Document 11077031

advertisement

*

o."

T^,C''^

..-''

M.I.T.

LIBRARIES

~

DEWEY

OtW^Y

HD28

.M414

?s

i

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

SENESCENT INDUSTRY COLLAPSE REVISITED

S. Lael

Brainard and Thierry Verdier

Massachusetts Institute of Technology

WP#3628-93-EFA

November 1993

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

SENESCENT INDUSTRY COLLAPSE REVISITED

and Thierry Verdier

S. Lael Brainard*

Massachusetts Institute of Technology

WP#3628-93-EFA

*

**

MIT

Sloan School and

CERAS

and

November 1993

NBER, Cambridge USA.

DELTA-ENS

Paris and

CEPR

London.

M.I.T.

LIBRARIES

SENESCENT INDUSTRY COLLAPSE REVISITED

Abstract

One of

the most robust empirical regularities in the political

persistence of protection.

economy of

trade

is

the

This paper explains persistent protection in terms of the interaction

between industry adjustment, lobbying, and the political response. Faced with a trade shock,

owners of industry-specific factors can undertake costly adjustment, or they can lobby politicians

for trade protection and thereby mitigate the need for adjustment. The choice will depend on

the returns

from adjusting

relative to lobbying.

can be shown that the level of

tariffs is

By

introducing an explicit lobbying process,

an increasing function of past

tariffs.

it

Since current

adjustment diminishes future lobbying intensity, and protection reduces adjustment, current

protection raises future protection. This simple lobbying feedback effect has an important

dynamic resource

allocation effect: declining industries contract

fully adjust. In addition, the

and Hillman (1986)

The paper

is

model makes clear

more slowly over time and never

by Gassing

that the type of collapse predicted

only possible under special conditions, such as a fixed cost to lobbying.

also considers the symmetric case of lobbying in

growing

industries.

INTRODUCTION

I.

One of the most

of trade

is

the persistence of protection.

in explaining current protection levels in

instance, in their study of the pattern of protection that

Kennedy Round of

the

GATT, Marvel

liberalisation, after controlling for industry

Rounds, Baldwin (1985) found

were

greater

characteristics,

growth

rates,

was

growth

its

in the

that

an industry was more

level of protection preceding

Similarly, in studies of both the

levels of protection,

and import penetration

an industry.

U.S. following the

rates, industry concentration,

that industries received

pre-liberalisation

emerged

and Ray (1983) found

successful in resisting liberalisation the higher

advantage, and buyer concentration.

economy

Empirical research by a number of authors suggests

of protection are significant

that past levels

For

robust and least discussed empirical regularities in the political

more

the

comparative

Kennedy and Tokyo

post-liberalisation protection the

even after controlling for labor force

ratios.

In empirical tests explaining

corporations' positions on 6 trade initiatives during the 1970s, Pugel and Walters (1985) found

that the

demand

for protectionism

was

strongly increasing in the industry's initial tariff level,

controlling for import penetration and variables reflecting exporting strength.

This paper offers an explanation for the persistence of protection in terms of the

interaction

between industry adjustment, lobbying, and protection. The story

results are quite striking.

is

simple, but the

Faced with a trade shock, owners of industry-specific

respond by undertaking costly adjustment.

Alternatively, they can lobby politicians for trade

protection, and thereby mitigate the need for adjustment.

reflect the relative profitability

capital can

The choice between

of adjusting versus lobbying.

the

two

will

In equilibrium, the level of

protection will depend on the intensity of lobbying and on the value politicians place on lobbying

1

revenues relative to the welfare cost of the intervention, and will in turn affect firms' marginal

By

adjustment decisions.

Helpman (1992),

it

introducing an explicit lobbying process similar to

can be shown that the level of

Grossman and

an increasing function of past

tariffs is

This relationship works indirectly through the adjustment process:

tariffs.

since current adjustment

diminishes future lobbying effectiveness, and protection reduces current adjustment, current

protection raises future protection.

This simple lobbying feedback effect has an important

dynamic resource allocation

declining industries contract

would

contract less than they

effect:

in the

more slowly over time and

absence of protection.

Hillman

Several papers have studied protection and lobbying in declining industries.

(1982) examines political-support protectionist responses to declining industries by adapting the

regulatory capture framework of Stigler (1971) and Peltzman (1976) to an international trade

context.

He shows

that the derived protection

does not

fiilly

compensate specific factors

import-competing industry for the adverse terms-of-trade shock.

Long and Vousden (1991)

extend the analysis to a general equilibrium Ricardo-Viner framework, and discuss

partial

compensation

result is affected

owners and by the way

tariff

by the degree of

revenues are redistributed.

analysis is static and the political support function

Dynamic

is

risk aversion

how

this

of the specific factor

Both papers share the feature that the

specified exogenously as a black box.

aspects of protectionist policies have also been investigated.

Several authors

have analysed circumstances under which the adjustment path under protection

suboptimal in the absence of lobbying.'

in the

is

socially

In contrast, Gassing and Hillman's (1986) analysis of

See Matsuyama (1987), Tomell (1991), and Brainard (1993). These results generally hinge

on a dynamic inconsistency problem.

'

senescent industry collapse explicitly considers the effect of lobbying on industry dynamics.

Gassing, Hillman model differs from the one presented below in two important respects.

the Gassing, Hillman analysis hinges on an ad hoc tariff response function, which

in the level

politician

of labor in an industry, whereas

and specific factor owners

in

we

derive

it

explicitly

is

The

First,

increasing

from interaction between a

Secondly, the Gassing, Hillman model

an industry.

predicts that initially resources will shift gradually out of an industry in response to an adverse

trade shock,

to

some

point at which protection

This discontinuous adjustment behavior

collapses.^

tariff

up

response function, which

smooth path of decline

in

is

ad hoc.

abruptly terminated, and the industry

is

is

attributable to an inflection point in the

In contrast, the

response to an adverse shock.

model presented below predicts a

In an extension,

we show

that results

similar to those of Gassing and Hillman require an additional assumption, such as a per period

fixed cost to lobbying.

The model

industry.

is

designed so that

it

can be applied symmetrically to the case of a growing

We examine this case in another extension

to

make

the point that the disproportionate

share of protection afforded to mature industries in countries such as the

by a

bias in the political process than

by pure economic differences.

US

is

We

better explained

also discuss the

implications for general equilibrium.

The paper proceeds

interaction

as follows.

Section

II

constructs a general, two-period

between a trade-impacted industry and a

politician.

Section

III

model of the

extends this model

Lawrence and Lawrence (1987) also develop a model in which labor adjustment in a

is discontinuous.

However, there is no political intervention in their model.

The discontinuity is attributable to the combination of lumpy capacity reduction with monopoly

behavior on the part of labor.

^

declining industry

to a discrete time, infinite horizon

and the

politician.

framework by simplifying the

FV extends

Section

the

model

interaction

between the industry

to consider industry collapse.

V

VI concludes.

considers growing industries and the implications for general equilibrium. Section

TWO-PERIOD MODEL

n.

We

start

with an industry that

specific factor in the industry,

The

labour.

variable factor

specific factor.

industry

amount

is

x,

occurred.

(where

a price taker on international markets.

is fixed,

and a variable factor

x>0

=

y,-x„

the next period, y,+i

.

implies contraction).

E

{1,2}, the stock of

specific factor input, output is

which

is

There

is

a cost of adjustment,

production cost, C, which

is

is

will refer to as

employment

in the

employment by some

assumed equal

<t>,

employment

which

</>'(Xt)>0

assumed convex and increasing

is

to adjust

also just equal to the stock of

amount of adjustment:

Domestic demand, D,

we

a

is

Production takes place after the adjustment has

increasing function of the

absence of intervention

t

Each period, the industry chooses

y,.

that

There

supplied competitively, and any rents accrue to the owners of the

is

Given the fixed

q,

which

is

At the beginning of each period

given by

employment,

is

to the net level

at the

assumed

to

in output:

beginning of

be a convex,

There

and (t>"ix^>0.

of

is

also a

C'(qi)>0, C"(qt)>0.

a decreasing function of the domestic price, p„ which in the

just equal to the

that the international price is constant

0.

Section

exogenously given world price, p„

,.

We will assume

over time, with the exception of a discrete jump

at

time

Prior to that time, both the international price and the domestic price are constant at pb,

which

is

consistent with an equilibrium

employment

level, y„°.

The employment

such that the marginal cost of production equals the price: C'(yw'*)=Po-

4

At time

level is chosen

0, a

permanent

shock

in the international

of employment

market causes a decline

at the outset

of period

and the industry must contract

new

in

1,

in the

world price

yi=yj', exceeds the

to p„

< po.

new long run

Thus, the stock

equilibrium level,

order to bring the marginal costs of production

down

to the

international price.

Adjustment:

In the absence of lobbying, the industry does not receive any protection, since there are

no market imperfections.

In this case,

its

adjustment program

is

defined as

:

(1)

where p

The

first

is

the discount factor of the industry, and profits in period

are defined:

t

order conditions are:

-Py^^^'^i -^i) * 9{-Py,^C'(y, -X, -Xj)] =^'{x,)

(2)

-P^^C'{y,-x^-x^)=^'{x^)

In each period the industry trades off the marginal return to adjustment against the marginal cost.

Solutions

of

Xi*>Pw)=X2'(yi,Pw)-

this

system

can

Solving the two

convexity assumptions establishes that

international

price

0<3x,/3y,<

level,

p„,

first

Xi=x,*(yi,p„)

as:

is

and

X2=X2(yi-

order conditions under the usual concavity and

period adjustment,

in

the

initial

x,*,

an increasing function of

increasing in the initial stock of employment,

y,.

is

decreasing in the

employment

and therefore the second period employment stock,

1,

is

first

written

and increasing

addition, second period adjustment, X2,

value of X2'

be

yj*, is

y2,

The

stock,

yi,

new

with

increasing in y,. In

and thus the equilibrium

full

impact of the world

price p^

on

X2* is

a priori ambiguous:

through decreases in x/

the direct effect is negative, while the indirect effect

If the direct effect

is positive.

outweighs the indirect

smaller price shock results in lower adjustment in period two: 3x2*/3p»

demand and

<

effect, then

0. In the case

a

of linear

quadratic costs, the direct effect dominates and the optimal adjustment levels are:

(1*4>(1+P))

^i=(Po-Pj-

(1

(3)

+<!>)

Lobbying

is

P*

^

X2 = (Po-Pj

Thus, adjustment in each period

+

increasing in the size of the price shock.

:

Next we assume the industry has the option of lobbying

The domestic

price

is

to influence the

domestic price.

the product of an endogenously determined ad valorem tariff, &„ and the

exogenous world price: p,=(l +^t)Pw.f Following Helpman and Grossman (1992),

lobbying process as a contribution

level of the tariff

of the

tariff,

t

^(Pry,'^,)

each period, the industry can influence the

to the

incumbent politician as a function

are:

= Pr(yr^,)-c(y,-x,)-^(xyF,(p,j>j

restrict consideration to differentiable

does not provide any contribution

if

The policymaker values both

(5)

the

or equivalently, of the two prices, F(R,p„). Given world price p„, and employment

(4)

degrees.

in

by offering a schedule of contributions

adjustment, x„ profits in period

We

game where,

we model

We

assume

there

lobbying contributions, and assume that the industry

is

no protection: F,(p»,,p„)=0.

social welfare,

W,

and lobbying contributions

that the utility function is linear in both elements:

G(p„y,^,) = pw^(P„yA)^(i-P)^,(Pr^H)

in different

where the weight on welfare,

/3,

lies

between 1/2 and

1.

Welfare

is

the

sum of consumer

surplus, industry profits and tariff revenue:

W(p„yrX) = [Diu)du *

p,(y,-x,) -

C(y,-xy^ix)

^ (p,-/)J[D(p,)-(y,-A:,)]

Pt

This objective function

is

the partial equilibrium,

dynamic analogue of

that

developed

Grossman and Helpman (1992).'

In the interests of simplicity,

features of political interaction,

especially competition between political parties.

Grossman, Helpman point out, evidence

to incumbents,

and frequently contribute

simplification has

period

>

ignores a host of interesting

But, as

lobby groups disproportionately make contributions

to candidates after they

have won, suggests

this

some empirical credence.

The timing of

the

game

is

as follows:

period 2

1

>

Industry

Government

Fi

p,

In each of the

that

it

in

> ...|.

Industry

two periods,

>

>

Industry

Government

Fj

X,

the industry first chooses

> ..^

Industry

X2

P2

its

contribution function,

F„ the

politician

then chooses the domestic price, p„ given the contribution schedule, and finally the industry

chooses the level of adjustment,

x,."*

'

The welfare weight parameter,

*

Qualitatively similar results obtain if instead the government

a, in

Grossman, Helpman

is

just equal to /3/(l-/3) here.

is

assumed

schedule as a function of the contribution, and the firm then chooses

employment

level simultaneously.

its

to

choose a price

contribution and

The second period lobbying game:

Solving backwards, the industry chooses Xj to maximize T(p2,y2,X2), yielding

first

order

conditions:

-p,^C%-x^)=^'ix^)

(6)

which gives

Xj as a function of

employment

x^ = xl(y^j>^

(7)

Second period adjustment

domestic price

level),

is

with

stock, yj,

—

^(P2.y2»X2*),

which

and of

is

<0 and

first

period adjustment, since

pj:

0<— <1

a decreasing function of the second period

adjustment from (7) into the profit function in

-

and domestic price,

tariff (reflected in the

y2= yrx,. Plugging

the optimal

r'(^,y-^

(4), yields the indirect profit function,

decreasing in the employment stock,

y2,

and increasing

in the

domestic

price, p2.

Fully anticipating the industry's employment response, the politician chooses the tariff

to

maximize

G(p2,y2,X2*).

The

first

order condition yields an expression relating the marginal

industry contribution to the domestic price level:

®

The

'v^T^*.-M D'ip^)

first

term in equation

(8) is the

marginal deadweight loss of the

tariff

weighted by

/3/(l-^).

In order to induce the politician to choose the domestic price level, p^, the trade-impacted

industry has to propose a contribution schedule that exactly compensates on the margin the

associated social welfare loss, weighted by the politician's preference for contributions.

level of tariff protection increases in the marginal contribution

politician

assigns

to

welfare,

under

the

assumption

8

that

and decreases

the

import

in the

demand

The

weight the

function,

M(y2,P2)=D(p2)-y2+X2.(y2,P2),

is

not overly convex in the domestic price.

values only social welfare, the tariff

The lobbying

When

the politician

is 0.

contribution schedule of the industry in period 2

is

then derived by

integrating (8):'

(^)

^2(P2^>v.y2) =

-A/("-/'w) D \u) +

|au

P..

Anticipating the politician's tariff response, the industry chooses

its

contribution in period 2 (or

equivalently the domestic price) so that the marginal cost of lobbying just equals the marginal

benefit to the industry

from increased protection:

iy,-4) -

(10)

^^^f^^^

dP2

which can be restated

in the usual

Ramsey form (Grossman, Helpman

^i-Pw)

(11)

where Mjipi)

is

import demand.

the import

demand

(1-p) ^y^-H)

in period

employment

and concave in the price

P2, the sign

2 and €M(p)=-M'(p)p/M(p)

In the Grossman,

in that period P2*(y2)-

of b^'lby2

is

the

it

lobbies.

lobbies and

Here,

this

For a program

same

is

the elasticity of

when

it

is

p2, as a

that is well-defined

as the sign of the expression:

Helpman general equilibrium framework, each

includes a constant in addition to this integral, which

when

1

Equation (10) defines the equilibrium second period domestic price,

function of the stock of

^

_

(1992)):

industry's contribution

equal to the difference between

its

return

does not, given the equilibrium contributions of the competing

term does not appear since there are no competing lobbies.

.

dx;

(11)

'~<p.-pj

1-

1-p

dy.

which

is

first

first

of second order for small

is

tariffs.

The

first

is positive.

As long

term in

The second

as the first term

sufficiently large relative to the second, the equilibrium level of protection in period

an increasing function of the employment stock,

adjustment undertaken in the previous period,

is

order condition in (10).

order effect of y2 on the output level, qj, and

term has an ambiguous sign,* but

is

dp^dy^

derived by totally differentiating the

brackets represents the

\

^^

y^^

x,.

two

is

^"^ therefore a decreasing function of the

In particular, in the linear-quadratic case

it

straightforward that:

(12)

P(l+4>)/',+<t>(l-P))'2

,

(13)

Pi =

-

(P(2+<|>)-1)

In this case, the second term in equation (11)

contribution, F2, does not depend directly

is

on

is identically

yj,

equal to zero, the second period

and B^'ldy2

an increasing function of the stock of employment

>

at the

0.

Second period protection

beginning of the period, and

therefore a decreasing function of the adjustment undertaken in the previous period.

The

first

period lobbying game:

Continuing backwards, the industry's

*

It

first

period adjustment level

is

chosen, taking into

cannot be signed without some additional conditions on the derivative of marginal costs.

In particular,

it

can be shown that for convex marginal production and adjustment cost functions,

The larger the industry, the less sensitive

3^2*/^P25y2

in domestic prices in period 2.

is

positive.

10

is

the adjustment to changes

account

its

effect

on the

level of protection

program for the industry can be written

and adjustment

as:

MAX^^ p,(y,-x,)-C(y^-x^)-^(x,)

(14)

The maximization

in period two.

Using the envelope theorem for the second period

+ p [n '(/j^Cy, -x,),y, -x,)]

profit function

and equation

(7), the first

order

condition for x, can be written as:

dF.

(15)

= i>'(x,)

-Pi^C'(y,-x,)*p ^^(y,-^,)]

^2.

The

is

first

two terms represent

the marginal gain

from adjustment

in period 1,

while the third term

the marginal adjustment cost saved in period 2 due to adjustment in period

represents the strategic impact of adjustment in period

2. Its sign

depends on

[d^

1

1.

The

on the lobbying contribution

Xz'/dpjdyJ. In the linear quadratic case,

it is

last

term

in period

equal to zero.

At the

equilibrium, the marginal direct and indirect returns from adjustment are balanced against the

marginal cost of adjustment in the current period.

For a well-defined concave problem,

defines the optimal adjustment level, x,*, as a function of the initial stock of

this

employment and

the domestic price, p,:

(16)

;cj

= JCi^i/jj)

with

—

!-<0

and

0<—^<1

Combining equation (16) with the condition derived above

that

the second period tariff

first

straightforward:

and the lower

is

the higher

is first

Continuing

an increasing function of the

is

period tariff

The

result that

intuition is

the domestic price in the first period, the less the industry adjusts,

period adjustment, the

farther

3p2*/3y2>0 yields the

backwards,

anticipating the effect of this price

the

more

the industry lobbies in period two.

government chooses the domestic

price,

pi,

on the industry's subsequent adjustment and lobbying

11

behavior in period 2, and taking as given the contribution schedule, F,, proposed in that period.

Assuming

the policymaker has the

optimization problem

^^^

same discount

rate as that

of the industry, the policymaker's

is:

Max^^ PI^(Pp)'i^;)Hl-P)F,(p,^,)+p[PJr(p;(y2);y2^*)+(l-P)F2(p;(y2);p,,y2)]

Using the envelope theorem with respect

to the optimal price

and adjustment

in period 2 yields

the first order condition for the politician:

(» dF,(p,j?J

_

(Pi-Pj

D'(p,)

(1-P) ay.

dPi

the equilibrium protection level, the lobbying contribution in period

terms

at the

margin.

The

first

term

second term reflects the loss of

in equation (18) is the usual static

tariff

revenue

implied by reduced adjustment in period

dF,

1

/ ^

.\

ax;

-P(P2-PJ

(1-P)

dPx

At

Av*\ Bxl

(

p

1.

in period

The

third

l^J

must balance three

1

deadweight

loss.

The

2 due to the increase in production

term

is

the strategic impact of period

1

protection on the lobbying contribution in period 2.

Integrating equation (18) yields the optimal

of the industry.

constraint.

The

first

period lobbying contribution schedule

industry chooses the optimal tariff taking the contribution schedule as a

Again, using the envelope theorem, the

first

order condition

is:

dF^(p^j)^y^)

(19)

yi-xi(j>i,yi)

=

dPi

which defines the equilibrium

stock, y,.

(20)

first

period protection level as a function of the

For a well-defined concave program, the sign of 3pi/3yi

^1*

^^i(PnPw»yi)

ay,

dp^ avj

1-

12

is

the

initial

same

employment

as the sign of:

The

term, which represents the direct effect of the

first

protection,

period

1

is

positive.

The higher

and the higher

,

the declining industry

is

when

stock.

The

positive,

is

the tariff.

the initial level of

The second term

and the policymaker.

linear-quadratic case and

Thus, 3pi/3yi

is

initial size

and protection

employment, the higher

reflects the

is

relatively impatient this

in period

larger is the initial shock, the larger

is

1

is

output in

lobbying interaction between

to sign in general.

It is difficult

the policymaker

of the employment stock on

term

However,

is

increasing in the initial

in the

also positive.

employment

the initial protection level and the larger

is

is

future protection.

m.

INFINITE HORIZON

We now

MODEL

extend the model to the infinite horizon case, simplifying in two ways.

in order to obtain explicit solutions,

cost and

demand

we

focus on a linear-quadratic version of the model, with

functions given by:

.2

Second,

assumed

politician

2

order to derive an explicit path of adjustment for employment and domestic prices

in

we

over an infinite horizon,

is

to

choose

its

simplify the structure of the stage game.

adjustment level and

then chooses a tariff level to

framework,

this

each period, but

its

is

the

Each period, the industry

contribution schedule simultaneously.

maximize

utility.

Compared

to

The

the two-period

timing assumption assigns greater commitment power to the industry's action

this is offset

by the

alternating sequence of

Both the industry and the politician are assumed

variable

First,

employment

stock,

whose evolution

13

is

to

moves

in

an

infinite

employ Markov

horizon context.

strategies.

The

described by the simple equation:

state

(22)

Then

= yrx,

y,.,

the politician's value function

Vp)

(23)

=

is:

Max^ [PW[p^y,)-(l-P)F,(p,^J+8F^(y,^,)]

Given the relationship between the domestic price and the contribution

politician's first order conditions, the industry

level

embodied

in the

maximizes

its

strategies,

the politician's protection decision

value function by

its

choice of

contribution and adjustment levels:

With

this

affects only

Therefore,

timing structure and

Markov

the contemporaneous levels of the contribution and

the politician's problem

Choosing the optimal

can be simplified to a

F(p„p„)= (p,-p»)V2a

Faced with

permitting the

this tariff

first

maximization problem.

level of protection as a function of contributions yields the

on the relationship between the marginal contribution and the

Integrating yields

static

employment adjustment.

,

where

a=

same condition

tariff level as in

equation (8).

(l-/3)//S.

response function, the industry's problem simplifies considerably,

order conditions to be expressed as a second order difference equation.

Substituting y,-y,+i for x„ incorporating the politician's tariff response in the industry's value

function, and differentiating with respect to the contribution yields the condition:

(25)

y

=

^'-PJ

while differentiating with respect to the employment level yields:

(26)

Combining

p^ = -p<t>y,,2+(l+4>(l + p)))',,i-4)>',

(25) and (26), and using the initial condition that the

14

employment stock

at

time

is

y„, (and setting the coefficient

on the larger root

to 0) yields the industry's optimal adjustment

path equation:

(27)

,^ ,

where the root

is

(28)

Po-

M'

(l-a))

^"

(l-a)

defined:

i^a)

-

l-fl^»(l^P)-V(t-fl)'^2(l-a)<t>(Up)-4p4>^-Kt>^(f^

2<t)p

and

0<b(a)<

1

for the restrictions

on

/3

adopted above, and b'(a)>0.

This path can be contrasted with the adjustment path in the free market equilibrium,

which

is

obtained by setting the politician's weight on welfare to

(29)

y, =

Comparing

the

1

(a=0):

(Po-pJHOy^p,

two expressions reveals three channels through which lobbying

adjustment path. The equilibrium stock of employment

is

affects the

higher each period because lobbying

reduces the rate of adjustment and reduces the cumulative amount of adjustment that takes place,

and these two effects more than offset the decrease

reduction in the price shock.

level of

employment

to welfare.

is

The

in the coefficient, po -Pw/(l-a),

rate of adjustment is slower,

higher, the greater

With lobbying, employment

is

is

due

to the

and the long run equilibrium

the politician's preference for contributions relative

adjusted

15

downward smoothly,

at

a decreasing pace.

.

eventually converging to a level that

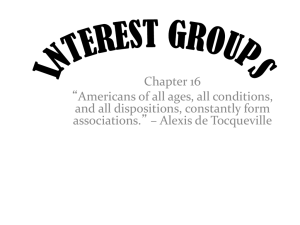

The two paths of adjustment

The path of

are

permanently above the efficient level of employment.

is

compared

in

Figure

1

the associated equilibrium tariff can be derived

first

order conditions with the adjustment path of employment:

The

level of protection declines

smoothly and gradually with employment over time, reflecting

the effect of past protection through the current stock of

higher at each point of time, the larger

advantage (measured by Po/pw).

and Young (1989).

new

adapt to the

The

by combining the industry's

This

is

employment.

Further, the tariff

the initial adverse shock or shift of comparative

closely related to "the compensation effect" of

is

is

larger the initial shock, the

more

Magee

the industry must adjust in order to

international environment, and the larger are the incentives to lobby for

protection to mitigate the need for costly adjustment.

rV.

SENESCENT INDUSTRY COLLAPSE

Our

result differs

declines smoothly up to

markedly from

some

result is attributable to the

to

concave

explicit, the

at

that

of Cassing, Hillman,

point, after

which

shape of their

tariff

some threshold

level of

framework above makes

it

response function, which switches from convex

By making

some kind of

variable contribution, then the industry

the tariff formation process

discontinuity

the industry's lobbying activities to yield a point of collapse.

the lobbying process each period required the

find that the industry

suddenly loses protection and collapses. This

employment.

clear that

who

16

in

In particular, if participation in

payment of a fixed

would lobby only

would be required

cost,

C,

in addition to the

as long as the intertemporal return to

Such a fixed cost might be associated with operating an

lobbying offsets the fixed cost.

information network, maintaining political connections, or paying lobbyist's fees.

Recall that with a zero fixed cost, the industry always lobbies, and adjusts gradually to

a level of employment, p^/(l-a) above the free market level, p„.

introducing a fixed per period cost

return to lobbying

never finds

it

is

is at its

maximum

to

levels, the industry lobbies

market

rate.

At time

lobbying and loses

its

market return

fi-ee

For a fixed cost

in

at

exceeds the

time 0, when

finite

number of periods,

T(yo).

Up

and contracts gradually, cushioned by the resulting protection.

this interval lies

t(.), it is

and

an intermediate range between these two

and receives protection for some

T(yo), the industry lobbies

The rate of contraction on

lobbying and the

If the fixed cost

a smooth

is

relative to the steady state value, the industry never lobbies

simply adjusts according to (29).

time

steady state, C<ap„^/2, then the industry

identical to that in equation (27).

difference between the return

to

its

of

below the per period

optimal to stop lobbying and receives protection permanently. There

adjustment process, which

employment

If the fixed cost is

is fairly clear.

when adjustment has reached

Intuitively, the effect

between

that

under permanent protection and the free

no longer worth paying the fixed

political influence.

cost, so the industry stops

Domestic protection collapses

to zero,

and adjustment

accelerates in a discontinuous manner.

The appendix proves

these results and specifies the relationship between the time,

fixed cost, C, and the other parameters of the model.

The proof proceeds by defining

t,

the

the value

function for a single period of lobbying followed by no lobbying, and then solves forward

recursively to determine the optimal

number of periods of lobbying before

lobbying. This value function for optimal temporary lobbying

17

is

compared

the switch to

no

to the value functions

for

permanent lobbying and for unprotected adjustment, and the resulting inequalities define the

ranges for the fixed cost relative to the intertemporal return from lobbying.

GROWING INDUSTRIES AND IMPLICATIONS FOR GENERAL EQUILIBRIUM

V.

Growing

Industries

The case of growing

framework, with rather

there

is

may be accommodated

industries

startling results.

Start

a permanent price shock at time

t,

by assuming there

quite simply in the above

is

no fixed

cost.

Suppose

such that po rises to some level, p„.

that

In the free

market economy, the industry will want to raise employment each period, to adjust to the steady

state level

yw=Pw>yo.

so that

employment adjustment

growing industry

analysis of lobbying in a

is

will

be positive

in equilibrium.

The

exactly symmetric to the case of decline, as are the

maximizing levels of contributions and employment adjustment each period. Proceeding through

the

same

steps as

for the declining industry in the infinite horizon

expression for the equilibrium stock of employment in period

(31)

y

=

''

where the

_P.w

(1-fl)

^^

\{\-a)

it

would

in the free

yields an

t:

-PoWy

characteristic root is defined as in equation (28).

grows more rapidly than

framework

When

it

lobbies, a

growing industry

market, at a rate increasing in the size of the price

shock, and the steady state level of output exceeds that in the free market by an amount that

increases with the politician's preference for contributions.

This

suggests

that

the

empirical

evidence

that

disproportionate share of protection in countries such as the

declining

US would

industries

receive

a

be better explained by

a bias in the political process than by pure economic differences. There are a variety of reasons

18

why

the political process

may be

biased against growing industries.

First,

there

may be

important differences in the cost of lobby formation for fledgling as opposed to mature

industries.

In the model above,

intertemporal return

is

we

simply assume that an industry lobbies whenever the

positive, thereby ignoring the critical issue of lobby formation.

more

research in political science suggests that industries are

likely to

overcome

However,

the free rider

problems of lobby formation when they have large committed resources and established unions.

In addition,

growing industries are characterized by rapidly changing market structures and a

high likelihood of future entry, while declining industries are more likely to have stable market

structures with a reduced threat of domestic entry.

dissipated with entry

The

may make lobby formation more

declining industries with clearly identified players and

greater risk that future rents will be

difficult in

growing industries than

more predictable

in

rents.

Secondly, in the presence of imperfect capital markets^, liquidity constraints on lobbying

activities

may be more

be the case

if

binding in a growing industry than in a declining industry.

incumbent domestic firms

in

This would

mature industries have more accumulated cash

reserves from past retained profits relative to investment opportunities than do firms in emerging

industries.

To

illustrate the effect

of a liquidity constraint, assume that firms must finance both

investment and contributions from current profits.

The

industry's maximization

program

is

modified to take into account the liquidity constraint as follows:

'

Imperfect capital markets

may

exist

because either

it is

not possible to borrow to finance

lobbying, or investors are less optimistic about an industry's future growth path than are industry

participants

due

to

asymmetric information.

19

(32)

Vp,X)

- Max^^^^^

(i-xyvp,^,,k,^,)

2

where

\ is

the multiplier

on the

2a

2

interval,

if

it

binds at

all.

employment only through

VJ-^;

Since the unconstrained equilibrium profit

liquidity constraint.

level rises monotonically over time, the constraint

When

^

must bind

the constraint binds,

it

initially

and over a continuous

affects the equilibrium stock of

the characteristic root:

bCUyL^

^ =

where

^-

L, =

24>pL,

-^

(lU,)

'

Thus, a binding constraint lowers the industry growth rate relative to the unconstrained lobbying

path.*

However, the growth

equilibrium value

is

the

rate remains

same as

above the free market

that for unconstrained lobbying.

paths for the unconstrained lobbying equilibrium,

constrained

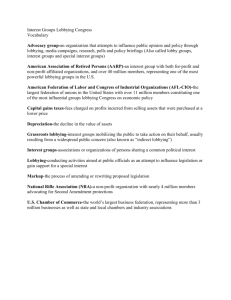

rate,

and the long run

The equilibrium adjustment

lobbying equilibrium, and

unconstrained free market equilibrium are compared in Figure 2.

In addition, a fixed cost in the lobbying process might create a bias against growing

Suppose, as above, that the fixed cost does not depend on the size of the industry.

industries.

If

an industry ever

starts to

lobby,

it

will not subsequentiy stop lobbying, since the return to

lobbying never decreases in a growing industry.

to wait before

it

the first period,

*

It is

constraint

starts

it

lobbying.

If the

Thus, an industry chooses

how many

periods

per period return to lobbying exceeds the fixed cost in

lobbies permanentiy, and conversely if the fixed cost exceeds the return to

not possible to solve for L, explicitiy. However, by combining (33) with the liquidity

it

can be shown that b

conditions, such that b

is

is

declining in

L

decreasing over time.

20

and

that

L

is

rising over time

under sensible

lobbying

lobbying.

at the steady-state level

If the fixed costs lies in

optimal number of periods until

cost,

of employment under lobbying, then the industry never

some intermediate range, then

it is

large

enough

the industry waits for

that the return to lobbying

starts

some

exceeds the fixed

and begins lobbying.

Implications for General Equilibrium

These

results ignore potential spillover effects

of lobbying across sectors, which

central consideration in understanding the effect of lobbying

on dynamic resource

industries with declining competitiveness.

in a static general equilibrium

The

away from

results derived

framework, where protection

a

allocation.

whereby the equilibrium

In a general competition for protection, there are a variety of channels

pattern of protection might result in a diversion of resources

is

infant industries toward

by Grossman and Helpman (1992)

spills

over between interest groups

through consumption, suggest that mature sectors would gain protection at the expense of infant

industries in a competition for protection if the infants

industries for

in a

any of the reasons cited above or

model where there

is

were

less well organised than

if the infants initially

a limited supply of a

common

mature

were smaller. Similarly,

factor of production, or the import-

competing sector produces an input used by the exporting sector, the equilibrium pattern of

protection might result in resources being directed

away from

industries, distorting adjustment in both directions.

growing industries would grow more slowly

in a

equilibrium.

21

the growing industries to mature

If the distortions

were

sufficiently great,

lobbying equilibrium than in the free market

VI.

CONCLUSION

Motivated by the strong empirical regularity that the best predictor of future protection

is

past protection, this paper has analyzed the adjustment path in declining industries under

By

endogenous protection.

developed

in a static

introducing an explicit political objective function similar to that

framework by Grossman and Helpman

adjustment costs, the paper shows that the level of

tariffs is

into a

dynamic model with convex

an increasing function of past

In this model, industry adjustment and lobbying are substitutes: the

the greater the protection

more

effective

it is

in

it

receives and the less

lobbying next period.

it

adjusts,

Lobbying

price shock, or equivalently of the gap between the

is

and the

more an

tariffs.

industry lobbies,

less the industry adjusts the

an increasing function of the

initial level

initial

of employment and the long run

equilibrium level.

The paper

finds that in the absence of nonconvexities in the lobbying process, the paths

of lobbying and adjustment are smooth. The industry contracts employment gradually over time

to a level that is

permanently above the free market level by an amount

value the politician places on lobbying contributions relative to welfare.

sharply with the Cassing and Hillman finding that there

to

an inflection point

in the path

in

an ad hoc

tariff

This result contrasts

a point of collapse, which corresponds

response function.

Here,

we

derive a similar collapse

of protection by introducing a per period fixed cost into the lobbying function.

the fixed cost lies in a range defined

lobbying

is

that increases in the

at the initial level

by the difference

of employment and

industry lobbies and receives protection for

in returns

between lobbying and not

at the steady-state level

some

finite

under protection, the

number of periods and then abruptly

stops lobbying, resulting in a collapse in protection and accelerated adjustment.

22

When

The

rate of

adjustment under temporary lobbying

lies

between the adjustment

rates

lobbying and no lobbying, and the associated long run employment level

is

under permanent

just the free

market

equilibrium.

Ultimately,

the

question

To

of whether

is

investigations

comparing adjustment paths across

small

number of

industries

and

protection

do not address

industries.

smooth

are

or

no systematic

the best of our knowledge, there have been

discontinuous

empirical.

adjustment

Several articles that investigate a

this issue directly.

However, our purpose was

to

investigate the conditions that determine the adjustment path rather than to establish the validity

of a particular path.

In addition, the paper

growing industries

will

grow

shows quite

faster

clearly that in a partial equilibrium

under endogenous protection unless there

against growing industries in the political process that

results are suggestive for general equilibrium,

makes lobby formation

where such a bias

in

sectors.

23

is

some

costly.

bias

These

combinaton with a resource

constraint or a vertical relationship between infant and mature industries

dynamic misallocaton of resources between

framework,

would

result in a

Figure

1

ADJUSTMENT TO NEGA TIVE SHOCK

110

100

90

c

I

B

80

70

60

50

40

O

C/3

30

20

10

"\^

I-

Figure 2

ADJUSTMENT TO POSFTIVE SHOCK

250

pw/(l-a)

200

p

S

150

B

o 100

o

o

«-»

50

Q

I

I

I

I

I

13

I

2

I

I

I

I

I

I

I

I

I

I

I

I

I

II

I

6

4

5

Time

25

I

8

7

10

9

Appendix

Assume

cost,

C, in each period.

lobby in any period after

when

it

F(p„p„) to the politician, the industry must pay a fixed

that in order to offer a contribution schedule

Assume

t.

We

also that if the industry does not pay the fixed cost at any time

start

does not lobby, and when

it

by defining the value functions of the industry when

some

lobbies for

number of periods and then

finite

it

t,

then

it

cannot

lobbies permanently,

stops.

Dilutions and notations

I.

1)

Define Vo(y) as the value fimction of the industry without lobbying:

(1)

with z

V^O-)

=

=Max,^^4p^z-^

y-x. Because the function h(z,y)

Lucas and Stokey (1989) establish

= p^

-2^/2

-

-^^

. p

nz)]

4>{y-zf-l2 is strictly

that there is a unique, continuous,

and

concave and quadratic,

strictly

results

from

concave value function Vg(.)

defined on the interval [0,yo] that satisfies this equation.

2) Further, define V,(y) as the value function of the industry with permanent lobbying

After optimization on p, this value function

V (y)

(2)

The same

= A/a.,, ,

result establishes that V,(y)

Moreover, V,(y)

It is

=

V,°(y)-C/(l-p),

is

is

on

the interval [0,yo].

equivalent to:

z-lll^ -^^I^

[;,

-C

p

V (z)]

a well-defined, continuous and strictly concave function

where W°(y)

also useful to define an operator,

is

T„

on

[0,yo].

the value function of permanent lobbying with zero fixed costs.

that associates to

any continuous function V(.) on

[0, y,] the

new

function (T,V) defined by:

(3)

T,V(.)

is

iTV)iy)-.Max,^^^^

is

b.Z-^

the value of lobbying in the current period followed

clear that V,(.) is the unique fixed point of this operator

26

-^

"C*

P

V(z)]

by the value function V(.)

on the

set,

in the following period.fl

QO,yo], of the continuous fimctions on

[0,yo]

(i.e.

(T.VJ = VJ.

that for

any

initial

R

continuous function

In addition, define the

3)

to

Define [TJ" as the k*

iterate

V on

of the operator T.:

[0,y°], the

T.'

^ T. o T. o T,...o T..

It is

well

known

sequence of functions ([TJ'V) converges uniformly to V,(.).

two 'unconstrained' operators,

Tq'

and T°„ on the

set

of

all

functions from

R

as:

(4)

(roV)(y)=Max^

inV)(y)=Max^

(5)

Again drawing on

results

[p^Z-^-^^yZ^

* pV(z)]

[p^Z-^1^-^^ -C

pV(z)]

from Lucas and Stokey (1989, Theorem 4.14 and

defined above and h(z,y,a)=p^ -(l-a)z^/2

-

p. 95),

because the functions h(z,y)

^(y-z)^/2 are strictly concave, quadratic in (z,y) for

all

OSa< 1,

the

operators To" and T", have unique fixed points, Vp'(.) and V,*(.) respectively, defined on R, which are well-defined,

quadratic, strictly concave functions in y.

The optimal adjustment paths

z(0,y) and z(a,y) associated with Vg' and

V,° are linear and increasing in y, with a slope less than unity, such that:

V

y

Va€

^

p„,

p„

^

[0,1)

and

V

z(0,y)

y

^

V y ^ p„ y ^

^y;

Pw^l-a.

P./l-a

Consider the restriction W^" of W^' to [p„ yj.

^

z(a.y)

It is

2d

z(0,y):S p,.

^

V

y;

y

^

y

P./l-".

^

z(a,y)^ Pw'l-a-

clear that the fiinction:

v-y

(6)

V(y) =

Kly)

satisfies the fixed point

restriction

property of Vq on CIO,yo] and

of V,' on [p^/l-a,

y^],

it is

If

is

y

I [p..

yj

therefore equal to Vq.

a simple matter to verify that:

2p^y-(l-a)y'-2C

if

(7)

2(1 -p)

y

6 [0.

(I

-a)

v,(y)

K(y)

if

27

y^l (l-a)

.

yj

Similarly, defining V,°'(y) as the

Vo(.) and V.(.) are therefore differ^itiable,

(8)

and using the envelope theorem

yields:

P^-il-a)y*pV^'(y)

(12)

if

-<i>(y-z!.(y))

From

if

y

e

y^]

[0,

{TV^'(y)

and

(4)

(5),

y

t

\yo

yj

,

unconstrained optimal adjustment without lobbying, z(0,y), and with permanent lobbying, z(a,y),

are determined respectively by:

(13)

z(0,y) = {z

(l-*)

It

z(a,y) = {z

I

p^-z*<t>(y-z) = -p\^(z)}

p^-z(l-a)*<t>(y-z) = -pVj(z)}

I

follows directly from inspection of (10), (13), and (14) and the fact that on [O.yJ

z(a,y)

>

>

Hence, p^(l-a)

in (8)

z'.(y)> z(0,y), for

yo'

>

Using

p,.

and (12), one concludes

V.'(y)

In particular,

>

we

Now

5)

this,

y

G

for all y

Vo'(y)

on

[0,yo].

Let

z,'(y)

<^^)

Then

t""

iterate

is

and V,'(y) obtained

increasing in y.

of the T, operator applied to Vj.

is

For

all

t

^1

and

all

y

G (O.yo],

one may

a differentiable, strictly concave, piecewise quadratic

be the solution of the following unconstrained program:

arjV^(y)=Max^^,

z,'(y) is

V(,'(y), (T.Vo)'(y)

G [CyJ

construct ([TJ'Vo)(y) recursively, given that ([TJ''Vo)(y)

fiinction

Vo'(y) that:

[O.yJ

and comparing the expressions of

conclude that (T,Vo)(y)-V(,(y)

consider the

>

that:

>

(T.Vo)'(y)

all

V.'(y)

[h(z,y,a)

-C*

p([rj'-'V^(z)]

the solution of the following equation:

(1®

z:

Because

([T.]'"'Vo)(y) is

= {z

I

P^-z(l-a)*<IKy-z) = -p(lTJ-'V^\z)}

concave and piecewise quadratic, (16) shows

increasing function in y with a slope less than unity.

that z',(y)

^

y

if

and only

if

y ^y",.

In addition, z',(0)

that for all

>

Hence, one may rewrite (ITJ'V(,)(y)

29

0.

y

in [0,

So there

as:

is

y,,],

z'.(y) is a linear,

a unique point, y'„ such

p^y-^^z^-cMiTj-'VoXy)

(17)

y

if

« [0. )'."]

aUV^(y)

iirjv^iy)

Using the envelope theorem,

a simple matter to see that ([T,rVo)(.)

it is

>«[>,', y^

if

differentiable, strictly concave,

is

and

piecewise quadratic on [0,y^ and:

P^ -(^-a)y*p({TX'y^'iy)

(18)

if

-<t>(y-zjy))

Now we

z.'-'(y)

show by forward recursion

<

z.'(y)

<

z(a,y)

Our discussion of (T.Vo) showed

notation).

show

Assume

first

< V*'(y) <

<

and ([TJ-'Vo)'(y)< ([TJ'V„)'(y)

that this property is true for

t>

t+ 1, we need

z(a,y)

t

[0, >,']

1.

Then

only show

it

is

tS 1:

y.

V.'(y)

for all

z(0,y)

clear that for all

y

=

t^r,

e

[O.yJ and

t^r.

with the previous

2?,(y)

y",.,

all

<

y',< p^/(l-a).

To

that:

from ([TJ'-'Vo)'(y)<

concave function in

y f:\y', y^

t=l (where

and ([TJ'Vo)'(y)< ([TJ-'Vo)'(y)

part of the assertion follows directly

fact that ([TJ'V(,)(y) is a strictly

if

the following property for

the property is also true for

that the property is true for

z'.(y)

The

y

([r]'v^'(y) =

The second

<

V;(y).

([TJ'V(,)'(y)

<

V,'(y), equation (16),

part follows directly

from

and the

(18).

Thus, the previous discussion establishes:

Lemma

1:

For

all

y GfO.yJ, for

1^1.

all

i)

The value funaion ([TJ

it)

([TJ

Hi)

f\{y) <tjiy) <z(a,y)

n.

The problem of lobbying with

yo)(y)

-

y()(y) is differentiable

{[TJ-' Va)(y)

We are now equipped to

is

and

strict fy

concave.

increasing in y.

for ally

^

[O.yJ and t>0.

Fixed costs

solve the problem of lobbying with fixed costs.

30

In any period

when

the industry

The value

has lobbied in the previous period, the industry chooses between lobbying and not lobbying.

industry v^th an initial size y, of

problem then

If the

argmax of

after a finite

Lemma

2:

periods of lobbying followed by no lobbying

is

an

simply ([TJ'Vo)(yo). The basic

is:

Max.^o

(A)

t

to

([TJ'Vo)(yo)

this

problem

oo, then

is

number of periods and

For

all ya

>

permanent lobbying will prevail. Otherwise, the industry stops lobbying

loses protection.

We

start

by showing the following lemma:

pjl-a,

we have ([TJ)V^yo) ^

i)

Iffor

some

ii)

Iffor

some f^l.we have VJy^)

f2.1,

^

(rrj'')Vo(ya), thenfor

(n'J^()(y(), thenfor all

k>

allk>

0,

we

0.

we

also have ([TJ**" V^^iy^

also have VJyo)

<

(fTJ*^

<

Vo)(yo).

Proof:

Consider

i)

t

^ 1,

such that ([TJ'Vo)(yo)

[P*.

yj,

we

conclude that for

Ip*',

yj,

we

get:

all

y in [p^,

([TX'VoXy)

y,),

^

([TJ'-'Vo)(yo).

([TJ'Vo)(y)

<

Since ([TJ'Vo)(y)-([T.]-'Vo)(y)

is

([TJ-'VoXy). Therefore, as ^^',(y)

increasing on

>

p*"

for y in

= h(Min[C(y),y],y,a)-C * (>([UV^{Min[z':'(y),y])

^^5^

<

Hence,

T,'*' Vo(yo)

have for

all

ii)

Consider

<

^

Using a similar argument,

T,' ygiyo)-

y in [p~,yo],

t

h(Min[C(y),y],y,a)-c + paU-'v^iMin[C(y),y])

1

,

([TJ'^'OVo)(y)

such that V.(yo)

that for all y in [p*',yo), V.(y)

<

<

^

([TJ'*''-')Vo(y).

([TJ'Vo)(yo).

As

we

^

can show by recursion that for

Result

i)

V.(y)-([TJ'Vo)(y)

is

have for

all

y in [p*,yo],

V.(y)

^

for y in Ip'-yJ,

<

([TJ'"^%)(y), and result

31

ii)

we

also

we

we

conclude

get:

<

([T^'V^iy)

Using a similar argument, we can show by recursion

([TJ'^'VjXyo).

k>

increasing in [p'.yo],

([TJ'Vo)(y). Therefore, since z(a,y)>z'.(y)>p''

h(Min[z(a,y),y],y,a)-C + paTJV^(Min[z(a,y),y])

<

all

follows immediately,

VCy) = h(Min[z{a,y),y],y,a)-C * pV^(Min[z(a,y),y])

Hence, V.iyo)

([Tjv^iy)

follows immediately.

that for all

k>

we

also

Lemma

2

implies that if problem (A) has a finite solution, there are at most two points r and

i)

can be the solution. H^ice, unless y^ belongs to a

that

there is at

most one

finite solution T(yo) to

set

problem (A). Note

V,°(y)-C/[l-p].

3

t

<

Temporary lobbying

00

we

costs,

that

Lemma

2

rewrite ([TJ'Vo)(y) as ([T,°]'

and only

will arise if

>

such that ([TJ'Vo)(yo)

oo

of isolated points y (such that ([T,]'Vo)(y) = ([TJ'*')Vo(y))

holds for

i)

all

C> 0.

Defining T,° as the operator T, associated with zero fixed costs, and recalling that V,°

permanent lobbying with zero fixed

t+ 1<

V^Xy)

-

C[l-p']/[l-p]

,

is

the value of

and V,(y) as

if:

V.Cy,)

or equivalently:

3

It is

t

<

oc such that

Vo(0)= (T.oVoXO)

By

<

clear that V(,(y)

=

V.°(y) for

all

y

>

u,

=

is

Lemma

Proof:

3

<

t

^<C/[l-p]< ^„. This

contradicts

Lemma

Since

it is

2

3

<

it is

<

V.°(y) for

clear that Vo(y)

([T,°]'^'Vj)(y) for all y

- ([T.'']'V„)(yo)]/p'.

3: The sequence of points (uj,

Suppose the contrary:

increasing in y,

([T,°]"Vo(y))

>

<

y>

0. Also, since

([T/JVoXy) for

Finally,

0.

all

we

all

y>0.

can conclude that the

monotonically converging to V,°(yQ) from below.

[V.^Cy,)

equivalent to the condition:

([T.TVo)(yo)]/p'.

Then by recursion

0.

and ([T.'']Vo)(y)-Vo(y)

([T,°]'V5)(y(,) is

Let us define

-

[V.°(y„)

recursion one can also see that ([T,°]'Vo)(y)

sequence of points

is

C/[l-p]>

t

oo such that

is

3t

the condition,

C/[l-p]>

<

u,

oo

<

u,+,.

such

that:

3

t

<

oo

such that ([T.]'Vo)(yo)

>

V.(yo),

u,.

a decreasing sequence

such that

implies that

Then

(ie.

u,

S

u,^,for all

Then one can choose

([T J'Vo)(yo)

> V.(yo)

I

ciO).

a level of fixed cost

C

such that

and ([TJ*'Vo(yo))< V.(yo). This

ii).

a decreasing, positive sequence, (uJ, converges towards a limit

guarantees that this limit

is strictly

positive:

32

u^O. The

following proposition

Proposition 1: If VJp")

>

Vgfp"),

In this case, the adjustment path

>

Proof: Given that V.'(y)

Therefore, by recursion,

([TJ'Vo)(yo),

that for

which says

^

any yo

protection

A

p,

is

that

it is

apJ/2, then there

is

permanent lobbying and permanent protection.

given by y,+,=z(a,yj with the initial condition

\„'(y) for

Vy G

C<

i.e.

all

y

(p", y,],

G

[p", yj,

>

V.(y)

^

V.(pJ

Vo(pJ impUes

([TJ'Vo)(y) for

all

y^.

that

Vy G

[p.,

Thus, for

12:1.

yj, V.(y)^V„(y).

all

tSO,

always beneficial for the industry to continue lobbying. Consequently,

p^(l-a), there

is

permanent lobbying and protection.

are such that y,= z(a,y,.,), and p,=

p''

The

adjustmrait process

y,

V,(yo)

>

we conclude

and domestic

+ az(a,y,.,).

corollary follows directly from this proposition:

Corollary 1: For all

We

are

now

t

SO and all C ^

apJ/2

>

u,

,

C/fl-p].

Hence u = Lim

u,

S

apj/2[l-p]

>

0.

able to state our main result:

Proposition 2:

i)

If the fixed cost

C

is

such that C/fl-pJ

^

u, then there is

permanent lobbying and protection never

collapses,

ii)

If the fixed cost

C is such

that C/[I-pJ

>

u, then there exists

enjoys temporary protection for T(y^ periods, after which

Hi)

When protection

trade

is

a unique time j(y^ S

it

stops lobbying

,

such that the industry

and protection

temporary, the adjustment path during the lobbying periods always

lies

collapses.

between the free

and permanent lobbying adjustment paths.

Proof:

i)

If

C

is

such that C/[l-p]

Hence, permanent lobbying

ii)

If

C

is

is

^

u, then for all

t,

C/[l-p]

<

u„ which

is

equivalent to V.(yo)

>

([TJ'Vo)(yo).

optimal.

such that C/[l-p]

>

u, then, because u, is decreasing (except in the case

of isolated poinU such that ([TJ'Vo)(y)

=

([TJ'+'Vo)(y)), there exists a unique

33

t

such

where

that:

yo belongs to a set

u,

=

[V."'(yo)-{[T.TVo)(yo)]/p'

([TJ'Vo)(yo)

t,

>

V,(yo).

that reaches the

Obviously, then

>

C/[l-p] and C/[l-p]

u,^,

=

[V/(yo)-([T.°]'Vo)(yo)]/p'.

Moreover, since the sequaice ([TJ'VoXyo) amverges

sup ([T.r'VoXyo).

it is

>

By Lemma 2

this point, T(yo), is

Then

for all

t'>t+l,

to V.(yo), there is a point, -riy^

unique for almost every yo

>

>

p^(l-a).

optimal for the industry to lobby for riy^ periods, and th»i to stop lobbying. Thus, there

is

temporary protection for riy^ periods.

iii)

y.-n

This follows immediately from

Lemma

1

and the

iii)

fact that at

time

t

along the adjustment path,

= Min(y„z'.(yO).

An

immediate corollary

Corollary 2: If ({TJVo}(yg)

<

is:

Vj/yJ, then there

is

no lobbying and no protection along the adjustment path.

34

References

Baldwin, R. (1985), The Political

Brainard, S.L. (1993), "Last

Review

Economy of US Import

One Out Wins: Trade

Policy

.

(Cambridge:

MIT

Press).

Policy in an International Exit Game," International Economic

.

Brock, W., and Magee, S.P. (1980), "Tariff Formation in a DenKx:racy,"

Current Issues in

Commercial Policy and Diplomacy (New York:

.

in J.

St.

Black and B. Hindley (eds.),

Martin's Press).

Magee, S.P., Brock, W. and Young L. (1989) Black Hole Tariffs and Endogenous Policy Theory:

Economy in General Equilibrium (Cambridge: Cambridge University Press).

Political

.

Cassing, J.H. and A.L. Hillman (1986), 'Shifting Comparative Advantage and Senescent Industry Colltqise,"

American Economic Review 76,

.

p.

516-23.

Grossman, G.M., and E. Helpman (1992), "Protection for Sale,"

NBER

Working Paper No. 4149.

Grossman, G.M., and E. Helpman (1993), "Trade Wars and Trade Talks,"

NBER

Working Paper No. 4280.

Hillman, A. (1982), "Declining Industries and Political-Support Protectionist Motives. American Economic Review.

72, p. 1180-7.

Hufbauer, G.C., D.T. Berliner, and K.A.

(Washington:

Elliott (1986),

Institute for International

Trade Protection

in

the

US:

31

Case Studies

.

Economics).

Lawrence, R., and C. Lawr^ice (1985), "Manufacturing Wage Dispersion: an End

Papers on Economic Activity p. 49-83.

Game Interpretation,"

Brookings

,

Marvel, Howard P., and Edward

Trade

in the

J.

Ray (1983), 'The Kennedy Round: Evidence on

.

Matsuyama, K.,(1987) "Perfect Equilibria

Mayer W. (1984)

Peltzman

S.

"

I.

Trade Liberalisation Game," American Economic Review

Endogenous Tariff Formation" American Economic Review 74,

"

p.

Walter,

"US Corporate

Statistics , pp.

Interests

and the

Political

Economy of Trade

.

970-85.

Towards a More General Theory of Regulation", Journal of Law and Economics

Economics and

Stigler G. (1971)

in a

.

(1976)

Pugel, T. and

the Regulation of International

United States," American Economic Review 73, p. 190-7.

Policy,"

.

19, p. 211.

The Review of

465-473.

"The Theory of Economic Regulation", Bell Journal of Economics

,

2, p. 3-21.

Tomell, A. (1991), "On the Ineffectiveness of Made-to-Measure Protectionist Programs" in E. Helpman and A.

Razin (eds.). International Trade and Trade Policy (Cambridge: MIT Press), p. 66-79.

.

34

MIT

3

TOflO

LIBRARIES DLIPL

DDfiSb7T7 3

22S7 UJj

Date Due