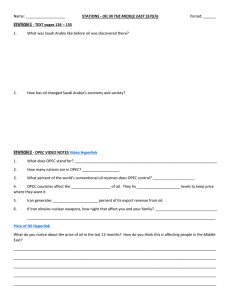

CARTEL BEHAVIOR AND EXHAUSTIBLE CASE

advertisement