Chapter 6 Cost-Volume-Profit Relationships

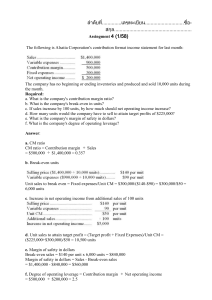

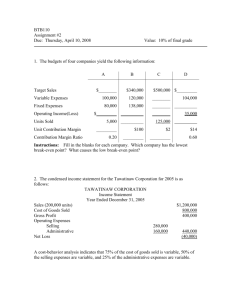

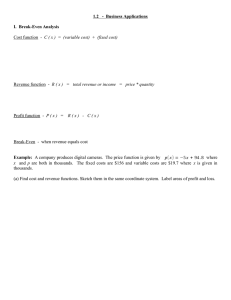

advertisement

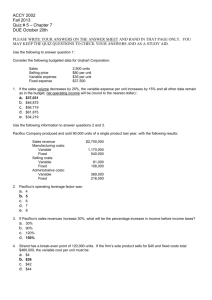

Chapter 6 Cost-Volume-Profit Relationships The Contribution Format Used primarily for external reporting. Used primarily by management. Micro Wave Co. Contribution Income Statement For the Month of June Total Per Unit Sales (500 ovens) $ 250,000 $ 500 Less: variable expenses 150,000 300 Contribution margin 100,000 $ 200 Less: fixed expenses 80,000 Operating income $ 20,000 Practice… (a) Per Unit Selling Price (b) Var. Cost Per Unit $30 $10 (c) Total Units Sold (d) Total CM (e) Total Fixed Costs 120,000 $720,000 $640,000 $6 100,000 $9 80,000 $320,000 $160,000 $120,000 (f) Operating Income Contribution-Margin Ratio Sales revenue, variable expenses and contribution for Micro Wave can be expressed as a percentage of sales Total Sales (500 ovens) $ 250,000 Less: variable expenses 150,000 Contribution margin $ 100,000 Less: fixed expenses 80,000 Operating Income $ 20,000 Per Unit $ 500 300 $ 200 Percent 100% 60% 40% Pop Quiz Tasty Bagel is a snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. What is the CM Ratio for Tasty Bagel? a. 1.319 b. 0.758 c. 0.242 d. 4.139 Contribution Margin Method to Determine Break-even The contribution margin method is a variation of the equation method. Break-even point in units sold = Break-even point in total sales dollars = Fixed expenses Unit contribution margin Fixed expenses CM ratio Pop Quiz Tasty Bagel is a snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. What is the break-even sales in units? a. 872 bagels b. 3,611 bagels c. 1,200 bagels d. 1,150 bagels Pop Quiz Tasty Bagel is a snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. What is the break-even sales in dollars? a. $1,300 b. $1,715 c. $1,788 d. $3,129 CVP Graph 450,000 400,000 Total Sales 350,000 300,000 Total Expenses 250,000 200,000 Fixed expenses 150,000 100,000 50,000 - 100 200 300 Units 400 500 600 700 800 CVP Graph 450,000 400,000 350,000 300,000 250,000 200,000 Break-even point 150,000 100,000 50,000 - 100 200 300 Units 400 500 600 700 800 Break-even Reduction Micro is currently selling 500 ovens per month. Break-even units are 400 per month under the current cost structure. What would be the break-even units if fixed costs decrease to $70,000? What would be the break-even units if variable costs were reduced to $250? What would be the break-even units if selling price was increased to $513.33? Target Operating Profit - CM Approach Original contribution margin formula: Break Even Point in Units = Fixed Expenses Contribution Margin per Unit Target operating profit modification: Units Sold to Earn Target Profit = Fixed Expenses +Target Op. Profit Unit Contribution Margin Pop Quiz Tasty Bagel is a snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. How many bagels would have to be sold to attain target profits of $2,500 per month? a. 3,363 bagels b. 2,212 bagels c. 1,150 bagels d. 4,200 bagels Sensitivity Analysis – Fixed Costs Micro Wave Co. is currently selling 500 ovens per month The sales manager believes that an increase of $10,000 in the monthly advertising budget would increase sales of ovens to 540 per month Should the increase in advertising be made? Change in Variable Costs and Sales Volume Micro Wave management is contemplating the use of higherquality components, which would increase variable costs by $15 per oven. However, the sales manager predicts that the overall higher quality would increase sales to 600 ovens per month. Should the higher quality components be used? Change in Fixed Cost, Sales Price, and Sales Volume To increase sales, the sales manager would like to cut the selling price by $40 per oven and increase the advertising budget by $30,000 per month. The sales manager believes that if these two steps are taken, unit sales will increase by 60% to 800 ovens per month. Should the changes be made? Change in Variable Cost, Fixed Cost, and Sales Volume The sales manager would like to place the sales staff on commission basis of $40 per oven sold, rather than on flat salaries that now total $10,000 per month. The sales manager is confident that the change will increase monthly sales by 15% to 575 ovens per month. Should the change be made? Change in Regular Sales Price The company has an opportunity to make a bulk sale of 200 ovens to a wholesaler if an acceptable price can be worked out. This sale would not have any effect on the company’s regular sales. What price per oven should be quoted to the wholesaler if Micro wants to increase its Operating profits by $5,000? The Margin of Safety Excess of budgeted (or actual) sales over the break-even volume of sales. The amount by which sales can drop before losses begin to be incurred. Margin of safety = Total sales - Break-even sales Let’s calculate the margin of safety for Micro The Margin of Safety Micro has a break-even point of $200,000. If actual sales are $250,000, the margin of safety is $50,000 or 100 ovens. Break-even sales 400 units Sales $ 200,000 Less: variable expenses 120,000 Contribution margin 80,000 Less: fixed expenses 80,000 Net operating income $ - Actual sales 500 units $ 250,000 150,000 100,000 80,000 $ 20,000 The Margin of Safety The margin of safety can be expressed as 20% of sales. ($50,000 ÷ $250,000) Break-even sales 400 units Sales $ 200,000 Less: variable expenses 120,000 Contribution margin 80,000 Less: fixed expenses 80,000 Net operating income $ - Actual sales 500 units $ 250,000 150,000 100,000 80,000 $ 20,000 Pop Quiz Tasty Bagel is a snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. What is the margin of safety? a. 3,250 bagels b. 950 bagels c. 1,150 bagels d. 2,100 bagels Cost Structure and Profitability Alpha Beta Gamma Amount % Amount % Amount % Sales $800,000 100% $800,000 100% $800,000 100% Variable Expenses 400,000 50% 300,000 37.5% 200,000 25% Contribution Margin 400,000 50% 500,000 62.5% 600,000 75% Fixed Expenses 300,000 400,000 500,000 Op. Income $ 100,000 $ 100,000 $ 100,000 Effect on Profit of 10% Increase in Sales Revenue Increase in Sales Revenue Contribution Margin Ratio Alpha $80,000 X 50% Beta $80,000 X 62.5% Gamma $80,000 X 75% = = = Increase in Op.Income $40,000 +40% $50,000 +50% $60,000 +60% Break-Even Points Contribution Margin Ratio Fixed Expenses Break-Even Sales Revenue Alpha $300,000 / 50% = $600,000 Beta $400,000 / 62.5% = $640,000 Gamma $500,000 / 75% = $666,667 Margin of Safety Actual Sales Revenue Break-Even Sales Revenue Margin of Safety Alpha $800,000 - $600,000 = $200,000 Beta 800,000 - 640,000 = 160,000 Gamma 800,000 - 666,667 = 133,333 Definition of Operating Leverage The relative mix of a firm’s fixed and variable costs determines its operating leverage. At a given level of sales: Degree of operating = leverage Contribution Margin Operating Income The higher a firm’s fixed cost as compared to its variable cost, the greater its operating leverage. Operating leverage acts like a multiplier. The greater the operating leverage, the greater the change in operating income for a given change in sales. Let’s calculate the operating leverage for each firm. Application of Operating Leverage At a given level of sales, the operating leverage is a measure of how a given percentage change in sales will affect operating profits. In fact, the operating profit will increase by the operating leverage times the percentage change in sales. For a 10% increase in sales , Firm Alpha’s operating income increased 40% (4 times 10%). For a 10% increase in sales , Firm Beta’s operating income increased 50% (5 times 10%). For a 10% increase in sales , Firm Gamma’s operating income increased 60% (6 times 10%). Pop Quiz Tasty Bagel is an snack shop in a strip mall. The average selling price of a bagel is $1.49 and the average variable expense per bagel is $0.36. The average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. What is the operating leverage? a. 2.21 b. 0.45 c. 0.34 d. 2.92 Pop Quiz At Tasty Bagel the average selling price of a bagel is $1.49, the average variable expense per bagel is $0.36, and the average fixed expense per month is $1,300. 2,100 bagels are sold each month on average. If sales increase by 20%, by how much should operating income increase? a. 30.0% b. 20.0% c. 22.1% d. 44.2% Break-even Analysis (in Units) with Multiple Products Curl Company provides us with the following information: Description Surfboards Sailboards Total sold Unit Unit Selling Variable Contribution Price Cost Margin $ 20 $ 14 $ 6 30 18 12 Description Surfboards Sailboarads Total sold Unit Sales 15,000 5,000 20,000 Unit Sales 15,000 5,000 20,000 % of Total 75.0% 25.0% 100.0% Fixed cost is $120,000. What is the break-even point in units? What are the sales of Surfboards and Sailboards at the break-even point? POP QUIZ Mark Corporation produces two models of calculators. The Business model sells for $60, and the Math model sells for $40. The variable expenses are given below: Business Math Model Model Variable production costs per unit $15 $16 Variable selling and administrative expenses per unit $9 $6 The fixed expenses are $75,000 per month. The expected monthly sales of each model are: Business, 1,000 units; Math, 500 units. The break-even point for the expected sales mix is (round to nearest whole unit): A) 833 of each B) 1,667 Business and 833 Math C) 1,667 of each D) 833 Business and 1,667 Math Break-even Analysis (in Sales Dollars) with Multiple Products Curl’s Contribution Margin income statement is shown below: Sales $ Var. exp. Contrib. margin $ Fixed exp. Operating income Sales mix $ Surfboards Sailboards 300,000 100% $ 150,000 210,000 70% 90,000 90,000 30% $ 60,000 300,000 67% $ 150,000 $150,000 $450,000 100% 60% 40% 33% Total $ 450,000 300,000 150,000 120,000 $ 30,000 $ 450,000 100.0% 66.7% 33.3% 100.0% = 33.3% What is the break-even point in Sales? What are the sales of Surfboards and Sailboards at the break-even point? Break-even Analysis (in Sales Dollars) with Multiple Products A Shift in Sales Mix Sales $ Var. exp. Contrib. margin $ Fixed exp. Operating income Sales mix $ Surfboards Sailboards 150,000 100% $ 300,000 105,000 70% 180,000 45,000 30% $ 120,000 150,000 33% $ 300,000 $165,000 $450,000 100% 60% 40% 67% Total $ 450,000 285,000 165,000 120,000 $ 45,000 $ 450,000 100.0% 63.3% 36.7% 100.0% = 36.7% What is the break-even point in Sales? How does it compare with the previous amount? Pop Quiz Shirley’s Shoes sells two products. information: Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Net Income The controller provides you with the following Low Heel In Total Per Unit $120,000 $1.20 60,000 0.60 $60,000 $0.60 High Heel In Total Per Unit $80,000 $0.80 60,000 0.60 $20,000 $0.20 What is Shirley’s Shoes breakeven point in dollars? (a) (b) (c) (d) (e) $66,667 $100,000 $125,000 $180,000 $300,000 Combined $200,000 120,000 80.000 50,000 $30,000 Assumptions Underlying CVP Analysis • Selling price is constant throughout the entire relevant range • Costs are linear over the relevant range (costs can be divided into variable and fixed) • In multi-product companies, the sales mix is constant • In manufacturing firms, inventories do not change (units produced = units sold)