2013-2018 SOUTH CENTRAL CONNECTICUT Comprehensive Economic Development Strategy

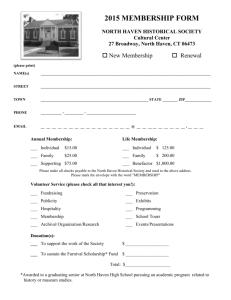

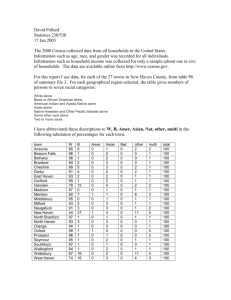

advertisement