1. Rising Framing's cost formula for its supplies... per frame. For the month of January, the company planned... AMIS 212

advertisement

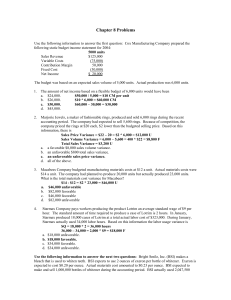

AMIS 212 Sample Questions for Exam 3 1. Rising Framing's cost formula for its supplies cost is $2,210 per month plus $10 per frame. For the month of January, the company planned for activity of 710 frames, but the actual level of activity was 705 frames. The actual supplies cost for the month was $9,500. The supplies cost in the flexible budget for January would be closest to: A. $9,260 B. $9,244 C. $9,500 D. $9,310 2. Portsche Snow Removal's cost formula for its vehicle operating cost is $2,310 per month plus $317 per snow-day. For the month of November, the company planned for activity of 18 snow-days, but the actual level of activity was 20 snow-days. The actual vehicle operating cost for the month was $8,730. The activity variance for vehicle operating cost in November would be closest to: A. $714 U B. $714 F C. $634 F D. $634 U 3. Dunklin Medical Clinic measures its activity in terms of patient-visits. Last month, the budgeted level of activity was 1,620 patient-visits and the actual level of activity was 1,540 patient-visits. The cost formula for administrative expenses is $3.20 per patient-visit plus $14,300 per month. The actual administrative expense was $21,050. In the clinic's flexible budget performance report for last month, the spending variance for administrative expenses was: A. $118 F B. $256 F C. $1,566 U D. $1,822 U 1 Use the following to answer questions 4-5: The following data relate to product no. 89 of Des Moines Corporation: Direct material standard: 3 square feet at $2.50 per square foot Direct material purchases: 30,000 square feet at $2.60 per square foot Direct material consumed: 29,200 square feet Manufacturing activity, product no. 89: 9,600 units completed 4. The direct-material quantity variance is: A. $1,000F. B. $1,000U. C. $1,040F. D. $1,040U. E. $2,000F. 5. The direct-material price variance is: A. $2,880U. B. $2,920F. C. $2,920U. D. $3,000F. E. $3,000U. 6. Courtney purchased and consumed 50,000 gallons of direct material that was used in the production of 11,000 finished units of product. According to engineering specifications, each finished unit had a manufacturing standard of five gallons. If a review of Courtney's accounting records at the end of the period disclosed a material price variance of $5,000U and a material quantity variance of $3,000F, determine the actual price paid for a gallon of direct material. A. $0.50. B. $0.60. C. $0.70. D. An amount other than those shown above. E. Not enough information to judge. 7. Simms Corporation had a favorable direct-labor efficiency variance of $6,000 for the period just ended. The actual wage rate was $0.50 more than the standard rate of $12.00. If the company's standard hours allowed for actual production totaled 9,500, how many hours did the firm actually work? A. 9,000. B. 9,020. C. 9,980. D. 10,000. 2 Use the following to answer questions 8-9: Abbott has a standard variable overhead rate of $4.50 per machine hour, and each unit produced has a standard time allowed of three hours. The company's static budget was based on 46,000 units. Actual results for the year follow. Actual units produced: 42,000 Actual machine hours worked: 120,000 Actual variable overhead incurred: $520,000 8. Abbott's variable-overhead spending variance is: A. $20,000 favorable. B. $27,000 favorable. C. $20,000 unfavorable. D. $27,000 unfavorable. E. not listed above. 9. Abbott's variable-overhead efficiency variance is: A. $20,000 favorable. B. $27,000 favorable. C. $20,000 unfavorable. D. $27,000 unfavorable. E. not listed above. Use the following to answer questions 10-11: Benson Company, which uses a standard cost system, budgeted $600,000 of fixed overhead when 40,000 machine hours were anticipated. Other data for the period were: Actual units produced: 10,000 Standard production time per unit: 3.9 machine hours Fixed overhead incurred: $620,000 Actual machine hours worked: 42,000 10. Benson's fixed-overhead budget variance is: A. $10,000 favorable. B. $15,000 favorable. C. $20,000 favorable. D. $15,000 unfavorable. E. $20,000 unfavorable. 3 11. Benson's fixed-overhead volume variance is: A. $10,000 favorable. B. $15,000 favorable. C. $20,000 favorable. D. $15,000 unfavorable. E. $20,000 unfavorable. 12. Mission, Inc., reported a return on investment of 12%, a turnover of 5, and operating income of $180,000. On the basis of this information, the company's average assets were: A. $300,000. B. $900,000. C. $1,500,000. D. $7,500,000. E. some other amount. 13. Which of the following performance measures will decrease if the minimum required rate of return increases? A. B. C. D. 14. Return on Residual Investment Income Yes Yes No Yes Yes No No No Extron Division reported a residual income of $200,000 for the year just ended. The division had $8,000,000 of average operating assets and $1,000,000 of operating income. On the basis of this information, the minimum required rate of return was: A. 2.5%. B. 10.0%. C. 12.5%. D. 20.0%. E. some other figure. 4 15. The Florida Division of McKenna Company makes and sells batteries that can either be sold to outside customers or transferred to the Alabama Division of McKenna Company. The following data are available from last month: Florida Division: Selling price per battery to outside customers ........................... Variable cost per battery when sold to outside customers ......... Capacity in batteries ................................................................... $50 $35 15,000 Alabama Division: Number of batteries needed per month ...................................... Price per battery paid to an outside supplier .............................. 5,000 $47 If Florida Division sells the batteries to Alabama Division, Florida Division can avoid $2 per battery in sales commissions. Suppose that Florida Division sells 11,500 batteries each month to outside customers. According to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division? A. $47.00 B. $43.50 C. $37.50 D. $34.73 16. Sound, Inc., reported the following results from the sale of 24,000 units of IT-54: Sales Variable manufacturing costs Fixed manufacturing costs Variable selling costs Fixed administrative costs $528,000 288,000 120,000 52,800 35,200 Rhythm Company has offered to purchase 3,000 IT-54s at $16 each. Sound has available capacity, and the president is in favor of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost" of production is $17. Which of the following correctly notes the change in income if the special order is accepted? A. $3,000 decrease. B. $3,000 increase. C. $12,000 decrease. D. $12,000 increase. E. None of the above. 5 17. The Shoe Department at the Baton Rouge Department Store is being considered for closure. The following information relates to shoe activity: Sales revenue Variable costs: Cost of goods sold Sales commissions Fixed operating costs $350,000 280,000 30,000 90,000 If 70% of the fixed operating costs are avoidable, should the Shoe Department be closed? A. Yes, Baton Rouge would be better off by $23,000. B. Yes, Baton Rouge would be better off by $50,000. C. No, Baton Rouge would be worse off by $13,000. D. No, Baton Rouge would be worse off by $40,000. E. None of the above. 18. Lido manufactures A and B from a joint process (cost = $80,000). Five thousand pounds of A can be sold at split-off for $20 per pound or processed further at an additional cost of $20,000 and then sold for $25. Ten thousand pounds of B can be sold at split-off for $15 per pound or processed further at an additional cost of $20,000 and later sold for $16. If Lido decides to process B beyond the split-off point, operating income will: A. increase by $10,000. B. increase by $20,000. C. decrease by $10,000. D. decrease by $20,000. E. decrease by $58,000. 6 19. Smith Manufacturing has 27,000 labor hours available for producing X and Y. Consider the following information: Required labor time per unit (hours) Maximum demand (units) Contribution margin per unit Product X 2 6,000 $5.00 Product Y 3 8,000 $6.00 If Smith follows proper managerial accounting practices, which of the following production schedules should the company set? A. B. C. D. E. Product X 0 units 1,500 units 6,000 units 6,000 units 6,000 units Product Y 8,000 units 8,000 units 0 units 5,000 units 8,000 units 20. Donaldson Company can acquire a $650,000 machine now that will benefit the firm over the next 9 years. Annual savings in cash operating costs are expected to total $105,000. If the discount rate is 12%, the investment's net present value is: A. $(21,010). B. $(90,560). C. $(308,855). D. $295,000. E. none of the above. 21. A new machine that costs $80,800 is expected to save annual cash operating costs of $20,000 over each of the next seven years. The machine's internal rate of return is: A. approximately 12%. B. approximately 14%. C. approximately 16%. D. approximately 18%. E. some other figure not noted above. 7 22. Paulsen is considering the acquisition of a $217,750 machine that is expected to produce annual savings in cash operating costs of $50,000 over the next six years. If Paulsen uses the internal rate of return (IRR) to evaluate new investments and the firm has a hurdle rate of 12%, which of the following statements is correct? A. The machine's IRR is less than 4%, and the machine should not be acquired. B. The machine's IRR is approximately 10%, and the machine should not be acquired. C. The machine's IRR is approximately 10%, and the machine should be acquired. D. The machine's IRR is approximately 12%, and the machine should be acquired. E. All of the preceding statements are false. 23.Which of the following is the proper calculation of savings associated with a company's depreciation tax shield? A. Depreciation ÷ tax rate. B. Depreciation ÷ (1 - tax rate). C. Depreciation x tax rate. D. Depreciation x (1 - tax rate). E. Depreciation deduction + income taxes. 24. Sugarland Company is studying a capital project that will produce $500,000 of added sales revenue, $300,000 of additional cash operating expenses, and $40,000 of depreciation (all on an annual basis). Assuming a 30% income tax rate, the company's after-tax cash annual inflow (outflow) is: A. $70,000. B. $128,000. C. $140,000. D. $152,000. E. some other amount. 25. Carnes Company received $14,000 cash from the sale of a machine that had a $9,000 book value. If the company is subject to a 30% income tax rate, the net cash flow to use in a discounted-cash-flow analysis would be: A. $3,500. B. $6,500. C. $12,500. D. $14,000. E. $15,500. 8 26. If a proposal's profitability index is greater than zero: A. the net present value is negative. B. the net present value is positive. C. the net present value is zero. D. none of the above, because the net present value cannot be gauged by the profitability index. E. the proposal should be rejected. 27. A piece of equipment costs $30,000, and is expected to generate $8,500 of annual cash revenues and $1,500 of annual cash expenses. The disposal value at the end of the estimated 10-year life is $3,000. Ignoring income taxes, the payback period is: A. 3.53 years. B. 3.86 years. C. 4.29 years. D. 6.98 years. E. some other period of time not noted above. 9