PECAN ENTERPRISE COST ANALYSIS

advertisement

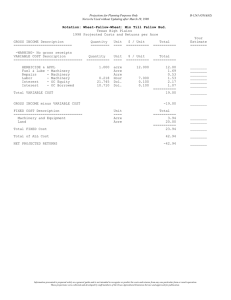

PECAN ENTERPRISE COST ANALYSIS Cooperative Extension Service Agricultural and Applied Economics The University of Georgia College of Agricultural and Environmental Sciences Acknowledgments We are indebted to the following retired extension employees: George Westberry, Extension Economist, Tom Crocker, Extension Horticulturist, and Roy Goodson, Extension Coordinator, Lee County, who masterminded the 1992 Estimated Costs of Producing Pecans, Cooperative Extension Publication and the 1998 unpublished version of which this publication is based. Equal thanks to Paul Sumner, Wojciech Florkoswki, William Givan, and Frank Funderburk for their various contributions and expertise that made this publication possible. PECAN ENTERPRISE COST ANALYSIS SEPTEMBER 2002 Prepared by: Greg E. Fonsah, Extension Economist, UGA Kerry Harrison, Extension Engineer,UGA Brad Mitchell, Extension Coordinator, Mitchell County Pecan Production in Georgia. Nationwide, Georgia has position herself as number one in the production of Pecans. USDA and NASS reports (2001) indicates that in 1999, 2000 and 2001, the State of Georgia alone produced 29.5%, 38.0% and 30% of all pecans grown in the United States. For the improved varieties, GA produced 38.7%, 40.0% and 33.8% in 1999, 2000 and 2001 (Fig 1). Fig: 1. Percentage of Georgia Utilized Pecan Production, 1999 - 2001 40.00 35.00 % of U.S. 30.00 25.00 20.00 15.00 10.00 5.00 0.00 1999 2000 2001 Years Improved Varieties Native & Seedling Source: Agricultural Statistics Board, NASS, USDA (2002) Non-citrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. 2 All Pecan/USA Fig: 2. All Pecan Production-Major States, 1999-2001 450,000 400,000 350,000 Ibs 300,000 250,000 200,000 150,000 100,000 50,000 0 1999 2000 2001 Years GA NM TX OK USA Source: Agricultural Statistics Board, NASS, USDA (2002) Non-citrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. The same USDA and NASS report shows that out of the 406, 209.9 and 315 million pounds of Pecan produced in 1999, 2000 and 2001, Georgia contributed 120, 80, and 95 million pounds respectively (Fig. 2). This is equivalent to 35, 15 and 15 million pounds of Native and Seedlings (Fig 3), and 85, 65 and 80 million pounds for the Improved Varieties respectively for the same years (Fig. 4). 3 Fig: 3. Pecan Production: Major States: Native and Seedling, 1999-2001 250,000 Million Pounds 200,000 150,000 100,000 50,000 0 1999 2000 2001 Years GA LA TX OK Source: Agricultural Statistics Board, NASS, USDA (2002) Non-citrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. 4 USA Fig: 4. Pecan Production - Major States, Improved Varieties, 1999-2001 (1,000 Pounds) 250,000 200,000 150,000 100,000 50,000 0 1999 2000 2001 Years GA NM TX USA Source: Agricultural Statistics Board, NASS, USDA (2002) Noncitrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. From 1991 – 2001, the United States Pecan production (in-shell basis) illustrates a chain saw trend due to the alternate bearing cycles and the introduction of improved varieties (fig. 5). 5 Fig. 5. Pecan Production (in-shell basis): United States, 1991-2001 450000 400000 (1,000 Pounds) 350000 300000 250000 200000 150000 100000 50000 0 1 2 3 4 5 6 7 8 9 10 11 1991 - 2001 Series 1 Series 2 Source: Agricultural Statistics Board, NASS, USDA (2002) Noncitrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. It is equally important to know your market as well as cost of production to determine profit margin and how much capital is needed especially during the establishment years. The pecan budget should be used simply as a guide for inputting your own costs. 6 Pecan Price Trend Pecan prices are volatile, sensitive and fluctuating. This volatility depends on several factors, including the variety, locality and aggregate productivity. Price trend for the past ten years vary from 154 to 43.4 cents per pound (fig. 6). Fig: 6. Price Trend: Improved Varieties, Native & Seedling, and All Pecans, 1991-2001 180 160 (Cents per Ib) 140 120 100 80 60 40 20 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Years Improved Varieties Native & Seedling All Pecans Source: Agricultural Statistics Board, NASS, USDA (2002) Non-citrus Fruits and Nuts 2001 Preliminary Summary, pp 74-75. Farm Input Prices There are several factors that can influence prices of inputs, total cost of production and profit margin respectively. Most farmers in Georgia may not invest in drip and overhead irrigation materials or dig a new well since they already have them available. If so, that would significantly increase profitability. Small Pecan farmers, i.e. from one to thirty acres may or may not install an irrigation system. Also motor size (HP) may differ depending on the number of acreage. Quantity discounts may affect prices of inputs. The cost estimate in this budget reflects a combination of the current agricultural practices in Georgia and recommendations from UGA specialists. The prices are actual prices from vendors around the counties involved in pecan production and they exclude quantity discounts. 7 Machinery costs Estimated total annual fixed machinery costs for pecans is $139.00 per acre. This cost varies based on the size of the farm. Again, small growers (1-30 acres) may not accrue this cost. However, if they decide to invest in machinery, overhead cost per acre may be relatively higher as the annual machinery investment costs are spread over a smaller acreage. Growers with 40 to 100 acres large farms may incur some of the cost. Also, only one equipment like sweeper will be needed by a farmer with less than 100 acres. A rational grower may simply purchase used equipments such as herbicide sprayer, air-blast sprayer, rotary mower, wagon, tractor, sweeper etc. to minimize cost and eventually maximize profit. Types of Costs Total costs of cultivating pecan include fixed and variable cost respectively. Variable costs are broken down into pre-harvest, harvesting and marketing costs. Fixed cost components include machinery, irrigation, recaptured establishment costs, land, overhead and management. Pre-harvest variable cost is $424. Harvesting and Marketing cost is $144. Total variable cost is $568. On the other hand, total fixed cost is $678 while the total budgeted cost per acre is $1,246, excluding cost of land. The estimated establishment and first year maintenance cost per acre for Georgia Pecan is $734. This cost trends down from second through fourth year to $429 and trends up from fifth through seventh years to $626. For more costs details, please turn to the budget section of this publication. Irrigation Costs Drip and solid set irrigation costs have been incorporated in this enterprise cost analysis. Annual fixed costs per acre for drip irrigation is estimated at $66 while total annual costs per acre is $103. The estimated annual fixed costs per acre for the solid set irrigation system is $105 while the total annual costs per acre is $184. The solid set system is relatively more expensive in terms of initial investment per acre. Micro-sprayer irrigation system is also used by some pecan growers in Georgia. This system is the most efficient especially on sandy soil and due to its water dispersal surface area coverage of to 3 to 20 ft diameter (1– 7 meters). However, the system is not incorporated in this enterprise cost analysis but would be very much in line with the estimated drip costs. Therefore, it is recommended that growers with micro-sprayer system should use the drip irrigation budget and those with micro-sprinkler system, should use the solid set irrigation budget respectively. 8 PECANS (Total Cost Budget) *Number of acres = IRRIGATION: Enter 0 for none, 1 for drip, 2 for Solid Set *Yield (lbs) *Price per lb. Best Opt 1600 1.25 Item Variable Costs Lime, applied Nitrogen Phosphorus Potassium Zinc Sulfate Fungicides Herbicides Insecticide Labor Machinery Fuel Rep & maint. Land rent Irrigation Other Interest on Oper. Cap. Pre-Harvest Variable Costs Harvest and Marketing Costs Fuel Machinery Labor Cleaning & Drying Median Pess Worst 1400 1.05 1200 0.85 1000 0.65 800 0.45 Unit Quant. Price $Amt/ac TOTAL Ton Lbs. Lbs. Lbs. Lbs. Appl Appl Appl Hr. 0.5 150 30 100 10 9 2 8 3.46 22.00 0.300 0.250 0.140 0.30 12.22 6.79 10.83 7.00 11.00 45.00 7.50 14.00 3.00 109.98 13.58 86.64 24.20 11 45 8 14 3 110 14 87 24 Gal. Acre Acre Acre Acre $ 32.25 1 1 1 1 386.84 0.95 41.30 0.00 37.49 0.00 0.10 30.64 41.30 0.00 37.49 0.00 19.34 424.33 31 41 0 37 0 19 424 Gal. Acre Hr. Lbs. 14.21 1 3.44 1200 0.95 20.26 7.00 0.08 3.27 20.26 24.08 96.00 3 20 24 96 143.60 567.93 144 568 139.07 65.92 430.76 0.00 42.43 678.17 139 66 431 0 42 678 1246.10 1246 Total Harvesting and Marketing Costs Total Variable Costs FIXED COST Machinery Cost Irrigation Recapture estab. costs Land Overhead and Management Total Fixed Costs 1 1 Hr. Acre Acre Acre $ 1.00 1.00 1.00 1.00 424 139.07 65.92 430.76 Total budgeted cost per acre Costs Per Lb. Pre-harvest variable cost per lb. Harvest & marketing cost per lb. Fixed costs per lb. Total budgeted cost per lb. 0.10 0.35 0.12 0.57 1.04 (continued on next page) 9 EXPECTED RETURNS FROM TOTAL ACREAGE ACRES EXPECTED YIELD/AC VOLUME MARKETED EXPECTED PRICE TOTAL RETURNS 1 1200 1200 0.85 1020 RISK RATED RETURNS OVER TOTAL COSTS Net return levels (TOP ROW); The chances of obtaining this level or more (MIDDLE ROW); and The chances of obtaining this level or less (BOTTOM ROW). Optimistic *Returns($) Chances Chances CHANCES FOR PROFIT = 195 7% 55 16% 21% Expected (86) 31% (226) 50% 50% Pessimistic (367) (507) (648) 31% 16% 7% BASE BUDGETED NET REVENUE = 10 (226) ESTIMATED ESTABLISHMENT AND FIRST YEAR MAINTENANCE COST PER ACRE FOR GEORGIA PECAN, 2002 ITEM UNIT QUANT. PRICE AMOUNT TON Ib LBS APPL TREE ACRE HRS 2 120 50 3 27 1 20 22.00 0.30 0.30 6.79 8.25 15.00 7.00 44.00 36.00 15.00 20.37 222.75 15.00 140.00 16.02 1 1 0.95 48.00 37.49 15.22 48.00 37.49 OPERATING COSTS LIME (DOL.) FERT (10-10-10) ZINC SULFATE HERBICIDES TREES SPRAY MAT'L LABOR MACHINERY FUEL REP & MAINT IRRIGATION OTHER GAL ACRE TOTAL OPERATING COSTS 593.83 FIXED COSTS TRACT & EQUIP GEN OVERHEAD IRRIGATION LAND OTHER TOTAL FIXED COSTS $ $ $ $ 1 593.83 1 45.00 0.05 65.92 0.06 45.00 29.69 65.92 0 140.61 TOTAL ESTABLISHMENT COSTS 734.44 11 ESTIMATED ANNUAL MAINTENANCE COST FOR PECANS, SECOND THROUGH FOURTH YEARS, GEORGIA, 2002 ITEM UNIT QUANT. PRICE AMOUNT TON Ib LBS APPL ACRE HRS 0.33 480 0 3 1 6 22.00 0.30 0.30 6.79 15.00 7.00 7.26 144.00 0.00 20.37 15.00 42.00 GAL 9.07 1 1 0.95 28.00 37.49 8.62 28.00 37.49 OPERATING COSTS LIME (DOL.) FERT (10-10-10) ZINC SULFATE HERBICIDES SPRAY MAT'L LABOR MACHINERY FUEL REP & MAINT IRRIGATION OTHER ACRE TOTAL OPERATING COSTS 302.74 FIXED COSTS TRACT & EQUIP GEN OVERHEAD IRRIGATION LAND OTHER TOTAL FIXED COSTS $ $ $ $ 1 302.74 1 45.00 0.05 65.92 0.06 45.00 15.14 65.92 0.00 126.05 TOTAL COSTS 428.79 12 ESTIMATED ANNUAL MAINTENANCE COST FOR PECANS, FIFTH THROUGH SEVENTH YEARS, GEORGIA, 2002 ITEM UNIT QUANT. PRICE AMOUNT TON IBS LBS APPL TREE ACRE HRS 0.33 960 15 3 0 1 9 22.00 0.30 0.30 6.79 8.00 15.00 7.00 7.26 288.00 4.50 20.37 0.00 15.00 63.00 GAL 15.88 1 1 0.95 40.00 37.49 15.09 40.00 37.49 OPERATING COSTS LIME (DOL.) FERT (10-10-10) ZINC SULFATE HERBICIDES TREES SPRAY MAT'L LABOR MACHINERY FUEL REP & MAINT IRRIGATION OTHER ACRE TOTAL OPERATING COSTS 490.70 FIXED COSTS TRACT & EQUIP GEN OVERHEAD IRRIGATION LAND OTHER TOTAL FIXED COSTS $ $ $ $ 1 490.70 1 45.00 0.05 65.92 0.06 45.00 24.54 65.92 0.00 135.45 TOTAL COSTS 626.16 COMPOUND AND RECAPTURE OF ESTABLISHMENT COSTS COMPOUNDING RATE COMPOUND ESTAB. COST RECAPTURE ESTAB. COST YEARS INTEREST ANNUAL COST YEARS TO PRODUCTION 0.06 7 6 5 4 3 2 1 1.50 1.42 1.34 1.26 1.19 1.12 1.06 734 429 429 429 626 626 626 1104 608 574 541 746 704 664 4941 20 0.06 --------------> 13 431 CHEMICALS FOR PECANS Item Unit Quantity Price Amt/Ac. Herbicide Herbicide Herbicide Appl. Appl. Appl. 1 1 0 $6.42 $7.15 $0.00 $6.42 $7.15 $0.00 Insecticide Insecticide Insecticide Insecticide Insecticide Appl. Appl. Appl. Appl. Appl. 1 3 1 3 0 $4.00 $11.00 $7.65 $14.00 $0.00 $4.00 $33.00 $7.65 $42.00 $0.00 Fungicide Fungicide Fungicide Fungicide Fungicide Fungicide Appl. Appl. Appl. Appl. Appl. Appl. 4 5 0 0 0 0 $10.00 $14.00 $0.00 $0.00 $0.00 $0.00 $40.00 $70.00 $0.00 $0.00 $0.00 $0.00 Other Other Other Other Appl. Appl. Appl. Appl. 0 0 0 0 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Total 19 $210.22 14 ESTIMATING MACHINERY OPERATING COSTS FOR PECANS Operation Equip. Width (ft.) Field Speed (mph) Field Effic. % Acres Per Hour Number Times Over Fuel Use (Gal.) Mach Repairs ($) Labor Use (Hr.) Pre-Harvest Sprayer: Herbicide Air Blast Rotary Mower 20.00 40.00 15.00 3.00 2.50 6.00 70 65 95 5.09 7.88 10.36 2 12 10 1.47 24.75 6.03 1.72 35.43 4.14 0.47 1.83 1.16 32.25 41.30 3.46 3.09 3.44 2.68 5.00 5.50 9.37 4.89 0.50 0.83 1.10 0.51 1.00 14.21 20.26 3.44 Total Pre-Harvest Harvest Shake Sweep Harvest Haul 40 10 10 1.00 3.00 2.00 90 90 80 4.36 3.27 7.00 Total Harvest 15 3 3 3 ESTIMATED TOTAL ANNUAL FIXED MACHINERY COSTS FOR PECANS Acres Interest 400 10.0% Item Percent Used For Crop Sprayer,herbicide Sprayer,airblast Rotary Mower(15') Wagon(dump) Wagons(4 used) Tractor(2)* Tractor Truck Blower Sweeper(2)** Harvester Shaker Total Investment 75% 100% 75% 100% 50% 60% 50% 30% 100% 100% 100% 100% Purchase Price Salvage Value Yrs. Life Deprec. 600 65000 7500 10000 3600 67500 57000 20000 3700 10000 32000 95000 120 13000 1500 2000 500 13500 11400 4000 740 2000 6400 19000 5 5 7 15 5 8 8 1 5 10 10 10 72 10400 643 533 310 4050 2850 4800 592 800 2560 7600 27 3900 338 600 103 2430 1710 360 222 600 1920 5700 4 546 47 84 14 340 239 50 31 84 269 798 0.26 37.12 2.57 3.04 1.07 17.05 12.00 13.03 2.11 3.71 11.87 35.25 371,900 74160 35210 17909 2507 139 Int Tax & Ins 35210 17909 2507 TOTAL FIXED COSTS FIXED COSTS per ACRE $ * These prices are for new equipments. Used equipments could be purchased. **Only one sweeper is required for 100 acres or less. 16 55626 139.07 FC/Ac DRIP IRRIGATION FOR PECANS BASED ON SPACING 40 by INTEREST ON INVESTMENT CAPITAL TAXES & INSURANCE DEPTH OF WELL IN FEET 100 40 ACRES 10.00% 0.015 350 INVESTMENT AND ANNUAL FIXED COSTS PIPE & FITTINGS TUBING & EMITTERS WELL PUMP & MOTOR FILTER & AUTO MISC. INSTALLATION TOTAL INVESTMENT NEW COST 10300 9500 8400 3500 2600 1029 20600 55929 YRS.LIFE 20 10 25 15 10 20 20 DEPREC. INTEREST TAX & INS. 515 515 77 950 475 71 336 420 63 233 175 26 260 130 20 51 51 8 1030 1030 155 3376 2796 419 TOTAL ANNUAL FIXED COSTS 6592 ANNUAL FIXED COSTS PER ACRE 65.92 OPERATING COSTS MOTOR SIZE (HP) REPAIRS ANNUAL PUMPING HOURS ELECTRICITY Demand (standby charge) per YEAR Rate $ per KWH ANNUAL ENERGY COST ANNUAL ENERGY COST PER ACRE OPERATING COST PER ACRE PER YEAR 20 1337 1820 240 0.08 2412 24.12 37.49 TOTAL ANNUAL COSTS PER ACRE 103.41 17 SOLID SET IRRIGATION FOR PECANS BASED ON SPACING 40 by INTEREST ON INVESTMENT CAPITAL TAXES & INSURANCE DEPTH OF WELL IN FEET 100 40 10.00% 0.015 400 INVESTMENT AND ANNUAL FIXED COSTS NEW COST YRS.LIFE PIPE & FITTINGS SPRINKLERS WELL PUMP & MOTOR FILTER & AUTO MISC. INSTALLATION TOTAL INVESTMENT 30900 10000 9600 6500 2600 1550 30900 92050 ACRES 20 10 25 15 10 20 20 DEPREC. 1545 1000 384 433 260 77 1545 5245 INTEREST TAX & INS. 1545 500 480 325 130 77 1545 4602 232 75 72 49 20 12 232 690 TOTAL ANNUAL FIXED COSTS 10538 ANNUAL FIXED COSTS PER ACRE 105.38 OPERATING COSTS MOTOR SIZE (HP) REPAIRS ANNUAL PUMPING HOURS ELECTRICITY Demand (standby charge) per YEAR Rate $ per KWH ANNUAL ENERGY COST ANNUAL ENERGY COST PER ACRE OPERATING COST PER ACRE PER YEAR TOTAL ANNUAL COSTS PER ACRE 50 1823 1820 600 0.08 6031 60.31 78.54 183.92 18 PECAN RETURNS This example assumes very good management practices. Year Yield 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0 0 0 0 0 0 0 135 270 405 540 675 810 945 1190 **** Price $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 0.90 Var. Cost 593.83 302.74 302.74 302.74 490.70 490.70 490.70 508.25 525.80 476.98 494.53 512.08 529.63 547.18 579.03 Return over Return over Var. Cost Total Cost Total Cost -593.83 -302.74 -302.74 -302.74 -490.70 -490.70 -490.70 -386.75 -282.80 -112.48 -8.53 95.42 199.37 303.32 491.97 734.44 428.79 428.79 428.79 626.16 626.16 626.16 643.71 661.26 1155.15 1172.70 1190.25 1207.80 1225.35 1257.20 -734.44 -428.79 -428.79 -428.79 -626.16 -626.16 -626.16 -522.21 -418.26 -790.65 **** -686.70 -582.75 -478.80 -374.85 -186.20 This year fixed costs for the mature orchard was used. In reality , the higher fixed costs may begin earlier or later. 19 Prepared by: Greg E. Fonsah, Extension Economist, UGA, Kerry Harrison, Extension Engineer, UGA and Brad Mitchell, Extension Coordinator, Mitchell County The University of Georgia College and Agricultural & Environmental Sciences and Ft. Valley State University, and the U.S. Department of Agricultural and counties of the state cooperating. The Cooperative Extension Service offers educational programs, assistance and materials to all people without regard to race, color, national origin, age, sex or disability. An equal opportunity/affirmative action organization committed to a diverse work force. AGECON -02-077 September 2002 Issued in furtherance of Cooperative Extension, Acts of May 8 and June 30, 1914, the University of Georgia College of Agricultural and Environmental Sciences and Fort Valley State University, and the U.S. Department of Agriculture Cooperating. Dr. Gale A. Buchanan, Dean & Director College of Agricultural & Environmental Sciences