LEARNING FROM VENTURE CAPITAL

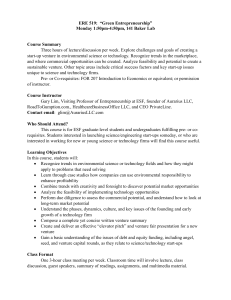

advertisement