Sample Letter to IRA Administrators Re: [insert donor's name]

advertisement

![Sample Letter to IRA Administrators Re: [insert donor's name]](http://s2.studylib.net/store/data/011091828_1-1539f7035f828b9a4e7e7829cb9c07e3-768x994.png)

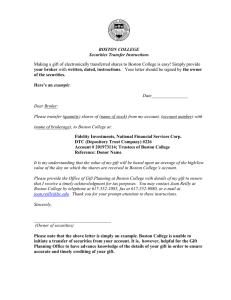

Sample Letter to IRA Administrators Date Financial Institution Name Address City, State, Zip Re: Request for charitable distribution from [insert donor's name] individual retirement account Dear Sir or Madam: Please make a direct charitable distribution of $ [insert dollar amount] from my IRA account number [insert account number] made payable to "The Trustees of Boston College" (Tax ID: 042103545). This gift is made free of tax as provided in H.R. 2029: Division Q – Protecting Americans from Tax Hikes Act of 2015. The check should be mailed to: Boston College Office of Gift Processing Cadigan Alumni Center 140 Commonwealth Avenue Chestnut Hill, MA 02467 Attn: IRA Gift Administration It is my intention to have this transfer qualify for the ___ tax year. Therefore, it is imperative this distribution be made no later than Dec. 31, ___. Please list my name and address as the donor for the transfer, and please send me a copy of the correspondence with Boston College. Please contact the Boston College Office of Gift Processing, if you need any additional information from the University. They can be reached at 617-552-4844 or uagifts@bc.edu. If you have any questions for me, please contact me at [insert phone number]. Sincerely, Name of Donor Address City, State, Zip

![Current use fund [insert Donor name and address] [date]](http://s2.studylib.net/store/data/012137120_1-ab1eaa5e11bccf5db9a603bf39d855e1-300x300.png)