UNIVERSITY-AFFILIATED RETIREMENT COMMUNITY DEVELOPMENT: A RESOURCE FOR UNIVERSITIES .

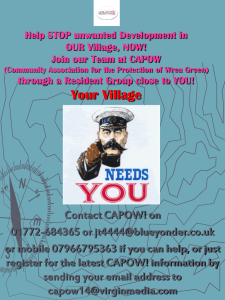

advertisement