Economic Analysis of Product-Flexible Decisions by

advertisement

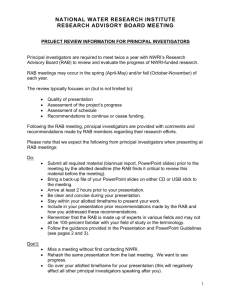

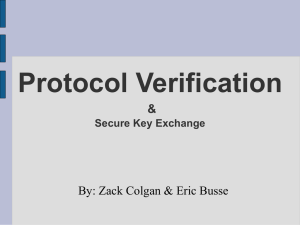

Economic Analysis of Product-Flexible Manufacturing System Investment Decisions by Charles H. Fine Robert M. Freund Working Paper #1757-86 Sloan School of Management Massachusetts Institute of Technology 02139 Cambridge, Massachusetts Comments are welcome. March 1986 Economic Analysis of Product-Flexible Manufacturing System Investment Decisions by Charles H. Fine Robert M. Freund ABSTRACT This paper presents a model of the tradeoffs involved in investing in flexible manufacturing capacity. Our model assumes that the firm must make its investment decision in manufacturing capacity before the resolution of uncertainty in product demand. Flexible capacity provides to the firm the ability to be responsive to a wide variety of future demand outcomes. This benefit is weighed against the increased cost of flexible manufacturing capacity vis a vis dedicated or nonflexible capacity. We provide a general formulation of the two-product version of this problem where the firm must choose a portfolio of flexible and nonflexible capacity before receiving final demand information. Under the assumption that demand curves are linear, our model is a two-stage convex quadratic program. Our results characterize the optimal profit function and the optimal investment policies. Furthermore, we present general sensitivity analysis results that show how changes in the acquisition costs of flexible and nonflexible capacity affect the optimal investment decisions. Finally, we present a numerical example where we compute the optimal investment decisions and the value of flexibility in the context of an automibile engine plant investment decision. Economic Analysis of Product-Flexible Manufacturing System Investment Decisions by Charles H. Fine Robert M. Freund Introduction Advances in microprocessor-based manufacturing technologies have hastened the development of automated manufacturing systems Compared with the that are being noted for their flexibility. less automated systems they are designed to replace, flexible manufacturing sytems often cost more to acquire and install, yield lower variable costs, and greater flexibility. higher product conformance but (quality), Management analysts have a great deal of knowledge and experience in how to evaluate investments that reduce operating costs, experience less a moderate amount of knowledge and in evaluating cost and quality tradeoffs, and much knowledge and experience in evaluating investments that enhance flexibility. The model in this paper analyzing investments of the economics of flexibility has The subject been of interest to (see, e.g., in Jones and Ostroy significant interest to the knowledge base on in manufacturing flexibility. economists for a long time many references contributes Stigler [19841), [1939], and the but has become of in the OR/MS community only recently, following the increasing viability of flexible, computercontrolled manufacturing systems. a large amount of work in and Suri [1984], Adler This new interest has spurred a very short time. 1985], Kulatilaka 1 (See, e.g., 1985]). Stecke 11 The fundamental decision problem timing of structure of the flexibility investment is quite simple. The central investment and production decisions of uncertainty. Our model assumes that plant and equipment before they receive on product demand. Thus, issues are the and the resolution firms must invest in their final information firms will prefer plant and equipment with manufacturing flexibility so that they can set production optimally once the final demand information becomes This desired flexibility can be but only at a cost. obtained at the Herein lies the tension the real-life decision in available. investment stage, the model (and in problem). We provide a general formulation of the two-product version of this problem where the firm must choose a portfolio of flexible and nonflexible information. Our results function and the optimal capacity before receiving final demand characterize the optimal profit investment policies. Furthermore, provide a sensitivity analysis to show how changes acquisition costs optimal we in the of flexible an.d nonflexible capacity affect the investment decisions. Our model focuses on investments in product-flexible manufacturing systems (PFMS). By a product-flexible manufacturing system, we mean one that can produce a number of different products with very low changeover costs and times. This definition of flexibility is consistent with Mandelbaum's (1978] and Buzacott's [1984] production flexibility. for a review of the [1982] state flexibility and Browne's (See also Adler often confusing, classifications and definitions). 2 [1985] Section 4 non-standardized flexibility In this paper, we concentrate on investments Even in a world of certainty, uncertainty. in PFMS under product-flexibility is valuable, because equipment downtime for changeovers affected favorably by the use of flexible equipment. is Tradeoffs of this sort are appropriately analyzed by comparing total costs of system operation after optimizing the scheduling rules for both flexible and nonflexible systems. paper at a more aggregate level, complexities for PFMS. In order to focus our we assume away the scheduling We think that these scheduling issues are very important, but this modelling choice allows us to concentrate on the effects of the uncertainty in product demand and (short-term) irreversibility of investment decisions on the optimal In mix of flexible and nonflexible the next section we present derive some basic properties properties of examine of the model. investment levels Section 2 presents In Section 3 we for flexible and Section 4 presents a numerical example where we optimal investment decisions and the value flexibility in an automobile engine plant Section 5 formulation and technologies and provide a sensitivity analysis for these resul ts. compute the our model the optimal value function. the optimal nonflexible manufacturing capacity. of investment setting. contains a discussion of extensions and implications of the model. 1. PFMS Model Formulation and Basic Properties of the Model. We assume that the firm can produce two different products, A and B. Before producing, investment decisions. Three the firm must make capacity types of capacity are available: dedicated A-capacity, dedicated B-capacity, and flexible AB- 3 III capacity. We denote by KA, KB, and KAB, the amounts of each of these types of capacity invested in by the firm. purchase costs for these capacity types are respectively. Before making production decisions, but after making capacity investment decisions, rA, The per unit rB, and rAB, the firm observes a random variable that provides information about the state of for market demand for products A and B. the world We assume there are k states of the world and the probability that state i occurs is Pi, where Pi > 0 for all i and £ Pi = 1. After observing state i i, the firm chooses its production levels XAi and XBi of products A and B, capacity constraints subject to the imposed by the earlier investment decisions. The state firm faces a linear demand curve for each product. i, the price consumers ei-fiXAi. In pay for each unit of product A is Similarly, the demand curve for product B is gi-hiXBi. For simplicity, we assume there is only one period in which the firm makes production decisions. Finally, we assume that the variable cost of production of a unit of product A (or product B) is the same whether a unit is produced with flexible or nonflexible capacity. Thus, without loss of generality, we assume that the variable costs implications of relaxing of production are zero. this and other The assumptions are discussed in section 5 of the paper. With this notation, we can formulate the PFMS decision problem as PFM1: 4 investment k -rAKA-rBKB-rABKAB + maximize Pi(XAi(ei-fiXAi) E + XBi(gi-hiXBi) ) i=1 KA,KB,KAB XAi,XBi,i=, ... subject ,k XAi-KA-KAB < 0 i=l ... ,k () (6i) XBi-KB-KAB < 0 i=l,...,k (ii) (ei) XAi+XBi-KA-KB-KAB < 0 i=l,...,k (iii) (Xi) to: 0 XAi,XBi KA O, > KB > O, i=i, ... ,k > 0 KAB (qi,ri) (iv) (v) (m,n,p) The notation for the Lagrange multipliers for each of the inequalities (i)-(v) is given to the far right of each line. We make the following assumptions: Al. ei > 0, gi > 0, i.e., the intercept of each demand curve is positive. A2. fi, hi > 0, i.e., each product's demand curve is strictly downward sloping. A3. rA > 0, rB > 0, rAB > 0, i.e., there are positive purchase costs for all capacities. A4. rAB > rA, rAB > r B , i.e. the per unit cost of flexible capacity strictly exceeds the per unit cost of nonflexible capacity for either product. (Note that if rAB < rA and rAB PFMS problem simplifies significantly because no rB, then the firm would ever purchase any nonflexible capacity.) A5. rAB < rA + rB , strictly less i.e. the per unit cost of flexible capacity is than the per unit cost capacity for both products. obviously of purchasing nonflexible (Otherwise, never economical. flexible capacity is When assumption A5 is violated, the PFMS problem splits into separate investment decision problems solution, for each product, and see Freund and Fine 5 each problem has a closed form [1986].) III di ci = Pigi, = Pihi, are equivalent to ai, ci, in PFM1. di > 0, The Karush-Kuhn-Tucker program. XBi, i=l,...,k, KA, KB, = iei, ai = Pi f i , Assumptions Al and A2 then i=l,...,k. is a convex quadratic assumptions A1-A5 the PFMS problem Under XAi, i=l,...,k bi, substitute bi we will For notational convenience, (K-K-T) conditions ensure that KAB constitute an optimal solution to the PFMS problem if and only if there exists nonnegative multipliers m, n, p. Xi, Si, conditions ei, qi, ri, i=l,...,k, for which the following hold: bi - 2 di - 2ciXBi aiXAi = i = ei + ... ,k - qi i= + Xi - ri i=l,...,k Xi k rA E = (Si + Xi) + m (ei + Xi) + n (Si + ei + Xi) i=1 k rB E = i=1 k E rAB = i=1 + P together with the complementary slackness conditions: 6 i(XAi - KA - KAB) = O ei(XBi - KA - KAB) = O Xi(XAi + XBi - and qiXAi = O, riXBi KA - = 0, KB - KAB) i=l,..,k, 6 = O mKA = O, nKB = , PKAB = 0. Theorem (Existence and Uniqueness of Solutions) 1. the PFMS problem has a unique optimal solution assumptions A1-A5, XAi, XBi, PROOF: KAB, 1: PROOF: is straightforward and Under assumptions A1-A5, and XAi, of the (see, i=l,...,k, KA, KB, KAB. The proof Corollary Under XBi, From the theory of de Panne piecewise-linear upper single valued, and so continuous. rB, optimal values KA, KB, functions and rAB. parametric quadratic programming 1975]), the set of optimal solutions is a semi-continuous mapping of the linear in the objective function. coefficients the in the Appendix. i=l,...,k are piecewise-linear continuous capacity cost data rA, e.g., Van is presented is a piecewise By Theorem 1, this mapping is linear function and is [X] Assumptions A4 and A5 play a critical role in guaranteeing the uniqueness of The necessity of the solution in the PFMS problem. is illustrated these assumptions in the following nonflexible capacity are rA = rB = 10, example. Costs of and there are two future states, with data: ai bi c i di 1 1/2 60 1/2 30 2 1/2 30 1/2 60 State The table below shows different values of function of i optimal rAB. solutions to the PFMS Figure 1 illustrates rAB- 7 problem for three the optimal KAB as a III Solution AR EA #1 10 0 0 #2 10 25 #3 15 #4 #5 EA EAf au A B1 80 55 25 25 55 0 0 5 0 0 5 25 30 55 25 25 55 0 0 5 0 0 5 27.5 27.5 25 52.5 27.5 27.5 52.5 5 0 2.5 0 5 2.5 20 30 30 20 50 30 30 50 10 0 0 0 10 0 20 50 50 0 50 30 30 50 10 0 0 0 10 0 Upon setting q = q2 = rl = r2 = , m = n = p = 0, it m 2 is easily verified that the solutions above satisfy the K-K-T conditions, and so are optimal. A4. is Solutions #1 When rAB = 10, rAB = r A = and #2 are each optimal indifferent between building a mix of capacity (solution #2) Solutions #4 violating assumption in this state. The firm flexible and nonflexible and building all flexible capacity (solution When rAB = 20, rAB = #1). r, rA + r, violating assumption A5. and #5 are each optimal. In this case, the firm is indifferent between building a mix of flexible and nonflexible capcity (solution 4), and building all nonflexible capacity (solution #5). Figure 1 shows as a function of rAB in this example. of KAB = rB values of KAB Note that the optimal values is a piecewise linear point-to-set mapping, and is a continuous function over rA the optimal < rAB the range 10 < rAB < 20, i.e., < rA + rB. We now turn our attention to sensitivity analysis and comparative statics for the PFMS problem. facilitated by transforming the problem. levels XAi, XBi = YBi XBi, + ZBi, Our analysis For given production these quantities can be split where YAi is is into XAi = YAi + ZAi, that portion of total A production being produced with nonflexible A-capacity, and 8 ZAi is that portion JI.. KAB 90 80 - 70 - 60 - 50- 40 - 30 - 20 - 10 - - I 0 5 Figure 1. 10 15 Optimal values of KAB as a function of rAB 9 S 20 rAB III of A production being produced with flexible AB-capacity similarly for B production). (and With this change of variables, the PFMS problem now becomes PFM2: k maximize KA, KB, YAi, rB KB - rAB KAB + - [ai (YAi+ZAi) 2 [ci (Bi+ZBi) + bi i=l k KAB ZAi, i=l, .... rA KA - YBi, ZBi k + subject to: ZAi YAi - KA < YBi - KB 0 KAB 0 YAi 0 i=l YBi 0 i =1 ,.... ZAi 0 i =1 ZBi 0 i =1 ,...,k KAB 0 + ZBi KA, i - KB, 2 YBi+ZBi)] (i) ((ai) , ... ,k (ii) (si) ,... k (iii) (Yi) ,...,k (iv) (si) (v) (ti) (vi) (ui) (vii) (vi) (viii (m,n,p) i=l,.....k i=l + di= ( YAi+ZAi) I k ... k It is a straightforward exercise to verify that PFM2 is equivalent to PFM1, with the transformations: XAi = YAi + ZAi Xbi = YBi + ZBi and KA, 0) - KB, 0) YAi = min (XAi, KA), ZAi = max (XAi - YBi = (XBi, KB), ZBi = max (XBi min i=l,...k. Theorem 1 asserts KA, KB, KAB, and determined that under assumptions A1-A5, (YAi + ZAi), (YBi + ZBi), in an optimal solution. 10 the quantities i=l,...,k are uniquely In the program PFM2, decoupled and appear prices a, Bi, the strategic variables KA, in separate constraints. and Yi are easier to value of an extra unit of A-capacity we would expect and KAB are Furthermore, interpret. marginal KB, the shadow For example, ai in state i. is the Therefore, k that at an optimal ai = solution, rA, equating i=1 marginal value and marginal cost k of A-capacity. Similarly, we would k B Si expect = Yi rB and i=l = rAB. Indeed, the optimality conditions i=l for the problem bear out this intuition. PFM2 ensure that a feasible i=l,...,k, is an optimal solution KA, KB, solution to PFM2 exist nonnegative multipliers i=l,...,k, for which the The K-K-T conditions for m, n, p, KAB, if and i, Bi, following conditions YAi, only if Yi, si, hold: (I) bi - 2ai (YAi + ZAi) = ai - Si i=1, . . . k (II) bi - 2a i (YAi + = Yi - Ui i=1, . . . k (III) di - 2ci (YBi + ZBi) = Si - ti i=1' . . . k (IV) di - 2c (YBi + = -i Vi i=1, . . . k (V) rA = i ZAi ) ZBi ) k E + i=1 (VI) rB (VII) rAB = = k E i=1 k E Y + P -=1 11 ZAi, YBi, ZBi, there ti, ui, vi, III i (KA - Ai) = 0 i (KB - Bi) = 0 Yi (KAB - ZAi - (VIII) (IX) Si YAi m KA = = O, ZBi) = = 0, ti YBi , n KB = 0, Note that si, t i, u i, 0 i ZAi = 0, v = 0, i i i=l,...,k, p KAB = 0. vi, m, n, and p represent shadow prices on the nonnegativity conditions (iv) - (viii) of the problem PFM2. If production with each capacity is positive in each state, then by the complementary slackness conditions = p = O, i=l,...,k. (IX), Si = ti = ui = Vi = m = n Condition (V) states that the sum of the marginal contributions of nonflexible capacity for product A must be less than or equal to the cost of nonflexible A-capacity, with equality holding when A-capacity is purchased, (by (IX)). Conditions (VI) and (VII) are interpreted in similar fashion for nonflexible B-capacity, and for flexible AB-capacity. The PFMS problem has a natural interpretation as a two-stage program, where the capacity variables KA, KB, KAB are the first-stage variables, and the production variables YAi, second-stage variables. and KAB, ZAi, YBi, ZBi are the Given optimal values KA, KB, KAB for KA, KB, in the PFMS problem, the k independent second-stage programs P(i) are: 12 maximize YAi, ZAi, YBi, ZBi - ai (YAi + ZAi)2 + bi (YAi + ZAi) - ci (YBi + ZBi) 2 + di (YBi subject to: YAi KA (ai) YBi KB (8i) KAB (Yi) ZAi + ZBi An optimal solution YAi, + ZBi) YAi > 0 (si) YBi > 0 (t i ) ZAi > 0 (u i ) ZBi 0 ZAi, (vi) YBi, ZBi to P(i), i=l,...,k, together with KA, KB, KAB will constitute an optimal solution to the PFMS problem, and under assumptions A1-A5, the total production quantity (YAi + ZA1) in program P(i) will be unique. For notational convenience, let K = (KA, KBg, vector of optimal capacity values. By K > KAB) represent the we mean KA > 0, KB > 0, and KAB > 0. Lemma 1. Let K be optimal capacity levels for the PFMS problem satisfying assumptions A1-A5, solutions to P(i), i=l,...,k. and let YAi, ZAI, YBi, ZBi, be optimal Then the set of multipliers defined in (1) below is an optimal set of K-K-T multipliers for the PFMS problem. Furthermore, if K > 0, then these K-K-T multipliers are the unique K-K-T multipliers for the PFMS problem. 13 ill = [bi - ai (YAi + ZAi)] + , Si = [bi - ai (YAi + ZAi)- , Si = [di - ci (YBi + ZBi)] ti [di - ci (YBi i = Yi = max (i, Ui = Yi Vi = i + + ZBi)]- Si) - i + - i + ti i (1) , i=...,k. k = rA - E ~i i=1 k n = rB - si E i=l k p = rAB - £ Yi i=1 PROOF: The quantities YAi, to P(i) if and only if they form a solution to the PFMS problem together with the optimal Theorem 1, are the quantities ZAi, YBi, ZBi are an optimal capacity levels KA, KB, (YAi + ZAi) = XAi and YAi + ZAi and YBi + ZBi, i=l,...,k. PFMS problem. conditions m, n, (IX) satisfy (I) - It thus remains (VII) to defined in By = XBi the the formulas as functions of All multipliers nonnegative with the possible exception of m, these multipliers and KAB. (YBi + ZBi) uniquely determined, and so the multipliers theorem are uniquely specified by solution n, are obviously and p. Furthermore, of the K-K-T conditions for the show that the complementarity of the K-K-T conditions are met, as well as that p are nonnegative. If i, of optimal BSi, Yi, i, ti, ui, , K-K-T multipliers, vi, i=l,...k, m, n, p are a set then from the uniqueness of 14 (YAi + ZAi), - we must have that a i and all quantities must = Si be nonnegative, i=l,...,k. Similarly, we can show that u > ui , i vi v i, i=l,...,k. and similarly ti YBi = 0, u k k m = E so m KA = 0 n KB = 0 ai > rA - implies ai E set of multipliers then m = 0, and i, < ai = ai, Corollary 2. that There Note that, specified in and and the ai = rAB Similarly, ti = ti, p = . Thus, i=l O, Si = = Yi, vi = vi, establishing the i=l,....,k. in particular, if K > O, Bi, Yi ui = ui, K-K-T multipliers (ai, Bi), Also k in this case. exists a unique set of optimal satisfy Yi = max ZBi = 0. so m > 0 and m > m, ai i=l,...,k, and m = m = n = n = p = the uniqueness of the optimal i and indeed are the smallest ~ so = si, Yi > Yi, can take. i=l,...,k. and it then follows that si ti, > si, YAi = 0, then i Thus the multipliers i=l since ai i, ti ZAi = 0, v i k If K > O, > si > ai, Similarly, n > 0, p > 0, theorem are optimal K-K-T multipliers, values that any i = 0 But ai-si whereby ai > 0, and that m KA = 0. = O. and p KAB = si. because s Thus, Si YAi = 0, rA - i - X] K-K-T multipliers [X] then the optimal K-K-T multipliers are unique and hence must satisfy Yi = max (ai, Bi), i=l,...,k. The economic significance of this corollary is clear. ai and Si The represent the marginal values of A-capacity and B-capacity, respectively, in state i, i=l,...,k. marginal value of AB-capacity in state 15 Furthermore, i, i=l,...,k. i represents the The condition 11 Yi = max (ai, i), i=l,...,k asserts that in each value of AB-capacity is the state the marginal larger of the marginal value of A-capacity or of B-capacity. In the absence of flexible capacity, of the firm faces the decision how much A-capacity and B-capacity to build by solving the two independent manufacturing investment problems AMS AMS: and BMS: BMS: max KA,XAi i=1 .... subject k 2 E [-ai(XAi) + bi i=1 rA KA + XAi] k XAi - to: KA < 0 (i) > 0 (si) KA > 0 (m) XAi k max - rB KB + KB,XBi i=l i= .. ,k subject [-Ci(XBiJ XBi - to: KB < 0 (i) > 0 (ti) KB > 0 (n) KBi As is discussed in a companion paper (Freund and Fine +di [1986]), these two problems possess unique solutions and unique K-K-T multipliers, and can be solved analytically. In view of corollary 2, we have the following theorem: Theorem 2 (Necessary and sufficient conditions for purchasing flexible capacity). Let KA, XAi, be optimal i, Si, i=1,...,k, m, and KB, solutions and K-K-T multipliers Xgi, Bi, ti, =1 ... ,k, for the independent manufacturing investment problems AMS and BMS, under assumptions A1-A5. Then KAB > 0 in the optimal solution to the PFMS problem k and only if rAB < E max (ai, i). i=1 16 if n XBi] The economic interpretation of respective problems values of extra A- represents AMS and BMS, production of either A or B, The be economical, states, ai and Bi and B-capacity in state the marginal value capacity. Theorem 2 should i.e., i. Thus the marginal that in order cost rAB must be less of the marginal value In the represent the marginal max(ai, of capacity that can be used theorem states its be clear. Bi) in value of flexible for flexible capacity to than the sum, over all of the capacity's most valuable use in that state. k PROOF: If rAB > max E (i, Si), define Yi max (i, Bi), i=l k ui Yi - ai + si, Yi vi - + ti, Bi and p - rAB Yi. i=1 Then the K-K-T conditions KAB for the PFMS problem are satisfied with = 0. On the other hand, if rAB < k ~ max i=l (i, Si), then the above solution is the unique solution to the K-K-T conditions satisfying k (1). However, (rAB - Yi) E < 0, and so by lemma 1, the solution i=l KA, 2. KB, XAi, XBi, i=l,...,k, and KAB Properties of the Optimal Value We now turn our attention to problem to the costs of z*(rA, rAB) rB, for given = 0 cannot be optimal. Function the sensitivity of the PFMS capacity, namely rA, be the optimal capacity costs rA, value rB, rB, and rAB. Let function of the PFMS problem and rAB. 17 [X] Our concern with IH z*(rA, rB, rAB) lies value function, in ascertaining the properties of to predict the savings or costs this optimal due to decreased or increased capacity costs. Let r = ar = (rA, costs. (rA, rB, Then rB, be the vector of rAB) denote a vector of z*(r+Ar) = z*(rA the optimal value Theorem 3 rAB) capacity costs. changes + ArA, rB + ArB, Let in optimal capacity rAB + ArAB) measures of the PFMS problem when capacity costs are r + (Characterization of the Optimal r. Value Function) Under assumptions A1-A5, (i) z*(rA, rB, with (ii) rAB) is a convex piecewise-quadratic function, continuous first If K = (KA, KB, KAB) capacity costs are rA = partial derivatives. are optimal capacity values when r = (rA, rB, rAB), then -KA arA arB (iii) where z*(r) = -KB 2rAB -KAB If r = (rA, rB, rAB) is in the interior of a region is a quadratic form, and r is sufficiently small, then z*(r+Ar) = z*(r)-KA(ArA)KB(ArB)K-KAB(ArAB) M is a symmetric negative semi-definite matrix. is negative definite, and so z*(r+Ar) This theorem gives it - (1/2)(Ar)TM(Ar), Furthermore, partial derivatives given by (ii) The interpretation of these first partial 18 then M is strictly convex. us the structure of the optimal is convex and piecewise-quadratic. continuous first If K > 0, where value function it has in Theorem 3. derivatives is that profit declines with increases in optimal costs capacity value. on op2timal capacity costs at a rate The effects of small equal to the changes capacity levels and consequently in capacity second-order. The theorem also shows that the optimal value is decreasing in each capacity cost, because KA and KAB > O. The formula form for z*(r+Ar) part of the PROOF: KB > 0, and gives us an explicit functional (iii) In the next section, if we know the matrix M. proof of Theorem 4, O, function we will show how to construct as the and hence how to construct the functional form in part matrix M, (iii) in are of on profits the above theorem. of The proof properties of of this theorem follows from the duality convex quadratic programming, see Dorn [1960]. standard quadratic programming dual of the PFMS problem PFPM2, we denote as the DFMS problem, can be derived as: k minimize aiBii si,t i i=l ... ,k E k (bi-ai+si)2 /(4ai) E + (di-8i+ti) 2 /(4ci) i=l i=l k subject to: E ai < rA (KA) si < rB (KB) Yi < (KAB) i=1 k E i=l k E i=1 19 rAB The which III i-si-Yi < 0 , i=l, .. ,k (ZAi) Bi-ti-Yi < 0 , i=l,...,k (ZBi) i=l,...,k (YAi) Si > 0 , ti > 0 ,i=l,...,k ai > 0 , Si > 0 Yi V >> 00 1 where the primal been written in Note that i=l,...,k i=l...,k , i=1,...,k. variables corresponding the dual constraints have to the right next to the appropriate dual constraint. the capacity costs rA, rB, and rAB now appear as RHS coefficients of dual constraints whose optimal KA, KB, (Ygi) K-K-T multipliers and KAB will form a solution to the primal problem. the theory of Lagrange z*(rA, rB, rAB) (KA, KB, KAB) duality, the optimal is a convex function. value function Also, from Lagrange duality, are optimal K-K-T multipliers for the first three constraints of the DFMS problem is a subgradient of z*(rA, rB, if and only if rAB), (-KA, see Geoffrion the gradient of z*(rA, rB, rAB), derivative, obtaining formulas 1, these rAB. (ii) -KB, [1971]. by Theorem 1, KA, KB, KAB are uniquely determined, is From -KAB) However, so (-KA, -KB, -KAB) and each component is a partial of the theorem. first partial derivatives are continuous From corollary in rA, rB, and Finally, from the theory of parametric quadratic programming, see Van de Panne [1975], quadratic function of the optimal value the RHS coefficients function is a piecewise rA, r, rAB of the dual problem. In each region where z*(r) z*(r) is a quadratic form, the Hessian of exists and is a symmetric positive 20 semi-definite matrix, because z*(r) is convex, whereby the matrix M given in symmetric and negative semi-definite. follows (iii) of the theorem is The formula given in from Taylor's theorem and the fact that z*(r) is piecewise- quadratic and therefore has no n-order terms beyond n=2. The proof that M strictly convex) [X] is negative definite (and hence z*(r) when K > 0 is deferred until (iii) is the next section, and follows as part of the proof of Theorem 4. One important point regarding Theorem 3 deserves further elaboration. The theory of parametric quadratic e.g. Van de Panne [1975], asserts that z*(rA, r, piecewise-quadratic function. quadratic form (rA, rB, rAB) rAB) is a convex Furthermore, there are a finite S 1 ,...,SJ in the space R 3 of number J of closed polyhedral regions values of r = programming, see for which the function in each region Sj, j=l,...,J. z*(.) Each of is a these regions can be presumed to be 3-dimensional. The set of boundary points B c R3 i.e., at which z*(.) derivatives measure has no Hessian, is given by B = zero in R 3 . Thus 3 is valid for all r = J u aSJ, j=1 no second-partial and is a set of Lebesgue the formula of assertion (rA, r, rAB) (iii) except for those of Theorem r B; and B has measure zero. 3. Directional Properties of In this section, levels Under KA, KgB, the Optimal Capacity Function we examine the sensitivity of the optimal capacity and KAB to changes assumptions A1-A5, Theorem functions of rA, rB, KB(rA, rB, rAB), rAB, and so and KAB(rA, rB, in capacity costs 1 ensures that KA, rA, r, KB, and KAB are can be written as KA(rA, rAB), 21 rAB. and the vector K = rB, rAB), (KA, KB, KAB) [II can be written as K(rA, "(rA, parenthesized form lies rAB). We will rB, in determining function relative to changes rAB)" KB, KAB) Our properties of the optimal capacity in (rA, aKA arA 2KB arA aKAB arA SKA aKB aKA arB arB )rB arAB aKBKA arAB 9K KAB arAB rB, rAB). In particular, direction and magnitude of changes the derivatives, _ give valuable relative to changes in (KA, for notational convenience. matrix of optimal capacity/cost partial when it exists, will to K = refer but will usually omit the capacity function, as the optimal interest rB, (2) information regarding the in optimal capacity levels capacity costs. Corollary 3 (Characterization of the Optimal Capacity Function). Under assumptions A1-A5, if r = is a quadratic a region where z*(r) optimal capacity values for K(r+r = K(r) + M(Ar), is the matrix given in for (iii) in PROOF: This result gradient Hessian of is rB, rAB), in the interior of (KA, KB, KAB) are then r sufficiently small, where M of Theorem 3. In particular, M is capacity/cost partial derivatives (2). defined (ii) rAB) form, and K = r = (rA, precisely the matrix of optimal parts (rA, rB, and is an immediate (iii). z*(r), of z*(r). From part consequence of Theorem 3, (ii), and-the matrix M is Thus, for example, 22 (-KA, -KB, -KAB) is the precisely the negative of the MAAB = MA,AB z Az*/r r BrAB arAB a rA A _ KA arAB and similarly, 9KA MA, A = MA = B , + M(tr) for = is piecewise linear, compute the matrix M. the (2). whereby K(r+Ar) = [XI we will show how to proof of the next theorem, As part of the M is derivates given in sufficiently small. r Therefore, AB capacity/cost partial From Corollary 1, K(r) K(r) MAB,AB 9, = and MB,AB 'rA· 9rr B matrix of optimal MB B corollary 3 can be viewed as Hence, constructive. section is: Our major result of this Theorem 4 (Optimal Capacity/cost Directions and Magnitudes). assumptions A1-A5, (1) if K(r) > 0, strictly then decreasing rA KA is (B) KB is strictly decreasing in rB (AB) KAB is strictly decreasing (2) in (A) in rAB (AB) KA is strictly increasing in rAB KB is strictly increasing in rAB (A) KAB is strictly increasing in rA (B) KAB is strictly increasing in rB 23 Under (3) (4) (5) (6) (A) KB is strictly decreasing in rA (B) KA is strictly decreasing in rB (A) KA + KAB is decreasing in rAB (B) KB + KAB is decreasing in rAB (A) KA + KAB is decreasing in rA (B) KAB + KB is (A) KB + KAB (B) KAB increasing in rA is decreasing + KA is in rB increasing in rB Before proceeding to the proof of this theorem, interpretation of this theorem and its Taken together, rAB statements we present an immediate consequences. ()-(AB) and (2)-(AB) assert that as increases, the firm will purchase less flexible capacity and more of each type of nonflexible capacity. (2)-(A), and purchase Statements (3)-(A) assert that as rA increases, less A-capacity, more AB-capacity and Statements (1)-(A) and the firm will less B-capacity. (2)-(A) are quite intuitive. follows because the substitution of flexible (1)-(A), Statement (3)-(A) capacity for A-capacity induced by an increase in rA also reduces the value, and hence the need, for B-capacity, B-capacity. the above because flexible capacity also substitutes for Statements (1)-(B), statements, for product Assertions (4), (5) and (6) (2)-(B) and B. of the theorem indicate a effect due to changes in capacity costs. as the cost of AB-capacity is (3)-(B) are analogous to increased, 24 "ripple" According to statement the decrease in flexible (4), capacity is larger in magnitude than the increase in either type of nonflexible capacity. has a similar (5) Statement interpretation. the cost of nonflexible A-capacity is (a decrease) change increased, when For example, the magnitude of the in A-capacity is the largest, followed by the (an increase), and then by the change in B- change in AB-capacity capacity (a decrease). The A-capacity is the B- the most affected, capacity is the least affected, with the AB-capacity falling between the two nonflexible capacities. Statement The "ripple" to statement of the theorem is analogous (6) effect is A to AB (5), to B. for product B. Before presenting the formal proof of Theorem 4 we first preceded by an explanation of the underlying three antecedent lemmas, economic and mathematical K(r+ar) from corollary 3, concepts used in = K(r) + M(Ar) B, where B E finitely many polyhedral convex sets sj Recall that r sufficiently small the boundaries of the in the space of rER 3 ). is continuous in r under assumptions A-A5, it suffices to prove Theorem 4 when becomes a proof of rB, and hence becomes MA,A < 0, to prove the proof of Theorem 4 certain properties of the matrix M of optimal capacity/cost partial derivatives. order the proofs. for is the union of (except for r Because K(r) present statement For example, statement (1)-(A) (4)-(B) becomes MB,A + MAB,A < 0, etc. In the theorem, then, we will explictly construct the matrix M. As a means toward computing the matrix M of optimal capacity/cost partial derivatives, subproblems P(i), solution to P(i) we will proceed by first solving the state i=l,...,k, and then examining the parametric as K changes. We 25 then will use this analysis to 11 construct a matrix N that will AK = K(r+Ar) ,- K(r) for all satisfy -N(AK) sufficiently small Theorem 3 and corollary 3 is given by M = the sign and magnitude Thus P(i), r, r. -N- 1 . where The matrix M of We then will Let K = values for capacity costs Note that the (KA, KB, KAB) r = rB, (rA, subproblems capacity be the optimal rAB) satisfying assumptions economics of subproblem P(i) implies marginal profit from producing an extra unit of product A decreasing in XAi = (YAi + ZAi) and zero when at XBi = di/2ci. subproblem P(i) Figure 2 plots the optimal six regions bounded by the inequalities regions numbered #1-#6, in The optimal the space of the optimal is given according to Table and di/2c i KB, (bi/2ai) and in the figure. (di/2ci), In each of natural Region economic 1. 1, which also gives the optimal As figure in Table 1 interpretation as follows: is enough capacity KA, KgB, and KAB to attain bi/2ai and B production to attain di/2c Therefore, the capacity constraints in binding, and K-K-T Each of the six regions of Table 1 has a In this region there for A production the solution to the subproblem P(i) the regions #1-#6 given by the inequalities are nonoverlapping. and and KAB- multipliers and the algebraic description of each region. 2 indicates, i. solution to the capacity values KA, indicated is profit is decreasing and will depend on the quantities bi/2ai their relationship to that the = bi/2a reaches zero at XAi Similarly, for product B, the marginal reaches examine of specific elements of M. our first task will be to solve the state i=l,...,k. A1-A5. = subproblem P(i) are not there is no need to allocate scarce capacity. 26 i. Region 2. marginal In this region, profit there (ai = 0), from product A capacity for product B to is ample A-capacity to attain zero but not enough B- attain zero marginal profit. and AB- Thus product B uses up all of the B- and AB-capacity, which will have positive shadow values at the Region 3. optimum In this region, (i.e., There marginal value is devoted to There is but not enough A- and AB(i = Yi > 0). and AB-capacity. or B-capacity to attain zero Furthermore, A-production insufficient A- the flexible AB-capacity. so dominates the marginal that of B-production marginal value of either product's B-production 0), B-capacity to attain zero of either product's production without resorting to A-production so dominates Region 5. the A- is insufficient A- the flexible AB-capacity. capacity (Bi = > 0). A to attain zero marginal value Thus product A uses up all of Region 4. Yi there is ample marginal profit of B production capacity for product = Bi (ai = Yi > profit of that all i > flexible 0). or B-capacity to attain zero production without resorting to Furthermore, the marginal value of that of A-production capacity is devoted to B-production (Bi Region 6. insufficient A- or B-capacity to attain zero There is marginal value the of either product's flexible AB-capacity. Both = Bi = Yi > i > ai > 0). production without resorting to products share the AB-capacity and the marginal value of A-production (lti = that all flexible 0). 27 and B-production are the same (di/2ci ) Region #5 Region #2 I cm - Region #6 di/2ci = KB KB + KAB KAB 'b.>0 x Region #4 = KB KB Region #1 om Region #3 II -4 ci -4 . KA - KAB KA Figure 2 - The Six Regions of Lemma 2 2I (bi/2ai) *1Q 'P'4 m E m IYL o IYL O Co, .1N i tr 0 0 0 I) IN q-6re 1 N I= I + + _ - .0 I P 0 ,C )a C re I + v O Q0 Q C CN l x"ce·co ++_ 1, 'E .0 Co O C. rlc,, O 0 V) .0 MM 1x S _r 0 m I1 o r q ci C.) N CO r D _9' .- 4.1 co C Vl Vl vl i~ 4:0 + V0dol 1N " NQ N C; " l o 1:) CN N a) 0 NC N Al 9- . v VI co l _ Al Al A1 Ai VI N N AI Vl I + M bC 1 + + + .pl v! - Ib .0 0 N Al - - VI ld L <4 + 9 m iY N C AI AI o C c c r· ).0 _ Cr- Q0 s < I: 0 + l0 Q X m v+ · .I .,. 0 Na C) N CI CrI N I:Y + CU o 0 CO 4* v 4* CD #* 29 C.) c co .- Nq III Co m < 1x 1C.) _ _ I)>. 0 U V *r .4 C< m < m im < y~ 1:S Q Cm C) .0 *9.9 *. X I IN -. 4 *1- C.) C) N4 N c Co - +c) 0 m N m m .4 N 0 I o N + Im I C.) NI C.) N: I C. .9. C.) - 0 I N 0 I Ild W -4 I .0 I I Co co m 0 0 N I NU I I C a I N + 0 0 o 0 C) 9.1I4i o0 O 0 C 0 E O 0 0 a Co co 0 0 0:: 4 I 1 0 4 I + I 0 0 o 0 0o IaM 4ii I~Q x - U 1-1 co - m *" Co t) (b < NNu N¢4 IxIL Mw *Q 0 + x la_ 0 i .0OC I N M: _ o co 4* .^ cO d30 30 ut CO c; C.) N + + .9. NM IO + O + N _ *_ for subproblem P(i). optimal the Furthermore, the K-K-T multipliers s i , With r = (rA, rB, ti, u i, rAB) given, (ArA, ArB, rAB) be a vector of Let K = K(r+Ar) - the Knowing 1. unit change unit changes per unit ,KAB- allows us the data for state = bi-2aiKA - in i, Bi, changes 1) are in ai, For example, i results in Bi, in the bottom row of Table N Yi from di ) 2c i ( 2a I 2aiKAB, and the per These per KAB let the matrix Ni denote the negative and vi relative to a change in KA, KB, is the negative of i relative to a change in KAB. i) of the negative , shown in Table 2. the element n,AB of Ni By definition, nB,AB, to easily compute Vi relative to changes in KA, KB, each subproblem P(i), unit change capacity/cost partial in ai relative to a change in KAB is -2ai. (derived from Table For (AKA, AKB, AKAB) then ai Let capacity values the subproblem shadow prices ai, if For example, falling in region #4, = K in satisfy According to corollary 3, r. is the matrix of optimal where M i Bi and be the change in the optimal K(r) per unit changes Table ai, small capacity cost changes. induced by the change in capacity costs derivatives. vi, in the each region let us assume that rB. Ar = AK = M(ar), in 1. lemma (1) of formulas 1, and so the solutions given are in Table satisfied for each region table, verify that the K-K-T conditions are is straightforward to It 2. = the per This denotation appears Define the matrix N by k E Ni i=l for example, . represents per unit change in Bi 31 (3) the sum (over all states relative to a change in KAB, III .)- o 0 N C.) 04 * C.) c1 cu + 0 + C.) o c 1 4 - ) 0 .)C'J cu II- -c O O .1 cl .1 IX o I C.) E 4 4 4 0 C.) bO 0 C ' 4c aQ) Q Q) C) .m C.)I1Q Cu caJ .m 0 -M o CM co I e + . c) cs X I C (1) .C C.) o E a 0 o 0 0 cl cq ul o 0 a.) . C.) cr Q . -C$4 c C'J I C'j I E _ ..4- - 0 0 C.) C'J 1 i C.) C)J ++ Cu0" U( CD C Cu + I to F4 CL Q Cu ) W .0 Q) C) M C c, _c X )· r C C E: Q 3 IdC 1 0 0 0 O a) .C .Cu -4 + C N 1 + C C.) r.( Wr 0. CQe Q O Q d 1Qd O C.) Q) a _r O C\J I cla cm 0 C _r to.o+ I -4 Q O O O 0O tO C 0 Q e Q bD u (d C C 1 .1 Q O O c.j cl Co Cu I' C) 0 + N 0 C 0 .- 4' C 0o 0bO 4* Ci 4* In 4* 4* CO 4* * a) a.) 04) CM 32 k i.e., nBAB is the negative £ change in the Bi relative to a i=l k If KB > change in KAB. 0, then £ Bi = rB, and so nB,AB is the i=1 negative per unit change in rB relative to a change in KAB. similar logic for the other components of N, Lemma 2. K(r) > Under assumptions A1-A5, if r = Using we have: (rA, rB, rAB) B, and 0, then the matrix N defined by Table 1, Table 2, and (3), satisfies N(AK) If the matrix N Lemma 3. Table 2, is invertible, -N - 1 . must have M = = -(ar) Thus, [xl . = (-N- then aK our next task is )(Ar), whereby we to prove Under assumptions A-A5, the matrix N defined and (3) has a positive determinant. matrix N can be written as N 1 = e+b e e+a e e+d e+c e+a e+c e+a+c , where E a = iER 2ai UR 3 4 E 2a iER 3 UR4 UR 5 b = c = £ R 2 uR d = iER e= i 2Ci 5 E 2ci uR uR 2 4 5 2aici E iER 6 ai+c 33 (4) by Table Furthermore, the 1, III and R in region j as defined in j=1,...,6. Table 1 (or Figure 2), PROOF: i that are the set of state denotes See Appendix. [XI By Cramer's rule, we obtain: Lemma 4. K(r) Under assumptions A1-A5, > O, det(N) r = (rA, if rB, rAB) B, and then nB,AB nB,AB -nB,B nAB,AB nA,B nAB,AB -nA,AB nB,AB nB,B nA,AB -nA,B nB,AB nA,B nAB,AB -nA,AB nB,AB nA,AB nA,AB -nA,A nAB,AB nA,A nB,AB -nA,B nA,AB nA,A nB,AB nA,B nA,B nB,B nA,AB -nA,B nB,AB -nA,B nA,AB -nA,A nB,B [X] With the formula for M given in lemma 3, Theorem 4, which describes how optimal we are in position to prove capacity levels change as a function of the capacity costs. Proof of Theorem 4: and from equation Given the formula for the matrix M from lemma 4 (4), the proof of Theorem 4 is accomplished by verifying certain inequality relationships among matrix M. The details of this procedure are in the Appendix Theorem 4 is conditioned on the supposition capacity values are positive. values, is say KA, is that all the [X]. optimal When one of the optimal capacity zero, we obviously can no strictly decreasing the elements of longer assert that KA Furthermore, the computation of in rA. matrix M cannot be accomplished as the in the proof of Theorem 4, k because we may not have £ a i = rA, i.e., m could be positive. i=l However, using logic similar to that in Theorem 4, Corollary 4: 4 Under assumptions A1-A5, the six assertions of remain valid, without the strict monotonicity 34 we can prove: in assertions Theorem (1)-(3). 4. Example with Calculation of the Value of Flexibility Consider a firm that produces two basic and faces uncertainty about If this firm must make its product lines, A and B, the future demand for each product line. investment decisions on flexible and on nonflexible capacity levels before the demand uncertainty is resolved, then our model provides a useful tool decision problem. industry. for analysis of the investment One instance of such a setting occurs in the auto In their engine plants, automobile manufacturers choice of building nonflexible machining one size engine block or between four and lines that can only produce flexible lines that can switch, six cylinder engines. cars with small or movements large for example, Since engine plant construction lead times and useful lives are frequency of oil price face the long relative to the (which affect consumer demand for engines), automobile manufacturers may have an incentive to build some flexible engine line capacity that can be used for either large or small engines. The following example automobile illustrates the calculations that such an manufacturer could perform to analyze manufacturing system investment decision. for this example, its We will product-flexible also illustrate, a calculation of the value of flexibility as a function of the per unit cost of flexible capacity. The value of flexibility as a function of rAB is measured by z*(rA, z*(rA, rB, is available do not ), the additional profits obtained when flexible capacity at a cost of rAB per unit. reflect actual - rB, rAB) The numerical data presented industry conditions. They are only used for purposes of illustration. Suppose there are four possible future states depending on whether oil of the world, prices are high or low, and whether 35 the U.S. III growth is high or low. gross national product for products A and B (small and suppose demand linear large engines) is respectively, and that the state of of A and B, the notation of the previous and di=pig i, product demand slopes are unity, i.e., The data Oil Prices for i=1,2,3,4. For Pi in simplicity, we assume the fi=hi=l for the example are as GNP Growth Thus, sections, the random variables are bi=Piei ai=ci=Pi). in the prices the world only affects intercept of the products' demand functions. the vertical St ate i Further, Small engine (Product A) demand intercept, e i for all i (so that follows: Large engine (Product B) demand intercept, gi Large a nd Small E ngine demand slope fi, h i 1 High High .10 18 10 1 2 High Low .30 16 6 1 3 Low High .40 8 18 1 4 Low Low .20 4 16 1 Further, we assume the per unit capacity costs are rB = 2.2, The rAB = 3.8. table below shows terms of the quantities State i rA = 2.6, ai ai, i the data bi, for each state expressed ci, in di. ci di 1 .10 1.8 .10 1.0 2 .30 4.8 .30 1.8 3 .40 3.2 .40 7.2 4 .20 .8 .20 3.2 Clearly, the assumptions Al A5 are satisfied, problem exhibits a unique solution. 36 and so this PFMS This optimal solution is KA = 3, KB = 4, KAB = 3. the two However, as the to hold less some the uncertainty in the demands for products make purchase of 3 units flexible capacity efficient. well non flexibile capacity costs the firm optimally chooses than flexible capacity, nonflexible capacity. Since The dual region (from Figure 2 of the more prices a i , in the previous Bi, expensive and Yi, section) as for each state are given below. ai State i i Region # 1 .6 .2 .6 4 2 1.2 0 1.2 3 3 .8 1.6 1.6 5 4 0 .4 .4 2 Straightforward calculation shows that z*(2.6, 2.2, order to compute the value of flexibility, +c) 50 1/12 by solving the PFMS problem will = the value of flexibility In order in (when rAB = 3.8) to obtain N, = 52.5. we compute z*(2.6, rAB = +. is 52.5 - the matrix of negative 2 to first calculate Ni for each state procedure, we obtain 37 ·11__^1______11____ .._ In 2.2, Therefore, 50 1/12 = 2 5/12. per unit changes the capacity shadow prices relative to the capacity levels, use Table _11_ 3.8) i. we Following this II .2 0 .2 .2 and M = = -N 0i - 1 = = .4 .4 .4 , -17/16 3/4 -3/4 7/8 -2 1 .5 1.5 7/8 .6 J 0 0 0 .8 .8 LO .8 .8 = 1.6 0 .8 0 1.4 1.2 _ .8 1.2 2 N = and N3 , o .6 0[ .4 .8 .6 0o O .2 0 N4 , N2 O 0 o .6 .2 -1.75 Thus, z*(2.6+ArA, 2 .2 +ArB, + 1/2 rA ar 3 . 8 +ArAB) = T -17/16 3/4 B \&rAB In particular, 3 52.5 - 7/8 (ArA) -3/4 7/8 -2 1.5 1 -1.75 1. v - 4(ArB) / - (ArAB) rA ar B ACrAB rB / for example az* arAB = -3 and That is, with an incremental increase aKA A arAB 77 8 in the cost of flexible capacity, optimal profits decrease at the rate of three units, and dedicated A-capacity increases at the rate of 5. 3 optimal .875 units. Discussion Our model provides the beginnings of a conceptual framework for evaluating investments in To ease product-flexible manufacturing systems. the analysis of the model, we have assumed that the firm produces only two different products and 38 can invest in only three different technologies. An alternate formulation, due to Kulatilaka [1985], allows M different types of nonflexible technologies, of which may be optimal each in certain states; and analyzes the optimal use over an infinite horizon of a flexible technology whose "mode" can be switched each period (at a cost) so as to emulate any of the M nonflexible technologies. The modelling cost of this richer formulation is that Kulatilaka makes a very specific assumption on the distribution of the sequence of random variables relevant to the optimal single-period technology choice. (The random process is a discrete version of mean-reverting Weiner process.) Kulatilaka is able to calculate optimal policies for specific numerical examples. In contrast, our model, which we restrict to only two products, assumes that the firm may invest in a portfolio of flexible and nonflexible technologies and that the switching costs are either zero (for the flexible technology) or infinite (for the nonflexible technologies.) Our model formulation PFMI can easily accommodate multiple time periods by adding a time index to XA i, XBi, fi, gi, hi, Pi, ei, summing the profits over the time periods in the objective function, and adding a discount factor. The analysis remains the same, assuming the firm does not carry inventories from period to period. If we permit inventories, then the analysis of the model becomes significantly more difficult. Our intuition is that the presence of inventories would reduce the value of flexible capacity to the firm since holding inventories provides flexibility for firms in meeting demand. We think that an extension of the model, exploring this conjecture, warrants further analysis. Another extension of our model would be to assume that the per unit variable cost of production differs, depending on whether the 39 1 _1___1__1___11·1__1__--_I^_____ _-- HI1 unit is produced with the flexible or nonflexible Many capacity. analysts claim that automated flexible manufacturing systems than do their less flexible lower per unit variable costs When this substitutes. have is the case, the firm will obviously buy more flexible and less nonflexible for the formulation analyzed here. capacity than would be the case Suppose, in addition, we generalize the form of the acquisition cost to include a fixed component if any positive level of a certain technology is chosen. assume that investing in KAB > 0 units of flexible For example, capacity costs RAB + rAB.KAB, where RAB > 0. nonflexible capacity investment costs we are RA + rAKA and RB + rBKB. increase the difference between the variable cost of producing with the flexible versus the nonflexible increase RA, RB, KA and KB will purchased. and KAB as levels of KA, KB, if we look at the optimal In this case, Similarly, assume technology or as we and RAB, then at some point the optimal levels become zero and only flexible capacity will Thus, a more realistic of be production cost and acquisition cost structure can yield a solution where the option of investing in nonflexible capacity is abandoned completely in favor of investment We think that an exploration of this solely.in flexible capacity. extension merits further work. A final direction for further exploration of this look at how competition affects flexible capacity. firms' optimal investment is viewed as threatening to enter market A in [1979], Bulow et al. 40 If firm 2 (only) then firm 1 may want to hold some excess A-capacity to deter entry. Dixit to In one two-firm extension of our model, suppose that firm 1 is a monopolist in product markets A and B. Spence [1977], model is [1985].) (See, e.g., The question of interest is whether firm 1 can deter entry by holding productflexible (KAB) capacity. Holding KAB to deter entry is less costly than holding only KA to deter entry because unused KAB capacity has an alternate use. However, KAB may not be a credible The because of this alternate use, holding threat to potential entrants. crucial issue here relates commitment and flexibility. to the conflicting effects of To deter entry, an established firm must appear to the entrant to be committed to behavior that will detrimental to a new entrant. credible, for example, that marginal in a new market [1983]). Such a commitment can be made by having already costs of production are Alternatively, be invested in capacity so low (as in Dixit 1980]). a firm may demonstrate commitment by investing early (as in Spence [1979], and Fudenberg and Tirole Holding product-flexible capacity would appear to reduce the credibility of commitment to high post-entry production. is because, once entry has occurred, have a higher marginal product multimarket monopolist who is This the flexible capacity might if deployed elsewhere. Therefore a threatened by potential entrants may not wish to hold flexible capacity because it detracts from the credibility of commitment to defend the threatened market. Countering this effect, prefer to hold some the previous however, a multimarket monopolist will flexible capacity if demand sections) uncertain because the or if entry is uncertain. potential entrant's [1983], Milgrom and Roberts Further analysis (Entry may be Kreps and Wilson [1982], is required to resolve how flexible technology affects equilibrium capacity investment when these two conflicting forces 41 (as in costs are not observable by the incumbent as in Saloner [1982a].) is uncertain are present. and III Similar questions revolve around how product-flexible capacity might be used by potential entrants. In particular, purchasing product-flexible capacity for entering a new market may be a less risky way to enter a market controlled by an costs. That is, Eaton and Lipsey incumbent with unknown low exit costs may reduce the costs of [1980] for additional entry. perspective on this (See issue.) However, an incumbent might play tougher against an entrant who is known to have product-flexible capacity that can be used in other markets. (This is especially likely if opportunity for reputation formation as or Milgrom and Roberts [1982b]). the incumbent has an in Kreps and Wilson Obviously, there [1982] is much work to be done to determine how the existence of product-flexible capacity affects competition and entry in this multi-market oligopoly entry game. 42 Appendix PROOF of Theorem 1: The PFMS problem is always feasible, since the PFMS problem is a convex quadratic A2 and A3 it is bounded from above. Because the objective function is XAi and XBi, i=l,...,k, XAi, It remains to by assumptions strictly convex in XBi are uniquely determined Assuming the contrary, suppose 2 2 2 (KA, KB, KAB). program, and It thus attains its optimum. show that KA, KgB, alternative optimal By assumption A2, is feasible. i=l,...,k, KA=KB=KAB=O XAi=XBi=, i. KAB are uniquely determined. 1 1 KA, KB, values of KA, for each 1 2 2 KAB and KA, KB, KB, and KAB, and 2 KAB are 1 1 1 (KA, KB, KAB) * 1 1 1 2 2 2 Then rAKA + rBKB + rABKAB = rAKA + rBKB + rABKAB. We have two cases: Case 1. 1 2 KAB = KAB. 1 2 that KA > KA > 0, i=l,...,k, m, Then XAi 2 < KB, and n, 1 Then KA 2 1 and hence KB > KB p) be any optimal KA < KA, whereby so ei = 2 1 KA and KB * , > 0. 2 K, Let = O. i = 0, i=l,...,k. rA = rAB Xi and rB = 1 KA then rAB = 2 then KAB = KAB = 0. 2 KA and XBi X, and i=1 + P- If p = 0, But 2 and KB > 0, k Xi, i=1 k = E i=l ri, Similarly XBi < KB 1 Also, since KA > 0, =1,...,k. Thus ei, Xi, qi, (i, K-K-T multipliers. k m = O and n and we can assume KB rA, violating assumption A4. For each 1 + KAB = KB, + KB + KAB, and so Xi = index i=l,...,k, and so XAi + XBi , i=l,...,k. contradiction. 43 XAi Thus p > 0. 2 2 < KA + KAB 2 1 1 1 KA + KB < KA + KB = Thus rA = O, a = I[ Case 2: KAB 1 2 KAB > KAB > 0, addition. (ei Without and so i Then -. k £ KAB. + Xi) = that 1 1 2 2 Suppose that KA + KAB KA + KAB, in k i=l,...,k, whereby rAB = E (Si + ei + Xi) j~~~~i=1 0, n. i=l assumption A4. of generality, we can assume p = 0. ~~~~~~ = rB - loss This 1 implies that rAB 1 2 rB, = violating 2 Therefore KA + KAB = KA + KAB, and by an identical argument, it must be true that KB + KAB = K + KAB. Therefore, 2 1 1 2 1 2 However, it is also true that KB = KA - KA. KB KAB - KAB 1 2 rAB (KAB KAB) - rA (KA = KA) + rB (KB - Kg). This forces rAB = rA + rB, which violates assumption A5, proving the theorem. PROOF of Lemma 3: We note the following inequalities as a consequence of Table 2: i i nAA nA,AB i i nBB > nB,AB i nAB,AB i nAB,AB i > nA,B > 0 i nB,A > 0 i nA,AB > 0 i > nB,AB > 0 i i nA,B = nB,A i i nAB,A = nA,AB i nAB,B = - which i nB,AB imply: nAA > nA,AB > nA,B nB,B > nB,AB > nB,A 0 0 nAB,AB > nA,AB > 0 nAB,AB > nB,AB nA,B - nB,A nAB,A = nA,AB nAB,B = nB,AB [X] > 0O O 44 Note, in particular, symmetric and nonnegative. set of states denote the j=i,...,6, in Table that N is i that are in Now let Rj, region j as defined 1 (or Figure 2). Define the following numbers: a = 2ai E iER 3 UR b = iER c 4 E 2ai UR UR 5 3 4 £ = 2ci R 2 uR 5 d = iER e = Then the _ 2ci UR UR 2 4 5 E iER 2aici 2asc ai+ci 6 matrix N can be written N = e+b e e+a e e+d e+c e+a e+c e+a+c in the form: (4) The determinant of N is: det(N) = ad(b-a) Because a, b, of the above + bc(d-c) c, d, terms + e e are all (b-a)(d-c) nonnegative, are nonnegative, to show that some term is = + c(d-c) and b > a, whereby det(N) > + ac]. and d > c, O. It remains Therefore derive a contradiction. 0 and bc(d-c) = O. Then one of the following nine cases must be true: Case 1. or 6. a = But O, then, b = O. Thus all states by Table all strictly positive. Assuming the contrary, we will we assume that ad(b-a) + a(b-a) 1, i = must be in Yi for all contradicting assumption A4. 45 regions 1, 2, i, whereby r B = rAB, M11 Case 2. a = 0, By Table 1, c = 0. i = Thus all states must be in Yi for all i, whereby rB = rAB, regions 1 or 6. contradicting assumption A4. Case a = 0, d = c. 3. 5, or 6. By Table Thus all states must be in 1, B =i Yi for all i, whereby r B regions 1, 2, = rAB, contradicting assumption A4. Case 4. d = 0, By Table 1, ai b = 0. = Yi, Thus all states must be in regions 1 or 6. for all i, whereby rA = rAB, contradicting assumption A4. Case 5. or 6. d = 0, c = 0. By Table 1, Thus all states must be in regions 1, 3, i = Yi, for all i, whereby rA = rAB, contradicting assumption A4. Case 6. d = 0, d Case 7. b = a, b = 0. This is Case 8. b = a, c = 0. Thus all states must be regions 1, 3, 1, ai = Yi, or 6. By Table = c. This is identical to case 5. identical to case 1. for all 4, i, whereby rA = rAB, contradicting assumption A4. Case 9. b = a, d = c. 3, or 6. (i + Bi = Yi, If e = 0, Thus all states must be in regions 1, 2, then all states are for all i. This contradicting assumption A5. a = 0 or c = 0. regions 1, 2, If a = 0, 5, or 6, and this implies all rA = rAB, a contradiction. Thus det(N) implies Thus, in regions e > 0, and det(N) so rB = rAB, regions > O. or 3, and that rA + rB = rAB, then this implies states are in 1, 2, = eac. all states are a contradiction. 1, 3, 4, or 6, If Thus in c = 0, and so [X] 46 Proof of Theorem 4: det(N) = 1. (1) Without We prove each loss of generality, of the six assertions We must show that AA < 0, Because nBB nB,AB and nAB,AB nAB,AB) < 0. If or (iii) A,A = 0, nB,B = nB,AB = nAB,AB1 or 3, regions 1, implying rA = rAB = 0. regions results 0, 1, 2, 5, or 6, If If We must show that 0. m (ii), (iii), B,B < 0 A,AB > , B,AB nB,AB) > 0O then all nAB,AB = 0, in Since in states must be each case mA,A < 0. Similar AB,AB < 0. > O, AB,A nA,B, > 0, A,AB = If mAAB = 0, then either ng,gB = nA,B- nB,B then all states are and Because nB,B > nB,AB and nA,AB - nA,B (ii) then all states are implying rB = rAB. or nB,B = nB,AB and n A ,AB rAB, (i), (nB,AB nB,AB - nB,B = 0, in a contradiction of assumption A4, (2) nA,AB If (i) separately. and mAB,AB < 0. nB,AB, mA,A = implying rA = rAB. logic can be used to deduce that mAB,B > mBB < 0, then either regions in we can assume The first and (nB,B = 0, n A ,AB case implies that the second implies thar rB = rAB, and the third = rA implies that rB-= rAB. Thus we obtain a contradiction to assumption A4, Similar logic M is symmetric, (3) nAB,AB a > be A4. can be used to show that mB,AB m nA,AB nB,AB) > 0, in regions 1, Similarly, contradiction. > 0. 0. Furthermore, since A,AB = mAB,A and mB,AB = mAB,B- We must show that 0 and c and mA,AB > by = (e(e+a+c) (4). 0, - if a = 0, whereby rB = rAB, otherwise Thus -ac < 0, B,A < 0. (e+a)(e+c)) Furthermore, 2, 5 or 6, c > A,B < 0 and and rA = < 0. = (-ac) < 0, (nA,B because then all states must contradicting assumption rAB, which again so mA,B 47 = mA,B is a II (4) Note We must that + AB,AB + mA,AB = nA,B nB,AB). But -nA,A nA,A + nA,AB) nB,B(- O because b > a. shows (5) nB,B We must (nAB,AB c(d-c) > 0, (nB,B - - equal nB,AB nB,AB + nB,AB + nB,B - nA,AB - nA,B nB,AB - = -(e+d)(b-a) nA,B) e(c) = < 0 A parallel argument mA,AB > -m B,A + (nA,B Thus nA,B nB,AB - . - - > 0, 48 + (e+c)(-c) = But this all components of which i.e., identical to that of A nB,B nA,AB = nA,AB nB,AB). + ea + a(d-c), -mA, Second, mA,AB + mA,B -mA,A > mA,AB. + mA,B First, nB,AB) = (e+d)(c) + nA,B nAB,AB to e(d-c) is A,B B 0. < 0. Thus m A ,AB This proof and mB,AB + mAB,AB + nB,B nA,AB mAB,AB + mA,AB > 0. nA,B nB,AB are nonnegative. (6) nA,B(nB,AB because d > c. second term is + nA,B nA,B < 0 + nA, A,A nB,B show that -mA,A nA,AB) nA,AB - (- nB,B + mAB,AB = nB,B nAB,AB - mA,AB - Thus that mB,AB + mAB,AB show that mA,AB mA,AB > (5). [X] mA,B- REFERENCES A Selective Review of the Managing Flexibility: 1985. Adler, P. Challenges of Managing the New Production Technologies' Mimeo, Department of Industrial Potential for Flexibility. Engineering and Engineering Management, Stanford University. Classification of Flexible Manufacturing Systems. 1984. Browne, J. The FMS Magazine, April. "Holding Idle 1985. Bulow, J., J. Geanokopolos, and P. Klemperer. Capacity to Deter Entry," forthcoming, Economic Journal, March. The Fundamental Principles of Flexibility in 1982. Buzacott, J.A. Proceedings of the First International Manufacturing Systems. Brighton, U.K. Conference on Flexible Manufacturing_Systems. "A Model of Duopoly Suggesting a Theory of Entry 1979. Dixit, A. Barriers," Bell Journal of Economics, Spring, pp. 20-32. Dorn, W.S. Math. 1960. 18, pp. "Duality in Quadratic 155-162. Programming," 9uart._ARR1. 1980. "Exit Barriers as Entry Barriers," Eaton, B. and R. Lipsey. Bell Journal of Economics, Autumn, pp. 721-729. "An Algorithm for Computing 1986. Freund, R.M., and C.H. Fine. Optimal Capacity Levels for the Product-Flexible Manufacturing System Investment Problem," in preparation. "Capital as Commitment: 1983. Fudenberg, D. and J. Tirole. Journal of Economic Deter Entry," Strategic Investment to Theory, 31, pp. 227-250. A "Duality in Nonlinear Programming: 1971. Geoffrion, A.M. Simplified Application-Oriented Development," SIAM Review 13 pp. 1-37. 1984. Jones, R.A., and J.M. Ostroy. Review of Economic Studies, LI, Flexibility and Uncertainty. 13-32. "Reputation and Imperfect 1982. Kreps, D.M., and R.B. Wilson. Information," Journal of Economic Theory, Vol. 27, pp. 253-279. 1985. Kulatilaka, N. Unversity School The Value of Flexibility. of Management. Mimeo, Boston An Flexibility in Decision Making: 1978. Mandelbaum, M. Exploration and Unification, Ph.D. dissertation, Department of Industrial Engineering, University of Toronto, Ontario, Canada. "Limit Pricing and Entry 1982a. Milgrom, P.R. and D.J. Roberts. An Equilibrium Analysis," under Incomplete Information: 50, March, pp. 443-460. Econometrica, __ _ ___ __ _ i___ III Milgrom, P.R. and D.J. Roberts. Entry Deterrence," Journal pp. 280-321. 1982b. "Predation, Reputation and of Economic Theory, Vol. 27, "Dynamic Equilibrium Limit-Pricing in an 1983. Saloner, G. Uncertain Environment," M.I.T. Department of Economics working paper. "Entry, Capacity, Investment and Oligopolistic 1977. Spence, A.M. Pricing," Bell Journal of Economics, Autumn, pp. 534-544. Spence, A.M. Market," 1979. "Investment Strategy and Growth in a New Bell Journal of Economics, 10, Spring, pp. 1-19. Proceedings_ of the First ORSA/TIMS 1984. Stecke, K., and R. Suri. Ann Arbor, Conference on Flexible Manufacturing_Systems. Michigan. Stigler, G. Journal Production and Distribution 1939. of Political Economy, 47, 305-328. Van de Panne, C. Programming, in the Short Run. Methods for Linear and _uadratic 1975. North-Holland, Amsterdam.