Global Sheepmeat Prospects 2010/11

advertisement

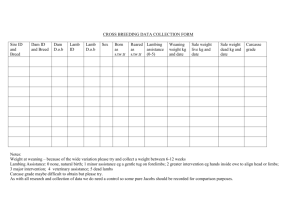

Global Sheepmeat Prospects 2010/11 July 2010 Page 1 of 8 Table of Contents 2 Introduction ................................................................................................................................................3 New Zealand ...............................................................................................................................................4 Production..........................................................................................................................................4 Exports ...............................................................................................................................................4 Australia ......................................................................................................................................................5 Production..........................................................................................................................................5 Exports ...............................................................................................................................................6 United Kingdom ..........................................................................................................................................6 Production..........................................................................................................................................6 Exports ...............................................................................................................................................6 France..........................................................................................................................................................7 Production..........................................................................................................................................7 Trade & Consumption ........................................................................................................................7 EU Sheep Meat Situation ............................................................................................................................8 Production..........................................................................................................................................8 Trade & Consumption ........................................................................................................................8 Page 2 of 8 Introduction Lamb production for the three key global producers, New Zealand, Australia and the UK is expected to edge up for 2010, with production set to ease slightly in 2011. This pattern is expected to be repeated for exports for these three key producers. The marked downturn in availability of New Zealand lamb in 2008/09 is being replaced by a significant recovery in 2009/10 as the record lambing rate in spring 2009 has more than offset the fall in the breeding flock resulting in higher lamb slaughtering, albeit later than normal given adverse weather conditions. Some reduction in the lambing rate seems inevitable in spring 2010 and so lamb production could fall back in 2010/11, which would reduce NZ lamb exports in 2011. High lamb prices have restored confidence in the UK sheep industry and so the previous declines in the breeding flock have now largely ended but production will still show some downturn in 2010 before edging up in 2011. UK exports have continued to perform well, although some downturn seems probable in 2010 given lower domestic production, some recovery in sterling and no increase in French import demand. After falling sharply in 2009 French lamb production is expected to be more stable or even edge up in 2010 and 2011. As a result, import demand will be more dependent on the level of consumer demand for lamb. For the EU as a whole lower production and consumption of sheepmeat is evident in 2010, although the prospects for 2011 are for relative stability. However, recent months have seen some improvement in French consumption levels. Wholesale prices for lamb in the EU have been firm helped by tighter supplies while at retail level, lamb has only marginally lost price competitiveness to other meats. Page 3 of 8 New Zealand Production New Zealand experienced a recovery in its lamb availability for the 2009/10 marketing season following the lowest lamb kill in 20 years in 2008/09 and this in turn will increase exports. The total breeding flock in June 2009 was 4% lower than a year earlier. However, some flock rebuilding took place with the number of hogget’s put to the ram increasing by 24% in June 2009. Record lambing percentages in spring last year, which was 11% higher than the drought reduced averages of the two previous seasons helped increase New Zealand lamb crop for the 2009/10 marketing year, which commenced last October. Lamb supplies and production are expected by MLNZ to increase by 6% in 2009/2010. Lamb supplies were 15% lower than a year earlier during the October 2009 to February 2010 period, whereas from March to April they were almost 24% higher than the corresponding period in the 2008/09 season. This would point to increased lamb marketing taking place from May to September 2010. '000 head 4,000 New Zealand Monthly Export Lamb Slaughter 2003-08 ann av 2008/09 2009/10 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Tentative forecasts for 2010/11 suggest that New Zealand lamb production and exports could experience another small downturn due to lack of confidence within the industry despite export demand increasing as a strengthening of NZ dollar of 24% against the euro and 14% against sterling over the last year has affected competitiveness. Exports The breeding flock in June 2010 is predicted to ease given the ongoing tight financial situation of producers and the reduction in usage of farm inputs. The exceptional lambing rate of spring 2009 is Page 4 of 8 unlikely to be repeated, which will lead to a reduction in production and exports in the 2010/11 marketing year. Chilled lamb exports to the EU during the October 2009 to April 2010 period were 20% higher than year earlier levels despite the late start to the season. Total NZ sheepmeat exports during the same period were 4% higher than year earlier levels. Tonnes 12,000 New Zealand Chilled Lamb Exports to EU: Quantity 2007/08 10,000 2008/09 2009/10 8,000 6,000 4,000 2,000 0 Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep In the calendar year 2009, New Zealand utilised 98% of its EU quota compared with 99% in 2008, suggesting there is small scope for a rise in trade with the EU in 2010. In the January to April period this year, shipments to the EU were down 4% on year earlier levels due to less frozen product being exported, with chilled product up 17%. Australia Production Australian lamb export availability continues to increase but growth is slowing down. Domestic production in 2009 recovered, reflecting better climatic conditions and good lamb prices, despite the Australian dollar strengthening, as producers continue to focus on prime lamb production. In 2010 and 2011, lamb production is expected to remain relatively unchanged, as the Australian sheep flock fell by 7% in June 2009 with some further decline expected in June 2010. Page 5 of 8 Exports Lamb exports reached record levels in 2009 with lamb shipments to the EU increasing by 9% to 14,600 tonnes. For 2010 and 2011, total lamb exports are expected to slowdown in response to the declining sheep flock. United Kingdom Production Lamb production in the United Kingdom for 2010 is expected to fall by 7% to 284,000 tonnes. For the first four months of 2010, lamb production was back by 15%, suggesting that supplies should start to settle down again for the remainder of the year. For 2011, lamb production is expected to improve somewhat. This is expected to occur as confidence within the sheep industry has been partly restored, reflecting the firmer lamb market since the autumn of 2009. A slightly larger lamb crop is expected on the back of a 16% increase in ewe lambs put to the ram in the 2009 December livestock survey, with the overall breeding flock declining by just 1%. These ewe lambs are expected to boost lambing rates for 2011 as they mature into ewes. Lamb output for 2011 is being helped further by a 23% fall in ewe supplies for the first 4 months of 2010. Exports Sheep meat exports from the United Kingdom for 2010 are unlikely to match last year’s levels given lower UK production, a weakening euro and weaker demand on the French market being evident. For the first four months of 2010, UK shipments were back 10% on last year’s corresponding period. Some further downward pressure on exports is likely for 2011 as domestic demand stabilises. Page 6 of 8 France Production French production is forecast to show some recovery in 2010. Some recovery in ewe productivity after previous reductions associated with blue tongue and lower usage of sponges, should give a slight boost to lamb supplies over the year, even though the breeding flock in November 2009 was 2% lower. Other factors contributing to increased sheepmeat production include, improving carcase weights and greater numbers of live sheep being imported. For the January to April period this year, sheep meat production was 2% higher than a year earlier in spite of a 4% fall in mutton output. Assuming that only a marginal decline in the breeding flock occurs in November 2010, lamb supplies should be broadly stable in 2011. Source: Agreste, AgriMer Trade & Consumption Lower volumes of imported lamb so far in 2010 have contributed towards a fall of over 3.5% in household purchases up until the 16th May, while the average retail price of lamb has risen by 2% during a time when retail prices of other meats have declined. Sheep meat imports in the first quarter of 2010 were 19% below the corresponding period last year. For the remainder of the year, imports are expected to resume more normal patterns of activity. Imports from all major suppliers will decline for the year apart from Spain. In 2011, a somewhat more stable demand situation is forecast, with any further decline in imports likely to be small. Page 7 of 8 EU Sheep Meat Situation Production EU sheepmeat production has been in decline over the last few years, although indications suggest some stabilisation in 2011. Production in 2009 declined in France, Spain the UK and Ireland with further falls expected for the two latter countries in 2010 leading to a drop of more than 3% to 915,000 tonnes. Spanish production in 2009 declined by 22% and was 45% below its mid-2000’s levels as low profitability, shortages of shepherds, adoption of partial de-coupling, blue tongue disease and several droughts adversely affected output. Trade & Consumption EU sheep meat imports remain stable but the switch from frozen to chilled lamb accelerated in 2009 and even more so in 2010, as New Zealand in particular has been pushing chilled product helped by shortages of British product. Further growth in chilled product imports seems likely for 2011, but the increase may be less than in 2010, assuming there is no further marked fall in carry-over of UK lambs into 2011. EU consumption has been in sharp decline since 2007, as consumers switch to lower priced alternative sources of protein. However, some slowdown in the rate of decline is anticipated in 2010 with indications of a more stable consumption situation in 2011. Page 8 of 8