Factory Outlet Centers: Implications for Development ... Roger P. Mann, Jr. Bachelor of Arts in Government by

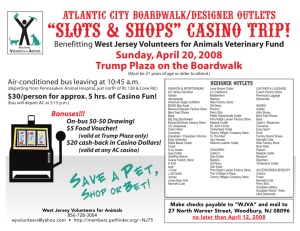

advertisement