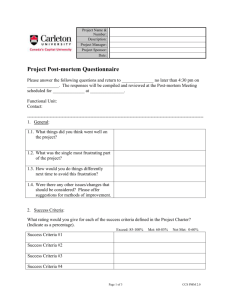

Document 11130837

advertisement