

}

j^ dt

is

(

2? )

is

=

0.

increasing in d \/d

by assumption, the

t

it is

achieved by

,

-SB

This implies

and

Given i SB the expected welfare as a function of d

= yS^SB} + R ( iSBj _

W

The

1,

since distributional concerns are not relevant for welfare

optimal to give the manager the best possible investment incentives. This

choosing p

=

dw = E.

chooses

Proof: Since

5.

< E and

(28)

decreasing in d

uniquely characterizes a global

W>E

maximum.

Q.E.D.

This result has a very intuitive interpretation. The optimal level of dilution should

be specified such that a takeover

cost

t is

is

carried out whenever the realization of the takeover

smaller than the expected efficiency increase E.

Proposition 6 compares the welfare maximizing corporate charter with the two candidates for a privately optimal corporate charter.

16

Welfare maximizing given the constraints of incomplete contracts, asymmetric information and that

the manager cannot be

made

residual claimant.

20

Proposition 6 Suppose

a) If the

manager

allowed to use poison

is

manager

=

pills (p

is

not allowed to use poison

may

optimal level of dilution, do,

privately optimal

I), the

can never exceed the socially optimal

level of dilution

b) If the

the level of dilution can be chosen continuously.

pills (p

=

level, i.e. d\

0),

<

d\\r.

then the privately

exceed the socially optimal

level,

dw-

Proof: a) Consider the function

g(d)

=

W\d) - V e (d\p =

=

V s {i SB + R(i SB -

1)

)

)

SB

i

+f[E- t)f(t)dt - V s

(i

SB

)

-(E- d)F{d)

Jo

rd

=

R(i

SB

)-i

SB

+

[E

-

- (E -

t]f(t)dt

d)F{d)

(29)

.

Jo

Note g(d)

is

increasing since

^- = [ESuppose

d\

> dw-

Since d x 6 argmax

V

Similarly, since

-\E- d]f{d) + F(d) =

d]f(d)

dw = argmax

e

e

(d\p

e

e

(31)

g(d w )

But

b)

is

this is

and (32)

=

W

e

(d

e

b)

"unproductive",

dV e (d\p =

we

i.e.

(d

W

>

)

w -V

must be true that

w \p=l)

e

{d x )

)

e

(d

w \p =

1)

>

=

0.

Then

^=

W

e

is

and

0)

dd

di

=

(31)

.

(32)

.

(d,)

-

V'idrlp

ai

^

=

1)

=

g(d 1 )

(33)

d.

> dw- Suppose

0.

.

the investment

Therefore

^ + [E + R(i) - d]f{d) - F(d)

[E+R(i)-d]f(d)-F(d).

21

=

increasing with

construct an example in which do

e,-

(30)

.

yields

a contradiction to the fact that g(d)

To prove part

1) it

>

we have

W {dw

Combining

=

\p=\)>V

(d 1

W

V

F(d)

(34)

^r

d

0)

= -^f(d) +

=

Suppose that f(d)

the

derivative of

first

dV e {d\p =

want

+

constant.

Then

V

V

=

0) at

+

R(i)

0)

dd

We

is

[E

e

=

to construct the

Thus, by choosing

fj.

\i

p.

close

(d\p

= dw

d

d]f'(d)

=

0)

-

2f(d)

(35)

.

a concave function of

is

d.

Evaluating

shows that

- d w ]f(d w - F(d w

)

example such that

(l-A*){yf

close to

increases, then R(i)

exists a

[E

e

-

=

)

R(i)f(E)

- F(E)

=

1,

s

this

is

B

we can make

E

and F(E)

— e(yf,z,0 2 )]

e(yf

I

i^)}.

(37)

arbitrarily small. Furthermore,

goes up. Since /(•)

constant there

is

enough to one such that

0)

=

R(i)f(E)

- F(E) >

(38)

.

dd

Given concavity

is

(36)

strictly positive. Recall that

-e(yf ,i,»i)-»f +

p[e(yf,i,6i)

dV e (d\p =

than

.

d=d w

E =

if

(d\p

R(i)

+ R(i)-d]f(d)-2f(d)

[E

this implies that the shareholders will

choose a higher level of dilution

Q.E.D.

socially optimal.

Proposition 6 says that in case of p

=

1

the shareholders choose d always inefficiently

low because they do not take into account the positive externality of d on the raider. Thus,

some

of the takeovers that would be ex post efficient (in the sense that

take place. In case of p

=

0,

however, the shareholders

encourage takeovers that are ex post

inefficient.

from rent shifting which add nothing to

It is this last effect

which

critics

The

may

reason

t)

do not

choose d too high and thus

is

that there are private gains

social welfare.

may have in mind when

to appropriate rents leads to socially inefficient takeovers.

not very large with respect to managerial rents

also rents of other stakeholders of the

E >

company

it

While

may be

(e.g.

they claim that the intention

this effect

of considerable

is

presumably

importance

if

workers or suppliers) are on stake.

6 Conclusions

This paper shows that the impact of takeovers on the value of a company cannot be

judged only on the grounds of the value increase a raider might bring about when he

22

actually takes over the company.

The reason

is

that this value increase

may be

by

offset

ex ante reactions of stakeholders to anticipated takeovers, for instance by underinvesting

in relationship specific assets.

We have shown that shareholders can overcome this underinvestment problem caused

by takeovers by choosing the appropriate governance structure

for the

company.

If

the

shareholders give up part of their residual control rights and allow the manager to use poi-

son

pills

they can induce second best investments. Using additionally golden parachutes

the shareholders can

make

sure that poison

post profitable takeovers can take place.

holders approve of poison

pills

and

offer

pills

are never used in equilibrium

This result explains

golden parachutes

is

why

enough the shareholders

vestment. In this case

it

will

Thus,

if

the fact that share-

not so puzzling after

However, our analysis has also made clear that shareholders

shifting through a higher takeover price.

and so ex

may

benefit

all.

from rent

the gains from rent shifting are high

not choose the corporate charter which prevents underin-

may happen

that ex post inefficient takeovers are encouraged

solely for the sake of rent shifting.

23

Appendix

Proof of Proposition

=

Let z

1:

L(z,A)

By

=

{u>i,w 2 ,yi,y 2 } and A

the Kuhn-Tucker

=

{A x A 2 A 3 A 4 } and define the Langrangian function

,

,

- fi)(yi - wi) + n(y 2 - w2

I

(

,

-w

+

+

Aj [wi

+

\2[w2-w +

+

A 3 [t0i-e(yi,i,0i)]

+

A 4 [w 2

Theorem

2

-

e(y 2

Let z*

=

{ttij, i«2, 2/1,2/2}

show that

this

i,

#i)

-

e(y u

i.e.

i,

X )]

(39)

6 2 ))

(see e.g. Intriligator (1971, p. 56))

saddle point of the Lagrangian,

<

i,

,

,

e{yi,i,0 2 )-e(y2,i,0 2 )]

l

the maximization problem of the shareholders

L(z,A*)

e(y 2

)

we know

that z* solves

there exists a A*, such that (z*, A*)

if

is

a

if

Z,(z*,A*)

<

L(z*,A)

Vz>0,A>0.

as characterized in Proposition

1

and A*

=

(40)

{0,/z, 1,0}.

We

will

indeed a saddle point of the Lagrangian and hence, that z* solves the

is

maximization problem.

Note

2/i

< y[

B

first

<

y2

that by (8) e y (y*,i,6i)

B =

IR2 are not. Thus,

Given

y\.

it is

z*,

<

1,

whereas by

=

1.

Thus,

easy to check that A* indeed minimizes Z(x*,A), so the second

is satisfied.

To prove that the

part of (40) holds (given A*)

first

e y (y2,i,8 2 )

conditions IC2 and IR1 are binding whereas ICl and

part of inequality (40)

first

(9)

order conditions for a

maximum

we have

to

show that

and that L(z, A*)

of L(z, A*)

is

z* satisfies the

concave.

The FOCs

are given by:

-Q-

dL

-^—

dy 2

dL

dL

dw 2

=

(^-^) +

=

fi- fi-e y (y 2 ,i,6 2 )

=

-(l-/i)-/z +

=

-fi

+

fi

^-ey(yi,i,0 2 )-e y {y u i,e 1 )

l

<

<

<

<

(41)

(42)

(43)

(44)

24

Obviously they are

with equality at z", so the complementary slackness conditions

satisfied

hold as well.

To

see that L(z, A*)

is

concave,

we have

to

show that the Hessian matrix of

negative semidefinite. Note that by Assumption 2.1 and 2.2

while

all

=

/«i«(yi.*,02)-e w (yi,»,0i)

L V2U2

=

-^yy(y2,i,0 2 ) < 0,

-jj?-

=

Suppose the raider

if

<

-^-

=

offers

the majority of

—t, so

7r

—Tp-

<

Suppose the raider

(46)

.

<

7r

-£f-

<

by Assumptions

2.3

and

2.5

Q.E.D.

^-j^-

The

individual shareholder strictly prefers not to

shareholders tenders, and he

all

is

indifferent

is

the only undominated strategy.

the majority does

if

The

raider's payoff

is

cannot have been optimal.

offers

=

7r

VT -

N

However, for any given positive

v ^~ d

+

e,

t

>

0.

are indifferent no matter

In this case each individual shareholder

is

V ~d

+ c\-t = d-N-e-t.

(

e

there exists a smaller

So the only equilibrium candidate

an equilibrium only

2.3,

2.5.

weakly prefers to tender and the raider's payoff

payoff.

(45)

3:

not tender. Thus, to hold out

II

by Assumption

by Assumption

Proof of Proposition

tender

<

the other second derivatives vanish.

=

-|j-

is

we have

Lyivx

Finally, note that

and

L(-)

offer is

ir*

e'

(47)

which would have yielded a higher

—

^

Given

.

tt'

what the other shareholders are doing. But

if it is

accepted for sure by at least n

> —

all

-k*

shareholders

can be part of

shareholders. Otherwise

the raider would have done better offering slightly more. Hence the only subgame perfect

equilibrium outcome

is

that the raider offers

ir*

=

v

^

d

and

at least

> y

n

shareholders

accept. Note that the raider's payoff

nd

N—n

)..,.__,*-* =

+

-

.

(£-)

n-(

is

independent of

-

n.

-

,

,

d

nd

---t

,

Furthermore, the equilibrium payoff of each shareholder

matter whether he tenders or not.

25

.,„.

= d-t

(48)

is

N no

Q.E.D

References

AUERBACH, A.J

(ED.) (1988), Corporate Takeovers: Causes and Consequences, Chicago,

London.

Grossman,

S.

and O. Hart

(1980), "Takeover Bids, the Free-Rider Problem,

Theory of the Corporation", Bell Journal of Economics,

GROSSMAN,

S.

Vol. 11,

No.

1,

and the

42-64.

"The Costs and Benefits of Ownership: A Theory

and Lateral Integration", Journal of Political Economy, Vol. 94, 691-

AND O. Hart

of Vertical

(1986),

719.

HERMALIN

B.

AND M. KATZ

(1991), "Moral

Renegotiation in Agency"

HOLMSTROM,

AND

,

Hazard and

Econometrica, Vol. 59,

NALEBUFF

Verifiability:

1

The

Effects of

735-1 753.

"To the Raider Goes the Surplus?

Reexamination of the Free- Rider-Problem", mimeo.

B.

INTRILIGATOR, M.

wood

LAFFONT

B.

(1990),

(1971), Mathematical Optimization

A

and Economic Theory, Engle-

Cliffs.

AND

J. TlROLE (1988), "Repeated Auctions of Incentive Contracts, Investand

ment,

Bidding Parity with an Application to Takeovers", Rand Journal, Vol.

J.

19, 516-537.

MANNE, H.

Corporate Control", Journal of Political

(1979), "Incentive Compatibility

and the Bargaining Problem", Econo-

Economy,

MYERSON, R.

and the Market

for

(1965), "Mergers

Vol.

73,

110-120.

metrica, Vol. 47, 61-74.

SAPPINGTON, D.

(1983), "Limited Liability Contracts between Principal

and Agent",

Journal of Economic Theory, Vol. 29, 1-21.

SCHARFSTEIN, D.

(1988),

"The Disciplinary Role of Takeovers", Review of Economic

Studies, Vol. 55, 185-199.

SHLEIFER, A. AND L. SUMMERS (1988), "Breach

Auerbach (1988), 33-67.

WILLIAMSON, O.

(1985),

The Economic

of Trust in Hostile Takeovers", in:

Institutions of Capitalism,

Press.

27

New

York:

The Free

MIT LIBRARIES DUPL

3

TOflO

007MbT3E