Document 11157827

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/changesinwagestrOOacem

HB31

.M415

oevv^y

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

CHANGES

IN

THE WAGE STRUCTURE, FAMILY INCOME,

AND CHILDREN'S EDUCATION

Daron Acemoglu, MIT

Jom-Steffen Pischke,

LSE

Working Paper 00-29

SEPTEMBER 2000

Room

E52-251

50 Memorial Drive

Cambridge, MA 02142

This paper can be downloaded without charge from the

Network Paper Collection at

http:/ /papers. ssrn. com/paper. taf?abstract_id=246028

Social Science Research

MASSACHUSETTS ilMSTITUTE

OF TECHWOLOGY

OCT

3

2000

LIBRARIES

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

CHANGES

IN

THE WAGE STRUCTURE, FAMILY INCOME,

AND CHILDREN'S EDUCATION

MIT

Jom-Steffen Pischke, LSE

Daron Acernoglu,

Working Paper 00-29

SEPTEMBER 2000

Room

E52-251

50 Memorial Drive

Cambridge, MA 02142

This paper can be downloaded without charge from the

Social Science Research Network Paper Collection at

http:/ /papers. ssrn.com/paper.taf?abstract_id=246028

Abstract

We exploit the changes

in the distribution of family

resources on college education.

the

income

opposite

is

distribution

Our

income

to estimate the effect

strategy exploits the fact that families at the

were much poorer

in the

1990s than they were

true for families in the top quartile of the distribution.

effects of family

income on enrollments. For example, we find

family income

associated with a

is

1

.4

Our

of parental

bottom of

in the 1970s,

while the

estimates suggest large

that a 10 percent increase in

percent increase in the probability of attending a four-

year college.

*Paper prepared for the European Economics Association Meeting 2000, Bolzano,

Italy. We thank seminar participants in the European Economic Association 2000

Conference, the MIT labor lunch, and the University of Chicago Harris School Seminar for

helpful comments.

Some of the work

for this paper

was undertaken while

Pisclike

was

Northwestern University/University of Chicago Joint Center for Poverty

Research. He thanks the Center for their hospitality and financial support.

visiting the

Introduction

1

Wage

and

inequality in the U.S. has increased dramatically since the 1970s (e.g.

Pierce, 1993;

observed

in the return to

returns to

skills

Katz and Minrphy, 1992). For most of the period,

The standard theory

skills.

should encourage investments in

1997) have concluded that

we do

human

of

human

capital.

Juhn,

Murphy

meant an increase

this also

capital implies that higher

Many

observers

(e.g.

Topel,

actually observe faster skill accumulation, and this increase

in the supply of skills should eventually mitigate the increase in inequality.

Rising wage and income inequality affects not only the returns to education, but also the

resources that families have available to finance education.

Family income might matter

education decisions because of credit constraints, or because education

is

good. The change in the structure of wages during the 1980s, which reduced the wages of

skilled workers,

may have made

it

for

not a pure investment

less

harder for children firom these families to attend college,

despite the higher returns.^ In fact, while there

was a large increase

children from the poorest backgrounds

in the college

enrollment

was a much smaller increase

rates for children from richer families during the 1980s, there

for

(McPherson and Schapiro, 1991, Ellwood and Kane,

1999, and Table 1 below).

In this paper,

we

exploit the changes in the distribution of family income that have taken

place over the past 30 years to estimate the effect of parental resources on college education.

Our

strategy exploits the fact that families at the

much poorer

in the

of the income distribution were

1990s than they were in the 1970s, while the opposite

in the top quartile of the distribution.

in family

bottom

income caused by changes

This approach

in the U.S.

is

attractive since

is

it

true for families

exploits variations

income distribution, which are unlikely to be

correlated with other (observed and unobserved) characteristics affecting education choices.

Our estimates suggest

income on enrollments.

large effects of family

that a 10 percent increase in family income

is

For example, we find

associated with a 1.4 percentage point increase

in the probability of attending a four-year college.

Although there are numerous studies investigating the impact of family resources on education outcomes, whether income truly matters

this area just relate schooling

regressions, family

income may be proxying

reduce the

and controls

effect of

1999, Ellwood

for

OLS

In fact,

many

and Kane, 1998, or Cameron and Taber, 2000).

measurement

errors

and

variables correlated with

may be

transitory

seriously biased

movements

permanent income,

'See also Acemoglu and Pischke (1999)

investments in training

in

Most studies

equations. However, in

in

OLS

education

studies find that including par-

the family income on children's education

attenuating the effect of income on education.

"The empirical

in

type of school attended previously or test scores substantially

of the income elasticity of education

stantial

a hotly debated issue. ^

for family characteristics affecting "the

production function" (Lang and Ruud, 1986).

ents' education

is still

outcomes to family income

for

in

(e.g.

Cameron and Heckman,

Nevertheless, such estimates

downwards.

This attenuation bias

like parents'

will

be worse

if

other

education or the type of secondary

the argument that a higher return to

the presence of labor market imperfections.

literature has been surveyed by

First, there are sub-

incomes measured at a point in time,

Haveman and Wolfe

(1995).

human

capital

may reduce

As a

substantially understated. Second,

scores and previous schooling experience are

,

test

may be

estimate of the income effect

school chosen, are included as controls.

result, the

likely to

be endogenous and also affected by family income, so their inclusion may lead to biased

esti-

In fact, our strategy which does not suffer from these problems leads to substantially

mates.

larger estimates of the effect of parents' resources

Our

strategy

effect of

is

more

negative income tax experiments provide the only experimental study of the

The

income.

on children's education.

closely related to studies exploiting exogenous variation in parents'

income on schoohng, but they confound the

effect of

tax rates affecting the decisions of youths to work (see

e.g.

income with changes

Venti, 1984).

have made other attempts to address the possibility that income

unobserved factors which predict schooling outcomes of the

may

child.

A

in

marginal

few recent studies

also be correlated

Duncan

et al.

with

(1998) use

sibhng differences arguing that family income varies while other family characteristics remain

the same.

Shea (2000) uses industry and union wage

to job displacement as instruments for family income

finds

no

effects of parental resources

on education, but

differentials

and income changes due

and argues that these proxy

"luck."

his estimates are quite imprecise.

He

Both

of Shea's instruments are also not entirely convincing, since they are likely correlated with

parental attitudes towards education.'^

Mayer (1997) uses a

variety of approaches to argue

that unobserved family characteristics affecting education are relatively unimportant. She uses

variation in income induced by state welfare rules, compares the impact of different sources

of income,

and compares the

Using her estimates, she also

effect of

tries

income before and

after a child's education takes place.

to assess whether changes

in

income inequality predict the

enrollment patterns for children from different income groups over time. This comes closest to

our strategy of using changes in income inequality as an instrument for family income.

2

A

We now

Our

lasts

Simple Model of Schooling With Credit Constraints

outline a simple

objective

is

model

of investment in schooling based on Becker

and Tomes (1986).^

to obtain a simple estimating framework for our empirical work.

two periods.

In period

1,

an individual (parent) works, consumes

whether to send their offspring to

college, e

The

is

cost of schooling for family

where q denotes the income

below we can allow

i

exp{6i).

(ability) quartile of the family, so that in

income

is

s,

decides

the empirical work

unobserved characteristics across households

(ability) distribution.

education costs captures that there

saves

= or 1, and then dies at the end of the period.

We assume that the distribution of 6i is Gq {0),

for different distributions of

in different parts of the

c,

The economy

heterogeneity

The

among

fact that there

children or

is

among

a distribution of

the attitudes of

Duflo (2000) exploits the expansion of old-age pensions in South Africa to analyze the effect of family

resources on child health. She finds positive effect of resources on health, though given the differences in the

level of

development across South Africa and the U.S.,

it is

not clear whether these results can be generalized

to the U.S. context.

This model is also related to the large macroeconomic literature on credit constraints. See, among others,

Galor and Zeira (1993), Benabou (1996), Durlauf (1996), and Fernandez and Rogerson (1996) on the effect of

credit constraints

on human capital investments, and Acemoglu (1997) on the interaction between credit and

labor market imperfections in determining

human

capital investments.

.

families towards education. Skilled individuals (those with education) receive a

wage ^5 and

an unskilled worker receives WuAll families have utility given as:

Inc

where

+ Plnc

the consumption of the offspring.

c is

future (offspring's) consumption

is

Consider a family with income

(1)

a parameter that measures

/? is

relative to current consumption.

In the absence of credit market problems, this family

y.

would simply maximize net present discounted value of income.

which implies that

how important

We

assume no discounting,

this family should invest in education as long as

e<e = \n[ws- Wu]

The important

point

matter.

very high, but

If 9 is

is

that, because education

than

still less

9,

is

(2)

a pure investment good, income does not

then the family will borrow pledging the future

earnings of their offspring in order to achieve consumption smoothing.

Instead, here,

we assume

that

all

families face credit

pledging the future income of their offspring.

maximize

by choosing

(1)

c, c, s,

and

More

market problems, and cannot borrow

problem of parent

formally, the

i

is

to

e subject to:

+ exp{6i)e + s <yi

c = s + Wy, + {ws — Wu)e

c

(3)

s>0

The

first

condition

sumption of the

investment

first

period,

If

(s

>

lem

in

the budget constraint for the family.

is

child,

and the

final

one

is

The second determines

the "credit constraint". This constraint implies that

education comes at the cost of consumption smoothing (low consumption in the

and high consumption

the level of income

is

in (3) (Becker

in the second period).

high enough, so that parents would like to leave positive bequests

0) to their offspring, credit

market problems

and Tomes, 1986).

will

not matter in the maximization prob-

Such a family already has high enough income, and

consumption smoothing would mean transferring resources to their

so using the

The

most

efficient

combination of

condition guaranteeing that

we

human

income

is

capital investment

high enough that even at the

with optimal investment in

Hence among

skills),

families with

offspring.

2ws

They

will

do

and monetary bequests.

are in the positive bequest region

y>y = Ws + exp \9j —

In this case,

the con-

is

- Wu-

maximum

cost of education (consistent

parents would leave positive bequests.

income y >y, the fraction investing

Gr{9)=Gr{\n[w,-Wu]),

in

education

is

(4)

where Gr

the distribution of education costs

is

main point

to note

among

The

"rich" (unconstrained) famihes.

that the fraction investing depends only on skilled-unskilled wage pre-

is

mium, and not on income.

Next, consider a "poor" family with income y

Then

in schooling.

their hfetime utility will

consume the income

period, they

unskilled earnings, Wy,.

U{e

=

=

1)

ln(y

-

their offspring obtains

in

Wu, and suppose that

=

be U{e

=

0)

+ pinWs.

{wg

— Wu)/wu

investing in education

(3\nWu, since in the

first

Now,

their first period

consumption

is

-

y

exp

(6'i),

who have

abihty 6

e*

=

is

the college premium.

ln

<

Iny

y

w.

is

a cutoff level of

ability, 6*,

such

9* invest in schooling, with

+ /?lnr

Therefore, the fraction of poor families

is

Gp(r)«Gp(lny + /31nr),

where Gp

fraction

3

is

the distribution of education costs

now

but

consumption w^.

that only poor parents with children

=

+

does not invest

the second period, their offspring consumes the

Comparison of these two expressions implies that there

where r

Iny

it

in contrast, they send their child to school, they obtain utility

If,

exp(6'i))

and

y,

<

among poor

(5)

Unlike in eq.

families.

(4),

the

depends not only on the college premium, but also on family income.

Empirical Strategy

The above model

easily translated into a simple linear estimating equation.

is

identify in the data

who

If

we could

we should run

the unconstrained and the constrained families were,

equations of the following form:

where

i

For unconstrained families

:

For constrained families

:

Sijt

sm —

8r-\- Sj

8p

+ 5j

+ 6t + ocrT'jt + ^ijt

+ 5f + O-pTjt + jSp ^liyiqjt + ^ijt,

denotes individual family, j denotes region, and

which denotes whether the individual

error term.

Since

denotes time.

in question attends college, djt

premium and family income

we do not observe which

where the

t

is

Sijt is

a 0-1 variable

an individual specific

These expressions follow from our theoretical model above, and allow both the

effect of the college

effect of family

also allow the relationship

This

may be

of a

more general model

quartiles.

Such a

between income quartile and enrollments to be non-

useful because the poorest households

thanks to need based financial

financial aid,

we think

and poor households.

income on enrollments varies across income

monotonic.

is

to differ across rich

families are constrained,

model would

colleges.

—

may be

relatively unconstrained

aid, while middle-class households,

constrained, especially

if

who do

not qualify for

they wish to send their children to private

This gives us the following model

^iqjt

(5, -f-

6j

+

6t

+ aqTjt + Pq In yrqjt + e^qjt,

(6)

,

where

q denotes

(6) nests our

allows

income

and

We will

= a and 13^ =

j3

as before j denotes region,

=

more general heterogeneous

quartiles.

aq

quartile,

model above when Pg

for rich famihes,

effects of

in order to

make

(6) includes

main

changes in federal financial aid and the

same region

>

for

poor famihes, but

premium

across income

income quartiles by setting

boom

the college

like

The

effects.

related to the

we have written the

In addition,

like.

which implies that families look

latter

Vietnam

relevant

premium that apphes

at the college

in

Both of these assumptions appear reasonable: most people

the region at the time of schooling.

in the

/?

college

income quartile and time

effects of

era,

as Vjt,

denotes time. Expression

t

better use of the limited variation in our data.

capture the effects of aggregate conditions

work

/3g

income and the

will

premium

=

also present results restricting the effects across

Note that equation

college

and

and

as they completed schooling (see

Acemoglu and Pischke, 2000), and

the existing time-series evidence suggests that current returns, not expected future returns

matter most

income

In any case,

(Freeman, 1976).

for schooling decisions

elasticity of college enrollments

is

insensitive to

how we

we show below that the

control for the effect of returns

to college.

Equation

(6)

can be aggregated across individuals to be written in a more compact form:

Sqjt

where

(or

Sqjt

among

6q

+

6J

+6t+ aqTjt + (3 q In Yq;jt + Sqjt,

the fraction of students attending college

those in the right age bracket) in region

and

college,

time

is

=

In Ygt

is

j,

among

those

who completed

income quartile

the log average income of family

is

(7)

g,

in region j,

and time

t

high school

who

income quartile

attend

g,

and

t.

It is

also useful to note that the estimation of equation (7) can

be thought of as instrumental

variables (IV) estimation of

Sqjt

using the

full set

=

6J

+6t

+ aqrjt + /?, In Yq^t + Cqjt

of quartile-region-time interactions as the instruments for In Yqjt.

interpretation clarifies

why our

with parental

labor supply or other reasons.

may be

ability,

correlated with the error

is

empirical strategy

term

in equation (8).

because we are controlhng

attractive.

Family income

As captured

in the

is

likely to

vary

model, these factors

Our

for

the parents' rank in the income distribution,

in InYqjt conditional

structure which have taken place in

differential variation in the parental

wage

on

this rank.

income distribution across

The changes

in

is

the wage

differentials

quartiles.

wage structure over time, our estimation strategy

have changed

also

differently in different states or regions.

relying completely on within region variations we can control

and parental background group

Identification

the United States during the 1970s and 1980s provide

In addition to using variation in the

exploits the fact that

is

strategy avoids the bias that will arise from

close to a sufficient statistic for their unobservable characteristics.

then achieved from the variations

By

is

This IV

correlated with the family's costs (attitudes) of educating their child, so that In Yqjt

this correlation,

which

(8)

at the aggregate level in the college

for

the interactions of time

attendance equation. This

allows us to also estimate models that control for other factors which might have affected the

children of richer or poorer parents differently, like differential changes in tuition costs at

private

and public

universities, or the

changes in the availability of Pell grants and Guaranteed

Student Loans.

Data

4

We study the effect of family income on college attendance,

of high school leavers sponsored

using the three longitudinal surveys

by the U.S. National Center

for

Education Statistics (NCES):

the National Longitudinal Study of the High School Class of 1972 (NLS-72), the High School

and Beyond Survey (HSB), which started with high school seniors and sophomores

and the National Educational Longitudinal Study (NELS), which started with a

graders in 1988.

These surveys roughly span the two decades of the 1970s and the 1980s

which returns to college

Each

on the educational background of the parents

and on family income when the respondent was a senior

various stages during the

(see

Duncan

life

et al., 1998)

might

of a child

and opportunity

variables for income,

affect its

we want

quartile in the

may impede

these two distributions,

We

in

we

Follow-up information after leaving high school was

From

overcome

ever attended a four-year college.

We

this

problem by

fitting

derive the enrollment rate for each

first

in the quartile.

two years

collected

this follow-up wave,

whether an individual ever attended any college

income to cover the

the sample of college entrants and

income distribution and the average family income

spondents were in their senior year.

seems to be

schooling datasets record only bracketed

and there are 10 to 18 brackets.

From

the cognitive

in high school

to focus on the role of

The

costs of attending college.

Family income at

ultimate chance of attending college

income during the senior year

parametric Singh-Maddala distributions to the incomes

in the entire sample.

in high school.

because fewer resources at a young age

child. Nevertheless,

the correct concept for our project because

direct

in

decreased and then increased.

first

of these surveys collected information

development of a

in 1980,

class of 8th

in the interim,

we

after the re-

construct measures of

and whether the individual

derived information on returns from the 1970, 1980,

and 1990 Censuses by calculating the average wages of those with exactly 16 and exactly 12

years of education (those with a college degree and a high school degree, respectively)

workers with

is

1

to 5 years of experience.

Our

definition of the return

approximately equal to the return to one year of

Table

1

gives

summary

statistics for

is

among

\n{wi^/wi2)l^, which

college.

our sample by family income quartiles and year.

The

top panel gives the fraction of children from families of different quartiles ever attending any

college within

two years of high school.

The second panel shows the same information

attending four-year college, and the bottom panel

statistics

by region and

A number

in

year,

and the variation

is

for family

in the college

of patterns are clearly visible from Tables

1

income.

premium

and

2.

Table 2 gives similar

across regions

There has been

the fraction of children attending four-year college between 1972 and 1982.

and 1992, there has been a substantial

children in the upper two quartiles.

increase, but this increase

The bottom

is

for

and time.

little

increase

Between 1982

concentrated

among the

panel in the table shows that family incomes

have only risen

and

quartiles,

top quartile over this period, stagnated for the middle two

for families in the

These patterns are therefore

fallen slightly for families in the lowest quartile.

consistent with substantial income effects on enrollments in the aggregate.

that there

any

a

is

much weaker

This

college.

contrast across quartiles

in line

is

and attending four-year

is

difference

noteworthy

at the fraction ever attending

between attending any college

mostly made up by community colleges, which are very cheap,

and pose a lower opportunity cost

from poor backgrounds since the duration

for families

is

Therefore, in the presence of significant credit market barriers affecting education

shorter.

choices,

The

with our thinking.

college

when looking

It is also

we would expect

community

colleges

families to increase the rate at

much more than

may be

also implies that there

which they send

their children to

to four-year colleges over this period.

This observation

quite significant heterogeneity in the quality of colleges that

children from poorer and richer families are attending within these broad categories of two-year

and four-year

colleges.

Table 2 reveals that there

Northeast and the least

is

substantial variation in the variables of interest across the

Both income and

four Census regions.

but there

is

in the

West.

college enrollment rates have

Returns have moved mostly

some heterogeneity across regions

the 1970s.

in

grown the most

in

the

during the 1980s

in line

This illustrates that the region

variation will be quite helpful in identifying our models.

Results

5

We

is

with the regressions which do not control

start in Table 3

for quartile effects.

equivalent to estimating (8) without instrumenting for family income.

The

This

coefficient

on

family income in these models therefore captures both the effect of income and any other effect

of family

background which

In this

is

and the following

correlated with income.

tables, the first four

college in a region-income quartile-year cell as

dependent variable, while the

are for the fraction attending four-year college.

four columns are

more important

for

columns have the fraction attending any

The

our argument.

It

of the effect of log income

on enrollments, 0.18, implies that a 10 percent increase in family income

1.8 percentage point increase in enrollments.

This

is

four columns

turns out that the coefficients on

The estimate

family income are very stable across specifications.

Isist

discussion above suggests that the last

is

associated by a

a fairly large effect of family income on

college enrollments.

The

first

and

fifth

columns do not control

national changes in family income and

for

time

in the college

effects, so

premium

they effectively exploit the

to identify the effects on enroll-

ments. These columns also show moderate effects of returns of attending college. For example,

the estimate of 0.82 for log returns in column (5) imphes that a 4 log point increase in the

college return, which

is

roughly the increase from 1980 to 1990, should lead to a 3.3 percentage

point increase in college enrollments. In the remaining columns,

second and sixth columns, we drop returns to

to college are included.

In

all

college, while in

we add year

columns

(3)

cases, the estimates of the effect of family

effects.

and

(7),

In the

returns

income on college

attendance

is

is

unaffected.

Interestingly, in

columns

making

consider only the national return in

also

wisdom that returns

and

Although

estimated to be insignificant and negative.

ventional

(3)

the effect of college returns

(7),

may be

this result

college decisions,

because families

sheds some doubt on the con-

it

to education have a major effect on enrollment decisions (see

Acemoglu and Pischke, 2000).

Here we add dummies

Table 4 gives our main results.

for the

income

This

quartile.

should control for any invariant family background effects related to the rank of a family in the

income distribution and

in

columns

Table

3.

and

(1)

time

which do not control

(5),

Nevertheless, there are

Our

college enrollments.

effects

and

many

other aggregate trends, which might have affected

columns

we

and the

That the

3.

some

eliminating

is

family income. Nevertheless,

The

the estimate of the income elasticity.

(6) therefore include

coefficient for family

effect of

family income

is

income

income

for

both enrollment

columns

(3)

and

(7)

has

insignificant.

columns

(4)

Finally,

and

(8)

adding second

not

on

on the

level interactions

changes the general magnitude of

much

the estimates httle, though, since these controls eliminate

is

little effect

Interestingly, in these specifications the estimates

in

is

now

smaller

enrollment (although this difference

in the region in

become

and time

of income quartile, region,

and

of the unobserved characteristics correlated with

effect is larger for four- year college

returns to schooling once again

(2)

find a significant effect of family

Adding returns to coUege

results

are very similar to those in

effects,

exploit only the within region variation.

implies that our strategy

significant).

time

for

preferred specifications, in

lower than those in column (1) and in Table

variables,

income on enrollments. The

isolate the true effect of family

of the variation in the data,

the effects are no longer statistically significant

We therefore conclude that there is

Our

It

a robust effect of family income on enrollments decisions.

baseline estimate of 0.14 indicates an economically very significant effect of family income.

implies that family income, rather than other factors related to family background, explain

27 percentage points of the 36 percentage point difference in the enrollment rates of children

from the bottom and top quartiles

have found positive

in 1992.

income.

effects of

This

is

large

compared to other

studies,

which

For example, Ellwood and Kane (1999) find that family

income explains only 9 percentage points of the 26 percentage points enrollment difference

between the top and bottom quartiles

The framework we

and returns by income

families.

It is

possible to estimate separate effects for family income

The

quartile.

results are less clear-cut,

we do not

1982 after introducing various controls.

outlined above suggested that the effects of family income might differ

between rich and poor

effects are allowed to

in

vary by income quartile.

find that family

income

is

even relatively rich families

some

for reasons other

may

To the degree that there

most important

in the case of four-year college, the opposite

matter

These

results of this exercise are given in Table 5.

mostly because the estimates become relatively imprecise once the

for

are any patterns,

the lowest income families

seems to be true).

(in fact

This might indicate that

not be completely unconstrained. In addition, income

than credit market constraints,

for

example, because college

may

is,

to

degree, a consumption good rather than a pure investment good. Since the estimates are

imprecise,

it is

difficult to

draw firm conclusions from the

results in

Table

5.

Summary

6

The income

nomics

elasticity of

of

a key parameter for the labor and macroeco-

is

knowing how responsive

college enrollments will

income may have become even more important with the increase

schooling, which

be

in the returns to

expected to encourage greater enrollments.

is

we proposed

In this paper,

We

The importance

literatures.

to family

education decisions

a novel identification strategy for estimating this elasticity.

exploited variations in family income over time due to changes in the overall income

distribution.

in family

We

income

find reasonably robust

is

and large income

A

elasticities.

predicted to increase college enrollments by

1

10 percent increase

to 1.4 percentage points.

References

1]

Acemoglu Daron (1997) "Matching, heterogeneity and the evolution

Journal of Economic Growth

2]

Economic Journal Features

MIT

in imperfect

109, F112-F142.

and LSE.

Becker, Gary and Nigel

Tomes

Journal of Labor Economics

5]

61-92.

Acemoglu, Daron and Jorn-Steffen Pischke (2000) "Does inequality encourage education?"

Mimeo,

4]

income inequality"

Acemoglu, Daron and Jorn-Steffen Pischke (1999) "Beyond Becker: Training

labor markets"

3]

2,

of

4,

(1986)

"Human

and the

rise

and

fall

of families,"

S1-S39.

Benabou, Roland (1996) "Heterogeneity,

plications of

capital

stratification

community structure and school

finance"

and growth: Macroeconomic im-

American Economic Review

86,

584-609.

6]

Cameron, Stephen and James Heckman (1999) "The dynamics

for blacks, Hispanics,

7]

9]

NBER Working

Paper No. 7761.

Duflo, Esther (2000) "Child health

and household resources

from the old age pensions program"

MIT

in

South Africa: Evidence

mimeo.

Duncan, Greg, Wei-Jun Yeung, Jeanne Brooks-Gunn, and Judith Smith (1998) "How

much does childhood poverty

Review 63

[10]

NBER

Cameron, Stephen and Christopher Taber (2000) "Borrowing constraints and the returns

to schooling,"

8]

and whites,"

of educational attainment

Working Paper No. 7249.

(3),

1,

chances of children?"

American

Sociological

406-423.

Durlauf, Steven (1996)

Growth

affect the life

75-93.

"A theory

of persistent

income inequality" Journal of Economic

[11]

Ellwood, David and

Thomas Kane

background and the growing gaps

"Who

(1999)

in enrollment"

is

getting a college education? Family

mimeo.,

JFK

School of Government,

Harvard University.

[12]

Fernandez, Raquel and Richard Rogerson (1996) "Income distribution, communities and

the quality of public education" Quarterly Journal of Economics 111, 135-164.

[13]

Freeman, Richard (1976) The over-educated American. London: Academic Press.

[14]

Galor,

of

[15]

[16]

Oded and Joseph

Economic Studies

Juhn, Chinhui, Kevin Murphy and Brooks Pierce (1993) "Wage inequality and the

skill,"

Journal of Political

Katz, Lawrence and Kevin

and demand

[18]

60, 35-52.

Haveman, Robert and Barbara Wolfe (1995) "The determinants of children's attainment:

A review of methods and findings," Journal of Economic Literature 33, 1829-1878.

returns to

[17]

Zeira (1993) "Income distribution and macroeconomics," Review

Murphy

factors," Quarterly

Economy

101, 4^0-442-

(1992) "Changes in relative wages, 1963-1987: Supply

Journal of Economics 107, 35-78.

Lang, Kevin and Ruud, Paul A. (1986)." Returns to schooling, implicit discount rates and

black-white wage differentials" Review of Economics

[19]

rise in

&

Statistics 68, 41-47.

Mayer, Susan (1997) What money can't buy: Family income and children's

life

chances.

Cambridge: Harvard University Press.

[20]

McPherson, Michael and Morton Owen Schapiro (1991) Keeping

college affordable.

ernment and educational opportunity. Washington: The Brookings

[21]

Shea, John (2000) "Does parents'

money

Gov-

Institution.

matter," Journal of Public Economics 77

(2),

155-184.

[22]

Topel, Robert (1997) "Factor proportions and relative wages:

The supply

side determi-

nants of wage inequality," Journal of Economic Perspectives 11, 55-74.

[23]

Venti, Stephen (1984)

market

"The

activities of youths,"

effect of

income maintenance on work, schoohng, and non-

Review of Economics and

10

Statistics 66, 16-25.

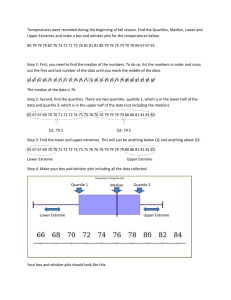

Table

1

Means of Fraction Ever Attending Any College Within Two Years of High School and Family Income

by Year and Family Income Quartile, 1972-1 992

12

Family Income Quartile

Year

3

4

Attending Any College

1972

0.37

0.45

0.53

0.69

1980

0.45

0.52

0.60

0.72

1982

0.44

0.54

0.61

0.73

1992

0.56

0.66

0.75

0.87

Attending Four Year College

1972

0.22

0.28

0.34

0.51

1980

0.25

0.30

0.38

0.53

1982

0.26

0.33

0.39

0.53

1992

0.30

0.38

0.47

0.66

Family Income

Note: Cell level

Students

left

means

for

(in

$1,000)

1972

16.8

30.7

43.6

69.8

1980

16.6

28.5

40.9

81.4

1982

16.6

30.4

44.2

77.4

1992

13.7

30.0

48.4

92.2

4 Census regions. Data from the NLS-72,

high school in 1972, 1980, 1982, and 1992.

HSB

Senior and

Sophomore

cohorts, and the

NELS.

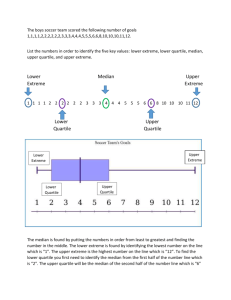

Table 2

Means of Fraction Ever Attending Any College Within Two Years of High School and Family Income

by Year and Census Region, 1972-1992

Census Region

V

Year

North

„

North

„

East

Attending

„

,

.

...

^

South

West

Central

Any College

1972

0.53

0.48

0.46

0.57

1980

0.58

0.55

0.52

0.63

1982

0.58

0.57

0.52

0.66

1992

0.76

0.70

0.68

0.69

Attending Four Year College

1972

0.40

0.36

0.33

0.28

1980

0.43

0.41

0.34

0.28

1982

0.43

0.41

0.34

0.34

1992

0.57

0.48

0.42

0.34

Family Income

(in

$1,000)

1972

41.4

41.1

36.7

41.7

1980

47.5

41.7

36.0

42.2

1982

42.3

42.3

37.2

46.8

1992

51.4

46.2

41.0

46.0

Returns

1972

0.125

0.098

0.113

0.079

1980/82

0.076

0.070

0.079

0.069

1992

0.114

0.115

0.116

0.114

Note: Cell level means for 4 Census regions. Data from the NLS-72, HSB Senior and Sophomore cohorts, and the

left high school in 1972, 1980, 1982, and 1992. Returns are calculated from the 1970, 1980, and 1990 Censuses.

NELS.

Students

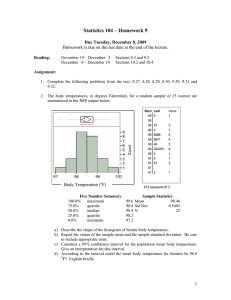

Table 3

Fixed Effects Regressions for the Probability of Attending College Within

No

Region by Income Quartile

Cells,

Log Mean Family Income

Return to College

0)

of High School

1972-1992

Ever Attending Any College

Independent Variable

Two Years

Controls for Income Quartile

(2)

(V

Ever Attending Four Year College

(4)

(5)

(6)

(7)

(S)

0.186

0.183

0.183

0.182

0.184

0.183

0.183

0.182

(0.016)

(0.007)

(0.007)

(0.006)

(0.011)

(0.008)

(0.008)

(0.008)

1.341

—

-0.790

—

0.822

—

-0.945

—

(0.485)

(0.667)

(0.751)

(0.351)

Region Effects

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Year Effects

No

Yes

Yes

Yes

No

Yes

Yes

Yes

No

No

No

Yes

No

No

No

Yes

Region

*

Year Effects

cell level means for 4 Census regions, 4 years, and 4 quartiles for the income of the student's family. Number of

Dependent variable is the fraction of students enrolled in any college or in a four year college within two years of high

school graduation calculated from the NLS-72, HSB Senior and Sophomore cohorts, and the NELS. Students left high school in

1972, 1980, 1982, and 1992. Return to college is the relative wage of those with exactly 4 years of college to those with a high

school degree (for workers with 1-5 years of experience) calculated from the Census for 1970, 1980, and 1990.

Note: Data are

cells is 64.

Table 4

Fixed Effects Regressions for the Probability of Attending College Within

Two

Years of High School

Controlling for Income Quartile

Region by Income Quartile

Cells,

1972-1992

Ever Attending Any College

Independent Variable

Log Mean Family Income

Return to College

(1)

(2)

(3)

(4)

Ever Attending Four Year College

(5)

(6)

(7)

(8)

0.218

0.107

0.102

0.146

0.212

0.148

0.142

0.093

(0.101)

(0.044)

(0.044)

(0.107)

(0.065)

(0.041)

(0.040)

(0.108)

...

1.336

-0.887

0.817

-0.994

(0.491)

(0.616)

(0.314)

(0.556)

Region Effects

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Income Quartile Effects

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Year Effects

No

Yes

Yes

Yes

No

Yes

Yes

Yes

Income Quartile

*

Region Effects

No

No

No

Yes

No

No

Yes

Yes

Income Quartile

*

Year Effects

No

No

No

Yes

No

No

Yes

Yes

No

No

No

Yes

No

No

No

Yes

Region

*

Year Effects

cell level means for 4 Census regions, 4 years, and 4 quartiles for the income of the student's family. Number of

Dependent variable is the fraction of students enrolled in any college or in a four year college within two years of high

school graduation calculated from the NLS-72, HSB Senior and Sophomore cohorts, and the NELS. Students left high school in

1972, 1980, 1982, and 1992. Return to college is the relative wage of those with exactly 4 years of college to those with a high

school degree (for workers with 1 - 5 years of experience) calculated from the Census for 1970, 1980, and 1990.

Note: Data are

cells is 64.

Table 5

Fixed Effects Regressions for the Probability of Attending College Within

Two Years

of High School

by Income Quartile

Region by Income Quartile Cells, 1972-1992

Effects

Ever Attending Any College

Independent Variable

(1)

Log Mean Family Income

Quartile

1

Return

Quartile

(0.187)

(0.085)

(0.052)

(0.053)

(0.190)

0.229

0.189

0.167

0.201

0.151

0.128

0.087

-0.205

(0.258)

(0.113)

(0.117)

(0.334)

(0.153)

(0.105)

(0.101)

(0.339)

0.617

0.161

0.148

0.328

0.428

0.174

0.150

-0.039

(0.273)

(0.116)

(0.129)

(0.283)

(0.162)

(0.107)

(0.112)

(0.287)

0.405

0.012

-0.005

0.231

0.392

0.212

0.183

0.147

(0.152)

(0.071)

(0.072)

(0.132)

(0.092)

(0.066)

(0.063)

(0.134)

0.691

—

-1.049

—

-0.053

—

-1.577

—

—

0.481

1.367

College

to

—

—

-0.963

—

—

-0.438

—

0.171

—

—

1.304

—

-1.115

—

(0.627)

—

-0.226

—

(0.627)

(0.564)

(0.723)

-1.121

(0.630)

(0.622)

(0.722)

(0.952)

0.599

(0.556)

(0.726)

(1.050)

Quartile 4

-1.032

(0.659)

(0.623)

(0.759)

(0.938)

Return to College

Return

(8)

-0.016

0.139

1.144

Quartile 3

(7)

0.064

(0.064)

Return to College

Quartile 2

(6)

0.108

0.154

(1.052)

1

(5)

0.010

(0.056)

College

to

(4)

0.018

Log Mean Family Income

Quartile 4

(3)

(0.143)

Log Mean Family Income

Quartile 3

<

-0.039

Log Mean Family Income

Quartile 2

(2)

Ever Attending Four Year College

Region Effects

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Income Quartile Effects

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Year Effects

No

Yes

Yes

Yes

No

Yes

Yes

Yes

Income Quartile

*

Region Effects

No

No

No

Yes

No

Yes

Yes

Yes

Income Quartile

*

Year Effects

No

No

No

Yes

No

Yes

Yes

Yes

No

No

No

Yes

No

No

No

Yes

Region

*

Year Effects

cell level means for 4 Census regions, 4 years, and 4 quartiles for the income of the student's family. Number of

Dependent variable is the fraction of students enrolled in any college or in a four year college within two years of high

school graduation calculated from the NLS-72, HSB Senior and Sophomore cohorts, and the NELS. Students left high school in

Note; Data are

cells is 64.

is the relative wage of those with exactly 4 years of college to those with a high

of experience) calculated from the Census for 1970, 1980, and 1990.

1972, 1980, 1982, and 1992. Return to college

school degree (for workers with

1

-

5 years

537^ UI7

MIT LIBRARIES

3 9080 02237 4 82