Document 11157787

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/competitionefficOOacem

HB31

•M415

DEVVcY

m.C>s-C6>

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

COMPETITION AND EFFICIENCY

CONGESTED MARKETS .

IN

Daron Acemoglu

Asuman

E. Ozdaglar

Working Paper 05-06

February 7, 2005

1

Room

E52-251

50 Memorial Drive

Cambridge, MA 021 42

This paper can be downloaded without charge from the

Social Science

Research Network Paper Collection

http://ssrn.com/abstract=676662

at

'>3SACHUSETTS INSTITUTE

OF TECHNOLOGY

MAR

1

2005

LIBRARIES

1

Competition and Efficiency

in

Congested Markets*

Daron Acemoglu

Department of Economics

Massachusetts Institute of Technology

Asuman

Department

E. Ozdaglar

of Electrical Engineering

and Computer Science

Massachusetts Institute of Technology

February

17,

2005

Abstract

We study the

efficiency of oligopoly equilibria in congested markets.

The moti-

vating examples are the allocation of network flows in a communication network or

We show that increasing competition among

measured as the difference between users' willingness to pay and delay costs. We characterize a tight bound of 5/6 on efficiency

in pure strategy equilibria. This bound is tight even when the number of routes

and oligopolists is arbitrarily large. We also study the efficiency properties of

mixed strategy equilibria.

of

traJfi-C

in a transportation

oligopolists

can reduce

network.

efficiency,

'We thank Xin Huang, Ramesh Johari, Eric Maskin, Nicolas Stier Moses, Jean Tirole, John Tsitsiklis,

Muhamet Yildiz and participants at the INFORMS conference, Denver 2004 for useful

Ivan Werning,

comments.

Introduction

1

We

analj'ze price competition in the presence of congestion costs. Consider the following

environment: one unit of

traffic

can use one of / alternative routes. More

traffic

on a

particular route causes delays, exerting a negative (congestion) externahty on existing

Congestion costs are captured by a route-specific non-decreasing convex latency

traffic.^

function,

li

(•).

denoted by

pi.

Profit-maximizing oligopohsts set prices

We

each price vector,

for

(tolls) for travel

on each route

analyze subgame perfect Nash equilibria of this environment, where

p, all traffic

chooses the path that has

minimum

(toll

plus delay)

maximize profits.

of practical importance for a number of settings.

These include transportation and communication networks, where additional use of a

route (path) generates greater congestion for all users, and markets in which there are

"snob" effects, so that goods consumed by fewer other consumers are more valuable (see

h+Pi, and oligopohsts choose

The environment we analyze is

cost,

example,

for

The key

[38]).

prices to

feature of these environments

externality that users exert on others.

is

the negative congestion

This externality has been well-recognized since

[33], Wardrop [41], Beckmann et al.

and by Orda et. al. [23], Korilis et. al. [18], Kelly [17],

Low [20] in communication networks. More recently, there has been a growing literature

that focuses on quantification of efficiency loss (referred to as the price of anarchy) that

results from externaUties and strategic behavior in different classes of problems; selfish

routing (Koutsoupias and Papadimitriou [19], Roughgarden and Tardos [31], Correa,

Schulz, and Stier-Moses [8], Perakis [26], and Friedman [12]), resource allocation by

market mechanisms (Johari and Tsitsiklis [16], Sanghavi and Hajek [32]), and network

the work by Pigou

[27] in

economics, by Samuelson

in transportation networks,

[4]

design (Anshelevich

et.al.

[2]).

Nevertheless, the game-theoretic interactions between

and users, or the effects of competition among the providers

has not been considered. This is an important area for analysis

(multiple) service providers

on the

efficiency loss

since in

most

Moreover, we

applications, (competing) profit-maximizing entities charge prices for use.

will

show that the nature of the analysis changes

significantly in the

presence of price competition.

We provide a general framework for the analysis of price competition among providers

in

a congested (and potentiaUy capacitated) network, study existence of pure strategy

and mixed strategy equihbria, and characterize and quantify the efficiency properties of

There are four sets of major results from our analysis.

First, though the equilibrium of traffic assignment without prices can be highly

inefficient (e.g., [27], [31], [8]), price-setting by a monopolist internalizes the negative

externality and achieves efficiency.

Second, increasing competition can increase inefficiency. In fact, changing the market

structure from monopoly to duopoly almost always increases inefficiency. This result

contrasts with most existing results in the economics literature where greater competition

equilibria.

tends to improve the allocation of resources

result

is

(e.g.

driven by the presence of congestion and

see Tirole [36]).

is

illustrated

The

intuition for this

by the example we discuss

below.^

^

An

externality arises

when

the actions of the player in a

game

^Because users are homogeneous and have a constant reservation

affects the payoff of other players.

utility in

our model, in the absence

we provide a tight bound on the extent of inefficiency in the presence of

which apphes irrespective of the number of routes, /. We show that social

surplus (defined as the difference between users' willingness to pay and the delay cost)

in any pure strategy oligopoly equilibrium is always greater than 5/6 of the maximum

Simple examples reach this 5/6 bound. Interestingly, this bound is

social surplus.

Third,

pricing,

obtained even

when

the

number

of routes, /,

Fourth, pure strategy equilibria

the fact that

what we have here

is

may

fail

is

arbitrarily large.

This

to exist.

is

not surprising in view of

a version of a Bertrand-Edgeworth game where pure

strategy equilibria do not exist in the presence of convex costs of production or capacity constraints (e.g.,

Edgeworth

[11],

Shubik

Benassy

[35],

[6],

Vives

[40]).

However,

environment we show that when latency functions are linear, a pure

strategy equihbrium always exists, essentially because some amount of congestion externahties remove the payoff discontinuities inherent in the Bertrand-Edgeworth game.

in our oligopoly

Non-existence becomes an issue in our environment

convex. In this case,

we prove that mixed

when

latency functions are highly

strategy equilibria always exist.

We

also

show

that mixed strategy equilibria can lead to arbitrarily inefficient worst-case realizations;

in particular, social surplus

maximum

can become arbitrarily small relative to the

social

surplus.

The

following example illustrates

Example

1

Figure

1

some

of these results.

shows a situation similar to the one first analyzed by Pigou [27]

due to congestion externalities. One unit of traffic will travel

to highlight the inefficiency

from origin A to destination B, using either route

are given by

x^

^1

It is

= —,

{x)

h

or route

1

[x)

=

straightforward to see that the efficient allocation

2.

The

latency functions

2

-X.

[i.e.,

one that minimizes the total

2/3 and xf = 1/3, while the (Wardrop) equilibrium

allocation that equates delay on the two paths is x^^ w .73 > xf and x'^^ « .27 < xf

delay cost '^^li{xi)xi]

The

xf

is

source of the inefficiency

=

is

that each unit of traffic does not internalize the greater

increase in delay from travel on route

1,

so there

is

too

much

use of this route relative

to the efficient allocation.

Now

consider a monopolist controlling both routes and setting prices for travel to

maximize

its profits.

olist will set

We

will

show

below that in this case, the monop(when li is differentiable), which exactly

in greater detail

a price including a markup,

x^l'^

internalizes the congestion externality. In other words, this

markup

is

equivalent to the

Pigovian tax that a social planner would set in order to induce decentralized

traffic to

choose the efficient allocation. Consequently, in this simple example, monopoly prices

win be

in the

pf ^ = {2/^f + k and pf ^ =

Wardrop equilibrium will be

(2/3^)

+ ^,

for

some constant

k.

The

identical to the efficient allocation,

resulting traffic

i.e.,

x^^ —

2/3

and x^^^ = 1/3.

Next consider a duopoly situation, where each route is controlled by a different profitmaximizing provider. In this case, it can be shown that equilibrium prices will take the

all market structures would achieve

would have no efficiency consequence.

of congestion externalities,

to duopoly, for example,

efRciency,

and a change from monopoly

,

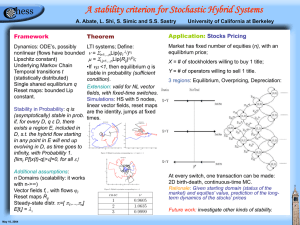

Ii(x)=x73

l2(x)=(2/3)x

Figure

form pf-^

p^^

=

?» 0.44.

A

1:

Xi

{l[

The

two link network with congestion-dependant latency functions.

+

I'o)

Eq. (20) in Section

[see

resulting equihbrium traffic

4],

or

xf^

more

w

specifically,

.58

pf^

^

< xf and x^^ «

and

0.61

.42

>

xf

which also differs from the efficient allocation. We will show that this is generally the case

in the ohgopoly equilibrium. Interestingly, while in the Wardrop equihbrium without

prices, there was too much traffic on route 1, now there is too little traffic because

of its greater markup. It is also noteworthy that although the duopoly equilibrium

is

monopoly equihbrium, in the monopoly equilibrium k is

consumer surplus is captured by the monopolist, while in the

oligopoly equilibrium users may have positive consumer surplus.^

is

inefficient relative to the

chosen such that

The

follows.

all

of the

intuition for the inefficiency of duopoly relative to

There

is

now a new

which they exploit by distorting the pattern of

1,

charges a higher price,

2,

raising congestion

it

monopoly can be obtained

2.

But

this

"locked-in," because their outside option,

when provider

traffic:

realizes that this will

on route

push some

traffic

1,

controlling route

from route

1

to route

makes the traffic using route 1 become more

travel on the route 2, has become worse."* As

a result, the optimal price that each duopolist charges will include an additional

over the Pigovian markup. These are XiZj for route

two markups are generally

as

source of (differential) monopoly power for each duopolist,

1

and

X2l'i

markup

for route 2. Since these

different, they will distort the pattern of traffic

away from

the efficient allocation. Naturally, however, prices are typically lower with duopoly, so

even though social surplus declines, users

will

command

will

be better

off

than in monopoly

(i.e.,

they

a positive consumer surplus).

Although there is a large hterature on models of congestion both in transportation

and communication networks, very few studies have investigated the implications of

having the "property rights" over routes assigned to profit-maximizing providers. In

Basar and Srikant analyze monopoly pricing under specific assumptions on the

[3],

utility

and latency functions. He and Walrand [15] study competition and cooperation among

internet service providers under specific demand models. Issues of efficient allocation of

^Consumer surplus is defined as the difference between users' willingness to pay and effective costs,

li{xi), and is thus different from social surplus (which is the difference between users' willingness

to pay and latency cost, li{xi), thus also takes into account producer surplus/profits). See Mas-Colell,

Winston, and Green [21].

*Using economics terminology, we could also say that the demand for route 1 becomes more "inelastic". Since this term has a different meaning in the communication networks literature (see [34]), we

Pi

+

do not use

it

here.

do not arise in these papers. Our previous work [1] studies

monopoly problem and contains the efficiency of the monopoly result (with inelastic

traffic and more restrictive assumptions on latencies), but none of the other results here.

To minimize overlap, we discuss the monopoly problem only briefly in this paper.

In the rest of the paper, we use the terminology of a (communication) network,

flows or traffic across routes

the

though

of the analysis applies to resource allocation in transportation networks,

all

markets, and other economic applications. Section 2 describes the basic en-

electricity

Section 3 briefly characterizes the monopoly equihbrium and establishes

vironment.

Section 4 defines and characterizes the oligopoly equilibria with compet-

its efficiency.

ing profit-maximizing providers. Section 5 contains the

main

results

and characterizes

the efficiency properties of the ohgopoly equilibrium and provide bounds on efficiency.

Section 6 contains concluding comments.

Regarding notation,

all

vectors are viewed as

be interpreted componentwise.

vectors. Let

We

d be a closed subset of

oo)

[0,

column

M^

denote by

and

vectors,

and inequalities are to

the set of nonnegative /-dimensional

let

/

:

Q

M

i—>

We

be a convex function.

use df{x) to denote the set of subgradients of / at x, and f~{x) and f'^{x) to denote

the

left

and

right derivatives of

/

at x.

Model

2

We

consider a network with / parallel links. Let

Let X, denote the total flow on link

Each

i,

=

and x

I=

[xi,

.

.

.

{!,...,/} denote the set of links.

denote the vector of link flows.

,xi]

network has a flow-dependent latency function k{xi), which measures

i. We denote the price

link in the

the travel time (or delay) as a function of the total flow on link

per unit flow (bandwidth) of link

We

i

hy

Let p

Pi.

=

denote the vector of prices.

,Pi]

{pi,-

are interested in the problem of routing d units of flow across the / links.

sume that

this

the aggregate flow of

is

many

"small" users

principle (see [41]) in characterizing the flow distribution in the network;

are routed along paths with

at the given flow

ciple

is

minimum

and the price

used extensively

in

effective cost, defined as the

traffic

and communication networks

a reservation utility R and decide not

[9],

[25])

the reservation

utility.

as-

sum

i.e.,

the flows

of the latency

path (see the definition below). Wardrop's prin-

of that

modelling

We

and thus adopt the Wardrop's

([31],

to

behavior in transportation networks

[8]).

We

send their fiow

([4],

assume that the users have

also

if

the effective cost exceeds

This implies that user preferences can be represented by the

piecewise hnear aggregate utility function u{-) depicted in Figure 2.^

Definition 1

For a given price vector

p >

0,^

a vector

x^^ G Mi

is

a Wardrop

This simplifying assumption implies that all users arc "homogeneous" in the sense that they have

utility, R. We discuss potential issues in extending this work to users with elastic

and heterogeneous requirements in the concluding section.

the

same reservation

''Since the reservation utility of users

i.

Throughout the paper, wc use p >

is

equal to R,

and p €

[0,

RY

we can

also restrict attention to pi

interchangeably.

<

R

for all

u(x)

Figure

equilibrium

(WE)

2:

Aggregate

utility function.

if

(1)

We

denote the set of

We

WE

at a given

p by W{p).

adopt the following assumption on the latency functions throughout the paper.

Assumption

1 For each

i

6 X, the latency function

convex, nondecreasing, and satisfies

/^(O)

=

li

:

[0, cx))

Hence, we allow the latency functions to be extended

Ci

=

for

problem

i—>

[0,

oo] is

proper closed

0.

real- valued

(see

[7]).

Let

{x E [0, oo)

li{x) < oo} denote the effective domain of li. By Assumption 1,

Ci is a closed interval of the form [0, b] or [0, oo). Let bd = sup^g,-;^ x. Without loss of

generality, we can add the constraint Xj £ C, in Eq. (1). Using the optimality conditions

I

and there

(1),

exists

we see that a vector x^^ € M^ is a WE if and only if

some A > such that A( X^^^^ x^^ — d) = and for all

R-k{xf^)-p, <X ifxf'^-O,

= A if < xf"^ <

>A ifxf^ = 6c..

When

the latency functions are real-valued

WE,

characterization of a

This

lemma

equalized on

Lemma

which

states that in the

all links

1 Let

[i.e.,

Ci

=

[0,

d

(2)

be

oo)],

we obtain the following

often used as the definition of a

WE,

<

WE in the literature.

the effective costs, defined as li{xf^^)

+

pi,

all

i

are

with positive flows (proof omitted).

Assumption

Then a nonnegative

is

X^j^j xf^^

i,

1

hold,

vector x* E

li{x*)+pi

=

and assume further that Ci

if and only if

—

[0,

oo) for

G I.

W{p)

mm{lj{x*)

+ pj},

V

i

with X*

>

0,

(3)

li{x*)+pi

<

V

R,

with x*

i

>

0,

I

2

with J2i=i ^*

Example

=

2

c?

=1

if niirij

{/j(xj)

+Pj} <

R.

below shows that condition

latency functions are not real- valued. Next

lemma may

(3) in this

we

not hold

establish the existence of a

when

the

WE.

(Existence and Continuity) Let Assumption 1 hold. For any price

1

> 0, the set of WE, W{p), is nonempty. Moreover, the correspondence

M^ is upper semicontinuous.

Proposition

W

vector p

R^

^

Proof. Given any p

>

0,

:

consider the following optimization problem

maximize^>o

^^

subject to

({R -

2_, ^i

^

-

Pi)Xi

j

k[z)dz\

(4)

'^

i=l

Xi

In view of

Assumption

(1) (i.e.,

li

is

€

Ci,

V

i.

nondecreasing for

can be shown that the

all i), it

which is nonempty

G Cj) and convex. Moreover, the first order optimahty conditions of problem

optimality

(4), which are also sufRcient conditions for optimality, are identical to the

conditions [cf. Eq. (2)]

Hence a flow vector x^'^'^ G ^{v) if ^^nd only if it is an optimal

solution of problem (4). Since the objective function of problem (4) is continuous and

the constraint set is compact, this problem has an optimal solution, showing that W{p)

is nonempty. The fact that

is an upper semicontinuous correspondence at every p

follows by using the Theorem of the Maximum (see Berge [5], chapter 6) for problem

objective function of problem (4)

is

convex over the constraint

set,

(since

WE

.

W

(4).

Q.E.D.

WE flows satisfy intuitive monotonicity properties given in the following proposition.

The proof

follows from the optimality conditions

(a)

=

Ecj. (2)]

(Monotonicity) Let Assumption

Proposition 2

P-j

[cf.

1

and

hold.

is

omitted (see

For a given p

>

[1]).

0,

let

\PiWj-

For some p

(b) For some pj

for all

(c) For

let

i y^

<

<

p, let

x G

Pj, let

VV'(p)

and x G W{p). Then, X^j^j

>

x^

J^j^j

x G W{pj,p-j) and x G VF(pj,p_j). Then Xj

>

Xi.

Xj

and

Xj

<

Xi,

j.

some I C I, suppose that Pj <

X G W{p) and x G W{p). Then

X

and Pj

=

pj for all j

G

T,jei^'jiP)

^ Ejgi^j(p)-

Pj for all j

^ J, and

For a given price vector

example

Example

p,

the

WE

some properties

illustrates

need not be unique in general. The following

WE.

of the

Consider a two hnk network. Let the total flow be d

2

tion utility he

R=

Assume

1.

^

oo

I

At the

<

Pi>

=

P2

W{p)

I,

is

Xj

given by

all (0,

are not real- valued.

some

scalar a

>

<

X2) with

This example also illustrates that

for

Lemma

1

<

X2

is

given by the set of

all

2/3.

Consider, for instance, the price vector (^1,^2) = (1 ~ e, 1 ~ le)

In this case, the unique

is (xi,X2)

(1/3,2/3), and clearly

WE

1.

on the

further restrictions

which assumes

Proposition 3

reserva-

need not hold when latency functions

=

on the two routes are not equalized despite the

positive flows. This arises because the path with the lower

constrained, so no more traffic can use that path.

Under

and the

price vector {pi,P2) with

fact that they

effective costs

literature

1

otherwise.

= (1,1), the set of WE, W{p),

< 2/3 and X^j x, < 1. At any

price vector (pi,P2)

vectors (xi,X2) with

=

that the latency functions are given by

k,

we

effective cost

both have

is

capacity

obtain the following standard result in the

strictly increasing latency functions.

(Uniqueness) Let Assumption 1

For any price vector p

strictly increasing over Cj.

singleton. Moreover, the function

W

:

M^

W_^, >-^

is

Assume

hold.

>

the set of

0,

further that

WE,

W{p),

is

li

is

a

continuous.

Proof. Under the given assumptions, for any p > 0, the objective function of problem

This shows the

(4) is strictly convex, and therefore has a unique optimal solution.

uniqueness of the

at a given p. Since the correspondence

is upper semicontinuous

from Proposition 1 and single- valued, it is continuous. Q.E.D.

W

WE

In general, under the Assumption that

result,

which

Lemma

2

is

/j(0)

essential in our analysis with

Let Assumption

I=

{i

1

=

hold. For a given

Gl

\

for all

nonunique

p

>

0,

i

E X, we have the following

WE flows.

define the set

3 X, X E W{p) with x^

7^ x^}.

Then

h{xi)

-

Pi

==

0,

Pj,

Vie2, Vxe

V

z,

j e T.

W{p),

(5)

.

Proof. Consider some

such that

^

Xi

Xi-

&T. and x G W{p). Since

i

Assume without

E T, there

i

>

generahty that Xt

loss of

some x E W{p)

There are two cases

exists

Xi.

to consider:

(a)

If

>

Xk

Xk for

all

A;

^

optimality conditions

>

then Xljgi^i

i,

Eq.

[cf.

(2)] for

'^IjeJ^i-' '^^ich implies

x hold with A

=

0.

By

Eq.

1

(i.e.,

that the

and

(2)

Xi

WE

>

x,,

we have

which together imply that

=

/,(0)

(b)

If

Xk

<

0), it follows

Xk for

some

k,

that

by the

+Pi<

R,

li{xi)

+Pi>

R,

=

/i(xi)

/,(x,)

li{xi)

=

li{xi).

By Assumption

li

is

convex and

0.

WE optimality

conditions,

li{Xi)

+Pi<

lk{Xk)

+Pk,

k{x,)

+f)i>

IkiXk)

+Pk-

we obtain

Combining the above with Xj > x, and Xfc < x^, we see that /j(xj) = li{xi), and

(and also that

hi^k) = 4(^fc)- By Assumption 1, this shows that li{xi) =

=Pk)-

Pz

X,

Next consider some i, j € I. We will show that pi = pj. Since

X G W{p) such that Xi > Xi. There are three cases to consider:

• Xj

<

• Xj

>

Xj

.

Then

Xj.

If Xfc

i

E T, there

a similar argument to part (b) above shows that pi

>

Xk for

all

k

^

optimahty conditions hold with A

which together with

li{xi)

=

X^m^m ^

i,j,

then

=

Therefore,

0.

k{x,)

+Pt<

R,

lj{xj)

+ Pj >

R,

lj{Xj)

=

imply that

^'

exist

= pj

™ply™g

that the

WE

we have

pi

— pj.

= Xj. Since j E T, there exists some x E W{p) such that Xj ^ Xj. Repeating

the above two steps with Xj instead of Xj yields the desired result.

• Xj

Q.E.D.

We

next define the social problem and the social optimum, which

allocation) that

would be chosen by a planner that has

over the network.

full

is

the routing (flow

information and

full

control

A

Definition 2

social problem

flow vector x^

is

a social

niaximize2;>o

optimum

2.

(-^

~

an optimal solution of the

if it is

ki^i) jXi

(6)

2=1

/

>, ^i ^

subject to

In view of Assumption

1,

^•

the social problem has a continuous objective function and

a compact constraint set, guaranteeing the existence of a social optimum, x^. Moreover,

using the optimality conditions for a convex program (see

a vector x^ G

subgradient

for each

M^

gi.

E

is

a social optimum

dli{xf) for each

and only

if

and a

i,

>

A'^

if

[7],

Section 4.7),

X^j^^ xf

such that

<

A'^(

we

see that

d and there exists a

X],_i

xf

—

d)

=

and

i,

R-k[xf)-xfgi^

<X' ifxf^O,

= A^ iiO<xf<bc„

> A^ if if = 6c..

For future reference, for a given vector x 6 R^,

we

(7)

define the value of the objective

function in the social problem,

/

S{x)

= Y.{R-h{x,))x,,

(8)

1=1

as the social surplus,

i.e.,

the difference between users' willingness to pay and the total

latency.

3

Monopoly Equilibrium and

In this section,

we assume

that a monopolist service provider owns the / links and

charges a price of p^ per unit bandwidth on link

Acemoglu and Ozdaglar

[1]

for

of each of a finite set of users

i.

We

considered a related problem in

atomic users with inelastic

is

a step function)

differentiable latency functions.

general latency functions and the

The monopolist

Efficiency

,

traffic (i.e.,

the utility function

and with increasing,

demand model considered

sets the prices to

maximize

and

more

real- valued

Here we show that similar results hold

for the

in Section 2.

his profit given

by

/

?,=i

where x G W{p). This defines a two-stage dynamic pricing-congestion game, where the

monopolist sets prices anticipating the demand of users, and given the prices (i.e., in

each subgame), users choose their flow vectors according to the

WE.

.

Definition 3

A

vector {p'^'^ ,x^'^^)

>

a Monopoly Equilibrium

is

(ME)

if

x^

W{p^'^) and

n(p*^^, x^"^)

Our

definition of the

ME

>

V

n(p, x),

p,

V X G ly

stronger than the standard

is

librium concept for dynamic games.

With a sHght abuse

{p)

subgame

perfect

Nash

equi-

of terminology, let us associate

a subgame perfect Nash equilibrium with the on-the-equilibrium-path actions of the

two-stage game.

Definition 4

A

>

vector {p*,x*)

pricing-congestion

game

if

x*

is

a subgame perfect equihbrium (SPE) of the

G W{p*) and

for all

p

>

0,

there exists x 6

W

such

{p)

that

U{p*,x*)

The

>

U{p,x).

following proposition shows that under

coincide.

Since the proof

Assumption

1

,

the two solution concepts

not relevant for the rest of the argument, we provide

is

in

it

Appendix A.

Proposition 4

it is

an

SPE

ME

Since an

Let Assumption

1

hold.

of the pricing-congestion

{p*,x*)

is

A

vector [p^^^ ,x^'^)

is

ME

an

if

and only

if

game.

an optimal solution of the optimization problem

I

maximizep>o, x>o

subject to

it

is

slightly easier to

^^PiXi

(9)

X £ W{p),

work with than an SPE. Therefore, we use

ME

as the solution

concept in this paper.

The preceding problem has an optimal solution, which establishes

ME. In the next proposition, we show that the flow allocation at an

optimum are the same.

Proposition 5

only

if it is

3

1

hold.

A

vector x

is

and the

the flow vector at an

ME

social

if

and

a social optimum.

To prove

Lemma

Let Assumption

the existence of an

ME

this result,

we

first

Let Assumption

1

establish the following

hold. Let (p,x) be

an ME. Then

have

p,

=

R- li{x^).

10

lemma.

for all

i

with x^

>

0,

we

Proof. Define

+

j9j

li{xt)

<

R.

I=

We

{i

e

first

I

\

Xi

li{xi)

Suppose

a

WE

+Pi <

li{xi)

[cf

Eq.

the fact that

(2)],

(p,

the price vector

x)

p

lj{xj)

we

is

and has a

is

a

WE

By

0}.

+Pi =

+ pj

see that

the definition of a

for

lj{xj)

some

x € W{pi

+ Pj,

V

WE,

for all

i

E I, we have

at price p,

'

+ e + li(xi) <

i,

J

G

X.

G T. Using the optimality conditions

i,j

+ e,p^i)

an ME. Assume next that pi

where e^ is the

= p + e X^ j^j ^i

Pi

Hence, x

>

show that

for sufficiently small

+ li{xi) < R

y

R,

i

and therefore the vector

for

contradicting

some i E T. Consider

and e is such that

for

unit vector

i*''

e,

eJ.

(p,

x)

is

feasible for

problem

strictly higher objective function value, contradicting the fact that (p, x) is

(9)

an

ME. Q.E.D.

Proof of Proposition

5:

In view of

Lemma

maximize3;>o

2_.

we can

3,

rewrite problem (9) as

{R~ hi^i)

i=l

I

subject to

This problem

is

identical to the social

2_] ^i

problem

^^

problem

[cf

(6)],

completing the proof

Q.E.D.

In addition to the social surplus defined above,

sumer

it

is

also useful to define the con-

between users' willingness to pay and effective cost, i.e.,

~ hi^i) — Pi)xi (See Mas-Colell, Winston and Green, [21]). By Proposition 5

Y2i=i (-^

and Lemma 3, it is clear that even though the ME achieves the social optimum, all of

the surplus is captured by the monopolist, and users are just indifferent between sending

surplus, as the difi^erence

their information or not

(i.e.,

Our major motivation

receive

for the

a better approximation to reality,

no consumer

surplus).

study of ohgopolistic settings is that they provide

where there is typically competition among service

A secondary motivation is to see whether an ohgopoly equilibrium will achieve

an efhcient allocation like the ME, while also transferring some or all of the surplus to

providers.

the consumers.

4

Oligopoly Equilibrium

We

suppose that there are S service providers, denote the set of service providers by

and assume that each service provider s £ S owns a different subset Ts of the links.

Service provider s charges a price p^ per unit bandwidth on link i E Is- Given the vector

iS,

11

owned by other

of prices of links

provider s

service providers,

Ps =

\pi]i^i,,

the profit of service

is

==

UsiPs,P-s,x)

^PiXi,

X e W{ps,p-s), where Ps = \pi\ieXsobjective of each service provider, hke the monopoHst in the previous section,

is to maximize profits. Because their profits depend on the prices set by other service

providers, each service provider forms conjectures about the actions of other service

providers, as weh as the behavior of users, which, we assume, they do according to the

notion of (subgame perfect) Nash equihbrium. We refer to the game among service

providers as the price competition game.

for

The

Definition 5

if

x^^ S

A

{p'-'^

vector

W (p?^,p°f)

and

n,(pf^,pef,xO^)

We

refer to

p'-'^

as the

,

>

x'~'^)

for all s

is

a (pure strategy) Oligopoly Equilibrium (OE)

G 5,

> n,fe,pef,x),

Vp, >

0,

V X 6 H/fe,pef).

(10)

OE price.

OE and

Again associating the subgame perfect

equilibrium with the on-the-equilibrium-path actions, we have the following standard

As

for the

monopoly

case, there

is

a close relation between a pure strategy

a pure strategy subgame perfect equilibrium.

definition.

A vector

Definition 6

competition game

if

x*

{p*, x*)

E:

W

>

{p*)

is a subgame perfect equihbrium (SPE) of the price

and there exists a function x{p) G

[p) such that for

W

seS,

all

^s{P*s,P*-s^X*)>Ils{Ps.pls^x{ps,P*..,))

The

OE

following proposition generalizes Proposition 4

definition,

which

is

more convenient

that of Proposition 4 and

Proposition 6

is

an

SPE

is

for the

Vp, >0.

(11)

and enables us to work with the

subsequent analysis. The proof parallels

omitted.

Let Assumption

1

of the price competition

hold.

A

vector

{p'-'^ ,

x^^)

is

an

OE

if

and only

if it

game.

The price competition game is neither concave nor supermodular. Therefore, classical

arguments that are used to show the existence of a pure strategy equilibrium do not hold

(see [13], [37]). In the

next proposition, we show that for linear latency functions, there

exists a pure strategy

OE.

Proposition 7 Let Assumption 1 hold, and assume further that the latency functions

are linear. Then the price competition game has a pure strategy OE.

12

Proof. For

all

i

^ I,

let /j(x)

=

aiX. Define the set

Io^{ieI

=

\a,

0}.

Let Iq denote the cardinality of set Iq- There are two cases to consider:

>

Assume that there exist i, j € Xq such that i E Ts and j € Is' for some

for all

E S. Then it can be seen that a vector (p^-^, x"^-^) with pf ^ =

i E Iq and x'-'^ E W{p'-'^) is an OE. Assume next that for all i G 2o, we have i E Is

for some s E S. Then, we can assume without loss of generality that provider s

owns a single link i' with a^/ = and consider the case /q = 1.

• Iq

2:

s j^ s'

• /o

<

Let Bsiplf) be the set of

1:

pf^ such

max

(pf^,x°^)Garg

Let B{p'-'^)

=

[Bs[p2.f)]s^s-

that

^p^Xi.

(12)

In view of the hnearity of the latency functions,

it

an upper semicontinuous and convex- valued correspondence.

Hence, we can use Kakutani's fixed point theorem to assert the existence of a p'-'^

such that B{p'-'^) = p'^^ (see Berge [5]). To complete the proof, it remains to be

follows that B{p'^^)

shown that there

If

Iq

—

0,

(10) holds

Assume

is

x°^ E W{p'^^) such

exists

we have by Proposition

and

(p°-^,

IV (p°^))

finally that exactly

is

that Eq. (10) holds.

3 that W{p'^^)

is

a singleton, and therefore Eq.

an OE.

one of the

a^'s

(without loss of generality ai)

We

show that for all x, x E W{p'-'^), we have

EC{x,p°^) = mmj{lj{xj) +pf^}. If at least one of

to

0.

EC{x,p°^) < R,

holds, then one can

Y2iei i^i^i ^^

show that

(4), we

problem

or

Xi

=

Xi, for all

EC{x,p°^) <

i

is

^

equal

1.

Let

R

~

—

'^Substituting Xi = d

X^i=i ^i

X]t=i ^i

see that the objective function of problem (4)

—

is

convex in x_i = [x^jj^i, thus showing that x = x. If both EC{x,p^^) = R

and EC{x,p'^^) = R, then Xi = Xi = 1^^{R — pf^) for all i ^ 1, establishing our

strictly

claim.

For some x E W{p'^^), consider the vector x^-^

uniquely defined and Xi

incentive to deviate,

it

is

=

(d

— X^j^j Xj,x_i)

.

Since x_i

chosen such that the provider that owns link

follows that {p^^, x'~'^)

is

1

is

has no

an OE.

Q.E.D.

The

existence result cannot be generalized to piecewise linear latency functions or

to latency functions which are linear over their effective domain, as illustrated in the

following example.

13

Example

3 Consider a two link network. Let the total flow he d

=

Assume that the

1.

latency functions are given by

=

(

\

h{x)

,

n

1

f

\

l2{x)

0,

=

/O

<

^-5

iiO<x<S

^>^^

e >

and 6 > 1/2, with the convention that when e = 0, hix) = oo for x > 6.

show that there exists no pure strategy oligopoly equihbrium for small e (i.e.,

there exists no pure strategy subgame perfect equihbrium). The following list considers

all candidate oligopoly price equihbria {pi,P2) and profitable unilateral deviations for e

sufficiently small, thus estabhshing the nonexistence of an OE:

for

some

We

first

1.

=

Pi

2.

=

P2

0:

A

small increase in the price of provider

thus provider

profits,

= P2 > 0: Let x be the flow aflocation at the OE. If Xj =

has an incentive to decrease its price. If Xi < 1, then provider

pi

to decrease

<

3.

pi

<

generate positive

will

1

has an incentive to deviate.

1

1,

then provider 2

1

has an incentive

its price.

has an incentive to increase

p2- Player 1

its

price since its flow allocation

remains the same.

<

4.

p2

<

Pi:

For

sufficiently small, the profit function of player 2, given pi, is

e

strictly increasing as

increase

a function of

p2!

showing that provider 2 has an incentive to

its price.

OE always exists. We define a mixed strategy

mixed strategy subgame perfect equilibrium of the price competition game (see

Dasgupta and Maskin, [10]). Let B^ be the space of all (Borel) probability measures

on [0, i?]". Let /<, denote the cardinality of Jj, i.e., the number of hnks controlled by

service provider 5. Let fig G B^' be a probabihty measure, and denote the vector of these

probability measures by

and the vector of these probability measures excluding s by

We

OE

next show that a mixed strategy

as a

/j,

Definition 7

x*{p)

G

/

J[o,rY

W

(/i*,

(p) for

x*(p))

is

every p G

a mixed strategy Oligopoly Equilibrium (OE)

[0,

^s{Ps,P-s,x* {ps,p-s))

the function

if

R]^ and

d{i2l{p,) X i_i*_^{p_s))

>

Us{ps,P^s,X* {ps,P-s))d

/

{iJ-s

iPs)

X

IJ--,

{P-s))

J\O.R]'

'[0,R]'

for all s

and

/ig

G B'\

Therefore, a mixed strategy

to a different probability

OE

measure

simply requires that there

for

each oligopolist.

14

is

no profitable deviation

Example

OE

strategy

e

>

0,

but

3 (continued) We now show that the following strategy profile is a mixed

above game when e -^

(a mixed strategy OE also exists when

structure is more comphcated and less informative);

its

for the

(

Mp)-<

\

(

=

^2{P)

1-^

0<p<R{l-5),

R{l-6)<p<R,

1

otherwise,

0<p<R{l-6),

R{l-5)<p<R,

1-^

1

otherwise.

1

[

Notice that pi has an atom equal to 1 — 5 at i?. To verify that this profile is a mixed

strategy OE, let ji' be the density of /i, with the convention that jj' = oo when there is

an atom at that point. Let

strategy equihbrium,

for all Pi

it

Afj

=

{p

G Mi when the other

/i^

|

{p)

>

0}

To

.

establish that {pi,

show that the expected payoff

suffices to

player chooses p-i according to

fJ-2)

to player

/i_i

is

i is

a mixed

constant

(see [24]).

These

expected payoffs are

n {p,

I

p-i)

=

U,{p^,P-i,X {p^,P-i))dfl-^ (p^i)

/

,

Jo

which are constant

strategy

for all pi

G Mi

The next proposition shows

i

=

1.2.

This establishes that

(/^i./io) is

a mixed

that a mixed strategy equilibrium always exists.

Proposition 8 Let Assumption

strategy OE, (^^^,x°^(p)).

so

for

OE.

The proof of this proposition

given in Appendix B.

hold.

1

is

Then

game has

the price competition

a mixed

long and not directly related the rest of the argument,

it is

We

next provide an exphcit characterization of pure strategy OE.

independent

interest, these results are

most useful

Though

of also

for us to quantify' the efficiency loss

of oHgopoly in the next section.

The

following

lemma shows

that an equivalent to

Lemma

1

(which required real-

valued latency functions) also holds with more general latency functions at the pure

strategy

Lemma

OE.

4 Let Assumption

h{x?'^)+P?'^

1

hold.

If

{p'^^,x^^)

is

= min{/,(xH+p°^},

a pure strategy

OE, then

V?withxP>0,

(13)

Vzwithzp^>0,

(14)

j

k{x*)+pf^

<

R,

^xP

<

d,

(15)

15

^?^ = d^i mmj{lj{xf^) + Pj} < R.

with J2Li

Proof. Let {f^,x°^) be an OE. Since x°^ £ VF(p^^), conditions (14) and (15) follow

by the definition of a WE. Consider condition (13). As,sume that there exist some z, j G J

such that

with xf ^ > 0, x°^ >

;,(xf^)+pp^</,(x^°^)+pf^.

Using the optimality conditions

sider changing

we

see that

pf^

to pf-^

we can choose

service provider that

owns

+

e

e

(p*^"^, x'~'^)

that minj{/j(x^^)

Pj]

WE

some

WE, and

We

Eq.

[cf.

e

>

(2)], this

By

0.

i

i.

is

< R and

'Ylii=\

^?^ <

Given a pure strategy

0, then 1^ = {i}.

2

proof.

Note that

Lemma

this

assumption

if all

5 Let

Us denote the

OE

,

pf^ +

e

keeps

for a

=

x'-'^

bc^

as a

Q.E.D.

for

{p^^

we must have xf^

our price characterization.

x'-'^), if for

some

i

E

2

with xf^

>

0,

=

/^(xf^)

increasing or

Con-

hc^-

Using the optimality conditions

'^-

=

With

more profitable, completing the

Assumption

=

G H^(pf^ + e,p?f ). Hence

can deviate to pf -^ + e and increase its profits, contrais an OE. Finally, assume to arrive at the contradiction

need the following additional assumption

we have

implies that xf-^

checking the optimality conditions,

since J2i^i ^?^ < "^l' ^^^^ imphes that

a similar argument to above, a deviation to

[Eq. (2) with A

for

WE

some

sufficiently small such that x'^^

link

dicting the fact that

-\-

a

for

for

is

automatically satisfied

service providers

{p'-^^,x'-^^)

own only one

if all

latency functions are strictly

link.

be a pure strategy OE. Let Assumptions

1

and 2 hold. Let

profit of service provider s at {p'^^ ,x^^).

(a)

If

n^'

>

for

some

s'

(b)

If

n,

>

for

some

s

G 5, then n^ >

for all s

G 5, then pf^xf^ >

e S.

for all j

G T,.

Proof.

(a) For

some

lis

e

>

=

0.

j

K

= pf^ + lj{xf^), which is positive since

G Xy, define

some s. For k E Is, consider the price pfc = A' — e >

for

It

Ug'

>

for

0.

Assume

some small

WE

can be seen that at the price vector {pk,P-k)^ ^^^ corresponding

link

> 0. Hence, service provider s has an incentive to deviate to

flow would satisfy x^

pk at which he will make positive profit, contradicting the fact that {p^^,x^^)

a pure strategy OE.

is

> 0, we have p'^fx'^f > for some m G Is- By Assumption 2, we can

assume without loss of generality that Imi^m^) >

(otherwise, we are done). Let

j G Is and assume to arrive at a contradiction that p^^xf^ = 0. The profit of

(b) Since Ug

service provider s at the pure strategy

Yis

OE

can be written as

= ns+p^fx^f,

16

.

where

for

lis

some

Consider changing

.

=

n,

Note that

e

n^

n,

tlie

prices p'^^

+ {K - UxZ^ -

moved from link m to

same at the new WE. Hence,

- n, =

>

Since lm{x^^)

-

(/„(x^,^)

0, e

1

= L Assume

some a >

{p^^,x^^)

Assumption

is

is

strictly

an OE. Q.E.D.

2 cannot be dispensed with for part

this

=

link 2. Let the total flow be d

1

1 owns

and the reservation

that the latency functions are given by

=

Any price vector

0.

is

(2/3, 1/3, 0)

why

is

Consider a three link network with two providers, where provider

and 3 and provider 2 owns

h{xi)

see

link j such that the flows of

the change in the profit

lemma.

utiUty be i?

for

/,(e)).

can be chosen sufficiently small such that the above

following example shows that

Example 4

links

+ e{K -

UxZ^ - e))x^^ + e(/„(x^^ - e) - /,(e))).

positive, contradicting the fact that

The

e)){xZ^ -,)

units of flow are

other links remain the

(b) of this

K

m and j. Let p^^ = —lm{x'^)

and p^^ such that the new profit is

denotes the profits from hnks other than

K

0,

h{x3)=ax3,

l2ix2)=X2,

{pi,P2,P3)

a pure strategy OE, so ^3X3

= (2/3, 1/3, b)

= contrary

with b

>

2/3 and

(xi, X2, X3)

to part (b) of the

=

lemma. To

an equihbrium, note that provider 2 is clearly playing a best response.

= 4/9. We can represent any deviation of provider 1 by

is

Moreover, in this allocation Hi

= {2/3-5,2/3-ae-5),

{pi,Ps)

for

two scalars

e

and 6 which

The corresponding

,

lishing that provider 1

We

induce a

will

WE of (xi, X2, X3)

is

=

(2/3

+

5

—

e,

1/3

—

5,e)

4/9 — 5"^ < 4/9, estabalso playing a best response and we have a pure strategy OE.

profit of provider 1 at this deviation

is

Hi

=

OE

next establish that under an additional assumption, a pure strategy

will

never be at a point of non-difTerentiability of the latency functions.

Assumption

3 There exists some s E

differentiable for all

Lemma

6

some

i.

for

i

S

such that k

is

real-valued and continuously

Els

OE

Let (p°^, x°^) be an

Let Assumptions

1,

2

and

with min^ {p^^

3 hold.

where l^{xf^) and l~{xf^) are the right and

+

lj{xf^)}

< R and pf^xf ^ >

Then

left

derivatives of the function

li

at

xf^

respectively.

Since the proof of this

lemma

is

3 cannot be dispensed with in this

long,

it is

given in Appendix C. Note that Assumption

lemma. This

17

is

illustrated in the next example.

.

Example

5

be

tion utihty

Consider a two link network. Let the total flow be d

Assume

i? =: 2.

< X <

if

h{x)-l2ix)It

=

and the

1

reserva-

that the latency functions are given by

2(x-i)

,

i

otherwise.

can be verified that the vector {Pi^,P2^) = (1, 1), with (xf^,x^^) = (1/2, 1/2) is a

is at a point of non-differentiabiUty for both latency functions.

pure strategy OE, and

We

next provide an exphcit characterization of the

our efficiency analysis in Section

Proposition 9

Assumptions 1,

a)

Assume

The proof

5.

Let {p^^, x^^) be an

2,

and

that min^

(

??""={

OE

is

OE

prices,

which

essential in

is

given in Appendix D.

pf^xf^ >

such that

some

for

i

G I. Let

3 hold.

{pf^

+

lj{x'^^)}

<

R. Then, for

xf%{x°^),

if

xf^^K^P^)+

b) Assume that min^ {p'j^

+

v-^^'^'^^r

Ijix'j^)}

—

,

e

all s

l'j{x°^)

=

5

and

for

G

i

some

X,,

j

^

we have

Is,

(^6)

otherwise.

R- Then, for

all s

G

<S

and

i

£ Xg, we have

pf^>^,n-(:^?^)Moreover,

if

there exists

some

p?^ <

i

If

G

T

such that

^rc(^r) +

(17)

X = {i}

^

for

some

s

G 5, then

(18)

'

,

the latency functions U are all real-valued and continuously differentiable, then

Karush-Kuhn-Tucker conditions for ohgopolj' problem [Eq. (78) in Appendix

analysis of

D] immediately yields the following result:

Let (p°^, x°^) be an OE such that p°^x°^ >

for some i G I. Let Asand 2 hold. Assume also that Zj is real- valued and continuously differentiable

Then, for all s G 5 and i EiTs,^^ have

Corollary

sumptions

for all

i.

r

Pi

^

\

1

1

xf ^/^(xp^),

mm

r..ir.

P_

J i?

<^

l.f^OE\

/,(xf ^)

if

^OEv(^OE\

,

x?^l'AxY^)

£,

+ ^'^^

,

'

\

},

/;(xf^)

=

for

some

j

otherwise.

(19)

This corollary also implies that in the two link case with

differentiable latency functions

and with minimum

real- valued

effective cost less

and continuously

than R, the OE

prices are

pP = xf^(/;(x?^) + /^(xn)

as claimed in the Introduction.

18

(20)

^ J,

+

5

Efficiency of Oligopoly Equilibria

we study the

In this section,

measure of

efficiency properties of

ohgopoly pricing.

We

take as our

efficiency the ratio of the social surplus of the equilibrium flow allocation to

the social surplus of the social optimum, §(x*)/§(x'^), where x* refers to the

or the oligopoly equilibrium

[cf.

Eq.

In Section

(8)].

3,

we showed

monopoly

that the flow alloca-

monopoly equilibrium is a social optimum. Hence, in congestion games with

monopoly pricing, there is no efficiency loss. The following example shows that this is

tion at a

not necessarily the case in ohgopoly pricing.

Example

6 Consider a two link network. Let the total flow he d

utihty be i?

=

1

The

.

li{x)^0,

The unique

is

x^^ =

optimum

social

for this

=

and p^'^

(1,0)

=

1

and the reservation

latency functions are given by

=

kix)

3

~x.

is x'^ = (1, 0). The unique ME {p^^, x^^)

As expected, the flow allocations at the social

example

(1,1).

optimum and the ME are the same. Next consider a duopoly where each of these links

is owned by a different provider. Using Corollary 1 and Lemma 4, it follows that the

flow allocation at the OE, x'^^ satisfies

,

/i(xf^)

+

+

x?^[/;(x?^)

Solving this together with

oligopoly equilibrium

Ux'i^)]

xf^ + x^^ =

is x'-'^

=

= kix^ + x^^[l[{x?^) + l',ix^%

shows that the flow allocation at the unique

1

(2/3,1/3).

The

social surplus at the social

the monopoly equilibrium, and the oligopoly equilibrium are given by

1,

1,

optimum,

and 5/6,

respectively.

Before providing a more thorough analysis of the efficiency properties of the OE, the

next proposition proves that, as claimed in the Introduction and suggested by Example

6,

a change in the market structure from monopoly to duopoly in a two hnk network

typically reduces efficiency.

Proposition 10 Consider a two link network where each link is owned by a different provider. Let Assumption 1 hold. Let {p'^^,x^^) be a pure strategy OE such

that pP^xf^ >

for some i G J and mm,

{pf^ -f- lj{xf^)} < R. If /'i(xf^)/xf^ j^

l'2{x^^)/x^^, then S(xO-^)/S(x^)

Proof. Combining the

/i(xf^)

where we use the

OE

1

.

prices with the

xf^{i[{xf^)

fact that

<

WE conditions,

+ ux^)) = Hxr) + xriux'",") + ux^^)),

min, {pf^

+ lj{x?^)} <

conditions (7) to prove that a vector (xf ,xf)

/l(xf)

we have

+

>

is

R- Moreover, we can use optimality

a social optimum

xf/;(xf)=/2(xf)+xf/^(xf),

19

if

and only

if

(see also the

proof of

Lemma

4).

Since l[{x'^^)/x'^^

^

{^{x^^) j x^^ the result follows.

,

Q.E.D.

We

next quantify the efficiency of ohgopoly equilibria by providing a tight bound

on the efficiency

Section

loss in

congestion games with oligopoly pricing.

As we have shown

such games do not always have a pure strategy OE. In the following, we

4,

provide bounds on congestion games that have pure strategy equilibria.

efficiency properties of

mixed strategy

We

next study

equilibria.

Pure Strategy Equilibria

5.1

We consider price competition games that

have pure strategy equilibria

(this set includes,

games with linear latency functions, see Section 4).

latency functions that satisfy Assumptions 1, 2, and 3. Let £/ denote the

but

in

first

larger than,

is

We

consider

set of latency

game has a pure strategy OE and

Assumptions 1,2, and 3.^ Given a parallel link network with /

and latency functions {/,}iei £ C.I-, let 0£/({/i}) denote the set of flow allocations

functions {Zi}iei such that the associated congestion

the individual

links

at

an OE.

where x^

utihty.

We

is

Z^'s

satisfy

define the efficiency metric at

some

x'^^

G OE{{li\)

as

a social optimum given the latency functions {li}iei and R is the reservation

is the ratio of the social surplus in an

In other words, our efficiency metric

equilibrium relative to the surplus in the social optimum.

the "price of anarchy", in particular

[19],

an oligopoly equilibrium, so we look

for

inf

we

Following the literature on

are interested in the worst performance in

a lower

bound on

ri{{l,},x'^^).

inf

We first prove two lemmas, which reduce the set of latency functions that need to

be considered in bounding the efficiency metric. The next lemma allows us to use the

oligopoly price characterization given in Proposition 9

Lemma

Then

7 Let

x'^^

is

[p'^^, x'^^)

be a pure strategy

OE

such that

pf^x^^ =

for all

i

G I.

a social optimum.

We first show that k{xf^) = for all i G I. Assume that lj{xf^) > for

and therefore pf^ = 0. Since lj{xf^) > 0,

G I. This implies that xf^ >

it follows by Lemma 2 that for all x G W{p), we have Xj = x^^.

Consider increasing

p*?^ to some small e > 0. By the upper semicontinuity of W{p), it follows that for all

X G W{e,p9.f), we have \xj —Xj^\ < 5 for some 5 > 0. Moreover, by Lemma 2, we have,

for all X G W{e,p'ilf), Xi > .xf

for all i 7^ j. Hence, the profit of the provider that owns

Proof.

some

j

^More explicitly, Assumption 2 implies that

and li{xf^) = 0, then J, = {i}.

if

any

20

OE

{p°^ ,x^^) associated with

{i,}j(=i

has

xf^ >

link j

is

strictly higher at price vector [e^p'^f)

(p^^, ^0£)

x^^ >

Clearly

some

for

Lemma 4

which imphes by

all i, we have

j and hence

that J2i&x^?^

Rfor

than at

-

li{xf^)

mmi^j{pf^ +

=

d-

xf^gi^

Using

some gi^ G dli{xf^). Hence, x^^ satisfies the

optimum [cf. Eq. (7) with X^ = R], and the

The next lemma

>

X]i=i h{xf)xf

either

or

(i)

and

ELi ^?'^ <

x*^^

X]j^i xf^ =

—

•^Xli=i

and

lj{xf^)

=

G dli{xf^)

0,

for

y lel,

sufficient optimality conditions for a

Q.E.D.

result follows.

R Yli=i ^f ~

subsequent anatysis.

d in the

some

^2^ ^^^

optimum

social

is

a social optimum, implying that rj{{li},x'^^)

Assume that Ei=i^i(^f)^f — ^Yli=i^i- Since x^

x'-^^

G OE{{li})

2

is

k{xf))xf

> J^iR 1

the definition of a

i

WE, we

at the

is

a social

a feasible solution to the social problem [problem

=1

the price of hnk

x^,

d for some x^^ G 0^{{h}).

G OE{{li})

= ^(/? By

= pf^ +

0,

allows us to assume without loss of generality that

Yli=i ^ii^i)^i

Then every

Proof.

=

8 Let {k}iex G Cj. Assume that

(ii)

every

li{xf^)}

/^(xP'^)

=R,

social

Lemma

p*^^, contradicting the fact that

^^ OE.

is

OE)

k{xf''))xf^.

—

1.

optimum and

(6)], we have

V x^^ G ag({/0).

=1

have xf-^ >

and /? - kixf'^) > pf ^ >

(where pf-^ is

i. This combined with the preceding relation shows

for all

x^^ is a social optimum.

Assume next that Ei=i ^?^ < d

OE price. Assume that p^^x^^ >

that

7).

by

is

Since Ei=i

Lemma 5,

^?^ <

d,

for

we have by Lemma 4 that m.mj^j{pj-\-lj{xf^} = R. Moreover,

p^xf^ >

an optimal solution of the problem

it

some x'-^^ G 0S({/,}). Let p'^^ be the associated

some j & I (otherwise we are done by Lemma

for

follows that

maximize((p,)_gj^_j.)

subject to

for all

i

G X. Hence,

P^

+

l^{x,)

=

R,

=

/,(x,)

i?.

Tx?''<d.

maximize2:>o

e S, {{pf^)ieis

Y.V^X^

pf^ +

Substituting for {pi)iei, in the above,

for all s

we obtain

2.

21

[R — U{Xz))xi

Vtels,

-ii^ls

,

x'-'^)

,

subject to

E

Xi

^

Ti,

i

^

Is,

where T^ = {xj pf^ + k{xi) = R} is either a singleton or a closed

is a convex problem, using the optimality conditions, we obtain

interval. Since this

|

R-k{xf^)-xf^gi^ =

where

£ dk{xf^). By Eq.

gi^

VzgX„Vsg5,

0,

(7), it follows

that

x^^

is

a social optimum.

Q.E.D.

Hence, in finding a lower bound on the efficiency metric, we can restrict ourselves,

without

loss of generahty, to latency functions {/j}

for

RY!i=\ ^f

some

social

the following lemma,

Lemma

be an

optimum x^ and

,

we can

also

and x^ be a

social

G Cj such that X]i=i 'i(^f )^f <

^ d. for all x^^ G US{{li}). By

^?^

=

assume that X]i=i ^f

9 For a set of latency functions

OE

Yli=i

{/j},gj, let

d-

Assumption

1

hold. Let (p*^^,

x^^)

optimum. Then

iex

iei

Proof. Assume to arrive at a contradiction that Yli^jxf^ > X^jgjxf. This implies

that x'^^ > Xj for some j. We also have lj{x^^) > lj{x^). (Otherwise, we would have

lj{xj) = l'j{Xj) = 0, which yields a contradiction by the optimality conditions (7) and

the fact that ^^^jxf < d). Using the optimality conditions (2) and (7), we obtain

R-

/,(xf ^)

- p°^

>R- /,(xf

)

- xf 5;^

some gi^ G dlj{x^). Combining the preceding with lj{x^^) >

x^^Z~(x^^) (cf. Proposition 9), we see that

for

lj{xj)

and pj'^

>

xf%ixf^)<x^g„

contradicting

5.1.1

Two

x^^ > xJ and completing

the proof.

Q.E.D.

Links

We first consider a parallel link network with two links owned by two service providers.

The next theorem provides a tight lower bound on r2{{h},x'^^) [cf. Eq. (21)]. In the

following, we assume without loss of generality that d = I. Also recall that latency

functions in £2 satisfy Assumptions

Theorem

provider.

1

1, 2,

and

3.

Consider a two link network where each link

is

owned by a

difi'erent

Then

r2{{k},x^^)

>

^,

V

{/,},.i,2

22

e £2, x^^ e ag({/J),

(22)

—

,

and the bound

the lower

is

bound

tight,

i.e.,

there exists {li}i=i^2 S ^2 and x*^^ G OE{{li}) that attains

in Eq. (22).

Proof. The proof follows a number of

Step

1:

We

steps:

are interested in finding a lower

inf

inf

bound

for the

problem

r2({/J,x«^).

(23)

Given {/j} G C2, let x'-'^ 6 OE{{li}) and let x^ be a social optimum. By Lemmas 8

and 9, we can assume that 5Zi=i^?^ ~ Xli=i ^f — 1- This implies that there exists

some i such that xf^ < xf. Since the problem is symmetric, we can restrict ourselves

G £2 such that xf^ < xf.

to {li}

We

inf

claim

r2{{k},x^^)>r^f,

inf

(24)

where

^2,1

-

mmimize,s,

yf,

(,5),>o

——

T5-5

{E)

j^-^

yOE^o

subject to

if

<

yfilfy,

i

=

(25)

1, 2,

+ yUil)' = if + ynify,

^f + yf(^f)'<^,

(26)

il

E^f =

z

l'

(28)

=l

Zi

<

;f

/;

=

0,

(29)

if

li<y?^l[.

E?/?^ =

i

(27)

= 0.

^ = l,2,

(30)

/f

(31)

l'

(32)

=l

+

{Oligopoly Equilibrium Constraints};,

f

=

1,2.

Problem (E) can be viewed as a finite dimensional problem that captures the equihbrium and the social optimum characteristics of the infinite dimensional problem given in

Eq. (23). This implies that instead of optimizing over the entire function l^, we optimize

over the possible values of li{-) and dk{-) at the equilibrium and the social optimum,

which we denote by k,

if, (if)' [i.e., (if)' is a variable that represents all possible values

of gi^ G dli(yf)]. The constraints of the problem guarantee that these values satisfy the

necessary optimahty conditions for a social optimum and an OE. In particular, conditions (25) and (31) capture the convexity assumption on li{-) by relating the values li,l[

and /f (/f )' [note that the assumption 1^(0) = is essential here]. Condition (26) is the

l'^,

,

23

,

optimality condition for the social optimum. Condition (29) captures the nondecreasing

assumption on the latency functions; since we are considering {li} such that x^^ < xf

we must have li < if. Condition (30) captures the relation of li{-) and l[{-) at xf^;

since

is

xf^ <

xf, the fact that li{xf^)

=

h{xf)

=

by Assumption

implies,

1,

that

the unique element of dli{xf'^). Finally, the last set of constraints are the necessary

OE. These

conditions for a pure strategy

cases characterized in Proposition

are written separately for

i

=

we

giving us two bounds, which

9,

the two

show to be

1, 2, for

will

equal.

More

For

t

=

exphcitly, the Oligopoly Equilibrium constraints are given by;

[corresponding to a lower

1:

/;

For

=

t

=

l[{y?^),

I',

=

l,{yf^)}

l2]

= k + y^'^il'i +

l'2]

<

l',{y^'') [cf.

Eq.

where /; = /+(j/P^) and

^OE _ „OE

~

ip'~'^,y'^^),

a

with

(33)

R:

(16)].

bound

for

pure strategy OE, (p^^,y°^), with

= Ri

R-h

R-h

'2,1

pure strategy OE,

+ y?''[l[ +

[corresponding to a lower

2:

mm,{pf^ +

for

h+y?^[l[ +

h

where

bound

l'^

=

l:;{y^^)

> y^%,

< y?"^[/'i +

(34)

/2],

Eqs. (17), (18)].

[cf.

We

will

show

in

Step 4 that

'2,2

Note that given any feasible solution of problem (23), we have a feasible solution for

problem (E) with the same objective function value. Therefore, the optimum value of

problem (E) is indeed a lower bound on the optimum value of problem (23).

We

Step 2: Let {lf,yf)i=i,2 satisfy Eqs. (25)-(28).

^fyf

Using Eqs.

(26), (27),

and

(28),

+

ihi

If

(yf)-(^f

)'

+

iyl^iliy

we have using Eq.

Next,

straints

>

ilvl

+

(yf )'(^f )'

lf—0

for all

+

{yimy

z,

<

R-

If (yf)2(/f)'

+ {yDHllY =

0,

then

again showing the result.

Eq. (32) and one of the Oligopoly Equilibrium conwe can show that

Eqs. (33) or (34)]. Using a similar argument,

hy?''

Step 3:

(35)

we obtain

let (/i,yf'^)i=i,2 satisfy

[i.e.,

R-

then the result follows.

0,

(25) that

+ ihl <

show that

To

solve

i^fy Q'l)' JiJ'i^yf ^y?^)

without constraint

problem

(E),

we

+ l2y?''<Rfirst

(36)

relax the last constraint [Eq. (30)].

Let

denote the optimal solution of the relaxed problem [problem (E)

(30)].

We

show that

[f

=

24

for

i

=

1, 2.

—

Assign the Lagrange multipliers

/if, A'^,7'^

multiplier 9^ to Eq. (28). Using the

y^

first

(^ _ jsys _ jsysy

-^M + A^yf

-/xfyf-A^yf

to Eqs. (25), (26), (27), respectively,

order optimaht}' conditions,

+ A^2 +

=0

>0

A

-

If /^

>

>

if /?

=

(37)

0,

if(rf)'>0

if(rf)'

+ 7^yf =0

>0

if

=

(38)

0,

)'

([f

if([f)'

>

=

(39)

0.

^f^^F4&^M?-/^faT)'-A"(^"f)' + 7"(rf)' + ^^ =0 ifyf>0

{R-lfyf-lM?

>

^'

^^R-rn'm?

'

^'^^"^^

and

we obtain

if

yf

^ ''^^"^^ ^ '' =0 :fyf>0

>0

ify|

=

=

(40)

0,

(41)

0.

show that [f = 0. If yf = or (Ff)' = 0, we are done by Eq. (25). Assume

and (/|)' > 0. By Eq. (38), this imphes that A"^ = |uf > 0. We claim that

in this case Eq. (37) cannot be equal to 0. Assume to arrive at a contradiction that it

is. Using Step 2 and the fact that

yf > 0, we have //f + A^ < 0, which is a contradiction

and shows that Eq. (37) is strictly positive. This establishes that /f = 0.

We next show that if — 0. If yf = or (Jf)' = 0, we are done by Eq. (25). Assume

that yf >

and [if)' > 0. Assume to arrive at a contradiction that if > 0. Since Tf = 0,

by Eq^ (26), we have that yf (/"f )' < yf (^f )', and therefore both yf >

and (ff )' > 0.

Since /f = 0, these imply that Eq. (25) is slack, and hence /xf — 0- By Eq. (38), this

shows A'^yf = 0, and hence A'^ = 0. Furthermore, since iJ,2 = ^^ = 0, from Eq. (41)

we have 6^ = 0, and from Eq. (39), we have /if = 7'^. Plugging this all in Eq. (40), we

obtain a contradiction, showing that ff = 0.

We

first

that yf

>

=

view of Eq. (29), we have li = 0. Hence we can impose the

problem (E) without changing the optimal function value, and

we can rewrite the constraint in Eq. (30) as l[ = 0. Using in addition /f = 0, we see

Step 4: Since [f

extra constraint

that for

t

=

/j

=

0, in

in

1,2,

OF

r^t

9,0s

> mmmiize

i^y^

subject to

25

1

I2

-

<

7

^"^^2

^—

vi^l'i-,

<j?% > R.

y?

Ey?'

1,

and l[ =

that satisfies Eqs.

which follows because any vector {yf^,h,l'i} with ^i =

(33) or (34) is a feasible solution to the above problem. It is straightforward to show that

the optimal solution of this problem

follows that

= r?f =

r?f

5/6.

By

inf

{k}eC2

We

and

social

=

|x.

optimum

r2{{k},x'-^^)

=

As shown

is x'^