Is the Intrinsic Value of Macroeconomic News ∗ Thomas Gilbert

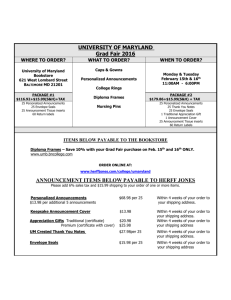

advertisement